Finance

How Often Does Ollo Increase Credit Limit

Published: March 5, 2024

Learn how often Ollo increases credit limits and manage your finances effectively. Find out the best practices for improving your credit limit with Ollo.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to managing credit cards, one of the key factors that cardholders often seek to improve is their credit limit. A higher credit limit not only provides greater purchasing power but also positively impacts the individual's credit utilization ratio, a crucial element in determining one's credit score. For Ollo credit card holders, understanding the dynamics of credit limit increases is essential for optimizing their financial management strategy.

In this comprehensive guide, we will delve into the intricacies of Ollo's credit limit increase policy and shed light on how often Ollo customers can request a credit limit increase. By exploring the factors that influence credit limit adjustments and offering actionable tips to enhance the likelihood of securing a credit limit increase, this article aims to empower Ollo cardholders with the knowledge needed to make informed decisions regarding their credit management.

Understanding the nuances of credit limit increases is pivotal in leveraging the full potential of one's credit card. Whether you are looking to accommodate larger purchases, improve your credit score, or simply enhance your financial flexibility, comprehending the mechanisms behind credit limit adjustments is a fundamental aspect of responsible credit card ownership. Join us as we unravel the intricacies of Ollo's credit limit increase process and equip you with the insights to navigate this aspect of credit management effectively.

Factors That Determine Credit Limit Increases

Several key factors come into play when credit card issuers assess whether to grant a credit limit increase to cardholders. Understanding these factors can provide valuable insights into the dynamics that influence credit limit adjustments. Here are the primary considerations that typically determine credit limit increases:

- Credit History: A cardholder’s credit history plays a pivotal role in determining their eligibility for a credit limit increase. Credit card issuers, including Ollo, assess the individual’s track record of managing credit and meeting financial obligations. A history of responsible credit usage, timely payments, and low credit utilization can significantly enhance the likelihood of a credit limit increase.

- Income and Financial Stability: Cardholders’ income and overall financial stability are crucial considerations for credit limit adjustments. A higher income and a stable financial standing can instill confidence in card issuers regarding the individual’s capacity to manage a higher credit limit responsibly.

- Payment History: Consistent on-time payments demonstrate reliability and financial discipline, which are factors that positively influence the decision to grant a credit limit increase.

- Credit Utilization Ratio: The ratio of credit card balances to credit limits, known as the credit utilization ratio, is a critical factor in credit limit assessments. Maintaining a low utilization ratio, ideally below 30%, signals responsible credit usage and can bolster the case for a credit limit increase.

- Duration of Account and Account Management: Long-standing accounts with a history of effective credit management can reflect positively on a cardholder’s credit limit increase prospects. Demonstrating prudent account management and a positive relationship with the card issuer can contribute to favorable credit limit adjustments.

By comprehending the significance of these factors, Ollo cardholders can gain a deeper understanding of the elements that influence credit limit increases. Armed with this knowledge, individuals can proactively align their financial behaviors and circumstances to enhance their eligibility for credit limit adjustments.

Ollo’s Credit Limit Increase Policy

Ollo, as a credit card issuer, maintains a structured policy regarding credit limit increases. Understanding the specifics of Ollo’s approach to credit limit adjustments is essential for cardholders seeking to navigate this aspect of their credit management effectively.

Ollo evaluates credit limit increase requests based on the cardholder’s creditworthiness and financial behavior. The company typically conducts periodic reviews of cardholder accounts to assess eligibility for credit limit adjustments. These reviews take into account various factors, including payment history, credit utilization, income, and overall credit management practices.

It’s important to note that Ollo may also consider external credit data and credit bureau information when evaluating credit limit increase requests. This comprehensive assessment enables Ollo to make informed decisions aligned with responsible lending practices and the individual cardholder’s financial circumstances.

Ollo strives to provide transparent and fair processes for credit limit adjustments, ensuring that cardholders have the opportunity to request increases in line with their evolving financial needs. By adhering to prudent credit management practices and demonstrating responsible financial behavior, Ollo cardholders can position themselves favorably for credit limit increases within the framework of Ollo’s policy.

Ultimately, Ollo’s credit limit increase policy is designed to facilitate the responsible expansion of credit limits for eligible cardholders while maintaining a prudent approach to risk management and financial well-being. By aligning with Ollo’s credit limit increase guidelines, cardholders can navigate the process with clarity and insight, optimizing their potential for securing higher credit limits that align with their financial goals and capabilities.

