Home>Finance>How To Complete Form 941-X For Employee Retention Credit

Finance

How To Complete Form 941-X For Employee Retention Credit

Modified: January 5, 2024

Learn how to complete Form 941-X to claim the Employee Retention Credit. Our finance experts provide step-by-step guidance for maximized tax savings.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on completing Form 941-X for the Employee Retention Credit (ERC). As a business owner, understanding the intricacies of this form and credit is essential for maximizing your financial benefits and ensuring compliance with tax regulations.

The Employee Retention Credit was introduced by the IRS to provide financial relief to eligible employers affected by the COVID-19 pandemic. It offers a refundable tax credit to businesses that continue to pay wages to their employees, even during periods of significant revenue decline or temporary closures.

Completing Form 941-X is necessary if you need to make adjustments to previously filed Form 941, which is used to report quarterly payroll taxes. It allows you to claim the Employee Retention Credit for any eligible wages that were not initially reported or were reported incorrectly on your original filings.

In this guide, we will break down the process of completing Form 941-X for the Employee Retention Credit in a step-by-step manner. We will provide detailed instructions and tips to ensure you navigate the form accurately and avoid common mistakes. By following this guide, you will be well-equipped to maximize your eligibility for the Employee Retention Credit and properly address any adjustments on your tax filings.

Before we dive into the details, it’s important to note that if you are a small business owner or self-employed individual, you may not need to complete Form 941-X. Instead, you can claim the Employee Retention Credit on your annual Form 944 or Form 1040.

Now, let’s get started with our comprehensive walkthrough of Form 941-X for the Employee Retention Credit!

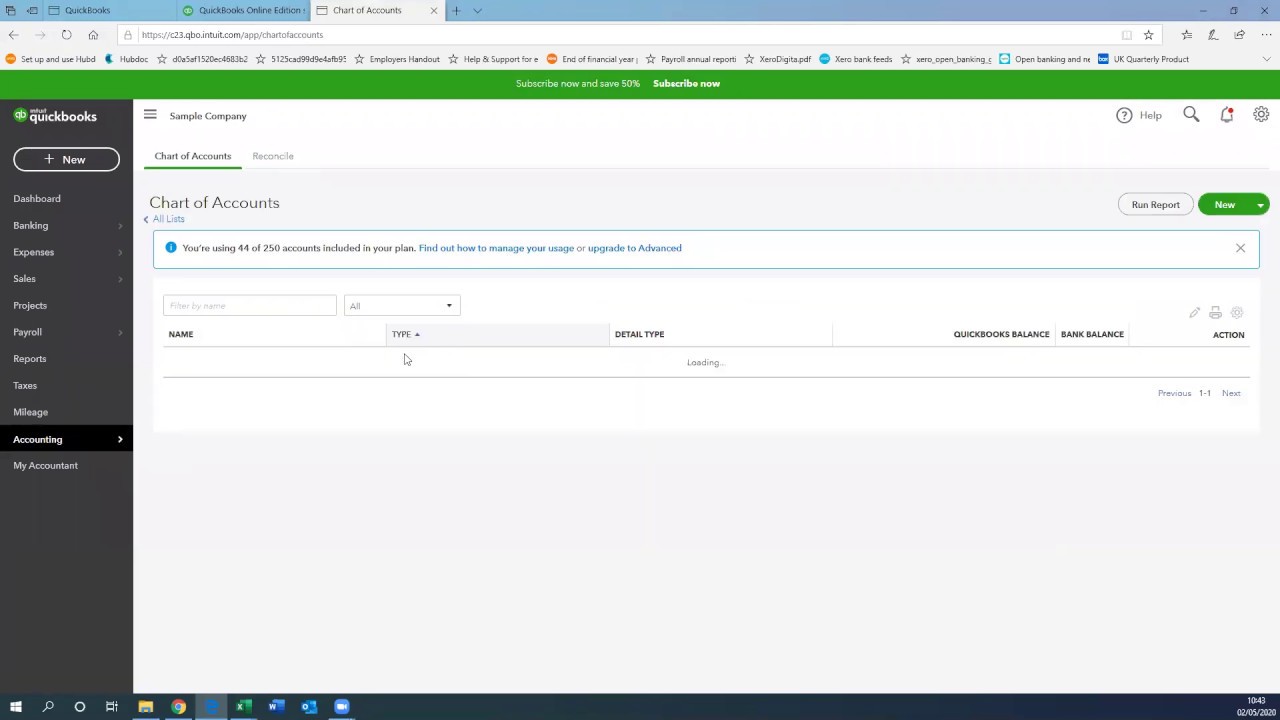

Overview of Form 941-X

Form 941-X is used to make corrections or adjustments to previously filed Form 941, the Employer’s Quarterly Federal Tax Return. When it comes to the Employee Retention Credit (ERC), Form 941-X allows eligible employers to claim any missed or incorrectly reported credits for eligible wages.

