Home>Finance>How Are Accounts Receivable Classified On The Balance Sheet

Finance

How Are Accounts Receivable Classified On The Balance Sheet

Published: December 27, 2023

Learn how accounts receivable are classified on the balance sheet in finance. Understand the importance of managing and analyzing this crucial aspect of your business.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Accounts receivable are an essential component of a company’s financial statements, specifically the balance sheet. They represent the amount of money owed to a business by its customers or clients for goods or services provided on credit. A crucial aspect of managing accounts receivable is the classification on the balance sheet, which helps provide a clear picture of the company’s financial position and health.

When classifying accounts receivable, businesses need to carefully consider the nature of the receivables and their estimated collection time. This classification is important for several reasons, including proper valuation, accurate financial reporting, and effective management of cash flow.

In this article, we will delve into the various classifications of accounts receivable on the balance sheet and understand their significance.

Let’s now explore the importance of properly classifying accounts receivable before delving into the different classifications on the balance sheet, such as current assets, notes receivable, trade receivables, non-trade receivables, and the classification relating to bad debts and the allowance for doubtful accounts.

Definition of Accounts Receivable

Accounts receivable refer to the outstanding amount of money that a company is owed by its customers or clients for the goods or services provided on credit. It represents a company’s right to receive payment for products or services delivered to its customers in the normal course of business. Accounts receivable are considered as a valuable asset on a company’s balance sheet.

Typically, when a business sells its products or services on credit, it issues an invoice to the customer specifying the amount owed and the payment terms. The customer then becomes a debtor and the amount owed is recorded as an account receivable in the company’s financial records. The amount owed is expected to be collected within a certain period, usually known as the payment term.

Accounts receivable can arise from various activities such as the sale of goods, provision of services, or lending money. They represent a company’s short-term credit transactions, often with a maturity period not exceeding one year. These receivables are considered important for the company’s cash flow and profitability, as they represent future cash inflows.

It is worth noting that accounts receivable are distinct from accounts payable. While accounts receivable represent the money owed to a company, accounts payable represent the money that a company owes to its suppliers or creditors.

Proper management of accounts receivable is crucial for a company’s financial stability and success. It requires effective credit policies, accurate tracking of outstanding amounts, timely collections, and proactive measures to address any potential bad debts.

Now that we have a clear understanding of what accounts receivable are, let’s explore the importance of classifying them on the balance sheet.

Importance of Classifying Accounts Receivable

Classifying accounts receivable on the balance sheet is vital for several reasons. It provides valuable insights into a company’s financial position, helps in accurate financial reporting, and enables effective management of cash flow. Let’s examine the importance of this classification in more detail:

- Clear Financial Picture: Classifying accounts receivable allows stakeholders, such as investors, lenders, and potential buyers, to understand the company’s financial standing. It provides transparency regarding the amount of money owed by customers, which is crucial in evaluating the company’s liquidity and solvency.

- Accurate Financial Reporting: Proper classification of accounts receivable ensures compliance with accounting standards and regulations. It allows for the accurate representation of the company’s financial statements, including the balance sheet and income statement. This accuracy is essential for stakeholders who rely on these reports for decision-making purposes.

- Evaluation of Credit Policies: Classifying accounts receivable helps assess the effectiveness of a company’s credit policies. By analyzing the aging of receivables, which categorizes outstanding balances based on the length of time they have been due, businesses can identify customers with longer payment cycles and potential credit risks. This information is vital for adjusting credit terms, setting credit limits, and improving collection strategies.

