Home>Finance>Where Does Right-Of-Use Asset Go On Balance Sheet

Finance

Where Does Right-Of-Use Asset Go On Balance Sheet

Modified: December 30, 2023

Learn where the right-of-use asset is recorded on the balance sheet in this comprehensive finance guide. Understand the crucial role of finance in managing assets.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the world of accounting and finance, it is crucial to have a clear understanding of various assets and their treatment on the balance sheet. One such asset that has gained significant attention in recent years is the right-of-use asset. As companies adapt to new leasing standards, it becomes important to know where the right-of-use asset should be recorded on the balance sheet.

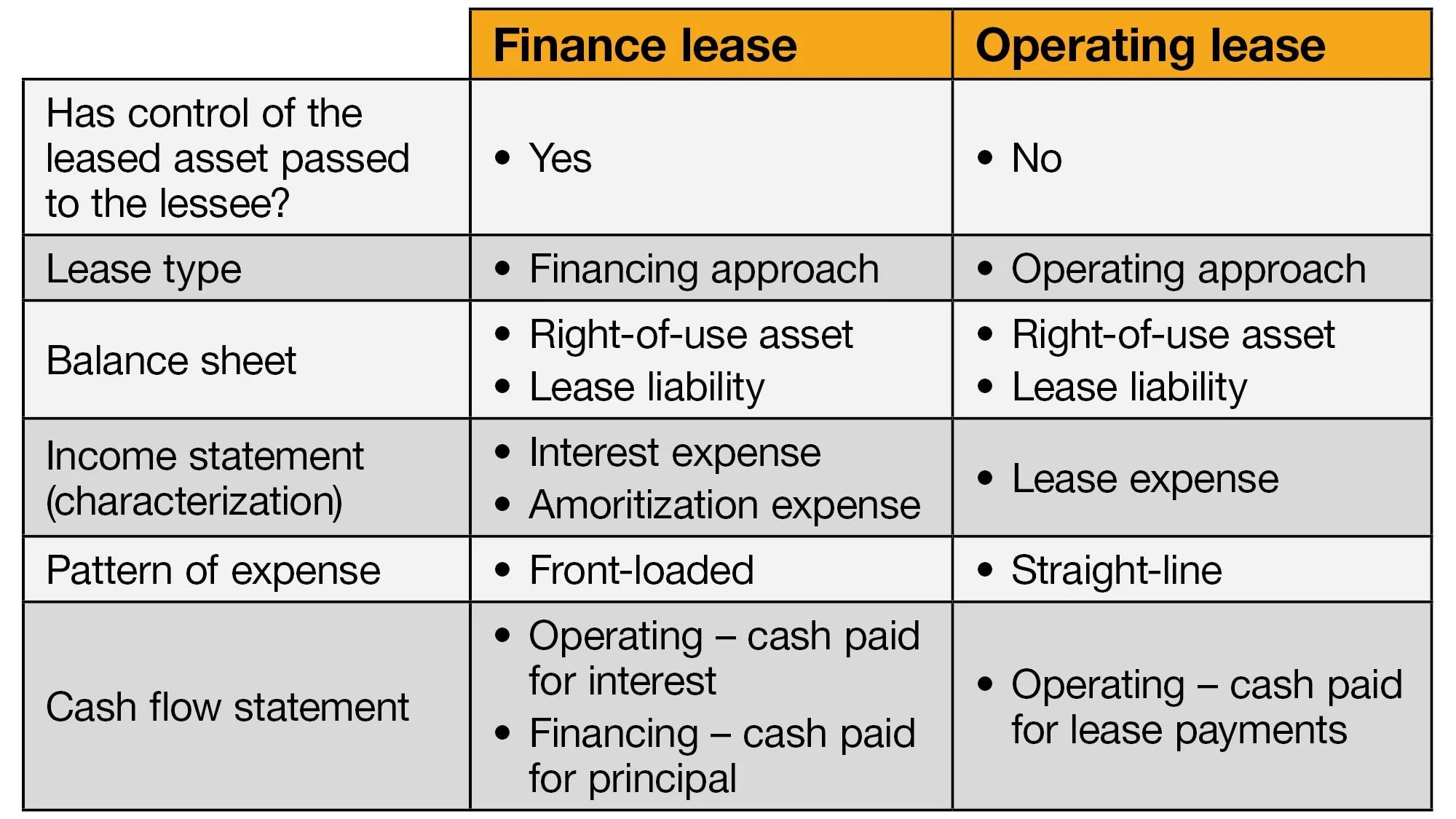

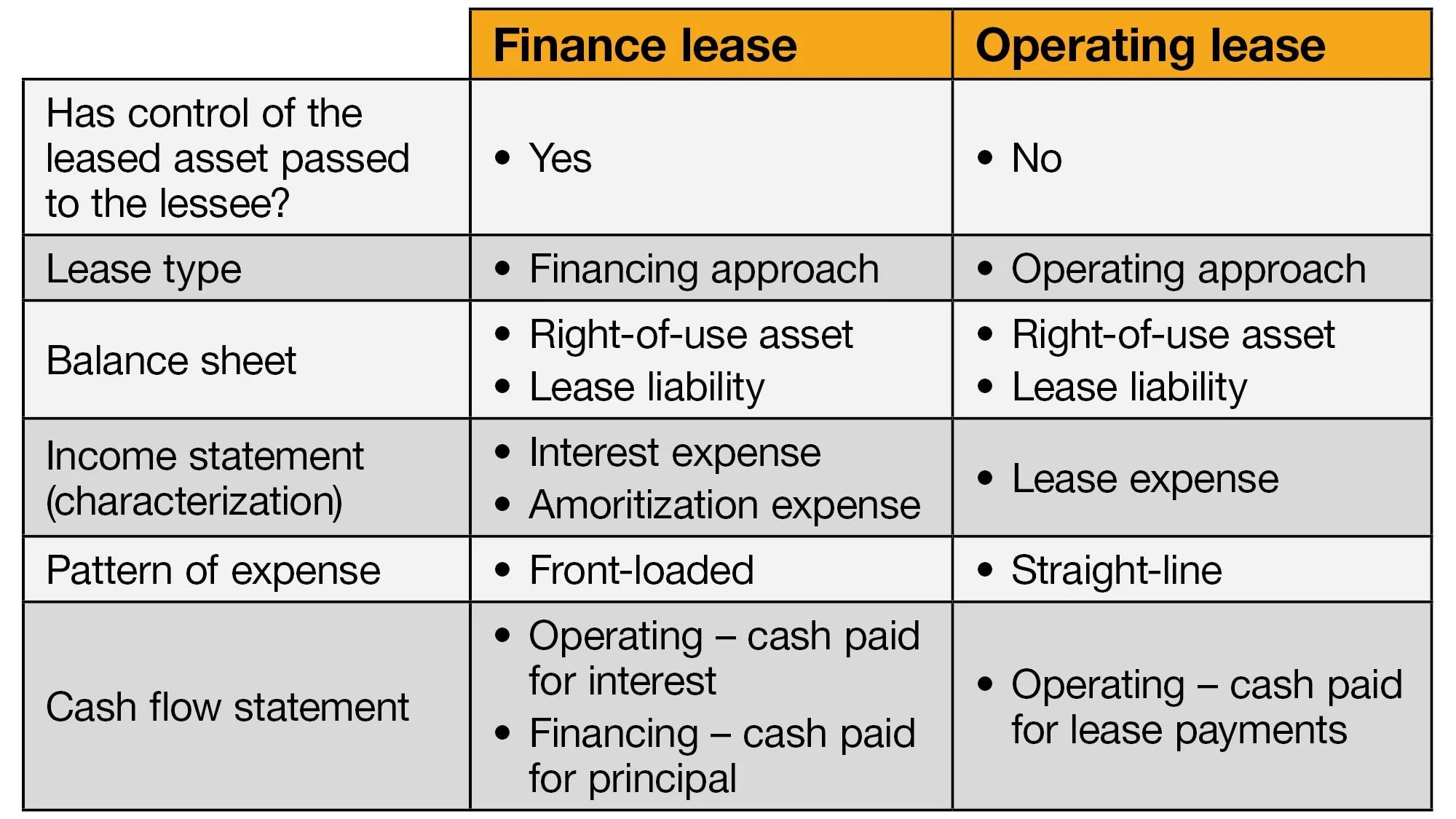

The concept of a right-of-use asset emerged as a result of the implementation of the International Financial Reporting Standards (IFRS) 16 and the Financial Accounting Standards Board (FASB) Accounting Standards Update (ASU) 2016-02. These standards require companies to recognize lease agreements on their balance sheets, bringing transparency to lease liabilities and assets. Previously, these leases were treated as operating expenses without appearing on the balance sheet.

