Finance

How To Stich Futures Contracts

Published: December 24, 2023

Learn how to stitch futures contracts and maximize your finance potential. Master intricate financial strategies with our step-by-step guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What are Futures Contracts?

- Understanding the Basics of Futures Contracts

- Selecting a Futures Contract to Trade

- Opening a Future Contract Position

- Managing and Monitoring Your Futures Contract

- Rolling Over or Closing Out your Futures Contract

- Tips for Successful Trading of Futures Contracts

- Conclusion

Introduction

When it comes to investing and seeking financial opportunities, one of the strategies that traders and investors often explore is futures contracts. Futures contracts are financial instruments that allow individuals to buy or sell certain assets at a predetermined price and date in the future. They are widely used in various industries, including commodities, currencies, and financial markets.

In this article, we will delve into the world of futures contracts and provide a comprehensive guide on how to trade them successfully. Whether you are a seasoned trader or just starting to explore the world of finance, understanding futures contracts can open up a new realm of opportunities for you.

By learning the basics of futures contracts, including how to select and trade them, you can potentially benefit from price movements and fluctuations in the market. However, it’s important to remember that futures trading involves a certain level of risk, and it’s crucial to have a solid understanding of the market before diving in.

Throughout this article, we will discuss the key concepts and strategies involved in trading futures contracts. By the end, you will have gained the knowledge and confidence to engage in futures trading and potentially enhance your financial portfolio.

So, let’s embark on this exciting journey and learn how to navigate the world of futures contracts!

What are Futures Contracts?

