Finance

How To Short Credit Default Swaps

Published: March 4, 2024

Learn how to short credit default swaps and manage risk in finance. Discover strategies for trading CDS in the market. Gain insights into hedging and speculation.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Understanding the Basics of Shorting Credit Default Swaps

- Deciphering the Mechanisms of Credit Default Swaps

- Unveiling the Strategy of Betting Against Creditworthiness

- Navigating the Complexities and Potential Pitfalls of Shorting Credit Default Swaps

- Navigating the Dynamics of Shorting Credit Default Swaps

Introduction

Understanding the Basics of Shorting Credit Default Swaps

In the complex realm of finance, the concept of shorting credit default swaps (CDS) has garnered significant attention. This practice involves betting against the creditworthiness of a particular entity, such as a corporation or government, by entering into a contract that pays out in the event of a default. While shorting CDS can potentially yield substantial profits, it also carries inherent risks that necessitate a comprehensive understanding of the financial instruments involved.

Shorting CDS is a speculative strategy that allows investors to profit from the deterioration of a borrower's credit quality. By essentially taking a negative position on the creditworthiness of an entity, investors can capitalize on the potential default of the underlying debt. This financial maneuver is not without controversy, as it has been associated with the 2008 global financial crisis and is often viewed as a form of profiting from the failure of others.

As we delve into the intricacies of shorting credit default swaps, it is essential to grasp the fundamental principles of credit derivatives and the mechanics of short selling. By gaining insights into the underlying dynamics, market participants can make informed decisions and navigate the complexities of this investment strategy. Let's embark on a journey to unravel the nuances of shorting credit default swaps and explore the risks and considerations associated with this speculative practice.

