Finance

How To Find Cash Flow From Assets

Published: December 21, 2023

Learn how to find cash flow from assets and improve your finance with our expert tips and strategies. Boost your financial stability today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where understanding and managing cash flow is essential for the success of any business or individual. Cash flow is the lifeblood of any organization, allowing it to meet its financial obligations and invest in growth opportunities.

One crucial aspect of cash flow management is the ability to find cash flow from assets. In simple terms, cash flow from assets refers to the amount of cash generated by an organization’s assets, such as property, equipment, inventory, and investments.

In this article, we will explore the importance of cash flow from assets, delve into how it is determined, and discuss strategies for improving it. Whether you are a business owner, investor, or simply interested in better understanding finances, this article will provide you with valuable insights.

Before we dive into the details, it’s important to note that cash flow from assets is not the same as profit or revenue. Profit is the amount of money left over after deducting expenses from revenue, whereas cash flow from assets focuses on the actual movement of cash in and out of a business.

For example, a company may appear to be profitable on paper, but if it has a negative cash flow from assets, it means that the company is not generating enough cash to cover its expenses and investments.

Understanding cash flow from assets is crucial for making informed financial decisions. It provides insights into the efficiency and effectiveness of an organization’s asset management, and helps determine its ability to generate cash in the short and long term.

In the following sections, we will explore how cash flow from assets is determined, analyze its components, and provide strategies for improving it. Let’s dive in!

Understanding Cash Flow from Assets

Before we discuss the importance and calculation of cash flow from assets, it’s important to have a clear understanding of what it entails. Cash flow from assets is a measure of the cash generated or consumed by an organization’s assets over a specific period of time.

Assets are the economic resources owned or controlled by a business, including tangible assets such as buildings, machinery, and inventory, as well as intangible assets such as patents, trademarks, and goodwill.