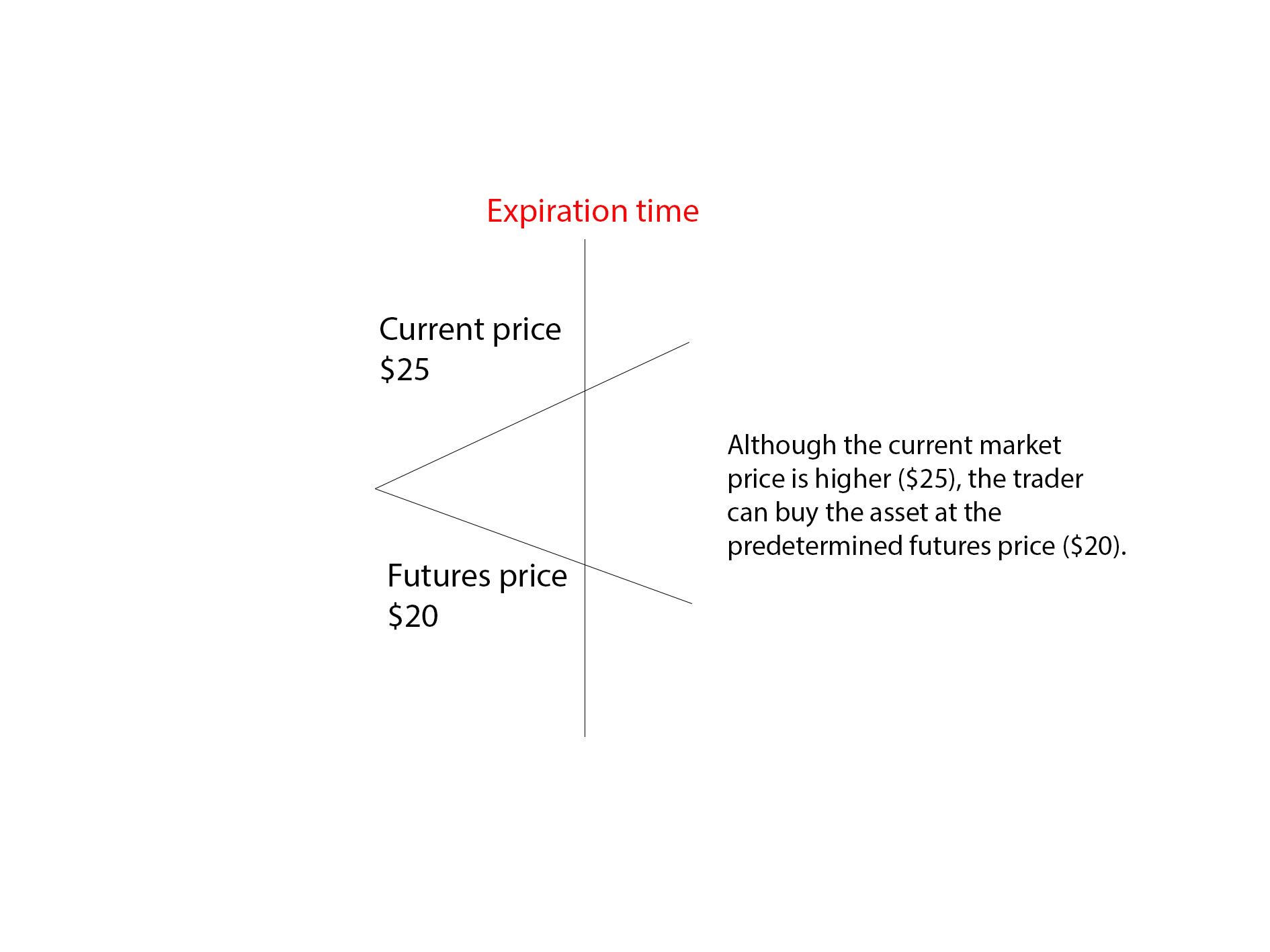

Futures contracts are financial agreements that obligate two parties to buy or sell an asset, such as commodities, currencies, or financial instruments, at a predetermined price and date in the future. These contracts are standardized and traded on exchanges, providing investors and traders with a regulated platform to engage in futures trading.

One of the key features of futures contracts is their expiration date, which specifies the deadline for executing the trade. This expiration date adds a time element to the contract, making futures trading different from spot trading, where assets are bought and sold for immediate delivery.

These contracts are typically used by individuals and businesses to hedge against price volatility and manage risk. For example, a farmer may enter into a futures contract to sell their crop at a predetermined price to protect themselves against potential price declines. On the other hand, a speculator may enter into a futures contract to take advantage of price movements and generate profits.

Futures contracts are categorized into different types based on the underlying assets being traded. Some common types include:

- Commodity Futures: These contracts involve the trading of commodities such as crude oil, gold, wheat, or natural gas.

- Financial Futures: These contracts are based on financial instruments like stock indexes, bonds, or currencies.

- Interest Rate Futures: These contracts involve the trading of interest rate-related instruments, such as treasury bonds or Eurodollar contracts.

- Equity Index Futures: These contracts are based on stock market indexes, such as the S&P 500 or NASDAQ 100.

Participants in the futures market can take two positions: long or short. Going long means buying a futures contract with the expectation that the price of the underlying asset will rise in the future, allowing them to sell it at a higher price. Conversely, going short involves selling a futures contract with the anticipation that the price of the underlying asset will decrease, enabling them to buy it back at a lower price and profit from the difference.

It is important to note that trading futures contracts carries a certain level of risk, and it is advisable to have a good understanding of the market dynamics and risk management strategies before entering into trades. By carefully monitoring market trends and utilizing appropriate hedging techniques, traders can potentially benefit from futures contracts and achieve their financial objectives.

Understanding the Basics of Futures Contracts

Before diving into futures trading, it is essential to grasp the basic concepts and mechanics of futures contracts. This understanding will enable you to make informed decisions and navigate the market successfully. Let’s explore some key elements of futures contracts:

Contract Specifications:

Each futures contract has specific parameters that are standardized and defined by the exchange on which it is traded. These specifications include the underlying asset, contract size, delivery month, tick size, and settlement method. It is crucial to familiarize yourself with these specifications before trading to ensure you choose the appropriate contract for your trading strategy.

Margin and Leverage:

Futures contracts require traders to deposit an initial margin, which is a percentage of the contract’s total value. This margin serves as collateral and ensures that traders have enough funds to cover potential losses. The use of margin allows traders to control positions that have a higher value than their account balances, increasing the potential for profits, but also amplifying potential losses. It is important to manage margin requirements and understand the associated risks.

Markets and Exchanges:

Futures contracts are traded on organized exchanges, such as the Chicago Mercantile Exchange (CME) or the New York Mercantile Exchange (NYMEX). These exchanges provide a regulated platform for buying and selling futures contracts, ensuring liquidity and transparency. Understanding the specific exchange where your chosen futures contract trades is essential for efficient trade execution.

