Home>Finance>How Can You Determine A Company’s Net Working Capital From A Balance Sheet?

Finance

How Can You Determine A Company’s Net Working Capital From A Balance Sheet?

Published: December 27, 2023

Learn how to determine a company's net working capital from its balance sheet in this finance guide. Find out the key indicators and calculations.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the Balance Sheet

- Net Working Capital

- Calculating Net Working Capital

- Step 1: Identifying Current Assets

- Step 2: Identifying Current Liabilities

- Step 3: Calculating Net Working Capital

- Interpreting the Net Working Capital

- Importance of Net Working Capital

- Factors Influencing Net Working Capital

- Conclusion

Introduction

When evaluating the financial health of a company, one essential aspect to consider is its net working capital. Net working capital serves as a measure of a company’s short-term liquidity and its ability to meet its current obligations.

Understanding net working capital requires a deep dive into a company’s balance sheet, which provides a snapshot of its financial position at a given point in time. By analyzing the balance sheet, investors and analysts can assess the amount of working capital available to a company and understand its financial solvency.

In this article, we will delve into the intricacies of net working capital and explain how to determine it from a balance sheet. We will explore the importance of net working capital, how to calculate it, and the factors that can influence it.

Whether you’re a finance professional, an investor, or simply someone interested in understanding the financial health of a company, this article will provide you with the knowledge you need to evaluate a company’s net working capital effectively.

Understanding the Balance Sheet

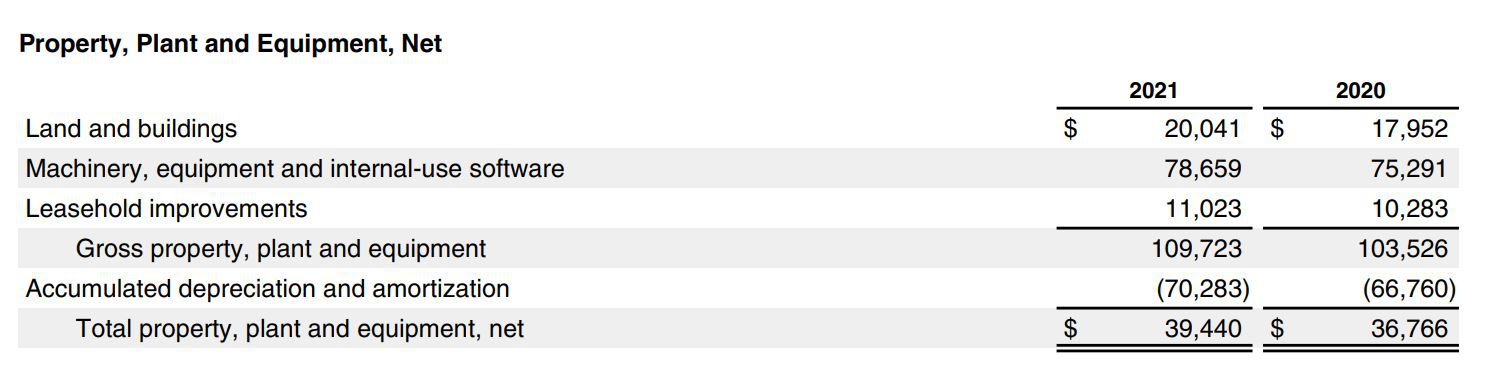

The balance sheet, also known as the statement of financial position, is a crucial financial statement that provides a snapshot of a company’s financial position at a specific point in time. It shows the company’s assets, liabilities, and shareholders’ equity.

The balance sheet follows a fundamental accounting equation: Assets = Liabilities + Shareholders’ Equity. This equation reflects the concept that a company’s assets are financed through either debt (liabilities) or owners’ investments (shareholders’ equity).

The balance sheet is divided into two main sections: the left side, which lists the company’s assets, and the right side, which displays its liabilities and shareholders’ equity. Assets are typically categorized as either current assets or non-current assets, depending on their liquidity and expected conversion into cash within the next year.

On the right side, liabilities are classified as either current liabilities or long-term liabilities, based on their maturity dates. Current liabilities represent obligations that are due within the next year, while long-term liabilities are those with a maturity date beyond one year.

