Finance

How To Improve Cash Flow Forecast

Modified: December 29, 2023

Improve your cash flow forecast with these effective finance strategies to ensure better financial management and optimize your business performance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Cash Flow Forecasting

- Importance of Cash Flow Forecast

- Challenges in Cash Flow Forecasting

- Tips to Improve Cash Flow Forecast Accuracy

- Enhancing Cash Flow Forecasting Techniques

- Utilizing Technology for Cash Flow Forecasting

- Best Practices for Cash Flow Forecasting

- Case Studies: Success Stories in Cash Flow Forecast Improvement

- Conclusion

Introduction

Cash flow forecasting is a crucial aspect of financial management that enables businesses to effectively plan and manage their cash inflows and outflows. It helps in predicting the future financial health of a company and enables timely decision-making to maintain a sustainable cash flow. Cash flow forecasting involves estimating the cash inflows and outflows over a specific period, typically on a monthly or quarterly basis.

Businesses across various industries rely on accurate cash flow forecasts to make informed financial decisions and mitigate financial risks. Whether it’s managing day-to-day expenses, planning for expansion, or anticipating potential cash flow gaps, a well-crafted cash flow forecast gives businesses a clear picture of their financial position and helps them take proactive measures to improve their cash flow.

The importance of cash flow forecasting cannot be overstated. It provides a roadmap for financial success, allowing businesses to identify potential cash shortages or surpluses in advance and take actions accordingly. By understanding their cash position, businesses can ensure they have enough funds to cover operating expenses, meet payment obligations, invest in growth opportunities, and handle unforeseen financial emergencies.

However, cash flow forecasting is not without its challenges. Businesses often struggle with inaccurate forecasts, leading to poor financial planning and decision-making. Factors such as volatile market conditions, unpredictable customer behavior, delayed payments, and changing economic scenarios can make cash flow forecasting a complex task.

Fortunately, there are several strategies and techniques that businesses can employ to improve the accuracy of their cash flow forecasts. By understanding these challenges and implementing best practices, businesses can optimize their cash flow forecasting processes and take control of their financial future.

Understanding Cash Flow Forecasting

Cash flow forecasting is the process of estimating and projecting the future cash inflows and outflows of a business. It provides a detailed analysis of the expected cash movements within a specific time period, which is typically a month, quarter, or year. By understanding the patterns and trends in cash flow, businesses can make informed decisions about their financial operations.

Cash flow forecasting involves categorizing cash inflows and outflows into different components. Cash inflows typically include revenue from sales, loans, investments, and other sources. On the other hand, cash outflows encompass expenses such as operating costs, salaries, rent, utilities, loan repayments, and taxes.

