Home>Finance>How Do I Calculate The Employee Retention Credit

Finance

How Do I Calculate The Employee Retention Credit

Modified: January 5, 2024

Learn how to calculate the Employee Retention Credit in finance and maximize your savings. Discover the eligibility criteria and claim this valuable tax benefit!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the Employee Retention Credit (ERC)

- Eligibility Criteria for the ERC

- Calculation of the Employee Retention Credit

- Qualified Wages for the ERC

- Maximum Employee Retention Credit Amount

- Interaction with Other COVID-19 Relief Programs

- Documentation and Recordkeeping Requirements for the ERC

- Claiming the Employee Retention Credit on Form 941

- Conclusion

Introduction

Welcome to the world of Finance where businesses strive to achieve growth and success. One essential aspect of running a successful business is attracting and retaining top talent. However, in the face of uncertain economic conditions, businesses often face challenges in retaining their employees. This is where the Employee Retention Credit (ERC) comes into play.

The Employee Retention Credit is a tax credit introduced as part of the COVID-19 relief measures aimed at helping businesses retain employees during the pandemic. It was initially established by the CARES Act in 2020 and has since been extended and modified by subsequent legislation.

The ERC provides eligible businesses with a valuable incentive to retain employees by offering them a refundable tax credit. This credit helps businesses offset the costs associated with keeping employees on their payroll, even in cases of reduced operations or loss of revenue.

In this article, we will explore the ins and outs of the Employee Retention Credit, how it is calculated, and what businesses need to know in order to claim this valuable benefit.

Please note that while this article aims to provide general guidance, it is important to consult with a tax professional or financial advisor for specific details regarding your business’s eligibility and the application of the ERC.

Understanding the Employee Retention Credit (ERC)

The Employee Retention Credit (ERC) is a tax credit designed to support businesses during challenging economic times, such as the COVID-19 pandemic. The goal of the ERC is to provide financial relief to businesses, helping them retain their employees and maintain their workforce. It is important to understand the key aspects of the ERC to take full advantage of this valuable credit.

The ERC is available to eligible employers who have experienced a significant decline in gross receipts or have been partially or fully suspended due to government orders. Eligible employers include businesses of all sizes, tax-exempt organizations, and certain governmental entities.

One of the key features of the ERC is that it is a refundable tax credit. This means that if the credit exceeds the employer’s total tax liability, the excess amount can be refunded to the employer. It provides direct financial assistance to businesses, allowing them to recoup a portion of the qualified wages paid to their employees.

It is important to note that employers who receive assistance through the Paycheck Protection Program (PPP) are not eligible for the ERC for the same wages used to qualify for PPP loan forgiveness. However, employers who did not receive PPP loans or who repaid their loans by the safe harbor deadline may still be eligible to claim the ERC.

The ERC is calculated based on qualified wages paid to eligible employees. Qualified wages are generally wages paid to employees who are not providing services due to a full or partial suspension of operations or a significant decline in gross receipts. The amount of qualified wages eligible for the ERC depends on the number of employees and the time period in which the credit is claimed.

To claim the ERC, employers must meet certain recordkeeping requirements and file Form 941, Employer’s Quarterly Federal Tax Return. It is essential to keep detailed records and documentation to support the eligibility and calculation of the credit. Failure to maintain adequate records may result in the denial of the credit or the need to repay the credits claimed.

Overall, the Employee Retention Credit serves as a vital lifeline for businesses, providing them with much-needed financial support to retain their employees in challenging times. By understanding the criteria and calculations involved, businesses can take advantage of this credit and minimize the impact of economic disruptions on their workforce.

Eligibility Criteria for the ERC

In order to qualify for the Employee Retention Credit (ERC), businesses must meet certain eligibility criteria. Understanding these criteria is crucial for determining if your business is eligible to claim the credit.

There are two main criteria that businesses must meet to be eligible for the ERC:

- Significant decline in gross receipts: Businesses must demonstrate a significant decline in gross receipts. This is typically determined by comparing the gross receipts of the current calendar quarter to the same quarter in the previous year. If the gross receipts for the current quarter have decreased by 50% or more compared to the prior year, the business is considered eligible for the ERC.

- Partial or full suspension of operations: Alternatively, businesses may be eligible for the ERC if they have been partially or fully suspended due to government orders. This means that the government has issued an order that restricts or suspends the business’s operations either partially or entirely. It is important to keep documentation of the government orders to support eligibility for the credit.

