Finance

How Often Does Quadpay Increase Credit Limit

Modified: March 5, 2024

Find out how often Quadpay increases credit limits and how it can benefit your personal finance goals.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of Quadpay, a flexible payment platform that allows you to split your purchases into four interest-free payments. If you’re a frequent shopper, you might be wondering about Quadpay’s credit limit and how often it gets increased. In this article, we’ll delve into the details of Quadpay’s credit limit and explore the factors that influence it.

Quadpay is a popular payment solution that enables consumers to make purchases and pay for them over time. With Quadpay, you can shop at a wide range of online stores and choose to split your payment into four equal installments, with the first one due at the time of purchase. This convenient payment method has gained popularity due to its ease of use and flexibility, allowing users to manage their budgets more effectively.

Understanding how Quadpay determines your credit limit is essential for maximizing your shopping experience. The credit limit represents the maximum amount you can spend using the Quadpay platform. It is directly linked to your ability to make timely payments and your overall financial standing.

Quadpay’s credit limit is not fixed and can be adjusted based on various factors. The company assesses your creditworthiness, spending patterns, and payment history to determine your initial credit limit. However, it is important to note that Quadpay’s credit limits are typically lower than traditional credit card limits.

In the next sections, we will explore the factors that influence Quadpay’s credit limit, understand how often it gets increased, and provide valuable tips for increasing your credit limit. So, let’s dive in and unravel the secrets behind Quadpay’s credit limits!

Understanding Quadpay

Before we delve into Quadpay’s credit limit, let’s first gain a better understanding of what Quadpay is and how it works. Quadpay is a Buy Now, Pay Later (BNPL) platform that allows consumers to split their purchases into four equal installments, with the first payment due at the time of purchase.

With Quadpay, consumers can shop at thousands of online stores and choose the Quadpay payment option during checkout. The platform integrates seamlessly with the retailer’s website, allowing users to select Quadpay as their payment method and create an account or log in to their existing account.

Once a purchase is approved, the total amount is divided into four equal payments, which are automatically charged to the user’s linked debit or credit card every two weeks. The best part? Quadpay does not charge any interest or hidden fees, making it an affordable and convenient option for budget-conscious shoppers.

Quadpay provides a user-friendly interface where customers can manage their purchases, view payment schedules, and make payments online. Users can also set up automatic payments for convenience and peace of mind.

It’s important to note that Quadpay is not a credit card. It does not involve a line of credit or require a credit check. Instead, Quadpay allows users to make installment payments on their purchases, helping them to spread out their expenses and stay within their budget.

Quadpay is committed to responsible spending and encourages users to make payments on time. By doing so, users can maintain a good payment track record, which can potentially lead to an increase in their credit limit over time.

Now that we have a clear understanding of what Quadpay is and how it works, let’s explore in more detail the credit limit offered by Quadpay and the factors that influence it.

Quadpay Credit Limit

The Quadpay credit limit represents the maximum amount you can spend using the Quadpay platform. It is a predetermined amount set by Quadpay based on various factors, including your creditworthiness, spending patterns, and payment history.

When you first sign up for Quadpay, your initial credit limit will be determined. This limit may vary from user to user and is typically lower than traditional credit card limits. Quadpay takes into account your financial standing, including factors such as income and credit history, to assess your creditworthiness and determine an appropriate credit limit.

It’s important to understand that Quadpay’s goal is to provide users with a responsible and manageable spending experience. Therefore, the credit limit set by Quadpay is designed to ensure that users can comfortably make their payments and avoid excessive debt.

Furthermore, Quadpay employs a real-time risk assessment technology that analyzes factors such as transaction size, purchase frequency, and payment history to determine if a purchase should be approved or declined. This further helps Quadpay in managing credit risk and ensuring a seamless and secure payment experience.

