Finance

How To Read A Financial Statements Book

Modified: February 21, 2024

Learn how to read financial statements and gain a deeper understanding of finance with our comprehensive book on the subject. Master the language of accounts, balance sheets, and cash flow statements.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to managing your personal finances or running a business, understanding financial statements is crucial. These documents provide a snapshot of your financial health and help you make informed decisions about budgeting, investing, and planning for the future.

However, for those without a background in finance, financial statements can seem complex and intimidating. That’s why we’ve created this comprehensive guide to help you decipher and read financial statements effectively.

In this article, we’ll walk you through the key components of financial statements, including the income statement, balance sheet, cash flow statement, and notes to the financial statements. We’ll also explore the importance of analyzing financial statements using ratios and key performance indicators. Lastly, we’ll highlight common pitfalls to avoid when interpreting financial statements.

Whether you’re an individual wanting to understand your personal financial situation or a business owner seeking to evaluate the financial health of your company, this guide will provide you with the knowledge and tools you need to confidently read and analyze financial statements.

So, let’s dive in and unlock the secrets behind financial statements!

Understanding Financial Statements

Financial statements are detailed reports that provide an overview of an entity’s financial activities and position. They serve as a reliable source of information for investors, creditors, and other stakeholders to assess the financial health and performance of a company.

There are three main types of financial statements: the income statement, the balance sheet, and the cash flow statement. Each statement focuses on different aspects of a company’s financial operations and collectively paint a comprehensive picture of its financial position.

The income statement, also known as the profit and loss statement, summarizes a company’s revenues, expenses, and net income over a specific period. It shows the company’s ability to generate profit by comparing the total revenues earned with the expenses incurred to produce those revenues.

The balance sheet provides a snapshot of a company’s assets, liabilities, and shareholders’ equity at a specific point in time. It showcases the company’s financial position and helps assess its liquidity, solvency, and overall stability.

The cash flow statement tracks a company’s cash inflows and outflows over a given period. It focuses on the movement of cash and helps analyze the company’s ability to generate positive cash flows, meet its financial obligations, and invest in future growth.

In addition to these three main financial statements, there are also notes to the financial statements. These footnotes provide additional details about the company’s accounting policies, significant events, contingent liabilities, and other relevant information that may impact the interpretation of the financial statements.

By understanding the purpose and components of these financial statements, you can gain valuable insights into the financial performance, position, and cash flow of a company. This understanding will enable you to make informed decisions about investments, lending, and business strategies.

Next, we’ll delve deeper into each financial statement and discuss how to interpret and analyze them effectively.

Components of Financial Statements

Financial statements are composed of various elements that provide a comprehensive view of a company’s financial performance and position. Understanding these components is essential for accurately interpreting and analyzing financial statements. Let’s explore the key components:

- Income Statement: The income statement, also known as the profit and loss statement, summarizes a company’s revenues, expenses, and net income for a specific period. It starts with the total revenues earned by the company during the period and deducts various expenses, such as the cost of goods sold, operating expenses, interest, and taxes, to arrive at the net income.

- Balance Sheet: The balance sheet provides a snapshot of a company’s financial position at a specific point in time. It consists of three main components: assets, liabilities, and shareholders’ equity. Assets represent what the company owns, such as cash, property, equipment, and inventory. Liabilities represent the company’s obligations, including loans, accounts payable, and accrued expenses. Shareholders’ equity reflects the residual interest in the company’s assets after deducting liabilities.

- Cash Flow Statement: The cash flow statement tracks the sources and uses of cash by a company over a specific period. It categorizes cash flows into three main activities: operating, investing, and financing. Operating cash flows include receipts and payments related to core business operations. Investing cash flows involve the acquisition or disposal of long-term assets. Financing cash flows include activities related to borrowing, issuing stock, or distributing dividends.

- Notes to the Financial Statements: The notes to the financial statements provide additional information and explanations about the numbers presented in the financial statements. They include details about accounting policies, contingencies, important events, and any other relevant information that helps users of financial statements understand the numbers better.

