Finance

How Many Futures Contracts Should You Buy?

Published: December 23, 2023

Learn how many futures contracts you should buy in the world of finance. Gain insights and make informed decisions for your investments.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Futures Contracts

- Factors to Consider

- Capital Available

- Risk Tolerance

- Market Volatility

- Contract Size

- Trading Strategy

- Psychological Factors

- Determining the Number of Contracts

- Calculation Method 1: Fixed Fractional Position Sizing

- Calculation Method 2: Risk-Based Position Sizing

- Conclusion

Introduction

Welcome to the world of futures trading! As a trader, one of the key decisions you will need to make is how many futures contracts to buy or sell in a trade. The number of contracts you choose can have a significant impact on your potential profits or losses. It’s important to carefully consider various factors before determining the appropriate number of contracts for your trades.

Futures contracts are derivative financial instruments that allow traders to speculate on the future price movements of an underlying asset such as stocks, bonds, commodities, or currencies. These contracts are standardized agreements to buy or sell the asset at a predetermined price and date in the future. Unlike stocks, which represent ownership in a company, futures contracts are purely speculative instruments.

So, how do you determine the right number of futures contracts to buy or sell? While there is no one-size-fits-all answer, there are several factors to consider that can guide your decision. These factors include your available capital, risk tolerance, market volatility, contract size, trading strategy, and even psychological factors.

First and foremost, you need to assess the capital you have available for trading. Futures contracts typically require margin, which is a fraction of the contract’s value that you must deposit with your broker. Margin requirements vary depending on the asset and the exchange, but they are generally a percentage of the total contract value. It’s important to allocate a portion of your capital to each trade and avoid overcommitting to avoid excessive risk.

Another important factor to consider is your risk tolerance. Every trader has a different appetite for risk, and it’s crucial to align the number of contracts you trade with your risk tolerance. If you are a conservative trader, you may choose to trade fewer contracts to limit potential losses. On the other hand, if you are a more aggressive trader, you might opt for a larger number of contracts to potentially maximize profits.

Market volatility is another consideration when determining the number of contracts to trade. Volatility refers to the magnitude of price fluctuations in the market. Higher volatility typically increases the potential for larger profits or losses. In highly volatile markets, you might consider reducing the number of contracts to mitigate the risk. Conversely, in less volatile markets, you may be more inclined to trade a larger number of contracts to capture potential gains.