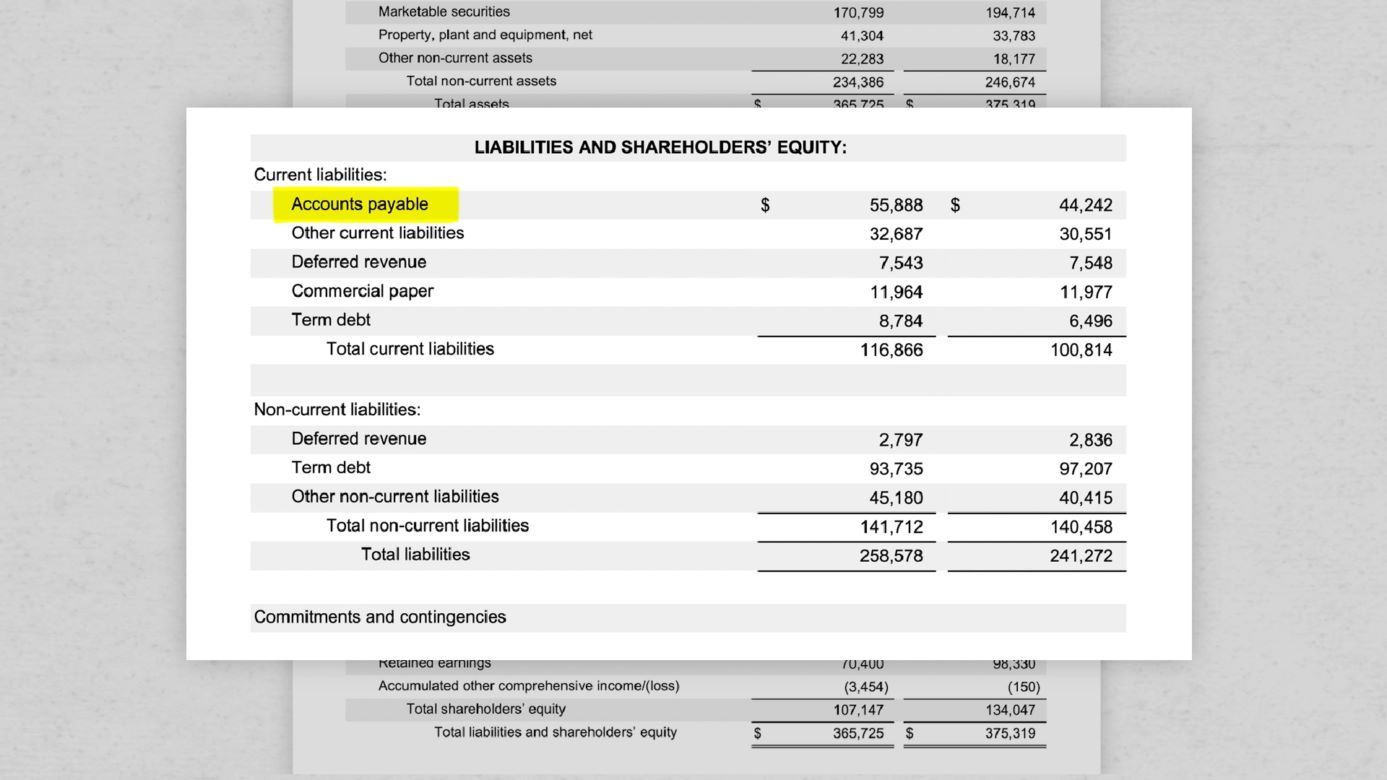

- Cash Flow Management: Proper classification assists in managing cash flow effectively. By distinguishing between current assets and long-term assets, companies can assess their short-term liquidity. The balance between accounts receivable and accounts payable plays a crucial role in ensuring a healthy and consistent cash flow for daily operations, working capital needs, and investment opportunities.

- Forecasting and Planning: The classification of accounts receivable provides insights into future revenue streams. By analyzing the historical collection patterns and the aging of receivables, businesses can make informed predictions about future cash inflows, allowing for effective financial forecasting and planning.

Overall, classifying accounts receivable on the balance sheet is essential for accurate financial reporting, managing cash flow, evaluating credit policies, and providing stakeholders with a clear understanding of a company’s financial position. It plays a crucial role in maintaining the financial stability and success of the business.

Current Assets Classification

When classifying accounts receivable on the balance sheet, one common classification is under current assets. Current assets are those that are expected to be converted into cash or used up within the normal operating cycle of a business, typically one year.

Accounts receivable classified as a current asset reflects the expectation that they will be collected within the next operating cycle. This classification indicates that the company expects to receive payment from its customers within a relatively short period. It represents the company’s short-term investment in outstanding invoices that are yet to be converted into cash.

The current assets section of the balance sheet includes other assets that are expected to be used up or converted into cash within the same period. These may include cash and cash equivalents, short-term investments, inventory, and prepaid expenses.

Classifying accounts receivable as a current asset is significant for several reasons:

- Liquidity Assessment: By classifying accounts receivable as a current asset, businesses can assess their short-term liquidity. It helps determine whether the company has enough cash and other assets readily available to cover immediate obligations.

- Working Capital Calculation: Current assets, including accounts receivable, are an integral part of calculating a company’s working capital. Working capital represents the financial resources available for daily operations and is calculated by subtracting current liabilities from current assets.

- Investor and Creditor Evaluation: The classification of accounts receivable as a current asset provides insight into a company’s ability to generate cash flow from its operations in the near term. Potential investors and creditors evaluate this information to assess the company’s financial health and its ability to meet short-term obligations.

- Management of Cash Flow: Proper classification of accounts receivable as a current asset aids in managing cash flow effectively. The balance between accounts receivable and accounts payable helps ensure a smooth inflow of cash to cover expenses and investments in the company’s daily operations.

