Finance

Where Is My Employee Retention Credit Refund

Modified: February 21, 2024

"Find out the details and process of claiming your employee retention credit refund in the finance department with our comprehensive guide."

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the Employee Retention Credit

- Eligibility for the Employee Retention Credit Refund

- Calculating the Employee Retention Credit Amount

- Claiming the Employee Retention Credit Refund

- Common Challenges and Delays in Receiving the Employee Retention Credit Refund

- Seeking Assistance for Finding Your Employee Retention Credit Refund

- Conclusion

Introduction

Welcome to the world of employee retention credits! If you’re a business owner or employer, you may be eligible for a refund in the form of an employee retention credit. This credit is intended to incentivize companies to retain employees during times of economic uncertainty, such as the recent global pandemic.

The employee retention credit is a tax benefit offered by the Internal Revenue Service (IRS) to businesses that experience significant disruptions due to events like COVID-19. This credit aims to provide financial relief to businesses and encourage them to continue paying their employees even when faced with economic challenges.

To ensure that you are fully informed and prepared, this article will guide you through the process of understanding, calculating, and claiming your employee retention credit refund. By the end, you’ll have a clear understanding of how to navigate the complexities of this credit and receive the refund that your business may be entitled to.

Before we dive into the details, it’s important to note that while this article aims to provide valuable insights, consulting with a tax professional is always recommended to address your specific circumstances. They can offer personalized advice tailored to your business.

Now, let’s embark on this journey to discover where your employee retention credit refund might be hiding!

Understanding the Employee Retention Credit

Before we delve into the process of finding your employee retention credit refund, let’s ensure we have a solid understanding of what the employee retention credit actually is.

The employee retention credit was introduced as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act in response to the economic challenges posed by the COVID-19 pandemic. The credit is designed to provide financial relief to businesses that were affected by the pandemic and encourage them to retain their employees.

Essentially, if your business experienced a significant decline in gross receipts or was subject to a full or partial suspension of operations due to a government order, you may be eligible for the employee retention credit. This credit is equal to a percentage of qualified wages paid to eligible employees during a specific period.

Qualified wages include the wages, plus certain qualified health plan expenses, paid to eligible employees. It’s important to note that there are certain limitations and eligibility criteria that need to be met to qualify for the credit.

The employee retention credit can provide substantial financial benefits for eligible businesses. It can be used to offset employment tax liabilities, including federal income tax withholding, and the employer’s share of Social Security and Medicare taxes. Any excess credit can be refunded to the business.

Now that we have a grasp of the basics of the employee retention credit, let’s move on to understanding who is eligible for this credit and how it is calculated.

Eligibility for the Employee Retention Credit Refund

Now that we understand the concept of the employee retention credit, let’s explore the eligibility requirements for businesses to claim the credit refund.

To be eligible for the employee retention credit refund, a business must meet the following criteria:

- The business must have experienced a decline in gross receipts during the eligibility period. This decline is determined by comparing the gross receipts of a quarter in 2021 to the same quarter in 2019. If the decline is 20% or more, the business may be eligible for the credit.

- Alternatively, if the business was fully or partially suspended due to a government order during any calendar quarter in 2021, they may also qualify for the credit.

- The business must have had an average of 500 or fewer full-time employees in 2019. For the purpose of this calculation, full-time employees are considered those who worked an average of at least 30 hours per week or 130 hours per month.

It’s worth noting that there are some exceptions and additional considerations based on the size of the business. For businesses with more than 500 employees, the criteria for calculating qualified wages and determining eligibility may differ.

Furthermore, certain industries that were hit hardest by the pandemic, such as restaurants and hospitality, may have different eligibility requirements and calculations for the employee retention credit.

It’s important to carefully review the specific guidelines and consult with a tax professional to ensure that your business meets all the necessary eligibility criteria.

Once you’ve determined that your business is eligible, the next step is to calculate the amount of the employee retention credit that you can claim. We will explore this calculation in the next section.

