Home>Finance>Non-Operating Asset: Definition, Balance Sheet Place, And Example

Finance

Non-Operating Asset: Definition, Balance Sheet Place, And Example

Published: January 1, 2024

Learn the definition and balance sheet placement of non-operating assets in finance. Get an example and understand their impact on financial statements.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Unlocking the Secrets of Non-Operating Assets: A Guide to Understanding and Managing Your Finances

When it comes to managing your finances, it’s crucial to have a clear understanding of all the different elements that make up your balance sheet. One such element that often goes overlooked is non-operating assets. So, what exactly are non-operating assets, where do they belong on your balance sheet, and why should you pay attention to them? Let’s dive deeper!

Key Takeaways:

- Non-operating assets are assets that are not directly involved in a company’s core operations.

- These assets can provide additional income or be sold to generate cash inflows.

Defining Non-Operating Assets

Non-operating assets, as the name suggests, are assets that are not directly engaged in a company’s core business operations. They are ancillary assets that businesses acquire either as a result of investing excess cash or through other non-operating activities. Non-operating assets generally do not contribute to the generation of revenue on a regular basis.

Examples of non-operating assets include:

- Investments in stocks, bonds, or other securities

- Real estate properties held for investment purposes

- Patents or copyrights not actively used in operations

- Unused or surplus equipment

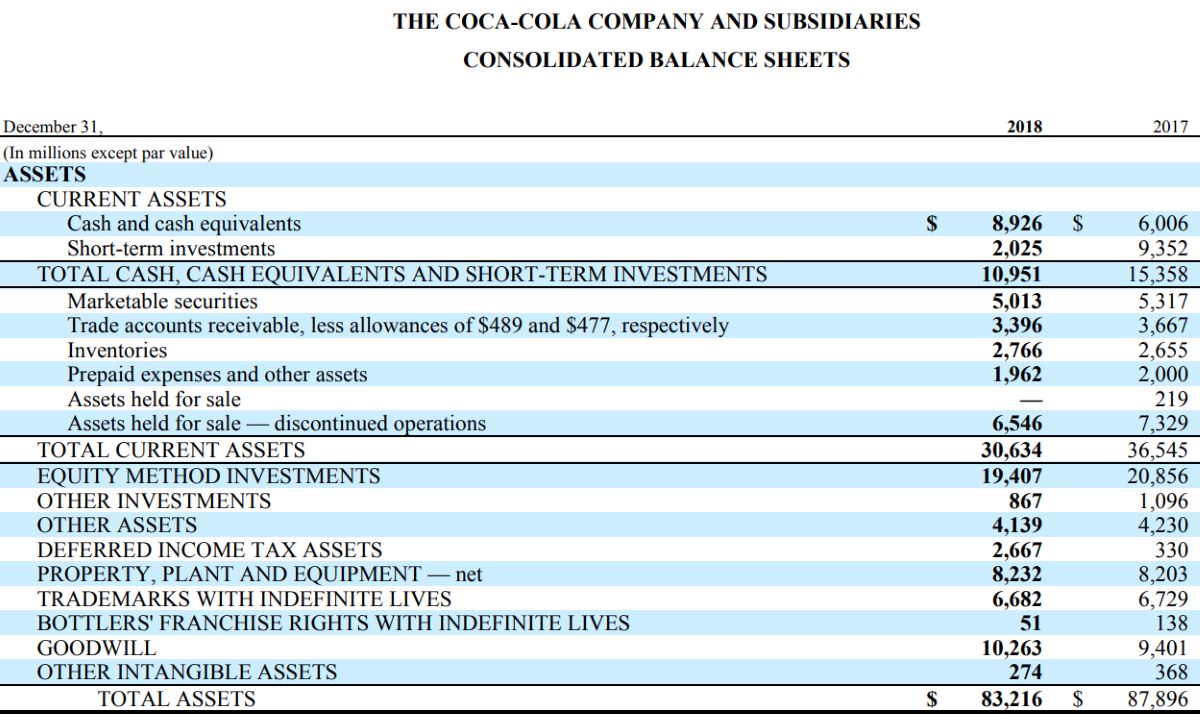

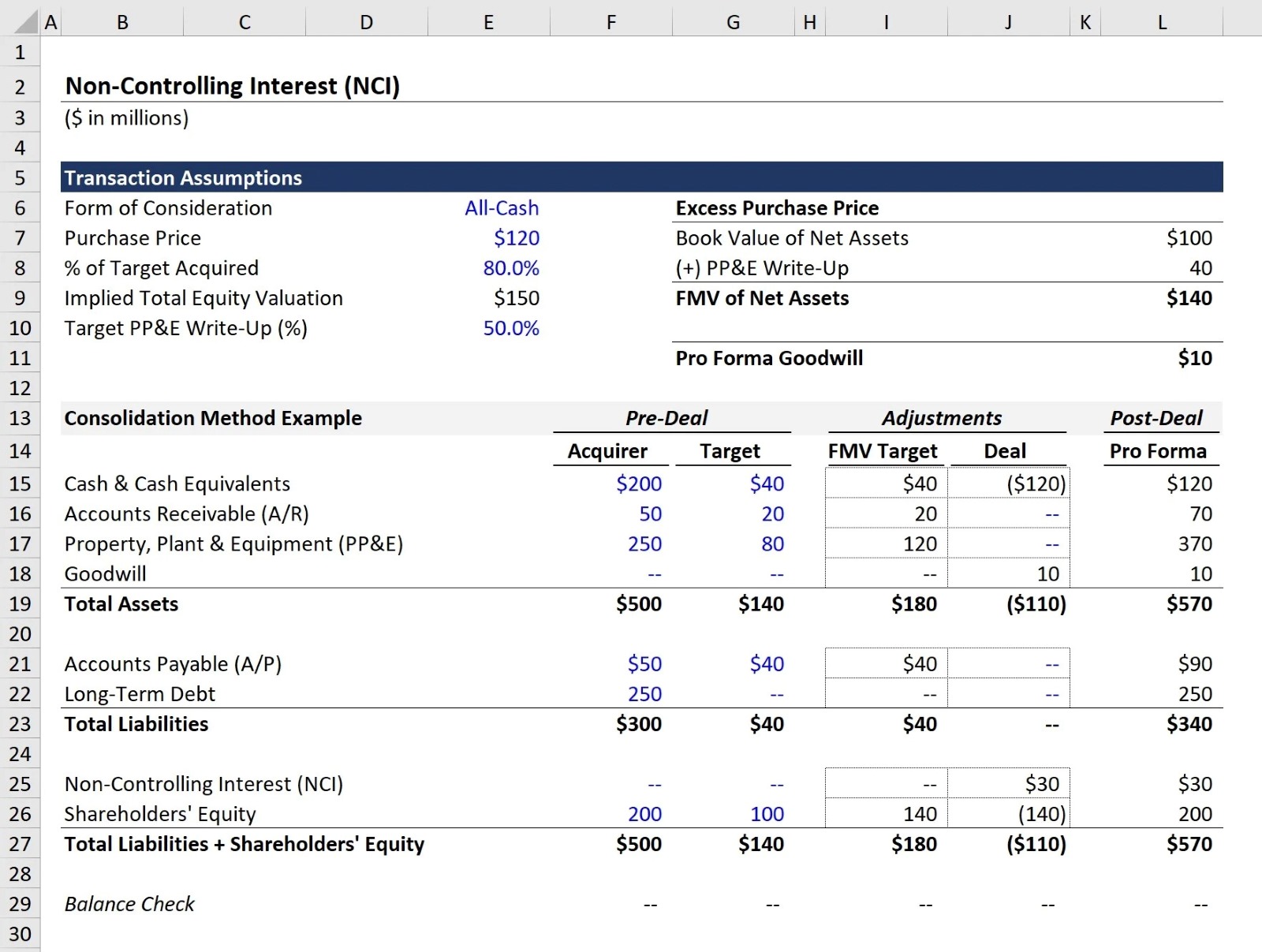

The Place of Non-Operating Assets on the Balance Sheet

