Finance

How Often Does Ulta Increase Credit Limit

Modified: January 15, 2024

Find out how often Ulta increases credit limit and manage your finances better. Understanding Ulta's credit limit policies can help you make informed financial decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of beauty and cosmetics! Ulta Beauty is a renowned retailer that offers an extensive range of makeup, skincare, and fragrance products. What sets Ulta apart from other beauty stores is its unique credit card program, which offers customers the opportunity to make purchases on credit and enjoy exclusive benefits.

One important aspect of any credit program is the credit limit, which dictates the maximum amount a cardholder can spend. If you’re an Ulta credit card holder or planning to become one, you may be wondering: “How often does Ulta increase credit limit?”. In this article, we will explore the factors that influence credit limit increases, Ulta’s credit limit increase policy, how often they raise credit limits, and tips to increase your Ulta credit limit.

Understanding how credit limits work and how to increase them can make a significant difference in your shopping experience at Ulta. So, let’s dive into the world of credit limits and find out how Ulta handles them!

Understanding Credit Limits

Before we delve into how often Ulta increases credit limits, let’s take a moment to understand what exactly a credit limit is and why it matters. A credit limit is the maximum amount of money that a credit card issuer, such as Ulta, allows cardholders to borrow and spend. Think of it as a financial safety net that sets boundaries on your spending.

When you apply for an Ulta credit card, the credit card issuer reviews your creditworthiness, taking into account factors such as your credit score, credit history, and income. Based on this evaluation, the issuer sets an initial credit limit for your Ulta card. This initial credit limit typically starts at a modest amount and can vary depending on your financial standing.

Having a credit limit serves several purposes. It helps prevent overspending beyond your means and encourages responsible financial behavior. It also provides a level of security for both the credit card issuer and the cardholder. For Ulta, the credit limit ensures that customers have a cap on their spending, while also allowing them the flexibility to make purchases and enjoy the benefits of the Ulta credit card program.

It’s important to note that your credit limit is not a fixed value and can be modified over time. Credit card issuers, including Ulta, periodically review cardholder accounts to assess their creditworthiness and may consider increasing credit limits for eligible individuals. Understanding the factors that influence credit limit increases can give you insight into how to potentially increase your Ulta credit limit.

Factors That Influence Credit Limit Increases

When it comes to credit limit increases, there are several factors that Ulta and other credit card issuers take into consideration. Here are some key factors that can influence whether or not your Ulta credit limit will be increased:

- Payment History: Your payment history is one of the most important factors that Ulta considers when determining credit limit increases. Making timely payments, paying at least the minimum amount due, and avoiding late payments or defaults demonstrate responsible financial behavior and increase your chances of receiving a credit limit increase.