Understanding Futures Contracts

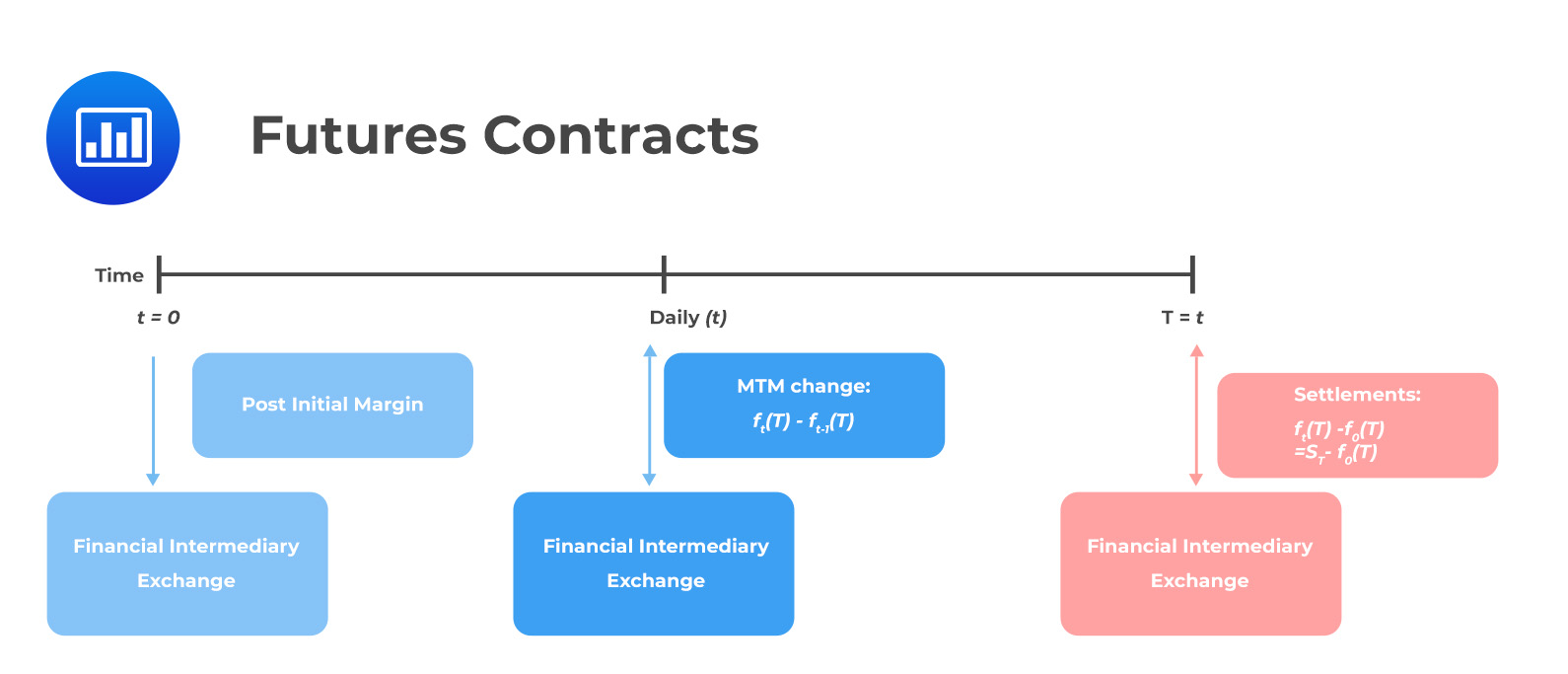

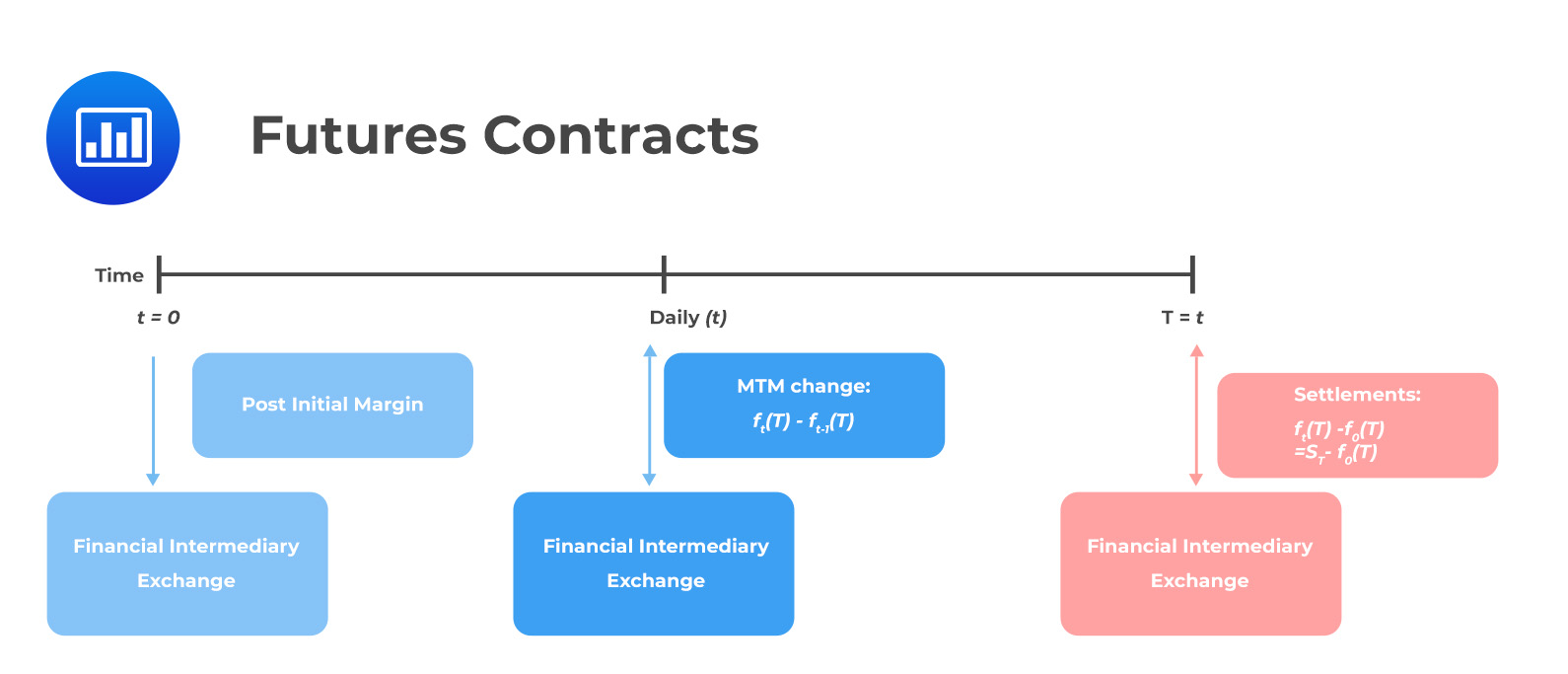

Before delving into determining the number of futures contracts to buy or sell, it’s essential to have a clear understanding of what futures contracts are. A futures contract is a legally binding agreement between two parties to buy or sell an asset at a predetermined price and date in the future.

