Home>Finance>How Does A Negative Equity Account Affect The Balance Sheet?

Finance

How Does A Negative Equity Account Affect The Balance Sheet?

Modified: December 30, 2023

Learn how a negative equity account impacts the balance sheet in finance. Understand the implications and consequences of this financial scenario.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on how a negative equity account can affect the balance sheet. If you are unfamiliar with the concept of negative equity, it refers to a situation in which the value of an asset falls below the outstanding balance owed on it. The balance sheet is a crucial financial statement that provides a snapshot of a company’s financial position by detailing its assets, liabilities, and equity.

In this article, we will dive deep into the components of a balance sheet and explore the impact of negative equity on this important financial document. Additionally, we will discuss how negative equity affects financial ratios and provide insights into how businesses can manage and mitigate the impact of negative equity.

Understanding how negative equity affects the balance sheet is essential for individuals, investors, and business owners. It allows them to gauge the financial health and stability of a company. Moreover, being aware of negative equity and its consequences can help make informed decisions when it comes to investment strategies, mergers and acquisitions, and overall risk management.

Throughout this article, we will break down complex financial concepts into easily digestible information, providing you with valuable insights and actionable knowledge. So, let’s dive into the world of negative equity and unravel its impact on the balance sheet.

Understanding Negative Equity

Negative equity occurs when the value of an asset, such as a home or a car, is less than the outstanding balance on the loan used to purchase it. This situation commonly arises in the context of real estate, where property values can fluctuate significantly over time. Suppose an individual purchases a house for $300,000 with a mortgage loan of $250,000. If the market value of the house subsequently decreases to $200,000, the homeowner will experience negative equity of $50,000.

In the case of businesses, negative equity can arise due to various factors, including a decline in the market value of assets, poor financial performance, or accumulating losses over time. Negative equity can significantly impact a company’s financial position and solvency.

It is important to note that negative equity is not inherently problematic. It becomes concerning when it persists for an extended period or reaches a level that threatens the company’s ability to meet its financial obligations. In such cases, businesses may face challenges in obtaining financing, attracting investors, or even surviving in the long term.

To gauge the severity of negative equity, businesses and investors often analyze the balance sheet, which provides a snapshot of a company’s financial position at a specific point in time.

Next, we will explore the components of the balance sheet and understand how negative equity impacts this critical financial statement.

