Finance

What Are Accounting Estimates

Modified: March 1, 2024

Discover the importance of accounting estimates in finance. Learn how these estimates help businesses make informed financial decisions and accurately report their financial statements.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Accounting Estimates

- Importance of Accounting Estimates

- Types of Accounting Estimates

- Factors Influencing Accounting Estimates

- Process of Making Accounting Estimates

- Challenges and Limitations of Accounting Estimates

- Examples of Accounting Estimates

- Importance of Accurate Accounting Estimates

- Conclusion

Introduction

Accounting estimates play a crucial role in the world of finance and business. They provide valuable insights and help organizations make informed decisions by predicting future outcomes based on current information and past performance. Accounting estimates are an essential part of financial reporting, as they allow companies to address uncertainties and allocate resources effectively.

In simple terms, accounting estimates refer to the process of approximating the value or measurement of certain financial elements when exact information is not readily available. These estimates are based on a combination of historical data, professional judgment, and relevant economic factors. They enable businesses to assess their financial position and performance, as well as make projections for budgeting and planning purposes.

Accuracy and reliability are key factors in accounting estimates. While they may not be precise due to the inherent uncertainties involved, they are based on reasonable assumptions and calculations. The International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP) provide guidelines and frameworks for making accounting estimates in a consistent and standardized manner.

The importance of accounting estimates cannot be overstated. They allow organizations to navigate the complex and ever-changing financial landscape. By providing a realistic picture of assets, liabilities, revenues, and expenses, accounting estimates enable businesses to assess their financial health and make informed decisions.

Definition of Accounting Estimates

Accounting estimates refer to the process of calculating and approximating the value or measurement of certain financial elements when exact information is not readily available. These estimates are utilized in financial reporting to account for uncertainties and provide a realistic representation of a company’s financial position and performance.

Accounting estimates can encompass various elements, including but not limited to:

- Asset valuations

- Valuation of contingent liabilities

- Provisions for bad debts or doubtful accounts

- Inventory valuation

- Depreciation and amortization expenses

- Revenue recognition

They are an integral part of financial statements, such as balance sheets, income statements, and cash flow statements, as they help provide a more accurate picture of the company’s financial health.

Accounting estimates are made using a combination of historical data, knowledge of the industry, and professional judgment. They involve analyzing past trends, economic conditions, and market factors to make reasonable assumptions and predictions about future outcomes. While they may not provide exact figures, accounting estimates aim to provide a fair representation of the financial position and performance of a company.

It is important to note that accounting estimates are not mere guesses or arbitrary numbers. They are based on sound financial analysis, supported by relevant data and expertise. Additionally, accounting estimates are subject to potential adjustments and revisions as new information becomes available or circumstances change.

These estimates are crucial for decision-making, allowing companies to allocate resources effectively, comply with regulatory requirements, and provide stakeholders with accurate and timely financial information.

Importance of Accounting Estimates

Accounting estimates are of paramount importance in the world of finance and accounting. They provide valuable insights and serve several purposes within an organization. Here are some key reasons why accounting estimates hold significant importance:

- Financial Decision Making: Accounting estimates enable organizations to make informed financial decisions. By providing a realistic representation of the company’s financial position and performance, these estimates help in budgeting, forecasting, and strategic planning.

- Resource Allocation: Accurate accounting estimates facilitate effective resource allocation. Organizations can identify areas that require additional investment or cost-cutting measures based on the estimated values of assets, liabilities, and expenses.

- Regulatory Compliance: Accounting estimates are crucial for complying with regulatory requirements. They ensure that financial statements are prepared in accordance with applicable accounting standards, such as the International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP).

- Investor Confidence: Financial statements backed by reliable accounting estimates inspire confidence in investors and stakeholders. They provide an accurate portrayal of the company’s financial position, which is vital for attracting investors, securing loans, and maintaining credibility in the marketplace.

- Risk Assessment: Accounting estimates help in evaluating and managing risks. By estimating provisions for bad debts or contingent liabilities, organizations can assess potential risks and make provisions for them in their financial statements.

- Performance Evaluation: Accounting estimates play a crucial role in evaluating the performance of a company. By taking into account various factors, such as revenue recognition, asset valuations, and depreciation expenses, organizations can gauge their overall financial performance accurately.

- Comparability: Accounting estimates ensure comparability between different periods and companies. By following standardized accounting principles and practices, organizations can provide financial information that is consistent and comparable, allowing for meaningful analysis and benchmarking.

