Finance

What Accounts Have A Normal Credit Balance

Published: January 14, 2024

Learn about the normal credit balances of finance accounts and how they impact your financial statements. Master the basics of finance and improve your money management skills.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where numbers rule and balances dictate the health of an organization’s financial standing. Understanding different accounts and their normal credit balances is essential for managing finances effectively. Whether you are a business owner, an accountant, or an individual trying to navigate personal finances, knowing which accounts typically have credit balances is crucial.

But what is a credit balance? In accounting, a credit balance refers to the amount of money or value recorded on the right side of a general ledger’s T-account. It represents the obligations and liabilities that an organization or individual owes. On the other hand, a debit balance represents assets, income, or equity.

While debit balances are more commonly associated with accounts, certain accounts have normal credit balances. Understanding these accounts, their purpose, and how they affect financial statements can empower individuals and businesses in making informed financial decisions.

In this article, we will delve into the types of accounts with normal credit balances, the benefits of maintaining these balances, and provide examples of some accounts in this category. So, let’s explore the world of financial credits together!

Understanding Credit Balances

Before delving into the accounts that have normal credit balances, let’s take a moment to understand the concept of credit balances in the context of accounting. In accounting, a credit balance is a positive amount recorded on the right side of a T-account in a general ledger.

Credit balances typically represent liabilities, such as loans, credit card balances, or accounts payable. When a payment is made towards a liability, the credit balance decreases, while a debit entry increases the balance. On the other hand, assets, equity, and income accounts usually have debit balances, which are recorded on the left side of a T-account.

The concept of credit balances is crucial for accurately recording and reporting financial transactions. It helps maintain the fundamental principle of double-entry bookkeeping, ensuring that each entry has an equal and opposite effect on both sides of the equation.

It’s important to note that a credit balance does not necessarily imply a positive financial position. Credit balances can also indicate amounts that are owed or payable. For example, if a company has an outstanding invoice from a supplier, the amount owed will be recorded as a credit balance until it is paid off.

Understanding credit balances is key to comprehending financial statements such as balance sheets and income statements. These statements provide a snapshot of an organization’s financial health, and knowing which accounts have normal credit balances is essential for accurate financial reporting.

Now that we have a basic understanding of credit balances, let’s explore the different types of accounts that typically have normal credit balances.

Types of Accounts

When it comes to accounting, various types of accounts are used to categorize and track financial transactions. These accounts can be broadly classified into five main categories: assets, liabilities, equity, revenue, and expenses.

1. Assets: Assets are economic resources that a company or individual owns. Common examples of assets include cash, accounts receivable, inventory, property, and equipment. Assets are recorded with debit balances, meaning they typically increase when debited and decrease when credited.

2. Liabilities: Liabilities represent an organization’s obligations or debts. Examples of liabilities include accounts payable, loans payable, and accrued expenses. Liabilities have normal credit balances, meaning they increase when credited and decrease when debited.

3. Equity: Equity is the residual interest in the assets of an organization after deducting liabilities. It represents the shareholders’ or owners’ claim to the company’s assets. Equity accounts, such as common stock and retained earnings, can have normal credit balances.

4. Revenue: Revenue accounts record the income a company generates from its core business activities. This can include sales revenue, service revenue, or interest income. Revenue accounts typically have credit balances because they increase when credited and decrease when debited.

5. Expenses: Expenses represent the costs incurred by a company in order to generate revenue. Examples of expenses include salaries, rent, utilities, and advertising expenses. Expense accounts usually have debit balances, as they increase when debited and decrease when credited.

Understanding the different types of accounts is crucial for accurate financial reporting and decision-making. Now let’s focus specifically on the accounts that typically have normal credit balances.

Accounts with Normal Credit Balances

While most accounts in accounting have debit balances, there are several types of accounts that typically have normal credit balances. These accounts represent liabilities, equity, and revenue. Let’s dive into each of these categories and explore some specific examples:

- Liability Accounts: Liabilities represent debts or obligations owed by an organization. Accounts such as accounts payable, loans payable, and credit card liabilities typically have normal credit balances. When a company incurs a liability, it is recorded as a credit entry, increasing the balance in the respective account.

