Finance

How To Trade Credit Default Swaps

Published: March 4, 2024

Learn the basics of trading credit default swaps in the finance market. Understand the risks and opportunities involved in CDS trading. Gain insights and strategies for successful CDS trading.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the complex yet intriguing world of credit default swaps (CDS). In this article, we will delve into the fundamentals of CDS trading, exploring its intricacies, risks, and potential rewards. Whether you're a seasoned investor or a newcomer to the financial realm, understanding the mechanisms of CDS is crucial in navigating the ever-evolving landscape of financial markets.

Credit default swaps are derivative instruments that enable investors to hedge against the risk of default on debt obligations or speculate on the creditworthiness of a particular entity. The allure of CDS lies in its potential to provide protection against credit events, thereby mitigating the impact of defaults or downgrades. However, it's essential to grasp the nuances of CDS trading to make informed decisions and effectively manage associated risks.

Throughout this article, we will explore the intricacies of credit default swaps, shedding light on the risks and benefits they entail. Moreover, we will outline the essential steps involved in trading CDS and discuss the critical factors that should be carefully considered before venturing into this domain.

Join us on this insightful journey as we demystify the world of credit default swaps, equipping you with the knowledge and understanding necessary to navigate the complexities of CDS trading. Whether you're seeking to bolster your investment portfolio or enhance your comprehension of financial instruments, this exploration of credit default swaps will provide valuable insights and practical guidance.