A right-of-use asset represents the lessee’s right to use a specific asset over the lease term. It is typically associated with long-term leases for property, equipment, or vehicles. The inclusion of the right-of-use asset on the balance sheet provides a more accurate reflection of a company’s financial position and allows investors and stakeholders to have a better understanding of its lease-related obligations.

Accounting for the right-of-use asset involves recognizing and measuring the asset at the commencement of the lease. The initial measurement includes the present value of lease payments, any initial direct costs, and any lease incentives received. Subsequent measurement includes depreciation of the asset and interest expense on the lease liability.

Definition of Right-of-Use Asset

A right-of-use asset is an intangible asset that represents the lessee’s right to use a specific asset for a defined period of time under a lease agreement. This asset is recognized on the balance sheet and reflects the lessee’s control over the leased asset, as well as the economic benefits that will be derived from its use.

Under the new lease accounting standards, IFRS 16 and ASU 2016-02, all leases, except for short-term leases and leases of low-value assets, are required to be recognized on the balance sheet. Instead of classifying lease payments as operating expenses, companies are now required to record lease liabilities and corresponding right-of-use assets.

The right-of-use asset typically arises from leases of property, equipment, or vehicles. For example, a company may enter into a lease agreement to rent office space or lease machinery for their manufacturing operations. In such cases, the lessee acquires the right to use the asset throughout the lease term, and this right is recognized as an intangible asset on the balance sheet.

It is important to note that the right-of-use asset is specific to the lessee. The lessor, who owns the leased asset, does not recognize a right-of-use asset on their financial statements. Instead, the lessor continues to recognize the leased asset as its own property.

By recognizing the right-of-use asset, companies provide transparent information about their lease-related obligations and the assets they control. This enhances the comparability and reliability of financial statements, allowing investors and stakeholders to make informed decisions based on a company’s true financial position.

Accounting for Right-of-Use Asset

Accounting for the right-of-use asset involves specific steps that need to be followed in accordance with the new lease accounting standards. These steps ensure accurate recognition, measurement, and disclosure of the asset on the balance sheet.