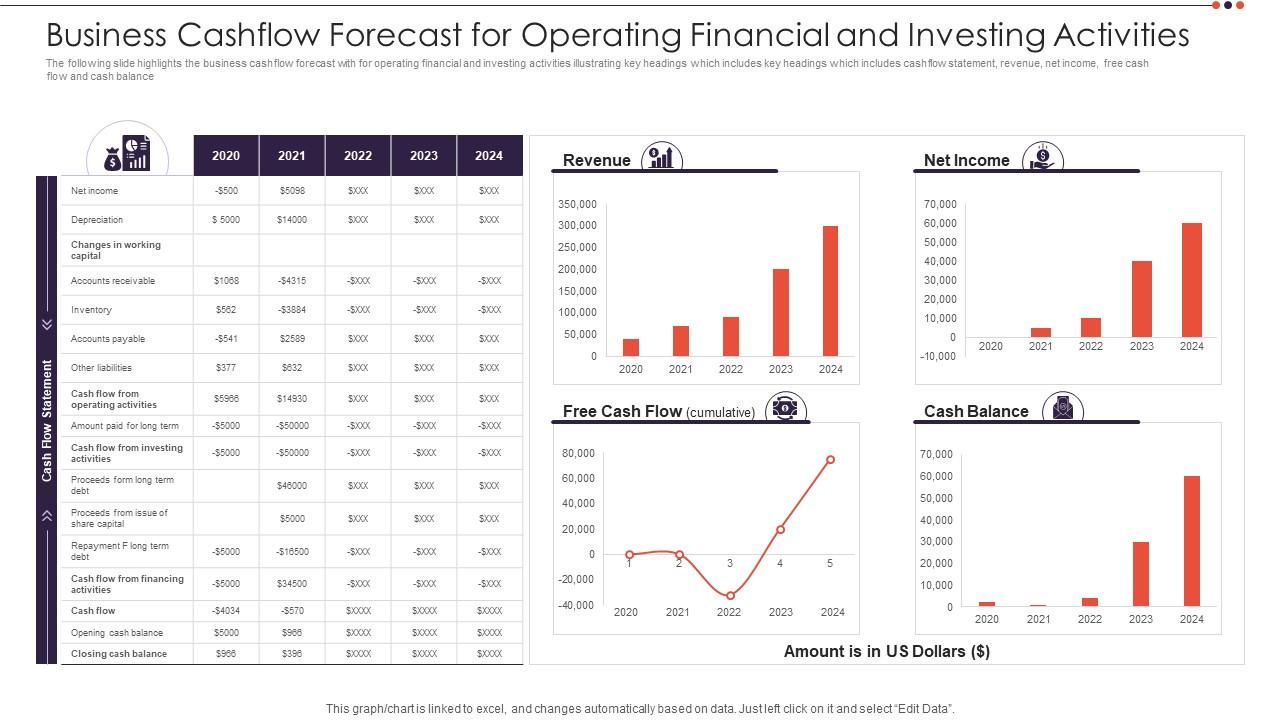

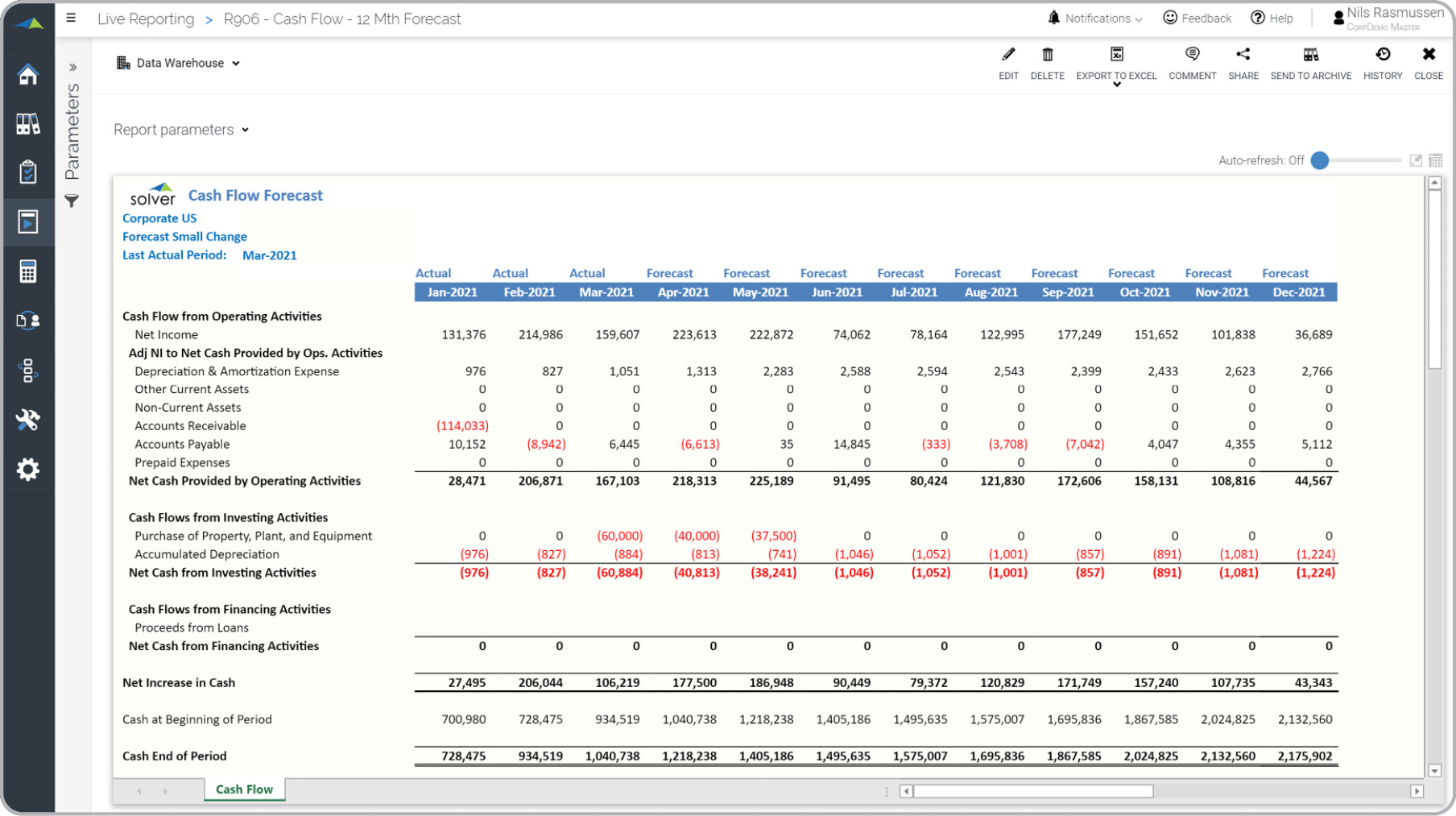

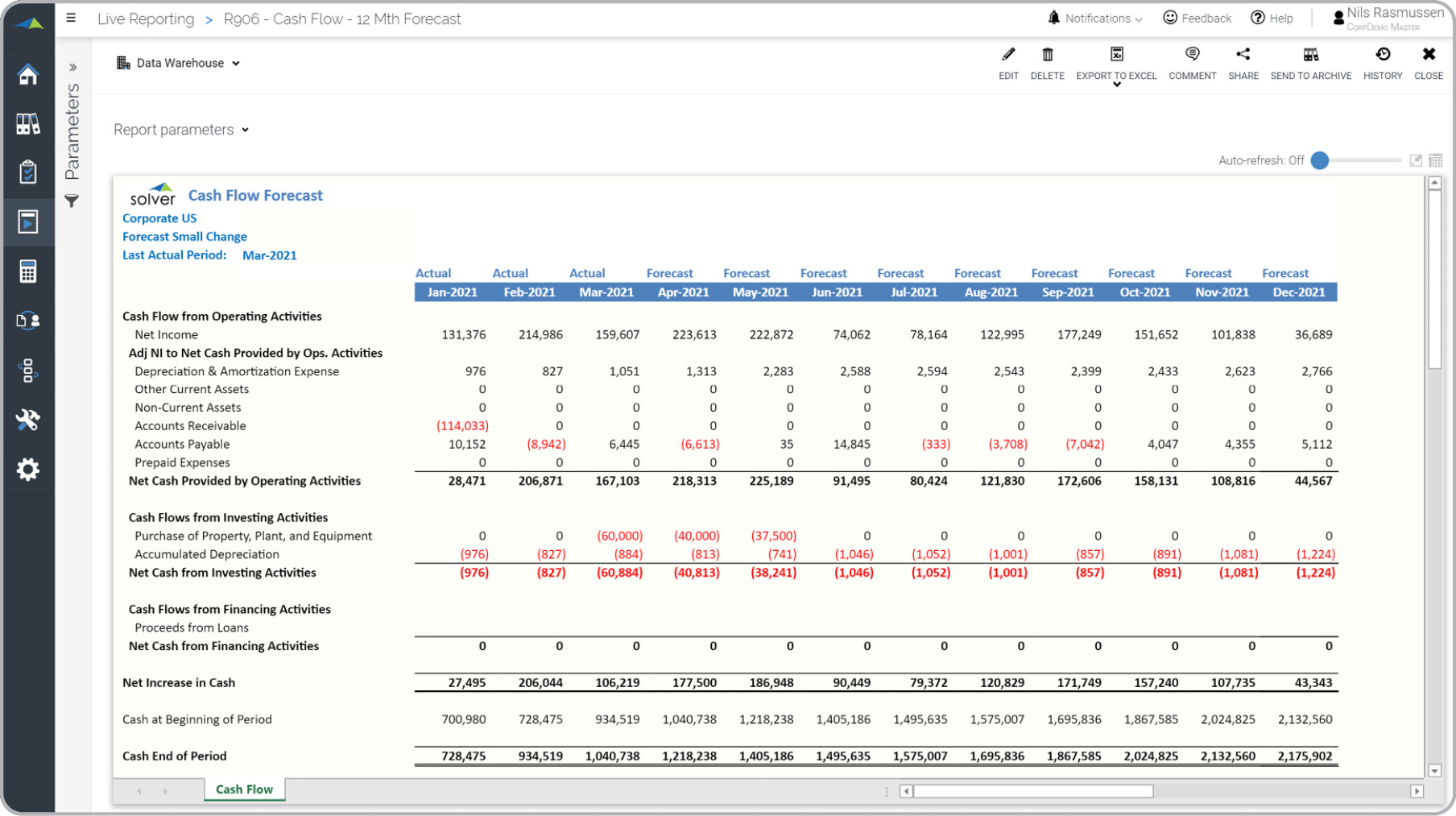

One of the key components of cash flow forecasting is the distinction between cash flow from operations, investing activities, and financing activities. Cash flow from operations refers to the cash generated or consumed by a company’s core business activities, such as sales and expenses. Cash flow from investing activities includes cash flows associated with the purchase or sale of assets, investments, and other capital expenditures. Financing activities consist of cash flows related to financing the business, such as borrowing, repaying loans, issuing or repurchasing stocks, and paying dividends.

By tracking these different categories of cash flows, businesses can gain insights into the sources and uses of their cash. This understanding allows them to identify potential cash flow challenges, make informed decisions on capital allocation, and plan for future financial needs.

There are two main types of cash flow forecasts: short-term and long-term. Short-term cash flow forecasts cover a specific time period, usually up to 12 months, and focus on near-term cash movements. These forecasts help businesses manage their immediate cash needs, maintain liquidity, and make short-term financial decisions. Long-term cash flow forecasts, on the other hand, extend beyond a year and provide a broader view of a business’s financial outlook. These forecasts are useful for strategic planning, investment decisions, and assessing long-term financial viability.

Overall, cash flow forecasting is an essential tool for businesses to manage their financial health. It offers valuable insights into the timing and magnitude of cash inflows and outflows, allowing businesses to optimize their cash management strategies and ensure long-term sustainability.

Importance of Cash Flow Forecast

Cash flow forecasting plays a vital role in the financial management of businesses. It offers several key benefits and helps businesses make informed decisions about their financial operations. Here are some of the reasons why cash flow forecasting is crucial:

- Financial Planning: Cash flow forecasts provide businesses with a clear understanding of their future cash position. By projecting cash inflows and outflows, businesses can plan their expenses, allocate resources, and set realistic financial goals. This enables them to create effective budgets, make strategic investments, and ensure they have sufficient funds to meet their financial obligations.

