Home>Finance>Cash Collected On Accounts Receivable Would Produce What Effect On The Balance Sheet?

Finance

Cash Collected On Accounts Receivable Would Produce What Effect On The Balance Sheet?

Modified: February 21, 2024

Cash collected on accounts receivable can positively impact the balance sheet, improving liquidity and reducing outstanding debts. Learn more about its transformative effect on finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Cash Collected on Accounts Receivable

- Understanding the Balance Sheet

- Effect of Cash Collected on Accounts Receivable on the Balance Sheet

- Increase in Cash Asset

- Decrease in Accounts Receivable

- Understanding the Accounts Receivable Turnover Ratio

- Impact on Current Ratio and Working Capital

- Conclusion

Introduction

Welcome to the world of finance where understanding the intricacies of a balance sheet can provide valuable insights into the financial health of a company. One key aspect of a balance sheet is the management of accounts receivable, which refers to the money owed to a company by its customers for goods or services provided on credit.

As a business, it is essential to carefully monitor and manage accounts receivable to ensure a healthy cash flow. This involves regular follow-ups and collections from customers. But have you ever wondered what effect the cash collected on accounts receivable has on the balance sheet?

In this article, we will delve into the impact of cash collected on accounts receivable and how it influences the balance sheet. Understanding this aspect is crucial for businesses to assess their liquidity, working capital, and overall financial strength.

So, let’s dive in and explore how cash collected on accounts receivable can shape the financial standing of a company and determine its future growth opportunities.

Definition of Cash Collected on Accounts Receivable

Before we delve into the effects of cash collected on accounts receivable on the balance sheet, let’s first understand what it means. Cash collected on accounts receivable refers to the payments received from customers in exchange for the goods or services provided on credit.

When a company extends credit to its customers, it records the amount as accounts receivable on its balance sheet. These receivables represent the amount owed by customers and are typically categorized as current assets. As customers make payments, the company collects the cash, reducing the accounts receivable balance.

Cash collected on accounts receivable is a vital component of a company’s cash flow, as it directly impacts its liquidity and ability to finance ongoing operations. It reflects the conversion of sales made on credit into cash, providing the funds necessary for the company to meet its financial obligations and invest in growth opportunities.

Efficient management of accounts receivable, including timely and effective collection of cash, is crucial for maintaining a healthy cash flow and optimizing operational efficiency. It allows businesses to effectively manage their working capital and minimize the risk of bad debts.

Now that we have a clear understanding of what cash collected on accounts receivable entails, let’s explore its impact on the balance sheet.

Understanding the Balance Sheet

Before we dive into the effects of cash collected on accounts receivable, it’s essential to have a solid understanding of the balance sheet itself. The balance sheet is one of the fundamental financial statements used by businesses to provide a snapshot of their financial position at a specific point in time.

