Finance

How To Find Your IRS Pin In TurboTax

Published: October 31, 2023

Learn how to find your IRS pin in TurboTax and ensure the security of your finances. Follow our step-by-step guide and protect your financial information today.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is an IRS PIN?

- Why do you need an IRS PIN?

- How to Sign Up for an IRS PIN in TurboTax

- Step 1: Create or log in to your TurboTax account

- Step 2: Navigate to the “Federal Taxes” section

- Step 3: Find the “Review” section and select “Tax Tools”

- Step 4: Select “Get an IP PIN”

- Step 5: Verify your identity

- Step 6: Retrieve your IRS PIN

- Tips for Creating a Strong IRS PIN

- Frequently Asked Questions (FAQs)

- Conclusion

Introduction

Welcome to TurboTax, where we strive to make your tax-filing experience quick, easy, and secure. When it comes to taxes, one of the most important things to consider is your IRS PIN. But what exactly is an IRS PIN and why do you need it?

An IRS PIN, or Individual Identification Number, is a unique six-digit code assigned to eligible taxpayers by the Internal Revenue Service (IRS). It serves as an added layer of security to protect your sensitive tax information and prevent identity theft. Without an IRS PIN, individuals attempting to file your taxes using your Social Security Number may face additional scrutiny and delays from the IRS.

In this article, we will guide you through the process of finding your IRS PIN using TurboTax. TurboTax is a trusted and widely used tax preparation software that offers a user-friendly interface and comprehensive tax-filing tools. By following our step-by-step instructions, you’ll be able to easily retrieve your IRS PIN and ensure a smooth tax-filing process.

So, if you’re ready to safeguard your tax information and avoid potential complications, let’s dive into the world of IRS PINs and discover how TurboTax can help!

What is an IRS PIN?

An IRS PIN, short for Individual Identification Number, is a unique six-digit code assigned by the IRS to eligible taxpayers. The main purpose of an IRS PIN is to provide an added layer of security and protect your sensitive tax information. In essence, it serves as a digital signature when filing your tax return.

The IRS PIN helps verify your identity and ensures that only you, or someone with your authorized PIN, can access and file your tax return. It acts as a safeguard against identity theft and fraudulent tax filings. With identity theft becoming an increasingly prevalent issue, the IRS PIN offers an effective means of combating this threat.

When you receive your IRS PIN, it is important to keep it secure and confidential. Do not share it with anyone else, including tax preparers or friends. The IRS will never ask for your PIN through phone calls, emails, or text messages. Therefore, it is crucial to be cautious and protect your PIN from potential scams or phishing attempts.

It’s worth mentioning that not all taxpayers are required to obtain an IRS PIN. However, it is highly recommended, especially if you have experienced identity theft or are concerned about the security of your tax information.

Now that you have a better understanding of what an IRS PIN is and its significance, let’s explore why you need an IRS PIN in the first place.

Why do you need an IRS PIN?

Having an IRS PIN is crucial for several reasons. It not only ensures the security of your tax information but also helps prevent fraudulent activity and potential delays in processing your tax return. Here are a few key reasons why you need an IRS PIN:

1. Protection against identity theft: Identity theft is a serious concern, especially during tax season. Criminals may attempt to file a tax return using your social security number and claim your tax refund. However, with an IRS PIN, it becomes much more difficult for them to do so. It adds an extra layer of protection by requiring the correct PIN to authenticate your identity.

2. Faster tax return processing: When you file your tax return with an IRS PIN, the IRS can quickly verify your identity and process your return. This can help expedite your refund and reduce the chances of encountering delays or complications.

3. Preventing tax-related fraud: Fraudulent tax returns can create numerous problems for both the IRS and taxpayers. By using an IRS PIN, you significantly reduce the risk of someone fraudulently filing a tax return under your name. It provides an added level of security, making it harder for criminals to steal your personal and financial information.

4. Peace of mind: Knowing that your tax information is protected and that you have taken steps to minimize the risk of identity theft can provide peace of mind. It allows you to focus on other important aspects of tax preparation without worrying about potential security breaches or unauthorized access.

5. Compliance with IRS requirements: While not all taxpayers are required to obtain an IRS PIN, certain individuals may be required to do so. For example, if you have previously been a victim of identity theft or if the IRS has flagged your account for potential fraud, they may automatically assign you an IRS PIN. It is important to comply with any IRS requirements regarding the use of an IRS PIN to avoid any penalties or issues with your tax return.