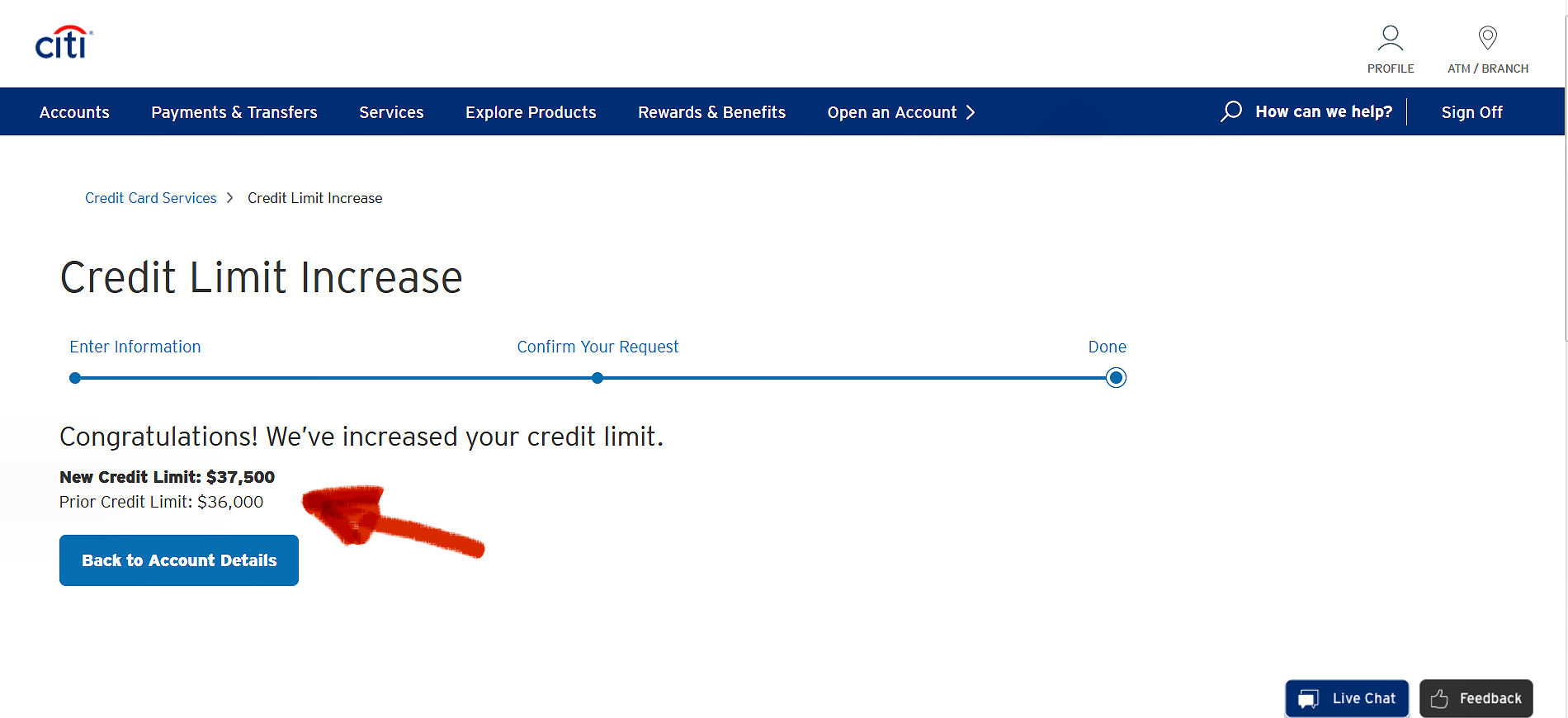

As you use Quadpay and make timely payments, Quadpay continuously evaluates your spending behavior and payment history. Based on your responsible use of the platform, Quadpay may periodically review and increase your credit limit. This means that you could have the opportunity to spend more using Quadpay as you build a positive payment record.

Keep in mind that Quadpay may also lower your credit limit or suspend your account if you consistently miss payment deadlines or demonstrate financial instability. It is crucial to fulfill your payment obligations and maintain good financial practices to maintain a healthy credit limit with Quadpay.