It is important to note that businesses that receive forgiveness for Paycheck Protection Program (PPP) loans are not eligible to claim the ERC for the same wages used to qualify for PPP loan forgiveness. This restriction was put in place to prevent “double-dipping” of benefits intended to support businesses during the pandemic. However, businesses that did not receive PPP loans or who repaid their loans by the safe harbor deadline may still be eligible for the ERC.

Additionally, businesses must consider the size of their workforce when determining eligibility for the ERC. The size of the business determines the maximum amount of qualified wages that can be considered for the credit. For businesses with more than 500 employees, only wages paid to employees who are not providing services due to a full or partial suspension of operations or a significant decline in gross receipts qualify for the ERC.

Understanding these eligibility criteria is crucial for businesses to determine if they are qualified for the Employee Retention Credit. It is recommended to consult with a tax professional or financial advisor to confirm eligibility and ensure compliance with the specific requirements outlined by the Internal Revenue Service (IRS).

Calculation of the Employee Retention Credit

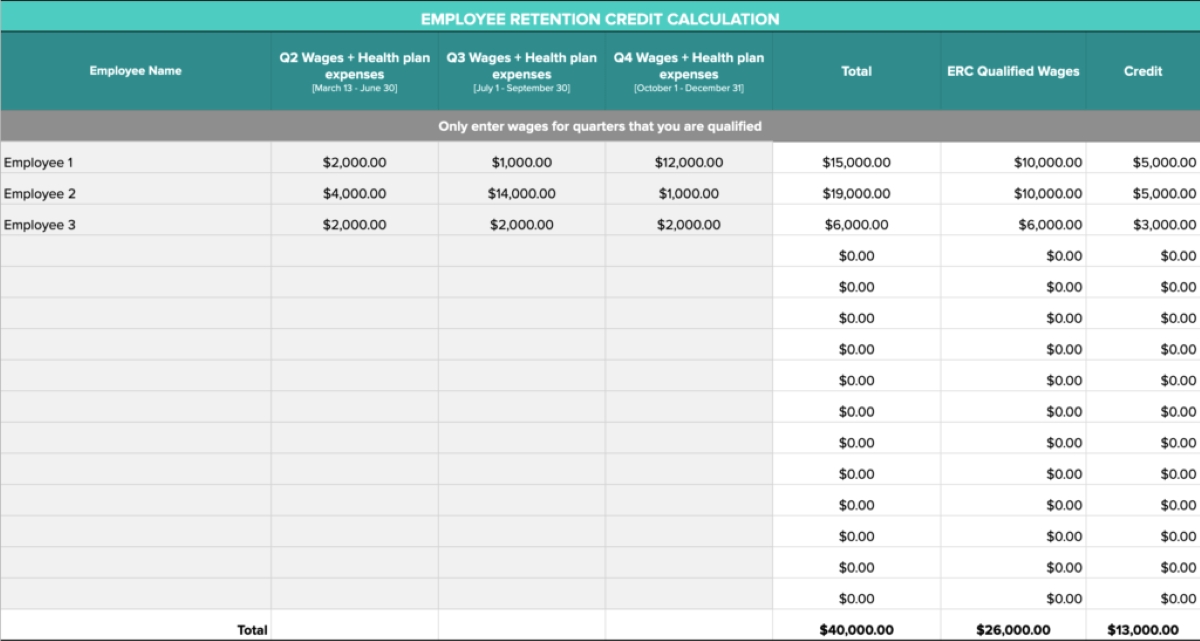

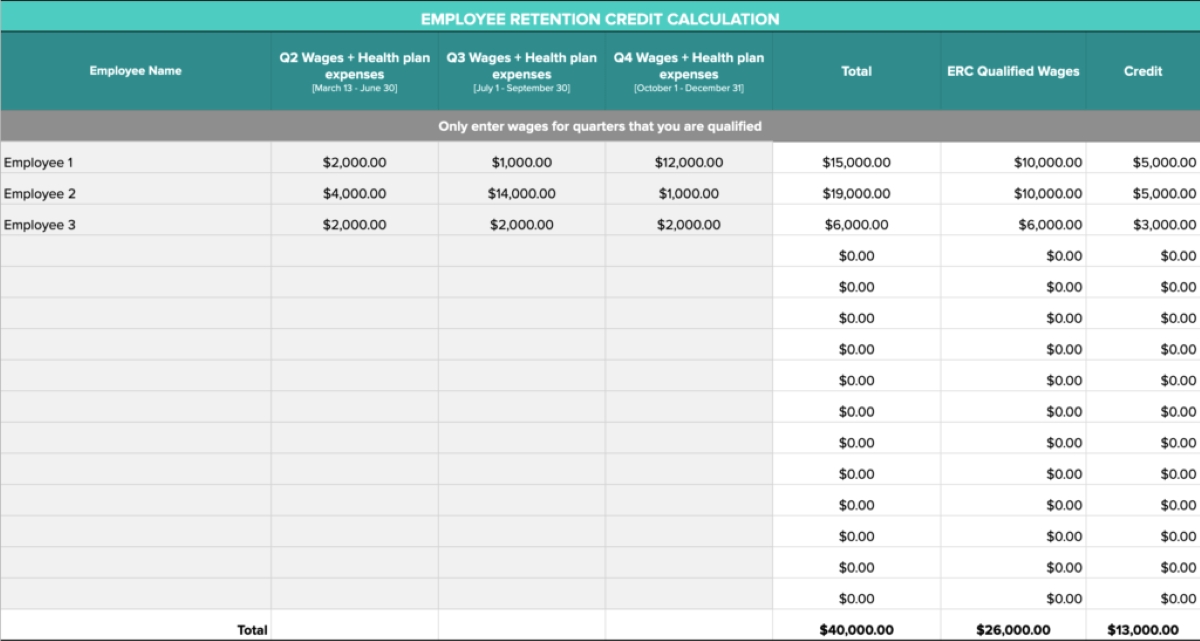

Calculating the amount of the Employee Retention Credit (ERC) can be complex, as it involves various factors such as qualified wages and the size of the business. Understanding the calculation method is important for businesses to accurately determine the credit they are eligible to claim.

The ERC is calculated based on the qualified wages paid to eligible employees during the eligible period. The amount of the credit is equal to a percentage of the qualified wages, which can vary depending on the time period in which the credit is claimed.

For eligible businesses with an average of 500 or fewer full-time employees in 2019, the ERC is calculated as 70% of the qualified wages per employee, up to a maximum of $10,000 in qualified wages per employee per quarter. This means that the maximum credit per employee per quarter is $7,000.

For eligible businesses with more than 500 employees in 2019, the ERC is calculated as 50% of the qualified wages per employee, up to a maximum of $10,000 in qualified wages per employee per quarter. This means that the maximum credit per employee per quarter is $5,000.

It is important to note that the qualified wages eligible for the ERC may vary depending on factors such as the size of the business and whether the business was fully or partially suspended or experienced a significant decline in gross receipts.