Price Discovery:

The price of a futures contract is determined through an auction-style process known as price discovery. Buyers and sellers place bids and offers in the market, and when these bids and offers match, a trade occurs. This process ensures fair pricing based on supply and demand dynamics. Traders use various technical and fundamental analysis techniques to assess market conditions and identify potential price movements.

Contract Settlement:

Futures contracts have different settlement methods. Some contracts settle physically, requiring the delivery of the underlying asset at the contract’s expiration. Others settle in cash, where the gain or loss is settled in cash without any physical delivery. Understanding how a contract is settled is crucial, as it determines the actions required when the contract expires.

By understanding these basic concepts, you will be better equipped to navigate the futures market. Keep in mind that futures trading involves risk, and it is advisable to start with smaller positions and gradually expand your exposure as you gain experience and confidence. Continuous learning and staying updated with market trends are key to successful futures trading.

Selecting a Futures Contract to Trade

Choosing the right futures contract to trade is a crucial step in your futures trading journey. The selection process requires careful consideration of various factors, including your trading goals, risk tolerance, and understanding of the underlying market. Here are some key steps to help you select the most suitable futures contract:

Identify Your Trading Goals:

Before selecting a futures contract, clearly define your trading objectives. Are you looking to hedge against price fluctuations or speculate on price movements for profit? Are you interested in trading commodities, currencies, or financial instruments? By understanding your goals, you can narrow down your options and focus on contracts that align with your trading strategy.

Research Underlying Markets:

Thoroughly research the underlying market related to the futures contract you are considering. Familiarize yourself with the factors that influence price movements in that market, such as supply and demand dynamics, global economic indicators, and geopolitical events. Understanding the fundamental and technical aspects of the market will help you make informed trading decisions.

Analyze Contract Specifications:

Each futures contract has specific contract specifications that you need to take into account. Pay attention to the contract size, tick size, expiration dates, and trading hours to ensure they align with your trading preferences. Consider factors such as the liquidity of the contract, as more liquid contracts offer tighter spreads and smoother execution.

Assess Market Volatility:

Evaluate the historical volatility and average daily trading range of the futures contract you are considering. Higher volatility may present more trading opportunities but can also bring increased risk. Consider your risk tolerance and adapt your trading strategy accordingly. Additionally, check if there are any scheduled events or economic releases that could impact the market during the contract’s lifespan.

Monitor Market Liquidity:

Liquidity is a critical factor when selecting a futures contract. Higher liquidity ensures that there is sufficient trading activity, tight bid-ask spreads, and minimal slippage. Low liquidity markets may present challenges in executing trades and can lead to higher transaction costs. It is essential to choose contracts with adequate liquidity to facilitate smoother trading experiences.

Use Paper Trading or Simulated Accounts:

If you are new to futures trading or uncertain about a particular contract, consider using paper trading or simulated accounts. These platforms allow you to trade virtual money and simulate real trading conditions. It provides an opportunity to test your strategies, understand the contract’s behavior, and gain confidence before committing real capital.

Selecting a futures contract involves careful analysis and research. It is crucial to strike a balance between market familiarity, contract specifications, and risk management. By following these steps and continuously learning about the markets, you can make informed decisions and increase your chances of successful futures trading.

Opening a Future Contract Position

Once you have selected the futures contract you want to trade, it’s time to open a position. Opening a futures contract position involves taking a long or short position in the contract. Here are the steps to open a futures contract position:

Select a Brokerage:

First, you need to choose a reputable brokerage that offers futures trading services. Look for a brokerage that provides a user-friendly trading platform, competitive fees, reliable customer support, and access to the specific exchanges where your chosen futures contract is traded.

Open an Account:

Next, you’ll need to open a trading account with the chosen brokerage. This typically involves providing personal information, completing any necessary documentation, and meeting any initial deposit requirements. Ensure that you carefully read and understand the terms and conditions of the account before proceeding.

Deposit Funds:

Once your trading account is open, you’ll need to deposit funds to cover the initial margin requirements. The initial margin amount varies depending on the contract and the brokerage, so be sure to check the specific margin requirements for your chosen futures contract. Depositing additional funds beyond the initial margin can provide a cushion and help manage potential losses.

