Finance

How To Get FICO Score 2, 4, 5 For Free

Published: March 6, 2024

Learn how to obtain your FICO Score 2, 4, and 5 without cost. Take control of your finances and access your credit scores for free. Discover the steps to access your FICO scores today.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of credit scores, where a three-digit number can hold significant sway over your financial opportunities. Understanding your creditworthiness is essential for making informed decisions about borrowing, as it directly impacts your ability to secure loans, credit cards, and favorable interest rates. Among the various credit scoring models, the FICO score is widely used by lenders to assess an individual's credit risk.

In this comprehensive guide, we will delve into the intricacies of FICO scores, focusing specifically on FICO Score 2, 4, and 5. By the end of this journey, you will not only grasp the significance of these scores but also learn how to obtain them for free. Whether you're a seasoned borrower or just beginning to navigate the world of credit, this article aims to equip you with the knowledge needed to take control of your financial well-being.

Understanding the nuances of credit scoring empowers individuals to make informed financial decisions, build a positive credit history, and ultimately achieve their long-term goals. So, let's embark on this enlightening expedition into the realm of FICO scores, where we'll unravel the mysteries behind these three distinct scoring models and discover how you can access them without spending a dime.

Understanding FICO Scores

Before diving into the specifics of FICO Score 2, 4, and 5, it’s crucial to grasp the fundamental principles of FICO scores. Developed by the Fair Isaac Corporation, FICO scores are used by lenders to assess an individual’s credit risk and determine the likelihood of timely loan repayment. These scores range from 300 to 850, with higher scores indicating lower credit risk and greater creditworthiness.

FICO scores are calculated based on several factors, including payment history, amounts owed, length of credit history, new credit, and credit mix. Payment history holds the most significant weight, emphasizing the importance of consistently making on-time payments for outstanding debts. Additionally, the amounts owed, comprising credit utilization and the ratio of balances to credit limits, play a pivotal role in determining FICO scores.

Understanding the composition of FICO scores enables individuals to take proactive steps to improve their credit profiles. By maintaining low credit card balances, making timely payments, and strategically managing credit accounts, individuals can positively influence their FICO scores over time. Moreover, comprehending the impact of credit inquiries and the benefits of a diverse credit mix empowers individuals to make informed decisions that align with their long-term financial objectives.

By familiarizing yourself with the core components of FICO scores, you gain the knowledge needed to navigate the credit landscape effectively. This understanding not only facilitates better financial planning but also equips you to interpret and leverage the FICO Score 2, 4, and 5, which we will explore in detail in the following sections.

FICO Score 2

FICO Score 2, also known as the Experian/FICO Risk Model, is specifically tailored for mortgage lending. This scoring model is used by mortgage lenders to assess an individual’s credit risk when applying for a home loan. FICO Score 2 places a strong emphasis on the borrower’s payment history, outstanding debts, length of credit history, new credit accounts, and the types of credit used, providing mortgage lenders with a comprehensive evaluation of the borrower’s creditworthiness.

Given its significance in the mortgage lending process, FICO Score 2 holds substantial weight in determining the terms and interest rates offered to potential homebuyers. A higher FICO Score 2 can lead to more favorable mortgage terms, including lower interest rates and reduced down payment requirements, ultimately translating to significant cost savings over the life of the loan.

For individuals aspiring to secure a mortgage, understanding and monitoring their FICO Score 2 is paramount. By proactively managing the factors that influence this specific score, such as maintaining a pristine payment history and optimizing credit utilization, prospective homebuyers can position themselves for a smoother and more affordable mortgage application process.

As we delve deeper into the world of FICO scores, it’s essential to recognize the unique role that FICO Score 2 plays in the realm of mortgage lending. By comprehending the intricacies of this scoring model, individuals can take proactive steps to bolster their credit profiles, thereby enhancing their prospects of obtaining a favorable mortgage and achieving the dream of homeownership.

FICO Score 4

FICO Score 4, also known as the TransUnion FICO Risk Model, is specifically tailored for mortgage lending and is utilized by mortgage lenders to evaluate the creditworthiness of potential borrowers. Similar to FICO Score 2, FICO Score 4 places significant emphasis on the individual’s payment history, amounts owed, length of credit history, new credit, and credit mix. By analyzing these key factors, FICO Score 4 provides mortgage lenders with a comprehensive assessment of an individual’s credit risk when applying for a home loan.