Overall, the current assets classification of accounts receivable on the balance sheet helps provide a snapshot of a company’s short-term liquidity, working capital, and ability to meet immediate financial obligations. It is crucial for financial analysis, decision-making, and maintaining a healthy cash flow position.

Notes Receivable Classification

In addition to classifying accounts receivable as current assets, companies may also have notes receivable, which are categorized separately on the balance sheet. Notes receivable represent a formal written promise to pay a specified amount of money on a specific date or upon demand.

Notes receivable have a more structured repayment plan compared to regular accounts receivable. They often include an agreement on interest payments, maturity dates, and any collateral provided as security. Notes receivable typically arise from transactions such as loans, installment sales, or any other formal financial agreements.

When classifying notes receivable on the balance sheet, they are listed as assets under a separate category from accounts receivable. This allows for better tracking and evaluation of these specific financial arrangements.

The classification of notes receivable is important for several reasons:

- Distinct Financial Arrangements: Separately classifying notes receivable distinguishes them from regular accounts receivable, as the repayment terms and nature of these transactions tend to be more structured and formalized.

- Interest Revenue Recognition: Notes receivable often involve an interest component. By classifying them separately, businesses can properly recognize and report interest revenue accrued from these financial agreements.

- Risk Assessment: The classification of notes receivable allows for a more accurate assessment of the risks associated with these specific financial arrangements. It helps evaluate factors such as the creditworthiness of the borrower, the presence of collateral, and the overall performance and reliability of the note holder.

- Investor Analysis: Separate classification provides investors with greater visibility into the company’s exposure to long-term financial agreements and their potential impact on the company’s financial position.

- Loan Portfolio Analysis: For financial institutions and lending organizations, the classification of notes receivable allows for a comprehensive analysis of their loan portfolio. It helps identify the total outstanding loan balances, interest income, and the overall credit quality of the borrowers.

By separately classifying notes receivable on the balance sheet, companies can effectively track and evaluate these financial arrangements. It provides transparency, enables appropriate revenue recognition, and allows for better risk assessment and analysis.

Trade Receivables Classification

Trade receivables, also known as trade accounts receivable, represent the outstanding balances owed to a company from the sale of goods or services in the normal course of business. When classifying accounts receivable on the balance sheet, trade receivables are a significant category to consider.

Trade receivables are typically short-term in nature, with payment expected within a short period defined by the terms of the sale. They arise from credit sales made to customers who are buying the company’s products or services for their own use or resale. These receivables form a vital part of a company’s working capital as they represent the credit extension granted to customers.

When classifying trade receivables on the balance sheet, they are typically listed as a current asset, along with other short-term assets and current liabilities. This classification provides a clear understanding of the company’s expected inflows from its core business operations.

Trade receivables classification is important for several reasons:

- Determining Sales Revenue: Trade receivables reflect the amount of revenue earned by the company from credit sales. Proper classification ensures accurate reporting of sales revenue on the income statement.

- Cash Flow Planning: By classifying trade receivables, businesses can project and plan their future cash inflows. This information is essential for managing day-to-day operations, ensuring sufficient cash flow for operational expenses, and making strategic decisions.

- Credit Management: Classification of trade receivables helps with effective credit management. Businesses can analyze the aging of trade receivables, identifying overdue accounts and potential bad debts. This information guides credit policies, collection efforts, and the establishment of credit limits for customers.

- Financial Analysis: Trade receivables are a key indicator of a company’s liquidity and profitability. Investors, lenders, and stakeholders analyze the trade receivables balance to evaluate the company’s ability to generate cash flow and assess its creditworthiness.

- Working Capital Management: Trade receivables impact a company’s working capital, which represents the funds available for day-to-day operations. Effective management of trade receivables ensures better working capital management and overall financial stability.

By appropriately classifying trade receivables on the balance sheet, companies can monitor and manage their credit sales, revenue, cash flow, and overall financial health. It provides valuable insights for effective credit management, cash flow planning, and financial analysis.

Non-Trade Receivables Classification

In addition to trade receivables, companies may also have non-trade receivables that need to be classified separately on the balance sheet. Non-trade receivables refer to amounts owed to a company that are not related to its core business operations of selling goods or services. These receivables arise from various sources and can have different characteristics than trade receivables.

Non-trade receivables can include amounts owed to a company for reasons such as loans to employees, advances to suppliers, tax refunds, insurance claims, or any other non-operational transactions that result in an outstanding balance. The classification of non-trade receivables on the balance sheet helps provide transparency and better understanding of these receivables.

When classifying non-trade receivables, it is crucial to differentiate them from trade receivables and other current assets. They should be listed under a separate category to ensure clear identification and accurate reporting.