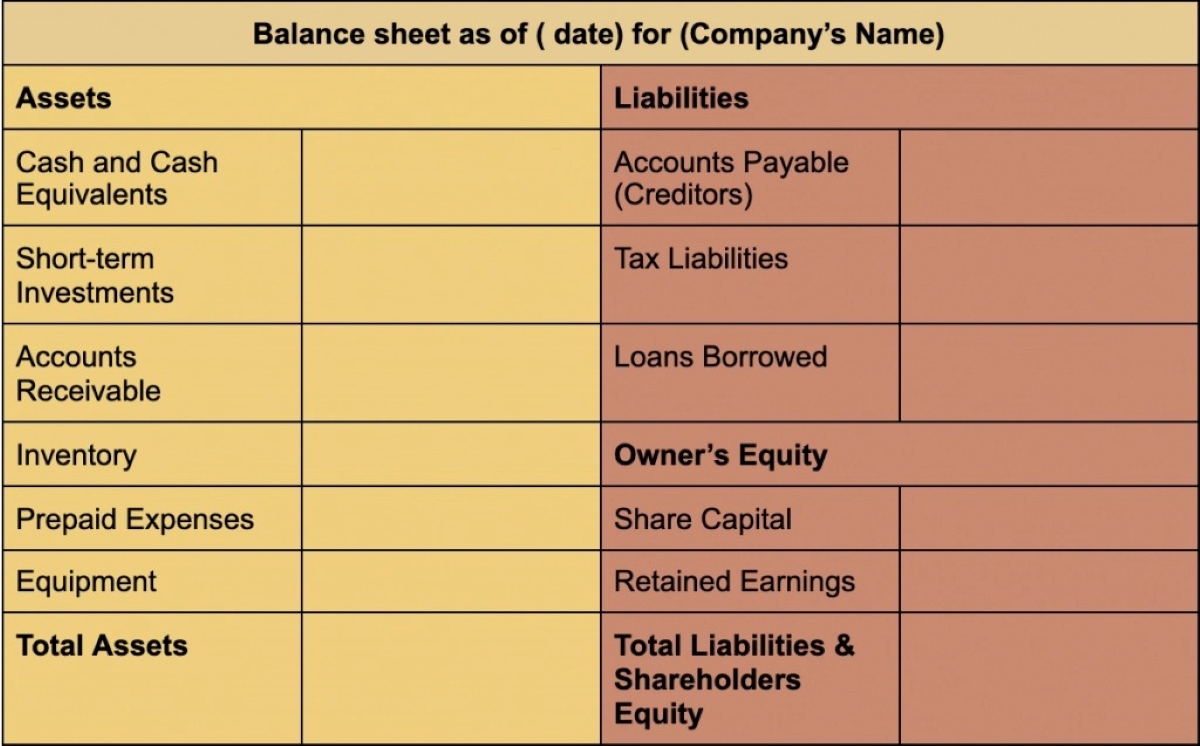

The balance sheet consists of three main sections: assets, liabilities, and equity. Assets represent what the company owns, liabilities indicate what the company owes, and equity represents the residual interest of the owners in the business.

The balance sheet follows the formula: Assets = Liabilities + Equity. It reflects the company’s financial resources and how those resources are financed through debt or equity. It provides valuable information about a company’s liquidity, solvency, and overall financial health.

Assets are further categorized as current and non-current. Current assets are those that are expected to be converted into cash within a year, while non-current assets are expected to provide economic benefits beyond a year. Accounts receivable falls under the category of current assets on the balance sheet.