Understanding the nuances of FICO Score 4 is crucial for individuals seeking to secure a mortgage, as this score directly influences the terms and interest rates offered by mortgage lenders. A higher FICO Score 4 can lead to more favorable mortgage terms, potentially resulting in lower monthly payments and reduced overall borrowing costs.

Monitoring and actively managing one’s FICO Score 4 is essential for individuals preparing to embark on the homeownership journey. By maintaining a strong payment history, optimizing credit utilization, and strategically managing credit accounts, prospective homebuyers can position themselves for a smoother mortgage application process and potentially qualify for more advantageous loan terms.

As we navigate the realm of FICO scores, it’s evident that FICO Score 4 holds significant sway in the mortgage lending landscape. By comprehending the intricacies of this scoring model and taking proactive steps to enhance one’s credit profile, individuals can pave the way for a more seamless and cost-effective path to homeownership.

FICO Score 5

FICO Score 5, also known as the Equifax FICO Risk Model, is specifically designed for mortgage lending and is utilized by mortgage lenders to evaluate the credit risk of potential borrowers. Similar to FICO Score 2 and 4, FICO Score 5 considers various factors, including payment history, amounts owed, length of credit history, new credit, and credit mix, to generate a comprehensive assessment of an individual’s creditworthiness when applying for a home loan.

For individuals navigating the mortgage application process, understanding the significance of FICO Score 5 is paramount. This score directly influences the terms and interest rates offered by mortgage lenders, making it a crucial determinant of the overall cost of homeownership. A higher FICO Score 5 can lead to more favorable mortgage terms, potentially resulting in lower monthly payments and reduced long-term borrowing expenses.

Monitoring and actively managing one’s FICO Score 5 is essential for individuals preparing to embark on the homeownership journey. By maintaining a strong payment history, optimizing credit utilization, and strategically managing credit accounts, prospective homebuyers can position themselves for a smoother mortgage application process and potentially qualify for more advantageous loan terms.

As we explore the realm of FICO scores, it becomes evident that FICO Score 5 plays a pivotal role in shaping the homeownership experience. By comprehending the intricacies of this scoring model and taking proactive steps to enhance one’s credit profile, individuals can pave the way for a more seamless and cost-effective path to realizing their homeownership aspirations.

How to Get Your FICO Scores for Free

Obtaining your FICO scores for free is not only feasible but also essential for gaining insight into your credit health. While there are numerous services that offer free credit scores, it’s important to ensure that you access your official FICO scores, as these are the scores most commonly used by lenders in their credit assessment processes. Here are some avenues to obtain your FICO scores without incurring any costs:

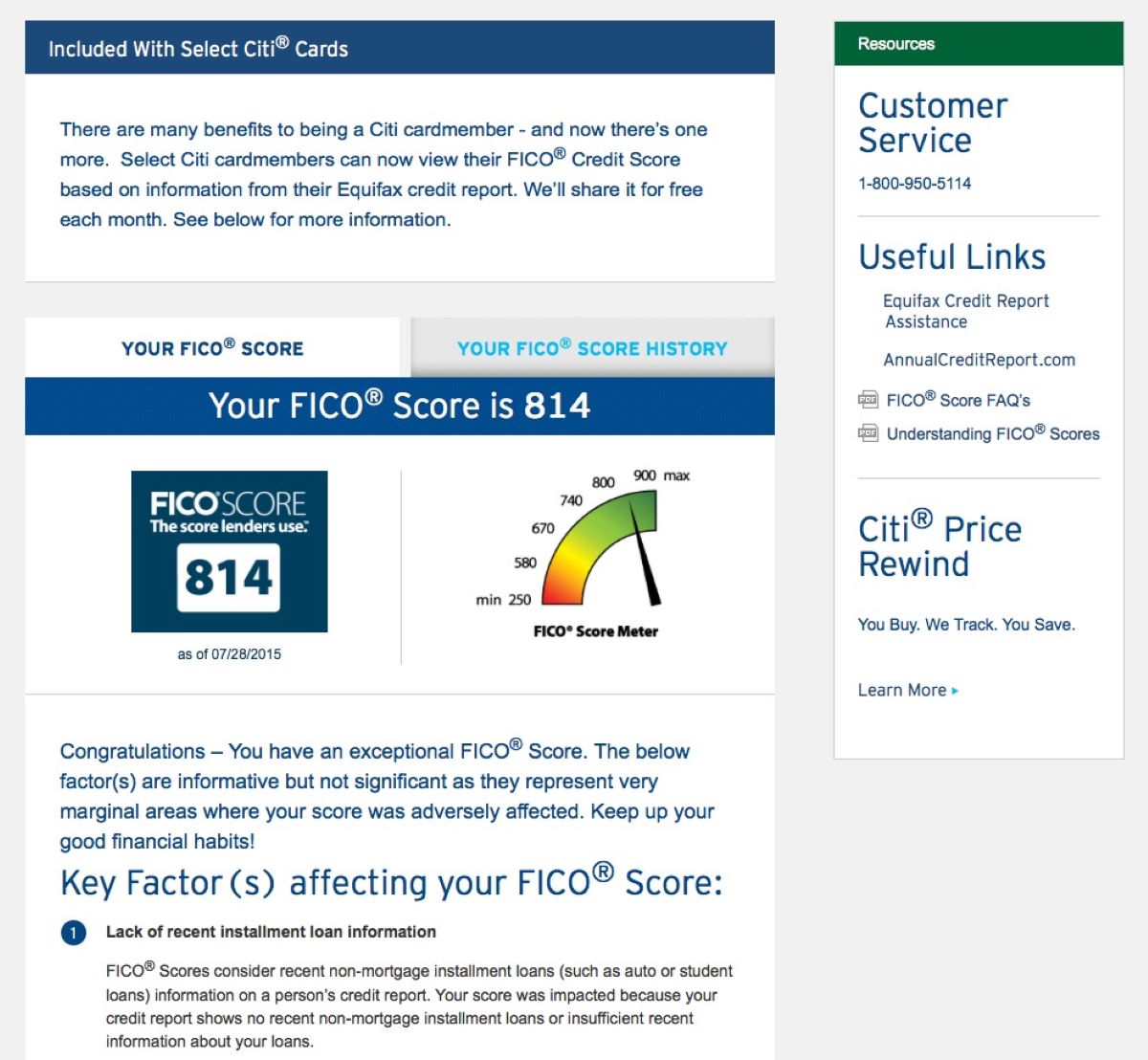

- FICO’s official website: FICO offers a program called FICO Score Open Access, which enables participating financial institutions to provide their customers with free access to their FICO scores. Check if your bank or credit card issuer participates in this program, as it allows you to view your FICO scores at no additional cost.

- Credit card issuers: Many credit card issuers now provide cardholders with access to their FICO scores as a complimentary benefit. Check if your credit card issuer offers this feature, as it can be a convenient way to monitor your FICO scores regularly.

- Financial apps and services: Numerous financial management apps and services offer free access to FICO scores as part of their offerings. Explore these options to leverage complimentary access to your official FICO scores.

- FICO Score resellers: Some FICO Score resellers, authorized by the Fair Isaac Corporation, provide individuals with access to their FICO scores at no cost. It’s important to verify the legitimacy of these resellers and ensure that the scores obtained are indeed official FICO scores.

By availing yourself of these avenues, you can securely access your official FICO scores without incurring any expenses, gaining valuable insights into your credit standing and empowering yourself to make informed financial decisions.

Conclusion

As we conclude our exploration of FICO scores, it’s evident that these three-digit numbers wield considerable influence over individuals’ financial opportunities, particularly in the realm of mortgage lending. Understanding the nuances of FICO Score 2, 4, and 5 is crucial for individuals aspiring to secure a home loan, as these scores directly impact the terms, interest rates, and overall affordability of mortgages.

By comprehending the factors that influence FICO scores and actively managing their credit profiles, individuals can position themselves for more favorable mortgage terms, potentially leading to substantial cost savings over the life of the loan. Monitoring and accessing one’s official FICO scores for free empowers individuals to stay informed about their credit health and take proactive steps to enhance their creditworthiness.

Ultimately, the journey toward homeownership is intertwined with credit management, and the knowledge gained from understanding and accessing FICO scores for free can significantly impact individuals’ ability to achieve their homeownership aspirations. By leveraging the resources available for obtaining official FICO scores at no cost, individuals can embark on their homeownership journey with confidence, armed with the insights needed to navigate the mortgage application process effectively.

In essence, the accessibility of official FICO scores for free provides individuals with a valuable tool for monitoring and improving their credit health, ultimately paving the way for a more secure financial future. By harnessing this knowledge and actively managing their credit profiles, individuals can embark on their homeownership journey with a clear understanding of their credit standing, positioning themselves for success in the pursuit of their homeownership dreams.