Now that you understand the importance of having an IRS PIN, let’s explore how you can sign up for an IRS PIN in TurboTax!

How to Sign Up for an IRS PIN in TurboTax

TurboTax makes it easy for taxpayers to obtain their IRS PIN and enhance the security of their tax filing process. Follow these step-by-step instructions to sign up for an IRS PIN in TurboTax:

- Step 1: Create or log in to your TurboTax account: If you don’t already have a TurboTax account, you will need to create one. If you already have an account, simply log in using your credentials.

- Step 2: Navigate to the “Federal Taxes” section: Once you are logged in to your TurboTax account, navigate to the section labeled “Federal Taxes.” This is where you will find all the tools and options related to your federal tax return.

- Step 3: Find the “Review” section and select “Tax Tools”: Within the “Federal Taxes” section, locate the “Review” section. In this section, you will find various tax tools that can assist you in the tax filing process. Select the option labeled “Tax Tools.”

- Step 4: Select “Get an IP PIN”: After selecting “Tax Tools,” look for the option that says “Get an IP PIN.” IP PIN stands for Identity Protection PIN, which is essentially the same as an IRS PIN. Click on this option to proceed.

- Step 5: Verify your identity: TurboTax will prompt you to verify your identity using various methods. This may include providing personal information, answering security questions, or verifying financial details. Follow the on-screen instructions to complete the identity verification process.

- Step 6: Retrieve your IRS PIN: Once your identity is successfully verified, TurboTax will provide you with your IRS PIN. Make sure to write down or securely save this PIN as you will need it when filing your tax return.

Congratulations! You have successfully signed up for an IRS PIN in TurboTax. With your IRS PIN in hand, you can proceed with peace of mind, knowing that your tax information is protected against identity theft and fraudulent activities.

Next, let’s explore some tips for creating a strong IRS PIN to further enhance your security.

Step 1: Create or log in to your TurboTax account

The first step to signing up for an IRS PIN in TurboTax is to create an account or log in if you already have one. Here’s how to do it:

If you don’t have a TurboTax account:

- Visit the TurboTax website and click on the “Sign In” or “Create an Account” button.

- Follow the instructions to create your account. You will be asked to provide your email address, create a password, and provide other necessary information.

- Once your account is created, you can proceed to log in using your credentials.

If you already have a TurboTax account:

- Go to the TurboTax website and click on the “Sign In” button.

- Enter your email address and password in the designated fields.

- Click on “Sign In” to log in to your TurboTax account.

Having a TurboTax account is essential to access the features and tools needed to sign up for an IRS PIN. If you’re new to TurboTax, creating an account is a simple process that requires only a few minutes of your time. If you’re a returning user, logging in allows you to pick up where you left off and access your previous tax information.

Once you have created or logged in to your TurboTax account, you are ready to proceed to the next step of signing up for an IRS PIN. Let’s move on to Step 2: Navigating to the “Federal Taxes” section.

Step 2: Navigate to the “Federal Taxes” section

After logging in to your TurboTax account, it’s time to navigate to the “Federal Taxes” section. This is where you will find all the tools and options related to your federal tax return. Follow these simple steps:

- Once you are logged in to your TurboTax account, you will land on your TurboTax dashboard or homepage.

- Look for the section labeled “Federal Taxes” or “Federal.” The exact placement and labeling may vary depending on the TurboTax version you are using, but it is typically prominently displayed.

- Click on the “Federal Taxes” section to access all the options related to your federal tax return.

By selecting the “Federal Taxes” section, you open the gateway to all the necessary tools and features that TurboTax offers to assist you in completing your federal tax return. This section provides a comprehensive and user-friendly interface where you can enter your tax information, review your return, and explore various tax-related resources.

Once you have successfully navigated to the “Federal Taxes” section, you are ready to move on to the next step: Finding the “Review” section and selecting “Tax Tools.” Let’s proceed to Step 3!