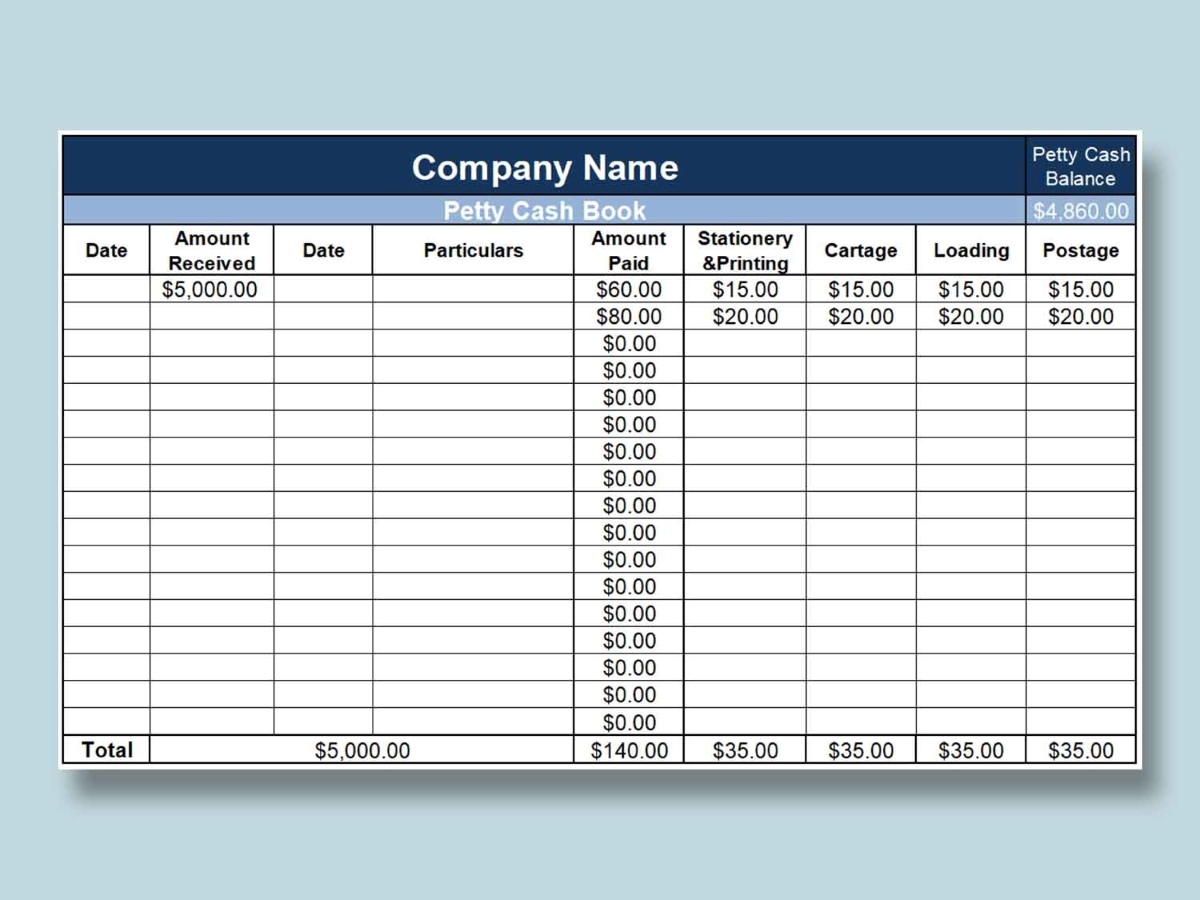

The initial recognition of the right-of-use asset occurs at the lease commencement date. At this point, the asset is measured at its cost, which includes the present value of lease payments, any initial direct costs incurred by the lessee, and any lease incentives received (such as rent holidays or leasehold improvements provided by the lessor).

Once the lease has commenced and the right-of-use asset is recognized, the subsequent measurement of the asset is required. This includes the depreciation of the asset and the interest expense on the lease liability.

Depreciation is calculated over the lease term, typically on a straight-line basis, unless there is an expected pattern of usage or obsolescence that warrants a different depreciation method. The depreciation charge is reported under operating expenses in the income statement.

The interest expense on the lease liability is determined using the effective interest rate method. This involves applying the effective interest rate to the lease liability balance, which decreases over time as the lease payments are made. The interest expense is reported as a separate line item in the income statement and is typically classified under finance costs.

It is important to note that the right-of-use asset should be assessed for impairment whenever there is an indication of potential impairment. If the carrying amount of the asset exceeds its recoverable amount, an impairment loss should be recognized, reducing the asset’s value on the balance sheet.

