Finance

Who Makes Credit Default Swaps

Published: March 4, 2024

Learn about credit default swaps in the finance industry, including the key players involved in their creation and trading. Understand the roles of various entities in the CDS market.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What are Credit Default Swaps?

- The Role of Banks in Credit Default Swaps

- The Role of Hedge Funds in Credit Default Swaps

- The Role of Insurance Companies in Credit Default Swaps

- The Role of Pension Funds in Credit Default Swaps

- The Role of Sovereign Wealth Funds in Credit Default Swaps

- Conclusion

Introduction

Introduction

When it comes to the intricate world of finance, certain financial instruments play a pivotal role in shaping the global economy. One such instrument that has garnered significant attention and controversy is the Credit Default Swap (CDS). Understanding who makes credit default swaps is crucial in comprehending the dynamics of this financial tool and its impact on the broader financial landscape.

Credit Default Swaps, often referred to as CDS, are a type of derivative contract that allows an investor to “swap” or transfer the credit risk of a bond or loan to another party. In essence, it acts as insurance against the default of a borrower or issuer. This financial tool gained notoriety during the 2008 financial crisis, where its widespread use and lack of regulation contributed to the turmoil in the financial markets.

Exploring the key players involved in the creation and trading of credit default swaps sheds light on the complex network of entities that influence the utilization and impact of these financial instruments. From banks to hedge funds, insurance companies to pension funds, and sovereign wealth funds, each entity plays a distinct role in the ecosystem of credit default swaps.

Delving into the roles and motivations of these entities provides valuable insights into the dynamics of credit default swaps and their broader implications for the financial industry and the global economy. Understanding who makes credit default swaps is essential for grasping the complexities of modern finance and the interconnectedness of various financial institutions in the global marketplace.

What are Credit Default Swaps?

What are Credit Default Swaps?