These contracts are traded on exchanges, such as the Chicago Mercantile Exchange (CME) or the New York Mercantile Exchange (NYMEX). They serve as a mechanism for hedging and speculating on the price movements of various assets, including commodities, stocks, bonds, currencies, and indices.

Unlike stocks, which represent ownership in a company, futures contracts are purely derivative instruments. They derive their value from the underlying asset and are settled in cash or physical delivery upon expiration.

Each futures contract specifies the quantity, delivery date, and terms of the underlying asset. For example, a crude oil futures contract may represent 1,000 barrels of oil, while a gold futures contract may represent 100 troy ounces of gold. The price at which the asset will be bought or sold is determined upfront, eliminating uncertainty about future market prices.

Futures contracts are typically leveraged instruments, meaning that traders only need to deposit a fraction of the contract’s value. This fraction, known as margin, acts as collateral against potential losses. The leverage allows traders to control a larger position with a smaller amount of capital, increasing the potential returns but also the risk.

It’s important to note that most futures contracts are standardized, meaning that they have predefined contract specifications, such as contract size, expiration date, and tick size. This standardization ensures liquidity in the market, as traders can easily buy and sell contracts with uniform terms.

There are two main types of futures contracts: long and short. A long position means the trader is buying a contract with the expectation that the price of the underlying asset will rise. In contrast, a short position involves selling a contract with the belief that the price will decline. Traders can profit from both rising and falling markets by taking the corresponding long or short positions.

Now that we have a solid understanding of futures contracts, let’s explore the factors that influence the decision of how many contracts to trade.

Factors to Consider

When determining the number of futures contracts to buy or sell, there are several factors that you need to take into account. These factors will help you make an informed decision based on your specific circumstances, trading goals, and risk tolerance. Let’s explore these factors in more detail:

- Capital Available: The amount of capital you have available for trading is a crucial factor in determining the number of contracts to trade. It’s important to allocate a portion of your capital to each trade, taking into consideration the margin requirements and potential losses. By managing your available capital effectively, you can balance risk and potential returns.

- Risk Tolerance: Every trader has a unique risk tolerance level. Some traders are more conservative and prefer to minimize risk, while others are more aggressive and comfortable with taking on higher levels of risk. Your risk tolerance will influence the number of contracts you feel comfortable trading. It’s vital to align your trading strategy with your risk tolerance to ensure a suitable risk-reward ratio.

- Market Volatility: The level of volatility in the market can impact the number of contracts you trade. Higher market volatility can increase the potential for larger profits or losses. In highly volatile markets, it might be prudent to reduce the number of contracts to mitigate risk. Conversely, in less volatile markets, you may consider trading a larger number of contracts to capture potential gains.

- Contract Size: Each futures contract represents a specific quantity of the underlying asset. The contract size can vary depending on the asset class. For example, a crude oil futures contract might represent 1,000 barrels of oil, while a gold futures contract could represent 100 troy ounces of gold. The contract size is an important factor to consider when determining the appropriate number of contracts to trade.

- Trading Strategy: Your trading strategy plays a significant role in determining the number of contracts to trade. Different strategies involve varying levels of risk and potential returns. If your strategy relies on short-term price fluctuations and quick trades, you might choose to trade a larger number of contracts. Conversely, if your strategy focuses on longer-term trends and lower-frequency trades, you might opt for fewer contracts.

- Psychological Factors: It’s important to consider your emotional and psychological state when determining the number of contracts to trade. Trading involves managing emotions such as fear and greed, and trading too many contracts can put emotional pressure on you. Maintaining a clear and objective mindset is crucial for making rational trading decisions.

By carefully considering these factors, you can determine the appropriate number of futures contracts to buy or sell in each trade. Different traders will have different approaches based on their individual circumstances and preferences. It’s important to find a balance that aligns with your risk tolerance, trading goals, and overall trading strategy.

Capital Available

When deciding the number of futures contracts to trade, one of the crucial factors to consider is the capital available for trading. The amount of capital you have will have a direct impact on the number of contracts you can trade and the overall risk exposure of your portfolio.

Futures contracts typically require an initial margin, which is a percentage of the contract’s total value that you must deposit with your broker. This margin acts as collateral against potential losses. The margin requirement varies depending on the asset class and the exchange where the contracts are traded. It’s important to understand the margin requirements specific to the futures contracts you intend to trade, as it can differ significantly between different assets.