Overall, accounting estimates are integral to financial reporting and decision-making processes. They provide organizations with a clearer understanding of their financial position, enable effective resource management, and instill trust and confidence among investors and stakeholders.

Types of Accounting Estimates

Accounting estimates come in various forms, each serving a specific purpose in financial reporting. Here are some common types of accounting estimates:

- Inventory Valuation: Estimating the value of inventory is crucial for determining the cost of goods sold and the value of ending inventory. This estimation involves considering factors such as the cost of purchase, production costs, and market conditions.

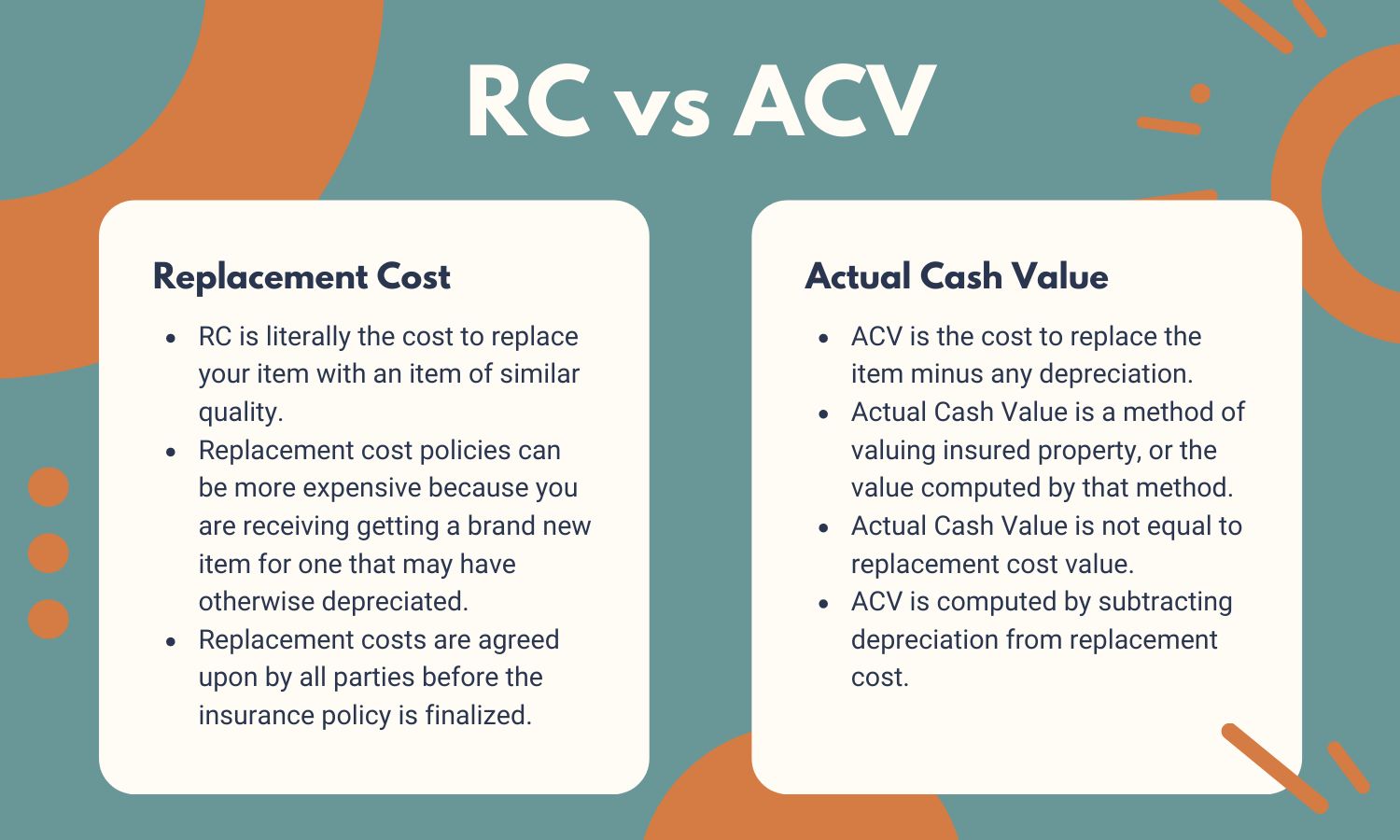

- Depreciation and Amortization: Accounting estimates are made to calculate the depreciation of tangible assets, such as buildings and machinery, and the amortization of intangible assets, like patents and trademarks. These estimates involve determining the useful life and residual value of the assets.