Shareholders’ equity represents the owners’ residual interest in the company after deducting liabilities from assets. It reflects the cumulative contributions made by shareholders, such as investments and retained earnings.

The balance sheet provides valuable information about a company’s liquidity, solvency, and financial stability. It allows investors, creditors, and other stakeholders to assess the company’s financial health and make informed decisions.

Now that we have a basic understanding of the balance sheet, let’s dive into the concept of net working capital and how it relates to a company’s financial position.

Net Working Capital

Net working capital is a key financial metric that measures the liquidity and short-term financial health of a company. It represents the difference between a company’s current assets and its current liabilities.

Current assets are those that are expected to be converted into cash or utilized within the next year. Examples of current assets include cash and cash equivalents, accounts receivable, inventory, and short-term investments. These assets are seen as readily available to meet a company’s short-term obligations.

On the other hand, current liabilities are the obligations that are due within the next year. They include accounts payable, accrued expenses, short-term debt, and other liabilities that require payment or settlement in the near term.

By subtracting current liabilities from current assets, we arrive at the net working capital figure. A positive net working capital indicates that a company has sufficient short-term assets to cover its current obligations, while a negative net working capital suggests a potential liquidity risk.

Net working capital is crucial because it reflects a company’s ability to finance its day-to-day operations and meet its short-term financial commitments. It plays a significant role in assessing a company’s liquidity, financial stability, and overall operational efficiency.

Investors and analysts use net working capital as an indicator of a company’s ability to manage its short-term cash flow needs. It helps identify potential liquidity problems or excessive reliance on short-term borrowing.

Moreover, net working capital is also important when analyzing a company’s operational efficiency. A higher net working capital generally indicates that a company has better control over its inventory, accounts receivable, and accounts payable. Conversely, a low net working capital may suggest inefficiencies in managing working capital components.

In the next section, we will discuss how to calculate net working capital from the information provided in a company’s balance sheet.

Calculating Net Working Capital

To calculate the net working capital of a company, you need to follow a simple formula: Net Working Capital = Current Assets – Current Liabilities.

Here are the steps to calculate the net working capital:

Step 1: Identifying Current Assets

Review the balance sheet to identify the current assets. These are the assets that are expected to be converted into cash or utilized within the next year. Common current assets include:

- Cash and cash equivalents

- Accounts receivable

- Inventory

- Short-term investments

- Prepaid expenses

Add up the values of these current assets to get the total current assets.

Step 2: Identifying Current Liabilities

Next, identify the current liabilities from the balance sheet. These are the obligations that are due within the next year. Common current liabilities include:

- Accounts payable

- Accrued expenses

- Short-term debt

- Current portion of long-term debt

- Income taxes payable

Add up the values of these current liabilities to get the total current liabilities.

Step 3: Calculating Net Working Capital

Once you have the total current assets and total current liabilities, subtract the total current liabilities from the total current assets. The result is the net working capital.

A positive net working capital indicates that a company has enough short-term assets to cover its current obligations. A negative net working capital indicates that a company may struggle with its short-term liquidity and meeting its current obligations.

It’s important to note that the net working capital figure should be interpreted in the context of the industry and the company’s specific circumstances. Comparing it to historical data or industry benchmarks can provide further insights into the company’s financial health.

Now that we know how to calculate net working capital, let’s explore the implications and importance of this metric in evaluating a company’s financial health.

Step 1: Identifying Current Assets

When calculating net working capital, the first step is to identify the current assets from the balance sheet. Current assets are those that are expected to be converted into cash or used up within the next year, providing a source of liquidity for the company’s operations.

Here are some common examples of current assets:

- Cash and Cash Equivalents: This includes physical cash, as well as highly liquid assets that can be easily converted into cash, such as bank deposits and short-term marketable securities.

- Accounts Receivable: These are amounts owed to the company by its customers for goods or services provided on credit. They represent the company’s claims to future cash inflows.

- Inventory: Inventory consists of the company’s raw materials, work-in-progress goods, and finished products. It represents the value of goods that are ready to be sold in the normal course of business.

