Home>Finance>How To Categorize Credit Card Payments In Quickbooks

Finance

How To Categorize Credit Card Payments In Quickbooks

Modified: February 21, 2024

Learn how to effectively categorize credit card payments in Quickbooks with our comprehensive finance guide. Streamline your bookkeeping process and improve financial management.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to QuickBooks, the leading accounting software for small businesses. If you’re a business owner or manager who uses credit cards for various expenses, it’s crucial to accurately categorize these payments in QuickBooks to maintain accurate financial records. By properly categorizing credit card payments, you can gain insights into your business’s financial health, track expenses, and make informed decisions.

In this article, we will guide you through the process of categorizing credit card payments in QuickBooks. We’ll cover the setup of income and expense accounts, as well as how to categorize credit card payments as income or expenses depending on your specific business needs. We’ll also explore how to split credit card payments and reconcile them in QuickBooks.

Whether you’re new to QuickBooks or looking for ways to streamline your credit card payment categorization process, this article will provide you with the knowledge and steps to effectively manage your financial transactions within the software.

Let’s dive in and learn how to categorize credit card payments in QuickBooks to keep your financial records organized and accurate.

Setting Up Income Accounts

Before you can categorize credit card payments in QuickBooks, you’ll need to set up the appropriate income accounts for your business. Income accounts are used to track the money that comes into your business from various sources, including credit card payments.

To set up income accounts in QuickBooks, follow these steps:

- Open QuickBooks and go to the Chart of Accounts.

- Click on “New” to create a new account.

- Select the account type as “Income”.

- Enter a name for the income account, such as “Credit Card Payments”.

- Assign an account number to the income account (optional).

- Click on “Save and Close” to create the income account.

Repeat these steps for each income account that you want to set up for your credit card payments. Depending on your business’s needs, you may want to create separate income accounts for different categories of credit card payments, such as “Online Sales” or “In-Store Sales”. This allows you to track and analyze your revenue sources more effectively.

Once you have set up the income accounts, you can proceed to categorizing your credit card payments as income in QuickBooks. This will ensure that your financial reports reflect the revenue generated from credit card transactions accurately.

Setting Up Expense Accounts

In addition to setting up income accounts, you’ll also need to create expense accounts in QuickBooks to properly categorize your credit card payments. Expense accounts help you keep track of where your money is going and provide insights into your business’s spending habits.

Here’s how you can set up expense accounts in QuickBooks:

- Navigate to the Chart of Accounts in QuickBooks.

- Click on “New” to create a new account.

- Select the account type as “Expense”.

- Provide a descriptive name for the expense account, such as “Office Supplies” or “Travel Expenses”.

- Assign an account number if desired.

- Save the account by clicking on “Save and Close”.

Repeat these steps to set up multiple expense accounts as needed for your business. You can create accounts for various expense categories, such as utilities, rent, marketing expenses, or equipment purchases.

By creating specific expense accounts, you can track and analyze your credit card payments more effectively, as well as gain insights into your business’s spending patterns and identify areas where you can potentially cut costs.

Once you have your expense accounts set up, you’re ready to categorize your credit card payments in QuickBooks based on the appropriate expense accounts. This will ensure that your financial records accurately reflect your business’s expenses and make budgeting and financial analysis more efficient.

Categorizing Credit Card Payments as Income

When it comes to categorizing credit card payments in QuickBooks, one option is to categorize them as income. This is appropriate when you receive credit card payments as revenue for your products or services.

To categorize credit card payments as income in QuickBooks, follow these steps:

- Open QuickBooks and go to the Banking or Transactions tab.

- Select the credit card account where the payment was deposited.

- Locate the credit card payment transaction.

- Categorize the transaction as income by selecting the appropriate income account you set up earlier. For example, if the credit card payment is for online sales, select the “Online Sales” income account.

- Enter the payment amount and any additional details, such as the customer’s name or invoice number, if applicable.

- Save the transaction.

By categorizing credit card payments as income, you’ll accurately reflect the revenue generated from your credit card transactions in your financial reports. This allows you to track and analyze your business’s income streams and make informed decisions based on the data.

It’s important to note that if you receive credit card payments for different types of income, such as both product sales and service fees, you’ll need to create separate income accounts for each type. This way, you can categorize the credit card payments based on the specific income category they belong to, ensuring proper categorization and accurate financial reporting.