These components work together to form a comprehensive view of a company’s financial health and help investors, creditors, and other stakeholders assess its performance and potential risks. By analyzing these components, you can gain insights into a company’s profitability, liquidity, solvency, and overall financial stability.

Now that we have a solid understanding of the key components of financial statements, let’s dive deeper into each statement and discuss how to analyze them effectively.

Income Statement

The income statement, also known as the profit and loss statement, is a fundamental financial statement that provides insights into a company’s revenue, expenses, and net income over a specific period. It helps evaluate the profitability and operating performance of a business. Let’s explore the key components of an income statement:

- Revenue: Revenue represents the total amount of money generated from sales of goods or services during the reporting period. It is the top line of the income statement and is critical for assessing a company’s ability to generate income.

- Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing or delivering the goods or services sold. It includes expenses such as raw materials, direct labor, and production overhead. Subtracting COGS from revenue gives us the gross profit.

- Operating Expenses: Operating expenses are the costs incurred in the regular operations of the business. These expenses include salaries, rent, utilities, marketing expenses, and other administrative costs. They are deducted from gross profit to arrive at operating profit.

- Non-Operating Income and Expenses: Non-operating income and expenses include items that are not directly related to the core operations of the business. Examples include interest income, interest expense, gains or losses from the sale of assets, and income from investments or subsidiaries.

- Taxes: Taxes represent the income tax expense incurred by the company based on its taxable income. The tax expense is subtracted from the operating profit to calculate the net income before extraordinary items.

- Net Income: Net income, also known as the bottom line or profit, is the final figure on the income statement. It represents the company’s total earnings after deducting all expenses and taxes. It is a key measure of the company’s profitability and is often used to assess its financial performance.

By analyzing the income statement, you can assess a company’s revenue growth, gross profit margins, operating efficiency, and overall profitability. It is important to compare income statements over multiple periods to identify trends and assess the company’s financial progress. Additionally, benchmarking the company’s performance against industry standards and competitors can provide valuable insights.

Understanding the income statement is essential for investors, creditors, and other stakeholders to evaluate a company’s ability to generate profits, manage expenses, and sustain growth. Utilizing the information from the income statement in conjunction with other financial statements helps form a comprehensive picture of a company’s financial health.

Now that we have explored the income statement, let’s move on to the next component, the balance sheet.