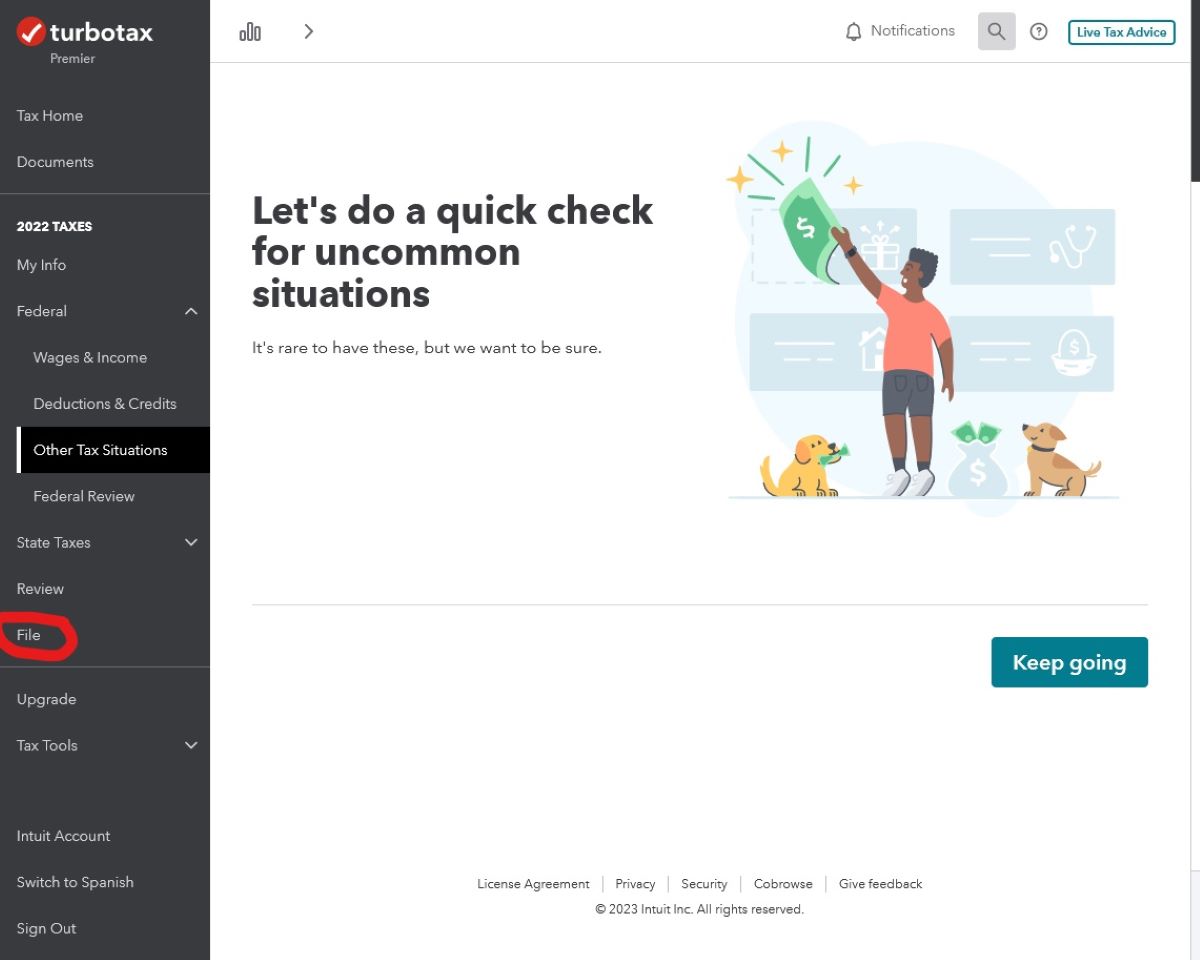

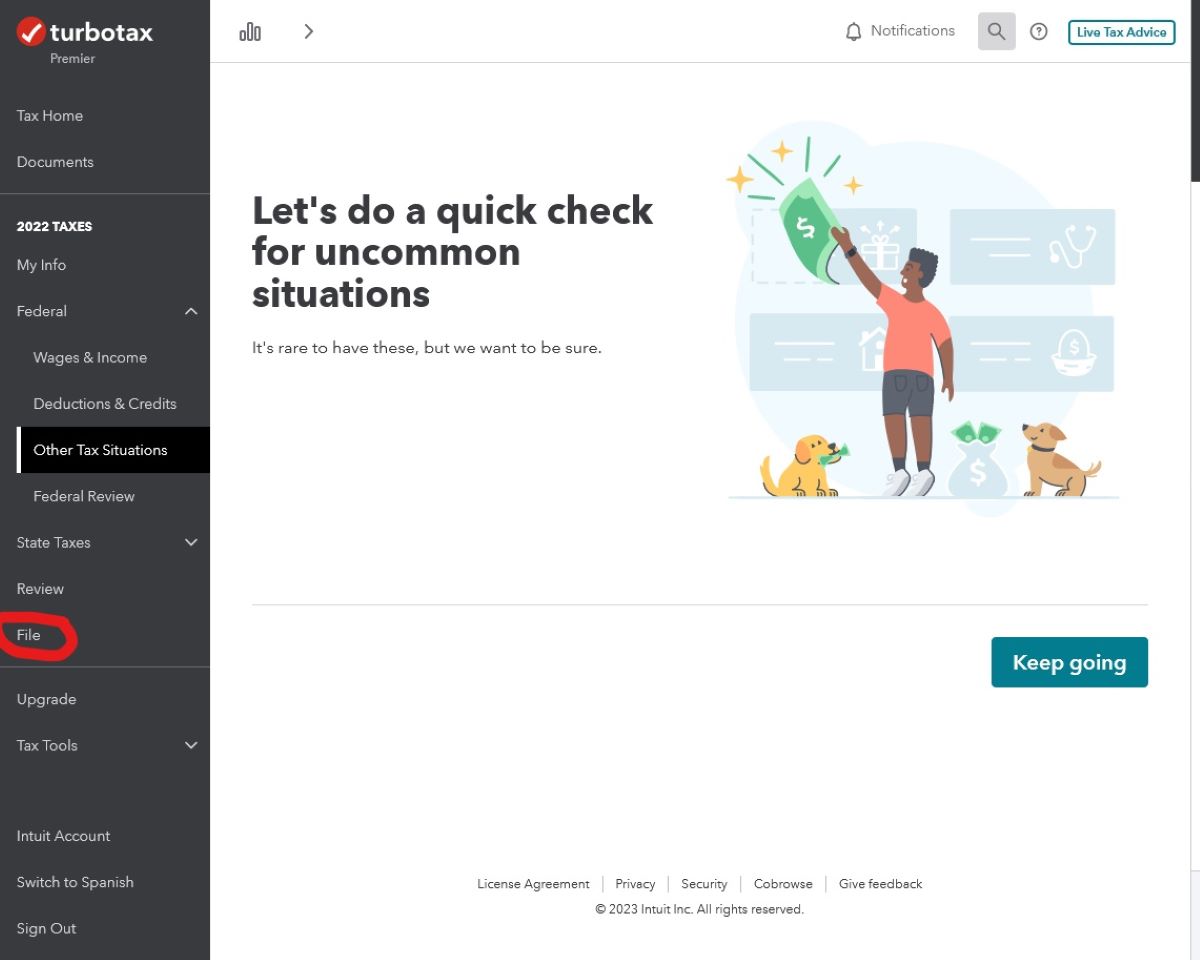

Step 3: Find the “Review” section and select “Tax Tools”

Now that you have accessed the “Federal Taxes” section in TurboTax, it’s time to find the “Review” section and select “Tax Tools.” This will allow you to access additional tools and features to assist you in the tax filing process. Follow these steps:

- Within the “Federal Taxes” section, look for the subsection labeled “Review.” This section is typically located towards the later stages of the tax preparation process.

- Click on the “Review” section to expand it and reveal additional options.

- Within the “Review” section, you will find various tools and features to assist you in reviewing your tax return for accuracy and completeness.

- Look for an option labeled “Tax Tools” or something similar. This option may be displayed as a separate link or as a dropdown menu.

- Click on “Tax Tools” to access a range of useful tools that can help streamline your tax preparation process.

By selecting “Tax Tools,” you gain access to a plethora of options that can enhance your tax filing experience. These tools include features like calculating estimated tax payments, checking the status of your refund, accessing tax calculators, and more. TurboTax provides a comprehensive set of tax tools to ensure that you have the resources you need to accurately complete your tax return.

Now that you have successfully found the “Review” section in TurboTax and selected “Tax Tools,” you’re ready to move on to the next step: Selecting “Get an IP PIN.” Let’s continue to Step 4!

Step 4: Select “Get an IP PIN”

Once you have accessed the “Tax Tools” section in TurboTax, it’s time to select “Get an IP PIN” to begin the process of obtaining your IRS PIN. Follow these steps:

- Within the “Tax Tools” section, scan the options available to you.