Here are some key points to understand about Form 941-X:

- Purpose: The main purpose of Form 941-X is to correct any errors or omissions on previously filed Form 941. For the ERC specifically, it allows eligible employers to claim the credit for any applicable quarters.

- Version: There is only one version of Form 941-X, which is available on the official website of the Internal Revenue Service (IRS). Be sure to download the most recent version to ensure accuracy.

- Amendment Period: Form 941-X can be filed to amend payroll tax returns for the previous three years. However, if you are specifically claiming the ERC, the amendment period is limited to the applicable quarters for which the credit is available.

- Submission Deadline: The deadline to file Form 941-X is generally within three years from the original filing date of Form 941. However, for the ERC, it’s important to note that the credit cannot be claimed for wages paid after December 31, 2021.

It’s important to keep in mind that Form 941-X should only be used to correct the reporting of the Employee Retention Credit. If you need to make other adjustments or corrections to your Form 941, such as correcting payroll tax amounts or other credits, you may need to use a different form or take other appropriate action.

Now that you have a high-level overview of Form 941-X, let’s move on to understanding the eligibility criteria for the Employee Retention Credit in the next section.

Employee Retention Credit (ERC) Eligibility

Before diving into the process of completing Form 941-X for the Employee Retention Credit (ERC), it’s important to determine if you are eligible for this valuable tax credit.

The Employee Retention Credit was initially introduced as part of the CARES Act in March 2020 to support eligible employers who were adversely affected by the COVID-19 pandemic. It was later extended and expanded under subsequent legislation.

Here are the key eligibility criteria for the Employee Retention Credit:

- Business Operations: To be eligible for the ERC, you must be an eligible employer that has experienced either a full or partial suspension of operations due to a government order or a significant decline in gross receipts compared to the same quarter in the previous year. The specific requirements and thresholds for the decline in gross receipts vary depending on the time period.

- Employment Status: You must have at least one employee during the calendar quarter to qualify for the ERC. The credit can be claimed for wages paid to both full-time and part-time employees, subject to certain limitations.

- Wage Qualification: The wages that qualify for the ERC depend on the size of your business. For eligible employers with an average of more than 100 full-time employees, qualified wages are those paid to employees who are not providing services due to a full or partial suspension of operations or a significant decline in gross receipts. For eligible employers with an average of 100 or fewer full-time employees, qualified wages include all wages paid during the specified period, regardless of whether the employees are providing services.

- Government Assistance: If you have received certain types of governmental assistance, such as a Paycheck Protection Program (PPP) loan, you may not be eligible for the ERC on those wages.

It’s worth noting that the eligibility criteria for the ERC have evolved over time due to legislative changes and updates from the IRS. Therefore, it’s important to consult the most recent guidance and regulations to ensure you meet the requirements.

Once you have determined your eligibility for the Employee Retention Credit, you can move forward with completing Form 941-X to claim the credit for appropriate quarters. The next section will provide you with detailed steps on how to complete the form accurately.

Steps to Complete Form 941-X for ERC

Completing Form 941-X for the Employee Retention Credit (ERC) may seem daunting at first, but by following a step-by-step approach, you can ensure accuracy and avoid common mistakes. Here is a breakdown of the steps to complete Form 941-X:

- Gather Documentation: Before you begin filling out Form 941-X, gather all pertinent documents, including your original Form 941 filings, payroll records, and any supporting documentation related to the ERC. This will help you accurately report the necessary wage and credit information.