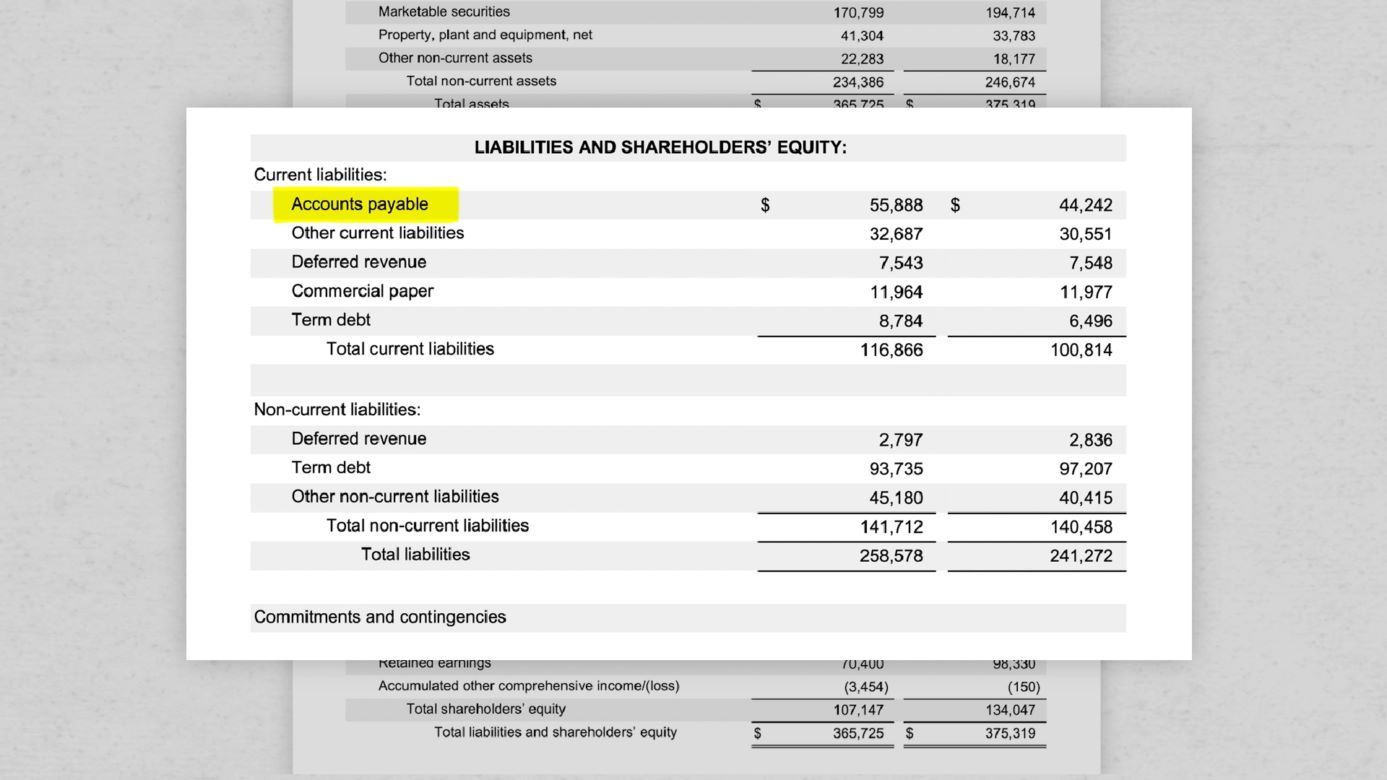

Liabilities, on the other hand, are categorized as current and non-current liabilities. Current liabilities are those that are due within a year, while non-current liabilities have longer-term repayment obligations. Equity represents the ownership interest in the company and is derived from the residual interest after deducting liabilities from assets.

The balance sheet provides insights into a company’s liquidity by analyzing the relationship between its current assets and current liabilities. It also helps assess the company’s financial stability, as it outlines the sources of financing and the composition of its capital structure.

Now that we have a clear understanding of the balance sheet, let’s explore how cash collected on accounts receivable impacts its components.

Effect of Cash Collected on Accounts Receivable on the Balance Sheet

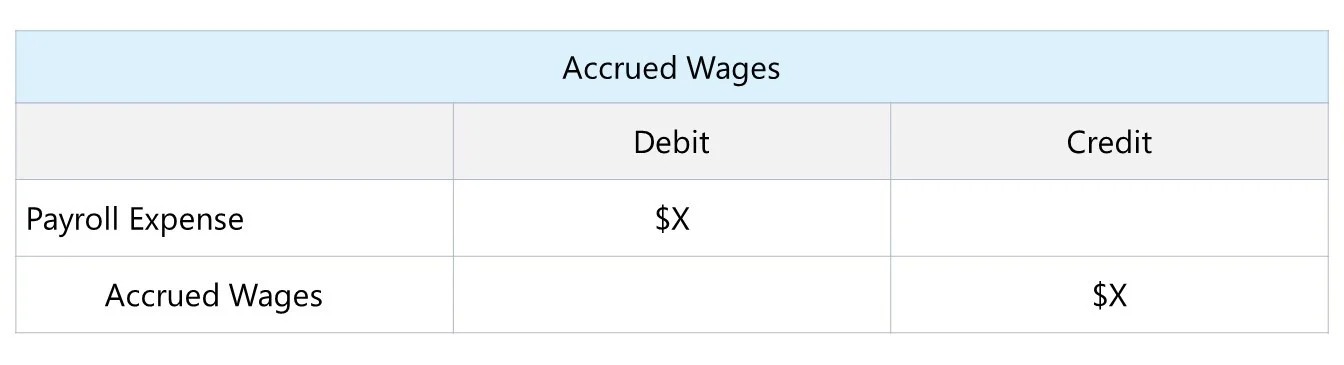

Cash collected on accounts receivable has a significant impact on the balance sheet by affecting the company’s assets and liabilities. Let’s take a closer look at how this process unfolds:

Increase in Cash Asset: When a company collects cash from its customers for the outstanding accounts receivable, it experiences an increase in its cash asset. This is reflected on the balance sheet under the asset section. The cash collected adds to the company’s available funds, improving its liquidity position and providing flexibility for future operations.

Decrease in Accounts Receivable: As the name suggests, accounts receivable represents the amount owed to the company by its customers. When cash is collected on accounts receivable, it leads to a decrease in the accounts receivable balance on the balance sheet. This reduction indicates that the company has successfully converted its credit sales into cash, enhancing its cash flow and reducing the risk of potential bad debts.

The combined effect of an increase in cash and a decrease in accounts receivable on the balance sheet highlights the successful conversion of credit sales into cash, improving the company’s overall financial standing.

It is important to note that efficient management of accounts receivable is crucial in maintaining a healthy cash flow and minimizing the risk of potential bad debts. Companies should establish effective credit policies, closely monitor the aging of accounts receivable, and diligently follow up with customers for timely payments. By doing so, businesses can ensure a steady inflow of cash and maintain a strong financial position.

Now that we understand the impact of cash collected on accounts receivable on the balance sheet, let’s explore the broader implications on financial ratios and working capital.

Increase in Cash Asset

When cash is collected on accounts receivable, it results in an increase in the cash asset of a company. This increase in cash can have several positive implications for the financial health and operations of the business.

Firstly, an increase in cash asset provides the company with improved liquidity. Liquidity refers to the ability of a company to meet its short-term financial obligations. By collecting cash on accounts receivable, a company can enhance its cash flow, ensuring that it has readily available funds to cover immediate expenses such as payroll, inventory purchases, and operational costs.

Having sufficient cash on hand also allows a company to take advantage of any potential business opportunities that may arise. It provides the flexibility to invest in growth initiatives, make strategic acquisitions, or weather unexpected economic downturns or challenges.

Furthermore, an increase in cash can positively impact the financial stability of a company. It provides a cushion against any financial shocks or unforeseen circumstances. For example, if a business experiences a decline in sales or faces unexpected expenses, having a solid cash reserve can help bridge the gap and maintain stability until the situation improves.

In addition, a healthy cash position can improve a company’s creditworthiness and enhance its ability to secure financing. Lenders and investors often view a strong cash position as a positive indicator of financial strength and stability. This can lead to more favorable borrowing terms, lower interest rates, and increased investor confidence.

Moreover, an increase in the cash asset demonstrates the company’s ability to efficiently manage its accounts receivable and collect payments in a timely manner. This indicates that the company has established effective credit management practices, resulting in a lower risk of bad debts and improved cash flow conversion cycle.

Overall, an increase in the cash asset resulting from cash collected on accounts receivable has numerous benefits for a company. It enhances liquidity, strengthens financial stability, creates opportunities for growth and investment, and improves creditworthiness. Therefore, businesses should strive to efficiently manage their accounts receivable and ensure a healthy cash flow to maximize these advantages.

Next, let’s explore the corresponding decrease in accounts receivable and its impact on the balance sheet.

Decrease in Accounts Receivable

When cash is collected on accounts receivable, it leads to a decrease in the accounts receivable balance on the balance sheet. This decrease signifies that the company has successfully converted its credit sales into cash, resulting in several positive outcomes.

Firstly, a decrease in accounts receivable indicates that the company has effectively collected payments from its customers. This reflects the efficiency of the company’s credit management processes, such as invoicing, follow-up, and timely collection. By reducing the outstanding accounts receivable, the company minimizes the risk of bad debts and improves its overall financial health.

