Finance

What Is A Cash Flow Forecast

Published: December 21, 2023

Learn the importance of cash flow forecasting in finance and how it can help businesses plan for the future and make informed financial decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Cash Flow Forecast

- Purpose of Cash Flow Forecast

- Benefits of Cash Flow Forecasting

- Components of Cash Flow Forecast

- Importance of Accurate Cash Flow Forecasting

- Steps to Create a Cash Flow Forecast

- Factors to Consider in Cash Flow Forecasting

- Common Mistakes to Avoid in Cash Flow Forecasting

- Conclusion

Introduction

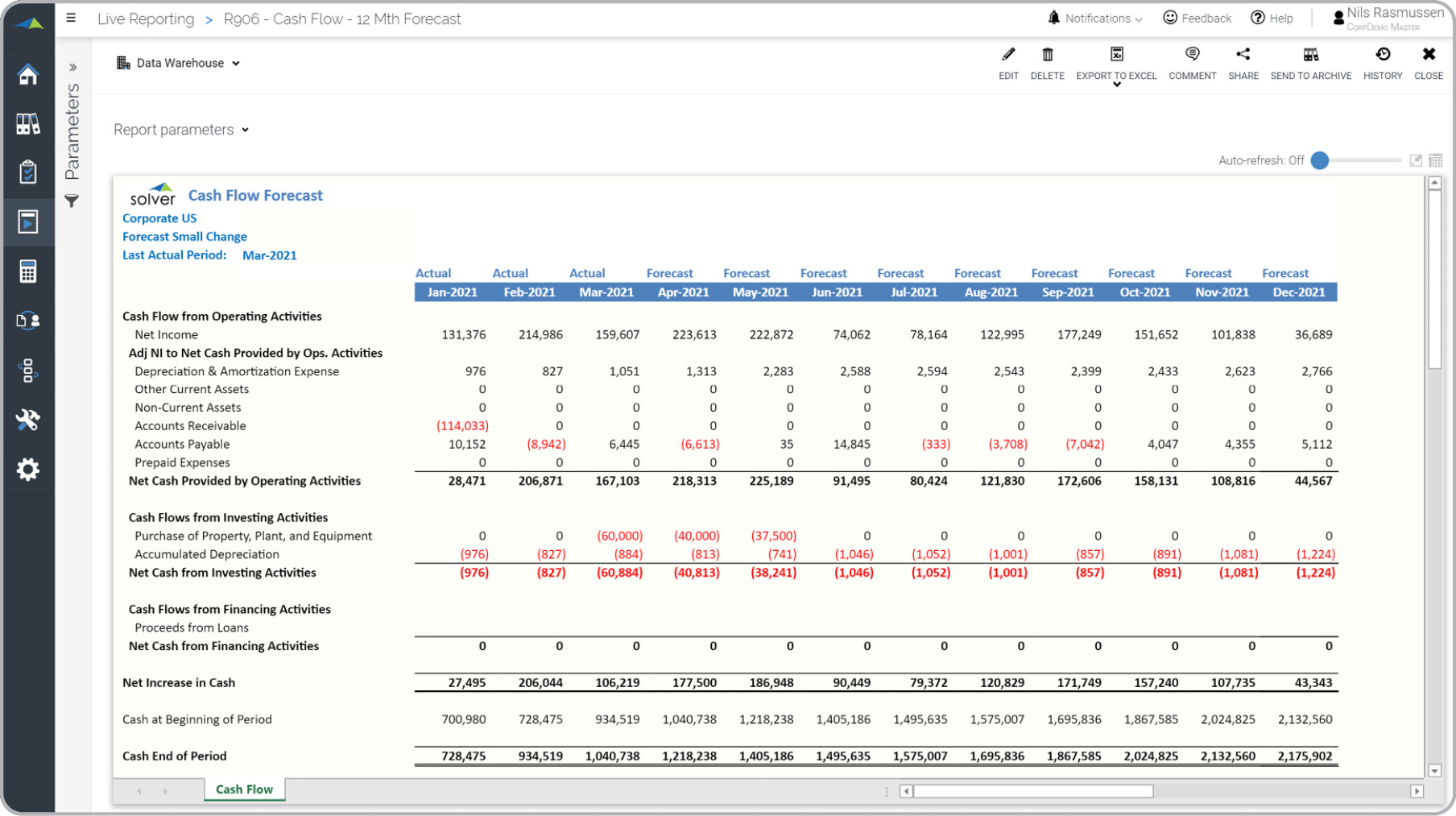

Managing finances is a crucial aspect of running a successful business. One key element of financial management is understanding and projecting cash flow. Cash flow forecasting provides businesses with valuable insights into their financial health, enabling them to make informed decisions and plan for the future.

A cash flow forecast is an estimation of the inflows and outflows of cash over a specific period, usually a month, a quarter, or a year. It helps businesses anticipate their future cash position, identifying potential cash gaps or surpluses. By analyzing this data, businesses can take proactive measures to address any financial challenges and optimize overall cash flow management.

The primary purpose of a cash flow forecast is to provide businesses with a clear picture of their projected cash flow. It allows them to assess their liquidity position, plan for upcoming expenses, and ensure they have enough cash on hand to cover operational costs, investments, and debt obligations.