Components of the Balance Sheet

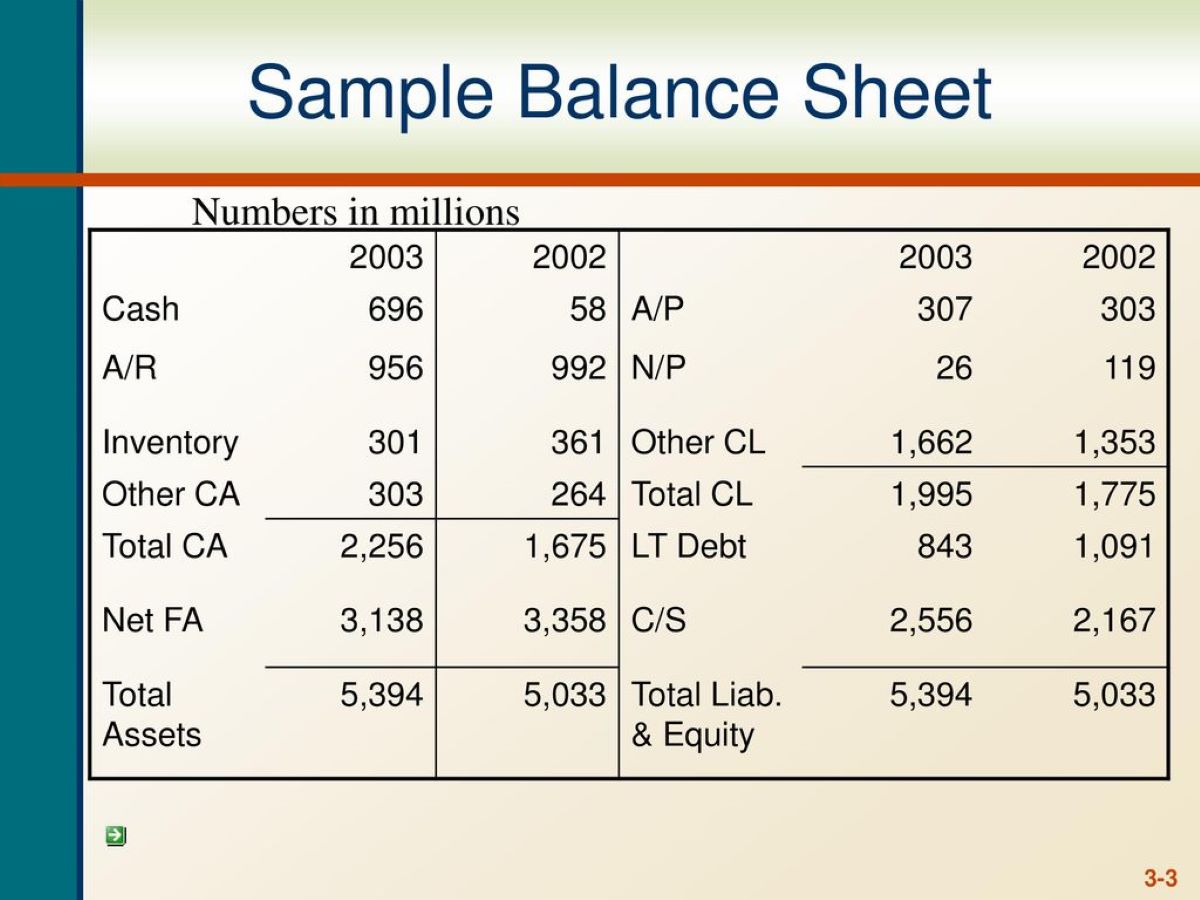

The balance sheet is divided into three main components: assets, liabilities, and equity. Let’s take a closer look at each of these components:

- Assets: Assets represent what a company owns and include tangible and intangible items. Tangible assets include cash and cash equivalents, inventory, property, and equipment. Intangible assets encompass intellectual property, patents, trademarks, and goodwill. It is important to note that assets are typically listed in order of liquidity, with the most liquid assets, such as cash, appearing first on the balance sheet.

