Finance

IRS Form 4868 Definition

Published: December 13, 2023

Discover the meaning and purpose of IRS Form 4868, an essential finance tool for tax extension requests. Simplify your financial planning with this comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

What is IRS Form 4868 Definition?

When it comes to filing taxes, many individuals find themselves rushing to meet the annual deadline. However, life sometimes gets in the way, leaving individuals unable to complete their tax returns on time. If you’re in this situation, fear not, because there’s a solution called IRS Form 4868 that can provide you with an extension. But what exactly is IRS Form 4868, and how does it work? In this article, we’ll dive into the definition of IRS Form 4868 and outline its key features that can help you navigate the tax-filing process with ease.

Key Takeaways:

- IRS Form 4868 is an application for an automatic extension of time to file individual tax returns.

- Filing IRS Form 4868 gives you an additional six months to submit your tax return, changing the deadline from April 15th to October 15th.

Understanding IRS Form 4868

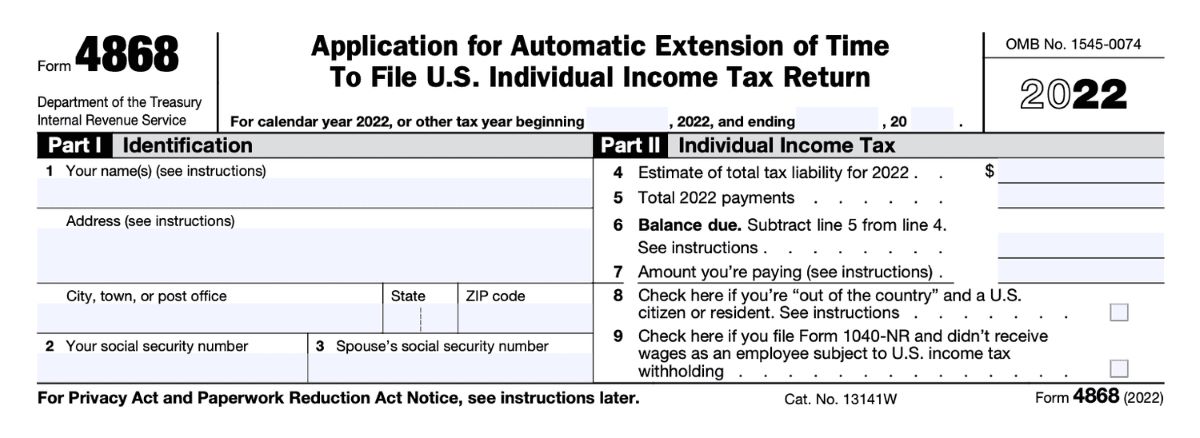

IRS Form 4868, also known as the “Application for Automatic Extension of Time to File U.S. Individual Income Tax Return,” is a form provided by the Internal Revenue Service (IRS) that allows individual taxpayers to request a six-month extension to file their tax returns. The main purpose of this form is to provide taxpayers with more time to gather the necessary financial information and complete their tax return accurately.

Although filling out IRS Form 4868 grants you an extension, it’s crucial to note that this extension only applies to the filing of your tax return—not the payment of any taxes owed. If you anticipate owing taxes, it’s still necessary to pay the estimated amount by the original deadline (April 15th) to avoid penalties and interest charges. The form includes sections for estimating your tax liability and making a payment if applicable.

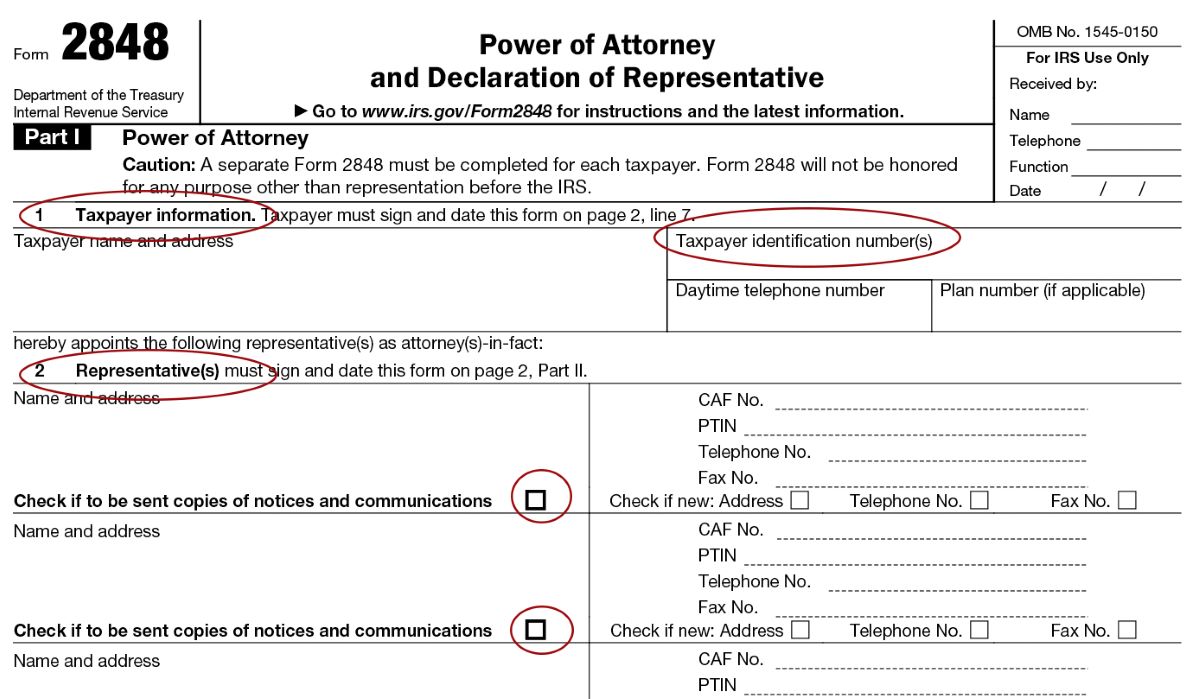

To request an extension using IRS Form 4868, all you need to do is complete the form with accurate information regarding your name, address, Social Security number, and estimated taxes due. You can submit the form electronically or mail it to the appropriate IRS address listed in the form’s instructions.

Benefits of IRS Form 4868

Filing IRS Form 4868 can provide several benefits for taxpayers who need more time to complete their tax returns:

- Reduced Stress: By granting individuals an extension, IRS Form 4868 can relieve the pressure and stress associated with meeting the original tax-filing deadline. This extra time allows taxpayers to thoroughly review their financial documents to ensure accurate reporting.

- Enhanced Accuracy: Rushing to complete tax returns by the original deadline can lead to mistakes or oversights. With an extension, individuals have more time to review their information carefully, reducing the likelihood of errors and minimizing the chance of being audited.

- Avoiding Penalties: Filing IRS Form 4868 and making any necessary tax payments by the original deadline can help individuals avoid costly penalties for late filing. Keep in mind that the extension only applies to filing, not payment. Therefore, it’s always wise to estimate and pay any taxes owed to prevent penalties or interest charges.

In conclusion, IRS Form 4868 is a valuable tool that provides individuals with an automatic extension for filing their tax returns. By understanding its definition and benefits, you can leverage this form to reduce stress, ensure accuracy, and avoid penalties in the tax-filing process. If you find yourself needing extra time to file your tax return, consider utilizing IRS Form 4868 and make the most of the extended deadline until October 15th.