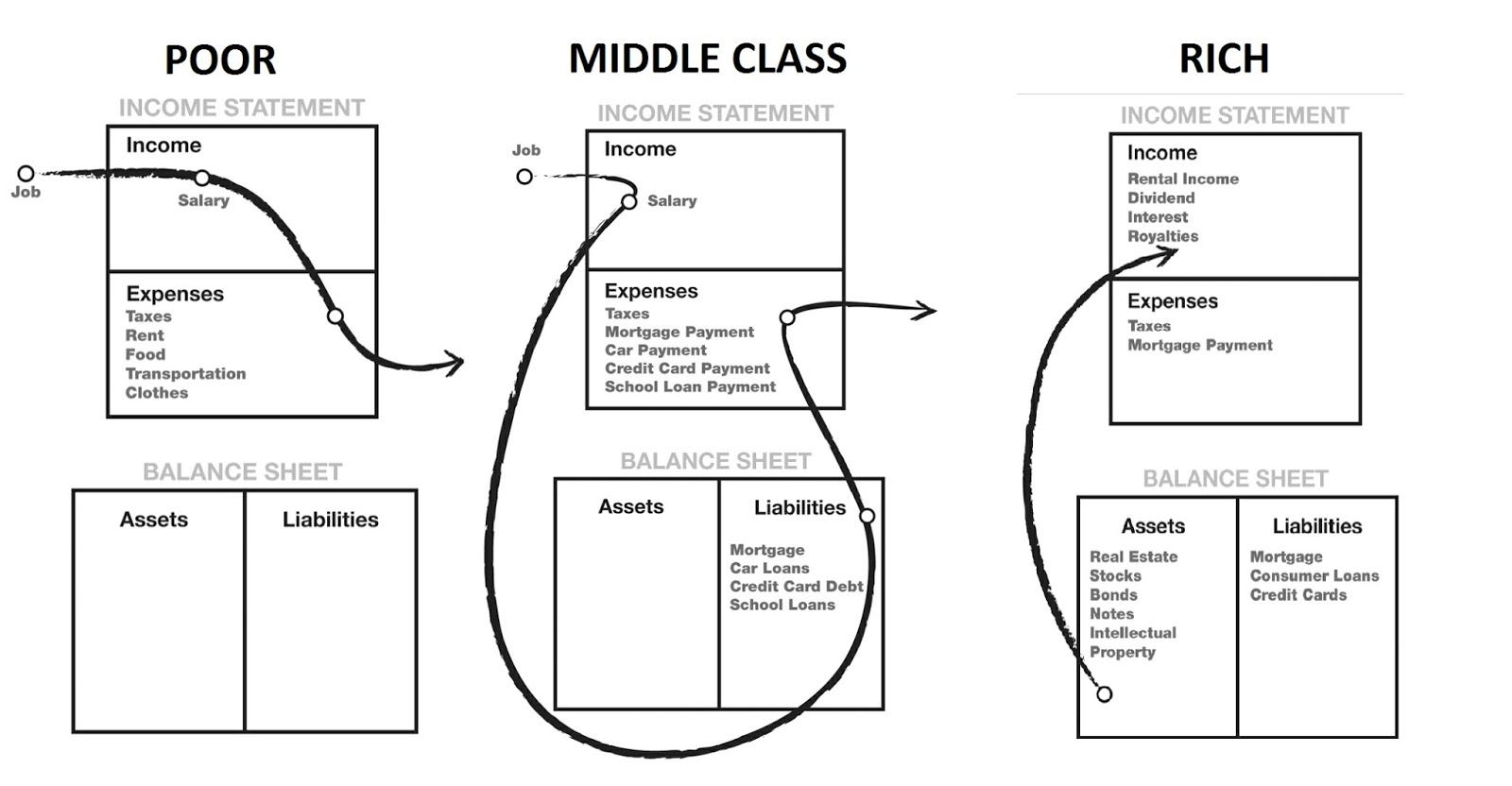

The cash flow from assets can be categorized into three components:

- Operating Cash Flow: This refers to the cash generated or consumed by the day-to-day operations of a business. It includes cash inflows from sales and services and cash outflows for expenses such as salaries, rent, and utilities.

- Investing Cash Flow: This represents the cash generated or consumed by investments in long-term assets, such as the purchase or sale of property, equipment, or investments in other companies.

- Financing Cash Flow: This reflects the cash generated or consumed from activities related to financing, such as borrowing or repaying loans, issuing or buying back shares, and payment of dividends.

By understanding these three components, we can assess the overall cash-generating capabilities of an organization’s assets and identify any potential areas of improvement or risk.

It’s worth noting that cash flow from assets is different from net income, which is the profit earned by a company in a given period. While net income is important for determining the financial health of a business, cash flow from assets provides valuable insights into the actual movement of cash in and out of the organization.

For example, a company may report high net income due to increased sales, but if it has significant investing cash outflows for the purchase of new equipment, the overall cash flow from assets may be negative.

Understanding and monitoring cash flow from assets allows businesses to make informed decisions about asset allocation, financing options, and overall financial sustainability. It helps identify potential liquidity issues, assess investment opportunities, and supports effective financial planning.

In the next sections, we will explore in more detail how to determine each component of cash flow from assets and discuss strategies for improving cash flow from assets. So, let’s delve deeper into the calculation of cash flow from assets.

Importance of Cash Flow from Assets

Cash flow from assets plays a crucial role in evaluating the financial health and sustainability of an organization. It provides valuable insights into the efficiency and effectiveness of its asset management. Here are a few key reasons why understanding and managing cash flow from assets is important:

- Assessing Financial Performance: Cash flow from assets allows businesses to assess their financial performance accurately. It provides a clear picture of the actual cash generated or consumed by their assets, helping to measure the organization’s ability to meet its financial obligations.

- Identifying Liquidity Issues: By analyzing the cash flow from assets, organizations can identify potential liquidity issues. If the cash inflows from operations are consistently lower than the outflows from investments and financing activities, it may indicate a need to improve cash management or seek additional sources of funding.