Overall, the accounting for the right-of-use asset ensures that companies accurately reflect their lease obligations and the economic benefits derived from the use of leased assets. It provides a comprehensive view of a company’s financial position, enhancing transparency and facilitating better decision-making for investors, lenders, and other stakeholders.

Classification of Right-of-Use Asset on the Balance Sheet

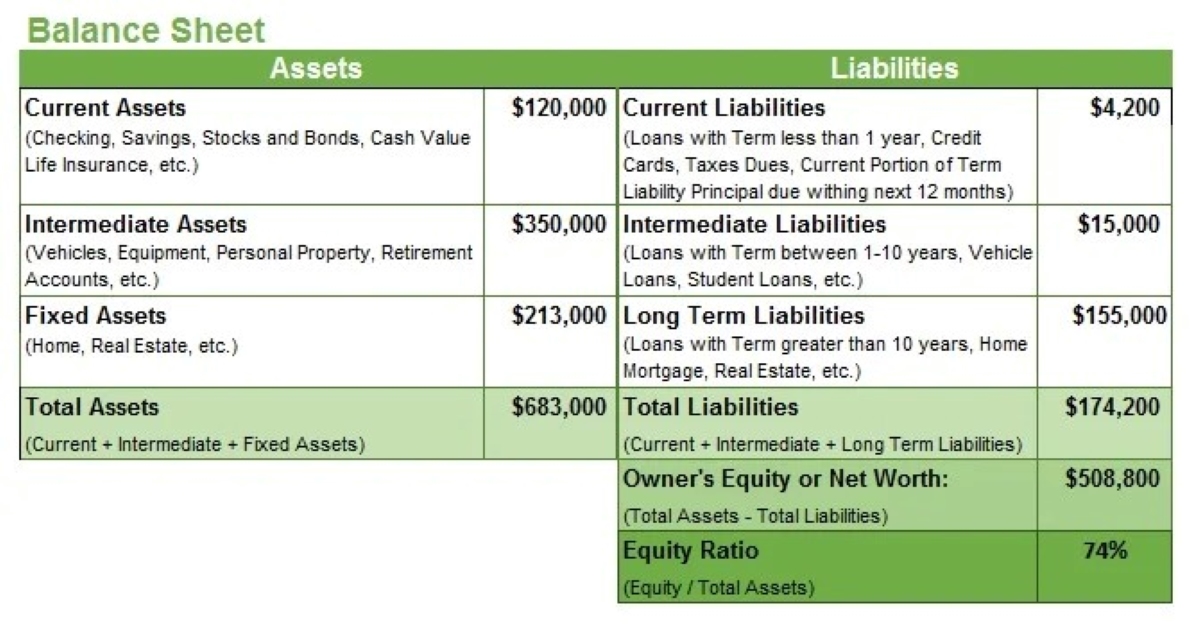

The right-of-use asset is classified as a non-current asset on the balance sheet. This classification indicates that the asset is expected to provide economic benefits over a period longer than one year. The specific location of the right-of-use asset on the balance sheet depends on the accounting standards followed by the reporting entity.

Under the International Financial Reporting Standards (IFRS), the right-of-use asset is typically presented separately from other assets. It is reported as a distinct line item, either under property, plant, and equipment (PP&E) or as a separate category within non-current assets.

On the other hand, under the Generally Accepted Accounting Principles (GAAP) followed in the United States, the right-of-use asset may be classified within the broader category of long-term assets, such as property, plant, and equipment, or as a separate line item within non-current assets.

Regardless of the specific location on the balance sheet, the right-of-use asset is disclosed separately from other assets to provide clarity and transparency to financial statement users. This distinction allows stakeholders to easily identify the impact of leasing activities on a company’s overall financial position.

