Finance

What Is A Progressive Income Tax Quizlet

Published: November 2, 2023

Learn about the concept of progressive income tax in finance with our informative quizlet. Understand how it works and its implications for individuals and economies.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Progressive Income Tax

- Purpose and Benefits of Progressive Income Tax

- How Progressive Income Tax Works

- Criticisms and Disadvantages of Progressive Income Tax

- Examples and Case Studies of Progressive Income Tax

- Comparison with Other Types of Tax Systems

- Policy Debates and Reforms on Progressive Income Tax

- Conclusion

Introduction

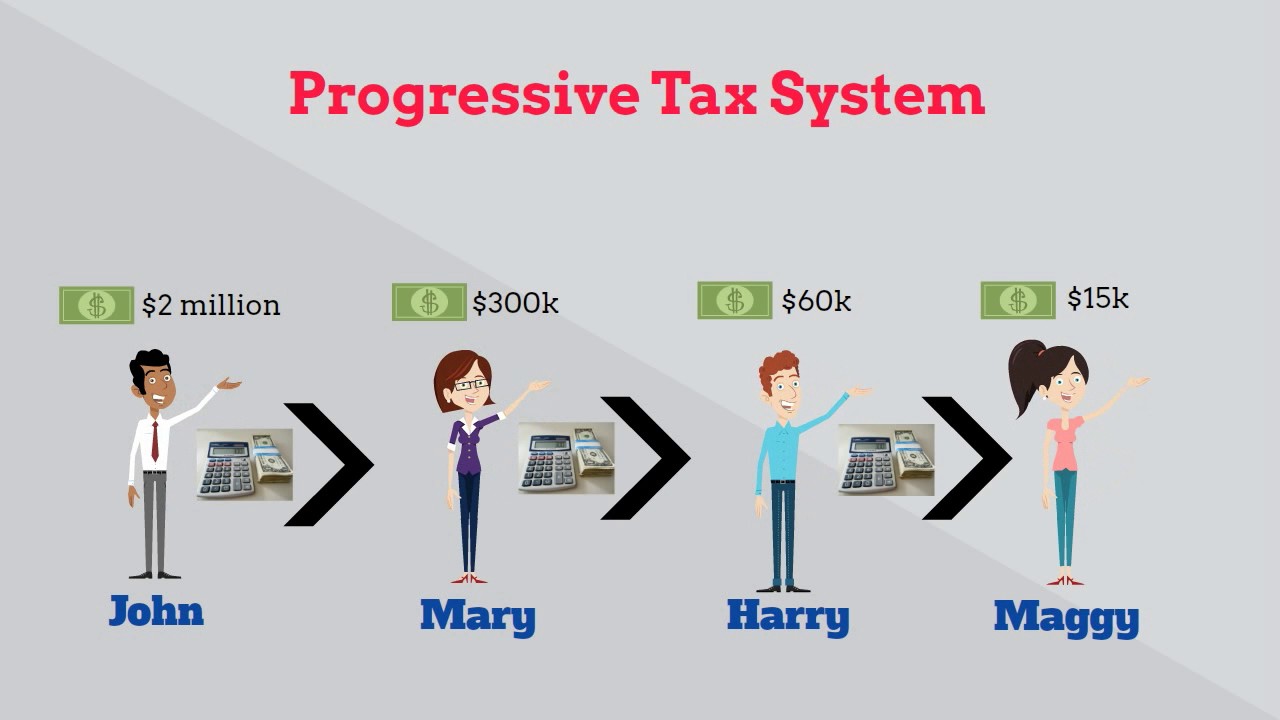

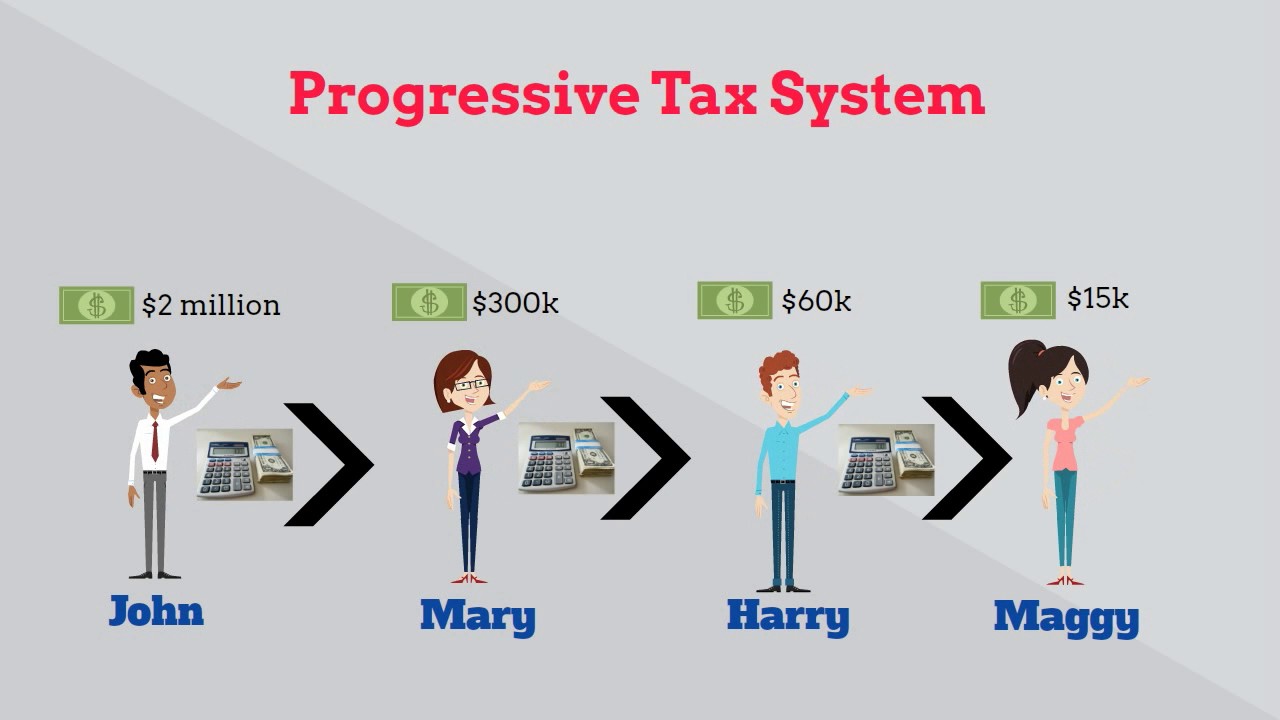

A progressive income tax is a taxation system where the tax rate increases as a person’s income level rises. It is based on the principle of taxing individuals with higher incomes at higher rates, allowing for a more equitable distribution of the tax burden within a society. This type of tax system aims to address income inequality by taking a larger proportion of income from those who can afford to contribute more.

The concept of a progressive income tax can be traced back to the late 18th century, when it was first proposed by Adam Smith, a renowned economist and philosopher. Today, it is one of the most commonly used tax systems in many countries around the world.

The main objective of a progressive income tax is to generate revenue for the government to fund public services and projects, such as healthcare, education, infrastructure development, and social welfare programs. By imposing higher tax rates on higher income brackets, the government can ensure that wealthier individuals contribute a greater share of their income to support the needs of society as a whole.

Progressive income tax systems operate on the principle of marginal tax rates, which means that different portions of a person’s income are taxed at different rates. For example, the first portion of income may be taxed at a lower rate, while subsequent portions are taxed at progressively higher rates. This ensures that individuals with higher incomes pay a higher overall tax rate while still maintaining a level of progressivity.

While the progressive income tax system is designed to be fair and equitable, it does have its share of criticisms and debates. Some argue that it discourages productivity and innovation, as individuals may be less motivated to earn higher incomes if they are taxed at higher rates. Others argue that it can create loopholes and opportunities for tax avoidance, as high-income individuals may seek to minimize their tax liability through various means.

Overall, the progressive income tax system plays a significant role in shaping the economic and social landscape of a country. It is a tool for income redistribution, ensuring that the financial burden is shared proportionally among citizens based on their ability to pay. By understanding the intricacies of a progressive income tax, we can better appreciate its impact on taxation and public finance.