Now that you understand how to categorize credit card payments as income, let’s explore the process of categorizing them as expenses in QuickBooks in case your credit card payments represent business expenses instead.

Categorizing Credit Card Payments as Expenses

In some cases, credit card payments may represent business expenses rather than revenue. For example, you might use a credit card to pay for office supplies or travel expenses. In QuickBooks, you can categorize these credit card payments as expenses to accurately track your business expenditures.

To categorize credit card payments as expenses in QuickBooks, follow these steps:

- Go to the Banking or Transactions tab in QuickBooks.

- Select the appropriate credit card account where the payment was charged.

- Locate the credit card payment transaction.

- Categorize the transaction as an expense by selecting the relevant expense account you created earlier. For instance, if the credit card payment is for office supplies, choose the “Office Supplies” expense account.

- Enter the payment amount and any necessary details, such as the vendor’s name or invoice number, if applicable.

- Save the transaction.

By categorizing credit card payments as expenses, you ensure that your financial records accurately reflect your business’s spending and enable better expense tracking and analysis. This helps with budgeting, identifying cost-saving opportunities, and understanding your overall financial health.

In cases where a credit card payment represents both income and expenses, such as when you use a business credit card for personal expenses, it’s crucial to separate the business portion from personal expenses. To do this, create separate expense accounts for each category and categorize the portion of the credit card payment accordingly.

Remember, accurate categorization of credit card payments is essential for generating useful financial reports and gaining insights into your business’s cash flow and profitability. It’s recommended to review and categorize credit card transactions regularly to ensure your financial records are up to date and accurate.

Now that you understand how to categorize credit card payments as expenses, we’ll explore the process of splitting credit card payments in QuickBooks, which can be helpful when a single payment represents multiple expense categories.

Splitting Credit Card Payments

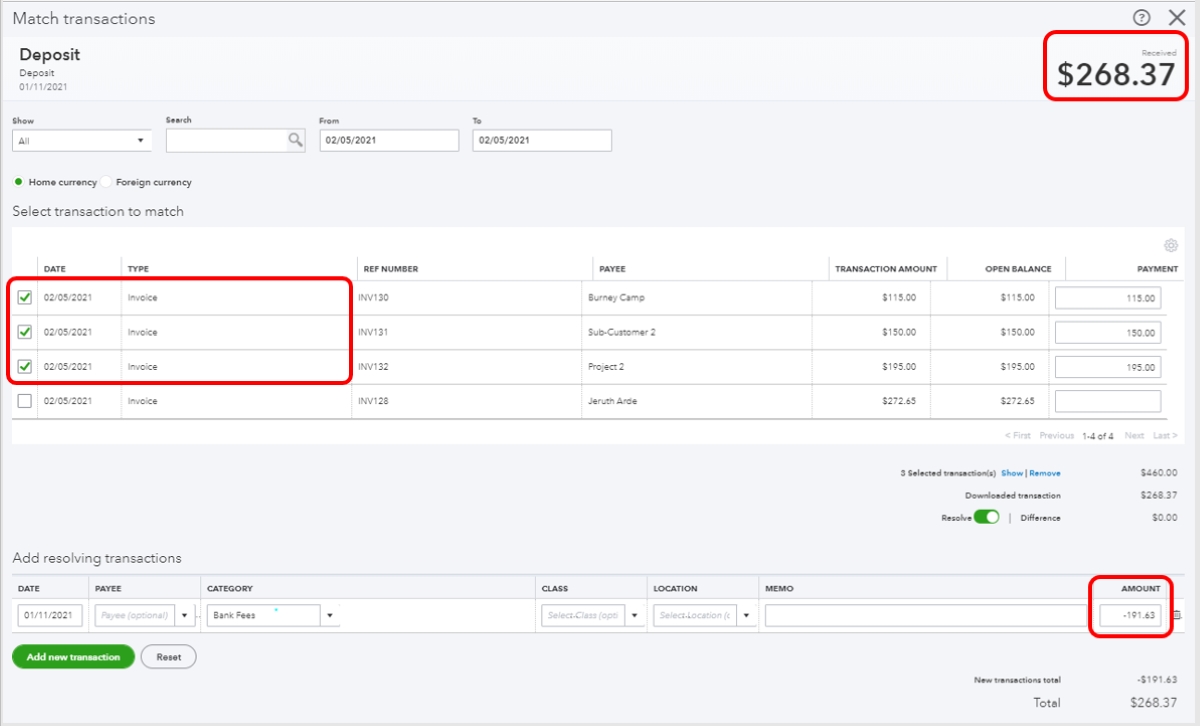

Sometimes, a single credit card payment may need to be allocated to multiple expense categories. For example, if you make a credit card payment that includes charges for both office supplies and travel expenses, you’ll need to split the payment to accurately reflect each expense category in QuickBooks.