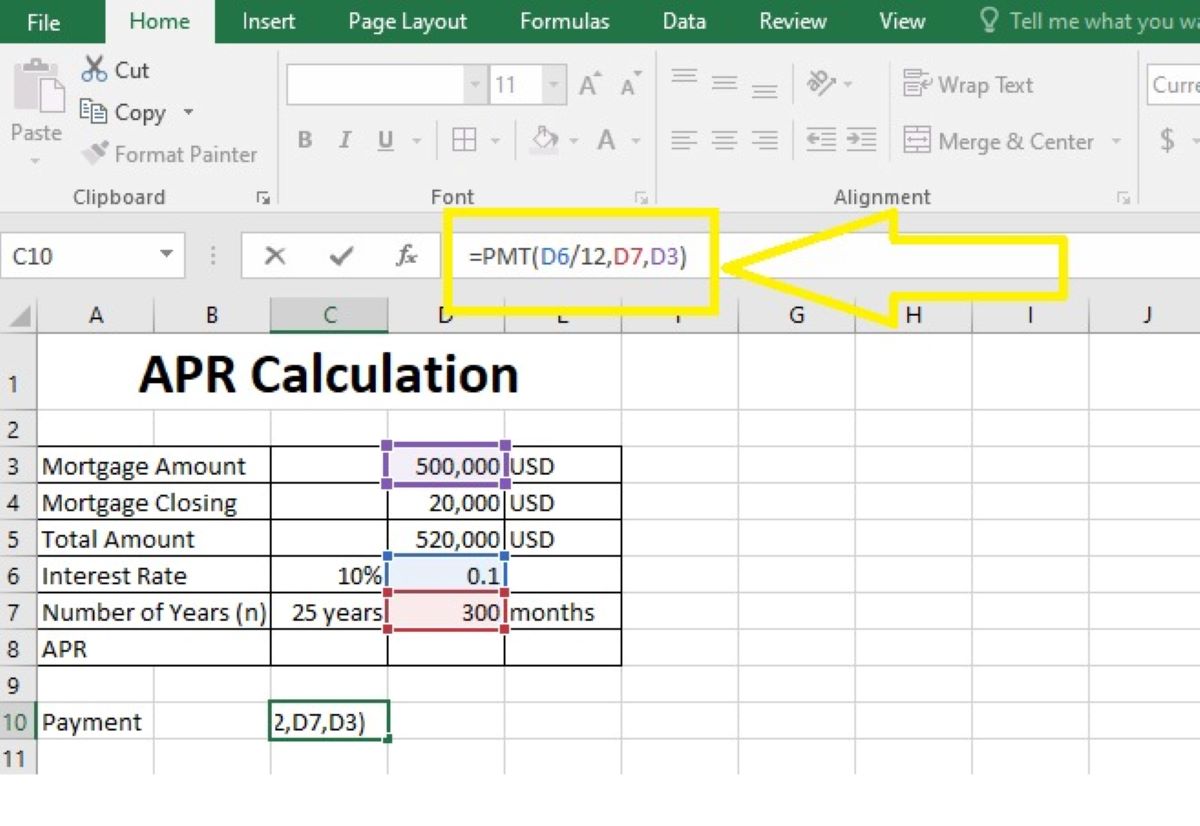

- Credit Utilization Ratio: Your credit utilization ratio is the percentage of your available credit that you are currently using. Ulta may consider increasing your credit limit if you consistently maintain a low credit utilization ratio. Ideally, keeping your utilization rate below 30% is recommended for a positive impact on your creditworthiness.

- Credit Score: Your credit score is a numerical representation of your creditworthiness. A higher credit score indicates a lower risk for the credit card issuer. If you have a good or excellent credit score, it demonstrates your ability to manage credit responsibly, which can enhance your chances of receiving a credit limit increase from Ulta.

- Income and Financial Stability: Your income and overall financial stability are factors that Ulta may consider when reviewing credit limit increase requests. Demonstrating a steady income and sound financial status can instill confidence in the credit card issuer and may improve your chances of receiving a credit limit increase.

- Length of Credit History: The length of your credit history is another factor that Ulta may take into account. If you have a long and positive credit history, it shows that you have a track record of responsible credit management, which can contribute to a credit limit increase.

Please note that while these factors play a significant role in determining credit limit increases, whether or not you receive an increase ultimately depends on the credit card issuer’s policies and your individual circumstances. It’s essential to maintain good credit habits and monitor your credit report regularly to maximize your chances of obtaining a credit limit increase from Ulta.

Ulta’s Credit Limit Increase Policy

Ulta Beauty has its own specific policies and guidelines when it comes to credit limit increases. While the exact details of their policy may vary, here is an overview of how Ulta generally handles credit limit increases:

Ulta periodically reviews the creditworthiness and financial standing of its credit cardholders to determine if they are eligible for a credit limit increase. This review process takes into account factors such as payment history, credit utilization ratio, credit score, income, and length of credit history.