Definition of Progressive Income Tax

A progressive income tax is a taxation system in which the tax rate increases as an individual’s income level rises. It is designed to be progressive in nature, meaning that the proportion of income paid in taxes increases as income increases. This type of tax system is based on the principle of vertical equity, aiming to distribute the tax burden more fairly among individuals based on their ability to pay.

In a progressive income tax system, tax rates are structured into multiple income brackets or tax brackets. Each bracket has its own tax rate, and individuals are taxed at the applicable rate for each portion of their income within that bracket. As a person’s income moves into a higher bracket, the tax rate for that portion of income increases.

For example, consider a progressive income tax system with three brackets: 10%, 20%, and 30%. If an individual’s income falls within the first bracket, they will be taxed at a rate of 10% on that portion of their income. As their income increases and falls into the second bracket, the tax rate for that portion will increase to 20%. The same principle applies when moving into the third bracket, where the tax rate is 30%.

The progressive income tax system allows for a more equitable distribution of the tax burden. Higher-income individuals, who have a greater ability to pay, are taxed at higher rates, while lower-income individuals are taxed at lower rates. This progressive structure ensures that individuals with lower incomes have a lower tax burden, allowing for a degree of income redistribution and helping to address income inequality within a society.

It is important to note that progressive income tax systems often include exemptions, deductions, and other mechanisms to mitigate the impact of taxes on lower-income individuals and provide targeted relief. These mechanisms can take various forms, such as standard deductions, tax credits for specific expenses, and provisions for tax-free income up to a certain threshold.

Overall, the progressive income tax system is a vital component of modern tax systems used by many countries around the world. It offers a fair and progressive approach to taxation, ensuring that the burden is distributed proportionally among individuals based on their income levels.

Purpose and Benefits of Progressive Income Tax

The progressive income tax system serves several important purposes and offers a range of benefits for individuals and society as a whole. Let’s explore some of its key purposes and benefits:

1. Income Redistribution:

One of the primary purposes of a progressive income tax is to redistribute wealth and reduce income inequality. By imposing higher tax rates on higher-income individuals, the progressive tax system ensures that a greater share of income is contributed by those who can afford to do so. This mechanism helps to address the wealth gap in society and promote a more equitable distribution of resources.

2. Ability to Pay Principle:

The progressive income tax aligns with the principle of ability to pay. It recognizes that individuals with higher incomes have a greater capacity to contribute to government funds and public services. By implementing a system where tax rates increase with income, the progressive tax system ensures that the tax burden is proportionate to an individual’s financial capacity.

3. Funding for Public Services:

The progressive income tax system generates revenue for the government, which is then used to fund public services and projects. These include essential services like education, healthcare, infrastructure development, social welfare programs, and more. By taxing higher-income individuals at higher rates, the progressive tax system helps to ensure adequate funding for these crucial public services.

4. Social Stability:

A progressive income tax system plays a role in promoting social stability. By addressing income inequality and providing support to lower-income individuals, it reduces the potential for social unrest and tensions. When individuals have access to basic necessities and opportunities for upward mobility, it fosters a more harmonious and stable society overall.

5. Economic Efficiency:

The progressive income tax system can also contribute to economic efficiency. By taxing high-income individuals at higher rates, it can help prevent the accumulation of excessive wealth and promote a more balanced distribution of resources. This can support economic growth by reducing income disparities and increasing overall purchasing power within the society.

Overall, the purpose and benefits of a progressive income tax system extend beyond simply generating revenue. It is a tool that promotes social equity, economic stability, and funds public services that benefit society as a whole. While it is not without its criticisms and challenges, the progressive income tax system remains a cornerstone of many countries’ tax systems in striving for a fairer and more inclusive society.

How Progressive Income Tax Works

The progressive income tax system operates on the principle that tax rates increase as an individual’s income level rises. This mechanism ensures that higher-income individuals contribute a greater portion of their income in taxes. Let’s explore how the progressive income tax works in more detail:

Income Brackets and Tax Rates:

The progressive income tax system is structured into income brackets, also known as tax brackets or tax bands. Each bracket has its own corresponding tax rate. Typically, lower-income individuals fall into lower tax brackets with lower tax rates, while higher-income individuals fall into higher tax brackets with higher tax rates.