- Evaluating Investment Opportunities: Understanding cash flow from assets is crucial when evaluating investment opportunities. It helps assess the cash-generating potential of new assets or projects, allowing organizations to make informed decisions about allocating their resources effectively.

- Supporting Financial Planning: Cash flow from assets provides essential information for effective financial planning. By understanding the cash inflows and outflows related to operations, investments, and financing, organizations can create realistic budgets, set achievable financial goals, and develop strategies for growth and sustainability.

- Managing Debt and Financing: Cash flow from assets is instrumental in managing debt and financing options. It helps organizations determine their ability to meet debt obligations, make interest payments, and generate sufficient cash for future business growth or expansion.

- Improving Business Operations: Analyzing cash flow from assets can highlight areas for improvement within the organization’s operations. For example, identifying excessive cash outflows from operating activities may indicate the need to optimize expenses, reduce waste, or improve inventory management.

In summary, cash flow from assets is a critical financial metric that provides valuable information about the overall health and sustainability of an organization. By understanding and managing this aspect effectively, businesses can make informed decisions, improve their financial performance, and position themselves for long-term success.

Determining Operating Cash Flow

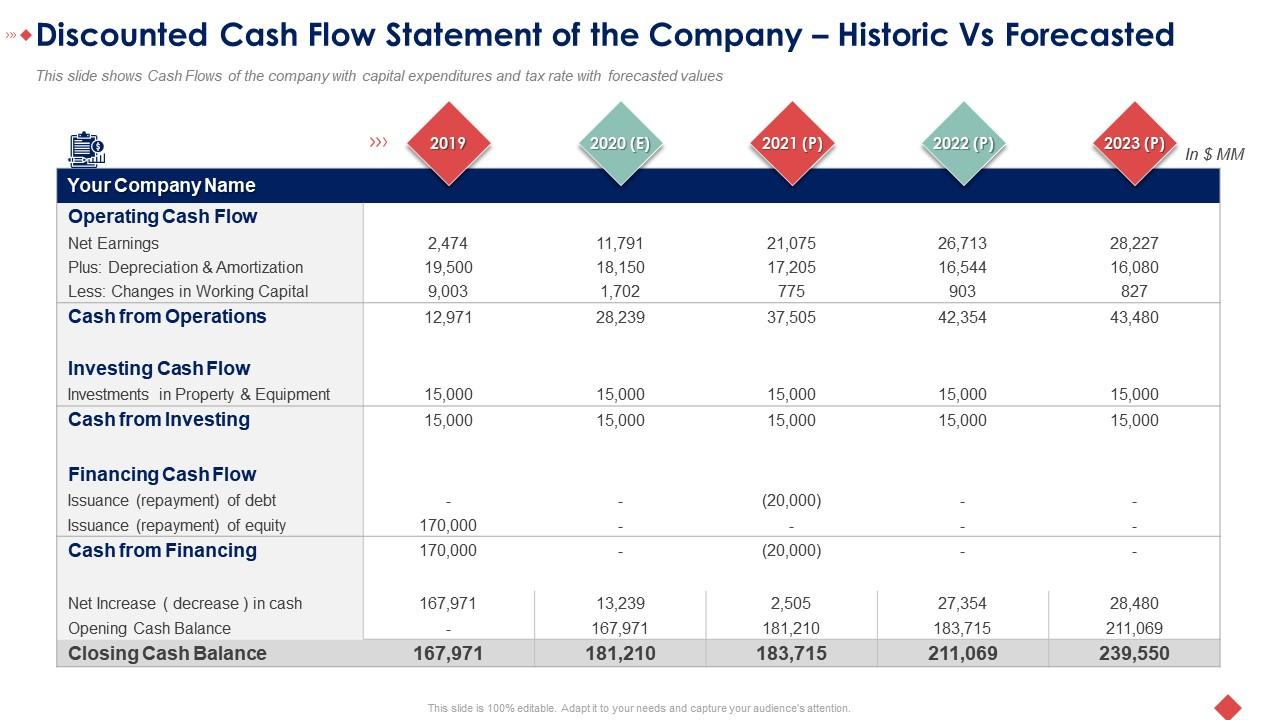

Operating cash flow is a key component of cash flow from assets and represents the cash generated or consumed by the day-to-day operations of a business. It provides valuable insights into the cash-generating capabilities of the organization’s core activities. Here’s a breakdown of how to determine operating cash flow:

The starting point for calculating operating cash flow is the net income of the business. Net income is the profit generated by the company before deducting taxes and interest expenses. While net income is an important measure of financial performance, operating cash flow goes a step further by accounting for the movement of cash in and out of the business.

To calculate operating cash flow, you need to consider several adjustments to the net income. These adjustments are necessary because net income includes non-cash expenses (such as depreciation and amortization) and non-operating items (such as interest income or gains/losses from the sale of assets) that do not directly impact the cash flow from operations.

The formula for determining operating cash flow is as follows:

Operating Cash Flow = Net Income + Depreciation/Amortization +/- Changes in Working Capital

The first component of the formula, net income, represents the profit earned by the company during a given period. It serves as a starting point for calculating operating cash flow.

The second component, depreciation and amortization, represents the non-cash expenses that are added back to net income. These expenses account for the wear and tear of physical assets or the gradual expiration of intangible assets over time. Since they are non-cash expenses, they do not affect the actual movement of cash, and thus need to be added back to calculate the operating cash flow.

The third component, changes in working capital, represents the movement of cash related to the company’s current assets and liabilities. Working capital includes items such as accounts receivable, inventory, accounts payable, and other short-term assets and liabilities. An increase in working capital (such as an increase in accounts receivable or inventory) represents a cash outflow, while a decrease in working capital represents a cash inflow. The changes in working capital are added or subtracted from the net income and depreciation/amortization to derive the operating cash flow.

Once you have determined the operating cash flow, you can use it to evaluate the cash-generating capabilities of the company’s core operations. A positive operating cash flow indicates that the company is generating cash from its day-to-day activities, while a negative operating cash flow may indicate potential issues that need to be addressed.

By accurately determining operating cash flow, businesses can assess their financial performance, identify areas for improvement, and make informed decisions about their operational strategies.

Calculating Investing Cash Flow

Investing cash flow is a key component of cash flow from assets and represents the cash generated or consumed as a result of investment activities. It focuses on the cash inflows and outflows related to the acquisition or disposal of long-term assets. Here’s an overview of how to calculate investing cash flow:

Investing cash flow includes cash flows from activities such as the purchase or sale of property, plant, and equipment, as well as investments in other companies and the acquisition or disposal of intangible assets.

Calculating investing cash flow involves analyzing the changes in the company’s non-current assets over a specific period. Non-current assets are long-term assets that are not intended for sale in the normal course of business, such as buildings, machinery, vehicles, and investments.

The formula for determining investing cash flow is as follows:

Investing Cash Flow = Cash Inflows from Investment Activities – Cash Outflows for Investment Activities

The cash inflows from investment activities include the proceeds from the sale of assets or investments, as well as any cash received from the repayment of loans made to other entities. These inflows represent a positive impact on the cash flow.

The cash outflows for investment activities include the cash spent on purchasing or acquiring new assets or investments. These outflows represent a negative impact on the cash flow.

By examining the cash inflows and outflows related to investment activities, businesses can assess the effectiveness of their investment decisions and the impact on cash flow. Positive investing cash flow indicates that the company is generating cash from its investments, while negative investing cash flow suggests that cash is being used to acquire new assets or investments.

Calculating investing cash flow is crucial for evaluating the organization’s capital expenditure decisions and long-term investment strategies. It helps determine the cash requirements for maintaining and expanding the asset base, as well as identifying potential opportunities for growth.

By closely monitoring the investing cash flow, companies can ensure that their investment activities align with their overall financial objectives and that the cash generated or consumed from these activities is effectively managed.