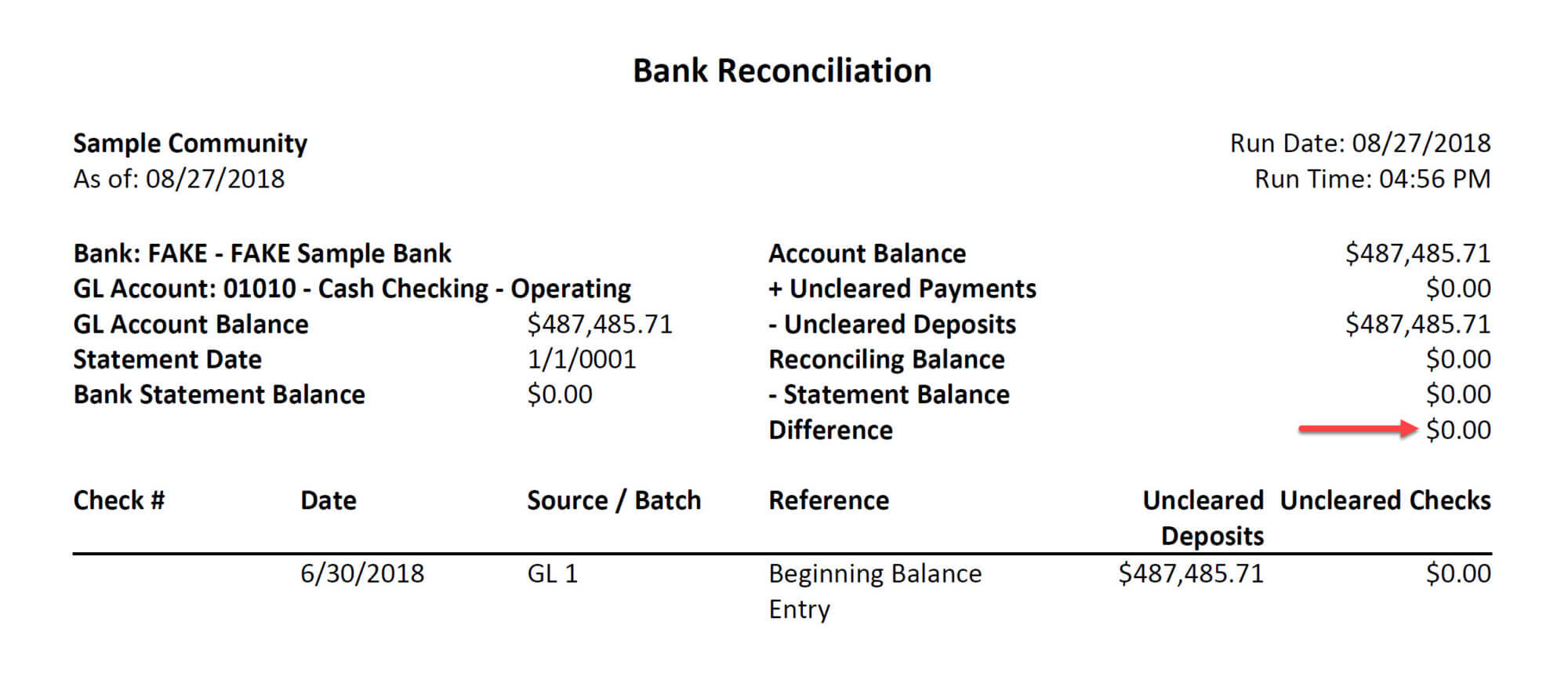

Balance Sheet

The balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It presents a summary of the company’s assets, liabilities, and shareholders’ equity. Let’s delve into the key components of a balance sheet:

- Assets: Assets represent what a company owns or controls and are classified into current and non-current assets. Current assets include cash, accounts receivable, inventory, and short-term investments. Non-current assets encompass long-term investments, property, plant, and equipment, intangible assets, and other long-term assets.

- Liabilities: Liabilities represent the company’s obligations to creditors, suppliers, and other stakeholders and are categorized into current and non-current liabilities. Current liabilities include accounts payable, accrued expenses, and short-term debt. Non-current liabilities include long-term debt, deferred tax liabilities, and other long-term obligations.

- Shareholders’ Equity: Shareholders’ equity represents the residual interest in the company’s assets after deducting liabilities. It includes the company’s initial capital contributions, retained earnings, and other equity components. Shareholders’ equity reflects the shareholders’ ownership and their stake in the company’s net assets.

The balance sheet follows the fundamental accounting equation: assets = liabilities + shareholders’ equity. This equation ensures that the balance sheet remains balanced, as the company’s assets must equal the sum of its liabilities and shareholders’ equity.

By analyzing the balance sheet, you can assess a company’s liquidity, solvency, and overall financial stability. Key financial ratios, such as the current ratio (current assets divided by current liabilities) and the debt-to-equity ratio (total debt divided by shareholders’ equity), can provide insights into a company’s ability to meet its short-term obligations and its use of debt to finance its operations.

Comparing balance sheets over multiple periods helps identify trends and assess a company’s financial progress. It is important to note that while the balance sheet offers a snapshot of a company’s financial position at a specific point, it does not provide information about the company’s profitability or cash flow.

Understanding the balance sheet is crucial for investors, creditors, and other stakeholders to evaluate a company’s financial health and make informed decisions. Analyzing the balance sheet in conjunction with the income statement and cash flow statement provides a comprehensive overview of a company’s financial performance and prospects.

Now that we have explored the balance sheet, let’s move on to the next component, the cash flow statement.

Cash Flow Statement

The cash flow statement is a financial statement that provides insights into a company’s cash inflows and outflows over a specific period. Unlike the income statement and balance sheet, which focus on profitability and financial position, respectively, the cash flow statement emphasizes the movement of cash. Let’s explore the key components of a cash flow statement:

- Operating Activities: This section reports the cash flows generated from a company’s primary business operations, such as revenue from sales, payments to suppliers, salaries, and taxes. Operating cash flows reflect the company’s ability to generate sufficient cash from its core operations. A positive operating cash flow indicates that the company’s day-to-day operations are generating cash.