When determining the appropriate number of contracts, you should allocate a portion of your available capital to each trade. This allocation will depend on your risk management strategy and the level of risk you are comfortable with taking. Generally, it is advisable to avoid overcommitting a significant portion of your trading capital to a single trade, as it increases the potential for excessive losses in case the trade goes against you.

As a guideline, many traders adhere to the 1% rule, which suggests risking no more than 1% of your capital on any single trade. For example, if you have $50,000 in trading capital, you would limit your risk to $500 per trade. By applying this rule, you can determine the maximum loss you are willing to accept in a trade and calculate the number of contracts accordingly.

Let’s assume you are trading E-mini S&P 500 futures, which have a contract size of $50 per index point and an initial margin requirement of $5,000 per contract. If you are willing to risk $500 per trade, you would divide that risk by the maximum potential loss per contract, which is determined by the difference between your entry price and your stop-loss level.

For instance, if you set a stop-loss at 10 points away from your entry price, the maximum potential loss per contract would be $500 (10 points * $50 per point). If you are comfortable risking this amount, you can divide your maximum risk per trade ($500) by the maximum potential loss per contract ($500), which results in 1 contract.

It’s important to note that this is just one approach to determining the number of contracts based on capital available and risk tolerance. You may adjust the percentage of risk you are willing to take or the amount of capital you allocate to each trade based on your personal preferences and trading strategy.

By effectively managing your available capital and considering your risk tolerance, you can determine the appropriate number of futures contracts to trade. This approach helps you maintain a disciplined and balanced trading strategy while limiting the potential impact of individual trades on your overall portfolio.

Risk Tolerance

When deciding on the number of futures contracts to trade, it’s crucial to take into account your risk tolerance. Risk tolerance refers to your willingness and ability to withstand potential losses in pursuit of potential gains. Every trader has a unique risk tolerance level, and it plays a significant role in determining the appropriate number of contracts to trade.

Some traders have a conservative risk tolerance and prefer to prioritize capital preservation over high-risk, high-reward strategies. They are more inclined to trade fewer contracts to limit potential losses and protect their trading capital. These traders value stability and are not comfortable with taking on excessive risk.

On the other hand, some traders have a higher risk tolerance and are willing to take on more significant market exposure for the potential of higher returns. These traders may opt for a larger number of contracts, seeking to capitalize on price movements in the market and maximize profits. They are more comfortable with the inherent volatility and uncertainty associated with trading futures contracts.

Understanding your risk tolerance is essential to maintaining a disciplined approach to trading. It allows you to establish appropriate risk management strategies and ensure that the number of contracts you trade aligns with your tolerance levels.

Factors that influence risk tolerance include your financial situation, investment goals, time horizon, and personal psychological makeup. It is crucial to evaluate these factors and be honest with yourself about your willingness to accept potential losses.

One way to assess your risk tolerance is to consider your reaction to previous losses. If you have experienced significant anxiety or emotional distress due to losses, it might indicate a lower risk tolerance. Conversely, if you have been relatively unaffected by losses and are more focused on potential gains, it may suggest a higher risk tolerance.

To determine the number of contracts based on your risk tolerance, you can establish a maximum percentage of your trading capital that you are willing to risk on a single trade. For example, if you decide that you are comfortable with risking 2% of your capital, you can calculate the number of contracts based on your stop-loss level and the potential loss per contract.

Ultimately, finding the right balance between risk and reward is a personal decision. It’s important to understand that trading involves risks, and managing those risks is an integral part of a successful trading strategy. By aligning the number of contracts you trade with your risk tolerance, you can build a trading approach that fits your individual risk profile and trading objectives.

Market Volatility

When determining the number of futures contracts to trade, it’s essential to consider market volatility. Volatility refers to the magnitude and frequency of price fluctuations in the market. Higher volatility often indicates larger price swings and potential opportunities for traders.

Market volatility can significantly impact the performance of your trades and the level of risk you are exposed to. Understanding the volatility of the specific asset you intend to trade is crucial in determining the appropriate number of contracts.

In highly volatile markets, the potential for larger profits or losses increases. In such cases, it may be prudent to trade fewer contracts to mitigate risk. By reducing the number of contracts, you are effectively limiting the exposure to potential price swings, which can help preserve capital and manage risk. This approach is particularly important for traders with lower risk tolerance or those who are still building their trading skills and experience.

Conversely, in less volatile markets, price movements are generally smaller and more predictable. This may provide an opportunity for traders to increase the number of contracts they trade, aiming to capture potential gains from small price fluctuations. This approach is commonly followed by more experienced and risk-tolerant traders who are actively seeking opportunities for profit.