Analyzing Financing Cash Flow

Financing cash flow is an essential component of cash flow from assets and represents the cash generated or consumed as a result of financing activities. It focuses on the cash inflows and outflows related to the company’s financing sources and liabilities. Here’s an overview of how to analyze financing cash flow:

Financing cash flow includes activities such as borrowing or repaying loans, issuing or buying back shares, and the payment of dividends to shareholders. These activities directly impact the company’s capital structure and financial obligations.

The formula for determining financing cash flow is as follows:

Financing Cash Flow = Cash Inflows from Financing Activities – Cash Outflows for Financing Activities

The cash inflows from financing activities include proceeds from issuing new debt or equity, as well as cash received from loans or other financing arrangements. These inflows represent a positive impact on the cash flow.

The cash outflows for financing activities include cash paid for the repayment of debt, repurchasing shares from shareholders, and payment of dividends. These outflows represent a negative impact on the cash flow.

Analyzing financing cash flow helps businesses evaluate their financing strategies, capital structure decisions, and the impact on their overall cash position. Positive financing cash flow indicates that the company is generating cash through financing activities, while negative financing cash flow suggests that cash is being used to fulfill financial obligations.

Understanding financing cash flow is crucial for assessing the company’s ability to meet its debt obligations, evaluate the cost of capital, and determine the impact of dividend payments on cash flow. It also provides insights into the company’s reliance on external financing sources for its operations and growth.

By monitoring and analyzing financing cash flow, organizations can make informed decisions about their financing options, manage their debt effectively, and maintain a healthy cash position for future investments and operations.

Evaluating Overall Cash Flow from Assets

When evaluating overall cash flow from assets, it is important to consider the combined impact of operating cash flow, investing cash flow, and financing cash flow. This comprehensive assessment provides a holistic view of the organization’s cash-generating capabilities and financial health. Here are some key factors to consider:

Positive and Negative Cash Flow: examine whether the overall cash flow from assets is positive or negative. A positive cash flow indicates that the organization is generating more cash than it is consuming, which is an encouraging sign of financial stability. On the other hand, a negative cash flow suggests that the company is spending more cash than it is generating, which may raise concerns about sustainability and liquidity.

Cash Flow Trend: analyze the trend of the overall cash flow from assets over multiple periods. A consistent positive trend indicates solid financial performance and growth, while a declining or fluctuating trend may require closer scrutiny to identify underlying issues or opportunities for improvement.

Relative Magnitude: assess the magnitude of the overall cash flow from assets in relation to the size and nature of the organization’s operations. Comparing cash flow figures to industry benchmarks or historical data can provide valuable insights into the company’s competitiveness and financial efficiency.

Reinvestment Ability: consider whether the overall cash flow from assets is sufficient to support the organization’s reinvestment needs. This includes the ability to fund capital expenditures, research and development, and other initiatives aimed at sustaining or expanding the business. Inadequate cash flow may restrict growth opportunities and hinder competitiveness.

Debt Servicing: evaluate whether the organization has enough cash flow to service its debt obligations, including interest payments and principal repayments. Inadequate cash flow for debt servicing can lead to financial distress and creditworthiness concerns.

Dividend Payments: analyze the impact of dividend payments on the overall cash flow from assets. While dividends are a way to distribute profits to shareholders, excessive dividend payouts can strain cash flow and limit the organization’s ability to reinvest in growth opportunities.

By evaluating the overall cash flow from assets and taking into account these factors, organizations can gain a comprehensive understanding of their financial performance and determine areas for improvement. It allows for effective financial planning, risk management, and strategic decision-making to ensure long-term sustainability and success.

Strategies for Improving Cash Flow from Assets

Improving cash flow from assets is crucial for the financial stability and growth of any organization. A strong cash flow allows businesses to meet financial obligations, invest in new opportunities, and weather economic downturns. Here are some effective strategies for improving cash flow from assets:

- Optimize Inventory Management: Excess inventory ties up cash and increases storage costs. Implementing efficient inventory management techniques such as just-in-time inventory or periodic inventory reviews can help reduce carrying costs and free up cash flow.