- Investing Activities: This section reflects the cash flows associated with the acquisition or disposal of long-term assets, such as property, plant, equipment, and investments. It includes cash inflows from asset sales and cash outflows from asset purchases. Investing cash flows provide insights into a company’s capital expenditure, investment decisions, and potential for future growth.

- Financing Activities: This section showcases the cash flows related to the company’s financing activities, such as issuing or repurchasing shares, borrowing or repaying loans, and paying dividends. Financing cash flows help assess how a company funds its operations and determines its capital structure. It also highlights the company’s dividend policy and its reliance on external sources of financing.

The cash flow statement is divided into these three sections to showcase the different sources and uses of cash within a company. By analyzing the cash flow statement, you can assess a company’s ability to generate positive cash flows, meet its financial obligations, and invest in future growth opportunities.

Additionally, the cash flow statement helps evaluate the quality of a company’s earnings by comparing its net income from the income statement to its operating cash flows. If a company consistently reports high net income but low operating cash flows, it may be a red flag indicating potential issues with revenue recognition or cash management.

Furthermore, analyzing the cash flow statement helps assess a company’s liquidity and financial flexibility. Key ratios, such as the operating cash flow ratio (operating cash flow divided by current liabilities) and the free cash flow (operating cash flow minus capital expenditures), provide insights into a company’s ability to meet short-term obligations and generate cash for future investments.

By examining the cash flow statement alongside the income statement and balance sheet, you can gain a comprehensive understanding of a company’s financial performance, cash flow dynamics, and ability to fund its operations and growth.

Now that we have covered the cash flow statement, let’s move on to the next component, the notes to the financial statements.

Notes to the Financial Statements

The notes to the financial statements, also known as footnotes, are an integral part of the financial reporting process. They provide additional information and explanations about the numbers presented in the financial statements, helping users understand the context, significance, and assumptions behind the reported figures. Let’s explore the key aspects of the notes to the financial statements:

- Accounting Policies: The notes disclose the specific accounting principles and methods used by the company to prepare its financial statements. It provides clarity on how certain transactions are recognized, measured, and presented in the financial statements.

- Significant Events and Transactions: The notes highlight any significant events or transactions that occurred during the reporting period and could impact the company’s financial position or performance. This may include mergers, acquisitions, divestitures, or changes in key contracts or agreements.

- Contingencies: Contingencies refer to potential liabilities or obligations that may arise from uncertain future events. The notes provide information about legal disputes, warranty claims, pending litigation, guarantees, and other contingencies that could impact the financial statements if they materialize.

- Related Party Transactions: If transactions occur between the company and its related parties, such as key shareholders, directors, or subsidiaries, the notes disclose the nature of these transactions and any potential conflicts of interest.

- Subsequent Events: Subsequent events are significant events that occur after the reporting period but before the financial statements are authorized for issuance. The notes to the financial statements provide insights into any subsequent events that could impact the company’s financial position or require adjustments to the financial statements.

- Other Disclosures: The notes may also contain additional information deemed necessary to provide a complete and accurate representation of the company’s financial statements. This could include details about long-term contracts, environmental matters, employee benefit plans, and other relevant disclosures.

The information presented within the notes to the financial statements is essential for a thorough understanding and analysis of the financial statements. It helps users of financial statements assess the risks, uncertainties, and judgments involved in preparing the financial statements and provides transparency about the company’s financial affairs.

As a reader, it is crucial to review the notes to the financial statements alongside the main financial statements to obtain a comprehensive understanding of the company’s financial position, performance, and potential future implications.

Now that we have explored the notes to the financial statements, let’s move on to analyzing financial statements using ratios and key performance indicators.

Analyzing Financial Statements

Once you have a clear understanding of the components of financial statements, the next step is to analyze the information they provide. Through financial analysis, you can gain valuable insights into a company’s performance, financial health, and potential risks. Let’s explore some key methods and tools for analyzing financial statements:

- Ratios Analysis: Financial ratios are numerical indicators that provide insights into various aspects of a company’s performance, liquidity, profitability, and solvency. Common ratios include the current ratio, which measures a company’s ability to meet short-term liabilities, and the return on equity (ROE), which assesses a company’s profitability relative to shareholders’ equity.