- Allowance for Doubtful Accounts: Organizations often estimate and create provisions for potential bad debts or doubtful accounts. This estimate involves analyzing historical data, customer payment patterns, and economic conditions to determine the amount of provision required.

- Contingent Liabilities: Accounting estimates are utilized to calculate provisions for potential contingent liabilities. These may include legal claims, warranties, or obligations arising from pending lawsuits or contractual obligations. The estimates are based on professional judgment, legal advice, and available information.

- Revenue Recognition: Estimating revenue is critical for financial reporting purposes. Organizations need to assess when revenue should be recognized, especially in long-term projects or contracts where revenue recognition may span multiple periods. This estimation considers factors such as the completion of performance obligations and the collectability of revenue.

- Asset Impairment: Accounting estimates are used to assess the impairment of assets, such as property, plant, and equipment, or intangible assets. Organizations need to estimate the recoverable amount of assets and compare it to their carrying value to determine any impairment loss.

It is important to note that these are just a few examples of accounting estimates. Depending on the nature of the business and industry, there may be other types of estimates specific to certain financial elements. Regardless of the type, all accounting estimates require careful consideration, analysis of relevant data, and professional judgment to ensure accuracy and reliability in financial reporting.

Factors Influencing Accounting Estimates

When making accounting estimates, several factors come into play that can influence the final determination. These factors can vary depending on the specific type of estimate being made. Here are some common factors that can influence accounting estimates:

- Economic Conditions: The prevailing economic conditions, such as inflation rates, interest rates, and overall market trends, can have a significant impact on accounting estimates. These conditions can affect the valuation of assets, the collectability of receivables, and the determination of provisions for potential liabilities.

- Industry and Competitive Landscape: Different industries have unique characteristics and dynamics that can influence accounting estimates. Factors such as changes in technology, regulatory requirements, and competitive pressures can impact revenue recognition, asset valuations, and other financial elements.

- Historical Trends: Past performance and trends play a crucial role in accounting estimates. Historical data is often used as a basis for predicting future outcomes. Analyzing historical trends helps organizations identify patterns and make informed estimates about revenues, costs, and asset valuations.

- Professional Judgment: Accounting estimates require the use of professional judgment. The expertise and experience of financial professionals come into play when making assumptions and calculations. Professional judgment helps in assessing the reliability of information, selecting appropriate valuation techniques, and addressing uncertainties.

- Regulatory Standards: Accounting estimates must adhere to regulatory standards such as International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP). These standards provide guidelines on the appropriate methods to be used, disclosure requirements, and the overall consistency of financial reporting.

- Management’s Intentions and Strategies: The intentions and strategies of the company’s management can influence accounting estimates. For example, if a company plans to hold an asset for a longer period, it may influence the useful life and depreciation estimation of that asset. Management’s estimate of future sales and their growth plans can also impact revenue recognition estimates.

- External Factors: External factors, such as changes in government regulations, tax laws, or legal judgments, can influence accounting estimates. These factors may require reassessment of provisions, impairment evaluations, or adjustments to revenue recognition.

It is important for organizations to carefully consider these factors when making accounting estimates. Proper assessment and analysis of these influences ensure that the estimates are accurate, reliable, and in compliance with relevant accounting standards.

Process of Making Accounting Estimates

The process of making accounting estimates involves several steps to ensure accuracy, reliability, and compliance with accounting standards. While the specifics may vary depending on the type of estimate being made, the general process can be outlined as follows:

- Identify the Need for an Estimate: The first step is to identify the financial element for which an estimate is required. This could include inventory valuation, asset impairment assessment, revenue recognition, or provision for bad debts, among others.

- Gather Relevant Data: In order to make an accurate estimate, it is important to gather relevant data. This may involve analyzing historical financial statements, market trends, economic indicators, and any other information that may impact the estimate.

- Apply Accounting Standards: Accounting estimates must be made in accordance with applicable accounting standards, such as International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP). These standards provide guidelines and frameworks for making estimates in a consistent and standardized manner.