It’s crucial to monitor and assess market volatility before entering a trade. Traders often use various technical indicators, such as average true range (ATR) or Bollinger Bands, to measure and evaluate market volatility. These indicators can provide insights into the historical volatility of an asset, helping you gauge the potential level of risk and adjust the number of contracts accordingly.

Additionally, it’s important to consider the impact of news events and economic releases on market volatility. Major announcements, such as central bank decisions, economic data releases, or geopolitical developments, can trigger significant market movements. Traders may choose to adjust the number of contracts or temporarily avoid trading during these high-impact events to mitigate the potential risks associated with increased volatility.

Understanding market volatility and its impact on the number of contracts you trade is crucial for effective risk management. By considering the level of volatility, you can tailor your trading approach to align with the market conditions, allowing you to optimize your trading opportunities while managing your risk exposure.

Contract Size

When determining the number of futures contracts to trade, it’s important to consider the contract size. The contract size refers to the specified quantity or measurement of the underlying asset that each futures contract represents.

Contract sizes vary depending on the asset class and the specific futures contract. For example, in commodities futures, each contract may represent a certain amount of the commodity, such as barrels of oil, bushels of wheat, or ounces of gold. In equity index futures, the contract size may represent a particular index value multiplied by a specific multiplier.

The contract size is an essential factor in determining the appropriate number of contracts to trade. It affects the level of exposure you have to the underlying asset and the potential gains or losses you can expect from a price movement.

Traders should consider their available trading capital and risk management strategy when determining the number of contracts based on the contract size. If the contract size is too large relative to your capital, it may lead to excessive risk and potential losses that are beyond your risk tolerance.

For example, let’s say you are trading crude oil futures, and each contract represents 1,000 barrels of oil. If the current price of crude oil is $60 per barrel, the value of each contract would be $60,000 ($60 x 1,000 barrels). If you have a trading capital of $100,000 and are willing to risk 2% of your capital per trade, you would need to calculate the appropriate number of contracts based on the potential loss per contract.

Suppose you set a stop-loss level at $58 per barrel, which would result in a potential loss of $2 per barrel. To determine the number of contracts, you would divide your maximum risk per trade ($2,000) by the potential loss per contract ($2 per barrel), resulting in 1,000 contracts.

It’s important to note that smaller contract sizes can provide more flexibility for traders with limited capital, allowing them to adjust the number of contracts according to their risk management strategy.

On the other hand, traders with larger capital can consider trading multiple contracts to increase their exposure to the underlying asset and potentially maximize their profits. However, it’s crucial to ensure that you are managing the risk appropriately relative to your available capital, risk tolerance, and trading strategy.

In summary, the contract size of the futures contract you are trading should be taken into consideration when determining the number of contracts you trade. By considering your available capital and risk management strategy, you can ensure that the number of contracts aligns with your risk tolerance and objectives.

Trading Strategy

When deciding on the number of futures contracts to trade, your trading strategy plays a crucial role. Your trading strategy encompasses the specific approach you take in the market, including the types of trades you execute, the timeframes you trade, and the risk management techniques you employ.

Your trading strategy should guide your decision on the number of contracts you trade, as different strategies have varying levels of risk and potential returns. Here are a few key points to consider:

Short-Term vs. Long-Term Trading: If your trading strategy focuses on short-term price fluctuations and quick trades, you might prefer to trade a larger number of contracts. Short-term traders aim to capture small price movements and frequently enter and exit trades. By trading more contracts, they increase their potential for quick profits. However, it’s important to carefully manage risk and use appropriate stop-loss orders.

Conversely, if your trading strategy is geared towards longer-term trends and lower-frequency trades, you might opt for fewer contracts. Swing traders or position traders analyze higher timeframes and aim to capture larger price moves. They often trade with a wider stop-loss and target bigger profits over a more extended period. Such traders might choose to allocate their available capital to a smaller number of contracts.

Scalping vs. Trend Following: Traders who employ a scalping strategy aim to make multiple small profits throughout the day, relying on high volume and tight stop-loss orders. Scalpers often trade multiple contracts and take advantage of small price differentials. On the other hand, trend followers focus on capturing big trends and aim for larger profits by holding positions for extended periods. They may allocate their capital to fewer contracts to allow for longer-term trades.

Volatile vs. Less Volatile Markets: Traders who gravitate towards volatile markets might choose to trade a larger number of contracts. Highly volatile markets offer increased potential for larger price movements and profits. However, it’s essential to carefully manage risk and adjust the position size to account for the increased volatility. Traders in less volatile markets might opt for a smaller number of contracts, recognizing that the potential for significant price swings is reduced.