For businesses that were fully or partially suspended due to government orders, all wages paid to employees during the suspension period are considered qualified wages for the ERC. This includes not only wages paid to employees who are not providing services but also wages paid to employees who are able to work remotely or perform services necessary to maintain the business’s operations.

For businesses that experienced a significant decline in gross receipts, qualified wages are only those paid to employees who are not providing services during the period of decline. The specific calculation method for determining the decline in gross receipts can be complex, and it is recommended to consult with a tax professional or financial advisor for guidance.

Keep in mind that the calculation of the ERC can be complex, and there may be additional considerations and limitations based on individual circumstances. It is important for businesses to consult with a tax professional or financial advisor to ensure accurate calculation and claim of the Employee Retention Credit.

Qualified Wages for the ERC

When calculating the Employee Retention Credit (ERC), it is crucial to understand what qualified wages are eligible for the credit. Qualified wages are the wages paid to eligible employees during the designated periods that meet the requirements set forth by the Internal Revenue Service (IRS).

For businesses that were fully or partially suspended due to government orders, all wages paid to employees during the suspension period are considered qualified wages for the ERC. This includes not only wages paid to employees who are not providing services but also wages paid to employees who are able to work remotely or perform services necessary to maintain the business’s operations.

If a business did not experience a full or partial suspension but had a significant decline in gross receipts, qualified wages are limited to those paid to employees who are not providing services during the period of decline. The decline in gross receipts is typically determined by comparing the gross receipts of the current quarter to the same quarter in the previous year. If the gross receipts have decreased by 50% or more, the business may qualify for the ERC.

It is important to note that qualified wages are subject to certain limitations and caps. The maximum amount of qualified wages that can be taken into account per employee per quarter is $10,000. This means that even if an employee’s wages exceed $10,000 in a quarter, only $10,000 will be considered for the ERC calculation.