- Use Appropriate Methods and Techniques: Depending on the nature of the estimate, different methods and techniques may be used. For example, inventory valuation may involve techniques such as First-In-First-Out (FIFO) or Weighted Average Cost. The choice of method should be applied consistently and be appropriate for the business and industry.

- Exercise Professional Judgment: Accounting estimates often require professional judgment. This involves considering factors such as industry knowledge, experience, and qualitative information that may not be readily quantifiable. Professional judgment ensures that estimates are reasonable, reliable, and consistent with the circumstances.

- Document Assumptions and Calculations: It is crucial to properly document the assumptions made and calculations performed when making accounting estimates. This documentation provides transparency and allows for review and audit purposes. It also enables the ability to revisit and revise estimates as necessary when new information becomes available.

- Monitor and Review Estimates: Accounting estimates are not static; they may need to be reviewed and adjusted as new information is obtained or circumstances change. Regular monitoring and review of estimates help to ensure their continued accuracy and relevance.

- Disclose the Estimates: As part of financial reporting, it is essential to disclose the nature of the estimates made, the methods employed, and any significant assumptions or uncertainties that may impact the financial statements. This disclosure enhances transparency and provides stakeholders with a clear understanding of the estimates made.

By following this process, organizations can make reliable and informed accounting estimates that contribute to accurate financial reporting and decision-making.

Challenges and Limitations of Accounting Estimates

While accounting estimates are a valuable tool in financial reporting, they are not without their challenges and limitations. Here are some common challenges and limitations that organizations may encounter when making accounting estimates:

- Uncertainty: Accounting estimates inherently involve a degree of uncertainty. They are based on assumptions and predictions about future events and economic conditions. As a result, there is always a risk of inaccuracies or deviations from the actual outcomes.

- Subjectivity: Accounting estimates often require professional judgment and subjective interpretation. Different individuals or organizations may have varying opinions and approaches, leading to inconsistencies or biases in the estimates made.

- Lack of Objective Data: In certain cases, there may be a lack of objective data to support accounting estimates. This can make it challenging to determine the appropriate values or measurements, leading to a higher degree of subjectivity in the estimation process.

- Complexity of Factors: Some accounting estimates involve complex calculations, such as revenue recognition for long-term contracts or determining the fair value of financial instruments. The complexity of these factors and the need to consider multiple variables can increase the difficulty of making accurate estimates.

- Changes in Circumstances: Accounting estimates may need to be revised due to changes in circumstances. New information, regulatory changes, or shifts in market conditions can require adjustments to previous estimates, potentially impacting financial statements and the comparability of financial data across periods.

- Potential for Manipulation: The subjective nature of accounting estimates can create opportunities for manipulation or bias. There is a risk that organizations may intentionally manipulate estimates to present a more favorable financial position or performance, which can undermine the transparency and reliability of financial reporting.

- Limited Predictive Power: Accounting estimates are based on historical data and assumptions about future events. However, they may not always accurately predict future outcomes. Unexpected changes in economic conditions, customer behavior, or industry dynamics can result in deviations from estimated values.

- Audit and Review: Accounting estimates are subject to scrutiny during audits and reviews. External auditors may challenge the reasonableness and accuracy of estimates, leading to additional assessments and potential adjustments. This can increase the time and resources required for financial reporting.

Despite these challenges and limitations, accounting estimates are still an essential tool for financial reporting. Organizations must strive to minimize bias, exercise professional judgment, and enhance transparency in order to mitigate the potential risks and limitations associated with accounting estimates.

Examples of Accounting Estimates

Accounting estimates are utilized in various financial elements to provide a more accurate representation of a company’s financial position and performance. Here are some examples of common accounting estimates:

- Depreciation Expense: Estimating the depreciation expense for tangible assets, such as buildings, vehicles, or machinery, involves determining the useful life of the assets and their residual value. This estimate affects the allocation of costs over the asset’s useful life.

- Provision for Bad Debts: Organizations estimate the provision for bad debts or doubtful accounts to account for the possibility of customer non-payment. This estimation involves analyzing historical patterns of customer payment behavior, current economic conditions, and the aging of accounts receivable.

- Inventory Valuation: Estimating the value of inventory on hand is crucial for financial reporting. Depending on the various inventory valuation methods, such as FIFO (First-In-First-Out) or LIFO (Last-In-First-Out), organizations estimate the cost of goods sold and the value of ending inventory.