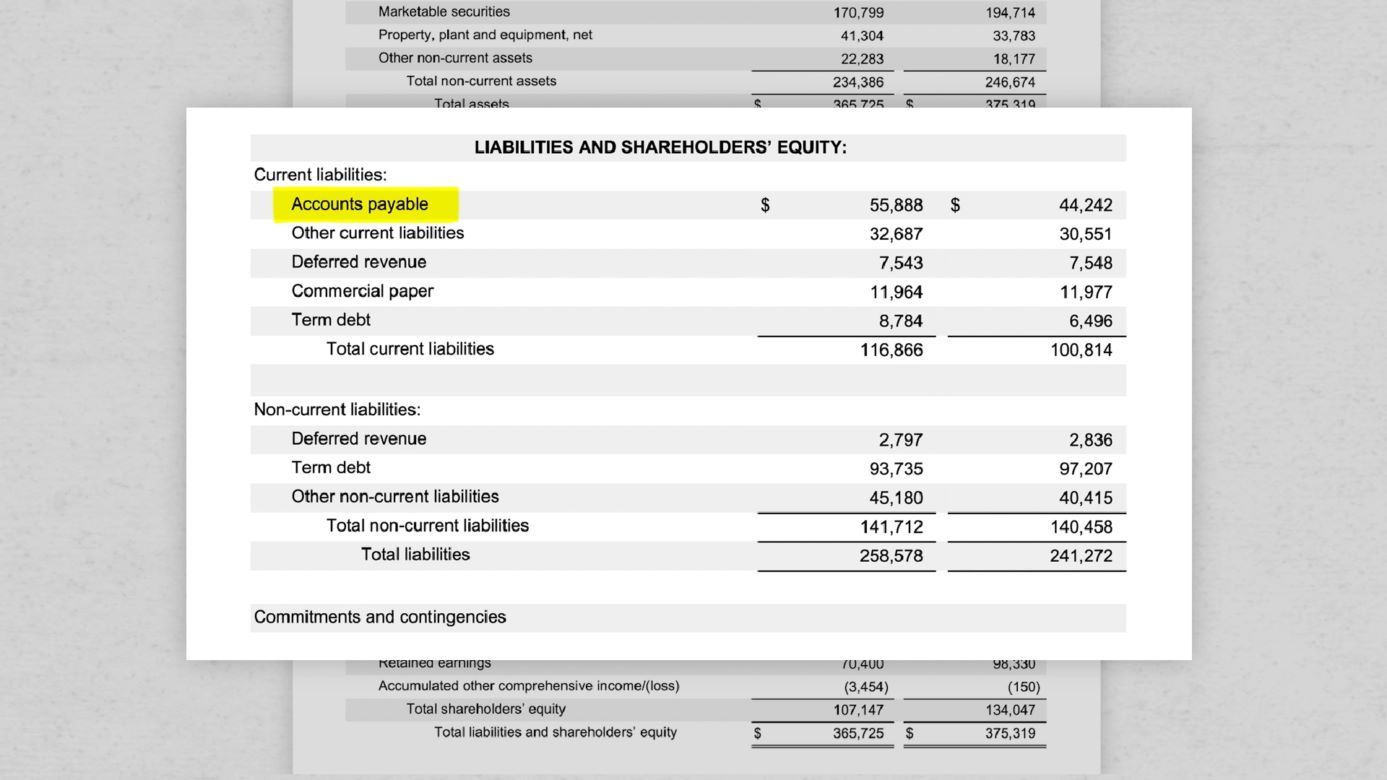

- Liabilities: Liabilities are the financial obligations or debts of a company. They can be classified as either current or long-term liabilities. Current liabilities include accounts payable, accrued expenses, and short-term borrowings. Long-term liabilities encompass long-term debt, leases, and other obligations that extend beyond one year. Liabilities are also presented in the order of maturity, with current liabilities appearing before long-term liabilities on the balance sheet.

- Equity: Equity represents the residual interest in the assets of a company after deducting its liabilities. It is often referred to as shareholders’ equity for publicly traded companies. Equity can be further divided into share capital, retained earnings, and additional paid-in capital. Share capital represents the initial funds invested by shareholders, while retained earnings include accumulated profits that have not been distributed as dividends. Additional paid-in capital refers to the funds received from shareholders in excess of the par value of the shares.

The balance sheet equation, also known as the accounting equation, is a fundamental concept in finance that governs the relationship between assets, liabilities, and equity. It states that assets must always equal the sum of liabilities and equity. This equation ensures that the balance sheet remains in balance, providing a clear and accurate representation of a company’s financial position.

Now that we have an understanding of the components of a balance sheet, let’s explore how negative equity affects this important financial statement.

Impact of Negative Equity on the Balance Sheet

When a company experiences negative equity, it has a significant impact on the balance sheet. Let’s examine how negative equity affects each of the components of the balance sheet:

- Assets: Negative equity reduces the overall value of a company’s assets. If the market value of assets decreases, while liabilities remain constant, the gap between the two widens, resulting in negative equity. For example, if a company’s assets were valued at $500,000 and it carries a debt of $600,000, the negative equity would amount to $100,000. This decrease in asset value can negatively impact the financial stability and creditworthiness of the company.

- Liabilities: Negative equity does not directly impact the amount owed in liabilities. However, it does expose the risk associated with the company’s financial health. Lenders and investors may be reluctant to provide additional financing or extend credit to a company with negative equity, as it suggests a higher risk of default. This could result in limited access to capital and higher borrowing costs for the business.

- Equity: Negative equity is reflected in the equity section of the balance sheet. Instead of having a positive value, equity is shown as a negative figure, indicating that the company’s liabilities outweigh its assets. Negative equity erodes shareholders’ value and can lead to a decline in investor confidence. It also limits the company’s ability to distribute dividends or repurchase shares.

Overall, negative equity on the balance sheet is a clear indicator of financial distress and can have far-reaching implications for a company’s operations and growth prospects. It is crucial for businesses to address negative equity and take appropriate measures to restore a positive equity position.

Next, we will delve into the impact of negative equity on financial ratios, which provide further insights into a company’s financial health.

Effect on Financial Ratios

When a company has negative equity, it has a profound impact on its financial ratios. Financial ratios are important tools used by investors, creditors, and analysts to assess a company’s financial performance, profitability, and solvency. Let’s explore how negative equity can influence some key financial ratios:

- Debt-to-Equity Ratio: The debt-to-equity ratio measures the proportion of a company’s financing that comes from debt compared to equity. A higher ratio indicates a higher reliance on debt financing. When a company has negative equity, the debt-to-equity ratio becomes distorted. This is because the equity component is negative, resulting in an artificially inflated ratio. Creditors may be hesitant to lend to a company with a high debt-to-equity ratio, as it reflects an increased risk of default.