Furthermore, the size of the business plays a role in determining which wages qualify for the credit. For businesses with an average of 500 or fewer full-time employees in 2019, all wages paid to eligible employees during the eligible periods are considered qualified wages. However, for businesses with more than 500 employees, only wages paid to employees who are not providing services due to a full or partial suspension or a significant decline in gross receipts qualify for the ERC.

It is essential to keep accurate records and documentation of the qualified wages paid to employees. Employers should maintain detailed payroll records, including information about the number of hours worked, rates of pay, and any qualified health plan expenses allocated to those wages.

Calculating qualified wages for the ERC requires careful consideration of the specific circumstances of each business. It is strongly recommended to consult with a tax professional or financial advisor to ensure compliance with the IRS guidelines and maximize the amount of qualified wages that can be claimed for the Employee Retention Credit.

Maximum Employee Retention Credit Amount

When claiming the Employee Retention Credit (ERC), businesses should be aware of the maximum credit amount that they can potentially receive. The ERC provides eligible businesses with a valuable tax credit that can help offset the costs of retaining their employees during challenging economic times.

The maximum amount of the ERC varies depending on the size of the business and the eligible time periods. For eligible businesses with an average of 500 or fewer full-time employees in 2019, the credit is calculated as 70% of the qualified wages per employee, up to a maximum of $10,000 in qualified wages per employee per quarter. This means that the maximum credit per employee per quarter is $7,000.

For eligible businesses with more than 500 employees in 2019, the credit is calculated as 50% of the qualified wages per employee, up to a maximum of $10,000 in qualified wages per employee per quarter. This means that the maximum credit per employee per quarter is $5,000.

It’s important to note that the maximum credit is based on per employee per quarter. If an employee’s qualified wages for a quarter exceed $10,000, only $10,000 can be considered for the calculation of the ERC. Additionally, the maximum credit cannot exceed the total payroll taxes owed by the business for the applicable quarter.

For example, if a qualifying business with fewer than 500 employees paid an eligible employee $8,000 in qualified wages for a quarter, the ERC for that employee would be $5,600 (70% of $8,000). However, if the business paid that employee $12,000 in qualified wages for the same quarter, the ERC would still be limited to $7,000, the maximum allowable amount.

It is important for businesses to keep accurate records of the qualified wages paid to employees in order to determine the maximum credit amount they are eligible to claim. Detailed documentation of the wages paid, including hours worked, rates of pay, and any qualified health plan expenses allocated to those wages, will assist in accurately calculating the maximum ERC.

Understanding the maximum Employee Retention Credit amount can help businesses make informed decisions about their workforce and the financial benefits they can expect to receive. However, it’s always advisable to consult with a tax professional or financial advisor to ensure compliance with IRS guidelines and to maximize the credit eligible for their specific business circumstances.

Interaction with Other COVID-19 Relief Programs

When considering the Employee Retention Credit (ERC), it is important to understand how it interacts with other COVID-19 relief programs that businesses may have participated in. Businesses should be aware of the potential impacts and limitations when claiming the ERC alongside other relief programs.

One such relief program is the Paycheck Protection Program (PPP), which provides forgivable loans to help businesses keep their employees on payroll. If a business received a PPP loan, they are generally not eligible to claim the ERC for the same wages used to qualify for PPP loan forgiveness. This is to prevent businesses from “double-dipping” and receiving simultaneous benefits from both programs.

However, the Consolidated Appropriations Act, 2021, introduced changes that allow businesses that received PPP loans to also claim the ERC for wages that were not used to support loan forgiveness. This change opens up the possibility for businesses to take advantage of both programs in certain circumstances.

Under the new law, businesses that received PPP loans can now claim the ERC for qualified wages that were not considered in the forgiveness calculation. This means that if a business used PPP funds to cover payroll costs, they can potentially claim the ERC for other wages, such as healthcare costs or retirement plan contributions.

It is important to note that the same wages cannot be used for both the PPP loan forgiveness and the ERC credit calculation. Only wages that were not used to support loan forgiveness can be considered for the ERC. Businesses must carefully review their payroll records and consult with a tax professional to accurately determine which wages are eligible for each program.

In addition to the PPP, businesses should also consider the interaction of the ERC with other relief programs such as the Families First Coronavirus Response Act (FFCRA), which provides paid leave for employees affected by COVID-19. It is important to understand that if a business received tax credits for paid leave under the FFCRA, those wages cannot be used to claim the ERC.