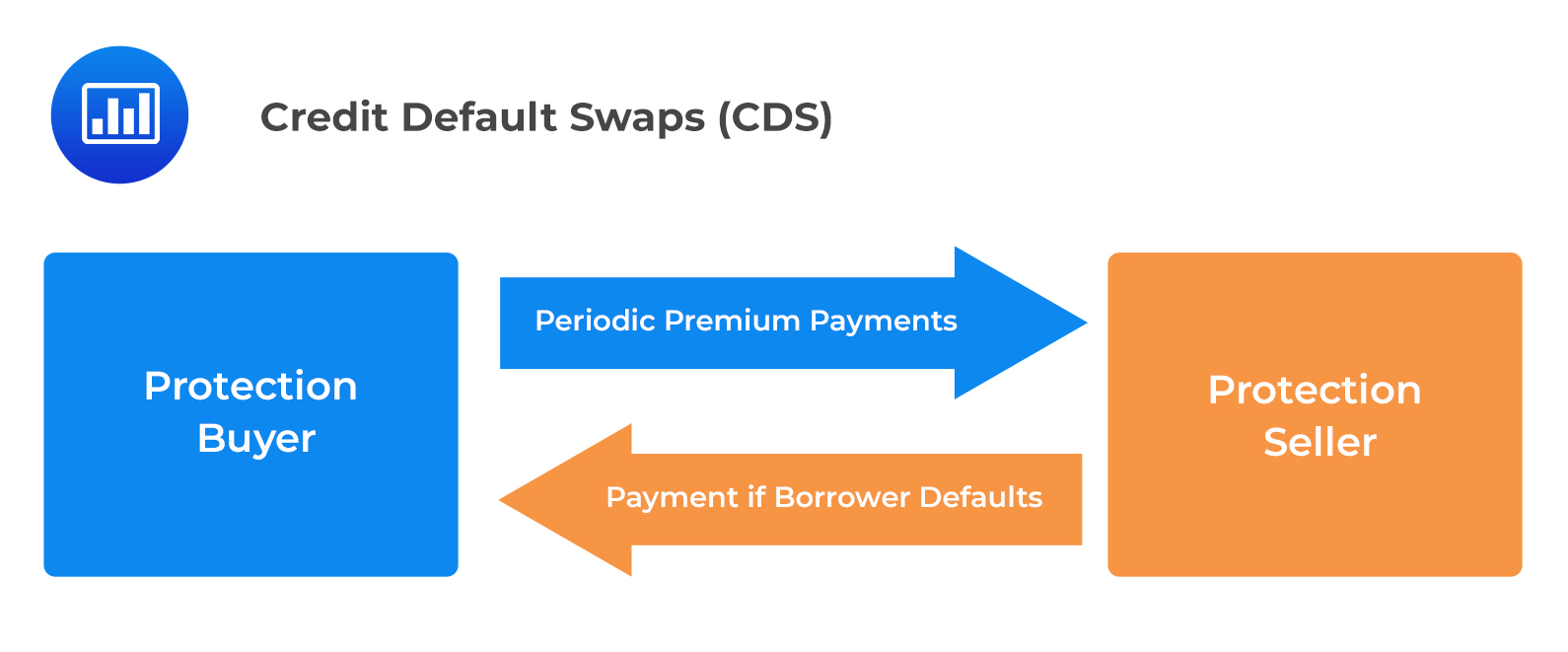

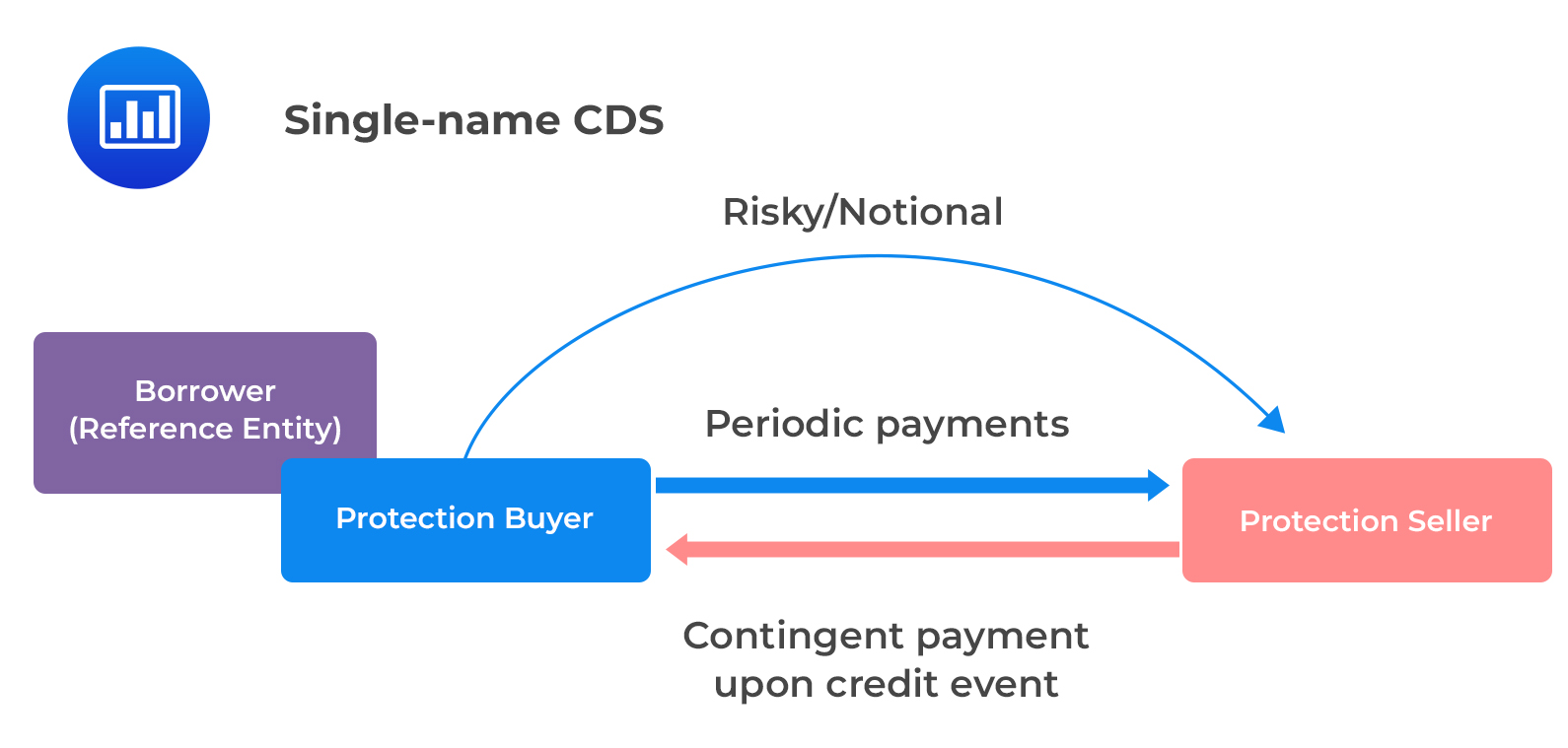

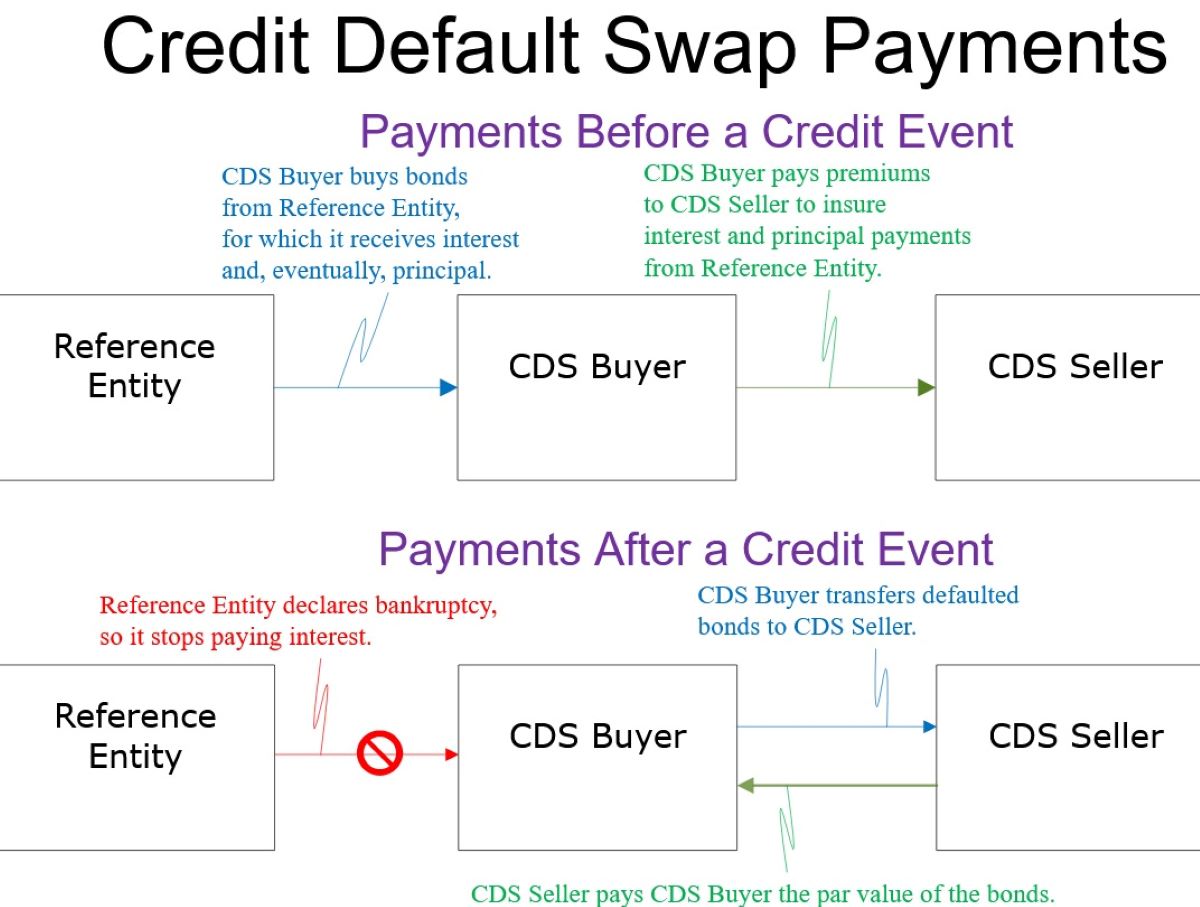

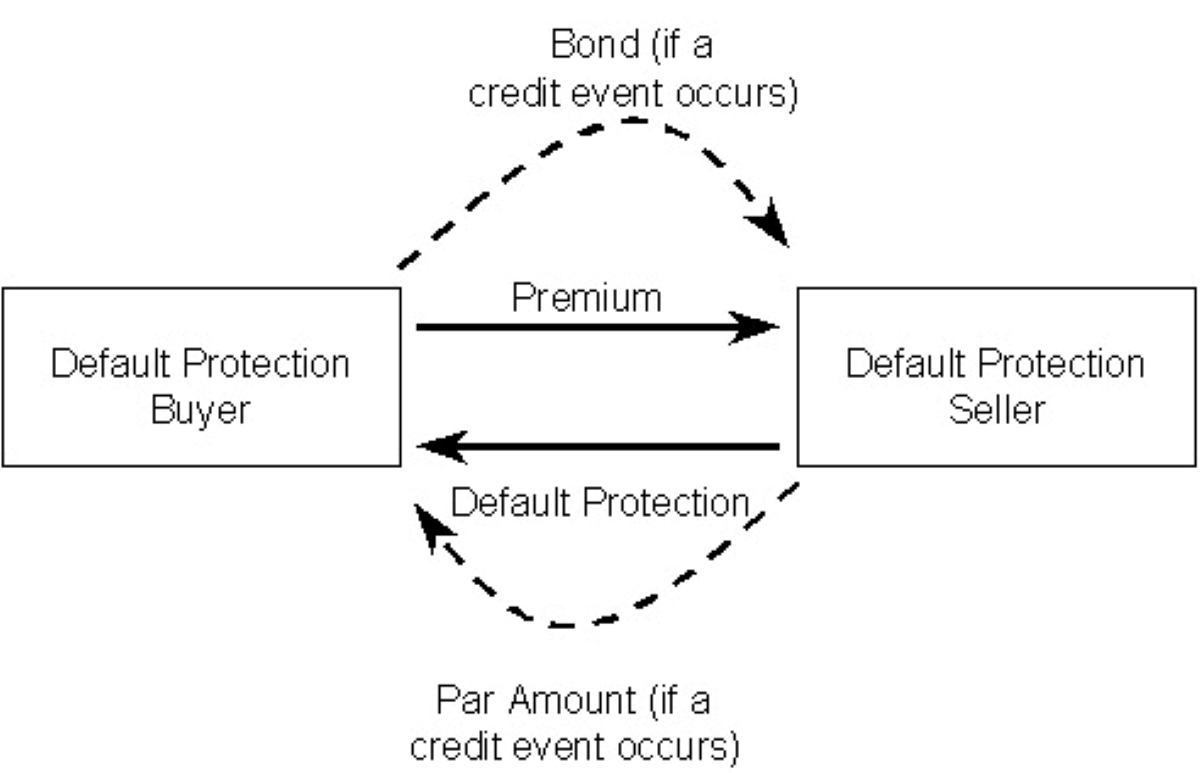

Credit Default Swaps (CDS) are financial derivatives that enable investors to hedge against the risk of a borrower defaulting on their debt obligations. In essence, a CDS functions as a form of insurance, where the buyer of the swap makes periodic payments to the seller in exchange for protection against potential credit events, such as default or restructuring, related to a particular debt instrument or issuer.

One of the defining features of CDS is that it allows investors to speculate on the creditworthiness of a particular entity or to mitigate the risk associated with their investments. The buyer of a CDS pays a premium to the seller, typically a financial institution, in exchange for protection in the event of a credit event. If a credit event occurs, the seller compensates the buyer for the loss incurred due to the default. This mechanism provides investors with a means to manage and transfer credit risk without owning the underlying debt instrument.

Credit Default Swaps are traded over-the-counter (OTC), meaning they are not transacted on a centralized exchange but rather directly between two parties. This characteristic contributes to the flexibility and customization of CDS contracts, as the terms can be tailored to the specific needs and risk exposures of the parties involved.