Here’s how you can split credit card payments in QuickBooks:

- Open QuickBooks and navigate to the Banking or Transactions tab.

- Select the credit card account associated with the payment.

- Locate the credit card payment transaction that needs to be split.

- Click on the transaction to open the details.

- Find the option to split the payment (usually labeled “Split” or “Allocate”).

- Allocate the payment amount to different expense accounts by entering the appropriate amounts for each expense category.

- Assign the correct expense accounts to each amount by selecting them from the drop-down menu.

- Ensure that the total amount allocated matches the original payment amount.

- Save the split transaction.

By splitting credit card payments, you can accurately reflect the different expense categories within a single payment. This allows for more precise analysis of your business’s spending and helps you stay organized when it comes to tracking your various expenses.

It’s important to note that if you find yourself frequently splitting credit card payments, it may be worth considering separate credit cards or accounts for specific expense categories. This can simplify the categorization process and make financial tracking more efficient.

Now that you know how to split credit card payments in QuickBooks, let’s move on to the next step: reconciling your credit card payments to ensure accurate financial records.

Reconciling Credit Card Payments in QuickBooks

Reconciling your credit card payments in QuickBooks is an essential step to ensure the accuracy of your financial records. Reconciliation helps you identify any discrepancies between your credit card statements and your recorded transactions, ensuring that all payments are accounted for and reconciled.

Here’s how you can reconcile credit card payments in QuickBooks:

- Go to the Banking or Transactions tab in QuickBooks.

- Select the appropriate credit card account to reconcile.

- Click on the “Reconcile” button or option.

- Enter the statement date and ending balance from your credit card statement.

- Review the list of transactions displayed in QuickBooks and compare them to your credit card statement. Check off each transaction that matches the statement.

- Look for any missing or additional transactions and ensure they are correctly categorized and accounted for in QuickBooks.

- Make adjustments to any transactions if necessary.

- Verify that the difference between the statement balance and the reconciled balance in QuickBooks is zero.

- Click on the “Finish” or “Reconcile” button to complete the reconciliation process.

By regularly reconciling your credit card payments, you can catch any potential errors or discrepancies, ensuring your financial records are accurate. Reconciliation also helps you identify any fraudulent transactions or unauthorized charges, providing an extra layer of security for your business.

It’s crucial to make reconciliation a part of your regular financial routine. Aim to reconcile your credit card payments on a monthly basis or according to your business’s billing cycle. This will help you stay on top of your finances, make informed decisions, and maintain accurate records for tax purposes.

Now that you have successfully reconciled your credit card payments in QuickBooks, you can have peace of mind knowing that your financial records are up to date and accurate. Regular reconciliation is an important practice that ensures the integrity of your business’s financial data.

Conclusion

Categorizing credit card payments accurately in QuickBooks is crucial for maintaining organized and accurate financial records for your business. Whether you categorize them as income or expenses, or even split them between different expense categories, proper categorization allows you to analyze your business’s financial health, make informed decisions, and prepare your financial reports with confidence.

In this article, we explored the process of setting up income and expense accounts in QuickBooks to categorize credit card payments. We learned how to categorize credit card payments as income when they represent revenue for your business and as expenses when they reflect your business’s spending. We also discussed how to split credit card payments when they involve multiple expense categories. Lastly, we emphasized the importance of reconciling credit card payments in QuickBooks to ensure the accuracy of your financial records.

By following these steps and incorporating them into your financial routine, you can streamline your credit card payment categorization process, maintain accurate records, and gain valuable insights into your business’s financial performance.

Remember, consistency and attention to detail are key when categorizing credit card payments. Regularly reviewing and reconciling your credit card transactions will help you identify any discrepancies and ensure that your financial records align with your credit card statements.

With a well-organized and accurate financial system within QuickBooks, you’ll have the confidence and clarity to make sound financial decisions that drive the success of your business.

Now that you have a solid understanding of how to categorize credit card payments in QuickBooks, put this knowledge into practice and unlock the full potential of your financial management capabilities.