Finance

How Often Does Fingerhut Increase Credit Limit

Modified: January 15, 2024

Learn how often Fingerhut increases credit limits and manage your finances effectively. Maximize your credit potential with Fingerhut's credit limit upgrades.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Factors That Determine Credit Limit Increases

- Fingerhut’s Credit Limit Increase Policy

- Frequency of Credit Limit Increases

- Steps to Request a Credit Limit Increase

- Tips to Increase Your Chances of Getting a Credit Limit Increase

- Potential Benefits and Risks of Credit Limit Increases

- Conclusion

Introduction

Having a higher credit limit can provide financial flexibility and purchasing power. It allows you to make larger purchases, manage emergency expenses, and improve your credit utilization ratio. One popular retailer offering credit to consumers is Fingerhut, known for its catalog and online shopping options.

Fingerhut offers a unique credit opportunity for individuals with less than ideal credit scores. As you consistently make on-time payments and demonstrate responsible borrowing habits, you may wonder how often Fingerhut increases credit limits.

In this article, we will explore the factors that determine credit limit increases at Fingerhut, their credit limit increase policy, the frequency of credit limit increases, steps to request a credit limit increase, and tips to increase your chances of getting one. We will also discuss the potential benefits and risks associated with credit limit increases.

Whether you are an existing Fingerhut customer or considering applying for Fingerhut credit, understanding their credit limit increase policies can help you make informed decisions about managing your credit and maximizing your purchasing power.

Factors That Determine Credit Limit Increases

When it comes to determining credit limit increases, Fingerhut takes various factors into account. These factors are used to assess your creditworthiness and determine if you are eligible for a higher credit limit. Here are some key factors that Fingerhut may consider:

- Payment History: Fingerhut will review your payment history to assess your level of financial responsibility. Consistently making on-time payments can increase your chances of getting a credit limit increase.

- Credit Utilization: Your credit utilization ratio is the amount of credit you are currently using compared to your total credit limit. If you have been effectively using a large portion of your current credit limit, it may indicate responsible borrowing and could potentially qualify you for a credit limit increase.

- Length of Credit History: Fingerhut may also consider the length of your credit history. Borrowers with a longer credit history often demonstrate a track record of managing credit responsibly, which can positively impact their chances of receiving a credit limit increase.

- Income: While Fingerhut does not explicitly disclose income requirements, your income level may still be factored into their decision-making process. A higher income could indicate an ability to handle a higher credit limit, making an increase more likely.

- Overall Creditworthiness: Fingerhut will assess your overall creditworthiness, including factors such as your credit score and any negative marks on your credit report. Maintaining a positive credit profile and minimizing negative items like late payments or collections can improve your chances of securing a credit limit increase.

It’s important to note that these factors are not exhaustive, and Fingerhut may have additional criteria they consider when determining credit limit increases. While some factors are within your control, such as payment history and credit utilization, others, like credit history length, may require more time to improve.

By understanding these factors, you can take steps to strengthen your credit profile and increase your chances of qualifying for a credit limit increase with Fingerhut.

Fingerhut’s Credit Limit Increase Policy

Fingerhut has a credit limit increase policy in place to determine when and how they grant credit limit increases to their customers. While specific details of their policy may vary, here is a general overview of Fingerhut’s credit limit increase guidelines:

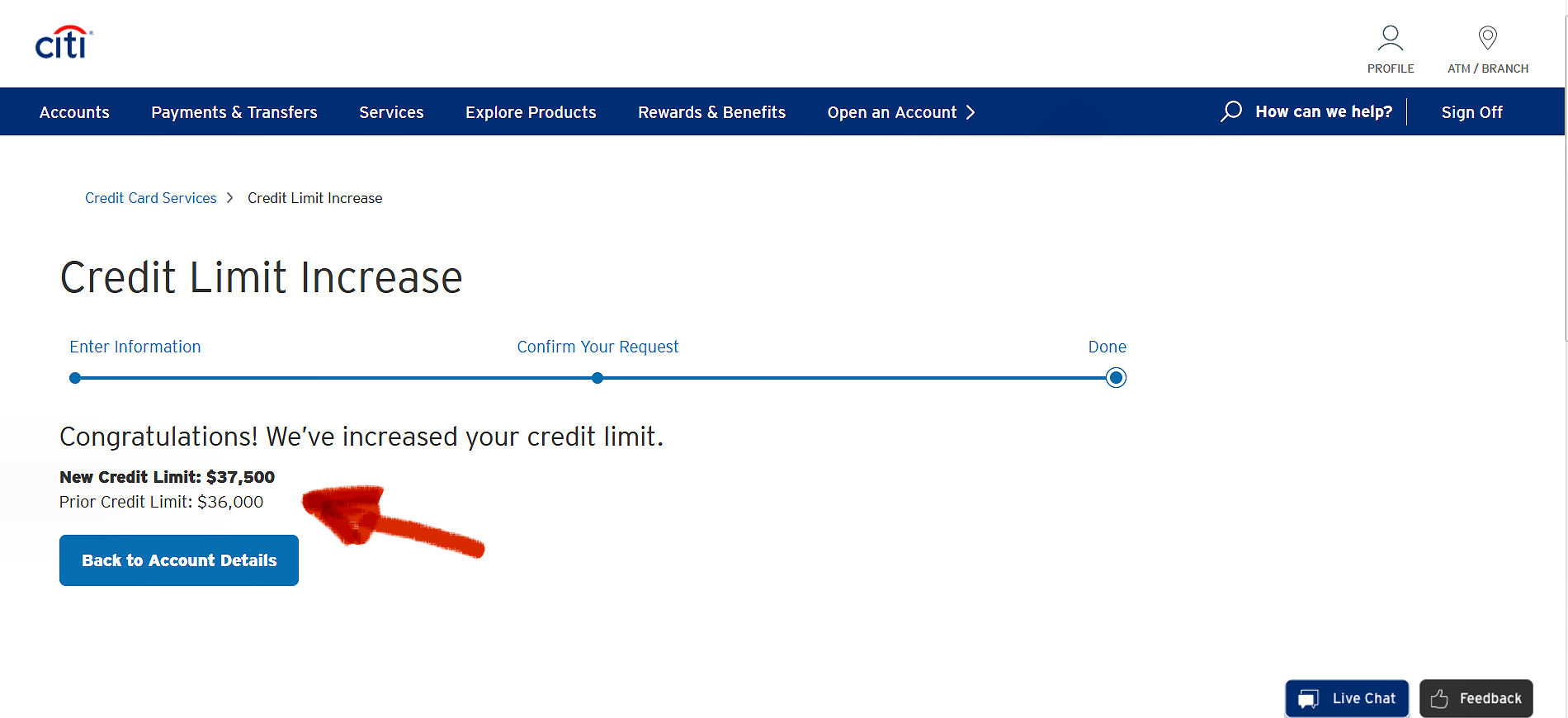

- Automatic Increases: Fingerhut periodically reviews customer accounts to identify individuals who may be eligible for an automatic credit limit increase. These increases are typically granted based on factors such as payment history, credit utilization, and overall creditworthiness.

- Proactive Increases: In addition to automatic increases, Fingerhut also allows customers to request proactive credit limit increases. This gives you the opportunity to actively pursue a higher credit limit based on your financial needs and improved creditworthiness. However, the approval of proactive increases is subject to Fingerhut’s internal criteria and evaluation.

- Responsibility Assessment: When considering credit limit increases, Fingerhut assesses your ability to handle a higher credit limit responsibly. They take into account factors like income, credit score, and payment history to determine if you are eligible for an increase.

- Review Period: Fingerhut typically reviews customer accounts for credit limit increases every six to twelve months. During this review period, they evaluate your account activity, payment history, and creditworthiness to determine if you qualify for a higher credit limit.

- No Impact on Credit Score: Fingerhut’s credit limit increase process does not involve a hard inquiry on your credit report, meaning that requesting or receiving a credit limit increase will not negatively impact your credit score.

It’s important to note that while Fingerhut has a credit limit increase policy in place, not all customers will qualify for an increase. It ultimately depends on individual circumstances and meeting the criteria set by Fingerhut. However, by maintaining good payment habits, responsible credit usage, and improving your overall creditworthiness, you can increase your chances of receiving a credit limit increase from Fingerhut.

Frequency of Credit Limit Increases

The frequency at which Fingerhut grants credit limit increases can vary depending on several factors, including your credit history, payment behavior, and overall creditworthiness. Fingerhut typically reviews customer accounts for credit limit increases every six to twelve months.

During these periodic account reviews, Fingerhut evaluates your payment history, credit utilization, income level, and other relevant factors to determine if you are eligible for a credit limit increase. If your account meets their criteria and demonstrates responsible borrowing habits, you may be granted an automatic increase without needing to request one.