- Enhance Accounts Receivable Management: Ensure prompt and efficient collection of accounts receivable. Implement clear credit policies, offer incentives for early payments, and actively follow up on overdue accounts to minimize outstanding receivables and improve cash flow.

- Manage Accounts Payable: Negotiate favorable payment terms with suppliers and take advantage of any available discounts for early payments. However, be mindful not to jeopardize important supplier relationships while seeking improvements in payment terms.

- Control Operating Expenses: Regularly review and analyze operating expenses to identify and eliminate any unnecessary or excessive costs. This can include renegotiating contracts with vendors or finding more cost-effective alternatives without sacrificing quality.

- Effective Capital Expenditure Planning: Carefully evaluate and prioritize capital expenditures to ensure they align with the organization’s strategic goals and cash flow capabilities. Consider alternative financing options such as leasing or equipment rental to mitigate the impact on cash flow.

- Explore Financing Options: Identify opportunities to secure alternative financing arrangements such as loans, lines of credit, or equity investments to boost cash flow. However, it is crucial to carefully assess the costs and risks associated with these options.

- Rationalize Product or Service Offerings: Evaluate the profitability of different product lines or services and consider discontinuing those that do not contribute significantly to cash flow. Focusing on the most profitable offerings allows businesses to optimize resources and improve overall cash flow.

- Increase Sales and Revenue: Implement targeted marketing and sales strategies to attract new customers and increase sales. Enhancing customer retention and loyalty can also lead to recurring revenue streams and improved cash flow.

- Monitor and Anticipate Cash Flow: Regularly assess and forecast cash flow to proactively address any potential shortfalls or issues. Being aware of upcoming cash flow challenges helps organizations take precautionary measures such as adjusting expenses or securing additional financing in advance.

- Invest in Technology: Utilize technology solutions that streamline processes and improve operational efficiency. Automated systems for invoicing, payment processing, and financial reporting can help reduce administrative costs and enhance cash flow management.

Implementing these strategies requires careful planning and constant monitoring of cash flow performance. It may be beneficial to seek guidance from financial advisors or consultants to identify specific areas for improvement and develop tailored approaches for optimizing cash flow from assets.

By adopting these effective strategies, businesses can enhance their cash flow from assets, improve financial stability, and position themselves for long-term success.

Conclusion

Cash flow from assets is a critical component of financial management, providing insights into the cash generated or consumed by an organization’s assets. Understanding and effectively managing cash flow from assets is essential for the financial stability, growth, and long-term success of any business.

In this article, we explored the importance of cash flow from assets and discussed how it is determined through operating cash flow, investing cash flow, and financing cash flow. Operating cash flow reflects the cash generated by day-to-day operations, while investing cash flow focuses on the cash inflows and outflows related to long-term asset acquisitions. Financing cash flow encompasses the cash generated or consumed from financing activities.

We also discussed strategies for improving cash flow from assets, including optimizing inventory management, enhancing accounts receivable and accounts payable management, controlling operating expenses, and exploring financing options. Additionally, we highlighted the significance of rationalizing product offerings, increasing sales and revenue, monitoring cash flow, investing in technology, and effective capital expenditure planning.

By implementing these strategies, businesses can enhance their cash flow from assets, improve financial stability, and make informed decisions about resource allocation, growth opportunities, and debt management. Regular monitoring, forecasting, and adjustment of cash flow practices are crucial to maintaining a healthy financial position.

In conclusion, cash flow from assets is a fundamental metric in financial management, reflecting the efficiency and effectiveness of asset utilization and cash generation. By understanding, analyzing, and actively managing cash flow from assets, organizations can position themselves for financial success and withstand economic challenges. It is essential to prioritize cash flow management and constantly adapt strategies to optimize cash flow from assets for sustainable growth and prosperity.