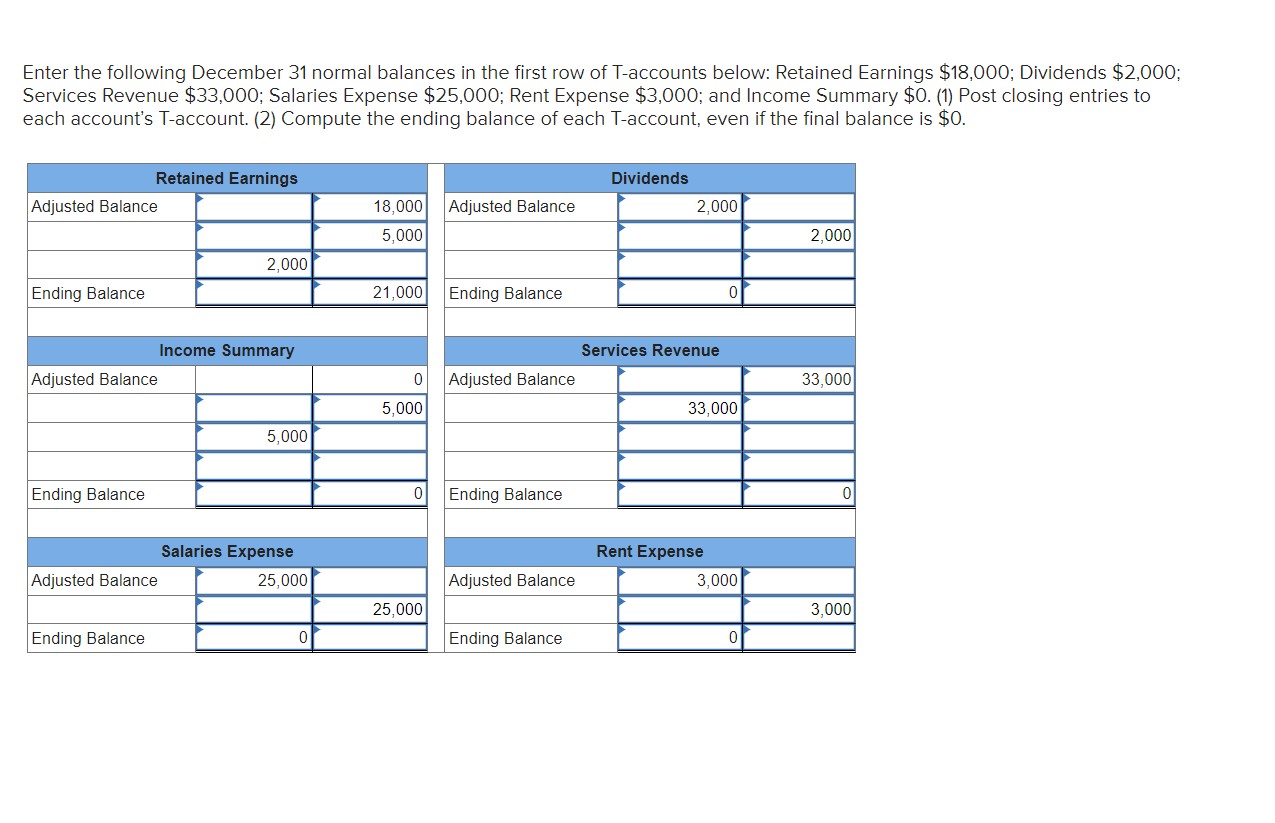

- Equity Accounts: Equity accounts reflect the owners’ or shareholders’ interests in a company’s assets. Common equity accounts like retained earnings and common stock usually have normal credit balances. Increases in equity, such as retained earnings from profitable operations or additional investments, are recorded as credit entries.

- Revenue Accounts: Revenue accounts capture the income generated from a company’s business activities. Examples include sales revenue, service revenue, and interest income. Revenue accounts usually have normal credit balances as they reflect an increase in the company’s earnings.

It’s important to note that while these accounts have normal credit balances, they can still be affected by debit entries. For example, if a company receives a payment for an outstanding accounts receivable, it would be recorded as a debit entry to decrease the accounts receivable balance, despite the account having a normal credit balance.

Maintaining proper credit balances in these accounts is crucial for accurate financial reporting. It allows for easier tracking of liabilities, equity, and revenue, providing a clear picture of an organization’s financial position.

Now that we have explored the accounts with normal credit balances, let’s move on to discussing the benefits of maintaining these balances.