- Short-Term Investments: These are relatively liquid investments that are expected to be converted into cash within the next year, such as bonds, money market funds, or other marketable securities.

- Prepaid Expenses: Prepaid expenses are payments made in advance for goods or services that will be received in the future. Examples include prepaid rent, prepaid insurance, or prepaid subscription fees.

It is important to carefully review the balance sheet and identify all relevant current assets. Make sure to include all applicable categories and their corresponding values.

Once you have identified the current assets, you can move on to the next step of calculating net working capital, which involves identifying the company’s current liabilities.

Note: When calculating net working capital, it is crucial to use the values from the balance sheet at a specific point in time. Balance sheets can change over time as transactions occur, so it is important to ensure you are working with the most recent financial statements.

Step 2: Identifying Current Liabilities

In the calculation of net working capital, the second step is to identify the current liabilities from the company’s balance sheet. Current liabilities represent the obligations that the company is expected to settle within the next year.

Here are some common examples of current liabilities:

- Accounts Payable: This includes the amounts owed by the company to its suppliers or vendors for goods or services received on credit.

- Accrued Expenses: These are expenses that the company has incurred but has not yet paid. Examples of accrued expenses include salaries payable, utilities payable, and interest payable.

- Short-Term Debt: Short-term debt refers to loans or borrowings that are due for repayment within the next year, such as bank loans or lines of credit.

- Current Portion of Long-Term Debt: If the company has long-term debt that is maturing within the next year, the portion due within that timeframe is considered a current liability.

- Income Taxes Payable: This represents the taxes that the company owes to tax authorities for the current year.

Identifying these current liabilities is critical for calculating net working capital accurately. Make sure to include all relevant categories of current liabilities and their corresponding amounts from the balance sheet.

Once you have identified the company’s current liabilities, you can proceed to the final step of calculating net working capital, which involves subtracting the total current liabilities from the total current assets.

Note: Just like with current assets, it is important to use the values from the balance sheet at a specific point in time when determining current liabilities. Financial statements can change over time, so ensure that you are working with the most up-to-date information available.

Step 3: Calculating Net Working Capital

The final step in calculating net working capital is to subtract the total current liabilities from the total current assets. This calculation provides a measure of a company’s liquidity and its ability to cover its short-term obligations.

Here’s the formula to calculate net working capital:

Net Working Capital = Total Current Assets – Total Current Liabilities

Let’s illustrate this calculation with an example:

Suppose a company has the following current assets:

- Cash and cash equivalents: $50,000

- Accounts receivable: $100,000

- Inventory: $80,000

- Short-term investments: $20,000

And it has the following current liabilities:

- Accounts payable: $60,000

- Accrued expenses: $30,000

- Short-term debt: $40,000

To calculate the net working capital, we subtract the total current liabilities from the total current assets:

Total Current Assets = $50,000 + $100,000 + $80,000 + $20,000 = $250,000

Total Current Liabilities = $60,000 + $30,000 + $40,000 = $130,000

Net Working Capital = $250,000 – $130,000 = $120,000

In this example, the company has a net working capital of $120,000, indicating that it has sufficient short-term assets to cover its current liabilities.

A positive net working capital suggests a healthy financial position and the ability to meet short-term obligations. On the other hand, if the result is negative, it could indicate potential liquidity issues, as the company may have more current liabilities than current assets to cover them.

It’s important to interpret the net working capital figure in the context of the industry, the company’s historical data, and its specific circumstances. Comparing the net working capital to industry benchmarks or historical trends can provide further insights into the company’s financial health.

Now that we have calculated the net working capital, let’s explore the significance of this metric in evaluating a company’s financial health in the next section.

Interpreting the Net Working Capital

Interpreting the net working capital figure is crucial for gaining insights into a company’s financial health and assessing its short-term liquidity. The net working capital represents the difference between a company’s current assets and its current liabilities, providing a measure of available funds to meet upcoming obligations.

Here are some key points to consider when interpreting the net working capital:

- Positive Net Working Capital: A positive net working capital indicates that a company has more current assets than current liabilities. This suggests a healthy financial position and the ability to cover short-term obligations. It reflects a company’s liquidity and its capacity to manage day-to-day operations without relying heavily on external financing.