Overall, businesses should be aware of how the Employee Retention Credit interacts with other COVID-19 relief programs they have participated in. Careful consideration and recordkeeping are essential to ensure compliance and maximize the benefits available to businesses during these challenging times. Consulting with a tax professional or financial advisor will provide valuable guidance on navigating the complexities of these programs and optimizing their utilization.

Documentation and Recordkeeping Requirements for the ERC

When claiming the Employee Retention Credit (ERC), businesses must meet certain documentation and recordkeeping requirements. It is important to maintain detailed and accurate records to substantiate eligibility and support the calculations for the credit.

Here are some key documentation and recordkeeping requirements for the ERC:

- Employee Information: Businesses should maintain records that clearly identify which employees are eligible for the ERC. This includes documentation such as employee names, social security numbers, dates of employment, and the number of hours worked during the eligible periods.

- Qualified Wage Calculation: Businesses must keep records of how they determined the qualified wages for the ERC. This includes supporting documents such as payroll reports, financial statements, and other relevant documentation that show the wages paid to eligible employees.

- Gross Receipts Documentation: If a business is claiming the ERC based on a significant decline in gross receipts, they must maintain records that demonstrate the decline. This may include financial statements, sales records, and other relevant documentation that substantiates the decrease in revenues.

- Documentation of Government Orders: For businesses that were fully or partially suspended due to government orders, it is important to keep copies of the official government orders or any other documentation that supports the suspension of operations.

- Allocation of Qualified Health Plan Expenses: If a business includes qualified health plan expenses in the calculation of qualified wages for the ERC, they must keep records that clearly identify and support the allocation of these expenses to eligible employees.

- Other Supporting Documents: Businesses should maintain any additional supporting documents that are relevant to the ERC claim. This could include documents used to determine the average number of full-time employees, records of PPP loan forgiveness, or any other necessary documentation requested by the IRS.

It is important to note that the IRS may request these documents and records to verify the eligibility and accuracy of the claimed ERC. Therefore, businesses must keep these records for a minimum of four years from the later of the due date of the tax return or the date the tax was paid.

It is highly recommended that businesses consult with a tax professional or financial advisor to ensure compliance with the specific recordkeeping requirements and to receive guidance on maintaining the necessary documentation. Accurate and organized records will not only substantiate the ERC claim but also provide peace of mind in the event of an IRS audit or inquiry.