Marginal Tax Rates:

The marginal tax rate is the tax rate applied to the last dollar of income earned within a particular tax bracket. It is important to understand that only the income within a specific bracket is taxed at that bracket’s tax rate, not the entire income. This means that as an individual’s income increases and moves into higher tax brackets, only the income within those brackets is taxed at the higher rates.

Example of Marginal Tax Rates:

Let’s use an example to illustrate how marginal tax rates work in a progressive income tax system. Consider a three-bracket system with tax rates of 10%, 20%, and 30%, respectively.

- Income up to $50,000 falls within the first bracket and is taxed at a rate of 10%, resulting in a tax liability of $5,000.

- If income increases to $70,000, the first $50,000 is still taxed at 10%, resulting in a tax liability of $5,000. The remaining $20,000 falls within the second bracket and is taxed at a rate of 20%, resulting in an additional tax liability of $4,000. The total tax liability is now $9,000.

- If income further increases to $100,000, the first $50,000 is still taxed at 10%, resulting in a tax liability of $5,000. The next $20,000 is taxed at 20%, resulting in an additional tax liability of $4,000. The remaining $30,000 falls within the third bracket and is taxed at a rate of 30%, resulting in an additional tax liability of $9,000. The total tax liability is now $18,000.

As demonstrated in this example, the progressive income tax system ensures that as income increases and falls into higher tax brackets, the tax liability increases due to the higher tax rates applied to each bracket’s portion of income.

Tax Deductions and Credits:

The progressive income tax system often incorporates deductions and credits to ensure a degree of fairness and mitigate the tax burden on lower-income individuals. Deductions reduce the taxable income, while credits directly reduce the amount of tax owed. These mechanisms can help individuals lower their overall tax liability and make the system more progressive.

It is important to note that tax laws and rates can vary across countries and jurisdictions. Different countries may have different income brackets, tax rates, deductions, and credits that apply within their respective progressive income tax systems.

Overall, the progressive income tax system ensures that the tax burden is distributed in proportion to an individual’s income level. It provides a mechanism for higher-income individuals to contribute more to society while aiming to reduce income inequality and promote social equity.

Criticisms and Disadvantages of Progressive Income Tax

While the progressive income tax system has its merits, it is not without its fair share of criticisms and disadvantages. Some of the key criticisms include:

1. Disincentives for Economic Growth:

One common criticism of the progressive income tax system is that it can create disincentives for economic growth and productivity. High-income individuals may be less motivated to work harder and earn more if they are subject to higher tax rates. Critics argue that this can hinder innovation, entrepreneurship, and overall economic development.

2. Tax Avoidance and Evasion:

Another criticism is that the progressive income tax system can create opportunities for tax avoidance and evasion. High-income individuals may be more likely to engage in complex financial strategies or exploit loopholes to minimize their tax liability. This can result in a reduction in government revenue and result in an unfair burden on those who cannot afford to employ such tactics.

3. Stifling of Investment and Savings:

Some argue that the progressive income tax can discourage investment and hinder capital formation. High tax rates on investment income may disincentivize individuals from saving and investing, as they may perceive the returns to be outweighed by the tax burden. This can have negative implications for economic growth and long-term wealth accumulation.

4. Unfair Burden on High Earners:

Opponents of progressive income tax assert that it unfairly burdens high earners by demanding a larger percentage of their income. They argue that high-income individuals already contribute more in absolute terms, and further increasing their tax rates can create feelings of resentment and discourage hard work and achievement.

5. Complexity and Administrative Costs:

Progressive income tax systems can be complex to administer and enforce. The need for multiple tax brackets, exemptions, and deductions increases the complexity of tax calculations. This complexity can lead to higher administrative costs for both individuals and governments, as well as a greater likelihood of errors and disputes.

It is important to note that these criticisms may vary in significance depending on the specific implementation and context of the progressive income tax system. Governments continuously evaluate and refine tax policies to address these concerns and strike a balance between generating revenue and promoting economic growth and fairness.

Despite these criticisms, the progressive income tax system remains a widely used approach to taxation due to its perceived ability to promote income redistribution and social equity. It is important to consider these criticisms and strive for continuous improvement in tax policies to ensure a fair and effective taxation system.