Benefits of Maintaining Normal Credit Balances

Keeping normal credit balances in specific accounts offers several advantages for individuals and businesses alike. Let’s take a closer look at the benefits:

- Accurate Financial Reporting: Maintaining normal credit balances ensures accurate financial reporting. It allows for the proper classification of liabilities, equity, and revenue on financial statements, such as balance sheets and income statements. This accuracy is essential for making informed decisions and providing transparent financial information to stakeholders.

- Effective Cash Flow Management: Normal credit balances in liability accounts, such as accounts payable and loans payable, enable businesses to effectively manage cash flow. By keeping track of outstanding payments and obligations, businesses can better plan their payment schedules and ensure they have sufficient funds to meet their financial commitments.

- Better Investor Relations: Maintaining normal credit balances in equity accounts, such as retained earnings, helps build investor confidence. It demonstrates that the company is meeting its financial obligations and retaining profits, which reflects positively on its financial stability and future prospects.

- Evaluation of Revenue Generation: Maintaining normal credit balances in revenue accounts allows businesses to evaluate the effectiveness of their revenue generation efforts. By comparing revenue figures over time, businesses can identify trends, assess the performance of different revenue streams, and make strategic decisions to optimize their income generation.

- Compliance with Accounting Standards: Following proper accounting practices and maintaining normal credit balances in the appropriate accounts ensures compliance with accounting standards and regulations. This is crucial for avoiding penalties, meeting reporting requirements, and ensuring financial transparency.

Overall, maintaining normal credit balances provides financial stability, accurate reporting, and effective management of liabilities, equity, and revenue. By adhering to these balances, businesses can make informed decisions, maintain healthy relationships with stakeholders, and work towards long-term financial sustainability.

Now, let’s delve into some specific examples of accounts that have normal credit balances.

Examples of Accounts with Normal Credit Balances

Now that we understand the concept and benefits of maintaining normal credit balances, let’s explore some specific examples of accounts that fall into this category:

- Accounts Payable: This account represents the amount owed to suppliers or vendors for goods or services received but not yet paid for. As a liability account, it has a normal credit balance. As payments are made to clear the outstanding balances, the credit balance decreases.

- Loans Payable: Loans Payable is a liability account that records the amount of money a company owes to financial institutions or lenders. Whether it’s a long-term loan or a short-term loan, the balance in this account typically has a normal credit balance. As payments are made towards the principal or interest, the credit balance decreases.

- Accrued Expenses: Accrued expenses represent expenses that have been incurred but not yet paid. Examples include accrued wages, accrued interest, or accrued taxes. Accrued expenses are recorded as credit entries, reflecting the amount owed, and have normal credit balances.

- Retained Earnings: Retained earnings is an equity account that represents the accumulated profits or losses of a company. It reflects the amount of earnings retained within the company after dividends are paid to shareholders. As a result, retained earnings typically have a normal credit balance.

- Sales Revenue: Sales revenue is a revenue account that records the income generated from the sale of goods or services. Since revenue accounts have normal credit balances, any increase in sales revenue is reflected as a credit entry, contributing to the overall balance in the account.

These are just a few examples of accounts with normal credit balances. It’s important to note that the specific accounts may vary depending on the nature of the business and industry. However, understanding these examples provides a fundamental understanding of how different accounts with normal credit balances are categorized.

By maintaining the appropriate credit balances in these accounts, individuals and businesses can accurately track liabilities, equity, and revenue, resulting in transparent financial reporting and effective financial management.

Now, let’s summarize the key points we have covered in this article.

Conclusion

Understanding the concept of normal credit balances and the different types of accounts that fall into this category is essential for individuals and businesses navigating the world of finance. While most accounts have debit balances, liabilities, equity, and revenue accounts typically have normal credit balances.

Maintaining normal credit balances offers numerous benefits, including accurate financial reporting, effective cash flow management, and better investor relations. It allows businesses to track their liabilities, equity, and revenue accurately, providing a clear picture of their financial health.

Some specific examples of accounts with normal credit balances include accounts payable, loans payable, accrued expenses, retained earnings, and sales revenue. These accounts play a crucial role in proper financial reporting and decision-making.

By adhering to these balances, individuals and businesses can meet accounting standards, maintain financial stability, and establish transparency with stakeholders.

In conclusion, understanding accounts with normal credit balances is vital for anyone involved in financial management. By ensuring proper credit balances in the appropriate accounts, individuals and businesses can effectively navigate the financial landscape, make informed decisions, and achieve long-term financial success.

Thank you for joining us on this journey of understanding accounts with normal credit balances!