- Impairment of Assets: Organizations make estimates to assess the impairment of assets, such as property, plant, and equipment, or intangible assets. These estimates compare the carrying value of the assets with their recoverable amount to determine if any impairment loss needs to be recognized.

- Revenue Recognition: Accountants estimate the recognition of revenue in certain situations, such as long-term contracts or projects. Estimating revenue involves considering factors like the stage of completion, collectability, and the transfer of control of goods or services to customers.

- Valuation of Contingent Liabilities: Organizations estimate provisions for potential contingent liabilities, such as legal claims or warranties. These estimates are made by evaluating the likelihood of occurrence, potential legal judgments or settlements, and probability-weighted outcomes.

- Amortization of Intangible Assets: Estimating the amortization expense of intangible assets, such as patents or trademarks, involves determining the useful life of the assets. This estimation impacts the allocation of the asset’s cost over its useful life.

These examples illustrate the range of accounting estimates used in financial reporting. Each estimate requires careful analysis, consideration of relevant factors, and compliance with accounting standards to ensure accurate financial representation.

Importance of Accurate Accounting Estimates

Accurate accounting estimates play a crucial role in financial reporting and decision-making for organizations. Here are some key reasons why accuracy in accounting estimates is of utmost importance:

- Financial Decision Making: Accurate accounting estimates provide reliable information for effective financial decision-making. Organizations rely on these estimates to allocate resources, plan budgets, determine pricing strategies, and evaluate investment opportunities.

- Resource Allocation: Accurate estimates ensure that resources are allocated efficiently and effectively. Organizations can make informed decisions regarding investments, inventory management, and debt management, based on reliable financial information.

- Transparency and Compliance: Accurate accounting estimates enhance transparency in financial reporting. They provide stakeholders, including investors, creditors, and regulators, with reliable information to assess the financial health, performance, and compliance of an organization with accounting standards.

- Investor Confidence: Accurate accounting estimates inspire confidence in investors and stakeholders. Reliable financial statements based on accurate estimates help attract potential investors, secure funding, and maintain credibility in the marketplace.

- Regulatory Compliance: Accurate estimates ensure compliance with accounting standards and regulations. Organizations must adhere to International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP) to provide standardized and reliable financial information.

- Effective Risk Management: Accurate estimates enable organizations to identify and manage financial risks effectively. Estimates for provisions, contingent liabilities, and impairment of assets help organizations anticipate and prepare for potential risks, minimizing any adverse financial impact.

- Comparability: Accurate accounting estimates contribute to the comparability of financial statements over time. Consistent and reliable estimates allow for meaningful analysis, benchmarking, and evaluation of an organization’s financial performance and position.

- Audit and Assurance: Accurate accounting estimates facilitate the audit and assurance process. External auditors rely on accurate estimates to validate the fairness, accuracy, and completeness of financial statements. Accurate estimates help ensure that financial statements are free from material misstatements.

Overall, the accuracy of accounting estimates is vital for organizations to make informed decisions, maintain stakeholder trust, fulfill regulatory requirements, manage risks effectively, and provide reliable financial information. By ensuring accuracy in accounting estimates, organizations can enhance transparency, improve decision-making, and foster confidence in their financial reporting.

Conclusion

Accounting estimates are an integral and necessary part of financial reporting in the world of finance and business. They provide valuable insights into a company’s financial position and performance, enabling organizations to make informed decisions and allocate resources effectively.

Throughout this article, we have explored the definition of accounting estimates, their importance, the types of estimates used, the factors that influence them, and the process of making these estimates. We have also discussed the challenges and limitations that organizations face when making accounting estimates.

Accurate accounting estimates are crucial for financial decision-making, resource allocation, regulatory compliance, and investor confidence. They ensure transparency in financial reporting, facilitate effective risk management, and enable comparability of financial statements over time. Accurate estimates also enhance the audit and assurance process, providing stakeholders with reliable financial information.

However, it is important to acknowledge the challenges and limitations associated with accounting estimates, such as uncertainty, subjectivity, and the potential for manipulation. To mitigate these risks, organizations must exercise professional judgment, follow accounting standards, document assumptions and calculations, and regularly review and monitor estimates.

In conclusion, accounting estimates are an essential tool that helps organizations navigate the complexities of the financial landscape. By making accurate estimates, organizations can make informed decisions, comply with regulations, manage risks effectively, gain stakeholder trust, and provide reliable financial information for the benefit of their stakeholders and the overall success of their business.