Finance

How To Raise Your Mortgage FICO Score

Published: March 7, 2024

Learn effective strategies to improve your mortgage FICO score and secure better finance options. Take control of your financial future today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of homeownership! If you're considering purchasing a house or refinancing your current mortgage, you'll want to ensure that your mortgage FICO score is in top shape. Your mortgage FICO score plays a crucial role in determining the interest rate you'll receive on your home loan. A higher score can potentially save you thousands of dollars over the life of your mortgage, making it essential to understand how to raise and maintain it.

In this comprehensive guide, we'll walk you through the steps to improve your mortgage FICO score, empowering you to secure the best possible terms on your home loan. Whether you're a first-time homebuyer or a seasoned homeowner looking to refinance, the insights provided here will help you navigate the intricacies of credit scoring and set you on the path to financial success.

Understanding the factors that influence your mortgage FICO score, such as payment history, credit utilization, and credit inquiries, is the first step toward boosting your score. By taking proactive measures to manage your credit responsibly, you can elevate your score and position yourself for a successful mortgage application.

So, let's dive into the world of mortgage FICO scores, credit reports, and the actionable strategies that can propel you toward your homeownership dreams. Whether you're aiming for a competitive interest rate or seeking approval for a larger loan amount, the knowledge and tips shared in this guide will empower you to take control of your financial future.