Understanding Credit Default Swaps

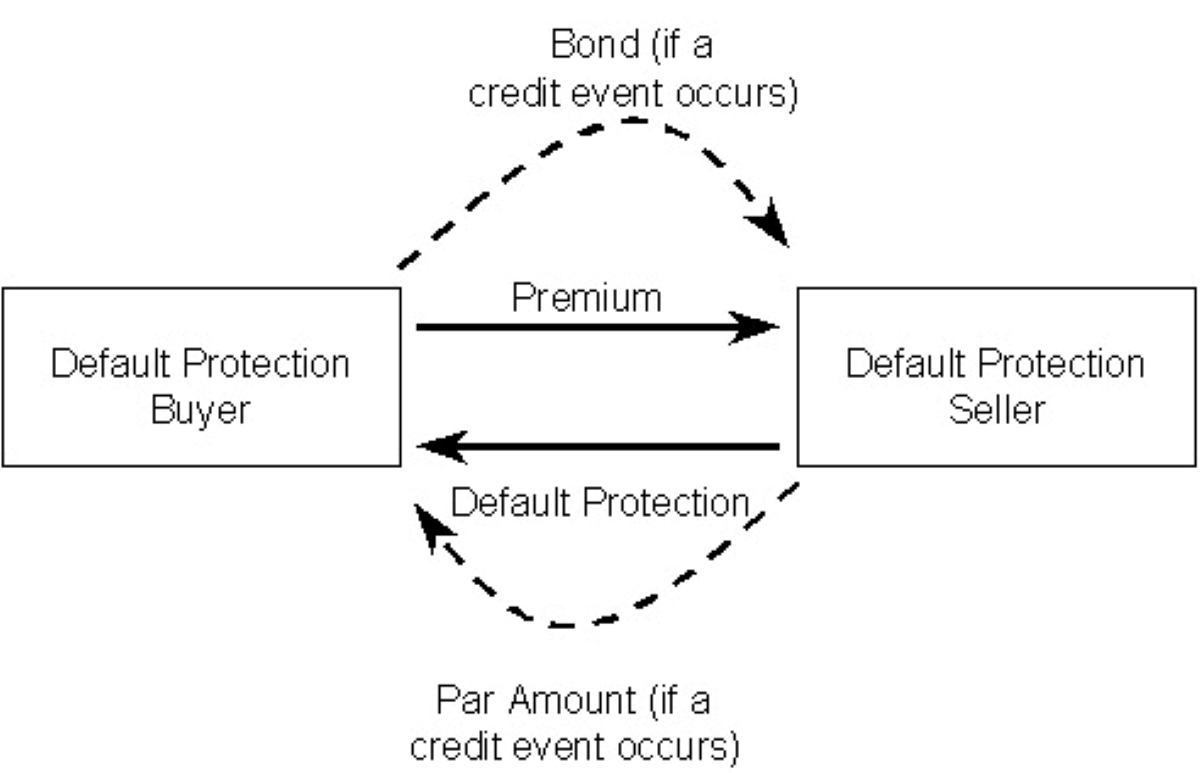

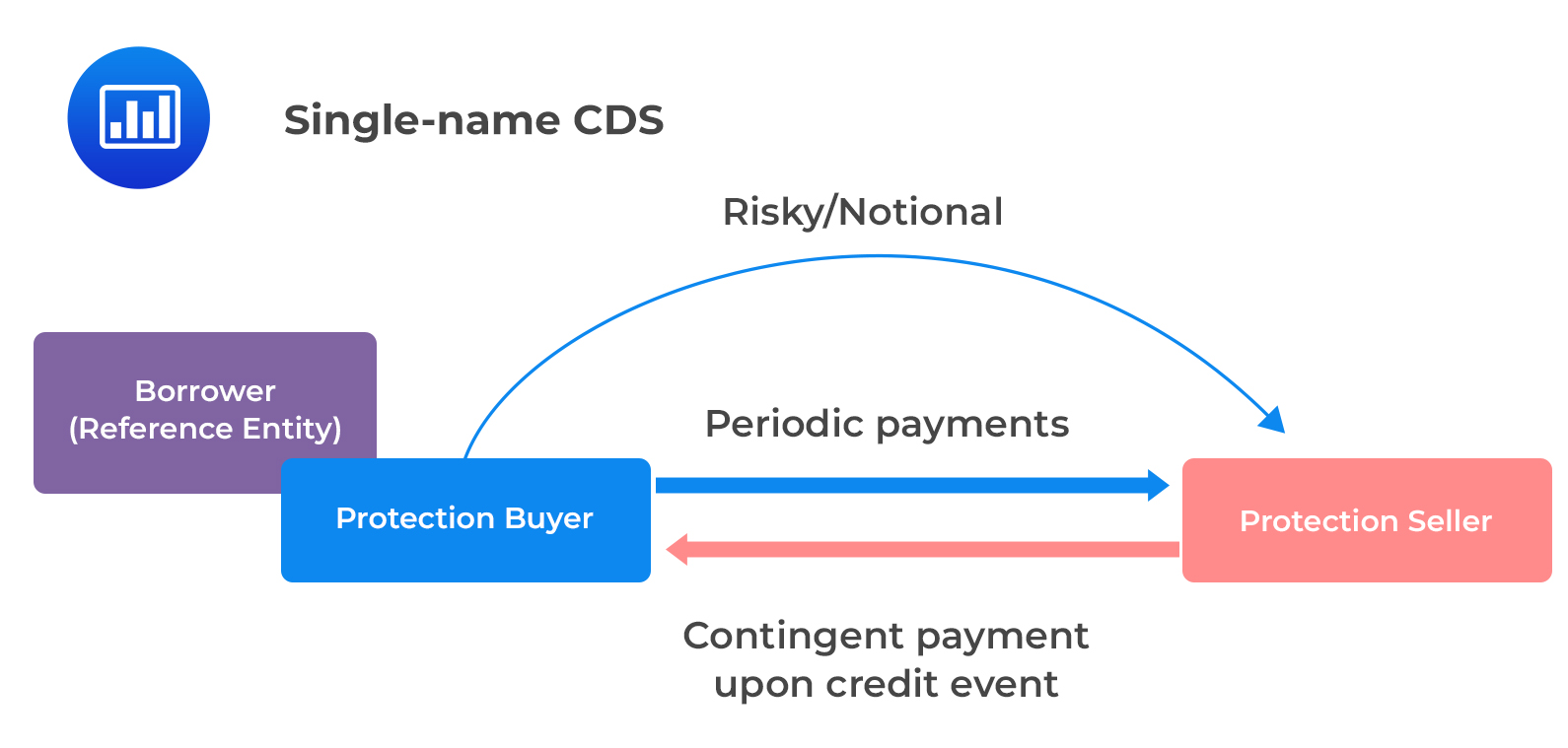

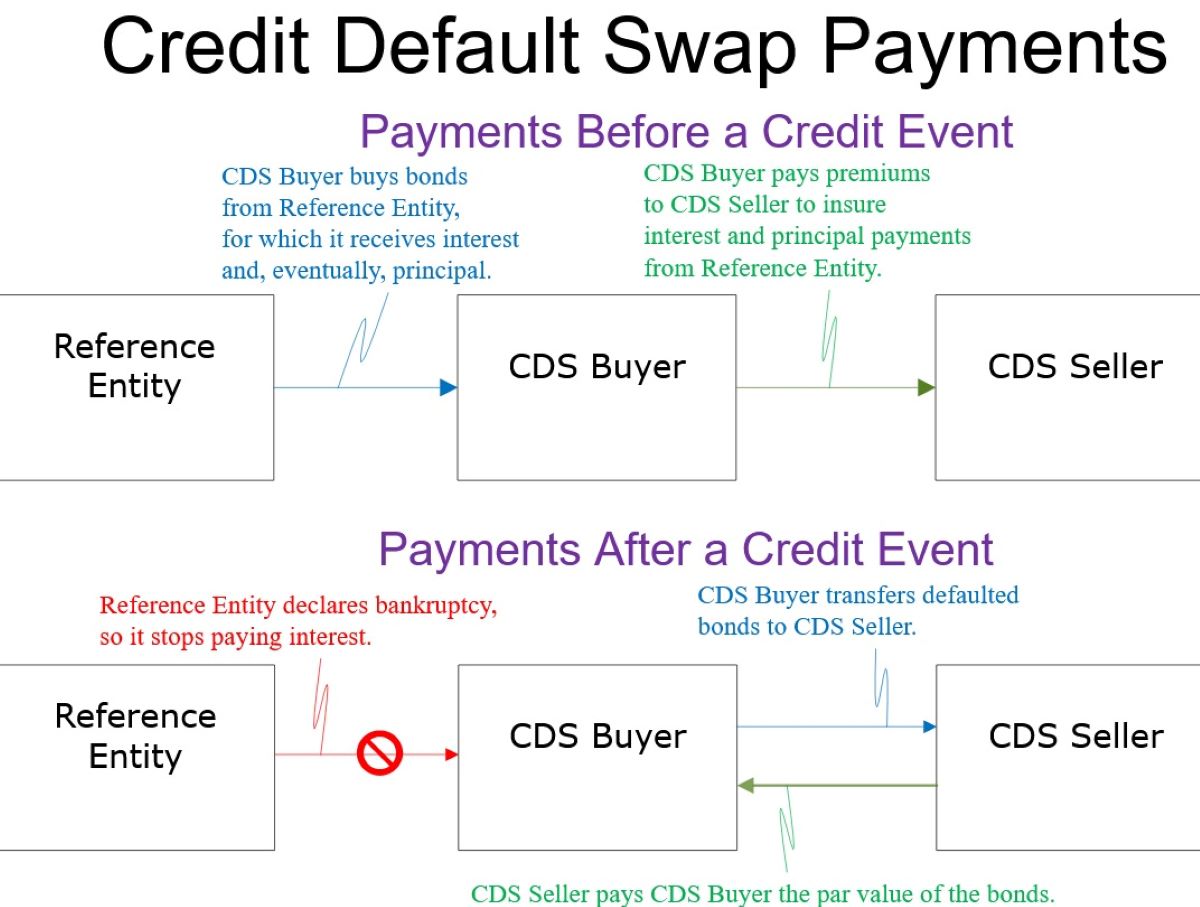

To comprehend credit default swaps (CDS), it’s vital to grasp their underlying concept and functionality. At its core, a CDS serves as a form of insurance against the default of a specific debt instrument, such as a corporate or sovereign bond. Essentially, the buyer of a CDS pays a premium to the seller in exchange for protection against potential credit events, such as defaults or restructuring of the underlying debt.