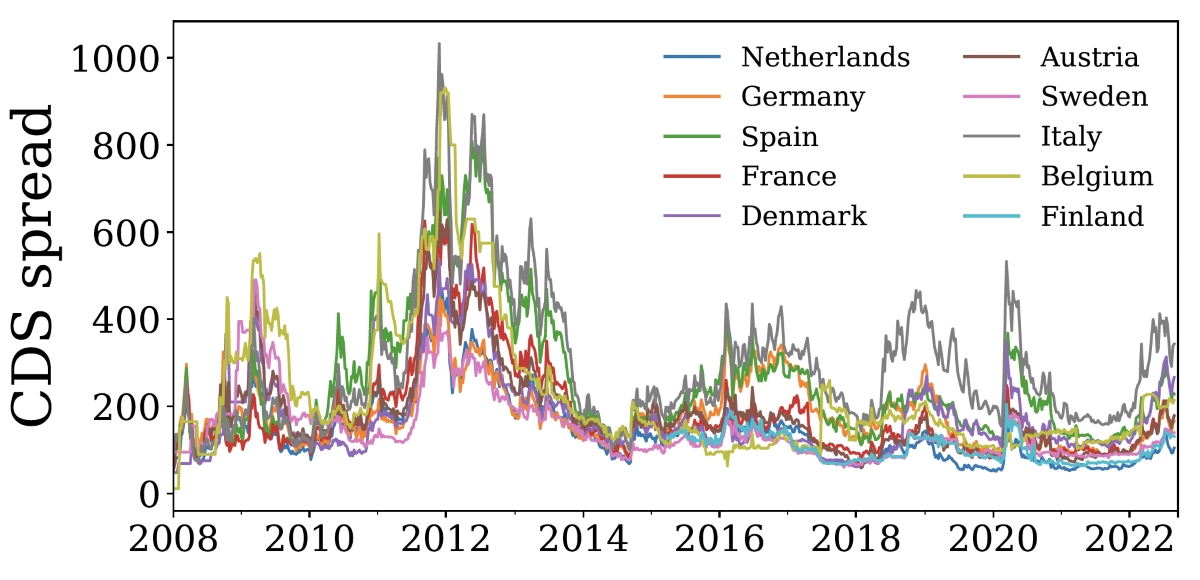

It’s important to note that while CDS can serve as a risk management tool, they have also been associated with speculative activities and excessive risk-taking, particularly leading up to the 2008 financial crisis. The lack of transparency and regulation in the CDS market has raised concerns about their potential to amplify systemic risk and contribute to market instability.

In summary, Credit Default Swaps are financial instruments that provide investors with a mechanism to hedge against the risk of credit default. While they offer opportunities for risk management and speculation, their complex nature and potential impact on financial markets warrant careful consideration and oversight.

The Role of Banks in Credit Default Swaps

The Role of Banks in Credit Default Swaps

Banks play a significant role in the creation, distribution, and trading of Credit Default Swaps (CDS). As financial intermediaries, banks act as both buyers and sellers of CDS contracts, facilitating the transfer of credit risk between parties. One of the primary functions of banks in the CDS market is to provide liquidity and market-making services, allowing investors to enter into CDS contracts and manage their credit exposure.

Through their trading desks and investment banking divisions, banks engage in the origination and structuring of CDS products, tailoring contracts to meet the specific needs of investors seeking to hedge or speculate on credit risk. Banks also act as counterparties in CDS transactions, assuming the risk of credit events in exchange for premiums from CDS buyers.

Furthermore, banks utilize Credit Default Swaps as a risk management tool within their own portfolios. By entering into CDS contracts, banks can hedge their exposure to credit risk associated with loans, bonds, and other debt instruments held on their balance sheets. This allows banks to mitigate potential losses stemming from defaults or credit deterioration of their counterparties.

It’s important to note that the role of banks in the CDS market has been subject to scrutiny, particularly in the aftermath of the 2008 financial crisis. The widespread use of CDS, coupled with the lack of transparency and oversight, contributed to systemic risk and amplified the impact of the crisis. Regulatory reforms have since been implemented to enhance transparency and mitigate the risks associated with CDS trading, placing greater scrutiny on the role of banks in the CDS market.

In summary, banks serve as key intermediaries and participants in the CDS market, facilitating the creation, trading, and risk management associated with Credit Default Swaps. Their involvement in the CDS market underscores the integral role of financial institutions in shaping the dynamics of credit risk transfer and financial market stability.

The Role of Hedge Funds in Credit Default Swaps

The Role of Hedge Funds in Credit Default Swaps

Hedge funds play a significant and often controversial role in the market for Credit Default Swaps (CDS). These alternative investment vehicles are active participants in the CDS market, utilizing these financial instruments for hedging, speculation, and arbitrage strategies.

One of the primary roles of hedge funds in the CDS market is speculative trading. By taking positions on the creditworthiness of specific entities or debt instruments, hedge funds seek to capitalize on potential changes in credit risk and associated CDS spreads. This speculative activity can contribute to market liquidity and price discovery, but it also introduces the potential for excessive risk-taking and market volatility.