- Comparative Analysis: Comparative analysis involves comparing a company’s financial performance over different periods or benchmarking it against industry peers. This allows you to identify trends, spot areas of improvement or weakness, and assess how the company is performing relative to its competitors.

- Key Performance Indicators (KPIs): KPIs are specific metrics that measure and evaluate a company’s progress towards its strategic goals. These can vary depending on the industry and company objectives but often include metrics such as sales growth rate, customer acquisition cost, or inventory turnover rate.

- Cash Flow Analysis: Analyzing the cash flow statement helps assess the company’s ability to generate cash, manage working capital, and fund its operations. Paying attention to cash flow trends, capital expenditure levels, and the company’s ability to generate free cash flow is crucial for understanding its financial stability.

- Vertical and Horizontal Analysis: Vertical analysis compares each item on the financial statement to a base value, usually expressed as a percentage of total assets, total liabilities, or total revenue. Horizontal analysis, on the other hand, compares financial statement items across multiple periods to identify changes and trends.

- Qualitative Factors: While financial analysis focuses on quantitative data, it’s important to consider qualitative factors as well. These factors include the company’s competitive advantage, management team, industry trends, and economic conditions, which can significantly impact the company’s future prospects.

By utilizing these analysis methods, you can evaluate a company’s financial performance, identify key strengths and weaknesses, and make informed decisions regarding investments, loans, or business strategies.

It’s worth noting that financial analysis is not a one-size-fits-all approach. The choice of ratios, metrics, and analysis techniques should be tailored to the specific industry, company size, and objectives. Moreover, it’s always advisable to compare the results of financial analysis to industry benchmarks or competitors for a more meaningful interpretation.

Now that we have discussed various methods for analyzing financial statements, let’s explore some common pitfalls to avoid during this process.

Ratios and Key Performance Indicators

Ratios and key performance indicators (KPIs) are powerful tools for analyzing financial statements and assessing a company’s performance, profitability, efficiency, and financial health. They provide valuable insights into various aspects of a company’s operations and help identify strengths, weaknesses, and areas for improvement. Let’s explore the importance and relevance of ratios and KPIs in financial analysis:

Ratios Analysis:

Ratios are quantitative measures that compare different financial statement items to provide meaningful insights into a company’s performance. They are calculated by dividing one financial metric by another and can be used to assess liquidity, profitability, solvency, and operational efficiency. Commonly used ratios include:

- Liquidity ratios, such as the current ratio and quick ratio, measure a company’s ability to meet short-term obligations.

- Profitability ratios, including the gross profit margin, operating profit margin, and return on investment, assess a company’s ability to generate profits relative to its revenue and capital invested.

- Solvency ratios, such as the debt-to-equity ratio and interest coverage ratio, evaluate a company’s long-term financial stability and its ability to meet debt obligations.

- Efficiency ratios, such as inventory turnover and days sales outstanding, measure how effectively a company utilizes its assets and manages its resources.

Ratio analysis provides a benchmark for comparing a company’s performance over time or against industry peers. By monitoring changes in ratios, you can identify trends, potential financial issues, and areas where the company may need improvement.

Key Performance Indicators (KPIs):

KPIs are specific metrics used to evaluate a company’s progress toward achieving its strategic goals and objectives. They are customized to reflect the company’s industry, size, and core business activities. KPIs may differ across organizations, but some common ones include:

- Sales growth rate: Measures the rate at which a company’s sales revenue is increasing over time.

- Customer acquisition cost: Calculates the cost incurred by the company to acquire a new customer.

- Churn rate: Measures the rate at which customers stop using or leave the company’s products or services.

- Employee productivity: Evaluates the efficiency and output of the company’s workforce.

- Return on investment (ROI): Analyzes the profitability of an investment relative to its cost.

KPIs serve as performance benchmarks and help monitor progress toward specific targets. They provide valuable insights into the effectiveness of the company’s strategies and initiatives. By tracking KPIs, companies can identify areas that require attention and take proactive measures to improve performance.