- Negative Net Working Capital: Conversely, a negative net working capital implies that a company has more current liabilities than current assets. This situation raises concerns about liquidity and the company’s ability to meet its short-term obligations. It may indicate that the company is relying on external financing or struggling with inefficient management of working capital components.

- Industry Benchmarks: Interpreting the net working capital should take into account the industry benchmarks and standards. Net working capital requirements vary across industries due to differences in business models, inventory turnover, and payment terms. Comparing the company’s net working capital to industry averages or competitors can provide insights into its relative financial health.

- Historical Trends: It is essential to analyze the company’s net working capital over time to identify potential trends. Comparing the current net working capital with historical data helps assess the company’s ability to effectively manage its working capital and adapt to changing market conditions. Significant fluctuations or consistent decline in net working capital might indicate underlying financial challenges.

- Working Capital Management: The net working capital figure should be understood in the context of the company’s working capital management strategies. Efficient management of working capital involves striking the right balance between optimizing cash flow, inventory levels, and credit terms. A well-managed working capital can positively impact profitability, operational efficiency, and financial stability.

It is important to interpret the net working capital in conjunction with other financial ratios and indicators to obtain a comprehensive understanding of a company’s financial health. Key ratios such as the current ratio (current assets divided by current liabilities) and the quick ratio (liquid assets divided by current liabilities) provide additional insights into the company’s ability to meet short-term obligations.

Overall, interpreting the net working capital requires considering industry benchmarks, historical trends, and the company’s working capital management practices. It helps investors, lenders, and management evaluate a company’s financial solvency, liquidity risks, and capacity to navigate short-term financial challenges.

Next, we will explore the importance of net working capital in assessing a company’s financial well-being.

Importance of Net Working Capital

Net working capital is a fundamental financial metric that plays a significant role in assessing a company’s short-term liquidity, financial health, and operational efficiency. Here are some key reasons why net working capital is important:

- Short-Term Liquidity Assessment: Net working capital provides insights into a company’s ability to meet its short-term obligations. Positive net working capital indicates that a company has sufficient current assets to cover its current liabilities, ensuring it can pay its bills, suppliers, and creditors in a timely manner. It serves as a measure of financial stability and mitigates liquidity risks.

- Operational Efficiency: Effective management of net working capital components, such as inventory, accounts receivable, and accounts payable, is crucial for operational efficiency. A well-managed net working capital allows a company to optimize inventory levels, expedite cash conversions, and negotiate favorable payment terms. This, in turn, improves cash flow, reduces financing costs, and enhances overall profitability.

- Funding and Investment Decisions: Understanding a company’s net working capital is important for both lenders and investors. Lenders consider net working capital as an indicator of a company’s ability to repay debt. Investors analyze net working capital to assess the company’s short-term financial health, stability, and the risk associated with their investment. A strong net working capital position may attract potential investors and lenders, providing easier access to funding at favorable terms.

- Financial Planning and Forecasting: Net working capital serves as a valuable tool for financial planning and forecasting. By analyzing trends in net working capital, a company can anticipate potential cash flow gaps, manage working capital needs, and make informed decisions about inventory levels, credit policies, and cash management strategies. Accurate forecasting of net working capital helps ensure sufficient liquidity to sustain day-to-day operations and support growth initiatives.

- Measuring Changes in Working Capital Efficiency: Monitoring changes in net working capital over time can reveal important insights about a company’s operational efficiency. It allows management to identify areas of improvement, such as reducing inventory holding costs, shortening collection periods for receivables, or negotiating better payment terms with suppliers. Enhancements in working capital efficiency can directly impact cash flow, profitability, and shareholder value.

Overall, net working capital serves as a vital financial metric that helps measure a company’s liquidity, financial stability, and ability to effectively manage its working capital. It aids decision-making processes, enables accurate financial planning, and enhances operational efficiency. By understanding and maintaining an optimal level of net working capital, companies can ensure they have the necessary resources to meet short-term obligations, withstand economic fluctuations, and drive long-term success.

In the next section, we will explore the factors that can influence a company’s net working capital.