- Return on Equity (ROE): ROE measures the profitability of a company in relation to the equity invested by shareholders. Negative equity severely impacts the ROE calculation since the equity component is negative. As a result, the ROE ratio will also be negative, indicating that the company is generating losses rather than profits. This can be concerning for investors and may result in a decline in the company’s valuation.

- Return on Assets (ROA): ROA measures a company’s ability to generate profits from its assets. Negative equity decreases the overall value of assets, which in turn affects the ROA calculation. As the numerator (net income) remains constant or decreases while the denominator (total assets) decreases, the ROA ratio may be distorted or reduced. A lower ROA ratio suggests lower profitability and efficiency in utilizing the company’s assets.

These are just a few examples of how negative equity impacts financial ratios. There are numerous other ratios, such as the current ratio, interest coverage ratio, and profitability ratios, that can be influenced by negative equity.

Understanding the effect of negative equity on financial ratios is essential for evaluating a company’s financial performance and making informed investment decisions. It highlights the need for businesses to address negative equity and take corrective measures to improve their financial position.

Next, let’s discuss some strategies for managing negative equity.

Managing Negative Equity

Managing negative equity is crucial for businesses to restore their financial health and improve their overall balance sheet. While the actions required will vary depending on the specific circumstances, here are some strategies that companies can consider:

- Improving Financial Performance: Businesses can focus on enhancing their profitability by implementing cost-cutting measures, increasing sales revenue, and optimizing their operations. By improving their financial performance, companies can generate higher profits and reduce the impact of negative equity on their balance sheets.

- Reducing Debt: Companies can explore options to reduce their debt burden, such as renegotiating loan terms, refinancing at lower interest rates, or restructuring debt. By reducing debt obligations, businesses can improve their equity position and decrease the negative impact of liabilities on their balance sheet.

- Increasing Equity Capital: Raising additional equity capital through various means, such as issuing new shares or seeking investment from external sources, can help enhance a company’s equity position. This infusion of fresh capital can offset the negative impact of liabilities and improve the overall financial stability of the business.

- Asset Disposal: Companies may consider selling non-core or underperforming assets to generate cash and reduce their liabilities. This can help alleviate the negative equity situation by decreasing the gap between assets and liabilities.

- Strategic Partnerships or Mergers: Collaborating with strategic partners or exploring merger opportunities can provide access to additional resources, expertise, and capital. This can help strengthen the company’s financial position, alleviate negative equity, and create synergies that lead to improved business performance.

It is important for businesses to carefully assess their options and develop a comprehensive plan tailored to their specific circumstances. Seeking professional advice from financial experts or engaging the services of turnaround specialists may also be beneficial in managing negative equity effectively.

By implementing these strategies and taking proactive measures, companies can work towards reducing negative equity, improving their financial position, and regaining the confidence of stakeholders.

Now, let’s wrap up our discussion.

Conclusion

In conclusion, negative equity has significant implications for a company’s balance sheet and overall financial health. It occurs when the value of assets falls below the outstanding liabilities, leading to a negative equity position. Understanding the impact of negative equity is crucial for stakeholders, as it provides insights into a company’s solvency and financial stability.

From a balance sheet perspective, negative equity reduces the value of assets, exposes the risk associated with liabilities, and results in a negative equity figure. This can hinder a company’s ability to attract financing, access capital, and make sound investment decisions.

Furthermore, negative equity distorts key financial ratios, such as the debt-to-equity ratio, return on equity (ROE), and return on assets (ROA). These ratios are essential tools used by investors and creditors to assess a company’s financial performance and profitability.

To manage negative equity, businesses can implement various strategies, including improving financial performance, reducing debt, increasing equity capital, disposing of assets, or pursuing strategic partnerships or mergers. Each company’s situation will require a tailored approach, and seeking professional advice can be beneficial in developing an effective plan.

In conclusion, addressing negative equity is vital for companies to restore their financial health, improve their balance sheets, and regain stakeholder confidence. Taking proactive measures and implementing appropriate strategies can lead to a positive equity position and set the stage for long-term growth and success.

Thank you for joining us on this comprehensive journey exploring the impact of negative equity on the balance sheet. We hope this guide has provided valuable insights and knowledge to assist you in navigating the complexities of managing negative equity effectively.