The classification of the right-of-use asset as a non-current asset highlights its long-term nature and affirms that it is expected to generate economic benefits over an extended period of time. It also aligns with the classification of other long-term assets, such as property, plant, and equipment, which also provide future economic benefits beyond the current year.

It is important for companies to accurately classify the right-of-use asset on the balance sheet in order to comply with the applicable accounting standards and provide relevant information to stakeholders. This classification helps investors, creditors, and other users of financial statements to assess the value and risk associated with a company’s lease-related obligations.

Presentation of Right-of-Use Asset on the Balance Sheet

The presentation of the right-of-use asset on the balance sheet depends on the accounting standards followed, but it generally requires separate disclosure from other assets to ensure transparency and clarity for financial statement users.

Under the International Financial Reporting Standards (IFRS), the right-of-use asset is typically presented as a separate line item on the balance sheet. It may be classified under property, plant, and equipment (PP&E) or treated as a distinct category within non-current assets.

In contrast, the Generally Accepted Accounting Principles (GAAP) in the United States may present the right-of-use asset under various categories, such as property, plant, and equipment, or within a separate line item within non-current assets.

Regardless of the specific presentation, it is important to clearly label and identify the right-of-use asset on the balance sheet. This allows stakeholders to easily understand its nature and distinguish it from other assets. The amount associated with the right-of-use asset should be reported net of accumulated depreciation, providing the carrying value or net book value of the asset.

Companies may also provide additional information in the notes to the financial statements, disclosing the significant terms and conditions of the lease agreements, the measurement basis used for the right-of-use asset, and any restrictions or obligations associated with the leased assets.

The presentation of the right-of-use asset on the balance sheet not only ensures compliance with accounting standards but also helps financial statement users to better comprehend a company’s lease-related obligations and the assets it controls. By providing this information in a clear and accessible manner, companies facilitate informed decision-making for investors, creditors, and other stakeholders.

Disclosure Requirements for Right-of-Use Asset

The recognition of the right-of-use asset on the balance sheet brings forth the need for additional disclosures in the financial statements. These disclosures aim to provide transparency and clarity regarding a company’s lease-related obligations and the impact on its financial position.

Under both International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP), companies are required to disclose significant information about their right-of-use assets in the notes to the financial statements. The specific disclosure requirements may vary depending on the accounting framework, but common elements include:

- General description of the nature of the right-of-use assets and the type of leases entered into by the company.

- Summary of the significant terms of the lease agreements, including lease periods, renewal options, and any restrictions or obligations related to the leased assets.

- Measurement basis used for the right-of-use asset (e.g., cost model or revaluation model) and any applicable revaluation policy.