- Decision Making: Accurate cash flow forecasts enable businesses to make well-informed decisions. It helps them determine the feasibility of new projects, assess the impact of business decisions on cash flow, and evaluate investment opportunities. With a clear understanding of their cash position, businesses can make timely and informed decisions that align with their financial goals.

- Liquidity Management: Cash flow forecasting allows businesses to manage their liquidity effectively. By anticipating future cash surpluses or shortages, businesses can take proactive measures to address cash flow gaps. This may involve securing additional funding, adjusting payment terms, or optimizing cash collection processes. By maintaining adequate liquidity, businesses can avoid financial crises, ensure smooth operations, and take advantage of growth opportunities.

- Debt and Finance Management: Cash flow forecasts assist businesses in managing their debts and financing activities. By understanding their future cash flow, businesses can arrange timely repayment of loans, negotiate favorable terms with lenders, and evaluate the impact of debt financing on their cash position. It helps in optimizing the mix of equity and debt and ensures that businesses have enough cash to meet their financial obligations.

- Risk Mitigation: Cash flow forecasting helps businesses identify potential financial risks and take steps to mitigate them. By tracking cash flow patterns, businesses can identify areas where cash outflows may exceed inflows, allowing them to implement risk management strategies such as cost-cutting measures, renegotiating contracts, or diversifying revenue sources. It helps in minimizing financial uncertainties and maintaining stability in an ever-changing business environment.

In summary, cash flow forecasting is an essential tool for businesses to effectively manage their finances. It provides valuable insights into the company’s financial health, guides decision-making processes, helps in liquidity management, and enables businesses to mitigate financial risks. By incorporating cash flow forecasting into their financial management practices, businesses can improve their financial stability, sustain growth, and enhance their long-term success.

Challenges in Cash Flow Forecasting

While cash flow forecasting is a valuable tool for businesses, it is not without its challenges. Several factors can make accurate cash flow forecasting a complex task. Here are some of the common challenges businesses face when creating cash flow forecasts:

- Uncertain Market Conditions: Market volatility and uncertainty can significantly impact cash flow forecasting. Fluctuations in customer demand, changes in market conditions, and unpredictable economic factors can make it challenging to accurately predict cash inflows and outflows. Businesses need to stay updated with market trends and adjust their forecasts accordingly.

- Delayed Payments: Late payments from customers can disrupt cash flow forecasts. When customers fail to make timely payments, it can create cash flow gaps and affect cash flow projections. Businesses should implement effective credit management strategies, such as setting strict payment terms and following up on outstanding invoices, to minimize the impact of delayed payments.

- Seasonality and Cyclical Nature of Business: For businesses with seasonal or cyclical sales patterns, accurately forecasting cash flow becomes more challenging. Fluctuations in demand and revenue throughout the year make it difficult to project cash inflows and outflows accurately. Businesses need to consider historical data, sales trends, and industry-specific factors to develop accurate seasonal cash flow forecasts.

- Changing Business Dynamics: As businesses grow and evolve, their cash flow dynamics can change. Expanding into new markets, introducing new products or services, or undergoing organizational changes can impact cash flow patterns. It is important for businesses to regularly revisit and adjust their cash flow forecasts to reflect these changing dynamics.

- Inaccurate Data: Cash flow forecasting relies on accurate and up-to-date financial data. Inaccurate or incomplete data can lead to flawed forecasts. It is crucial for businesses to maintain accurate financial records and implement robust systems to capture and analyze financial data effectively.

- Lack of Visibility: Limited visibility into future cash flow can hinder the accuracy of cash flow forecasts. For businesses with a diverse array of revenue sources, tracking and predicting cash flow from each source can be challenging. Implementing effective cash flow monitoring tools and utilizing comprehensive financial management systems can improve visibility and enhance forecast accuracy.

Overcoming these challenges requires businesses to adopt effective strategies and best practices in cash flow forecasting. By leveraging technology, integrating comprehensive financial management systems, and regularly reviewing and adjusting forecasts, businesses can improve the accuracy and reliability of their cash flow projections.

Tips to Improve Cash Flow Forecast Accuracy

Accurate cash flow forecasting is essential for effective financial management. It enables businesses to make informed decisions, plan for the future, and maintain a healthy cash flow. Here are some tips to improve the accuracy of your cash flow forecasts:

- 1. Use Historical Data: Analyze past cash flow data to identify patterns, trends, and seasonality. This historical data can serve as a valuable reference point for creating more accurate forecasts.

- 2. Segment Cash Flow: Categorize cash inflows and outflows into specific segments, such as operating activities, investing activities, and financing activities. By tracking each segment separately, you can gain deeper insights into the sources and uses of cash.

- 3. Consider Multiple Scenarios: Cash flow forecasts should not be based on single scenarios. Instead, consider multiple possible outcomes and create forecasts for each scenario. This will help you understand the potential variations in cash flow and prepare for different outcomes.

- 4. Incorporate Key Drivers: Identify the key drivers that impact your cash flow, such as sales volumes, payment terms, and inventory levels. By understanding and monitoring these drivers, you can make more accurate projections of cash inflows and outflows.