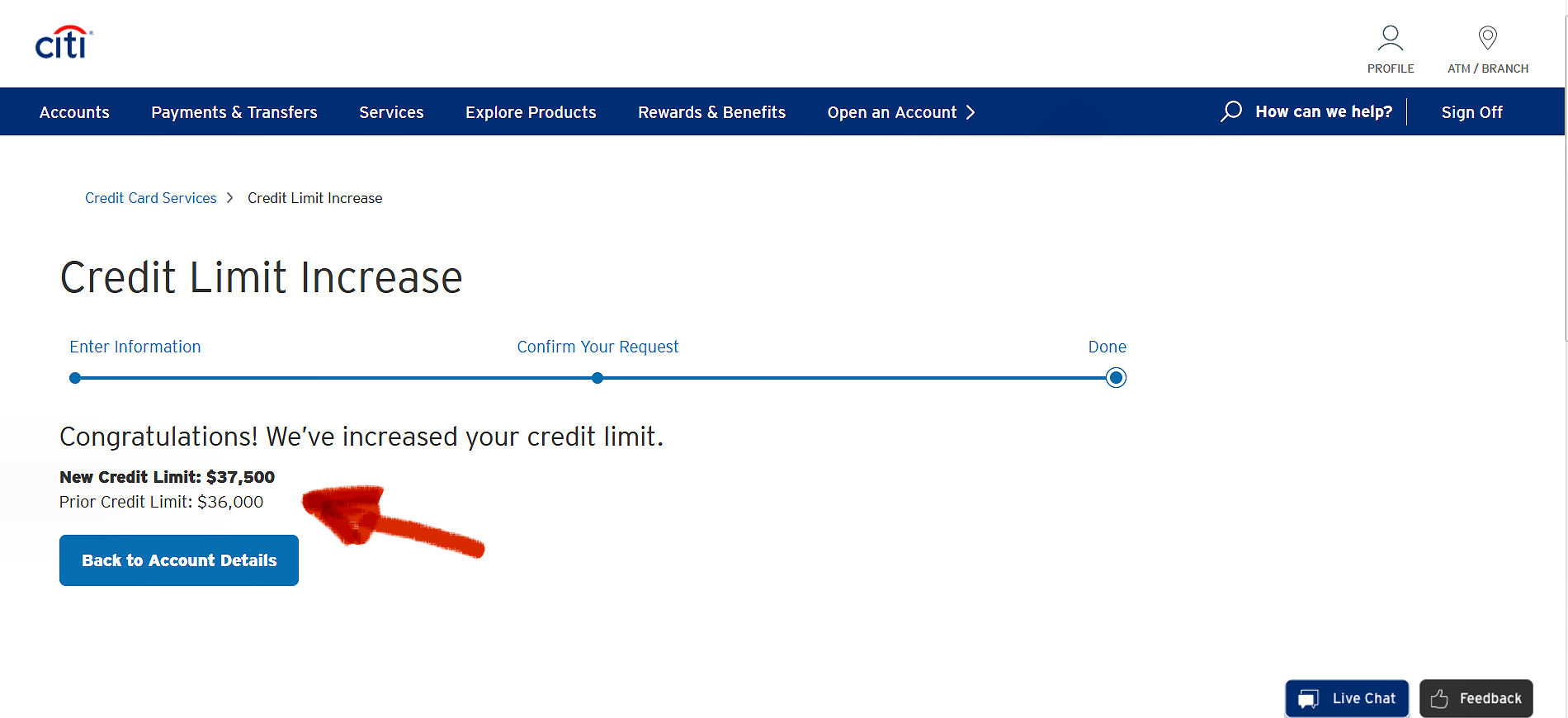

If Ulta determines that you meet their criteria for a credit limit increase, they may automatically raise your credit limit without any action required on your part. You will receive a notification informing you of the credit limit increase, and you can start enjoying the benefits of the higher limit immediately.

However, it’s important to note that Ulta does not guarantee credit limit increases for all cardholders. The decision to increase credit limits is at the discretion of Ulta and is based on their assessment of your creditworthiness. Factors like payment history, credit utilization, and credit score significantly influence their decision.

If you’re interested in requesting a credit limit increase, Ulta may provide an option to submit a request through their customer service channels. Keep in mind that even if you submit a request, Ulta will still evaluate your eligibility based on their established criteria. It’s crucial to demonstrate responsible credit behavior and maintain a good payment history to increase your chances of a successful credit limit increase request.

Remember, Ulta’s credit limit increase policy is subject to change, and it’s always a good idea to stay updated with the latest information by referring to their official website or reaching out to their customer service team.

How Often Ulta Increases Credit Limits

It’s natural to wonder how frequently Ulta increases credit limits for its cardholders. While there is no definitive answer as Ulta’s credit limit increase frequency can vary, Ulta typically reviews credit card accounts periodically to assess eligibility for credit limit increases. These reviews may occur every six months to one year, but it ultimately depends on Ulta’s internal policies and the individual cardholder’s creditworthiness.