Factors Influencing Net Working Capital

Several factors can significantly influence a company’s net working capital. Understanding these factors is crucial for effectively managing working capital and maintaining a healthy financial position. Here are some key factors that influence net working capital:

- Industry and Business Model: Different industries have varying working capital requirements. For example, manufacturing companies often have higher levels of inventory, while service-based companies may have minimal inventory but significant accounts receivable. Understanding the characteristics of the industry and the specific business model is essential to determine the optimal net working capital levels.

- Seasonality and Business Cycle: Seasonal businesses, such as retail or tourism, may experience fluctuations in net working capital throughout the year. Understanding the seasonal patterns and aligning working capital needs accordingly is crucial to ensure adequate liquidity during periods of high demand or lower sales volume.

- Supplier and Vendor Relationships: The payment terms negotiated with suppliers and vendors can have a significant impact on a company’s net working capital. Longer payment terms can provide more time to convert inventory into sales and accounts receivable into cash, improving net working capital. However, longer payment terms may strain supplier relationships and potentially impact discounts or credit terms available to the company.

- Customer Relationships and Credit Policies: The credit terms offered to customers can affect net working capital. Longer credit terms result in a longer cash conversion cycle, potentially tying up working capital. Setting appropriate credit policies, monitoring accounts receivable, and maintaining an efficient collection process are essential to optimize net working capital without sacrificing sales volume.

- Inventory Management: Effective inventory management has a direct impact on net working capital. Holding excessive inventory ties up cash and increases storage costs, while inadequate inventory levels may result in lost sales or increased carrying costs due to frequent stockouts. Implementing inventory control techniques, such as just-in-time (JIT) inventory, can help optimize net working capital by reducing excess inventory levels.

- Efficiency in Accounts Payable: Efficient management of accounts payable can positively impact net working capital. Negotiating favorable payment terms with suppliers and vendors, taking advantage of early payment discounts, and actively managing payment schedules can optimize cash flow and reduce the cash conversion cycle.

- Cash Management: Effective cash management practices, such as maintaining optimal cash reserves, monitoring cash flow projections, and carefully planning cash outflows, can significantly impact net working capital. Adequate liquidity ensures the ability to meet short-term obligations and reduces the reliance on expensive short-term borrowing.

Each company’s net working capital requirements are unique, influenced by industry dynamics, business operations, and management decisions. Therefore, it is essential for businesses to regularly assess and adapt their working capital management strategies to optimize net working capital and maintain financial stability.

By effectively managing these factors, companies can enhance operational efficiency, improve cash flow, and maintain a healthy net working capital position. Regular monitoring and analysis of the factors influencing net working capital enable businesses to make informed decisions, adapt to changing market conditions, and drive long-term success.

In the next section, we will conclude our discussion and summarize the key points discussed in this article.

Conclusion

Net working capital plays a vital role in assessing the short-term liquidity, financial health, and operational efficiency of a company. By understanding and evaluating net working capital, investors, creditors, and management can gain valuable insights into a company’s ability to meet its short-term obligations, manage its working capital, and ensure financial stability.

In this article, we explored the essential components related to net working capital. We started by understanding the balance sheet, which serves as a key source of information for calculating net working capital. We then delved into the calculation process itself, highlighting the steps involved in identifying current assets and current liabilities.

We discussed the importance of interpreting the net working capital figure, considering industry benchmarks, historical trends, and the company’s working capital management practices. Net working capital provides critical information for assessing short-term liquidity, making funding decisions, forecasting cash flow, and enhancing operational efficiency.

Finally, we explored the factors that influence net working capital, such as industry characteristics, business cycles, supplier relationships, customer credit policies, inventory management, accounts payable efficiency, and cash management practices. Recognizing and effectively managing these factors are integral to optimizing net working capital and maintaining a healthy financial position.

As the financial landscape continues to evolve, net working capital remains a fundamental metric for evaluating a company’s financial well-being. It is important for businesses to regularly monitor and analyze their net working capital, adapt their working capital management strategies, and make informed decisions that support their short-term liquidity and long-term growth.

By harnessing the power of net working capital, companies can enhance their financial stability, improve cash flow management, and position themselves for long-term success.