On a company’s balance sheet, non-operating assets are typically recorded as a separate line item under the broader category of “Investments” or “Other Assets.” They are displayed separately from the assets directly tied to the company’s core operations, such as accounts receivable, inventory, or property and equipment used in day-to-day business activities.

The separation of non-operating assets allows investors, creditors, and analysts to have a clearer understanding of the company’s financial situation and evaluate its performance based on the assets directly related to its primary operations.

Why Non-Operating Assets Matter

While non-operating assets may not contribute to a company’s regular revenue stream, they can still play an essential role in its overall financial health. Here are two key reasons why paying attention to non-operating assets is crucial:

- Additional Income: Non-operating assets, such as investments in stocks or bonds, can provide an additional source of income through dividends, interest, or capital gains. This extra income can boost a company’s profitability and help offset any downturns in its core operations.

- Strategic Decisions: Non-operating assets can also be strategically utilized to generate cash inflows. For example, a company may sell surplus equipment or unused real estate to raise funds for expansion, debt repayment, or other strategic initiatives.

By monitoring and effectively managing non-operating assets, companies can optimize their financial position, maximize returns, and make informed decisions that align with their overall business objectives.

Remember, non-operating assets may not be the primary drivers of a company’s revenue, but they still hold significant value. Understanding their role and impact on your balance sheet will give you a more comprehensive picture of your financial situation and help you make sound financial decisions.