Now that we understand what the Quadpay credit limit is, let’s explore the factors that influence this limit.

Factors Influencing Credit Limit

Quadpay considers several factors when deciding the credit limit for users. These factors help determine your creditworthiness and your ability to make timely payments. Here are some key factors that influence Quadpay’s credit limit:

- Payment History: Quadpay evaluates your payment history to assess your reliability and financial responsibility. Making consistent, on-time payments improves your creditworthiness and increases the likelihood of a credit limit increase.

- Income Level: Quadpay takes into account your income level to assess your repayment capacity. Higher income levels may result in a higher credit limit.

- Spending Patterns: Quadpay analyzes your spending patterns to understand your purchasing behavior. If you frequently use Quadpay for smaller, manageable purchases, it may reflect positively on your credit limit.

- Credit Utilization: Quadpay examines the proportion of available credit you are currently using. Maintaining a low credit utilization ratio demonstrates responsible credit management and can help in increasing your credit limit.

- Credit History: While Quadpay does not perform a traditional credit check, they may consider your credit history if available. A positive credit history can improve your creditworthiness and may result in a higher credit limit.

It’s important to note that Quadpay’s credit limit determination is not solely based on one specific factor. Instead, it is a combination of various factors that are considered holistically to evaluate your creditworthiness and repayment capability.

Keep in mind that the specific weightage given to each factor may vary, and Quadpay’s algorithm determines the credit limit based on their proprietary risk assessment technology. This technology assesses numerous data points and evaluates financial risk to ensure responsible lending practices.

Understanding the factors that influence Quadpay’s credit limit can help you make informed decisions and take steps to improve your creditworthiness. Now that we know what influences the credit limit, let’s explore how often Quadpay increases the credit limit for its users.

Frequency of Credit Limit Increases

Quadpay periodically reviews user accounts to determine if a credit limit increase is warranted. The frequency of credit limit increases can vary depending on several factors, including your payment history, spending patterns, and overall creditworthiness.

Typically, Quadpay considers giving credit limit increases to users who have demonstrated responsible use of the platform over a period of time. This includes making consistent, on-time payments and maintaining a positive payment track record.

Users who have been using Quadpay for a longer duration and have established a positive payment history are more likely to receive credit limit increases. However, there is no fixed timetable for when these increases may occur.

As part of their responsible lending practices, Quadpay ensures that credit limit increases are offered judiciously. The company evaluates the financial capability of users and takes into account factors such as income stability and overall payment behavior.

Some users may experience credit limit increases within a few months of using Quadpay, while others may need to demonstrate a longer track record of responsible borrowing and repayment. It is important to note that credit limit increases are not guaranteed and depend on individual circumstances.

To increase your chances of receiving a credit limit increase, it is crucial to use Quadpay responsibly. This means making timely payments, keeping your account in good standing, and managing your finances prudently.

If you have been using Quadpay responsibly and have not received a credit limit increase, don’t be discouraged. Continue to make consistent payments, keep your credit utilization low, and maintain good financial practices. Over time, your chances of receiving a credit limit increase may improve.

Now that we have explored the frequency of credit limit increases, let’s discuss how you can request a credit limit increase from Quadpay.

How to Request a Credit Limit Increase

If you’ve been using Quadpay responsibly and would like to request a credit limit increase, you may be wondering how to go about it. While there is no specific process to request an increase, there are steps you can take to increase your chances of a credit limit review:

- Maintain a Positive Payment History: Making consistent, on-time payments is crucial for demonstrating responsibility and building trust with Quadpay. A positive payment history increases the likelihood of a credit limit increase.

- Increase Your Spending Activity: Quadpay is more likely to consider a credit limit increase for active users who regularly make purchases and display responsible spending habits.

- Use Quadpay for Higher Value Purchases: Making larger purchases via Quadpay and paying them off successfully showcases your ability to manage higher credit limits.

