Home>Finance>How Do You Calculate APR On A Credit Card Balance

Finance

How Do You Calculate APR On A Credit Card Balance

Modified: December 29, 2023

Learn how to calculate the APR on your credit card balance and effectively manage your finances. Simplify your financial decisions with our expert advice.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to managing your finances, understanding the ins and outs of credit cards is key. One important aspect to grasp is the concept of APR, or Annual Percentage Rate, which plays a significant role in determining the cost of borrowing on a credit card. Whether you’re considering applying for a new credit card or want to make the most of your existing card, being able to calculate the APR on a credit card balance can help you make informed financial decisions.

Understanding APR is crucial because it represents the yearly interest rate that will accumulate on any unpaid credit card balance. It is expressed as a percentage and can vary depending on the credit card issuer and the type of card you hold. APR not only affects the cost of carrying a balance from month to month but also impacts the interest charges on purchases and cash advances.

To calculate the APR on a credit card balance, you need to have a clear understanding of the components involved in the calculation. By familiarizing yourself with the formula used to determine APR and its components, you will have the necessary tools to evaluate the cost of borrowing and make informed financial choices.

In this article, we will explore the formula for calculating the APR on a credit card balance, delve into the components of this calculation, provide an example to illustrate the process, and discuss the importance of knowing your APR. Additionally, we will offer some tips on how to potentially lower your APR and save on interest charges.

By the end of this article, you will have a comprehensive understanding of how to calculate APR on a credit card balance, helping you become a more savvy and informed credit card user.

Understanding APR

Before diving into the calculation of APR on a credit card balance, it’s important to have a solid grasp of what APR represents and how it impacts your finances.

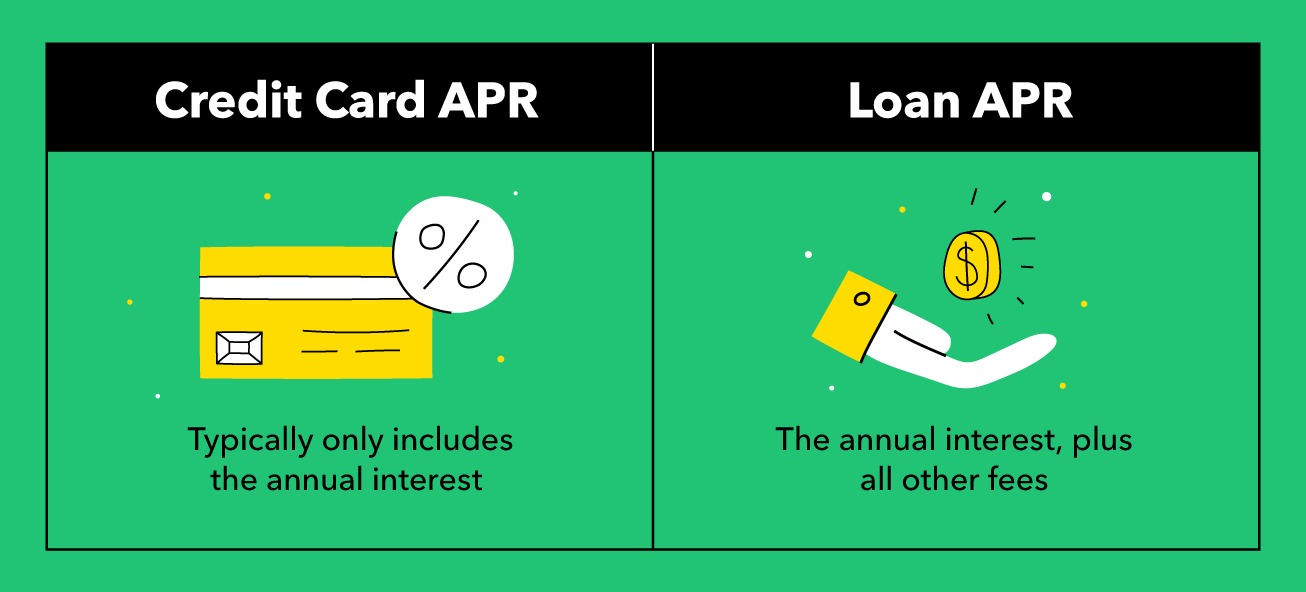

APR, or Annual Percentage Rate, is the annualized cost of borrowing money, expressed as a percentage. In the context of credit cards, APR refers to the interest rate charged on any outstanding balance carried from month to month. It is important to note that APR is different from the annual interest rate, as it also takes into account any additional fees or charges associated with borrowing, such as annual fees or balance transfer fees.

The APR on a credit card can vary based on several factors, including your creditworthiness and the type of credit card you have. Credit card issuers typically offer different APRs for different types of transactions, such as purchases, balance transfers, and cash advances. It’s essential to carefully review the terms and conditions of your credit card to understand the specific APRs applicable to each type of transaction.