When a credit event occurs, the protection seller compensates the protection buyer for the loss incurred due to the default. This transfer of risk from the buyer to the seller forms the basis of a credit default swap. Notably, CDS can also be utilized for speculative purposes, allowing investors to take positions on the credit quality of various entities without owning the underlying debt.

It’s important to recognize that credit default swaps are traded over-the-counter (OTC), which means they are not transacted on formal exchanges. Instead, CDS contracts are customized agreements between two parties, often facilitated by financial institutions or brokers. This bespoke nature of CDS contracts provides flexibility but also introduces counterparty risk, as the creditworthiness of the protection seller becomes a crucial consideration.

Furthermore, the notional value of a CDS does not require an upfront exchange of the full principal amount of the underlying debt. Instead, the premium is calculated based on the notional amount, which represents the value of the reference obligation. This characteristic enables investors to gain exposure to credit risk without holding the actual debt instrument, amplifying both the potential for profit and the risk of loss.

By understanding the mechanics of credit default swaps, investors can appreciate their role in managing credit risk and diversifying investment portfolios. However, it’s imperative to recognize the complexities and potential pitfalls associated with CDS trading, underscoring the need for thorough comprehension and diligent risk assessment.

Risks and Benefits of Credit Default Swaps

Credit default swaps (CDS) present a spectrum of risks and benefits that warrant careful consideration by investors. On one hand, CDS offer a range of potential advantages, including the ability to hedge against credit risk, diversify investment portfolios, and gain exposure to specific credit markets without owning the underlying debt instruments. Moreover, CDS can serve as a tool for speculation, allowing investors to take positions on the creditworthiness of entities and potentially capitalize on market movements.

However, the benefits of CDS are accompanied by inherent risks. One of the primary concerns is counterparty risk, which arises from the reliance on the financial stability of the protection seller. In the event of a default or insolvency of the protection seller, the protection buyer may face challenges in receiving the intended compensation, leading to potential financial losses.

Furthermore, the leverage inherent in credit default swaps can amplify both gains and losses, heightening the risk exposure for investors. The notional value of CDS contracts often exceeds the actual investment or capital deployed, magnifying the impact of market fluctuations. This leverage can accentuate profitability but also intensify potential downside, necessitating prudent risk management strategies.

Another consideration is the complexity of CDS contracts, which may pose challenges for investors in accurately assessing and understanding the associated risks. The intricacies of CDS, including the determination of credit events, settlement procedures, and valuation methodologies, can contribute to opacity and potential misinterpretation of contractual terms.

Despite these risks, credit default swaps remain a valuable instrument for managing credit exposure and implementing tailored investment strategies. By comprehensively evaluating the risks and benefits of CDS, investors can make informed decisions regarding their utilization, integrating them judiciously within their broader investment frameworks.

Steps to Trading Credit Default Swaps

Trading credit default swaps (CDS) involves a series of essential steps that are integral to navigating this specialized financial market. Whether you’re seeking to hedge against credit risk or capitalize on market opportunities, understanding the process of trading CDS is fundamental to effective participation in this domain.

Educational Foundation: Before engaging in CDS trading, it’s crucial to develop a comprehensive understanding of the underlying concepts, mechanisms, and market dynamics. Familiarizing oneself with the intricacies of credit default swaps, including the determination of credit events, valuation methodologies, and contractual terms, forms the bedrock of informed decision-making.

Selection of Counterparties: As CDS are typically traded over-the-counter (OTC), the selection of counterparties is a critical consideration. Establishing relationships with reputable and creditworthy financial institutions or counterparties is essential to mitigate counterparty risk and ensure the fulfillment of contractual obligations.

Assessment of Credit Risk: Prior to initiating CDS trades, conducting a thorough assessment of the credit risk associated with the underlying reference entities is imperative. This entails evaluating the creditworthiness, financial health, and market sentiment pertaining to the entities for which CDS protection is sought or offered.

Contract Negotiation and Documentation: The negotiation and documentation of CDS contracts entail the specification of terms, including the notional amount, premium payments, credit events, and settlement procedures. Engaging in clear and comprehensive contractual agreements is essential to delineate the rights and obligations of both parties involved in the CDS transaction.