Furthermore, a decrease in accounts receivable improves the company’s cash flow. As cash is collected, it increases the amount of available cash for the company to use for its daily operations, investments, or other business needs. This improved cash flow can enable the company to meet its financial obligations promptly and maintain a healthy working capital position.

A decrease in accounts receivable also has an impact on the company’s financial ratios. One key ratio affected is the accounts receivable turnover ratio. This ratio measures the efficiency of a company in collecting payments from its customers. As the accounts receivable balance decreases, and cash collected increases, the turnover ratio improves. A higher turnover ratio indicates that the company is able to collect payments more quickly, which is a positive indicator of effective credit management.

Decreasing accounts receivable can also have an impact on the company’s profitability. Outstanding accounts receivable represent potential income that has not yet been realized. By collecting cash on accounts receivable, the company is converting its sales into actual revenue. This can have a positive effect on the company’s profitability ratios, such as gross profit margin or net profit margin, as it reflects the realization of previously unrealized revenue.

Lastly, a decrease in accounts receivable can positively influence the company’s relationship with its suppliers and creditors. Having a lower accounts receivable balance signifies that the company is prompt in paying its own obligations. This can enhance its reputation and strengthen relationships with suppliers, potentially leading to improved credit terms or discounts on purchases.

In summary, a decrease in accounts receivable resulting from cash collection has several benefits for a company. It signifies efficient credit management, improves cash flow, enhances financial ratios, increases profitability, and strengthens relationships with suppliers and creditors. By diligently managing accounts receivable and effectively collecting payments, companies can enjoy these advantages and maintain a healthy balance sheet.

Next, let’s explore the impact of cash collected on accounts receivable on financial ratios and working capital.

Understanding the Accounts Receivable Turnover Ratio

The accounts receivable turnover ratio is a financial metric that measures the efficiency of a company in collecting payments from its customers. It provides valuable insights into the effectiveness of a company’s credit policies and collection efforts. To calculate the accounts receivable turnover ratio, the average accounts receivable balance is divided by net credit sales (sales made on credit) during a specific period.

The formula for the accounts receivable turnover ratio is:

Accounts Receivable Turnover Ratio = Net Credit Sales / Average Accounts Receivable

A high accounts receivable turnover ratio indicates that a company is efficient in collecting payment from its customers, while a low ratio suggests that the collection process needs improvement. This ratio is crucial for businesses as it helps assess the quality of their credit management practices and indicates the effectiveness of their accounts receivable collection efforts.

By tracking the accounts receivable turnover ratio over time, companies can gain insights into their customers’ payment behavior, identify any potential issues, and take necessary actions to improve their cash flow cycle. A higher turnover ratio suggests that the company is collecting cash on accounts receivable at a faster pace, which is a positive indicator of efficient credit management.

It’s important to note that the ideal accounts receivable turnover ratio may vary across industries. Some industries, such as retail, may have higher turnover ratios due to their short credit terms, while others, such as manufacturing or real estate, may have longer collection periods resulting in lower turnover ratios. Comparing the accounts receivable turnover ratio with industry benchmarks can provide additional context and help businesses evaluate their performance.

Companies can improve their accounts receivable turnover ratio by implementing effective credit management strategies. These may include setting clear credit policies, conducting credit checks on customers, promptly sending out invoices, offering incentives for early payments, and following up on overdue payments. By doing so, businesses can accelerate their cash collection, strengthen their cash flow, and maintain a healthier financial position.

The accounts receivable turnover ratio is a valuable tool for businesses to assess their credit management effectiveness and optimize their cash flow. By monitoring this ratio, companies can identify areas for improvement, implement strategies to enhance their collection process, and ultimately strengthen their financial performance.

Next, let’s explore the impact of cash collected on accounts receivable on the current ratio and working capital.

Impact on Current Ratio and Working Capital

The cash collected on accounts receivable has a significant impact on the current ratio and working capital of a company. These financial metrics provide insights into a company’s short-term liquidity and its ability to meet its immediate financial obligations.