Strategy-Specific Considerations: Each trading strategy has its own unique considerations that may influence the number of contracts traded. For example, if you are using a breakout strategy that relies on volatility expansion, you might choose to trade a larger number of contracts when a breakout occurs. If you are utilizing a mean-reversion strategy, where you anticipate prices to revert to their average, you might trade fewer contracts to reduce overall exposure.

It’s crucial to align the number of contracts you trade with your specific trading strategy, risk management rules, and personal preferences. Adequate planning, backtesting, and careful consideration of your strategy’s characteristics can guide your decision-making process.

Remember, your trading strategy should be adaptable and able to accommodate changes in market conditions. Regularly evaluate and refine your strategy to ensure it remains in line with your trading goals and risk management principles.

Psychological Factors

Psychological factors play a significant role in trading, and they can impact the decision of how many futures contracts to trade. Understanding and managing these psychological factors is crucial for maintaining a disciplined and successful trading approach.

Emotions: The emotions of fear and greed are prevalent in trading. Fear can lead to hesitation, missed opportunities, and the tendency to trade fewer contracts to minimize risk. Greed, on the other hand, can drive impulsive behavior and the desire to trade more contracts to maximize potential profits. It’s essential to recognize and manage these emotions to avoid making irrational decisions that may negatively impact your trading results.

Stress Management: Trading can be a stressful endeavor, and too much stress can impair decision-making abilities. Overtrading, or trading too many contracts, may amplify stress levels as it increases the pressure on each individual trade. Managing stress through relaxation techniques, setting realistic expectations, and adhering to a well-defined trading plan can help maintain a clear mindset when determining the number of contracts to trade.

Self-Control: Self-discipline and self-control are crucial for successful trading. It’s vital to have the discipline to stick to your risk management rules and avoid making impulsive decisions based on emotions. This includes having the self-control to limit the number of contracts you trade based on your risk tolerance and available capital, even when faced with potential opportunities in the market.

Confidence and Patience: Confidence in your trading plan and patience when waiting for the right setups are essential psychological factors in trading. It’s important to have confidence in your analysis and decision-making abilities. Traders who are more confident may be inclined to trade more contracts, while those who lack confidence may opt for fewer contracts. Additionally, exercising patience and waiting for high-probability trade setups can reduce impulsive trading decisions and provide a solid foundation for determining the number of contracts to trade.

Learning from Mistakes: Learning from past mistakes can help improve future decisions. Reflecting on previous trades and evaluating the outcomes can provide insight into areas for improvement and help refine your approach to determining the number of contracts to trade. By identifying patterns of success or areas where adjustments need to be made, you can enhance your trading strategy and overall performance.

Awareness of these psychological factors can make a substantial difference in your trading. Developing emotional intelligence, maintaining a positive mindset, and consistently evaluating your reactions and decision-making process can contribute to effective risk management and help you decide on the appropriate number of futures contracts to trade.

Remember, trading is as much a mental game as it is a financial one. Prioritizing psychological well-being, practicing self-discipline, and continuously working on your mindset will ultimately contribute to your long-term success as a trader.