Examples and Case Studies of Progressive Income Tax

Progressive income tax systems are implemented in various countries around the world. Let’s take a look at a few examples and case studies that highlight the application and impact of progressive income tax:

1. United States:

The United States has a progressive income tax system with multiple tax brackets. As of 2021, the tax rates range from 10% to 37%, with higher tax rates applying to higher-income individuals. The system also includes various deductions, exemptions, and tax credits to provide targeted relief to lower-income individuals. The progressive tax system in the United States plays a significant role in funding government programs and services.

2. Sweden:

Sweden is often cited as an example of a country with a strong progressive income tax system. The Swedish tax system has several tax brackets, with increasing tax rates for higher income levels. The top marginal tax rate in Sweden can be over 50%. The progressive income tax system in Sweden is aimed at achieving a more equal distribution of wealth and providing robust social welfare benefits to its citizens.

3. Germany:

Germany also employs a progressive income tax system. It has various tax brackets, with the top tax rate exceeding 40%. The German tax system focuses on income redistribution and providing support for social programs, such as healthcare, education, and infrastructure development. The progressive income tax system in Germany aims to ensure that higher-income individuals contribute more to funding public services.

4. France:

France is another country with a progressive income tax system. The French tax system has progressive tax rates that increase with higher income levels. Additionally, France has implemented a wealth tax, which applies to individuals with high net worth. The progressive income tax system in France is intended to address income inequality and generate revenue for public expenditures.

5. Case Study: Scandinavian Countries:

The Scandinavian countries, including Denmark, Norway, and Finland, are known for their comprehensive welfare systems supported by progressive income tax. These countries have high tax rates for high-income individuals and provide extensive social benefits, including universal healthcare, education, and childcare. The progressive income tax system in these countries plays a crucial role in financing these robust welfare programs and ensuring a high standard of living for all citizens.

These examples and case studies demonstrate how progressive income tax systems can be implemented at varying tax rates and brackets to achieve specific social and economic goals. The effectiveness of these systems depends on the country’s economic context, social policies, and government priorities.

Comparison with Other Types of Tax Systems

While the progressive income tax system is widely used, it is important to understand how it compares with other types of tax systems. Let’s explore a few key comparisons:

1. Flat Tax:

A flat tax is a tax system where individuals are taxed at a single, uniform rate, regardless of their income level. In contrast, the progressive income tax system applies different tax rates to different income brackets. The flat tax is often favored for its simplicity and perceived fairness, as everyone pays the same rate. However, critics argue that a flat tax can disproportionately burden low-income earners and exacerbate income inequality.

2. Regressive Tax:

A regressive tax is a system where the tax burden falls more heavily on low-income individuals, as the tax rate decreases as income increases. This is the opposite of the progressive tax system, where higher-income individuals bear a larger proportion of the tax burden. Regressive taxes, such as sales taxes or certain consumption taxes, are often criticized for their potential to disproportionately affect lower-income individuals and exacerbate income inequality.

3. Proportional Tax:

A proportional tax, also known as a flat tax, applies the same tax rate to all individuals, regardless of income. This differs from the progressive tax system, which applies increasing tax rates to higher-income individuals. Proportional taxes are often seen as equitable, as everyone pays the same proportion of their income. However, critics argue that this type of tax system can place a heavier burden on lower-income earners who may struggle to meet their basic needs.

4. Value Added Tax (VAT):

A value added tax (VAT) is a consumption-based tax that is typically applied to the sale of goods and services. Unlike the progressive income tax system, a VAT is not directly based on income levels. Instead, it is based on the consumption of goods and services. While a VAT can be regressive in nature, as it may disproportionately affect low-income earners, some countries implement measures, such as exemptions or reduced rates on essential goods, to mitigate this regressivity.

5. Wealth Tax:

A wealth tax is a tax on an individual’s net worth, typically targeting individuals with high levels of wealth. This type of tax is different from the progressive income tax system, which primarily focuses on taxing income. Wealth taxes aim to address wealth inequality by targeting those with substantial assets. One key difference is that wealth tax is applied on individuals’ total assets, regardless of whether there is corresponding income generated from those assets.