- Section 1: Reason for Filing

In Section 1, indicate the reason for filing Form 941-X. For the ERC, select the appropriate checkbox indicating you are claiming the credit for eligible wages. Provide a brief explanation of the reason for the adjustment. - Section 2: Employer Information

Fill out your business information in Section 2, including your Employer Identification Number (EIN), business name, address, and contact details. - Section 3: Quarter(s) to Be Corrected

In this section, select the calendar quarters and year for which you are making the adjustment. Specifically, choose the quarters in which you paid eligible wages and are claiming the ERC. - Section 4: Corrections to Form 941

Use Section 4 to correct the specific line items on Form 941 that need adjustment. This includes the reporting of qualified wages, the applicable credit for each quarter, and any other necessary corrections or changes. Provide detailed explanations for each correction made. - Section 5: Explanation of Adjustments

Provide a detailed explanation of the adjustments made in Section 5. This should include a breakdown of the qualified wages, the total ERC claimed for each quarter, and any other relevant information supporting your claim. - Section 6: Signature and Date

Sign and date the form in Section 6 to certify the accuracy of the information provided. - Attach Supporting Documentation

Be sure to include all supporting documentation that substantiates your claim for the ERC. This may include payroll records, financial statements, government orders, or any other relevant documents. - File the Form

Once the form is complete, make a copy for your records and submit the original Form 941-X to the appropriate IRS address based on your location.

It’s crucial to double-check all the information provided on Form 941-X for accuracy and ensure that it aligns with the supporting documentation. Remember to retain a copy of the completed form, attachments, and proof of submission for your records.

Now that you have a step-by-step guide for completing Form 941-X, let’s move on to the next section, which provides detailed instructions for each box on the form.

Box-by-Box Instructions for Form 941-X

Completing Form 941-X for the Employee Retention Credit (ERC) requires careful attention to detail as you navigate various boxes and sections. Here are box-by-box instructions to help you accurately complete the form:

- Box 1: Reason for Filing

Select the appropriate checkbox that indicates you are filing Form 941-X to claim the ERC for eligible wages. Provide a brief explanation of the reason for the adjustment. - Boxes 2-4: Employer Information

Fill out your business information, including your Employer Identification Number (EIN), business name, address, and contact details. - Boxes 5-8: Quarter(s) to Be Corrected

Select the calendar quarters and year for which you are making adjustments related to the ERC. Indicate the quarters in which you paid eligible wages and are claiming the credit. - Boxes 9-13: Corrections to Form 941

Use these boxes to correct line items on the original Form 941. Specifically, make adjustments to the reported amounts for qualified wages, the applicable credit for each quarter, and any other necessary changes or corrections. Provide detailed explanations for each correction made. - Boxes 14-17: Explanation of Adjustments

Provide a detailed breakdown and explanation of the adjustments made in these boxes. Include the total amounts of qualified wages, the ERC claimed for each quarter, and any other relevant information supporting your claim. - Box 18: Signature and Date

Sign and date the form to certify the accuracy of the information provided. - Attach Supporting Documentation

Include all necessary supporting documentation that substantiates your claim for the ERC. This can include payroll records, financial statements, government orders, or any other relevant documents.

It’s essential to review the completed Form 941-X thoroughly and cross-reference it with the supporting documentation to ensure accuracy. Keep copies of the completed form, attachments, and proof of submission for your records.

Understanding the box-by-box instructions on Form 941-X will help you navigate the process accurately. However, it’s always a good idea to consult the official instructions provided by the Internal Revenue Service (IRS) for any updates or clarifications specific to your situation.

Now that you have a clear understanding of completing Form 941-X, let’s explore some common mistakes to avoid in the next section.

Common Mistakes to Avoid

Completing Form 941-X for the Employee Retention Credit (ERC) requires attention to detail to ensure accuracy and avoid common mistakes that could delay the processing of your claim. Here are some common mistakes to avoid when filling out Form 941-X:

- Incomplete or Missing Information: One common mistake is failing to provide all the required information on the form. Ensure that you fill out all relevant sections, boxes, and lines accurately and completely. Missing information could result in the form being returned or the claim being denied.

- Incorrect Calculation of Credits: It’s crucial to calculate the Employee Retention Credit accurately for each quarter. Double-check your calculations and use the correct formula or guidelines provided by the IRS to determine the credit amount eligible for each period.

- Failure to Include Supporting Documentation: Supporting documentation is essential to substantiate your claim for the ERC. Ensure that you attach all relevant documentation, such as payroll records, financial statements, government orders, or any other necessary proof. Failing to include supporting documentation may lead to delays or rejection of your claim.

- Not Following the Correct Version of Form 941-X: The IRS periodically updates Form 941-X. Make sure you use the most recent version of the form available on the official IRS website to avoid discrepancies or errors caused by outdated forms.