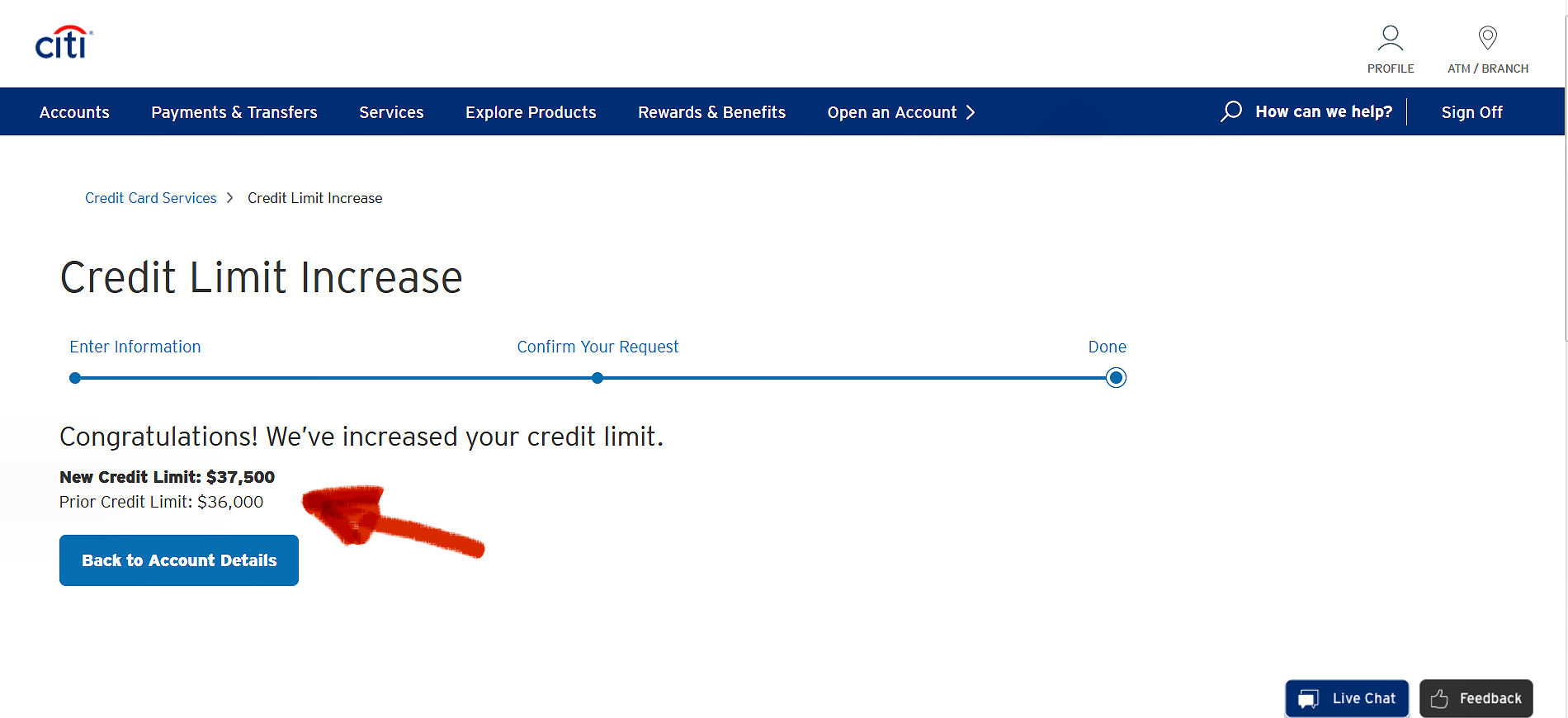

How Often Can Ollo Customers Request a Credit Limit Increase?

Ollo provides its cardholders with the opportunity to request a credit limit increase, empowering them to align their credit limits with their evolving financial needs. Understanding the frequency at which Ollo customers can request credit limit adjustments is essential for individuals seeking to optimize their credit management strategy.