Moreover, a cash flow forecast provides critical insights into a business’s ability to meet its short-term financial obligations and make informed decisions about expanding operations, investing in new initiatives, or seeking external financing. It is an essential tool for entrepreneurs, financial managers, and investors alike.

By accurately forecasting cash flow, businesses can anticipate and manage potential cash flow shortfalls or surpluses. This not only helps them maintain financial stability but also enables proactive decision-making and strategic planning. Cash flow forecasting allows businesses to forecast the impact of different scenarios, such as changes in sales volumes, payment delays, or fluctuations in expenses.

Overall, a cash flow forecast provides businesses with valuable insights and enables them to address potential financial challenges, make informed decisions, and plan for the future effectively. In the following sections, we will explore the benefits of cash flow forecasting, the key components of a cash flow forecast, steps to create one, factors to consider, and common mistakes to avoid.

Definition of Cash Flow Forecast

A cash flow forecast is a financial management tool that predicts the future cash inflows and outflows of a business over a specific period. It provides a detailed estimation of the timing and amount of cash that is expected to come into and go out of the company. By forecasting cash flow, businesses can plan and allocate their resources effectively, ensuring they have enough liquidity to meet their financial obligations.

Cash flow forecasts take into account various sources of cash inflow, including revenue from sales, loans, investments, and any other sources of income. On the other hand, cash outflows consist of expenses like payroll, rent, utilities, inventory purchases, loan repayments, and any other outgoing payments. By analyzing these expected cash flows, businesses can assess their financial health, manage their working capital, and make well-informed decisions about their future operations.

It’s important to note that a cash flow forecast is different from a profit and loss statement (P&L) or an income statement. While a P&L statement shows the profitability of a business over a specific period, a cash flow forecast focuses on actual cash inflows and outflows. This distinction is essential because a business can be profitable on paper but still face cash flow challenges due to delayed payments, high inventory levels, or significant capital investments.

A cash flow forecast typically spans a specific time frame, such as a month, a quarter, or a year, and is often created on a rolling basis. This means that businesses update their forecasts regularly as new information becomes available or as circumstances change. By doing this, businesses can refine their financial projections, adapt to emerging trends, and ensure that their cash flow management remains accurate and in line with their goals and objectives.

Overall, a cash flow forecast is a vital tool for businesses of all sizes and industries. It provides a clear and concise overview of a company’s expected cash position and helps business owners, financial managers, and stakeholders make informed decisions to ensure the financial stability and success of the organization.

Purpose of Cash Flow Forecast

The purpose of a cash flow forecast is to provide businesses with a comprehensive understanding of their projected cash inflows and outflows. It serves several crucial purposes that are instrumental in effective financial management and decision-making.

One of the primary purposes of a cash flow forecast is to help businesses assess their liquidity position. By projecting future cash flows, businesses can identify potential cash gaps or surpluses, which allows them to take proactive measures to manage their cash flow effectively. This information is essential for day-to-day operations, as it ensures that there is enough cash on hand to cover operating expenses, pay employees, and meet other short-term financial obligations.

Furthermore, a cash flow forecast assists businesses in planning for upcoming expenses and capital investments. By forecasting their cash flow, businesses can identify periods of higher cash outflows and plan accordingly. This can include arranging external financing, prioritizing expenses, or adjusting business operations to align with cash availability.

Another purpose of cash flow forecasting is to support strategic decision-making. By having a clear understanding of future cash inflows and outflows, businesses can make informed decisions about expanding operations, investing in new projects, or pursuing growth opportunities. It allows businesses to assess the financial feasibility of new initiatives and determine the impact these decisions will have on their cash flow.

Cash flow forecasts also contribute to effective working capital management. By identifying periods of cash surplus or deficit, businesses can optimize their operations and make adjustments to their cash flow cycle. For example, if a forecast shows an upcoming cash surplus, a business may consider investing those funds to generate additional income. Conversely, if a forecast indicates a cash shortage, a business can explore options for managing working capital, such as negotiating extended payment terms with suppliers or increasing credit facilities.

Additionally, cash flow forecasting plays a vital role in risk management. It helps businesses anticipate and prepare for potential cash flow challenges. By identifying potential cash gaps, businesses can take proactive steps to secure additional financing or implement cost-saving measures to mitigate the impact of negative cash flow events.

In summary, the purpose of a cash flow forecast is multifaceted. It helps businesses assess liquidity, plan for expenses and investments, support strategic decision-making, manage working capital effectively, and mitigate financial risks. By having a clear understanding of their future cash flows, businesses can make informed decisions to ensure their financial stability and growth.

Benefits of Cash Flow Forecasting

Cash flow forecasting offers numerous benefits for businesses of all sizes. By accurately predicting cash inflows and outflows, businesses can gain valuable insights and make informed decisions to ensure financial stability and growth. Here are some of the key benefits of cash flow forecasting:

- Improved financial planning: Cash flow forecasts provide businesses with a clear understanding of their future cash position. This allows them to plan their financial activities, such as budgeting, investing, and borrowing, more effectively. By aligning their cash flow projections with their business goals, businesses can make informed decisions to maximize profitability and minimize financial risks.

- Enhanced working capital management: Cash flow forecasts help businesses optimize their working capital management. By identifying periods of cash surplus or deficit, businesses can take appropriate measures to efficiently allocate their cash resources. They can negotiate better payment terms with suppliers, manage inventory levels more effectively, and ensure timely collections from customers. Effective working capital management improves cash flow efficiency and reduces the need for external financing.