During these reviews, Ulta evaluates various factors such as payment history, credit utilization ratio, credit score, income, and length of credit history to determine if a cardholder qualifies for a credit limit increase. If you have consistently demonstrated responsible credit management and meet Ulta’s criteria, there’s a chance that your credit limit may increase.

It’s important to note that credit limit increases are not automatic or guaranteed. Ulta assesses each cardholder’s account individually, and meeting the criteria doesn’t guarantee an increase. However, maintaining good credit habits, such as making on-time payments, keeping credit utilization low, and maintaining a positive credit history, can increase your chances of receiving a credit limit increase when Ulta conducts their regular account reviews.

If you haven’t received a credit limit increase after a certain period, you can consider reaching out to Ulta’s customer service and inquiring about the possibility of an increase. They may provide insight into their credit evaluation process or offer guidance on how to improve your chances of receiving a credit limit increase.

Remember, patience and responsible credit management are key when it comes to credit limit increases. By demonstrating your creditworthiness and maintaining good financial habits, you can increase the likelihood of receiving a credit limit increase from Ulta.

Tips to Increase Your Ulta Credit Limit

If you’re looking to increase your Ulta credit limit, there are several strategies you can employ to improve your chances. While there’s no guaranteed method, following these tips can increase the likelihood of receiving a credit limit increase:

- Maintain a Good Payment History: Pay your Ulta credit card bill on time and in full every month. Consistently making timely payments demonstrates responsible financial behavior and increases your creditworthiness.

- Keep Your Credit Utilization Low: Aim to keep your credit utilization ratio below 30%. This means utilizing only a small percentage of your available credit. Keeping your credit utilization low shows that you’re not overly reliant on credit and can handle larger credit limits.

- Monitor and Improve Your Credit Score: Regularly monitor your credit score and take steps to improve it. Paying down existing debt, resolving any credit report errors, and maintaining a healthy mix of credit can positively impact your credit score and increase your chances of a credit limit increase.

- Utilize the Ulta Credit Card Regularly: Show activity on your Ulta credit card by making regular purchases and paying them off responsibly. This demonstrates to Ulta that you are an active and reliable customer, increasing the likelihood of a credit limit increase.

- Request a Credit Limit Increase: If you believe you have demonstrated responsible credit management, consider reaching out to Ulta’s customer service to inquire about a credit limit increase. They may ask for additional information or review your account to assess your eligibility.

- Improve Your Financial Standing: Focus on improving your overall financial stability by increasing your income, reducing debt, and managing your finances effectively. A higher income and stronger financial position can contribute to an increased credit limit.

- Be Patient and Persistent: Credit limit increases are not guaranteed, and it may take time to see progress. Be patient and continue to practice good financial habits. Regularly monitor your account and credit reports to stay on top of changes and opportunities for a credit limit increase.

Remember, while these tips can improve your chances of receiving a credit limit increase from Ulta, the decision ultimately rests with the credit card issuer. Continuing to practice responsible credit management and maintaining good financial habits will not only increase your chances of a credit limit increase but also contribute to a healthy financial future.

Conclusion

Understanding how credit limits work and how to increase them is crucial for maximizing your benefits as an Ulta credit card holder. While there is no set frequency for credit limit increases at Ulta, they regularly review cardholder accounts to assess eligibility. By focusing on factors such as payment history, credit utilization ratio, credit score, income, and length of credit history, Ulta determines whether or not to raise a cardholder’s credit limit.

To increase your chances of receiving a credit limit increase, it is important to maintain good financial habits. Make timely payments, keep your credit utilization low, monitor and improve your credit score, and actively utilize your Ulta credit card. It’s also worth considering reaching out to Ulta’s customer service to inquire about a credit limit increase if you believe you meet the criteria.

However, it’s important to remember that credit limit increases are not guaranteed, and personal circumstances vary. Patience and perseverance are key as you continue to manage your credit responsibly and demonstrate your creditworthiness to Ulta.

By understanding Ulta’s credit limit increase policy and implementing the tips provided in this article, you can improve your chances of receiving a credit limit increase and enjoy a higher spending limit to indulge in your favorite beauty products at Ulta.

Always stay on top of your credit report, monitor your credit score, and follow good financial practices. This will not only improve your chances of credit limit increases but also contribute to a healthy and successful financial future.