- Look for an option labeled “Get an IP PIN” or something similar. This option is specifically designed for obtaining your IRS PIN.

- Click on “Get an IP PIN” to start the process of retrieving your IRS PIN.

Selecting “Get an IP PIN” will initiate the necessary steps and procedures to verify your identity and securely retrieve your IRS PIN. It’s important to note that IP PIN stands for Identity Protection PIN, and it is essentially the same as an IRS PIN. TurboTax uses the term IP PIN to refer to this unique six-digit code that helps protect your tax information.

By clicking on “Get an IP PIN,” you are taking a proactive step towards enhancing the security of your tax return and preventing identity theft. The process will guide you through the necessary verification steps to ensure that the IRS PIN is associated with your account and only accessible by you.

Now that you have selected “Get an IP PIN,” you’re just one step away from retrieving your IRS PIN. Let’s move on to Step 5: Verifying your identity.

Step 5: Verify your identity

After selecting “Get an IP PIN” in TurboTax, the next step is to verify your identity. This is an important security measure to ensure that the IRS PIN is associated with the correct taxpayer. Follow these steps to complete the identity verification process:

- TurboTax will prompt you to provide certain personal information to verify your identity. This information may include your name, address, date of birth, and social security number.

- Double-check that the information you provide is accurate and up-to-date. Any inconsistencies may affect the verification process.

- In some cases, TurboTax may require you to answer additional security questions to further validate your identity. These questions may be based on your personal history or financial information that only you would know.

- Follow the on-screen prompts and provide the information requested. Ensure that you answer all questions truthfully and to the best of your knowledge.

- Once you have successfully completed the identity verification process, TurboTax will validate your information and proceed to the next step.

It’s important to note that the identity verification process may vary depending on your individual circumstances and the requirements set by the IRS. The purpose of this step is to ensure that the person requesting the IRS PIN is in fact the taxpayer and not an unauthorized individual.

By verifying your identity, you are demonstrating your commitment to safeguarding your tax information and preventing fraudulent activity. It adds an extra layer of protection to your tax return and helps maintain the integrity of the tax system.

With your identity successfully verified, you’re now ready for the final step: Retrieving your IRS PIN. Let’s move on to Step 6!

Step 6: Retrieve your IRS PIN

After successfully verifying your identity, the final step is to retrieve your IRS PIN. TurboTax will provide you with your unique six-digit code, which serves as your IRS PIN for added security during the tax-filing process. Follow these steps to retrieve your IRS PIN:

- Once your identity is verified, TurboTax will display your IRS PIN on the screen. Take note of this six-digit code or consider printing a hard copy for your records.

- Ensure that you keep your IRS PIN in a safe and secure place. Treat it with the same level of confidentiality as you would with your social security number or any other sensitive information.

- It’s important to note that your IRS PIN may change from year to year. Therefore, make sure to obtain your IRS PIN for each tax year to maintain the highest level of security.

- With your IRS PIN in hand, you can proceed with confidence knowing that your tax information is well-protected and secure.

Retrieving your IRS PIN is the final step in the process of signing up for an IRS PIN in TurboTax. By following these steps, you have taken important measures to protect your tax information and minimize the risk of identity theft or fraudulent activity associated with your tax return.

Congratulations! You have successfully signed up for an IRS PIN and retrieved your unique six-digit code using TurboTax. Now, you’re ready to proceed with filing your tax return and enjoying the peace of mind that comes with knowing your information is protected.

Now that you have your IRS PIN, it’s important to consider tips for creating a strong PIN to further enhance your protection. Let’s explore some tips for creating a strong IRS PIN.

Tips for Creating a Strong IRS PIN

When it comes to creating your IRS PIN, it’s important to choose a strong and secure code to maximize its effectiveness in protecting your tax information. Here are some tips to keep in mind when creating your IRS PIN:

- Use a unique and random combination of numbers: Avoid using easily guessable numbers such as your birthdate, address, or phone number. Instead, opt for a combination of numbers that are unrelated to personal information and difficult to guess.

- Include a mix of uppercase and lowercase letters: Many PIN systems do not differentiate between uppercase and lowercase letters. However, TurboTax allows the use of both. By incorporating a mix of uppercase and lowercase letters, you increase the complexity and strength of your PIN.