- Better decision-making: Cash flow forecasting provides businesses with the necessary information to make informed decisions. By understanding their projected cash inflows and outflows, businesses can evaluate the financial feasibility of new projects, assess the impact of business decisions on cash flow, and identify areas where cost-saving measures can be implemented. This enables businesses to make strategic decisions that align with their financial objectives.

- Tightened control over cash flow: Cash flow forecasts allow businesses to have better control over their cash flow. By regularly monitoring and comparing actual cash flow against projected cash flow, businesses can quickly identify and address any variances or discrepancies. This helps prevent cash shortages, excessive spending, and other financial pitfalls that could pose a risk to the business’ financial stability.

- Improved financial relationships: Accurate cash flow forecasting enhances a business’ ability to manage its financial relationships. By demonstrating a solid understanding of their cash flow position, businesses can build trust and credibility with lenders, investors, and suppliers. This can lead to more favorable financing terms, increased access to capital, and stronger business partnerships.

In summary, cash flow forecasting offers several benefits that are crucial for the financial success of a business. It enables improved financial planning, enhances working capital management, supports better decision-making, tightens control over cash flow, and improves financial relationships. By leveraging the insights provided by cash flow forecasting, businesses can optimize their cash flow management and ensure sustainable growth.

Components of Cash Flow Forecast

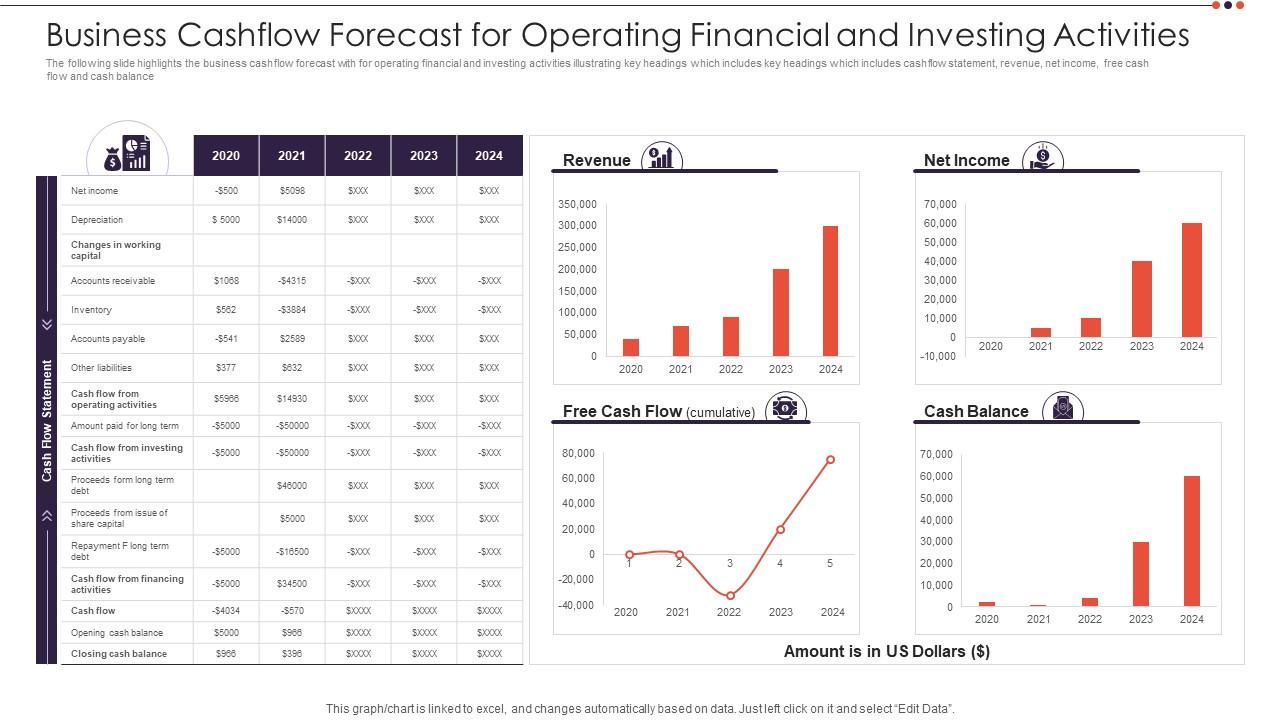

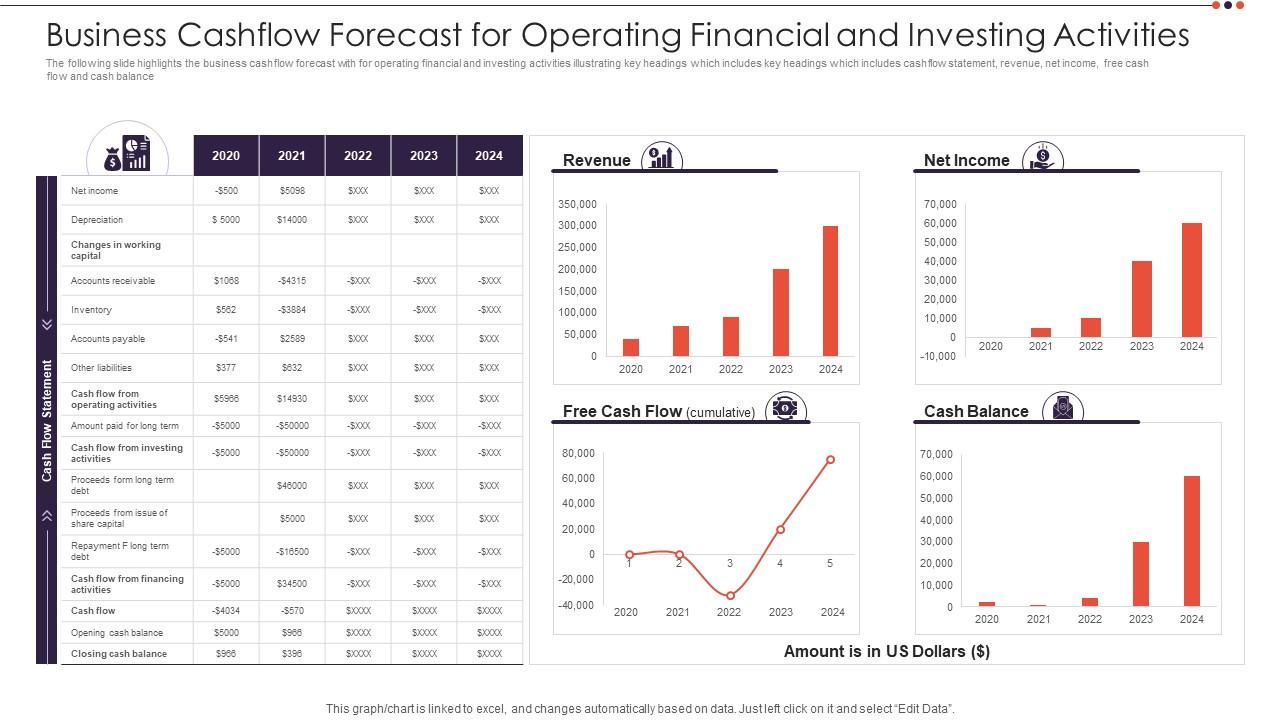

A cash flow forecast is comprised of several key components that provide a comprehensive view of a business’s expected cash inflows and outflows over a specific period. These components help businesses analyze and understand the various factors contributing to their cash flow position. Here are the key components of a cash flow forecast:

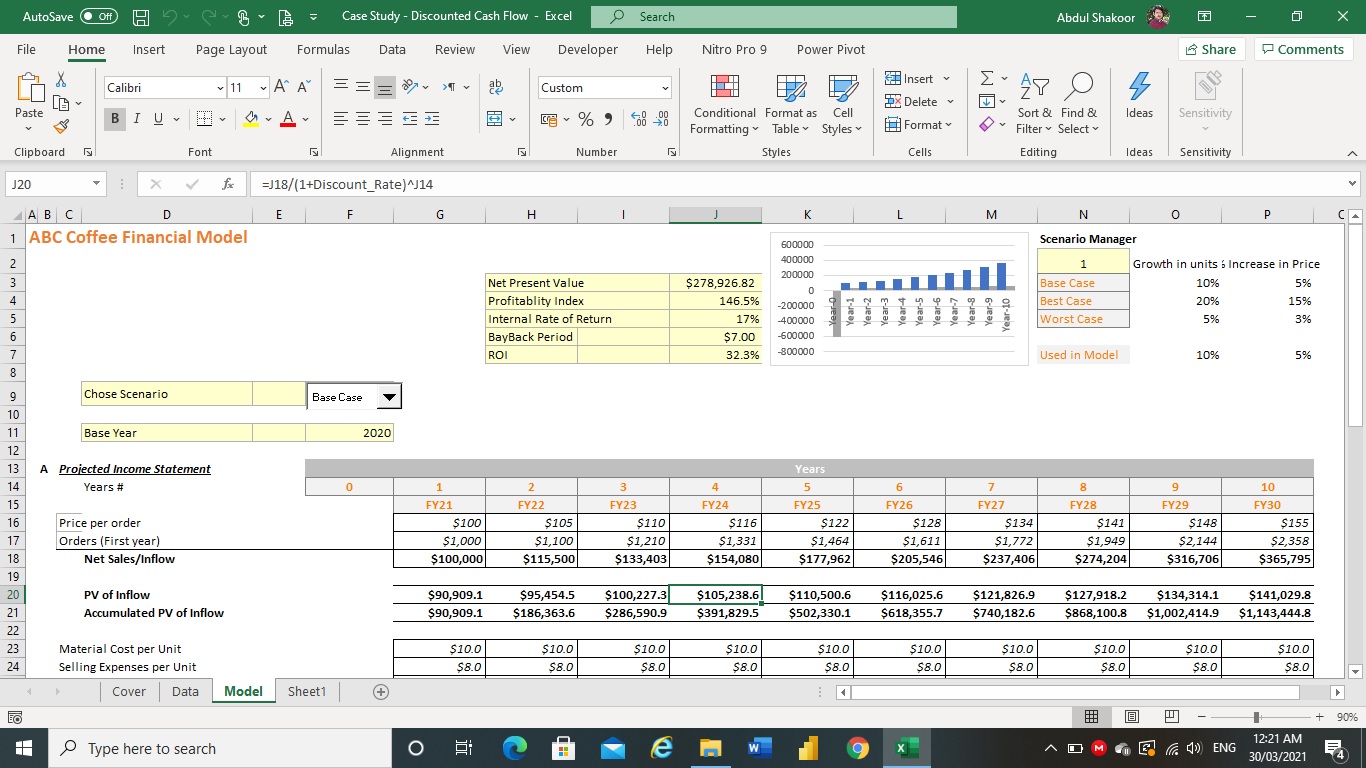

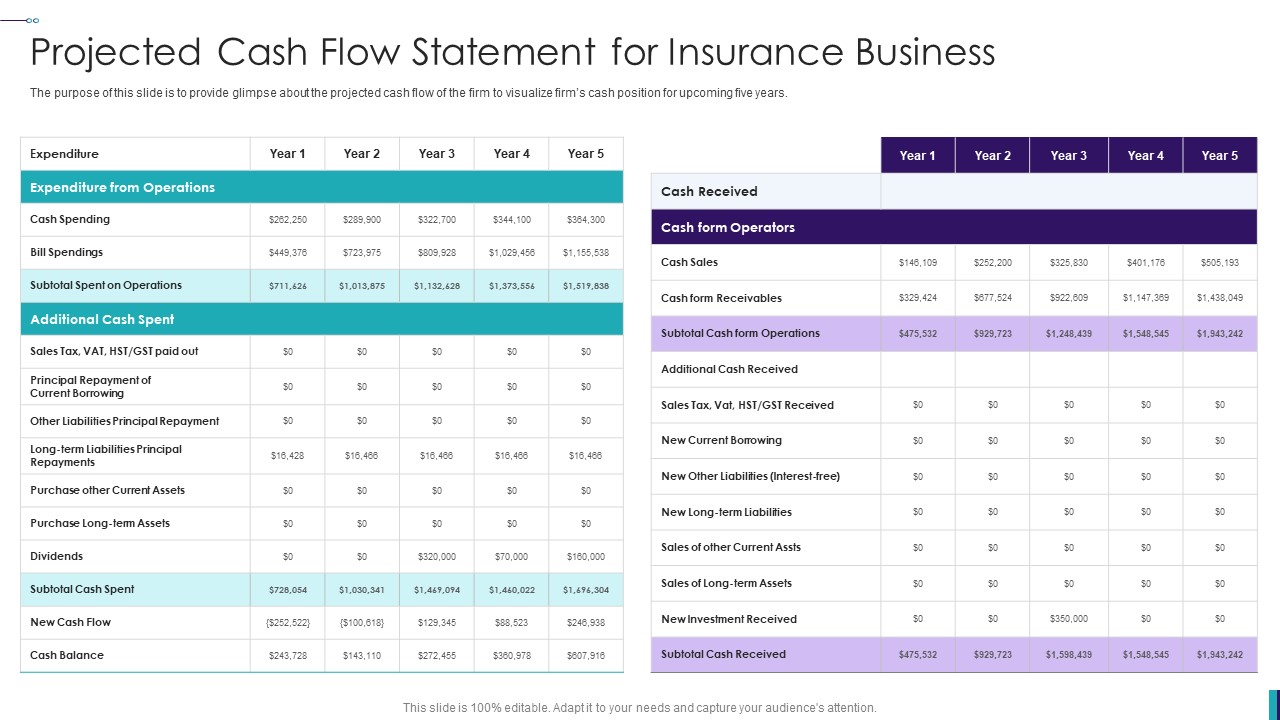

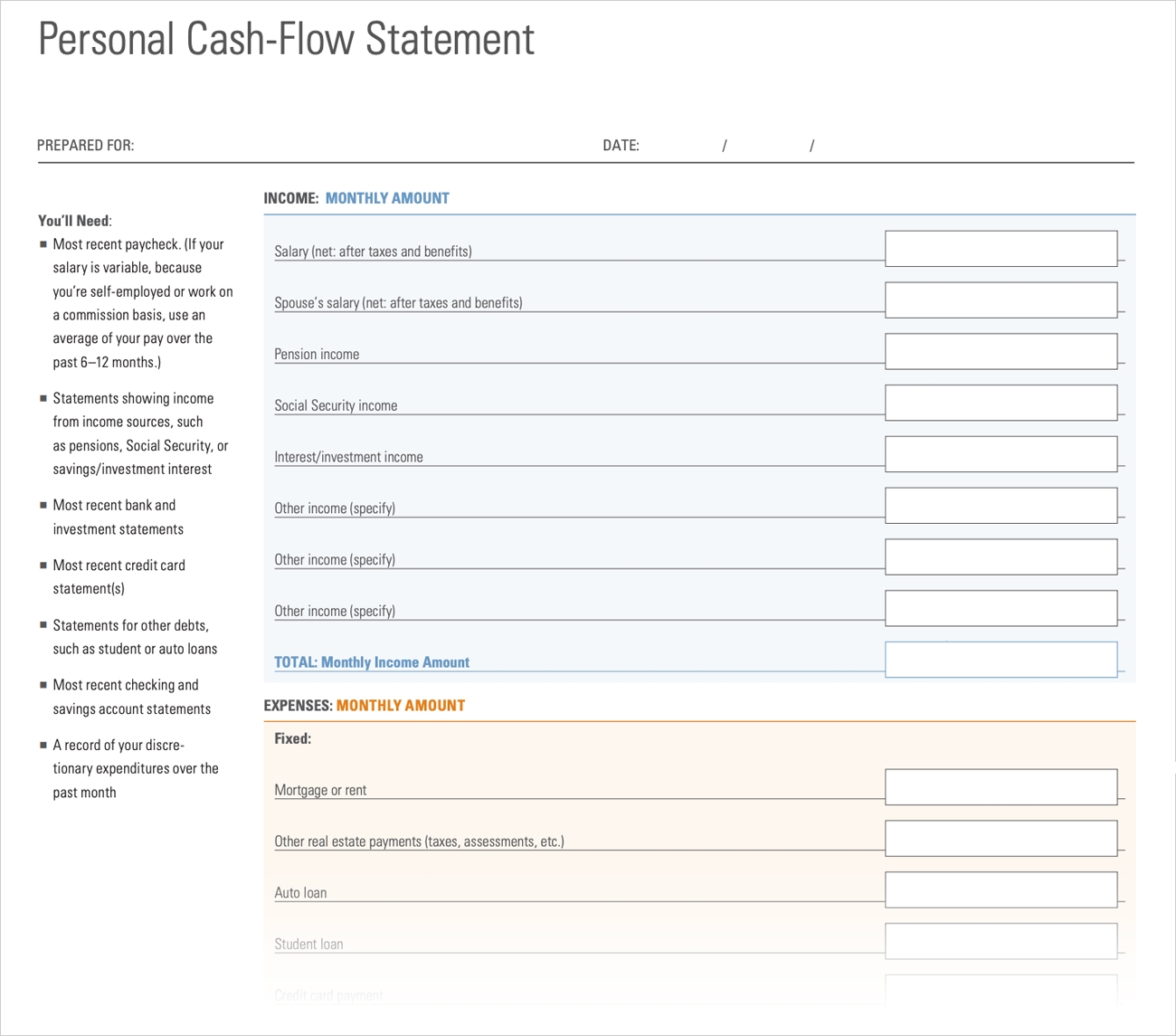

- Inflows: The inflows component of a cash flow forecast represents the expected sources of cash coming into the business. This includes revenue from sales, loans, investments, grants, and any other forms of income. It is essential to accurately project these inflows so that businesses can forecast their available cash resources.

- Outflows: The outflows component of a cash flow forecast represents the expected cash outflows or expenditures for a business. This includes expenses such as payroll, rent, utilities, insurance, inventory purchases, loan repayments, taxes, and other operating costs. Accurately estimating these outflows is crucial for businesses to plan and allocate their cash resources effectively.

- Accounts Receivable: Accounts receivable refers to the funds owed to the business by its customers for goods or services provided on credit. It is important to factor in the timing of collections from customers in the cash flow forecast, as delayed or missed payments can impact a business’s cash flow position.

- Accounts Payable: Accounts payable represents the funds that a business owes to its vendors or suppliers for goods or services received. It is important to include the timing of payments to suppliers in the cash flow forecast to ensure accurate cash flow management and maintain healthy relationships with suppliers.