Understanding Your Mortgage FICO Score

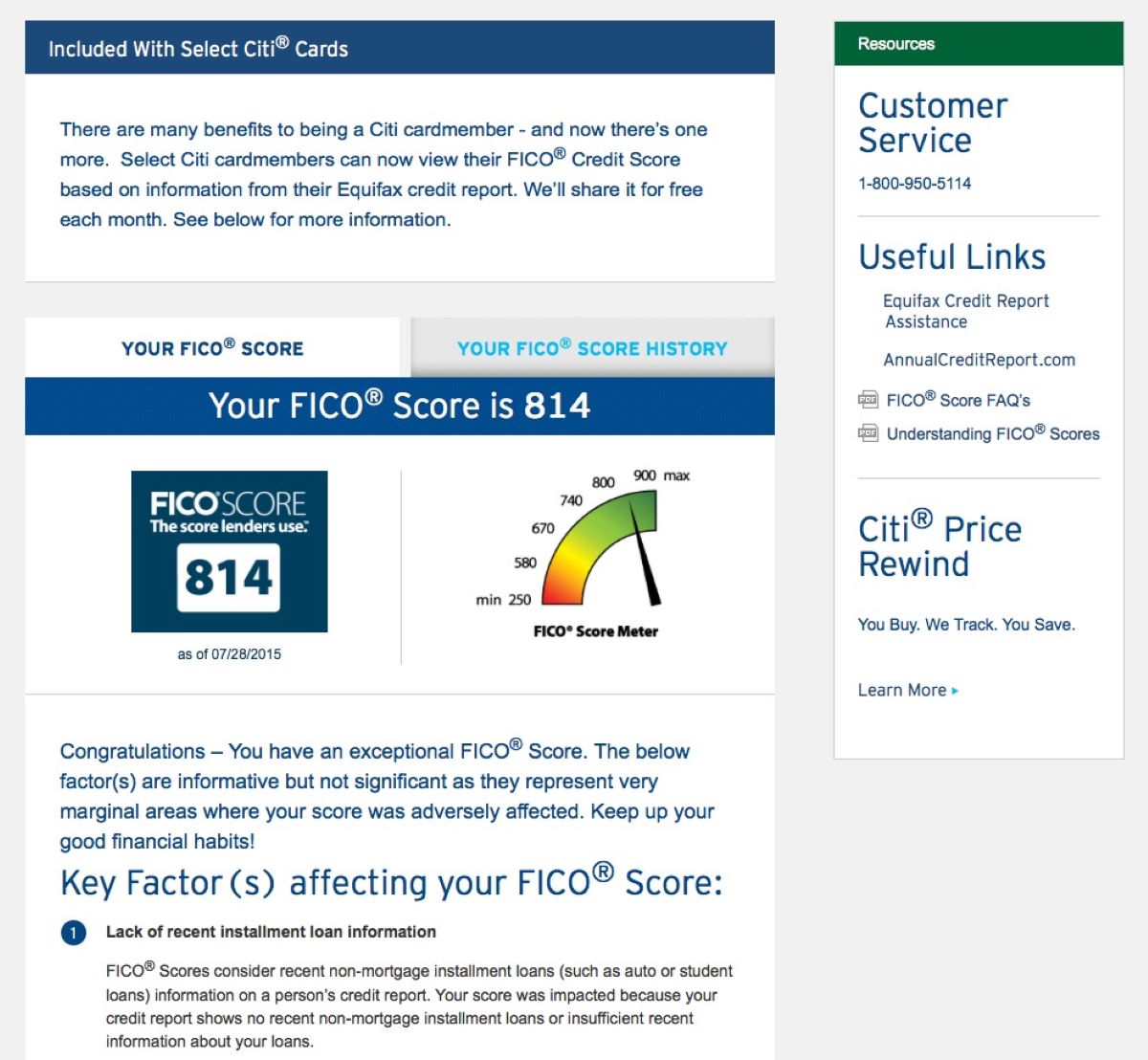

Before delving into the specific steps to raise your mortgage FICO score, it’s crucial to grasp the fundamentals of this influential metric. Your mortgage FICO score, also known as your credit score, is a numerical representation of your creditworthiness. Lenders use this score to assess the risk of extending a home loan to you. The higher your score, the lower the perceived risk, which can result in more favorable loan terms, such as a lower interest rate and a higher borrowing limit.

Most mortgage lenders rely on the FICO scoring model, developed by the Fair Isaac Corporation, to evaluate a borrower’s credit risk. This model considers several key factors when calculating your score:

- Your payment history, including the timeliness of past payments and any history of delinquencies or defaults.

- The amount of debt you owe, relative to your available credit limits, known as credit utilization.

- The length of your credit history, reflecting how long your accounts have been open and the age of your oldest account.

- Your credit mix, which encompasses the variety of credit accounts you hold, such as credit cards, installment loans, and mortgages.

- Recent credit inquiries and new credit accounts opened, as these actions can indicate an increased risk of financial strain.

Understanding the weight of each factor in determining your mortgage FICO score can provide valuable insights into how to strategically manage your credit profile. By focusing on the areas that carry the most significant impact, you can make informed decisions to bolster your score over time.

As we proceed, we’ll explore actionable tactics to address each of these factors, empowering you to optimize your credit standing and enhance your prospects for securing an advantageous mortgage. By gaining a deeper understanding of your mortgage FICO score and the elements that shape it, you’ll be better equipped to navigate the credit landscape and achieve your homeownership goals.

Checking Your Credit Report

One of the fundamental steps in managing and improving your mortgage FICO score is to regularly review your credit report. Your credit report serves as a detailed record of your credit history, encompassing information about your accounts, payment patterns, and any negative incidents, such as late payments or collection accounts. By obtaining and scrutinizing your credit report, you can identify any inaccuracies or derogatory marks that may be impacting your score.

Under the Fair Credit Reporting Act (FCRA), you are entitled to receive a free copy of your credit report from each of the three major credit bureaus – Equifax, Experian, and TransUnion – once every 12 months. Taking advantage of this opportunity allows you to monitor your credit profile for any discrepancies and take corrective actions as needed.

Upon receiving your credit reports, carefully examine the following key aspects:

- Verify the accuracy of personal information, including your name, address, and employment history.

- Review the status of each credit account to ensure that the reported balances and payment histories align with your records.

- Identify any accounts that may have been erroneously opened in your name, signaling potential identity theft or fraud.

- Check for any negative items, such as late payments, collections, or public records, and assess their validity.

If you spot any errors or discrepancies on your credit reports, it’s crucial to address them promptly. You can initiate a dispute with the credit bureau reporting the inaccurate information, providing supporting documentation to substantiate your claim. Resolving inaccuracies and rectifying any fraudulent activity can lead to a positive impact on your mortgage FICO score, as it ensures that your credit report accurately reflects your creditworthiness.

By regularly monitoring your credit reports and addressing any inaccuracies, you can proactively safeguard your credit standing and pave the way for an improved mortgage application experience. This proactive approach to credit management sets the stage for elevating your mortgage FICO score and positioning yourself as a favorable candidate in the eyes of potential lenders.