Determining the Number of Contracts

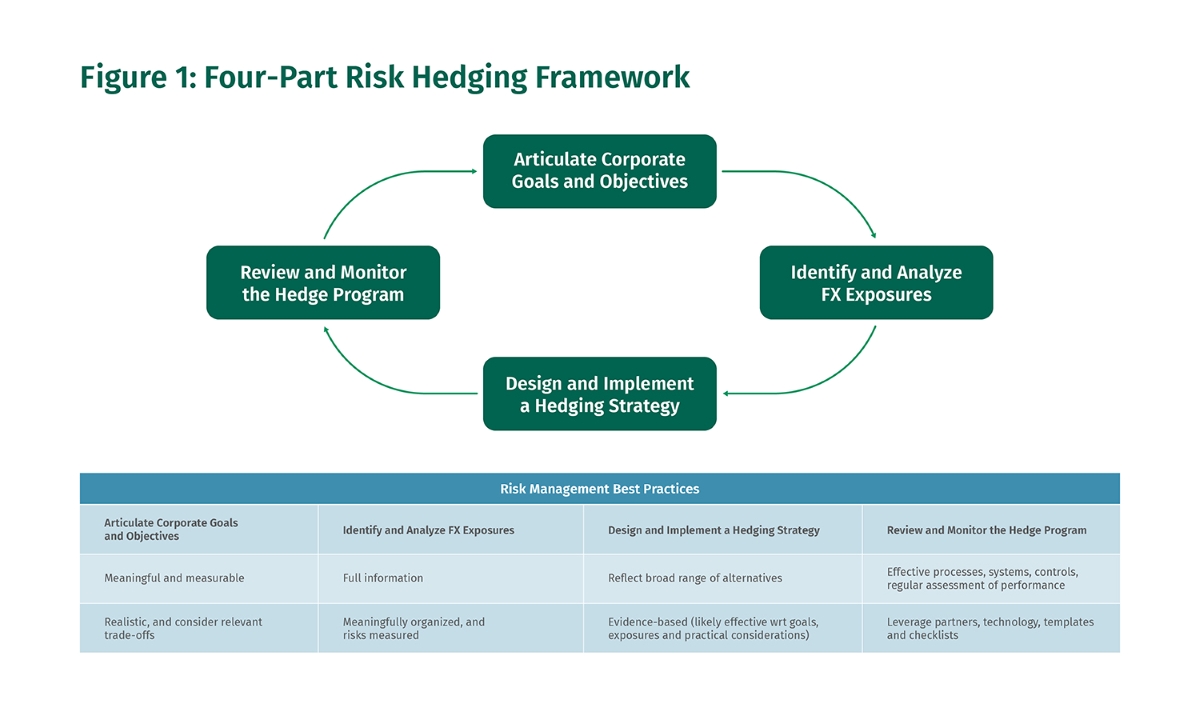

When it comes to determining the number of futures contracts to trade, it’s important to consider the various factors we’ve discussed: capital available, risk tolerance, market volatility, contract size, trading strategy, and psychological factors. By carefully analyzing these factors, you can arrive at a well-informed decision that aligns with your individual circumstances and trading objectives.

There are two common calculation methods that traders use to determine the number of contracts to trade: fixed fractional position sizing and risk-based position sizing.

The first method, fixed fractional position sizing, involves allocating a fixed percentage of your trading capital to each trade. For example, you might decide to risk 2% of your capital on each trade. In this case, you would calculate the maximum risk per trade based on the stop-loss level and the potential loss per contract. By dividing your maximum risk per trade by the potential loss per contract, you can determine the appropriate number of contracts to trade based on your risk tolerance and capital available.

The second method, risk-based position sizing, takes into account the specific risk profile of the trade. It involves calculating the size of the position based on the difference between the entry price and the stop-loss level, as well as the maximum amount you are willing to lose on the trade. This method allows for more customized position sizing and can be beneficial in managing risk in volatile or high-probability trading setups.

Ultimately, the goal is to find a balance between risk and potential reward. You want to ensure that you are not exposing too much of your trading capital to a single trade, while still allowing for an appropriate level of market exposure to generate potential profits.

It’s essential to conduct thorough analysis, backtesting, and evaluate the results of these calculation methods to ensure their effectiveness within your trading strategy. Each trader may have a slightly different approach, depending on their specific needs and preferences.

Keep in mind that determining the number of contracts is not a one-time decision. As your trading capital, risk tolerance, and market conditions evolve, you may need to re-evaluate and adjust the number of contracts you trade to ensure they align with your trading goals and risk management principles.

Consistency, discipline, and ongoing evaluation are key components of successfully determining the number of contracts to trade. By considering the factors we discussed and applying the appropriate calculation methods, you can optimize your trading approach and improve your chances of achieving your desired trading outcomes.

Calculation Method 1: Fixed Fractional Position Sizing

One commonly used method for determining the number of futures contracts to trade is the fixed fractional position sizing approach. This method involves allocating a fixed percentage of your trading capital to each trade, allowing you to manage risk and control the amount of capital at stake in each position.

Here’s how the fixed fractional position sizing method works:

- Set a percentage of your trading capital that you are willing to risk on each trade. This percentage will depend on your risk tolerance and trading strategy. For example, you might decide to risk 2% of your capital on each trade.

- Identify your maximum risk per trade, which is determined by the difference between your entry price and your predetermined stop-loss level.

- Calculate the potential loss per contract by multiplying the maximum risk per trade by the potential loss per contract (determined by the difference in contract value).

- Divide your maximum risk per trade by the potential loss per contract to determine the number of contracts you can trade. This will help ensure that you are not risking more than your predetermined percentage of capital on any given trade.

For example, let’s say you have a trading capital of $100,000 and you’ve decided to risk 2% on each trade. You are trading E-mini S&P 500 futures, where each contract has a value of $50 per index point. If your maximum risk per trade is $2,000, you would divide this by the potential loss per contract (determined by your stop-loss level) to determine the number of contracts.

