Finance

How Often Does Quadpay Increase Credit Limit

Published: March 5, 2024

Learn how Quadpay increases credit limits and manage your finances effectively. Discover the best practices to improve your credit limit with Quadpay.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of Quadpay, where the shopping experience is revolutionized through flexible payment options. Quadpay offers a convenient way to split purchases into four interest-free payments over six weeks. This payment platform has gained popularity for its transparency, user-friendly interface, and commitment to providing a seamless shopping experience.

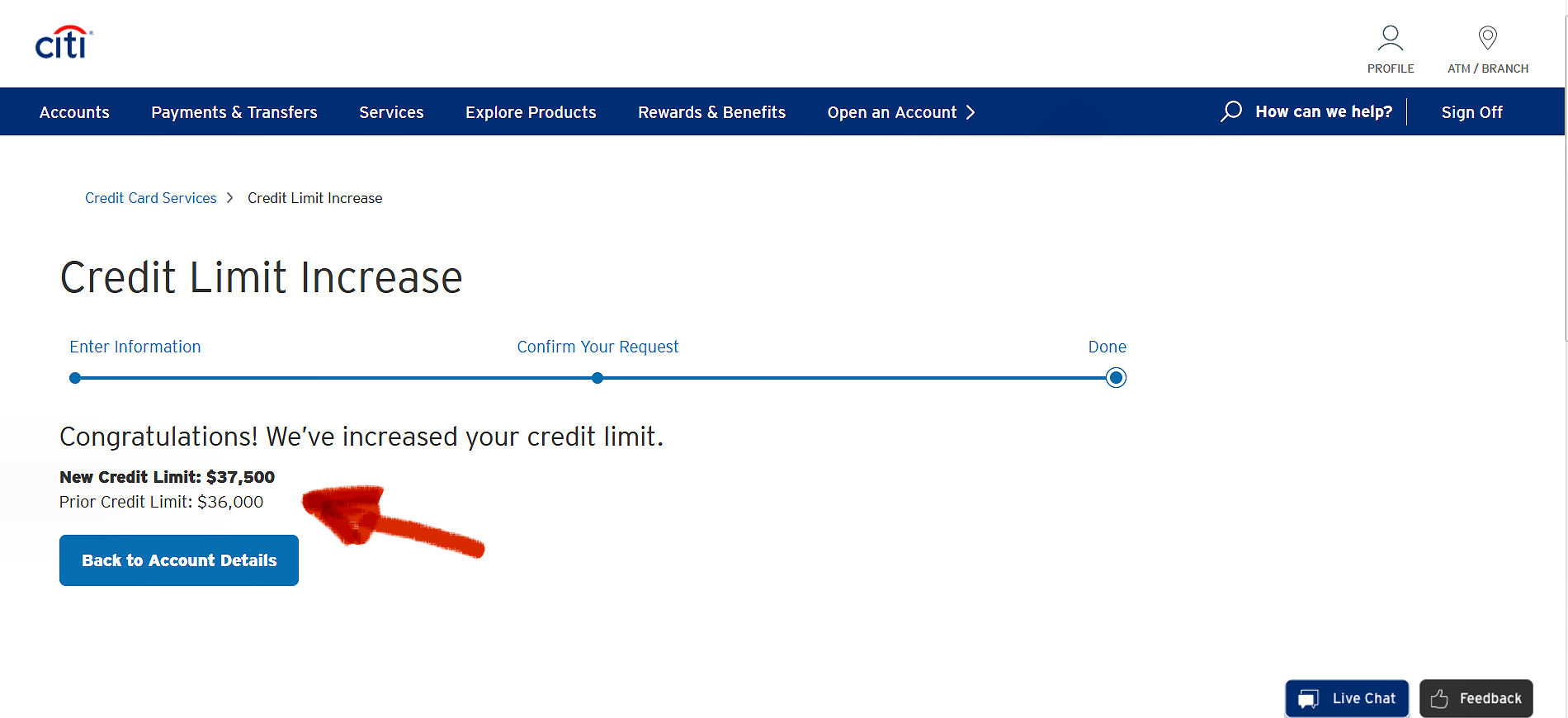

One of the key aspects of using Quadpay is understanding credit limits. Just like traditional credit cards, Quadpay assigns a credit limit to each user based on various factors. This credit limit determines the maximum amount a user can spend using Quadpay for a single purchase. Understanding how Quadpay credit limits work and how they can be increased is essential for maximizing the benefits of this payment platform.