Additionally, hedge funds utilize Credit Default Swaps as a tool for hedging and managing their overall portfolio risk. By entering into CDS contracts, hedge funds can protect their investments from potential credit events, thereby reducing the impact of defaults or credit deterioration on their portfolios.

Furthermore, hedge funds may engage in arbitrage strategies using CDS. This involves exploiting pricing inefficiencies or discrepancies between the CDS market and the underlying cash bond market. By identifying mispricings or divergences in the pricing of CDS and the related bonds, hedge funds can seek to generate profits through strategic trading activities.

It’s important to note that the role of hedge funds in the CDS market has been a subject of debate and regulatory scrutiny. The use of CDS for speculative purposes and the potential for market manipulation have raised concerns about the impact of hedge fund activities on financial stability and systemic risk.

In summary, hedge funds are active participants in the CDS market, engaging in speculative trading, risk management, and arbitrage strategies using these financial instruments. Their involvement contributes to market dynamics and liquidity but also raises considerations regarding market integrity and risk management practices.

The Role of Insurance Companies in Credit Default Swaps

The Role of Insurance Companies in Credit Default Swaps

Insurance companies play a significant role in the Credit Default Swap (CDS) market, leveraging these financial instruments to manage and hedge their exposure to credit risk. As providers of insurance and risk management services, insurance companies utilize CDS as a tool to mitigate the potential impact of credit events on their investment portfolios.

One of the primary roles of insurance companies in the CDS market is to offer protection to investors and counterparties against the risk of default or credit deterioration. Through the issuance of CDS contracts, insurance companies act as sellers, receiving premiums from buyers in exchange for assuming the risk of credit events related to specific debt instruments or issuers. This enables investors to transfer and diversify their credit risk, enhancing the overall stability of their investment portfolios.

Insurance companies also utilize Credit Default Swaps as a means of managing their own credit exposure. By entering into CDS contracts, insurance companies can hedge against the risk of default on the debt securities held within their investment portfolios. This risk management strategy allows insurance companies to safeguard their financial positions and fulfill their obligations to policyholders and beneficiaries.

Furthermore, insurance companies may engage in the trading of CDS to optimize their investment strategies and enhance portfolio performance. By actively participating in the CDS market, insurance companies can capitalize on opportunities to generate returns and manage their overall risk exposure.

It's important to note that the role of insurance companies in the CDS market is subject to regulatory oversight and risk management requirements. Given the systemic importance of insurance companies and their role in providing financial protection, regulatory authorities closely monitor their activities in the CDS market to ensure the stability and integrity of the financial system.

In summary, insurance companies serve as key participants in the CDS market, offering risk management solutions, liquidity, and credit protection to investors and counterparties. Their involvement contributes to the efficient transfer and mitigation of credit risk, enhancing the overall resilience of the financial markets.

The Role of Pension Funds in Credit Default Swaps

The Role of Pension Funds in Credit Default Swaps

Pension funds, as institutional investors responsible for managing retirement assets, play a nuanced role in the Credit Default Swap (CDS) market. These long-term investors utilize CDS as a risk management tool and a means of optimizing their investment portfolios while navigating the complexities of credit risk.

One of the primary functions of pension funds in the CDS market is to hedge against the credit risk associated with their fixed income and debt investments. By entering into CDS contracts, pension funds can protect their portfolios from potential credit events, such as defaults or downgrades, thus safeguarding the retirement savings and financial security of their beneficiaries. This risk mitigation strategy allows pension funds to manage their exposure to credit risk and enhance the overall stability of their investment holdings.

Additionally, pension funds may utilize Credit Default Swaps to enhance the diversification and performance of their investment portfolios. By selectively engaging in CDS transactions, pension funds can optimize their asset allocation and potentially capitalize on market opportunities while prudently managing their risk exposures. This strategic use of CDS contributes to the overall effectiveness of pension fund investment strategies and their ability to meet long-term financial obligations.

Furthermore, pension funds participate in the CDS market to ensure liquidity and efficient risk transfer within their investment portfolios. By engaging in CDS transactions, pension funds can enhance their ability to adjust their risk profiles and respond to changing market conditions, thereby maintaining the stability and resilience of their investment holdings.