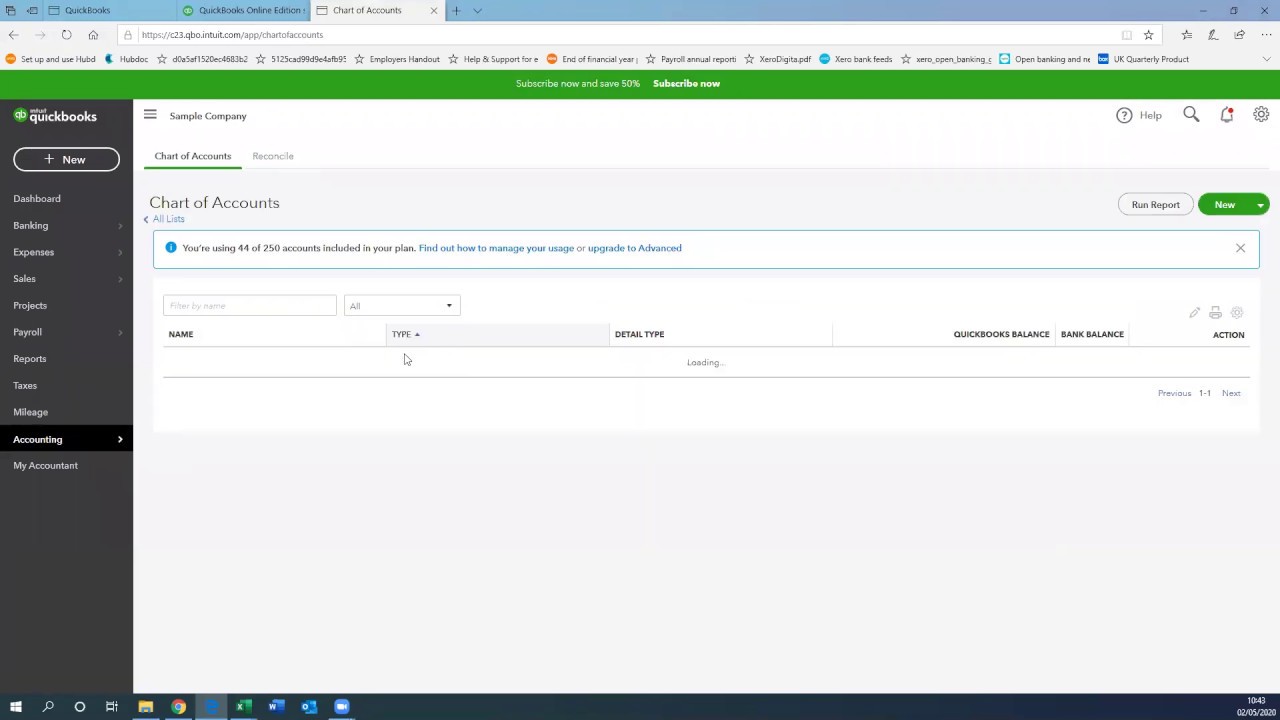

Claiming the Employee Retention Credit on Form 941

Businesses that are eligible for the Employee Retention Credit (ERC) can claim the credit on their quarterly federal tax return, Form 941. Form 941 is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employees’ wages, as well as the employer’s portion of Social Security and Medicare taxes.

Here are the key steps to follow when claiming the ERC on Form 941:

- Calculate the ERC: Before completing Form 941, businesses must calculate the amount of the ERC they are eligible to claim. This involves determining the qualified wages and applicable time periods.

- Fill out Form 941: On Form 941, businesses will need to complete various sections related to the reporting of wages, taxes withheld, and tax liability. Specific lines on Form 941 are designated for claiming the ERC, such as Line 11c and Line 13d. These lines are used to report the total qualified wages and the amount of the ERC claimed, respectively.

- Keep accurate records: It is crucial to maintain accurate records and documentation to support the ERC claim made on Form 941. This includes keeping documentation of qualified wages, proof of eligibility, and any other supporting documentation requested by the IRS.

- File Form 941: Form 941 must be filed with the IRS by the designated due dates, which are typically the last day of the month following the end of the calendar quarter. Businesses can file Form 941 electronically or by mail, depending on their preference and circumstances.

- Claiming the credit: The amount of the ERC claimed on Form 941 will be reported as a credit against the employer’s portion of Social Security tax and Medicare tax. If the credit claimed exceeds the total tax liability for the quarter, the excess amount can be carried forward or refunded, depending on the business’s circumstances.

It is important to note that businesses should consult with a tax professional or financial advisor for guidance on how to accurately complete Form 941 and claim the ERC. These professionals can provide valuable assistance in understanding the specific reporting requirements and ensuring compliance with the IRS guidelines.

By properly completing Form 941 and accurately claiming the ERC, businesses can maximize their eligibility for the credit and receive the financial relief they are entitled to during challenging economic times.

Conclusion

The Employee Retention Credit (ERC) has proven to be a vital lifeline for businesses during challenging economic times, such as the COVID-19 pandemic. Understanding the ins and outs of this valuable tax credit is essential for businesses to effectively navigate the complexities of claiming and maximizing its benefits.

In this article, we have explored various aspects of the ERC, including its eligibility criteria, calculation methods, documentation and recordkeeping requirements, and its interaction with other COVID-19 relief programs. By meeting the eligibility criteria, accurately calculating the qualified wages, and maintaining meticulous records, businesses can confidently claim the ERC and potentially reduce their financial strain while retaining their employees.

It is important to note that the ERC rules and regulations are subject to change, as they have been modified and extended by subsequent legislation. Therefore, staying updated with the latest guidance from the Internal Revenue Service (IRS) and consulting with a tax professional or financial advisor is highly recommended to ensure compliance and take advantage of any updates or changes to the program.

The ERC serves as an invaluable tool for businesses seeking to weather uncertain economic conditions and retain their workforce. By understanding the eligibility criteria, effectively calculating the credit, and meeting the necessary documentation requirements, businesses can confidently access the financial support provided by the ERC.

Remember, while this article provides general guidance, each business’s eligibility and circumstances may vary. Therefore, it is crucial to consult with a tax professional or financial advisor who can provide personalized advice based on your specific situation.

As businesses continue to adapt and recover from the economic impacts of the pandemic, the Employee Retention Credit remains a valuable resource that can help them overcome challenges and position themselves for future success.