- 5. Involve Cross-Functional Teams: Cash flow forecasting is not solely the responsibility of the finance department. Involve individuals from sales, operations, and procurement to gather input and insights on cash flow trends, customer behavior, and upcoming expenses.

- 6. Regularly Update Forecasts: Cash flow forecasts should not be a one-time exercise. Update your forecasts regularly as new information becomes available. This could include changes in customer orders, payment delays, or new business opportunities.

- 7. Evaluate Working Capital: Assess your working capital management and its impact on cash flow. Optimize inventory levels, negotiate favorable payment terms with suppliers, and implement effective credit management practices to improve cash flow.

- 8. Monitor Cash Flow in Real Time: Implement a real-time cash flow monitoring system to track your cash flow on a daily or weekly basis. This will allow you to spot any deviations from your forecasts quickly and take immediate corrective actions.

- 9. Review and Analyze Variances: Regularly review the variance between your actual cash flow and forecasted cash flow. Analyze the reasons for any discrepancies and adjust your future forecasts accordingly.

- 10. Seek Professional Advice: If cash flow forecasting is a complex task for your business, consider seeking assistance from financial experts or consultants who specialize in cash flow management. Their expertise can help you improve the accuracy and reliability of your cash flow forecasts.

By implementing these tips, you can enhance the accuracy of your cash flow forecasts, make more informed financial decisions, and ensure the long-term financial stability of your business.

Enhancing Cash Flow Forecasting Techniques

As cash flow forecasting is a critical aspect of financial management, businesses are continually striving to enhance their forecasting techniques. By adopting advanced methodologies and leveraging technology, businesses can improve the accuracy and reliability of their cash flow forecasts. Here are some techniques to enhance cash flow forecasting:

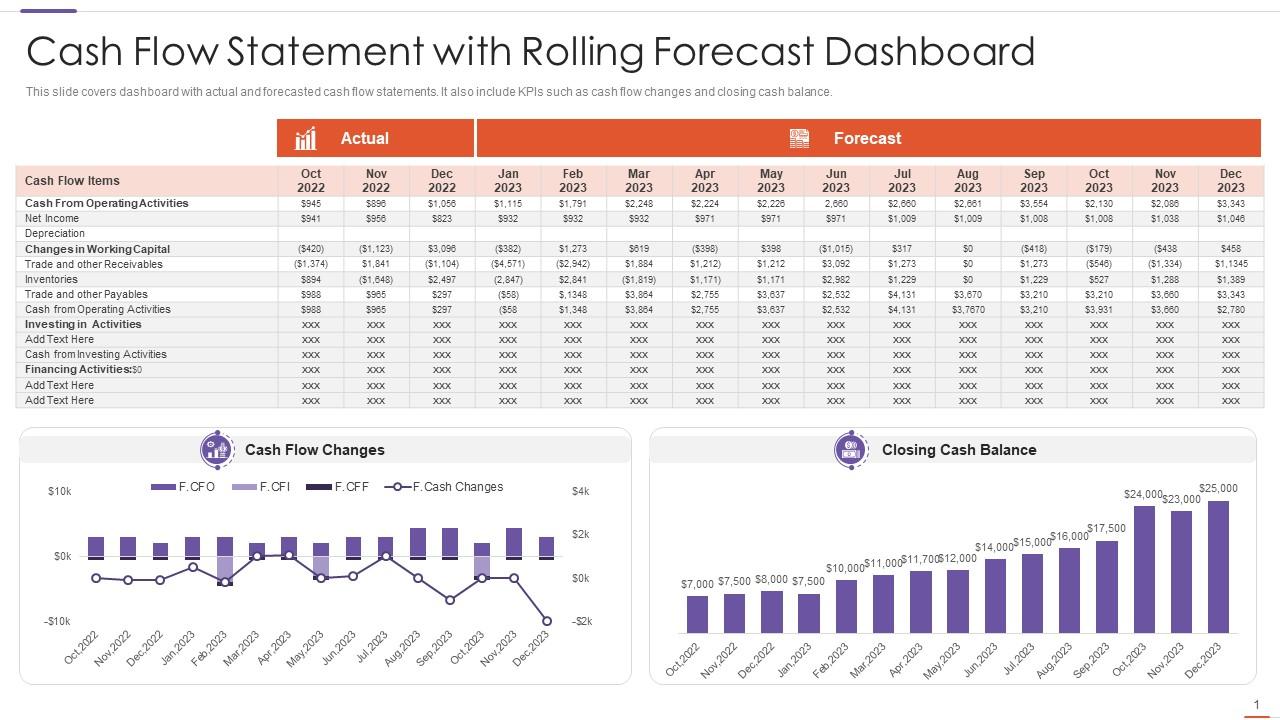

- 1. Rolling Cash Flow Forecasts: Instead of creating one-time forecasts, adopt a rolling forecast approach. This involves regularly updating your cash flow forecast by extending the forecast period and incorporating actual data as it becomes available. Rolling forecasts provide a more dynamic and accurate view of future cash flow.