- Missing the Deadline: It is imperative to file Form 941-X within the appropriate timeframe. Be aware of the deadline for filing amended returns and submit your form by the due date to avoid penalties and interest charges.

- Insufficient Explanation of Adjustments: When explaining the adjustments made on Form 941-X, provide detailed and clear explanations for each correction. This will help the IRS understand the basis for your claim and reduce the likelihood of further scrutiny or delays in processing.

By being mindful of these common mistakes, you can ensure that your Form 941-X is completed accurately and increases the chances of a successful ERC claim. Remember to review your form carefully before submission and consult the official IRS instructions or seek professional assistance if needed.

In the next section, we will provide some helpful tips for filing Form 941-X for the Employee Retention Credit.

Tips for Filing Form 941-X

Filing Form 941-X for the Employee Retention Credit (ERC) requires attention to detail and accuracy. Here are some helpful tips to guide you through the filing process:

- Review the Instructions: Familiarize yourself with the official instructions provided by the Internal Revenue Service (IRS) for Form 941-X. This will ensure you have a clear understanding of the requirements, eligibility criteria, and specific guidance for completing the form accurately.

- Keep Updated Records: Maintain organized and up-to-date records of all relevant documentation, including payroll records, financial statements, government orders, and any other supporting documents. This will help you substantiate your claim and provide the necessary evidence if requested by the IRS.

- Double-Check Your Calculations: Take the time to review your calculations carefully. Ensure that you have accurately computed the Employee Retention Credit for each eligible quarter and that your total credit amount aligns with your records.

- Attach Supporting Documentation: Gather and attach all required supporting documentation that demonstrates your eligibility for the ERC. These documents will strengthen your claim and provide the necessary evidence to support your adjustments.

- Be Thorough with Explanations: When explaining the adjustments made on Form 941-X, provide detailed and comprehensive explanations for each correction. Clearly state the reasoning behind the adjustment and provide any relevant context or additional information that supports your claim.

- Submit Corrected Forms: If you are making corrections to multiple quarters, ensure that you submit separate copies of the corrected Form 941 for each applicable quarter. Each corrected Form 941 should correspond to the specific quarter being adjusted.

- Consult with a Tax Professional: If you find the process of completing Form 941-X complex or if you have unique circumstances, consider consulting with a tax professional who specializes in payroll taxes or the ERC. Their expertise can provide valuable guidance and ensure that you file the form correctly.

- Retain Copies and Proof of Submission: Keep copies of the completed Form 941-X, attachments, and any proof of submission or delivery to the IRS. This will help you maintain a record of your filing and serve as evidence if any issues arise in the future.

Following these tips will help you navigate the process of filing Form 941-X for the Employee Retention Credit more effectively. Remember to stay informed about any changes or updates to the regulations and guidelines provided by the IRS.

Now, let’s address some frequently asked questions about Form 941-X and the Employee Retention Credit.

Frequently Asked Questions

Here are answers to some frequently asked questions regarding Form 941-X and the Employee Retention Credit (ERC):

- Q: Who can claim the Employee Retention Credit?

A: Eligible employers who experienced a full or partial suspension of operations due to a government order or a significant decline in gross receipts compared to the same quarter in the previous year can claim the ERC. Self-employed individuals may also qualify under certain circumstances. - Q: Can I claim the ERC on previously filed Form 941?