Paying Your Bills on Time

Consistently paying your bills on time is a foundational pillar of responsible credit management and a key determinant of your mortgage FICO score. Payment history holds substantial weight in the FICO scoring model, illustrating your ability to meet your financial obligations. Whether it’s credit card bills, loan installments, or other recurring payments, ensuring timely remittance is crucial for demonstrating your creditworthiness to potential mortgage lenders.

Missing a payment or making late payments can have adverse effects on your credit score, potentially leading to a lower mortgage FICO score and diminished borrowing prospects. To mitigate these risks and fortify your credit standing, consider implementing the following strategies:

- Set up automatic payments or reminders: Leveraging automated payment systems or setting calendar reminders can help you stay on top of your payment due dates, reducing the likelihood of oversights.

- Establish a budget and cash flow management system: By maintaining a clear overview of your income and expenses, you can allocate funds for bill payments and avoid cash flow challenges that may impede timely payments.

- Communicate with creditors in case of financial hardship: If you encounter unforeseen financial difficulties that could impact your ability to make timely payments, proactively engaging with your creditors and exploring alternative payment arrangements can help mitigate negative repercussions on your credit report.

By consistently meeting your financial obligations and prioritizing on-time bill payments, you can cultivate a positive payment history that bolsters your mortgage FICO score. This responsible credit behavior not only enhances your creditworthiness but also instills confidence in potential mortgage lenders, positioning you as a reliable and low-risk borrower.

As we progress through this guide, you’ll discover additional strategies and insights to further elevate your mortgage FICO score, equipping you with the knowledge and tools to navigate the credit landscape with confidence and achieve your homeownership aspirations.

Keeping Your Credit Card Balances Low

The utilization of credit, particularly in relation to your credit card balances, holds significant influence over your mortgage FICO score. Credit utilization refers to the ratio of your credit card balances to your credit limits and is a pivotal factor in the FICO scoring model. Maintaining low credit card balances relative to your available credit can positively impact your score and enhance your creditworthiness in the eyes of mortgage lenders.

To optimize your credit utilization and bolster your mortgage FICO score, consider the following strategies:

- Regularly monitor your credit card balances: Keeping a close eye on your credit card balances relative to your credit limits enables you to proactively manage your credit utilization. Aim to keep your balances well below the credit limits to demonstrate prudent credit management.

- Strategically pay down outstanding balances: If you carry balances on your credit cards, formulating a repayment plan to reduce these balances can yield positive effects on your credit utilization and, consequently, your mortgage FICO score.

- Consider increasing your credit limits: Requesting a credit limit increase on your existing credit cards can potentially lower your credit utilization ratio, provided that you maintain or decrease your balances following the increase.

- Avoid closing unused credit cards: Closing unused credit card accounts can diminish your available credit, potentially leading to a higher credit utilization ratio. Unless there are compelling reasons to close a credit card, such as excessive fees or poor terms, maintaining the account open can contribute to a healthier credit utilization ratio.

By prudently managing your credit card balances and optimizing your credit utilization, you can positively impact your mortgage FICO score and bolster your credit profile. These proactive measures not only enhance your creditworthiness but also position you favorably for securing competitive mortgage terms and realizing your homeownership aspirations.

As we delve deeper into the strategies for elevating your mortgage FICO score, you’ll gain a comprehensive understanding of the factors that shape your credit standing and the actionable steps you can take to optimize it. By leveraging these insights, you’ll be well-equipped to navigate the credit landscape and position yourself for a successful mortgage application.

Avoiding Opening Too Many New Accounts

While it may be tempting to open new credit accounts, doing so can have implications for your mortgage FICO score. Each time you apply for new credit, a hard inquiry is generated on your credit report, which can cause a temporary dip in your score. Additionally, opening multiple new accounts within a short timeframe may raise concerns for lenders, as it can suggest a heightened risk of financial strain or overextension.

To safeguard your mortgage FICO score and enhance your creditworthiness, consider the following strategies:

- Be selective with new credit applications: Prioritize quality over quantity when considering new credit accounts. Carefully assess the necessity and potential impact of each new account before submitting an application.

- Space out credit applications: Avoid applying for multiple credit accounts within a condensed timeframe, as this can trigger multiple hard inquiries and signal risk to potential lenders. Instead, space out your applications to minimize the impact on your credit score.

- Understand the implications of co-signed accounts: Co-signing for someone else’s credit account can also affect your credit profile, as it becomes part of your credit history. Exercise caution when considering co-signed obligations, as they can influence your mortgage FICO score.