The current ratio is a liquidity ratio that compares a company’s current assets to its current liabilities. It is calculated by dividing current assets by current liabilities. A higher current ratio indicates a better ability to cover short-term liabilities. Cash collected on accounts receivable increases the cash asset, which is typically included in the current assets section of the balance sheet. As a result, the current ratio improves, reflecting a stronger liquidity position for the company.

Working capital, on the other hand, represents the amount of funds a company has available to cover its day-to-day operations. It is calculated by subtracting current liabilities from current assets. Cash collected on accounts receivable increases the cash asset, which is a component of current assets. This increase in cash enhances the working capital of the company, providing additional resources to manage operational expenses, invest in growth opportunities, or pay off short-term liabilities.

By improving the current ratio and working capital, cash collected on accounts receivable enhances a company’s financial stability and flexibility. It strengthens the company’s ability to handle unexpected expenses, pursue growth initiatives, and withstand economic uncertainties.

It’s important for businesses to monitor their current ratio and working capital regularly and strive to maintain a healthy balance. An excessively high current ratio may indicate excess cash holdings that could be deployed more effectively, while a low current ratio may suggest liquidity challenges. Striking the right balance is key to ensuring optimal financial health.

Efficient management of accounts receivable plays a crucial role in optimizing the current ratio and working capital. Timely collection of cash from customers reduces the outstanding accounts receivable, freeing up cash resources that can be utilized to meet current obligations or invest in critical business activities.

Additionally, a strong current ratio and healthy working capital position bolster a company’s creditworthiness. Lenders and suppliers often view these metrics as indicators of financial stability and reliability. This improved creditworthiness can lead to more favorable borrowing terms, increased access to credit facilities, and enhanced relationships with suppliers.

In summary, cash collected on accounts receivable positively impacts the current ratio and working capital of a company. It improves liquidity, strengthens the company’s ability to cover short-term obligations, and provides flexibility for growth and investment opportunities. Maintaining a healthy current ratio and working capital position is vital for businesses to ensure financial stability and achieve long-term success.

Finally, let’s conclude our discussion on the effects of cash collected on accounts receivable.

Conclusion

Cash collected on accounts receivable plays a crucial role in shaping the financial position of a company and its overall performance. By understanding the effects of cash collected on accounts receivable on the balance sheet, businesses can optimize their cash flow, improve liquidity, and strengthen their financial health.

When cash is collected on accounts receivable, it results in an increase in the cash asset and a decrease in the accounts receivable balance on the balance sheet. This combination reflects the successful conversion of credit sales into cash, improving the company’s cash flow, and reducing the risk of bad debts.

An increase in cash asset enhances a company’s liquidity, providing readily available funds to meet financial obligations and seize growth opportunities. It also improves its financial stability, enhances creditworthiness, and strengthens relationships with suppliers and creditors.

A decrease in accounts receivable signifies that the company has effectively collected payments, demonstrating efficient credit management practices. It improves cash flow, enhances financial ratios such as the accounts receivable turnover ratio, and contributes to profitability through the realization of revenue.

The impact of cash collected on accounts receivable extends beyond the balance sheet. It improves the current ratio, reflecting a stronger ability to cover short-term liabilities, and enhances working capital, providing resources for day-to-day operations and strategic investments.

Efficient management of accounts receivable is crucial for maximizing the benefits of cash collection. Companies should establish effective credit policies, closely monitor aging receivables, and employ proactive collection strategies to ensure a healthy cash flow cycle.

Overall, the proper management of cash collected on accounts receivable contributes to a company’s financial stability, operational efficiency, and growth potential. By maintaining a healthy balance sheet and optimizing cash flow, businesses can position themselves for long-term success in a competitive marketplace.

Remember, the insights provided in this article serve as a guide to understanding the effects of cash collected on accounts receivable on the balance sheet. Each business is unique, and it’s important to consider specific industry dynamics and individual company circumstances when analyzing and managing accounts receivable. By doing so, businesses can make informed decisions and drive sustainable financial growth.