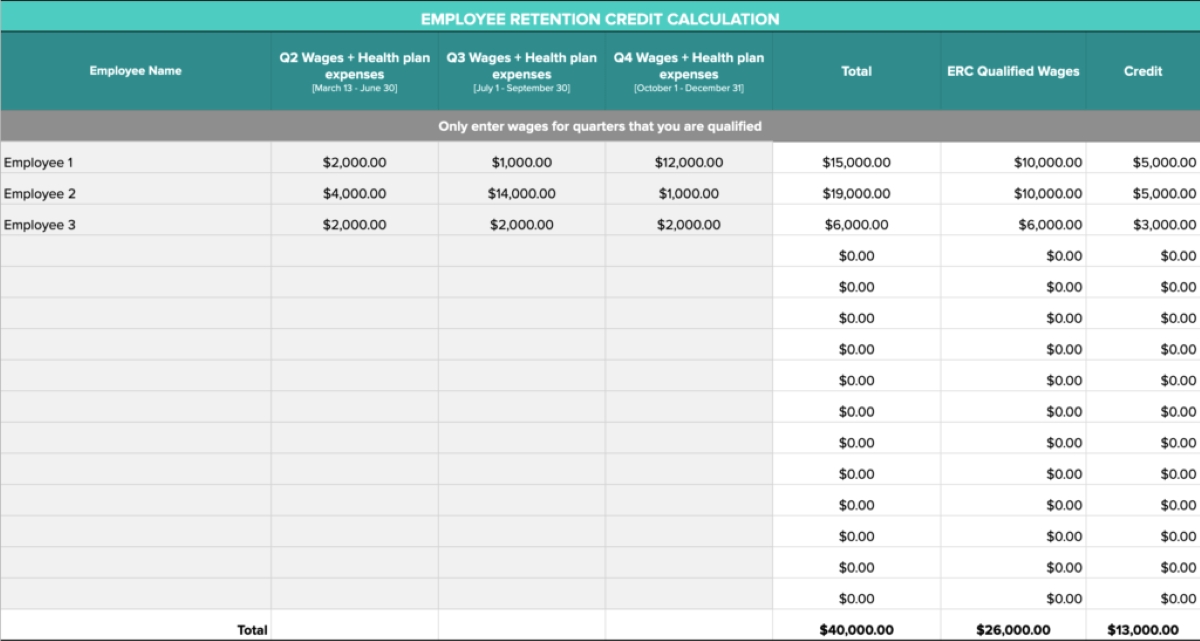

Calculating the Employee Retention Credit Amount

Now that we have established the eligibility criteria, let’s dive into the process of calculating the amount of the employee retention credit that your business may be entitled to.

The employee retention credit is calculated based on the qualified wages paid to eligible employees during the eligible period. Qualified wages include both the wages paid to employees and certain health plan expenses.

The calculation of the employee retention credit amount differs based on the size of the business:

- For businesses with 500 or fewer full-time employees – Qualified wages include all wages paid to eligible employees during the eligible period, regardless of whether the employee is providing services or not. The credit amount is equal to 70% of the qualified wages, up to a maximum of $10,000 per employee per quarter. In total, the maximum credit per employee for all eligible quarters is $28,000.

- For businesses with more than 500 full-time employees – Qualified wages are calculated differently for large businesses. The credit is only applicable to wages paid to employees who are not providing services due to either a full or partial suspension of operations or a significant decline in gross receipts. The credit amount is equal to 70% of the qualified wages, up to a maximum of $10,000 per employee per quarter.

It’s important to note that qualified health plan expenses, such as employer contributions to employee health insurance, are included in the calculation of qualified wages for both small and large businesses.

Once you have determined the qualified wages for eligible employees, you can calculate the employee retention credit amount by multiplying the qualified wages by the applicable credit percentage (70%). Make sure to apply any limitations or maximums as outlined in the guidelines.

Having an accurate understanding of how to calculate the employee retention credit amount will help you accurately assess the refund that your business may be eligible for. In the next section, we will explore the process of claiming the employee retention credit refund.

Claiming the Employee Retention Credit Refund

Now that you have determined your eligibility and calculated the amount of the employee retention credit, it’s time to explore the process of claiming the credit refund.

To claim the employee retention credit, you will need to complete and submit the appropriate forms to the IRS. The specific forms you need to file depend on your business structure:

- For employers, including tax-exempt organizations:

- Form 941, Employer’s Quarterly Federal Tax Return

- Form 8974, Qualified Small Business Payroll Tax Credit for Increasing Research Activities

- For eligible small businesses that have opted to use the Form 7200, Advance Payment of Employer Credits Due to COVID-19, you can receive an advance payment of the credit by submitting this form to the IRS.

It’s crucial to ensure that these forms are accurately completed and timely filed to avoid any delays or potential issues with your claim. Be sure to consult the instructions provided with each form and consider seeking professional assistance to ensure compliance with all requirements.

When completing these forms, you will need to provide details about your business, including your employer identification number (EIN), the number of eligible employees, and the amount of qualified wages paid during the eligible period. Additionally, you may need to provide supporting documentation to substantiate your claim.

Once the completed forms are submitted, the IRS will review and process your claim. If the credit amount exceeds your tax liabilities, you can receive a refund for the excess credit. Alternatively, you can choose to apply the credit against future tax liabilities.

It’s important to note that claiming the employee retention credit refund can be a complex process, and errors or omissions in the documentation can lead to delays or even potential penalties. Consider consulting with a tax professional who can guide you through the process and help ensure that your claim is accurate and compliant.

Next, we will discuss some common challenges and potential delays you may encounter while seeking your employee retention credit refund.

Common Challenges and Delays in Receiving the Employee Retention Credit Refund

While claiming the employee retention credit refund can provide much-needed financial relief for your business, it’s important to be aware of the common challenges and potential delays that you may encounter during the process.