It’s important to note that while Fingerhut does review accounts regularly, not all customers will receive a credit limit increase with each review. The approval of a credit limit increase depends on a variety of factors, including your individual financial situation and credit profile. It’s also worth mentioning that Fingerhut does not guarantee a credit limit increase, even if you meet their criteria.

If you believe you are eligible for a credit limit increase and have not received one automatically, you also have the option to request a proactive increase. By reaching out to Fingerhut’s customer service or using their online portal, you can make a formal request for a higher credit limit. However, the approval of proactive increases is still subject to Fingerhut’s internal evaluation process.

To increase your chances of receiving a credit limit increase from Fingerhut, it’s essential to demonstrate responsible borrowing habits. Make your payments on time, keep your credit utilization low, and maintain a positive credit profile. By doing so, you not only improve your chances of getting a credit limit increase with Fingerhut but also strengthen your overall creditworthiness.

Remember, even if you receive a credit limit increase, it’s important to use it wisely. Avoid overspending and continue to make timely payments to maintain a healthy credit profile.

Steps to Request a Credit Limit Increase

If you are looking to request a credit limit increase with Fingerhut, you have the option to submit a request through their customer service or online portal. Here are the general steps to follow when requesting a credit limit increase:

- Review Your Account: Before requesting a credit limit increase, take the time to review your Fingerhut account. Ensure that you have been consistently making on-time payments and managing your credit responsibly. This can increase your chances of being approved for a higher credit limit.

- Gather Necessary Information: Make sure you have all the necessary information handy, such as your account details, income information, and any additional documentation that may be required. This will help streamline the credit limit increase request process.

- Reach Out to Fingerhut Customer Service: Contact Fingerhut’s customer service through their hotline or online chat to initiate a credit limit increase request. You may need to provide your account details and answer some security questions for verification purposes.

- Submit Request Online: If Fingerhut offers an online portal for account management, you can log in to your account and navigate to the appropriate section to request a credit limit increase. Follow the on-screen instructions and provide the required information accurately.

- Provide Additional Information if Requested: Fingerhut may ask for additional information to evaluate your credit limit increase request. This may include income verification documents, updated contact information, or other relevant documentation. Be prepared to provide any requested information promptly.

- Wait for a Response: Once you have submitted the credit limit increase request, you will need to wait for a response from Fingerhut. The approval process may take some time as Fingerhut reviews your account and assesses your creditworthiness.

- Follow up if Necessary: If you do not receive a response within a reasonable timeframe, or if you have any questions or concerns regarding your credit limit increase request, don’t hesitate to follow up with Fingerhut’s customer service. They can provide you with updates and address any inquiries you may have.

It’s important to note that the approval of a credit limit increase is at Fingerhut’s discretion and subject to their internal evaluation criteria. Meeting the eligibility requirements does not guarantee a credit limit increase, but by following these steps and maintaining a positive credit profile, you can improve your chances of receiving a higher credit limit from Fingerhut.

Tips to Increase Your Chances of Getting a Credit Limit Increase

If you’re looking to increase your chances of getting a credit limit increase from Fingerhut, here are some tips to consider:

- Pay On Time: Consistently making on-time payments is crucial. This demonstrates your reliability and financial responsibility, increasing your chances of being approved for a credit limit increase.

- Manage Your Credit Utilization: Aim to keep your credit utilization ratio below 30%. This means using only a portion of your available credit. A lower credit utilization ratio can indicate responsible credit management, potentially boosting your eligibility for a credit limit increase.

- Improve Your Credit Score: Work on improving your credit score over time. Pay off any outstanding debts, resolve any negative marks on your credit report, and maintain a positive credit history. A higher credit score can make you more attractive to lenders and increase your chances of a credit limit increase.

- Build a Positive Payment History: Consistently making all your payments, not just with Fingerhut, can enhance your creditworthiness. Aim to establish a pattern of responsible payment behavior to increase your chances of a credit limit increase.

- Monitor Your Account Regularly: Keep a close eye on your Fingerhut account and regularly review your account activity. Ensure that all transactions are accurate, and any issues are promptly addressed. This proactive approach can help you stay on top of your credit and demonstrate vigilant account management.

- Increase Your Income: While not directly within your control, increasing your income can positively impact your creditworthiness. Higher income levels may indicate greater ability to handle a higher credit limit, making a credit limit increase more likely.

- Build a Longer Credit History: Establishing a longer credit history can improve your chances of a credit limit increase. The longer you have a positive credit history, the more evidence you have of responsible credit management, which can positively impact your creditworthiness.