- Financing Activities: Financing activities involve any cash inflows or outflows related to loans, investments, or equity financing. This component includes payments for loans, issuance of new shares, repayments of debt, or dividends paid to shareholders. Including financing activities helps businesses assess their overall cash flow position and the impact of external financing on their operations.

- One-time or Extraordinary Items: In addition to regular cash flows, businesses should also consider any one-time or extraordinary items that might affect their cash flow. These could include unexpected income or expenditure, such as insurance settlements, legal settlements, or government grants. Including these items helps businesses account for and manage any significant cash flow events.

By including these key components in a cash flow forecast, businesses can gain a comprehensive understanding of their expected cash inflows and outflows. This allows them to effectively plan and manage their cash resources, make informed decisions, and ensure their financial stability and growth.

Importance of Accurate Cash Flow Forecasting

Accurate cash flow forecasting is vital for businesses of all sizes and industries. It provides valuable insights into a company’s financial health and helps businesses make informed decisions to ensure their ongoing operations and growth. Here are some key reasons why accurate cash flow forecasting is important:

- Financial Stability: Accurate cash flow forecasting allows businesses to assess their liquidity position and ensure they have enough cash on hand to meet their immediate financial obligations. It helps businesses avoid cash shortages and ensures they can cover their operating expenses, payroll, and other essential costs. This promotes financial stability, reduces the risk of financial difficulties, and supports the long-term viability of the business.

- Budgeting and Planning: Cash flow forecasting helps businesses develop effective budgets and strategic plans. By accurately projecting their cash inflows and outflows, businesses can allocate their resources efficiently, plan for upcoming expenses, and identify potential cash gaps or surpluses. This enables businesses to make informed decisions about their investments, expansion initiatives, and operational strategies.

- Evaluating Financial Needs: Accurate cash flow forecasting allows businesses to evaluate their financial needs and plan for financing requirements. By understanding their future cash flow, businesses can determine whether they need to secure external financing to cover cash shortages or fund growth opportunities. This information is crucial for approaching lenders or investors and presenting a clear picture of the business’s financial position.

- Navigating Uncertain Times: In uncertain times, such as economic downturns or unexpected events, accurate cash flow forecasting becomes even more critical. It helps businesses assess the potential impact on their cash flow and take preemptive measures to conserve cash or secure additional funding. Accurate forecasting allows businesses to navigate challenges more effectively and adapt their financial strategies to maintain stability and sustainability.