Risk Management Strategies: Implementing robust risk management strategies is integral to prudent CDS trading. This involves the assessment of leverage, exposure limits, and potential scenarios to mitigate downside risks and optimize the risk-return profile of CDS positions.

Regulatory Compliance: Given the regulatory scrutiny and evolving landscape of financial markets, adherence to applicable regulations and compliance requirements is paramount. Staying abreast of regulatory developments and ensuring compliance with relevant frameworks is essential for responsible and sustainable CDS trading.

By methodically navigating these steps, investors and market participants can effectively engage in CDS trading, leveraging the potential benefits while prudently managing associated risks. Furthermore, maintaining a disciplined and informed approach to CDS trading is essential for fostering transparency, stability, and integrity within the broader financial ecosystem.

Factors to Consider Before Trading

Before delving into the realm of credit default swaps (CDS) trading, it’s essential to carefully evaluate a range of critical factors that can significantly impact the outcomes and experiences of market participants. By conscientiously considering these factors, investors can navigate the complexities of CDS trading with prudence and foresight, thereby enhancing the potential for informed decision-making and risk management.

Market Knowledge and Expertise: A foundational understanding of credit markets, financial instruments, and macroeconomic trends is indispensable for prospective CDS traders. Acquiring comprehensive knowledge and expertise in credit analysis, market dynamics, and regulatory frameworks forms the bedrock of informed participation in the CDS market.

Risk Appetite and Objectives: Clarifying risk appetite, investment objectives, and the role of CDS within the broader investment strategy is crucial. Whether seeking to hedge against credit risk, speculate on credit events, or diversify portfolios, aligning CDS trading activities with overarching investment goals is paramount.

Counterparty Selection and Due Diligence: Engaging in thorough due diligence and selecting reputable counterparties is essential to mitigate counterparty risk. Evaluating the creditworthiness, financial stability, and operational integrity of potential counterparties is integral to fostering trust and reliability in CDS transactions.

Regulatory and Legal Considerations: Adhering to regulatory requirements, legal frameworks, and compliance standards is imperative in CDS trading. Staying informed about regulatory developments, understanding the legal implications of CDS contracts, and ensuring compliance with applicable laws are critical considerations for market participants.

Risk Management Strategies: Developing robust risk management strategies tailored to the specificities of CDS trading is essential. This encompasses the assessment of leverage, exposure limits, stress testing, and scenario analysis to prudently manage risks and optimize the risk-return profile of CDS positions.