Place an Order:

With your trading account funded, you can now place an order to open a futures contract position. In your trading platform, select the specific futures contract you want to trade and specify whether you want to go long or short. Enter the desired quantity of contracts and set any additional parameters, such as order type (market order or limit order) and duration.

Review and Confirm:

Before executing the trade, carefully review all the details of your order, including contract specifications, quantity, price, and any associated fees or commissions. Check that the information is accurate, and make any necessary adjustments if needed. Once you are confident, confirm the order to execute the trade.

Monitor Your Position:

After opening your futures contract position, it’s important to keep a close eye on the market and monitor your position. Regularly check the market conditions, price movements, and any relevant news or events that could impact the contract. Consider setting up alerts or utilizing stop-loss orders to manage risk and protect your investment.

Remember that futures trading involves risks, and prices can fluctuate rapidly. It’s crucial to have a solid understanding of risk management techniques and develop a trading strategy that suits your individual goals and risk tolerance. Continuous learning and practice will help you refine your skills and increase your chances of success in the futures market.

Managing and Monitoring Your Futures Contract

Once you have opened a futures contract position, it’s important to actively manage and monitor your position to optimize your trading outcomes. Here are some key strategies for effectively managing and monitoring your futures contract:

Set Clear Objectives:

Before entering a futures contract, define your profit targets and risk tolerance. Having clear objectives allows you to make informed decisions about when to exit or adjust your position.

Regularly Review Market Conditions:

Stay updated on market trends, economic news, and other factors that can impact the price of the underlying asset. Regularly analyze charts, technical indicators, and fundamental data relevant to your chosen futures contract.

Implement Risk Management Tools:

Implement risk management tools such as stop-loss orders, which automatically close your position if the price reaches a certain level. Trailing stops can also be used to protect profits by adjusting the stop-loss level as the price moves in your favor.

Monitor Position Size and Margin Requirements:

Keep a close eye on your position size relative to your account balance to avoid overexposure. Ensure that you have sufficient funds to cover margin requirements and potential fluctuations in the market.

Utilize Technical Analysis:

Apply technical analysis tools and indicators to identify potential entry and exit points. Moving averages, trendlines, and oscillators can help you make informed decisions based on historical price patterns.

Stay Disciplined:

Stick to your trading plan and avoid making impulsive decisions based on emotions or short-term market fluctuations. Establishing and following a disciplined approach is key to long-term success in futures trading.

Adjust as the Market Evolves:

As market conditions change, be prepared to adjust your trading strategy. Assess the impact of new information and adapt your approach accordingly. This could involve modifying target levels, implementing trailing stops, or adding to or reducing your position.

Regularly Review and Assess Performance:

Periodically review and evaluate your trading performance. Assess the effectiveness of your strategy, identify any areas for improvement, and learn from both successful and unsuccessful trades.

Remember that futures trading involves risks, and it is important to execute proper risk management techniques. The ability to monitor your position and make well-informed decisions based on market conditions can greatly enhance your trading outcomes.

Rolling Over or Closing Out your Futures Contract

As a futures contract reaches its expiration date, traders have two options: rolling over the contract or closing it out. Managing the expiration of a futures contract is crucial to ensure a smooth transition and avoid any unwanted consequences. Let’s explore these options in more detail:

Rolling Over:

Rolling over a futures contract involves closing your current position in the expiring contract and simultaneously opening a new position in a contract with a later expiration date. This allows traders to maintain exposure to the underlying asset without having to take physical delivery or settle in cash.

To roll over a contract, you need to identify the new contract with desired expiration and take the appropriate steps in your trading platform. The process typically involves closing your current position and opening a new one at the prevailing market prices. Some traders prefer to roll over contracts a few weeks or months before expiration to ensure a smooth transition and minimize any potential disruptions.

Rolling over a futures contract can be advantageous in volatile markets or when further price exposure is desired. However, it’s important to note that rolling over contracts may incur additional costs, such as commissions and bid-ask spreads, which need to be considered in your trading strategy.

Closing Out:

Alternatively, traders can choose to close out their futures contract position entirely as the expiration date approaches. Closing out involves selling (for long positions) or buying (for short positions) the contract to offset your existing position.

Closing out a futures contract may be suitable if you no longer wish to maintain exposure to the underlying asset or if you have achieved your trading objectives. By closing out your position, you exit the contract and settle any gains or losses through a cash settlement.