Suppose your stop-loss level corresponds to a potential loss of $20 per contract. By dividing your maximum risk per trade ($2,000) by the potential loss per contract ($20), you would arrive at 100 contracts. This means that you can trade 100 E-mini S&P 500 futures contracts while still adhering to your predetermined risk tolerance of 2% per trade.

It’s important to note that the potential loss per contract is influenced by factors such as the contract size, the distance between your entry price and stop-loss level, and the tick size of the contract. These factors should be considered when calculating the number of contracts to ensure accurate risk management.

The fixed fractional position sizing method allows you to adjust your position size based on the specific risk profile of each trade. By risking a fixed percentage of your capital, you can withstand losses and preserve your trading capital during unfavorable market conditions while being able to seize opportunities for potential profits.

Remember to regularly evaluate and adjust your fixed percentage based on changes in your trading capital and risk tolerance. This method helps maintain consistency in risk management and ensures that the number of contracts you trade aligns with your risk profile and trading objectives.

Calculation Method 2: Risk-Based Position Sizing

Another approach to determining the number of futures contracts to trade is the risk-based position sizing method. This method takes into account the specific risk profile of each trade and allows for a more customized position size based on the amount you are willing to risk.

Here’s how the risk-based position sizing method works:

- Define the maximum amount you are willing to risk on the trade. This amount is typically determined by your risk tolerance and trading strategy. For example, you might decide that you are willing to risk $1,000 on a particular trade.

- Calculate the distance between your entry price and your stop-loss level, which represents the potential loss per contract.

- Divide the maximum risk amount by the potential loss per contract to determine the number of contracts you can trade.

For example, let’s say you want to trade crude oil futures, and based on your analysis, you set a stop-loss level that represents a potential loss of $500 per contract. If you are willing to risk $1,000 on the trade, you would divide this by the potential loss per contract ($500) to determine the number of contracts you can trade, which in this case would be 2 contracts.

The risk-based position sizing method allows you to tailor your position size to the specific risk parameters of each trade. By taking into account the potential loss per contract and the maximum risk amount you are willing to accept, you can ensure that your trades are proportionate to your risk management strategy.

It’s important to note that the potential loss per contract is influenced by factors such as the distance between your entry price and stop-loss level and the tick size of the contract. These factors should be considered when calculating the number of contracts to accurately manage risk.

This method allows for greater customization and flexibility in position sizing compared to fixed fractional position sizing. It enables you to adapt your position size based on the risk-reward profile and the specific market conditions of each trade.

It’s crucial to evaluate and adjust your risk parameters regularly to reflect changes in your trading capital, risk tolerance, and market conditions. By adopting a risk-based approach, you can optimize your position sizing and ensure that the number of contracts you trade aligns with your risk management principles and target risk levels.

Remember to exercise caution and avoid overexposing yourself to the market. Adhering to proper risk management practices is essential for long-term success in futures trading.

Conclusion

Determining the number of futures contracts to trade requires careful consideration of several factors, including capital available, risk tolerance, market volatility, contract size, trading strategy, and psychological factors. Each trader has unique circumstances and objectives, so finding the right balance is essential for successful trading.

By assessing your available capital and risk tolerance, you can allocate an appropriate portion of your capital to each trade. This helps ensure that you do not overcommit to a single trade and can manage risk effectively. Consideration of market volatility is crucial, as it impacts the potential for profits or losses. Adapting the number of contracts based on the level of volatility helps align your trading approach with prevailing market conditions.

The contract size of the futures contract being traded is an important factor to consider. It determines the exposure to the underlying asset and influences potential gains or losses. Matching the number of contracts to the contract size ensures that your position size is in line with your risk management strategy.

Your trading strategy guides your decision on the number of contracts. Whether you follow a scalping, trend-following, or other strategy, it is important to align the number of contracts with the specific characteristics and risk profile of your chosen approach.

Psychological factors, such as managing emotions, stress, and maintaining self-control, cannot be overlooked. They play a significant role in successful trading and can impact decision-making. Being aware of these psychological factors and developing strategies to manage them contributes to maintaining a disciplined and rational approach when determining the number of contracts to trade.

Two commonly used calculation methods, fixed fractional position sizing and risk-based position sizing, offer guidelines for determining the appropriate number of contracts. Both methods aim to manage risk effectively and optimize position sizing based on available capital and risk tolerance.

In conclusion, determining the number of futures contracts to trade requires a holistic approach that considers multiple factors. By evaluating these factors and employing suitable calculation methods, traders can optimize risk management, align position sizes with trading objectives, and foster disciplined and successful trading strategies. Regular evaluation and adjustment of your approach based on changing market conditions and personal circumstances are paramount to maintaining a fruitful trading journey.