1. Documentation requirements: One of the primary challenges businesses face is gathering and organizing the necessary documentation to support their claim. This includes records of eligible wages paid, proof of eligible employees, and any other relevant supporting documents. Failure to provide accurate and complete documentation can result in delays or rejection of your claim.

2. Calculation errors: The calculation of the employee retention credit can be complex, especially if your business has specific circumstances or falls under certain exceptions. Errors in calculating the credit amount can lead to delays or inaccurate claims. It’s crucial to double-check your calculations and consider seeking professional assistance if needed.

3. Timeliness of filing: Filing your forms accurately and timely is crucial to avoid delays in receiving your employee retention credit refund. Late filings can result in penalties and potentially missed opportunities to claim the credit.

4. IRS review and processing time: The IRS reviews each claim for the employee retention credit refund to ensure accuracy and compliance with the guidelines. The processing time can vary depending on several factors, including the volume of claims and the complexity of the case. It’s important to be patient and allow sufficient time for the IRS to process your claim.

5. A high volume of claims: Given the widespread impact of the COVID-19 pandemic, there has been a significant influx of businesses claiming the employee retention credit. This high volume of claims can lead to delays in processing times and increased scrutiny by the IRS. It’s important to be prepared for potential delays and to keep track of your claim’s progress.

To navigate these challenges and minimize delays, it’s recommended to seek professional assistance from a qualified tax advisor or accountant. They can help ensure that your documentation is in order, your calculations are accurate, and your claim is filed correctly and timely.

By being proactive in addressing these common challenges and potential delays, you can increase your chances of receiving your employee retention credit refund in a timely manner.

Now, let’s discuss the available resources and assistance you can seek to find your employee retention credit refund.

Seeking Assistance for Finding Your Employee Retention Credit Refund

Navigating the complexities of the employee retention credit refund process can be overwhelming, especially if you’re unfamiliar with tax regulations and procedures. Fortunately, there are various resources and assistance options available to help you find your employee retention credit refund.

1. Tax professionals: Consulting with a tax professional, such as a certified public accountant (CPA) or tax advisor, can provide invaluable guidance and expertise. They can help you understand the eligibility requirements, calculate the credit amount, complete the necessary forms accurately, and ensure compliance with all tax obligations. Tax professionals can also keep you updated on any changes or updates to the employee retention credit guidelines.

2. IRS guidance and resources: The Internal Revenue Service (IRS) provides comprehensive information and resources on their website related to the employee retention credit. You can access publications, forms, FAQs, and other relevant materials to assist you in understanding the requirements and claiming process. The IRS also offers helpline services and can provide answers to specific questions related to your business’s eligibility or claim.

3. Industry-specific organizations: Depending on the nature of your business, there may be industry-specific organizations or associations that can provide guidance and assistance regarding the employee retention credit. They may have resources, webinars, or forums where you can connect with other business owners and experts who have successfully navigated the credit refund process.

4. Networking and peer support: Engaging with other business owners who have claimed the employee retention credit can be a valuable source of information and support. Online communities, forums, and professional networks provide opportunities to share experiences, exchange tips, and learn from others who have gone through the process. These interactions can help you gain insights and potentially identify best practices to maximize your chances of receiving the credit refund.

Remember, seeking assistance and guidance from professionals and utilizing available resources can greatly enhance your understanding of the employee retention credit and improve your chances of successfully claiming your refund. They can help ensure that you navigate the process efficiently, minimize errors, and maximize your eligible credit amount.

Now, let’s wrap up our discussion.

Conclusion

Claiming your employee retention credit refund can provide much-needed financial relief for your business, especially during challenging times such as the COVID-19 pandemic. Understanding the eligibility requirements, calculating the credit amount, and navigating the claim process are essential steps to ensure you receive the refund you are entitled to.

In this article, we have explored the fundamentals of the employee retention credit, including its purpose and benefits. We have discussed the eligibility criteria and the calculation of the credit amount, emphasizing the importance of accurate documentation and timely filing. We have also highlighted common challenges and potential delays that businesses may face when seeking the credit refund.

Furthermore, we have emphasized the importance of seeking assistance and utilizing available resources to navigate the process effectively. Consulting with tax professionals, leveraging IRS guidance, connecting with industry-specific organizations, and engaging in peer support can greatly enhance your understanding and improve your chances of successfully claiming the employee retention credit refund.

It’s crucial to remain patient and allow sufficient time for the IRS to review and process your claim, considering the high volume of credit applications they are handling. By staying informed, seeking guidance, and following the proper procedures, you can increase your likelihood of receiving your employee retention credit refund in a timely manner.

Remember, every business’s situation is unique, so it’s recommended to consult with a tax professional who can provide personalized advice tailored to your specific circumstances.

Finally, we hope this article has shed light on the process of finding your employee retention credit refund. By taking the necessary steps and seeking assistance where needed, you can harness the benefits of this credit and secure financial relief for your business, helping you navigate these uncertain times with greater stability.