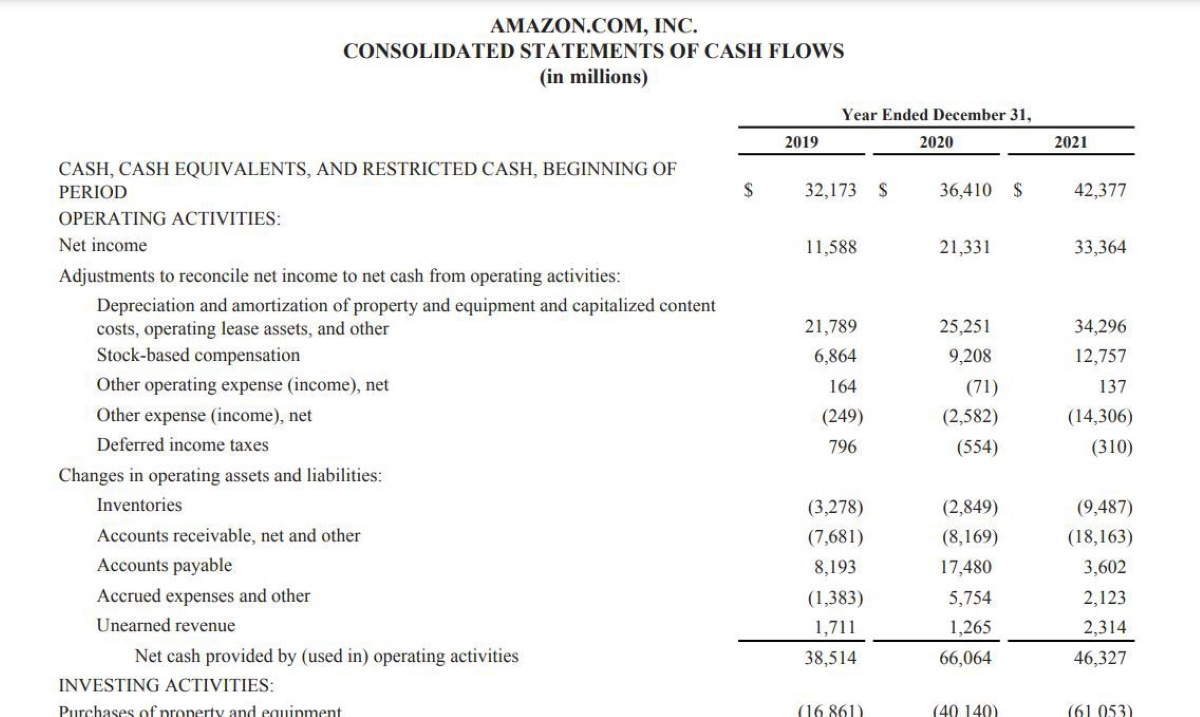

- Information about lease payments, including the total amount recognized as lease expense during the reporting period and a breakdown of lease expense by depreciation and interest.

- Explanation of any modifications or changes to the lease agreements and their impact on the right-of-use asset and lease liability.

- Qualitative and quantitative information about the company’s lease-related commitments, such as future minimum lease payments and lease maturity analysis.

- If applicable, disclosure of any new leases entered into during the reporting period and their impact on the financial statements.

These disclosure requirements are aimed at providing financial statement users with a comprehensive understanding of a company’s leasing activities and the associated financial impact. They enable investors, creditors, and other stakeholders to assess the magnitude and risks of lease obligations, as well as the potential impact on future cash flows and financial performance.

It is important for companies to ensure compliance with the disclosure requirements for right-of-use assets, as failure to do so may result in misinterpretation of financial statements and potential non-compliance with accounting standards.

Conclusion

The inclusion of the right-of-use asset on the balance sheet has significantly impacted the accounting and reporting of lease agreements. With the implementation of the International Financial Reporting Standards (IFRS) 16 and the Financial Accounting Standards Board (FASB) Accounting Standards Update (ASU) 2016-02, companies are required to recognize lease agreements, previously treated as operating expenses, as lease liabilities and corresponding right-of-use assets on the balance sheet.

Understanding the proper classification, presentation, and accounting treatment of the right-of-use asset is essential for accurate financial reporting. The right-of-use asset represents the lessee’s right to use a specific asset over the lease term and is recognized as a non-current asset on the balance sheet.

The accounting for the right-of-use asset involves recognizing and measuring the asset at the commencement of the lease, subsequent depreciation and interest expense, and potential impairment assessments. Presentation of the right-of-use asset on the balance sheet must clearly identify and disclose its carrying value, allowing stakeholders to easily identify the impact of leased assets on a company’s financial position.

The disclosure requirements for the right-of-use asset mandate providing additional information in the financial statements to enhance transparency and enable financial statement users to make informed decisions. These disclosures include descriptions of lease agreements, significant lease terms, measurement basis, lease payment breakdown, and information on lease-related commitments.

In conclusion, the accounting and reporting of the right-of-use asset bring greater transparency to lease obligations and provide a more accurate representation of a company’s financial position. By following the appropriate accounting standards and fulfilling the disclosure requirements, companies can effectively communicate the impact of lease agreements on their financial statements, facilitating better decision-making for investors, creditors, and stakeholders.