It's important to note that the involvement of pension funds in the CDS market is governed by regulatory oversight and fiduciary responsibilities to act in the best interests of their beneficiaries. As such, pension funds approach the use of CDS with a focus on prudent risk management and long-term financial sustainability, aligning their activities with the goal of securing retirement benefits for their members.

In summary, pension funds serve as strategic participants in the CDS market, utilizing these financial instruments for risk management, portfolio optimization, and liquidity enhancement. Their involvement underscores the importance of prudent risk management and long-term asset stewardship within the context of the broader financial ecosystem.

The Role of Sovereign Wealth Funds in Credit Default Swaps

The Role of Sovereign Wealth Funds in Credit Default Swaps

Sovereign Wealth Funds (SWFs) play a distinctive role in the Credit Default Swap (CDS) market, leveraging these financial instruments to manage sovereign assets, optimize risk exposures, and navigate the complexities of credit risk associated with sovereign debt holdings.

One of the primary functions of Sovereign Wealth Funds in the CDS market is to hedge against the credit risk inherent in their sovereign bond and debt investments. By utilizing CDS contracts, SWFs can protect their portfolios from potential credit events, such as sovereign defaults or credit downgrades, thereby enhancing the overall stability of their sovereign wealth holdings. This risk management strategy allows SWFs to prudently manage their exposure to sovereign credit risk and safeguard the long-term value of their assets.

Additionally, Sovereign Wealth Funds may engage in the trading of Credit Default Swaps to enhance the liquidity and flexibility of their investment portfolios. By actively participating in the CDS market, SWFs can optimize their risk profiles, adjust their asset allocations, and respond to evolving market conditions, thereby ensuring the resilience and adaptability of their sovereign wealth holdings.

Furthermore, Sovereign Wealth Funds utilize CDS as a tool for portfolio diversification and strategic asset management. By selectively entering into CDS transactions, SWFs can enhance the risk-return profile of their sovereign wealth portfolios, potentially capitalizing on market opportunities while prudently managing their credit exposures. This strategic use of CDS contributes to the overall effectiveness of Sovereign Wealth Fund investment strategies and their ability to fulfill their long-term financial objectives.

It’s important to note that the involvement of Sovereign Wealth Funds in the CDS market is subject to regulatory oversight and prudent investment stewardship. Given the systemic importance of SWFs and their role in managing sovereign assets, regulatory authorities closely monitor their activities in the CDS market to ensure the stability and integrity of sovereign wealth management.

In summary, Sovereign Wealth Funds serve as strategic participants in the CDS market, utilizing these financial instruments for sovereign risk management, portfolio optimization, and liquidity enhancement. Their involvement underscores the importance of prudent risk management and long-term asset stewardship within the context of sovereign wealth management and global financial markets.

Conclusion

In conclusion, the roles of various entities in the Credit Default Swap (CDS) market collectively shape the dynamics of credit risk transfer, risk management, and financial market stability. From banks to hedge funds, insurance companies to pension funds, and sovereign wealth funds, each participant contributes to the utilization and impact of CDS in the global financial landscape.

Understanding who makes credit default swaps is essential for comprehending the multifaceted nature of these financial instruments and their implications for the broader economy. Banks serve as intermediaries and market makers, facilitating the creation and trading of CDS while managing their own credit risk exposures. Hedge funds engage in speculative trading, risk management, and arbitrage strategies using CDS, influencing market dynamics and liquidity.

Insurance companies play a pivotal role in providing credit protection and risk management solutions through CDS, contributing to the efficient transfer and mitigation of credit risk. Pension funds utilize CDS for risk management, portfolio optimization, and liquidity enhancement, aligning their activities with the long-term financial sustainability of their investment holdings.

Sovereign Wealth Funds leverage CDS to manage sovereign credit risk, enhance portfolio resilience, and optimize their risk-return profiles, reflecting the strategic management of sovereign assets within the global financial landscape.

While the roles of these entities in the CDS market offer opportunities for risk management, portfolio optimization, and liquidity provision, they also warrant careful consideration of regulatory oversight, market integrity, and systemic risk implications. The evolution and impact of the CDS market underscore the interconnectedness of financial institutions and the importance of prudent risk management practices within the broader context of global finance.

Ultimately, the collective roles of banks, hedge funds, insurance companies, pension funds, and sovereign wealth funds in the CDS market underscore the intricate interplay of financial entities in shaping credit risk dynamics, market liquidity, and the resilience of the global financial system.