- Relevant Financial Reporting: Accurate cash flow forecasting ensures that businesses have the necessary information for compliance and reporting purposes. It enables businesses to produce accurate financial statements, such as cash flow statements, which are essential in demonstrating financial performance to stakeholders, shareholders, lenders, and regulatory authorities.

- Effective Risk Management: Accurate cash flow forecasting allows businesses to identify and mitigate potential cash flow risks. It helps businesses anticipate and address factors that could impact cash flow, such as customer payment delays, changes in market conditions, or unexpected expenses. By having a clear understanding of their cash flow, businesses can implement risk management strategies to minimize the impact of negative events on their financial stability.

In summary, accurate cash flow forecasting is essential for businesses to maintain financial stability, make informed decisions, evaluate financial needs, navigate uncertain times, meet reporting requirements, and effectively manage risks. By understanding their cash flow position, businesses can proactively manage their finances, ensure ongoing operations, and position themselves for long-term success in a dynamic and competitive business environment.

Steps to Create a Cash Flow Forecast

Creating a cash flow forecast is a systematic process that involves gathering relevant financial information, projecting future cash inflows and outflows, and analyzing the resulting data. Here are the key steps to create a cash flow forecast:

- Gather Financial Information: Start by gathering all relevant financial information, including historical cash flow data, sales and revenue figures, expenses, accounts receivable, accounts payable, and any other financial records. This provides a foundation for projecting future cash flows.

- Estimate Cash Inflows: Forecast your expected cash inflows by considering all sources of revenue, such as sales, loans, investments, grants, and any other forms of income. Project these cash inflows based on historical data, market trends, sales projections, and other relevant factors.

- Forecast Cash Outflows: Estimate your expected cash outflows by analyzing your historical expenses, including payroll, rent, utilities, inventory purchases, loan repayments, taxes, and other operating costs. Consider factors like inflation, changes in market conditions, and any anticipated increases or decreases in expenses.

- Consider Timing: Take into account the timing of cash inflows and outflows. Consider factors such as payment terms with customers, credit terms with suppliers, payroll schedules, and other relevant timing factors. This helps you project the actual timing of cash movements and ensure accuracy in your forecast.

- Factor in Seasonality: If your business experiences seasonal variations in cash flow, adjust your forecast accordingly. Analyze historical data to identify patterns and trends during peak and off-peak seasons. Incorporate these patterns into your forecast to accurately reflect the anticipated cash flows throughout the year.

- Review and Analyze: Once you have projected your cash inflows and outflows, review and analyze the resulting data. Look for potential cash gaps or surpluses, assess your liquidity position, evaluate your ability to cover expenses, and identify areas where you may need to take corrective actions or make adjustments.

- Update and Revise: Cash flow forecasting is an ongoing process, and it’s important to update and revise your forecast regularly. As new information becomes available, update your projections to reflect any changes in your business environment, market conditions, or financial circumstances. This ensures that your forecast remains accurate and aligned with your current reality.

By following these steps, businesses can create a comprehensive and accurate cash flow forecast. This enables them to evaluate their financial position, make informed decisions, and effectively manage their cash flow for sustained success.

Factors to Consider in Cash Flow Forecasting

When creating a cash flow forecast, there are several factors that businesses need to take into consideration to ensure accuracy and reliability. These factors encompass both internal and external influences that can impact a company’s cash inflows and outflows. Here are the key factors to consider in cash flow forecasting:

- Sales and Revenue: Consider the anticipated sales volume and revenue sources that will contribute to cash inflows. Analyze historical sales data, market trends, upcoming promotions or product launches, and customer payment patterns to project future sales and revenues accurately.

- Purchase and Inventory Management: Assess your inventory needs and purchasing patterns. Consider lead times, supplier terms, and any planned changes in inventory levels to accurately forecast cash outflows related to inventory purchases.

- Accounts Receivable: Evaluate the timing and likelihood of collecting payments from customers. Consider payment terms, customer creditworthiness, historical collection patterns, and any factors that may impact the speed of collections. Delays or defaults in receiving payments can disrupt cash flow, so accurate projections are crucial.

- Accounts Payable: Consider the timing of payments to suppliers and service providers. Take into account credit terms, negotiated payment arrangements, and any payment delays or extensions that may affect your cash outflows.

- Seasonality and Market Trends: If your business experiences seasonal variations or operates in industries with specific market trends, incorporate these factors into your forecast. Analyze historical data and industry benchmarks to identify patterns and adjust your projections accordingly.

- Non-cash Expenses: Consider non-cash expenses, such as depreciation and amortization, which do not involve actual cash outflows. While they don’t impact cash flow directly, they have accounting implications that need to be accounted for in financial reporting.

- Tax Obligations: Evaluate the timing and amount of tax payments, including income taxes, sales taxes, payroll taxes, and any other tax obligations. These obligations can significantly impact your cash outflows, so accurate forecasting is essential in ensuring timely compliance.

- Capital Expenditures: Assess the timing and costs associated with capital expenditures, such as investments in equipment, machinery, or infrastructure. These expenses can have a significant impact on cash outflows and should be factored into your cash flow forecast.

- Changes in Financing: Consider any changes in your financing arrangements, such as loan repayments, interest payments, or new financing obtained. These activities can affect your cash inflows or outflows, and accurate forecasting helps you plan for these financial obligations.