- Build a Relationship with Fingerhut: Being a long-term and loyal customer can work in your favor. Show your commitment to Fingerhut by regularly using your Fingerhut credit account and making responsible payments. This can demonstrate your reliability and increase your chances of a credit limit increase.

- Request a Proactive Increase: If you believe you are eligible for a credit limit increase, consider reaching out to Fingerhut and requesting one. Be prepared to provide any necessary documentation or information to support your request.

Keep in mind that while these tips can increase your chances of receiving a credit limit increase from Fingerhut, approval is ultimately at their discretion. Continuously practicing responsible borrowing habits and maintaining a positive credit profile can not only improve your chances of a credit limit increase with Fingerhut but also benefit your overall financial well-being.

Potential Benefits and Risks of Credit Limit Increases

Credit limit increases can have both potential benefits and risks. Understanding these factors is crucial in order to make informed decisions when considering a credit limit increase with Fingerhut or any other lender. Here are some key points to consider:

Potential Benefits:

- Increased Purchasing Power: A higher credit limit provides you with increased purchasing power, allowing you to make larger purchases or handle unexpected expenses without maxing out your credit card.

- Improved Credit Utilization Ratio: A credit limit increase can help improve your credit utilization ratio, which is the amount of credit you are currently using compared to your total credit limit. A lower credit utilization ratio is generally seen as positive and can benefit your credit score.

- Emergency Fund Buffer: With a higher credit limit, you have the peace of mind of having additional funds available in case of emergencies, which can serve as a temporary buffer until you are able to access other financial resources.

- Potential to Improve Credit Score: Responsible use of a higher credit limit can potentially improve your credit score over time. By making on-time payments, keeping your credit utilization low, and managing your credit responsibly, you can demonstrate financial responsibility and boost your creditworthiness.

- Opportunity for Better Rewards: Some credit cards offer rewards programs tied to spending thresholds. Increasing your credit limit may grant you the ability to spend more and unlock higher tiers of rewards or benefits.

Potential Risks:

- Temptation to Overspend: A higher credit limit can be enticing, leading to the temptation to make purchases beyond your means. It’s important to exercise discipline and use credit responsibly, ensuring that you can comfortably repay the borrowed funds.

- Accumulating Debt: If you’re not careful with a higher credit limit, you may find yourself accumulating more debt. This can lead to increased interest charges and potentially impact your financial stability in the long run.

- Impact on Credit Score in the Short Term: Initially, a credit limit increase might slightly impact your credit score due to a hard inquiry or increased credit utilization. However, with responsible credit management, any negative impact can be temporary and outweighed by the long-term benefits of a higher credit limit.

- Interest Charges: Higher credit limits come with the potential for higher balances, which can result in higher interest charges if you carry a balance from month to month. It’s important to understand and manage the cost of borrowing associated with a credit limit increase.

- Potential Risk of Debt Spiral: If mismanaged, a credit limit increase can contribute to a spiral of debt. It’s crucial to use the increased credit limit responsibly, making sure to make payments on time and keep your debt under control.

Considering both the potential benefits and risks of a credit limit increase can help you make an informed decision that aligns with your financial goals and circumstances. It’s essential to weigh these factors carefully and use credit responsibly to maximize the benefits and minimize the risks associated with a higher credit limit.

Conclusion

Understanding how credit limit increases work with Fingerhut can empower you to make informed decisions about managing your credit and maximizing your purchasing power. While specific details of Fingerhut’s credit limit increase policy may vary, factors such as payment history, credit utilization, income level, and creditworthiness are typically taken into account.

Receiving a credit limit increase from Fingerhut can offer numerous benefits, including increased purchasing power, improved credit utilization ratio, and the potential to improve your credit score. However, it’s important to be aware of the potential risks, such as the temptation to overspend, accumulating debt, and potential impact on your credit score in the short term.

To increase your chances of getting a credit limit increase, it’s essential to make on-time payments, manage your credit utilization, improve your credit score, and demonstrate responsible borrowing habits. Additionally, proactively requesting a credit limit increase and maintaining a positive relationship with Fingerhut can also work in your favor.

Remember, responsible credit management is key. Use your increased credit limit wisely, make payments on time, and avoid accumulating excessive debt. By doing so, you can make the most of your credit limit increase and work towards improving your financial well-being.

It’s always recommended that you carefully review Fingerhut’s specific credit limit increase policies and guidelines for the most accurate and up-to-date information. By staying informed, you can effectively navigate Fingerhut’s credit offerings and make decisions that align with your financial goals.