By exercising prudence and restraint in opening new credit accounts, you can mitigate potential negative effects on your mortgage FICO score and cultivate a credit profile that resonates positively with lenders. These proactive measures contribute to a stable and favorable credit standing, positioning you as a reliable and low-risk borrower in the pursuit of homeownership.

As we progress through this guide, you’ll gain further insights into the strategies for optimizing your credit profile and elevating your mortgage FICO score. Armed with this knowledge, you’ll be well-prepared to navigate the credit landscape and pursue your homeownership goals with confidence and financial acumen.

Disputing Any Errors on Your Credit Report

Errors on your credit report can have a detrimental impact on your mortgage FICO score, potentially leading to an inaccurate portrayal of your creditworthiness. It’s essential to thoroughly review your credit report for any discrepancies or inaccuracies and take prompt action to rectify them. By disputing and resolving errors on your credit report, you can safeguard your credit standing and fortify your prospects for securing a favorable mortgage.

To address errors on your credit report, consider the following steps:

- Thoroughly review your credit report: Carefully examine each section of your credit report to identify any inaccuracies, such as erroneous account information, incorrect balances, or unauthorized inquiries.

- Initiate a dispute with the credit bureau: If you uncover any errors, file a dispute with the relevant credit bureau to challenge the inaccurate information. Provide clear and specific details to support your dispute, such as account statements or correspondence with creditors.

- Follow up on the dispute process: Stay engaged in the dispute resolution process and respond promptly to any requests for additional information from the credit bureau. Persistence and thoroughness can expedite the resolution of credit report errors.

- Monitor for updates and corrections: Regularly check your credit report to ensure that the disputed errors have been rectified. Once the inaccuracies are addressed, your mortgage FICO score may reflect the positive adjustments.

By proactively addressing and rectifying errors on your credit report, you can uphold the integrity of your credit profile and bolster your mortgage FICO score. This diligent approach to credit management not only enhances your creditworthiness but also instills confidence in potential mortgage lenders, positioning you as a reliable and responsible borrower.

As we delve deeper into the strategies for optimizing your credit profile and elevating your mortgage FICO score, you’ll gain a comprehensive understanding of the steps you can take to proactively manage and enhance your credit standing. Armed with this knowledge, you’ll be well-equipped to navigate the credit landscape and pursue your homeownership goals with confidence and financial astuteness.

Conclusion

Congratulations on embarking on the journey toward optimizing your mortgage FICO score and enhancing your prospects for securing an advantageous home loan. By gaining a deeper understanding of the factors that shape your credit standing and implementing proactive strategies, you’ve taken significant strides toward achieving your homeownership goals.

Throughout this guide, we’ve explored the pivotal elements that influence your mortgage FICO score, from payment history and credit utilization to the impact of new credit accounts and the importance of addressing errors on your credit report. By comprehensively understanding these factors and their implications, you’ve empowered yourself to navigate the credit landscape with confidence and foresight.

As you continue on your path to homeownership, remember that responsible credit management is an ongoing endeavor. By consistently paying your bills on time, maintaining low credit card balances, and avoiding excessive new credit applications, you can cultivate a credit profile that resonates positively with potential mortgage lenders.

Furthermore, the vigilance in monitoring your credit report and disputing any inaccuracies underscores your commitment to upholding the accuracy and integrity of your credit standing. These proactive measures not only safeguard your mortgage FICO score but also position you as a credible and reliable borrower in the eyes of lenders.

Armed with the insights and strategies presented in this guide, you possess the knowledge and tools to navigate the credit landscape with acumen and determination. Your dedication to optimizing your mortgage FICO score exemplifies your commitment to financial responsibility and paves the way for a successful and rewarding homeownership experience.

As you apply these principles and strategies to elevate your credit standing, remember that the journey toward homeownership is as much about financial empowerment as it is about finding the perfect place to call home. Your diligence and proactive approach to credit management not only enhance your mortgage FICO score but also position you for long-term financial well-being.

With a clear understanding of your mortgage FICO score and the actionable steps to raise and maintain it, you’re poised to embark on this exciting chapter with confidence and resilience. Your dedication to financial prudence and credit optimization sets the stage for realizing your homeownership aspirations and securing a bright and prosperous future.