- Include special characters: TurboTax does not currently support the use of special characters in your IRS PIN, so focus on creating a strong PIN using numbers and letters. However, if you have the option to use special characters in other PIN systems, consider using them to further enhance your password’s strength.

- Avoid predictable patterns: Steer clear of sequential or repetitive patterns such as 123456 or 111111. These patterns are easy to guess and decrease the security of your IRS PIN.

- Change your PIN regularly: It’s good practice to change your IRS PIN regularly, ideally on an annual basis. This adds an additional layer of security by reducing the chances of someone guessing or obtaining your PIN over time.

- Keep your PIN confidential: Just like any sensitive information, it is crucial to keep your IRS PIN confidential. Never share your IRS PIN with anyone, including friends, family members, or tax preparers. The IRS will never ask for your PIN through phone calls, emails, or text messages.

- Store your PIN securely: Save your IRS PIN in a secure location, such as a password manager, encrypted file, or written document that is safeguarded. Ensure that it is kept separate from your other personal information to minimize the risk of unauthorized access.

By following these tips, you can create a strong and secure IRS PIN that enhances the protection of your tax information. It’s worth investing the time and effort to select a unique and strong PIN to reduce the risk of identity theft and fraudulent activity.

Now that you’re armed with the knowledge of creating a strong IRS PIN, you can confidently file your tax return using TurboTax, knowing that your information is well-protected.

Next, let’s address some common questions related to IRS PINs.

Frequently Asked Questions (FAQs)

Here are some frequently asked questions about IRS PINs:

- Who is eligible for an IRS PIN?

- Can I use the same IRS PIN every year?

- What if I forget my IRS PIN?

- Can I change my IRS PIN?

- Is the IRS PIN the same as my e-file signature or login password?

- Is having an IRS PIN mandatory?

- Can I use my IRS PIN for other purposes?

Not all taxpayers are required to obtain an IRS PIN. However, individuals who have experienced identity theft, received a CP01A Notice from the IRS, or were assigned an IRS PIN by the IRS in the past are eligible to sign up for an IRS PIN.

No, the IRS assigns a new IRS PIN each year for eligible taxpayers. This is done to increase the security of your tax information and prevent potential unauthorized access.

If you forget your IRS PIN, you can retrieve it using TurboTax or the IRS’s “Get an IP PIN” tool. Follow the process to verify your identity, and the system will provide you with your PIN.

You cannot change your IRS PIN directly. Instead, the IRS assigns a new PIN each year for eligible taxpayers. However, you can update your PIN by following the process to sign up for an IRS PIN through TurboTax or the IRS’s official methods.

No, the IRS PIN is a separate code used specifically for identity verification during the tax-filing process. It is not the same as your e-file signature or login password used in tax software.

While not mandatory for all taxpayers, it is highly recommended to obtain an IRS PIN, especially if you have experienced identity theft or have been notified by the IRS about potential fraudulent activity.

No, the IRS PIN is specifically used for tax-related purposes and identity verification during the tax-filing process. It should not be shared or used for any other purposes.

If you have additional questions or need further clarification regarding IRS PINs, it is recommended to consult with a tax professional or visit the IRS website for more information.

Now that we have addressed some common questions, let’s wrap up the article.

Conclusion

Securing your tax information and protecting yourself against identity theft are critical aspects of the tax-filing process. Obtaining an IRS PIN through TurboTax is a simple and effective way to enhance the security of your tax return. With your IRS PIN in hand, you can file your taxes with confidence, knowing that your sensitive information is well-protected.

In this article, we discussed what an IRS PIN is and why it is necessary. We also provided a step-by-step guide on how to sign up for an IRS PIN in TurboTax, from creating an account to retrieving your PIN. Along the way, we offered tips for creating a strong PIN and addressed some frequently asked questions to help clarify any uncertainties.

Remember, your IRS PIN is unique to you and should be treated with the utmost confidentiality. Never share your PIN with anyone and store it securely. It’s also important to retrieve a new IRS PIN each year, as the IRS assigns a new code annually for eligible taxpayers.

By taking these proactive steps and utilizing TurboTax’s user-friendly platform, you can ensure the security and accuracy of your tax-filing process. Embrace the peace of mind that comes with knowing you have done everything possible to safeguard your tax information.

So, with your newfound knowledge, go ahead and sign up for an IRS PIN in TurboTax. Protect your tax information, prevent identity theft, and enjoy a hassle-free tax-filing experience!