Home>Finance>Unappropriated Retained Earnings: Definition, Uses, Example

Finance

Unappropriated Retained Earnings: Definition, Uses, Example

Published: February 12, 2024

Learn the definition, uses, and example of unappropriated retained earnings in finance. Understand how it impacts a company's financial position and future growth.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Unappropriated Retained Earnings: Definition, Uses, Example

Finance is an essential aspect of our lives, and understanding its various concepts helps us make informed decisions for our financial well-being. One such concept that plays a significant role in financial management is unappropriated retained earnings. But what exactly does this term mean, and how can it benefit individuals and businesses? In this blog post, we will dive deeper into unappropriated retained earnings, exploring its definition, uses, and providing a real-life example to help demystify this concept for you.

Key Takeaways:

- Unappropriated retained earnings are the accumulated profits a company has not allocated for any specific purpose.

- These earnings can be used for various purposes, such as paying dividends, funding business expansion, or reducing debt.

Exploring Unappropriated Retained Earnings

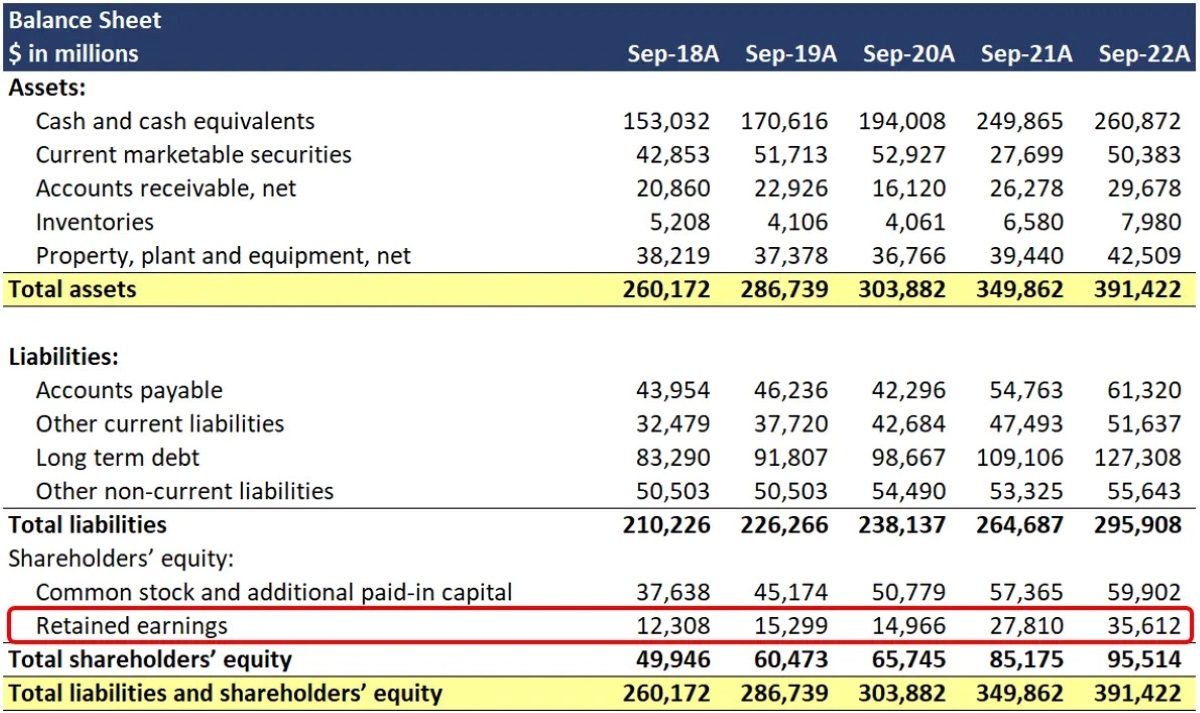

Unappropriated retained earnings, often referred to as accumulated profits, are the portion of a company’s net income that is not designated for any specific use or restricted by the company’s board of directors. When a company generates profits over time, these earnings accumulate on its balance sheet under the equity section, specifically in the retained earnings account.

These unappropriated retained earnings represent the company’s past profitability. They reflect the company’s success in generating revenue and creating value for its stakeholders. However, the company must decide how to allocate these earnings to ensure continued growth and success in the future.

Uses of Unappropriated Retained Earnings

A company can utilize unappropriated retained earnings in multiple ways to maximize its potential and drive further growth. Some common uses of these earnings include:

- Dividends: Companies can distribute a portion of their unappropriated retained earnings as dividends to their shareholders. Dividends are often paid in cash or additional shares of stock, providing a return on investment for the shareholders.

- Business Expansion: Unappropriated retained earnings can be reinvested back into the company to fund expansion initiatives. This can involve opening new locations, investing in new technologies, or acquiring other businesses.

- Debt Reduction: Companies can use these earnings to pay off their existing debts, reducing the interest burden and improving overall financial stability.

- Research and Development: Investing in research and development activities can help a company stay ahead of the competition. Unappropriated retained earnings can be utilized to fund these initiatives, driving innovation and product improvement.

- Operating Expenses: Allocating a portion of these earnings towards covering day-to-day operational expenses can help companies maintain their operations without relying heavily on external financing.

It’s important to note that the decision on how to use unappropriated retained earnings lies in the hands of the company’s management and board of directors. They must carefully evaluate the financial goals, market conditions, and future prospects of the company before making decisions regarding the allocation of these earnings.

Real-Life Example: Unappropriated Retained Earnings in Action

Let’s consider a hypothetical example to better understand how unappropriated retained earnings work. XYZ Corporation, a manufacturing company, has a healthy balance sheet and continues to generate profits year after year. As a result, the company has accumulated substantial unappropriated retained earnings.

In a board meeting, the management discusses potential uses for these earnings. They decide to allocate a portion of the earnings towards expanding their production capacity, allowing them to meet the increasing demand for their products. This decision aligns with their growth strategy and provides the company with a competitive advantage in the market.

The remaining unappropriated retained earnings are used to pay off a portion of their long-term debt, reducing the interest payments and improving the company’s financial stability. By strategically utilizing these earnings, XYZ Corporation ensures its continued growth, shareholder value, and long-term success.

Conclusion

Unappropriated retained earnings play a crucial role in financial management, providing flexibility and potential for growth to companies. By understanding this concept and exploring its uses, individuals and businesses can make informed decisions regarding the allocation of these earnings. Whether it’s funding expansion, paying dividends, reducing debt, or investing in research and development, unappropriated retained earnings can drive a company’s success in the dynamic world of finance.