One key distinction to be aware of is the difference between “introductory” APR and “regular” APR. Many credit cards offer a low or even 0% introductory APR for a specified period, usually ranging from 6 to 18 months. After the introductory period ends, the regular APR comes into effect. It’s essential to understand the timeline and conditions of the introductory APR to avoid any surprises once it expires.

Furthermore, it’s crucial to note that APR is calculated on a compound basis, meaning that interest accrues on both the principal balance and any unpaid interest charges from previous periods. This compounding effect can have a significant impact on the overall cost of carrying a credit card balance.

By understanding APR and its implications, you can make informed decisions when it comes to managing your credit card balance and choosing the most suitable credit card for your needs. Now let’s delve into the formula used to calculate APR on a credit card balance.

Formula for Calculating APR on Credit Card Balance

To calculate the APR on a credit card balance, you need to use a specific formula that takes into account the various components of the interest calculation. The formula for calculating APR on a credit card balance is as follows:

APR = (Interest Expense ÷ Average Daily Balance) x 365

Let’s break down each component of this formula:

- Interest Expense: This refers to the total amount of interest paid on the credit card balance over a specific period. It includes both the interest charges on the principal balance and any additional fees or charges related to borrowing.

- Average Daily Balance: This is calculated by adding up the daily balances on the credit card for a billing cycle and dividing it by the number of days in that billing cycle. The daily balance is the amount owed on the card at the end of each day.

- 365: This represents the number of days in a year and is used to convert the interest rate into an annual percentage rate.

By using this formula, you can calculate the APR on your credit card balance, giving you a clear understanding of the annualized cost of borrowing. It is important to note that this formula assumes a consistent daily balance and interest rate throughout the billing cycle, which may not always be the case. Additionally, it’s crucial to remember that APR calculations do not include any compounding or fees beyond the stated interest charges.

Now let’s move on to understanding the components involved in calculating the APR on a credit card balance.

Components of Calculating APR

Calculating the APR on a credit card balance requires considering several important components. Let’s take a closer look at each of these components:

- Interest Charges: The interest charges represent the amount of money that the credit card issuer charges for borrowing on the card. This can include both the principal balance and any unpaid interest from previous billing cycles.

- Balance Transfer Fees: Some credit cards may charge a fee for transferring a balance from one card to another. This fee, typically expressed as a percentage of the transferred amount, is considered a component of the APR calculation.

- Annual Fees: Certain credit cards may have an annual fee, which is a fixed amount charged yearly for the privileges and benefits offered by the card. The annual fee is another component that should be factored into the APR calculation.

- Promotional Rates: Promotional rates, such as introductory or promotional APRs, may be offered by credit card issuers for a specific period. These rates, which are often lower than the regular APR, should be considered when calculating the overall APR on a credit card balance.

- Grace Period: Many credit cards offer a grace period, which is a period of time during which no interest is charged on new purchases if the full balance is paid by the due date. However, if the balance is not paid in full, the grace period does not apply, and interest charges will be incurred.

By taking into account these various components, you can obtain a more accurate representation of the APR on your credit card balance. It’s important to review your credit card terms and conditions to understand the specific rates, fees, and promotional offers that apply to your card.

Now that we’ve explored the components involved in calculating APR, let’s delve into an example calculation to better understand how it works in practice.

Example Calculation of APR

To illustrate the calculation of APR on a credit card balance, let’s consider a hypothetical scenario:

Suppose you have a credit card with a balance of $1,000 and an interest rate of 18% per year. Over the course of a billing cycle, you made no additional purchases or payments. The credit card issuer also charges a balance transfer fee of 3%. The billing cycle lasts for 30 days.

To calculate the APR on this credit card balance, we would follow these steps:

- Calculate the interest charges: Multiply the balance by the annual interest rate and divide it by the number of days in the year. In this case, the interest charges would be (($1,000 * 0.18) / 365) x 30 = $14.79.

- Calculate the balance transfer fee: Multiply the balance by the balance transfer fee rate. In this case, the balance transfer fee would be $1,000 * 0.03 = $30.

- Add the interest charges and balance transfer fee: $14.79 + $30 = $44.79.

- Calculate the average daily balance: As there were no additional purchases or payments, the average daily balance would be $1,000.

- Calculate the APR: Divide the total charges ($44.79) by the average daily balance ($1,000) and multiply it by the number of days in a year (365). The APR would be ($44.79 / $1,000) x 365 = 16.39%.

Based on this calculation, the APR on this credit card balance would be approximately 16.39%. This example highlights the impact of additional fees, such as balance transfer fees, on the overall APR calculation.

By understanding how to calculate the APR on a credit card balance and considering all relevant components, you can make more informed decisions about managing your credit card debt and choosing the most cost-effective option.