Each type of tax system has its own advantages, disadvantages, and implications for income distribution and economic incentives. Governments carefully consider the trade-offs and societal goals when choosing the most appropriate tax system or a combination of tax systems to implement.

Policy Debates and Reforms on Progressive Income Tax

The implementation of a progressive income tax system has been a subject of ongoing policy debates and reforms. Various stakeholders have expressed their views on the effectiveness, fairness, and potential improvements to this tax system. Let’s explore some of the key policy debates and potential reforms surrounding the progressive income tax:

1. Tax Rate Structure:

One major policy debate revolves around the appropriate tax rate structure for a progressive income tax system. Some argue for higher tax rates on higher-income individuals, believing that it promotes greater income redistribution and addresses income inequality more effectively. Others propose lower tax rates to encourage economic growth, innovation, and investment. Reforming the tax rate structure requires careful consideration of its impact on government revenue, incentives, and income distribution.

2. Exemptions, Deductions, and Loopholes:

The issue of exemptions, deductions, and loopholes within the progressive income tax system has also been a topic of debate. Critics argue that certain provisions and loopholes can be exploited by high-income individuals, resulting in a disproportionate reduction in their tax liability. Reforms may involve eliminating or limiting these exemptions and closing loopholes to ensure fairness and prevent tax avoidance.

3. Alternative Taxation Approaches:

Some policy debates consider alternative approaches to progressive income tax. For instance, proponents of a wealth tax argue that taxing individuals’ net worth, rather than just their income, can address wealth inequality more directly. Others suggest a shift towards consumption-based taxes, such as a value-added tax (VAT), as a means to capture a broader tax base. Evaluating alternative tax approaches involves weighing their potential to achieve policy objectives, economic impact, and administrative feasibility.

4. Tax Transparency and Simplicity:

Policy discussions often revolve around making the progressive income tax system more transparent and simpler for individuals to understand. Critics argue that complex tax rules and lengthy forms can hinder compliance and erode public trust. Reforms may aim to simplify the tax code, improve tax reporting processes, and enhance taxpayer education to promote transparency and ease of compliance.

5. Balancing Revenue Generation and Economic Growth:

Debates arise regarding striking a balance between generating sufficient revenue for government programs and encouraging economic growth. Some argue that excessively high tax rates on high earners can deter investment, entrepreneurship, and economic activity. Policymakers strive to find the optimal tax rates and policies that generate the necessary revenue while fostering a conducive environment for economic growth and job creation.

Policymakers and experts continuously engage in these policy debates and reforms to optimize the progressive income tax system. The goal is to maintain a fair and efficient tax system that adequately funds government programs, promotes income redistribution, and supports economic development in a manner that aligns with societal goals and values.

Conclusion

The progressive income tax system is a fundamental component of many countries’ tax systems, designed to promote fairness, income redistribution, and the funding of public services. By imposing higher tax rates on higher-income individuals, the progressive income tax system seeks to address income inequality and ensure that those who are more financially capable contribute a greater share of their income to society.

While the progressive income tax system has its critics and faces ongoing policy debates and reforms, it offers several benefits. It allows for income redistribution, ensuring that the burden of taxation is proportionate to an individual’s ability to pay. The progressive income tax system also supports the funding of public services such as healthcare, education, infrastructure development, and social welfare programs.

It is important to note that the design and implementation of the progressive income tax system require striking a balance. Policy considerations often revolve around tax rate structures, exemptions, deductions, transparency, and simplicity. Additionally, alternative tax approaches, such as wealth taxes or consumption-based taxes, are subjects of ongoing debates and potential reforms.

By understanding the complexities and policy debates surrounding the progressive income tax system, we can appreciate its significance in shaping economic and social dynamics. It plays a pivotal role in achieving income redistribution, addressing income inequality, and funding essential public services that contribute to the overall well-being of society.

As discussions continue and policymakers strive to refine tax policies, it is crucial to consider the goals of revenue generation, economic growth, fairness, and social equity. With careful evaluation and thoughtful reforms, the progressive income tax system can be a vital tool for achieving a more equitable and prosperous society.