In this article, we will delve into the intricacies of Quadpay credit limits, exploring the factors that influence credit limit increases and providing insights into how often Quadpay increases credit limits. Additionally, we will share valuable tips to help you increase your Quadpay credit limit, empowering you to make the most of your shopping experiences while using this innovative payment solution. So, let's embark on this informative journey to unravel the mysteries of Quadpay credit limits and empower ourselves with the knowledge to make savvy financial decisions.

Understanding Quadpay Credit Limits

Quadpay credit limits play a pivotal role in shaping the shopping experience for users. When a customer signs up for Quadpay, the platform assesses various factors to determine an initial credit limit for the user. This credit limit represents the maximum amount that the user can spend on a single purchase using Quadpay. It is important to note that this credit limit is not static and can be increased over time based on the user’s financial behavior and other key factors.

Quadpay utilizes a proprietary algorithm to evaluate each user’s creditworthiness and spending behavior. This assessment includes factors such as the user’s credit score, payment history, income level, and the frequency of Quadpay usage. By analyzing these variables, Quadpay assigns an initial credit limit to the user, aiming to strike a balance between providing purchasing power and mitigating risk.

Understanding your Quadpay credit limit is essential for managing your finances effectively. By knowing your credit limit, you can make informed purchasing decisions and avoid exceeding your available funds. Additionally, understanding the factors that influence credit limit increases can empower you to take proactive steps to enhance your credit limit over time, thereby expanding your purchasing capabilities.

As we delve deeper into the world of Quadpay credit limits, we will explore the key factors that influence credit limit increases and shed light on how users can leverage this knowledge to their advantage. By gaining a comprehensive understanding of Quadpay credit limits, users can navigate the platform with confidence and maximize the benefits of this innovative payment solution.

Factors Affecting Quadpay Credit Limit Increases

Quadpay employs a dynamic approach to evaluating credit limit increases, taking into account various factors that reflect a user’s financial responsibility and purchasing behavior. Understanding these factors is crucial for users who aspire to enhance their credit limits and unlock greater purchasing power within the Quadpay ecosystem.

1. Payment History: A user’s payment history is a key determinant of credit limit increases. Consistently making on-time payments and fulfilling financial obligations demonstrates reliability and may lead to favorable adjustments in the credit limit.

2. Credit Score: Quadpay considers the user’s credit score as an indicator of creditworthiness. A higher credit score can positively influence the likelihood of credit limit increases, reflecting a user’s ability to manage credit responsibly.

3. Income Level: Users with higher income levels may be eligible for credit limit increases, as it signals a greater capacity to handle larger purchases and repayments effectively.

4. Frequency of Quadpay Usage: Active and responsible usage of Quadpay can contribute to credit limit increases. Regular usage, coupled with prudent financial behavior, can demonstrate a user’s reliability and commitment to responsible spending.

5. Credit Utilization: The ratio of a user’s current credit usage to their available credit limit is a significant factor in credit limit evaluations. Maintaining a lower credit utilization ratio can reflect positively on a user’s financial management and may contribute to credit limit increases.

By considering these factors, Quadpay assesses a user’s overall financial profile and spending behavior to determine the appropriateness of a credit limit increase. This holistic approach enables Quadpay to reward responsible users while mitigating potential risks associated with extending credit limits.

As we continue our exploration of Quadpay credit limits, it is important to recognize the interplay of these factors and how they collectively shape the credit limit adjustment process. By understanding these dynamics, users can proactively position themselves for credit limit increases and capitalize on the benefits of a higher credit limit within the Quadpay framework.

How Often Quadpay Increases Credit Limits

Quadpay adopts a proactive approach to evaluating credit limits, aiming to provide users with opportunities for credit limit increases based on their financial behavior and usage patterns. While the frequency of credit limit increases can vary depending on individual circumstances, Quadpay regularly reviews user accounts to assess eligibility for credit limit adjustments.

Quadpay typically initiates periodic reviews of user accounts to evaluate credit limit increases. These reviews consider factors such as payment history, credit score, income level, and the user’s overall financial profile. By conducting regular assessments, Quadpay endeavors to identify users who demonstrate responsible financial behavior and may be eligible for credit limit increases.