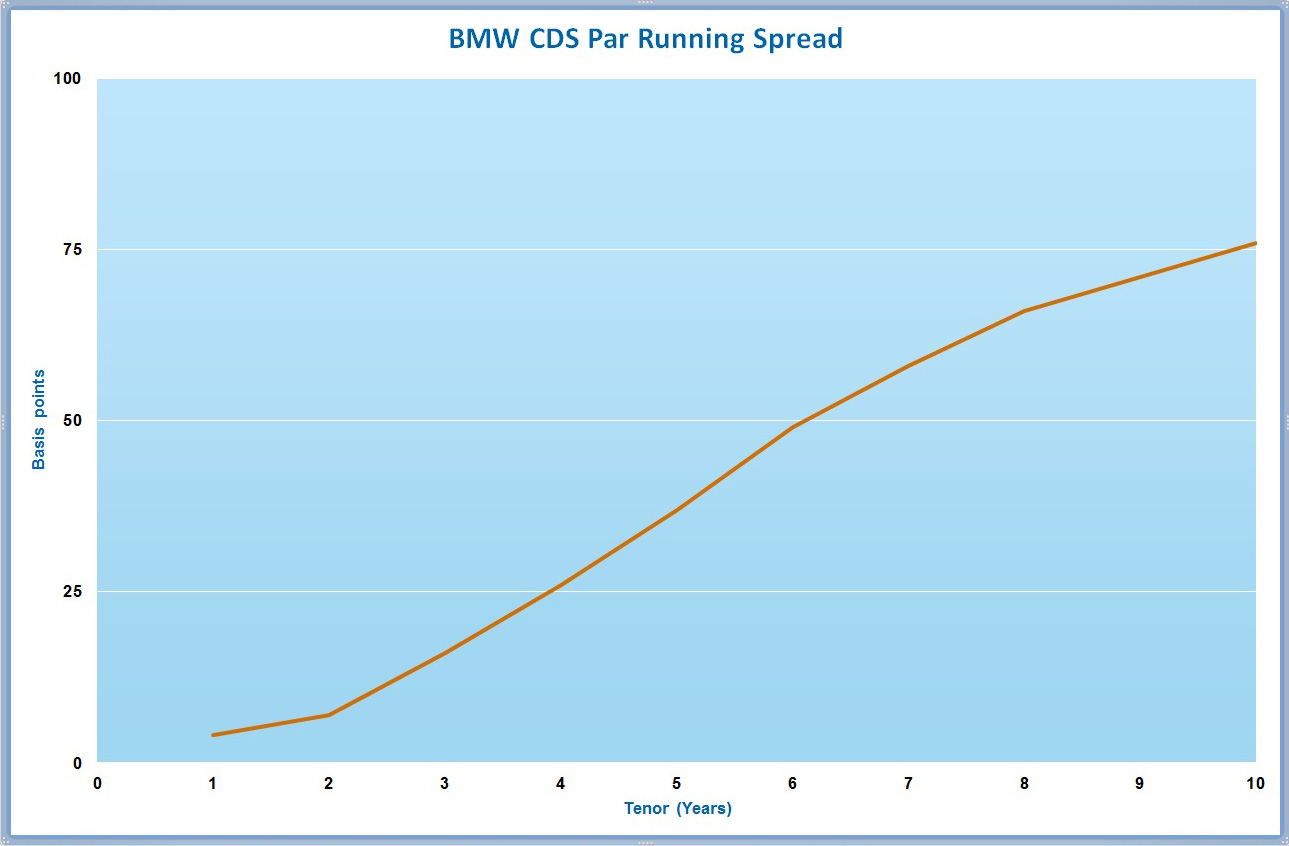

Market Liquidity and Pricing Dynamics: Assessing market liquidity, pricing mechanisms, and the availability of reliable market data is crucial for effective CDS trading. Understanding the nuances of CDS pricing, bid-ask spreads, and market depth facilitates informed decision-making and execution of CDS transactions.

By conscientiously considering these factors, prospective CDS traders can cultivate a comprehensive understanding of the intricacies and considerations inherent in CDS trading. This informed approach empowers market participants to navigate the complexities of CDS markets with diligence, prudence, and a focus on long-term sustainability and success.

Conclusion

As we conclude our exploration of credit default swaps (CDS), it’s evident that these financial instruments occupy a unique and multifaceted role within the realm of global finance. The intricacies of CDS trading, encompassing both risks and benefits, underscore the importance of informed decision-making, comprehensive risk assessment, and diligent market participation.

While CDS offer avenues for hedging against credit risk, diversifying portfolios, and speculating on credit events, it’s essential for market participants to approach CDS trading with a nuanced understanding of the underlying mechanisms and associated considerations. From the selection of counterparties to the development of robust risk management strategies, each facet of CDS trading demands careful attention and expertise.

Moreover, the evolving regulatory landscape and market dynamics necessitate ongoing vigilance and adaptability in navigating the complexities of CDS trading. Adhering to regulatory frameworks, staying abreast of market developments, and integrating best practices in risk management are integral to fostering transparency, stability, and integrity within the CDS market.

Ultimately, the prudent and informed engagement in CDS trading is predicated on a foundation of market knowledge, risk awareness, and a commitment to regulatory compliance. By conscientiously considering the multifaceted factors that influence CDS trading, market participants can cultivate a disciplined and sustainable approach, thereby contributing to the resilience and efficacy of the broader financial ecosystem.

As we continue to navigate the intricacies of financial markets, the insights gained from this exploration of credit default swaps serve as a compass for informed decision-making, responsible market participation, and the pursuit of sustainable financial outcomes. By embracing a holistic understanding of CDS and integrating best practices in trading, investors and market participants can harness the potential of credit default swaps while navigating the associated complexities with prudence and foresight.