Finance

Clean Balance Sheet Definition

Published: October 27, 2023

A clean balance sheet is a crucial aspect of finance management. Understand its definition and importance to maintain financial stability.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The Importance of a Clean Balance Sheet for Financial Success

In the world of finance, a clean balance sheet is like a shining beacon of success. It represents a company that has effectively managed its assets and liabilities, resulting in a strong financial position. But what exactly does it mean to have a clean balance sheet? Let’s dive in and explore the definition and significance of this financial term.

Key Takeaways:

- A clean balance sheet is an indicator of a company’s financial health and stability.

- It reflects a well-managed level of assets and liabilities, resulting in positive shareholder value.

A Closer Look at the Clean Balance Sheet

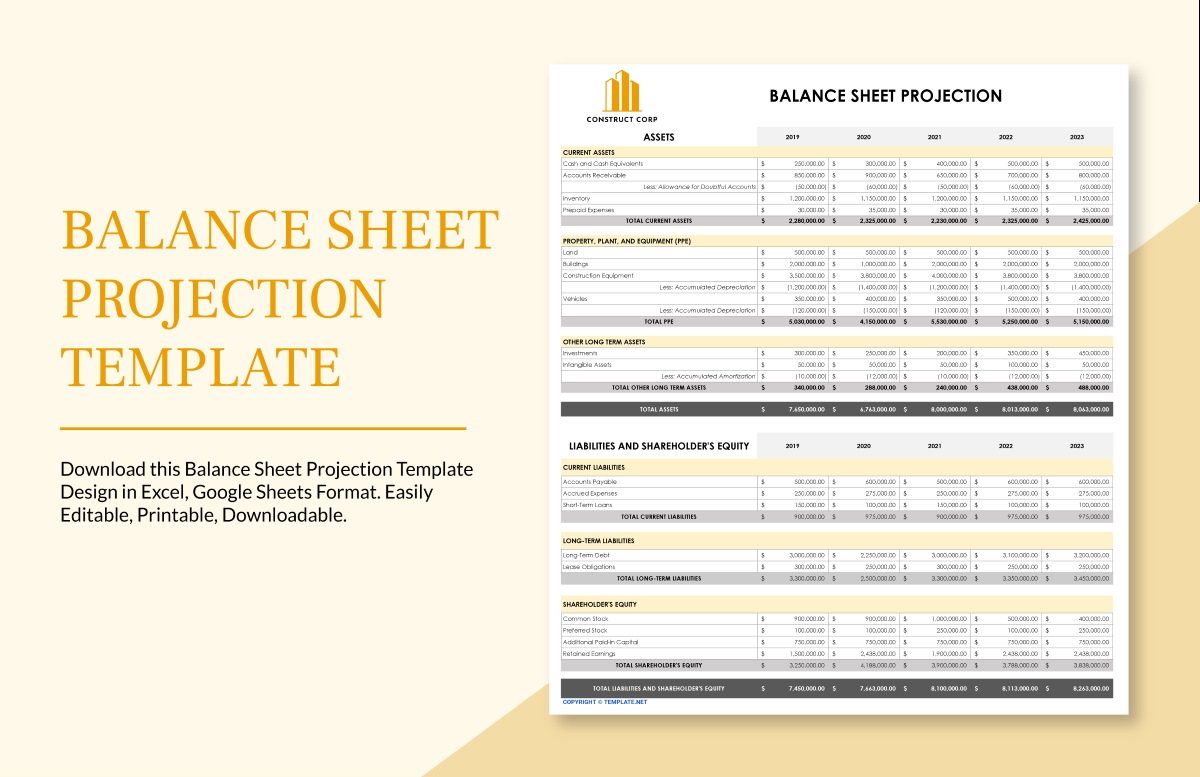

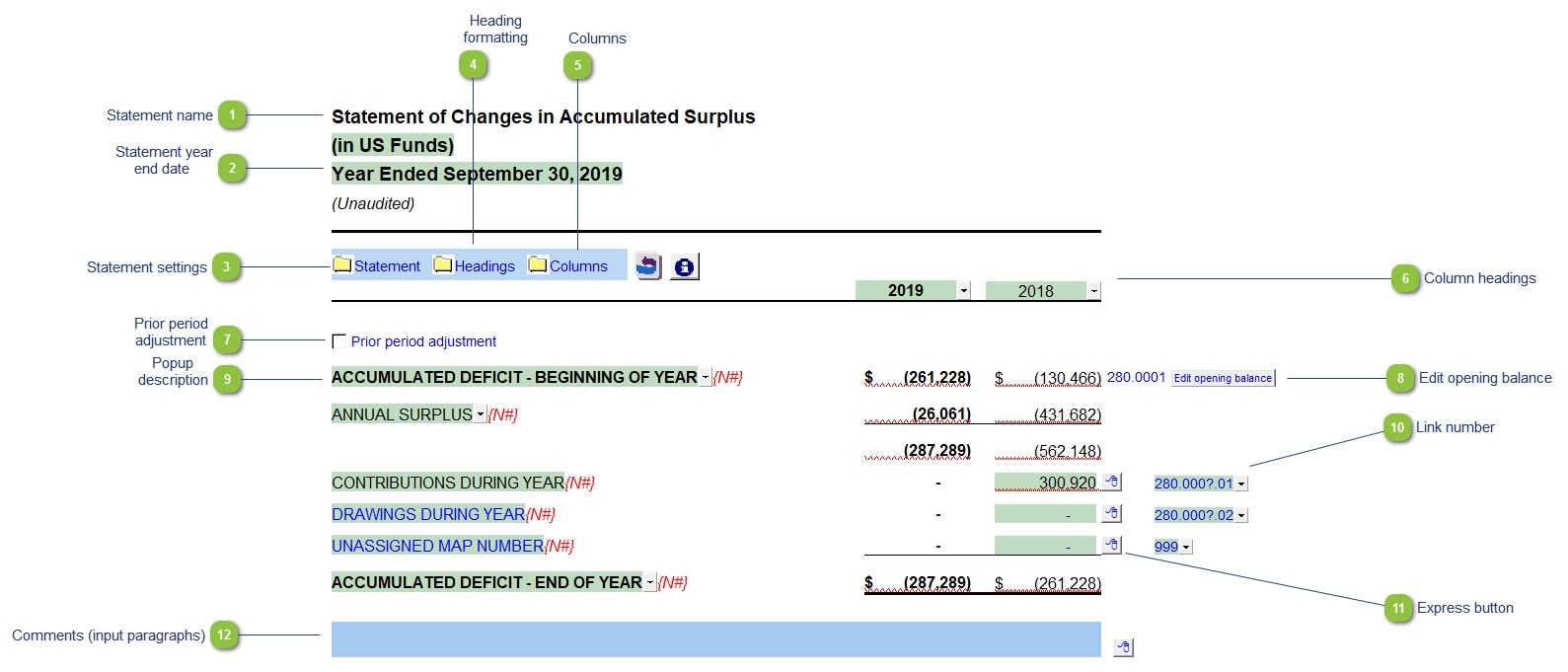

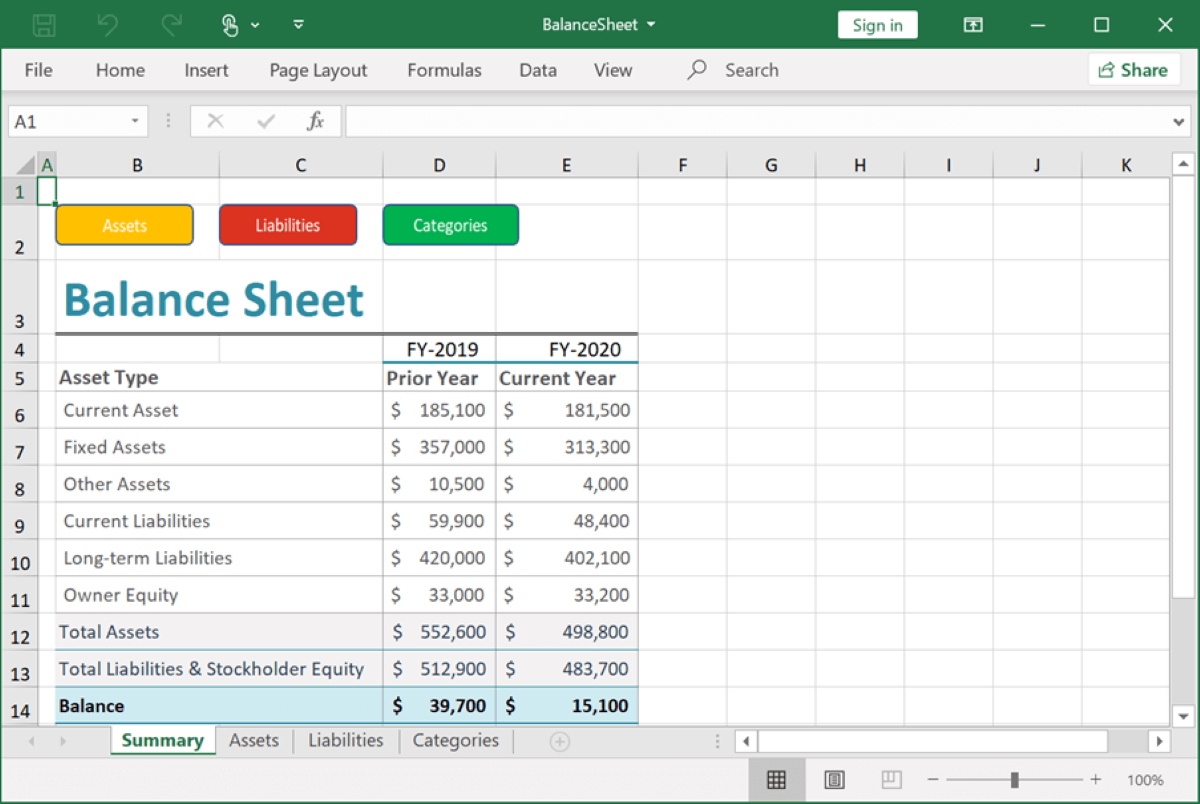

A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It presents a company’s assets, liabilities, and shareholders’ equity. When we refer to a clean balance sheet, we are essentially looking at a balance sheet that is pristine, with minimal or no red flags.

But what makes a balance sheet clean? Here are some characteristics of a clean balance sheet:

- Low Debt Levels: A company with a clean balance sheet will display manageable debt ratios. This means that its liabilities, such as loans and credit obligations, are kept under control, allowing the company to focus on generating profits and expanding its operations.

- High Asset Quality: A clean balance sheet showcases a solid asset base. This includes a healthy mix of cash, accounts receivable, inventory, and other valuable assets. These assets should be easily convertible into cash, ensuring liquidity for the company’s operations.

- Strong Equity Position: Clean balance sheets demonstrate a strong equity position. This means that the company has a substantial amount of shareholder equity, which is calculated by subtracting liabilities from assets. A high equity position provides a cushion in case of unforeseen financial challenges.

- Transparency and Accuracy: A clean balance sheet reflects accurate and transparent financial reporting. It should comply with generally accepted accounting principles and international accounting standards to provide stakeholders with a clear and reliable picture of the company’s financial health.

Now that we understand what a clean balance sheet entails, let’s explore the significance of having one.

The Significance of a Clean Balance Sheet

A clean balance sheet is of utmost importance for any company aiming for long-term financial success. Here’s why:

- Investor Confidence: A clean balance sheet instills confidence in investors and stakeholders. It demonstrates that a company is well-managed, financially stable, and capable of generating positive returns.

- Better Access to Capital: Companies with clean balance sheets are more likely to attract lenders and secure favorable loan terms. Financial institutions are more inclined to provide capital to businesses with solid financial positions, reducing the cost of borrowing.

- Growth Opportunities: A clean balance sheet lays the foundation for future growth. With a strong financial position, a company can seize opportunities for expansion, invest in research and development, or acquire competitors, fueling long-term success.

- Resilience in Economic Downturns: A clean balance sheet acts as a buffer during economic downturns. It allows companies to weather financial challenges, maintain operations, and continue serving customer needs even in challenging market conditions.

In conclusion, a clean balance sheet is a testament to a company’s financial strength and stability. It represents a well-run organization that has effectively managed its assets and liabilities, resulting in positive shareholder value. By maintaining a clean balance sheet, companies can attract investors, access capital, seize growth opportunities, and navigate economic uncertainties with resilience. It is a powerful tool for ensuring long-term financial success.