It is important to note that credit limit increases are not guaranteed and are subject to Quadpay’s assessment of each user’s financial standing. Users who exhibit consistent responsible financial behavior, such as making on-time payments, maintaining a healthy credit score, and demonstrating prudent credit utilization, are more likely to be considered for credit limit increases during these periodic reviews.

While there is no fixed timeline for credit limit increases, users can enhance their prospects of receiving a credit limit increase by actively managing their finances and utilizing Quadpay responsibly. By staying informed about the factors that influence credit limit increases and maintaining a positive financial track record, users can position themselves favorably for potential credit limit adjustments during Quadpay’s periodic reviews.

It is important for users to approach credit limit increases with a long-term perspective, focusing on sustainable financial habits and responsible credit management. By doing so, users can create opportunities for credit limit increases over time, thereby enhancing their purchasing capabilities and enjoying a seamless shopping experience with Quadpay.

As we navigate the landscape of credit limit increases within the Quadpay ecosystem, understanding the proactive approach adopted by Quadpay and the role of responsible financial behavior in influencing credit limit adjustments empowers users to make informed decisions and strive for enhanced financial flexibility within the Quadpay platform.

Tips for Increasing Your Quadpay Credit Limit

Empowering yourself with the knowledge and strategies to increase your Quadpay credit limit can pave the way for enhanced purchasing power and a more seamless shopping experience. By implementing the following tips, you can proactively position yourself for potential credit limit increases within the Quadpay ecosystem:

- Maintain a Positive Payment History: Consistently making on-time payments for your Quadpay purchases demonstrates reliability and financial discipline. By prioritizing timely repayments, you can showcase responsible payment behavior, which may contribute to favorable credit limit considerations.

- Monitor Your Credit Score: Keeping an eye on your credit score and taking steps to improve it can positively impact your creditworthiness. A higher credit score reflects responsible credit management and may bolster your eligibility for credit limit increases.

- Utilize Quadpay Responsibly: Using Quadpay for purchases within your means and managing your payment obligations prudently can reflect positively on your financial behavior. Responsible usage of Quadpay showcases your ability to handle credit effectively, potentially influencing credit limit evaluations.

- Increase Your Income: As your income level is a factor in credit limit assessments, seeking opportunities to boost your income can enhance your financial profile. A higher income level may indicate a greater capacity to manage larger purchases, potentially influencing credit limit considerations.

- Monitor Credit Utilization: Keeping your credit utilization ratio in check by managing your current credit usage in relation to your available credit limit is essential. Maintaining a lower credit utilization ratio can demonstrate prudent financial management and may be viewed favorably in credit limit evaluations.

By incorporating these tips into your financial management approach, you can proactively position yourself for potential credit limit increases within the Quadpay platform. It is important to approach credit limit enhancements with a focus on sustainable financial habits and responsible credit management, aiming to create long-term opportunities for increased purchasing capabilities and a more seamless shopping experience with Quadpay.

Conclusion

As we conclude our exploration of Quadpay credit limits, it becomes evident that understanding the dynamics of credit limit evaluations and increases is essential for maximizing the benefits of this innovative payment platform. Quadpay’s commitment to providing a transparent and user-centric experience is reflected in its approach to assessing credit limits and offering opportunities for credit limit increases based on responsible financial behavior.

By comprehending the factors that influence credit limit increases and embracing proactive financial management strategies, users can position themselves for potential credit limit adjustments within the Quadpay ecosystem. Consistently maintaining a positive payment history, monitoring credit scores, utilizing Quadpay responsibly, increasing income levels, and managing credit utilization can collectively contribute to creating opportunities for enhanced purchasing power and a more seamless shopping experience.

Quadpay’s periodic reviews of user accounts underscore the platform’s dedication to recognizing and rewarding responsible financial behavior. While credit limit increases are not guaranteed and are subject to individual assessments, users can leverage their understanding of credit limit dynamics to strive for enhanced financial flexibility within the Quadpay framework.

As users navigate the world of Quadpay, they are encouraged to approach credit limit increases with a focus on sustainable financial habits and responsible credit management. By embracing these principles, users can create long-term opportunities for increased purchasing capabilities, thereby enhancing their overall shopping experience while using Quadpay.

Ultimately, the journey to increasing Quadpay credit limits is anchored in informed decision-making, proactive financial management, and a commitment to responsible credit usage. By embracing these principles, users can unlock the full potential of Quadpay as a versatile and empowering payment solution, enriching their shopping experiences and financial well-being.