- Economic and Market Conditions: Evaluate the overall economic and market conditions that may impact your business. Factors such as inflation, interest rates, exchange rates, and industry-specific trends can affect your cash flow. Staying informed and incorporating these external influences into your forecast allows you to make more accurate projections.

By considering these factors in your cash flow forecasting process, you can ensure that your projections are more accurate and reliable. Regularly reviewing and adjusting these factors based on new information or changing circumstances will help you maintain an accurate cash flow forecast and make informed financial decisions for your business.

Common Mistakes to Avoid in Cash Flow Forecasting

Cash flow forecasting is a critical aspect of financial management, but it can be prone to certain common mistakes that can undermine its accuracy and effectiveness. Being aware of these mistakes can help businesses avoid them and create more reliable cash flow forecasts. Here are some common mistakes to avoid in cash flow forecasting:

- Overestimating Sales: One common mistake is overestimating future sales and revenue, leading to inflated cash inflow projections. It’s important to base sales projections on realistic data, market research, and historical trends, rather than unwarranted optimism.

- Underestimating Expenses: Underestimating expenses can lead to cash flow gaps or surprises. Take care to thoroughly assess all operational costs, including personnel, utilities, rent, insurance, and other overheads. Factor in potential price increases, inflation, and any upcoming changes in the cost structure.

- Ignoring Seasonality: Neglecting to account for seasonality can lead to inaccurate cash flow forecasts. Businesses with seasonal fluctuations need to consider the impact of peak and off-peak periods on cash inflows and outflows. Failing to do so can result in underestimating cash needs during slow periods or being caught off guard by unexpected spikes in expenses.

- Not Monitoring Accounts Receivable: Failing to closely monitor accounts receivable can lead to inaccuracies in cash flow forecasts. Delays or non-payments from customers can significantly impact cash inflows. Implement effective credit control measures, regularly review aging reports, and adjust cash inflow projections accordingly.

- Forgetting Non-cash Expenses: Neglecting to account for non-cash expenses, such as depreciation or amortization, can distort cash flow projections. While these expenses do not involve actual cash outflows, they have an impact on financial statements and should be considered in cash flow calculations.

- Not Considering Timing: Timing is crucial in cash flow forecasting. Failing to accurately account for the timing of cash inflows and outflows can result in misleading forecasts, leading to cash flow gaps or excessive funds that are not optimally utilized. Be meticulous in factoring in the actual timing of payments and receipts.

- Overlooking Tax Obligations: Taxes can significantly impact cash flow, and overlooking tax obligations can lead to inaccuracies in forecasts. Consider the timing and amount of tax payments, including income taxes, payroll taxes, and sales taxes, to ensure they are properly included in cash flow projections.

- Ignoring External Factors: Neglecting to consider external factors that can impact cash flow, such as changes in economic conditions, industry trends, or regulatory changes, can result in flawed cash flow forecasts. Stay updated on market influences and incorporate relevant external factors into your forecasting models.

- Failing to Regularly Review and Adjust: Cash flow forecasting is not a one-time exercise; it requires regular review and adjustment. Failing to update forecasts based on actual results, changing circumstances, or new information can lead to outdated and ineffective forecasts. Continuously monitor and revise your projections to maintain accuracy.

Avoiding these common mistakes in cash flow forecasting can help businesses create more reliable and accurate forecasts. By being diligent, proactive, and attentive to these potential pitfalls, businesses can enhance their financial planning, minimize cash flow challenges, and make more informed decisions to drive success.

Conclusion

Cash flow forecasting plays a crucial role in the financial management of businesses. It provides valuable insights into a company’s expected cash inflows and outflows, allowing businesses to make informed decisions, plan for the future, and maintain financial stability.

Throughout this article, we have explored the definition and purpose of cash flow forecasting. We have delved into the benefits it offers, such as improved financial planning, enhanced working capital management, better decision-making, tightened control over cash flow, and improved financial relationships.

We have also discussed the key components of a cash flow forecast, including inflows, outflows, accounts receivable, accounts payable, financing activities, and one-time or extraordinary items. By considering these components, businesses can create a comprehensive projection of their cash flow.

Moreover, we have highlighted the importance of accurate cash flow forecasting, emphasizing how it contributes to financial stability, effective budgeting, evaluating financial needs, navigating uncertain times, relevant financial reporting, and risk management.

In addition, we have outlined the essential steps to create a cash flow forecast, which include gathering financial information, estimating cash inflows and outflows, considering timing and seasonality, reviewing and analyzing the forecast, and regularly updating and revising it.

We have also discussed important factors to consider in cash flow forecasting, such as sales and revenue, purchase and inventory management, accounts receivable and payable, seasonality and market trends, non-cash expenses, tax obligations, capital expenditures, changes in financing, and economic and market conditions.

Lastly, we have highlighted common mistakes to avoid in cash flow forecasting, including overestimating sales, underestimating expenses, ignoring seasonality, not monitoring accounts receivable, forgetting non-cash expenses, not considering timing, overlooking tax obligations, ignoring external factors, and failing to regularly review and adjust forecasts.

In conclusion, accurate cash flow forecasting is essential for businesses to effectively manage their finances, make informed decisions, and maintain financial stability. By understanding the purpose, benefits, components, and potential pitfalls of cash flow forecasting, businesses can achieve greater control over their cash flow, improve their financial planning, and position themselves for long-term success.