It is important to note that ratios and KPIs should be used in conjunction with other relevant financial and non-financial information. They provide a quantitative basis for analysis but should be considered within the broader context of the company’s industry dynamics, competitive landscape, and strategic objectives.

Now that we have explored ratios and KPIs, let’s discuss some common pitfalls to avoid when analyzing financial statements.

Common Pitfalls to Avoid

When analyzing financial statements, it is essential to be aware of common pitfalls that can impact the accuracy and effectiveness of your analysis. By avoiding these pitfalls, you can ensure that your assessment is thorough and reliable. Let’s explore some common pitfalls to be mindful of:

- Misinterpreting ratios and trends: It is crucial to interpret ratios and trends in the context of the specific industry, company size, and business model. Comparing ratios to industry benchmarks or historical trends can provide valuable insights. Failing to consider industry-specific factors can lead to inaccurate assessments.

- Overlooking non-financial factors: Financial statements provide important quantitative information, but they don’t tell the whole story. It’s crucial to consider non-financial factors such as market conditions, regulatory changes, competitive landscape, and management quality. These factors can significantly impact a company’s performance and prospects.

- Ignoring qualitative disclosures: The notes to the financial statements often contain valuable qualitative information that can provide a deeper understanding of events, transactions, and accounting policies. Ignoring these disclosures can result in a limited view of the company’s financial position.

- Overreliance on a single measure: Relying solely on one financial ratio or KPI can be misleading. A comprehensive analysis requires considering multiple measures and considering them holistically. Different ratios and indicators provide different insights, so it’s important to analyze a range of metrics.

- Not considering the bigger picture: Viewing financial statements in isolation can result in an incomplete understanding of a company’s financial health. Examining the interrelationships between the income statement, balance sheet, and cash flow statement is crucial for a comprehensive analysis. Additionally, looking at multiple periods and comparing against industry peers helps provide a broader perspective.

- Failure to question assumptions: Financial statements can be subject to estimates, judgments, and assumptions made by management. It’s important to critically evaluate these assumptions and understand potential risks and uncertainties. Don’t assume that reported numbers are always accurate or that management’s decisions are always optimal.

- Not considering the impact of external factors: Economic, political, and industry-specific factors can significantly impact a company’s financial performance. Failing to consider the broader macroeconomic and external influences on the business can lead to a limited analysis.

By avoiding these common pitfalls, you can ensure a more accurate and comprehensive analysis of financial statements. Remember to consider both quantitative and qualitative factors, look beyond the numbers, and critically evaluate assumptions and external factors. This holistic approach will provide a more reliable assessment of a company’s financial health and prospects.

Now that we have explored common pitfalls to avoid, let’s conclude our guide to reading and analyzing financial statements.

Conclusion

Understanding and analyzing financial statements is a vital skill for individuals and businesses alike. By deciphering these documents, you gain valuable insights into your financial position and make informed decisions about investments, borrowing, and strategic planning. In this comprehensive guide, we have discussed the key components of financial statements, including the income statement, balance sheet, cash flow statement, and notes to the financial statements.

We also explored various methods for analyzing financial statements, such as ratio analysis and key performance indicators. These tools provide valuable insights into a company’s performance, profitability, efficiency, and financial health. However, it’s important to avoid common pitfalls, such as misinterpreting ratios, overlooking non-financial factors, and relying on a single measure.

By considering the complete picture, including industry benchmarks, qualitative factors, and the impact of external factors, you can conduct a more accurate, comprehensive, and meaningful analysis of financial statements. This enables you to make well-informed decisions and navigate the complexities of personal finance or business management.

Remember that financial analysis is an ongoing process. It requires regular monitoring of financial statements, comparing trends over time, and staying updated on industry developments. By continuously analyzing financial statements and adapting your strategies accordingly, you can position yourself or your business for long-term success.

Armed with the knowledge and skills gained from this guide, you are now equipped to confidently read, interpret, and analyze financial statements. So go forth, dive into the numbers, and uncover the insights that will guide your financial decisions!