- Monitor Your Credit Utilization: Keeping your credit utilization ratio low can positively impact your creditworthiness and may be a factor in determining a credit limit increase.

- Reach Out to Quadpay Customer Support: If you believe you have met the criteria for a credit limit increase and have a positive payment history, you can reach out to Quadpay’s customer support team to inquire about the possibility of a review. They may be able to provide further guidance or escalate your request for review.

Remember, requesting a credit limit increase does not guarantee approval. However, by following these steps and showing responsible financial behavior, you increase your chances of receiving a credit limit increase from Quadpay.

It’s important to note that Quadpay may also periodically review your credit limit without any action required on your part. They continuously assess user accounts and make adjustments based on each individual’s financial behavior and history.

Now that you know how to request a credit limit increase, let’s explore some additional tips to help you proactively increase your Quadpay credit limit.

Tips for Increasing your Quadpay Credit Limit

While credit limit increases are ultimately determined by Quadpay based on various factors, there are steps you can take to proactively increase your chances of receiving a higher credit limit. Here are some tips to consider:

- Make Timely Payments: Consistently making on-time payments is crucial for building a positive payment history. Timely payments demonstrate your reliability and financial responsibility, increasing the likelihood of a credit limit increase.

- Use Quadpay Frequently: Regularly using Quadpay and consistently making payments can showcase your responsible spending habits and may lead to a credit limit increase.

- Keep Your Credit Utilization Low: Aim to keep your credit utilization ratio—the percentage of available credit you are using—low. A lower ratio demonstrates responsible credit management and can positively impact your creditworthiness.

- Manage Your Finances Responsibly: Displaying good financial habits, such as maintaining a healthy credit score, paying off existing debts, and keeping track of your expenses, can contribute to a positive creditworthiness assessment by Quadpay.

- Communicate with Quadpay: If you believe you meet the criteria for a credit limit increase, don’t hesitate to reach out to Quadpay’s customer support. They can provide guidance on the next steps or escalate your request for a credit limit review.

- Build Long-Term Usage and Payment History: Quadpay is more likely to consider credit limit increases for users who have a longer track record of responsible usage and payment history. This includes regularly using Quadpay and making timely payments over an extended period of time.

Remember, credit limit increases are not guaranteed and depend on various factors and Quadpay’s assessment of your creditworthiness. However, by following these tips and displaying responsible financial behavior, you can increase your chances of receiving a higher credit limit from Quadpay.

Fostering a positive relationship with Quadpay and maintaining good financial practices can pay off in the form of a credit limit increase, providing you with more flexibility and purchasing power on the Quadpay platform.

Now that we have explored tips for increasing your Quadpay credit limit, let’s wrap up our discussion.

Conclusion

Quadpay’s credit limit plays a crucial role in determining the maximum amount you can spend using the platform. It is influenced by various factors such as payment history, income level, spending patterns, and credit utilization. While the specific frequency of credit limit increases may vary, Quadpay periodically reviews user accounts to assess eligibility for an increase.

To increase your chances of a credit limit increase, it is important to make timely payments, use Quadpay frequently, manage your finances responsibly, and maintain a positive payment history. Additionally, reaching out to Quadpay’s customer support team for inquiries or escalations can also be helpful.

Remember, responsible use of Quadpay and showcasing good financial habits are key to maximizing your credit limit and enjoying the benefits of the platform. By staying on top of your payments and maintaining a positive payment track record, you can potentially receive credit limit increases over time.

Quadpay aims to provide a responsible and flexible payment solution, and credit limit increases are offered based on individual circumstances and their assessment of your financial behavior. While credit limit increases are not guaranteed, by following the tips outlined in this article, you can increase your chances of receiving a higher credit limit from Quadpay.

Now that you have a comprehensive understanding of Quadpay’s credit limit, its influencing factors, and how to potentially increase your credit limit, you can make better-informed decisions when using the Quadpay platform. Enjoy the convenience and flexibility of splitting your payments with Quadpay while managing your finances responsibly.