- 2. Cash Flow Sensitivity Analysis: Perform sensitivity analysis to assess the impact of various factors on cash flow. Identify the drivers that have the most significant influence on your cash flow and evaluate different scenarios. By understanding the sensitivity of cash flow to changes in variables like sales, expenses, or payment terms, you can make more informed decisions.

- 3. Statistical Models: Utilize statistical models to analyze historical cash flow data and generate forecasts. Time-series analysis, regression analysis, and other statistical techniques can help identify patterns, trends, and seasonality in your cash flow data, enabling more accurate projections.

- 4. Cash Flow Waterfall Analysis: Apply the cash flow waterfall concept to track and analyze the movement of cash within your organization. By categorizing cash inflows and outflows into different stages, from operating activities to investing and financing activities, you can gain a comprehensive understanding of your cash flow and identify potential bottlenecks or areas for improvement.

- 5. Scenario Planning: Develop multiple scenarios to assess the potential impact of different business situations on your cash flow. Consider best-case, worst-case, and moderate-case scenarios and evaluate the cash flow implications of each. This approach helps in risk assessment and enables proactive decision-making.

- 6. Benchmarking: Compare your cash flow performance against industry benchmarks and peer organizations. Analyze the differences and identify areas of improvement. Benchmarking provides insights into industry best practices and can help you set realistic targets for your cash flow performance.

- 7. Collaboration with Stakeholders: Involve various stakeholders, such as sales teams, procurement departments, and finance professionals, in the cash flow forecasting process. Collaborating with different departments enhances the accuracy of forecasts by incorporating valuable insights from individuals with a deeper understanding of the business’s operations.

- 8. Integrated Financial Systems: Implement integrated financial management systems that streamline data collection, analysis, and reporting processes. Automated systems enhance accuracy, reduce human errors, and provide real-time visibility into your cash flow position.

- 9. Continual Learning and Improvement: Cash flow forecasting is an evolving process. Continually monitor, evaluate, and learn from your cash flow forecasts and their accuracy. Identify areas for improvement and implement corrective measures to enhance forecasting techniques over time.

- 10. Professional Development: Invest in the professional development of your finance team. Training them in cash flow management, forecasting techniques, and financial analysis can greatly enhance their skills and capabilities in generating accurate and reliable cash flow forecasts.

By incorporating these techniques, businesses can elevate their cash flow forecasting practices, enhance the accuracy of their forecasts, and gain valuable insights into their financial position. Improved cash flow forecasting enables better decision-making, ensures financial stability, and ultimately contributes to the long-term success of the business.

Utilizing Technology for Cash Flow Forecasting

Advanced technologies have revolutionized the way businesses approach cash flow forecasting. By leveraging technology tools and software, businesses can enhance the accuracy, efficiency, and timeliness of their forecasting processes. Here are some ways to utilize technology for cash flow forecasting:

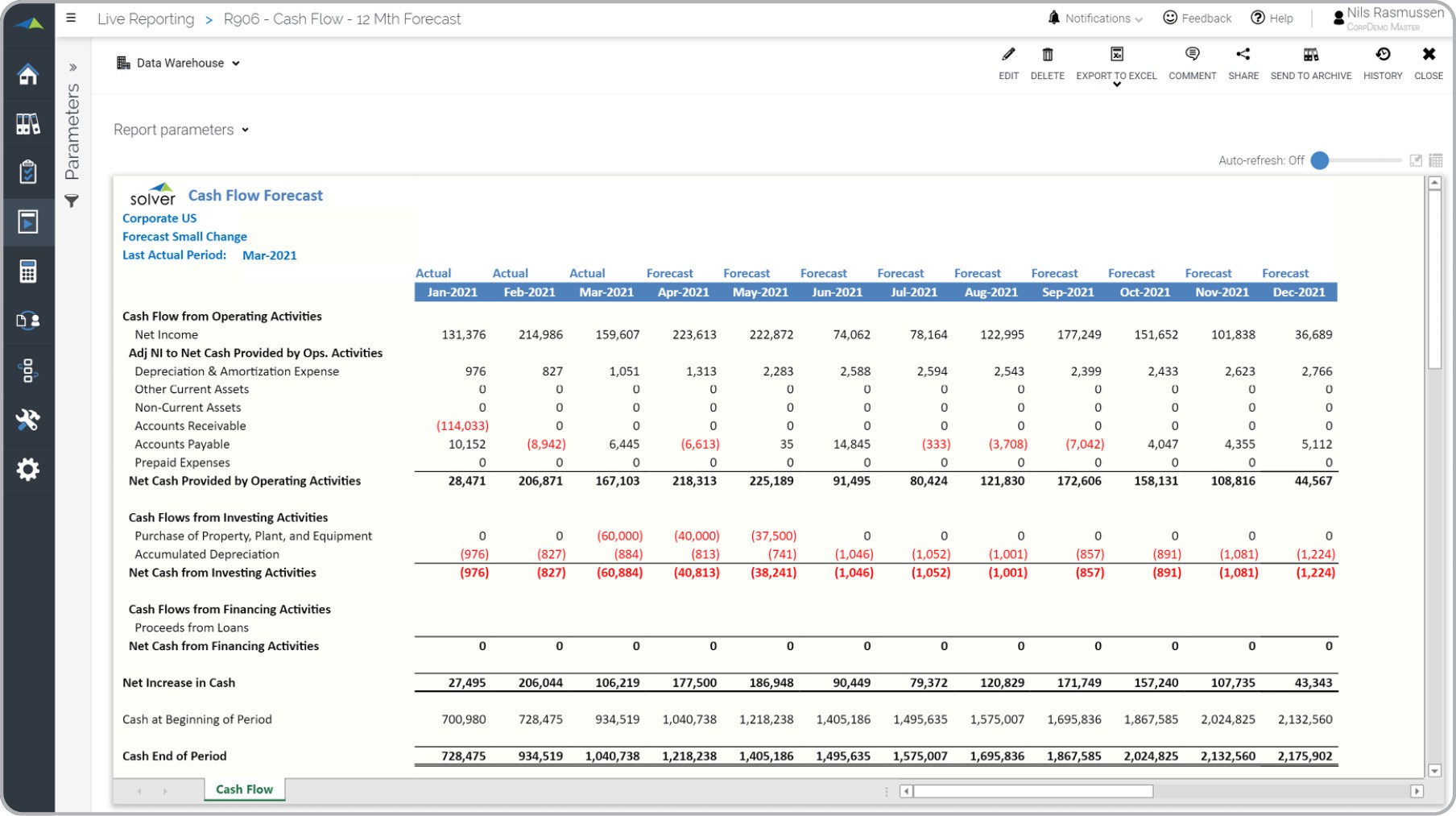

- Automated Cash Flow Management Systems: Implement specialized cash flow management software that automates data collection, analysis, and reporting. These systems can integrate with your accounting and financial systems, allowing for real-time data updates and accurate cash flow calculations.

- Data Visualization Tools: Utilize data visualization tools to present cash flow forecasts in a visually appealing and easy-to-understand format. Graphs, charts, and dashboards provide a clear overview of your cash flow trends, facilitating quick analysis and decision-making.

- Cloud-Based Solutions: Adopt cloud-based platforms for cash flow forecasting. Cloud technology enables secure access to cash flow data from any location, facilitates collaboration among team members, and ensures data accuracy and consistency across the organization.

- Artificial Intelligence (AI) and Machine Learning (ML): Harness the power of AI and ML algorithms for cash flow forecasting. These technologies can analyze large volumes of historical data, identify patterns and anomalies, and improve the accuracy of future cash flow predictions.

- Real-Time Monitoring Tools: Use real-time monitoring tools to track cash flow in real-time and receive alerts for any deviations or unexpected changes. These tools provide immediate visibility into your cash position, allowing for proactive decision-making and timely actions.

- Integration with Banking Systems: Integrate your cash flow forecasting systems with banking platforms to access up-to-the-minute information on cash inflows and outflows. This integration ensures accurate cash flow data and reduces manual data entry errors and delays.

- Scenario Modeling Software: Employ scenario modeling software that allows you to simulate different business scenarios and assess their impact on cash flow. This enables you to evaluate the financial implications of various decisions before implementing them, minimizing risks and optimizing cash flow.

- Data Analytics and Predictive Modeling: Utilize data analytics techniques and predictive modeling to analyze historical financial data, market trends, and external factors impacting cash flow. These tools can provide valuable insights and assist in generating more accurate cash flow forecasts.

- Collaborative Platforms: Use collaborative platforms that facilitate teamwork and communication among different stakeholders involved in cash flow forecasting. These platforms enable seamless collaboration, data sharing, and real-time updates, ensuring everyone has access to the most accurate and up-to-date information.

- Mobile Apps: Leverage mobile apps that allow you to access and manage cash flow forecasts on the go. Mobile apps enable you to monitor cash flow, receive notifications, and make informed decisions even when you are away from the office.

By embracing these technological advancements, businesses can transform their cash flow forecasting processes. Technology enables more accurate data analysis, enhances collaboration, provides real-time insights, and ultimately empowers businesses to make informed financial decisions based on reliable cash flow forecasts.

Best Practices for Cash Flow Forecasting

To ensure accurate and effective cash flow forecasting, businesses should follow best practices that promote financial stability and informed decision-making. Here are some key best practices to consider:

- Regularly Review and Update Forecasts: Cash flow forecasts should be regularly reviewed and updated to reflect the latest information and changes in the business environment. By keeping forecasts current, businesses can respond quickly to potential risks or opportunities.

- Adopt a conservative approach: It is advisable to err on the side of caution when forecasting cash flow. Be conservative in your revenue projections and factor in any potential delays or uncertainties in collecting payments.

- Include a Cash Buffer: Build in a cash buffer in your forecasts to account for unexpected expenses, delays in payments, or unforeseen market disruptions. This buffer will help mitigate potential cash flow challenges and provide a safety net for your business.

- Monitor and Manage Working Capital: Keep a close eye on your working capital components, such as inventory levels, receivables, and payables. Optimize your working capital management to ensure a healthy cash flow position.

- Engage in Cash Flow Analysis: Regularly analyze your actual cash flow against your forecasted cash flow to identify variances and patterns. Evaluate the reasons for deviations and adjust your forecasts and business strategies accordingly.