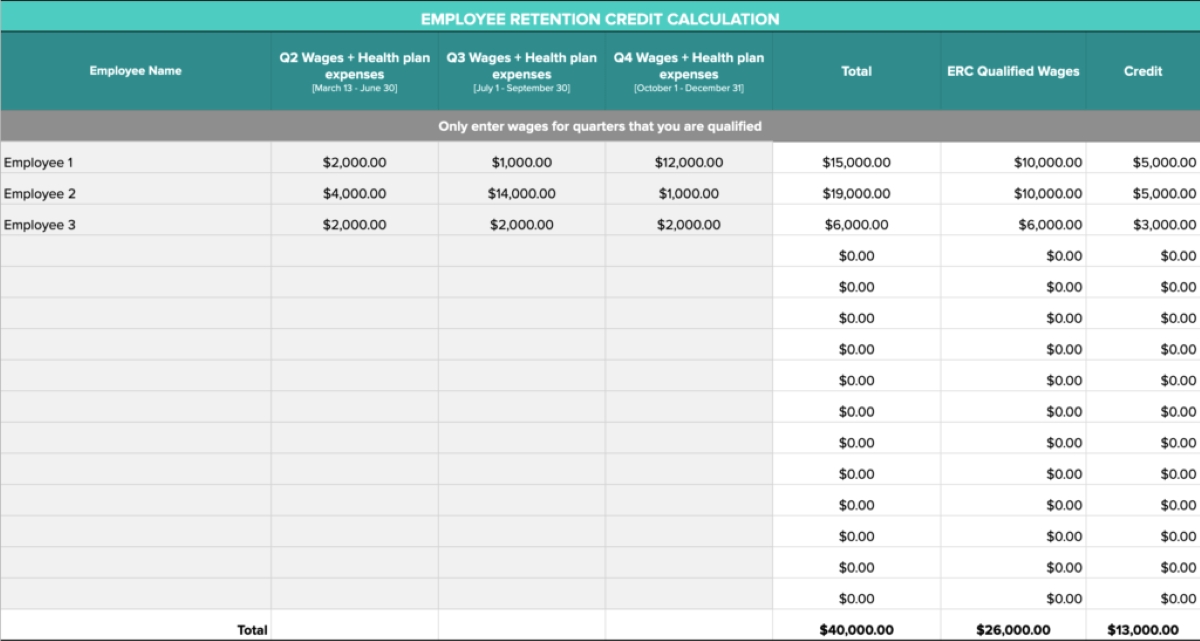

A: No, the ERC is claimed on Form 941-X. This form is used to correct errors or make adjustments to previously filed Form 941 to claim the credit for eligible wages retroactively. - Q: How do I determine the qualified wages for the ERC?

A: The calculation of qualified wages depends on the size of your business. For employers with an average of more than 100 full-time employees in 2019, qualified wages are those paid to employees who are not providing services due to a full or partial suspension of operations or a significant decline in gross receipts. For employers with an average of 100 or fewer full-time employees, qualified wages include all wages paid during the applicable quarters. - Q: Can I claim the ERC if I received a Paycheck Protection Program (PPP) loan?

A: Yes, you can claim the ERC even if you received a PPP loan. However, you cannot claim the credit on wages paid with PPP loan proceeds. The ERC can only be claimed on wages that were not paid with forgiven PPP loan funds. - Q: Can I file Form 941-X electronically?

A: As of now, Form 941-X cannot be filed electronically. It must be filed by mail to the appropriate IRS address based on your location. - Q: What is the deadline for filing Form 941-X?

A: Generally, Form 941-X should be filed within three years from the original filing date of Form 941. However, for the Employee Retention Credit, the credit cannot be claimed for wages paid after December 31, 2021.

These are just some of the common questions related to Form 941-X and the Employee Retention Credit. It’s important to consult the official guidance provided by the IRS and seek professional advice to address specific inquiries or unique circumstances.

Now, let’s conclude our comprehensive guide to completing Form 941-X for the Employee Retention Credit.

Conclusion

Completing Form 941-X for the Employee Retention Credit (ERC) may seem complex, but with the right knowledge and guidance, you can navigate the process successfully. By following the steps outlined in this comprehensive guide, you can ensure accuracy and maximize your eligibility for the ERC.

Remember to carefully review the instructions provided by the IRS, gather all necessary documentation, and calculate the credit accurately for each eligible quarter. Avoid common mistakes such as incomplete information, incorrect calculations, and missing supporting documentation.

Additionally, consider consulting with a tax professional if you have any uncertainties or unique circumstances related to the ERC and Form 941-X. Their expertise can provide valuable insights and ensure compliance with tax regulations.

As you complete Form 941-X, keep in mind the importance of retaining copies of the form, attachments, and proof of submission. These records will serve as evidence and help maintain accurate records of your filings.

Lastly, stay informed about any updates or changes to the regulations and guidelines provided by the IRS regarding the ERC and Form 941-X. The tax landscape is constantly evolving, and it’s crucial to stay up to date.

We hope this guide has provided you with a comprehensive understanding of how to complete Form 941-X for the Employee Retention Credit. By following the steps, tips, and instructions outlined, you can navigate the process with confidence and ensure accuracy in your filings.

Remember, if you have specific questions or concerns, it’s always advisable to consult the official resources provided by the IRS or seek advice from a tax professional.

Good luck with your Form 941-X filing, and may the Employee Retention Credit provide the financial relief and support your business needs during these challenging times.