Now, let’s explore the importance of knowing your APR and how it can affect your financial well-being

Importance of Knowing Your APR

Understanding your APR on a credit card balance is essential for several reasons:

1. Cost of Borrowing: Your APR directly affects the cost of borrowing on your credit card. By knowing your APR, you can gauge how much interest you will be charged on your outstanding balance if you carry the debt from month to month. This understanding allows you to make more informed decisions about managing your balance and controlling interest charges.

2. Financial Planning: Knowing your APR helps you create realistic and effective financial plans. If you are aware of the interest rate on your credit card, you can factor it into your budget and make appropriate adjustments. This ensures that you allocate enough funds to cover credit card payments and avoid unnecessary interest expenses.

3. Debt Management: If you carry a balance on your credit card, understanding your APR is crucial for managing your debt effectively. With this knowledge, you can prioritize paying off high-interest credit card balances first, helping you save money in the long run and potentially accelerate your path to debt freedom.

4. Comparison Shopping: The APR provides a standardized metric for comparing different credit card offers. By understanding the APR of various credit cards, you can evaluate which one offers the most favorable interest rate. This enables you to choose a credit card that aligns with your financial goals and minimizes unnecessary interest expenses.

5. Avoiding Surprise Charges: Knowing your APR helps you anticipate and avoid surprise interest charges. By being aware of the interest rate associated with your credit card, you can make timely payments and avoid penalties or late fees. It can also empower you to take advantage of promotional offers or introductory APRs before they expire.

Having a clear understanding of your credit card APR puts you in control of your financial situation. It allows you to make informed decisions, save money on interest charges, and plan your financial future more effectively.

Now, let’s explore some strategies for potentially lowering your APR and reducing your interest expenses.

How to Lower Your APR

Lowering your APR can help you save money on interest charges and make managing your credit card balance more manageable. While the final decision to change your APR rests with the credit card issuer, here are some strategies that may increase your chances of securing a lower rate:

1. Improve Your Credit Score: Lenders typically offer lower interest rates to borrowers with higher credit scores. By maintaining a good credit score, you demonstrate your creditworthiness and may qualify for a lower APR. Pay your bills on time, keep credit card balances low, and avoid opening unnecessary credit accounts to improve your credit score.

2. Negotiate with Your Credit Card Issuer: Reach out to your credit card issuer and inquire about the possibility of lowering your APR. If you have a history of responsible credit card usage and on-time payments, the issuer may be willing to adjust your APR to retain you as a customer.

3. Look for Balance Transfer Offers: Consider transferring your balance to a credit card with a lower APR or a promotional balance transfer offer. Many credit card issuers provide balance transfer promotions with introductory low or 0% APRs, allowing you to save on interest charges for a specific period. Be sure to read the terms and conditions, including any balance transfer fees, before making a decision.

4. Pay More than the Minimum Payment: Making only the minimum payment prolongs the time it takes to pay off your credit card balance and increases the amount of interest paid. By paying more than the minimum payment, you can reduce the principal balance faster and potentially lower the overall interest charges.

5. Consider a Personal Loan: If you have a significant credit card balance and struggle with high APRs, exploring the option of a personal loan could be worthwhile. Personal loans often have lower interest rates compared to credit cards, especially if you have good credit. Using a personal loan to pay off your credit card balance can consolidate your debt and potentially save on interest expenses.

6. Keep an Eye on Promotional Offers: Monitor credit card offers and keep an eye out for promotional APRs. Some credit card issuers offer temporary or long-term promotional rates that may be significantly lower than your current APR. Taking advantage of these offers when available can help reduce your interest charges.

It’s important to note that not all strategies may be suitable for everyone, and individual results may vary. It’s recommended to assess your financial situation and consult with a financial advisor before making any decisions.

By implementing these strategies and being proactive about managing your credit card balances, you can potentially lower your APR and save money on interest charges.

Now, let’s summarize the key points discussed in this article.

Conclusion

Understanding how to calculate the APR on a credit card balance is an essential skill for effectively managing your finances. By knowing your APR, you can make informed decisions regarding borrowing, budgeting, and debt repayment. It provides a clear understanding of the cost of carrying a credit card balance and allows you to compare different credit card offers.

In this article, we explored the formula for calculating APR on a credit card balance, delved into the components involved in the calculation, and provided an example to illustrate the process. We discussed the importance of knowing your APR, including its impact on the cost of borrowing, financial planning, and debt management. Additionally, we provided strategies for potentially lowering your APR and reducing your interest expenses.

Remember, improving your credit score, negotiating with your credit card issuer, considering balance transfer offers, and making more than the minimum payment can all work in your favor when it comes to reducing your APR. However, it’s crucial to assess your individual situation and consult with professionals before making any financial decisions.

By being aware of your APR and taking steps to manage it effectively, you can make significant strides towards achieving financial stability and optimizing your credit card usage.

So, take the time to understand your APR, evaluate your options, and make informed financial choices that align with your goals. By doing so, you’ll be on your way to mastering your credit card balances and achieving a healthier financial future.