- Collaboration and Communication: Foster collaboration and open communication between finance teams and other departmental stakeholders. Regularly engage with sales, procurement, and operations teams to gather insights and validate assumptions for more accurate forecasts.

- Consider Seasonality: Factor in seasonality and cyclical trends when creating cash flow forecasts. Understand how your cash flow is impacted during different times of the year and make adjustments accordingly.

- Utilize Multiple Data Sources: Incorporate data from various sources, such as historical financial records, customer data, industry benchmarks, and market information, to enhance the accuracy and reliability of your cash flow forecasts.

- Team Training and Development: Invest in the training and development of your finance team to enhance their cash flow forecasting skills. Continuous learning and staying updated with industry best practices will improve the quality of your forecasts.

- Monitor Cash Flow in Real-Time: Implement real-time cash flow monitoring systems to closely track your cash inflows and outflows. Real-time monitoring helps identify potential cash flow issues and allows for timely action.

Adhering to these best practices will not only improve the accuracy and reliability of your cash flow forecasts but also empower your business with valuable insights into your financial health. By effectively managing cash flow, businesses can make informed decisions, plan for the future, and maintain a strong financial position.

Case Studies: Success Stories in Cash Flow Forecast Improvement

Examining real-world examples of businesses that have successfully improved their cash flow forecasting can provide valuable insights and inspiration. Here are a few case studies highlighting successful cash flow forecast improvement:

Case Study 1: Company A – Retail Industry

Company A, a retail business, experienced cash flow challenges due to inconsistent sales and insufficient inventory management. By implementing more robust cash flow forecasting techniques, including historical data analysis and scenario planning, Company A gained a deeper understanding of their cash flow patterns. They identified the seasonal trends in their sales and adjusted their inventory management accordingly to ensure sufficient stock levels during peak periods. Additionally, they optimized their payment terms and credit management practices to improve cash inflows. As a result, Company A achieved more accurate forecasts, reduced cash flow gaps, and maintained a healthier cash position throughout the year.

Case Study 2: Company B – Manufacturing Industry

Company B, a manufacturing company, struggled with unpredictable cash flow due to lengthy production cycles and delayed customer payments. They adopted technology solutions, including cloud-based cash flow management software, to streamline their forecasting processes. By integrating the software with their ERP system and banking platforms, Company B gained real-time visibility into cash inflows and outflows. They utilized AI and ML algorithms to analyze historical data and predict customer payment behavior, enabling more accurate forecasts of cash receipts. Additionally, they implemented tighter credit control measures and negotiated better payment terms with their suppliers. These initiatives improved cash flow visibility, reduced the cash conversion cycle, and facilitated better decision-making for Company B.

Case Study 3: Company C – Service Industry

Company C, a service-based business, faced challenges in forecasting cash flow due to the variable nature of their project-based revenue. They implemented a rolling forecast approach, updating their cash flow projections on a monthly basis. To enhance accuracy, Company C collaborated closely with project managers and sales teams to gather detailed information on upcoming projects and client contracts. They analyzed historical project data to identify patterns and improve their revenue forecasting capabilities. Additionally, Company C focused on building strong client relationships and negotiating payment terms that aligned with project milestones. These initiatives helped Company C achieve more accurate cash flow forecasts, maintain a healthy cash position, and plan for resource allocation effectively.

These case studies demonstrate how businesses from various industries have successfully improved their cash flow forecasting practices. By leveraging techniques such as historical data analysis, technology adoption, collaborative approaches, and scenario planning, these companies were able to gain better visibility into their cash flow, make informed financial decisions, and maintain a strong financial position.

Conclusion

Cash flow forecasting is a critical component of financial management for businesses across industries. Accurate and reliable cash flow forecasts enable organizations to make informed decisions, plan for the future, and maintain a healthy cash position. By understanding the challenges involved and implementing best practices and techniques, businesses can enhance the accuracy and effectiveness of their cash flow forecasts.

Through this article, we have explored the importance of cash flow forecasting, the challenges businesses face, and the strategies that can be employed to improve the accuracy of cash flow forecasts. We have discussed the utilization of technology, such as automated cash flow management systems, data visualization tools, AI and ML algorithms, and collaborative platforms, to enhance forecasting processes.

We have also highlighted the significance of best practices, including regular reviews and updates of forecasts, a conservative approach, monitoring working capital, engaging in cash flow analysis, and collaboration among finance teams and other stakeholders. Moreover, we have examined success stories of companies that have successfully improved their cash flow forecasting techniques.

By following these recommendations and continuously refining cash flow forecasting processes, businesses can gain greater control over their financial future. Accurate cash flow forecasts enable better financial planning, informed decision-making, effective risk management, and improved strategic allocation of resources.

In conclusion, cash flow forecasting is not just a financial exercise; it is a crucial tool for businesses to navigate the complexities of the financial landscape with foresight and confidence. By incorporating the best practices, embracing technology, and learning from successful case studies, businesses can optimize their cash flow forecasting capabilities and position themselves for long-term financial stability and success.