It’s important to pay close attention to the expiration date of the futures contract, as closing out after the contract expires may result in physical delivery obligations or other unfavorable consequences.

Deciding whether to roll over or close out a futures contract should be based on your trading strategy, market conditions, and specific goals. Consult your broker or financial advisor for guidance on the best approach given your individual circumstances.

Overall, managing the expiration of futures contracts requires careful planning and prompt action. Rolling over or closing out the contract in a timely manner ensures a seamless transition and allows you to continue engaging in futures trading with your preferred market exposure.

Tips for Successful Trading of Futures Contracts

Trading futures contracts can be a rewarding endeavor if approached with the right mindset and strategies. While there is no guaranteed formula for success, here are some valuable tips to help improve your chances of success when trading futures contracts:

1. Educate Yourself:

Gain a solid understanding of futures contracts, market dynamics, and trading strategies. Continuously educate yourself through books, courses, webinars, and other educational resources to stay updated on the latest trends and techniques.

2. Develop a Trading Plan:

Create a well-defined trading plan that outlines your risk tolerance, objectives, entry and exit strategies, and risk management rules. Stick to your plan and avoid impulsive decisions based on emotions or short-term market fluctuations.

3. Start with Simulated Trading:

If you’re new to futures trading or testing out a new strategy, consider using simulated accounts or paper trading platforms. This allows you to practice trading without risking real money, helping you gain experience and evaluate the effectiveness of your approach.

4. Practice Risk Management:

Implement proper risk management techniques, such as setting stop-loss orders and managing position sizes. Never risk more than you can afford to lose, and always maintain sufficient funds to cover margin requirements.

5. Utilize Technical and Fundamental Analysis:

Combine technical analysis tools and indicators with an understanding of fundamental factors that can impact the market. Use charts, trendlines, moving averages, and economic data to make informed trading decisions.

6. Monitor Market News and Events:

Stay updated on market news, economic releases, and geopolitical events that can influence the futures market. Anticipate and analyze how these factors may impact the price of the underlying asset you are trading.

7. Diversify Your Portfolio:

Spread your risk by diversifying your futures contracts across different asset classes, industries, or geographical regions. This helps mitigate the impact of adverse price movements in a single contract.

8. Continuously Review and Adapt:

Regularly review and assess your trading performance. Learn from both successful and unsuccessful trades, identify patterns or mistakes, and adjust your strategies accordingly. Adaptability is key to long-term success in futures trading.

9. Control Your Emotions:

Keep your emotions in check and avoid making impulsive decisions based on fear or greed. Stick to your trading plan and maintain a disciplined approach even during periods of market volatility.

10. Seek Professional Advice:

Consider working with a qualified financial advisor or seek guidance from experienced traders. Their expertise and insights can provide valuable perspectives and help refine your trading strategies.

Remember, successful trading of futures contracts requires dedication, discipline, and continuous learning. By following these tips and refining your skills over time, you can enhance your chances of achieving consistent profitability in the futures market.

Conclusion

Futures contracts offer a world of opportunities for traders and investors to profit from price movements in various markets, ranging from commodities to currencies and financial instruments. By understanding the basics of futures contracts, selecting the right contract, and effectively managing your positions, you can navigate the futures market with confidence.

Throughout this article, we have explored the key concepts of futures contracts, from their definition to the process of opening, managing, and closing positions. We emphasized the importance of thorough research, risk management, and continuous learning to increase your chances of success.

Remember that futures trading involves inherent risks, and it is essential to have a solid understanding of the market dynamics before engaging in trades. Continuously monitor market conditions, stay updated on relevant news, and adapt your trading strategies as needed.

Developing a well-defined trading plan, utilizing both technical and fundamental analysis, and practicing proper risk management techniques will help you navigate the complexities of futures trading. Diversifying your portfolio and controlling your emotions are also key factors in achieving long-term success in this field.

As with any financial venture, seeking professional advice and guidance can provide valuable insights and help you refine your trading strategies. Consider working with a qualified financial advisor or engaging in communities of experienced traders to gain additional knowledge and perspectives.

In conclusion, futures contracts can be a powerful tool for generating profits and managing risk in the financial markets. With the right knowledge, skills, and strategies, you have the potential to unlock numerous opportunities and achieve your financial goals through successful futures trading.