Typically, Ollo allows cardholders to request a credit limit increase every six months. This timeframe provides a reasonable interval for cardholders to demonstrate responsible credit usage, financial stability, and the capacity to manage a higher credit limit effectively. By spacing out the credit limit increase requests, Ollo aims to ensure that cardholders have the opportunity to showcase sustained positive financial behavior and an improved credit profile.

It’s important for Ollo customers to approach credit limit increase requests strategically, considering factors such as their credit utilization ratio, payment history, and overall financial standing. By proactively managing these elements and maintaining a positive credit trajectory, cardholders can enhance their eligibility for credit limit increases when the six-month interval elapses.

Understanding the cadence of credit limit increase requests empowers Ollo customers to align their financial behaviors with the timeline set forth by the credit card issuer. By leveraging this knowledge, cardholders can strategically time their credit limit increase requests to maximize their chances of securing higher credit limits that cater to their financial requirements.

By adhering to Ollo’s guidelines regarding the frequency of credit limit increase requests, cardholders can approach this aspect of credit management with clarity and intention, positioning themselves for favorable credit limit adjustments that complement their financial goals and capabilities.

How to Increase Your Chances of Getting a Credit Limit Increase from Ollo

Maximizing the likelihood of securing a credit limit increase from Ollo involves strategic financial management and a proactive approach to demonstrating creditworthiness. By implementing the following actionable strategies, Ollo cardholders can enhance their eligibility for credit limit adjustments:

- Maintain a Positive Payment History: Consistently making on-time payments is crucial for showcasing financial responsibility and reliability. A history of timely payments can bolster the case for a credit limit increase.

- Manage Credit Utilization: Keeping credit card balances low in relation to credit limits is essential. Maintaining a low credit utilization ratio, ideally below 30%, signals prudent credit management and can strengthen the case for a credit limit increase.

- Strengthen Financial Stability: Demonstrating a stable income and overall financial stability can instill confidence in credit card issuers regarding the capacity to manage a higher credit limit responsibly.

- Periodically Review Credit Reports: Regularly monitoring credit reports can help identify any inaccuracies or areas for improvement. Ensuring the accuracy of credit reports is vital, as it directly influences creditworthiness assessments.

- Strategically Time Credit Limit Increase Requests: Understanding Ollo’s policy on credit limit increase frequency enables cardholders to strategically time their requests. By aligning requests with positive financial milestones and sustained responsible credit behavior, cardholders can enhance their chances of securing credit limit adjustments.

By proactively implementing these strategies, Ollo cardholders can position themselves favorably for credit limit increases, aligning their financial behaviors with the criteria that influence credit limit adjustments. Engaging in responsible credit management practices and showcasing a commitment to financial stability can significantly enhance the likelihood of securing higher credit limits from Ollo.

Conclusion

Navigating the terrain of credit limit increases with Ollo requires a comprehensive understanding of the factors that influence creditworthiness and the dynamics of credit management. By gaining insights into Ollo’s credit limit increase policy and the strategies that can enhance eligibility for credit limit adjustments, cardholders can proactively optimize their financial standing and align their credit limits with their evolving needs.

Understanding the pivotal role of credit history, income, payment behavior, and credit utilization ratio empowers Ollo cardholders to strategically manage these elements, positioning themselves favorably for credit limit increases. By maintaining a positive payment history, managing credit utilization, and strengthening financial stability, cardholders can bolster their creditworthiness and enhance their eligibility for credit limit adjustments.

Furthermore, comprehending Ollo’s policy on the frequency of credit limit increase requests enables cardholders to strategically time their requests, aligning them with positive financial milestones and sustained responsible credit behavior. This proactive approach enhances the likelihood of securing higher credit limits that cater to the individual’s financial goals and capabilities.

In essence, navigating the process of securing credit limit increases from Ollo entails a proactive and strategic approach to credit management. By adhering to prudent financial practices, maintaining responsible credit behavior, and leveraging a deep understanding of Ollo’s credit limit increase policy, cardholders can optimize their potential for securing higher credit limits that align with their evolving financial requirements.

Empowered with these insights and actionable strategies, Ollo cardholders can navigate the landscape of credit limit increases with clarity and intention, leveraging their financial behaviors to enhance their eligibility for credit limit adjustments. By aligning with Ollo’s credit management guidelines and demonstrating a commitment to responsible credit usage, cardholders can pave the way for expanded financial flexibility and improved credit management outcomes.