The classification of non-trade receivables is important for several reasons:

- Distinct Nature: Non-trade receivables represent financial obligations owed to a company for reasons other than the sale of goods or services. Separately classifying them helps in identifying these unique sources of debt.

- Transparency and Evaluation: The classification of non-trade receivables provides transparency in financial reporting and allows stakeholders to assess the nature and significance of these receivables. It enables evaluation of the company’s exposure to non-core business transactions.

- Legal and Compliance Requirements: Certain non-trade receivables, such as tax refunds or insurance claims, may have specific legal or regulatory requirements for reporting and treatment. Proper classification ensures compliance with these requirements and accurate financial reporting.

- Risk Assessment: The classification of non-trade receivables enables a more accurate assessment of the risks associated with these specific receivables. It helps evaluate factors such as repayment terms, collateral, and the likelihood of collection.

- Investor Analysis: Separate classification provides investors and creditors with insight into the company’s exposure to non-operational receivables, which may impact its financial position and risk profile.

By properly classifying non-trade receivables on the balance sheet, companies can accurately report and assess these unique financial obligations. It provides transparency, facilitates compliance with legal and regulatory requirements, and aids in risk assessment and financial analysis.

Bad Debts and Allowance for Doubtful Accounts Classification

When classifying accounts receivable on the balance sheet, it is essential to consider the potential for bad debts or uncollectible amounts. Bad debts refer to the portion of accounts receivable that a company estimates will not be collected due to customer defaults, bankruptcy, or other factors. To account for this anticipated loss, companies create an allowance for doubtful accounts.

The classification of bad debts and the allowance for doubtful accounts is crucial for accurate financial reporting. It involves estimating and recording the potential losses associated with uncollectible receivables, adjusting the carrying value of accounts receivable appropriately. This classification helps communicate the financial impact of anticipated bad debts to stakeholders.

Here’s why the classification of bad debts and the allowance for doubtful accounts is important:

- Accurate Financial Reporting: By classifying bad debts and the allowance for doubtful accounts, companies adhere to accounting principles such as matching the expense to revenue. This classification reflects the potential losses, ensuring that the balance sheet truly represents the net realizable value of accounts receivable.

- Proper Valuation of Accounts Receivable: The allowance for doubtful accounts is a contra-asset account that offsets the accounts receivable balance. This classification recognizes that not all accounts receivable will be collected in full. It provides a more realistic valuation of accounts receivable by accounting for potential losses inherent in the collection process.

- Effective Risk Management: Classifying bad debts and the allowance for doubtful accounts aids in risk assessment and risk management. It allows companies to evaluate the creditworthiness of customers, identify potential problem accounts, and take proactive measures to mitigate the risk of bad debts.

- Financial Analysis: Separately classifying the allowance for doubtful accounts helps stakeholders analyze the company’s exposure to potential losses from uncollectible accounts. It provides insight into the company’s credit quality, collection efforts, and overall financial health.

- Regulatory Compliance: Classifying bad debts and the allowance for doubtful accounts ensures compliance with accounting standards and regulations, such as the Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). This classification helps accurately represent the financial position and performance of the company.

By appropriately classifying bad debts and the allowance for doubtful accounts, companies present a more accurate picture of their financial position and the potential risks associated with uncollectible receivables. It allows for effective risk management, compliance with accounting standards, and informed decision-making by stakeholders.

Conclusion

Proper classification of accounts receivable on the balance sheet is crucial for portraying an accurate financial picture, facilitating effective financial management, and providing transparency to stakeholders. Understanding and classifying accounts receivable involves categorizing them based on their nature and expected collection time.

Accounts receivable can be classified as current assets, representing the short-term credit extended to customers. This classification helps assess liquidity, working capital, and cash flow management. Additionally, notes receivable, which involve more structured repayment terms, are classified separately to provide better tracking and evaluation of these specific financial arrangements.

Trade receivables, arising from the sale of goods or services, are a key classification. They enable accurate revenue recognition, cash flow planning, and assessment of credit management. Non-trade receivables, on the other hand, encompass amounts owed for non-operational transactions and must be classified separately for transparency and evaluation.

Furthermore, classifying bad debts and creating an allowance for doubtful accounts is crucial to account for anticipated losses from uncollectible receivables. This classification enhances financial reporting accuracy, accounts for potential valuation adjustments, and facilitates proactive risk management.

In conclusion, the proper classification of accounts receivable on the balance sheet provides crucial information for evaluating a company’s financial position, managing cash flow, assessing credit policies, and making informed decisions. It plays a vital role in ensuring accurate financial reporting and maintaining the financial stability and success of businesses.