Understanding Credit Default Swaps

Deciphering the Mechanisms of Credit Default Swaps

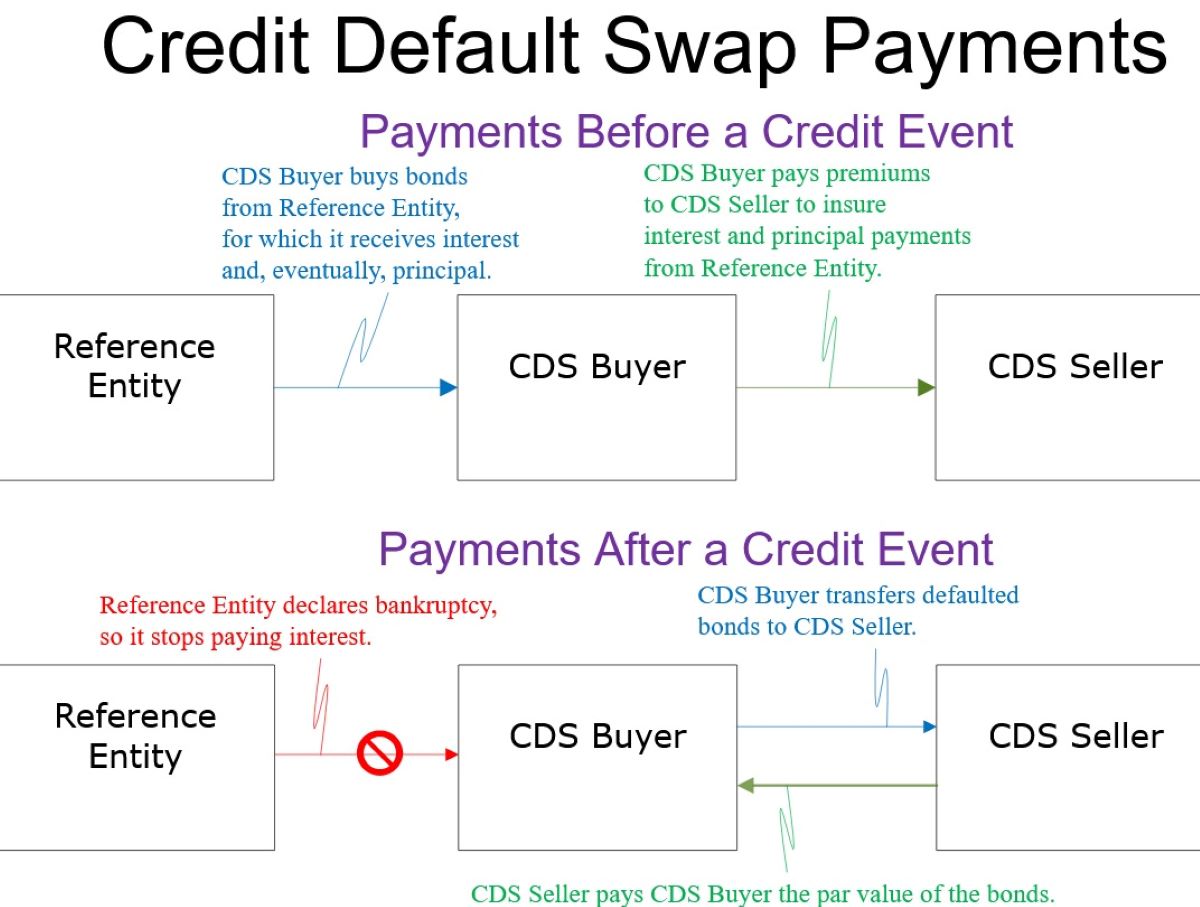

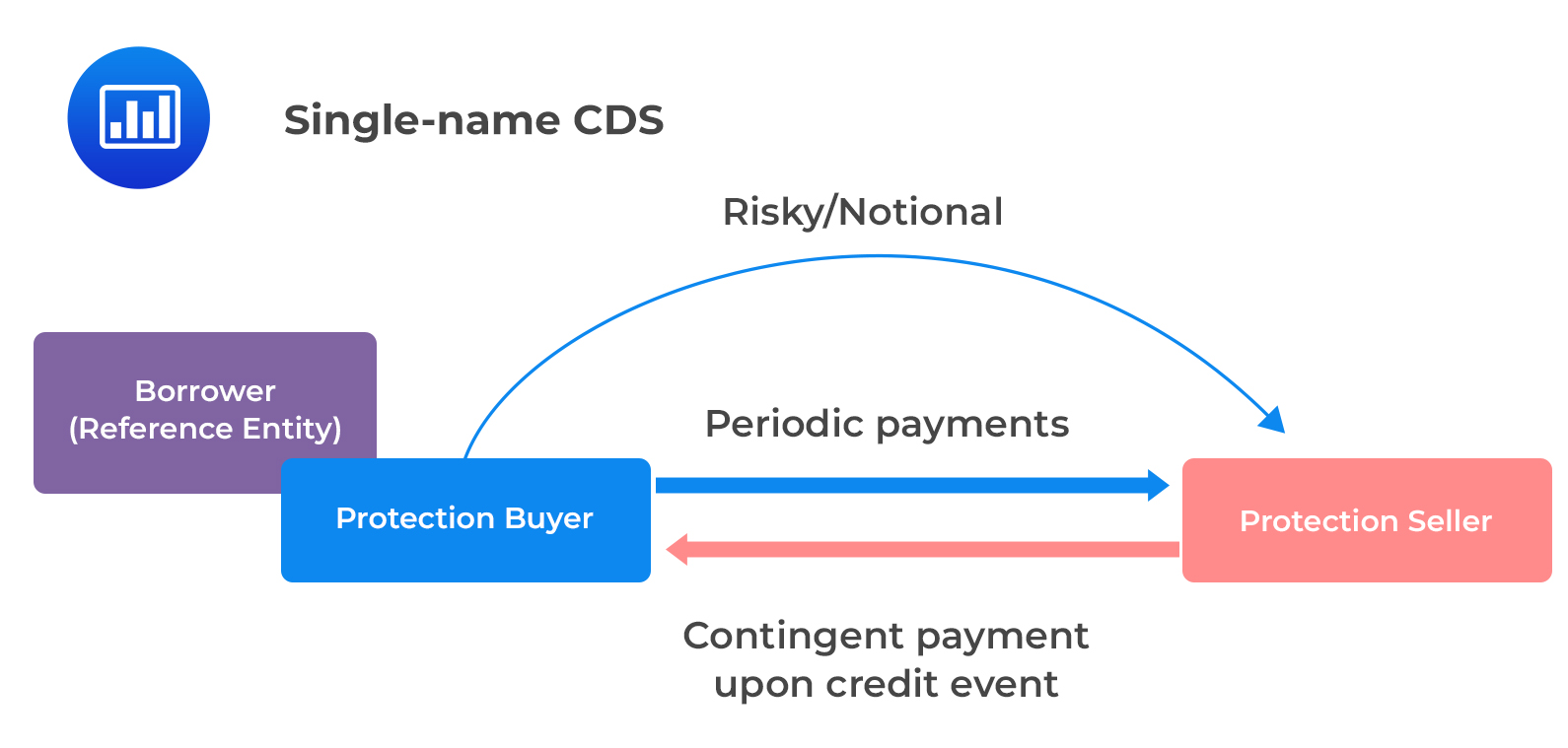

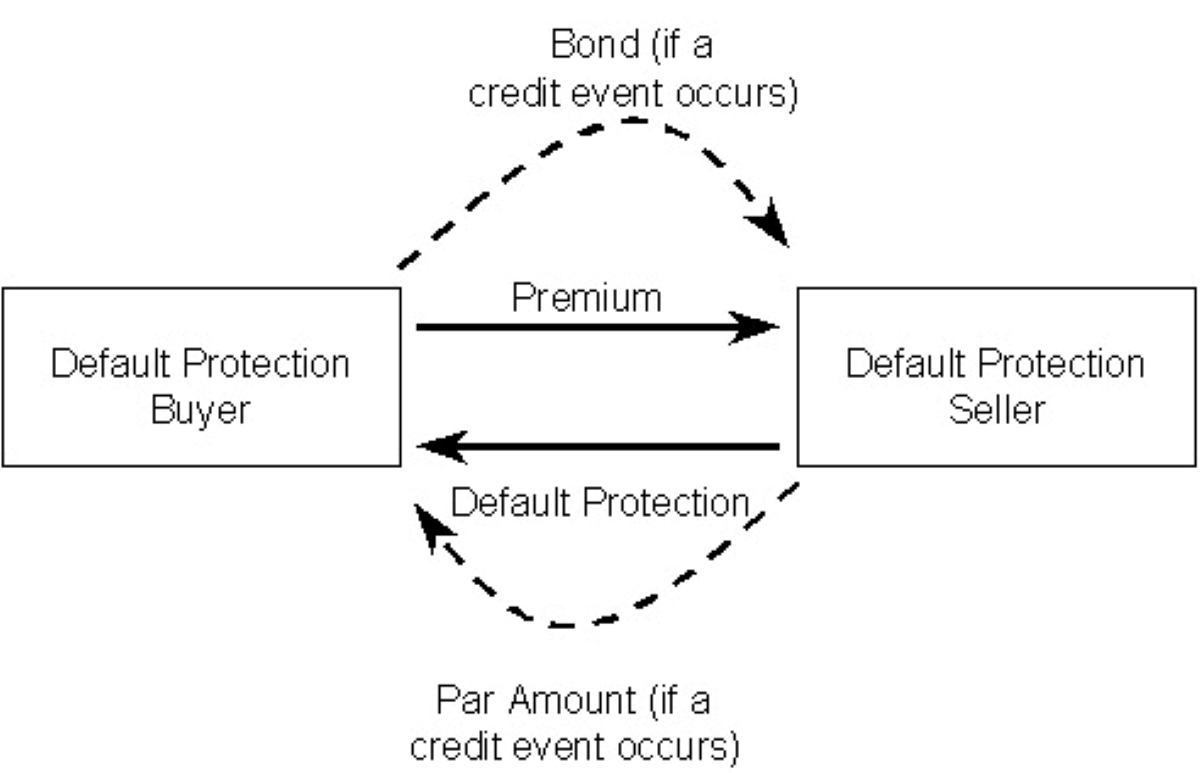

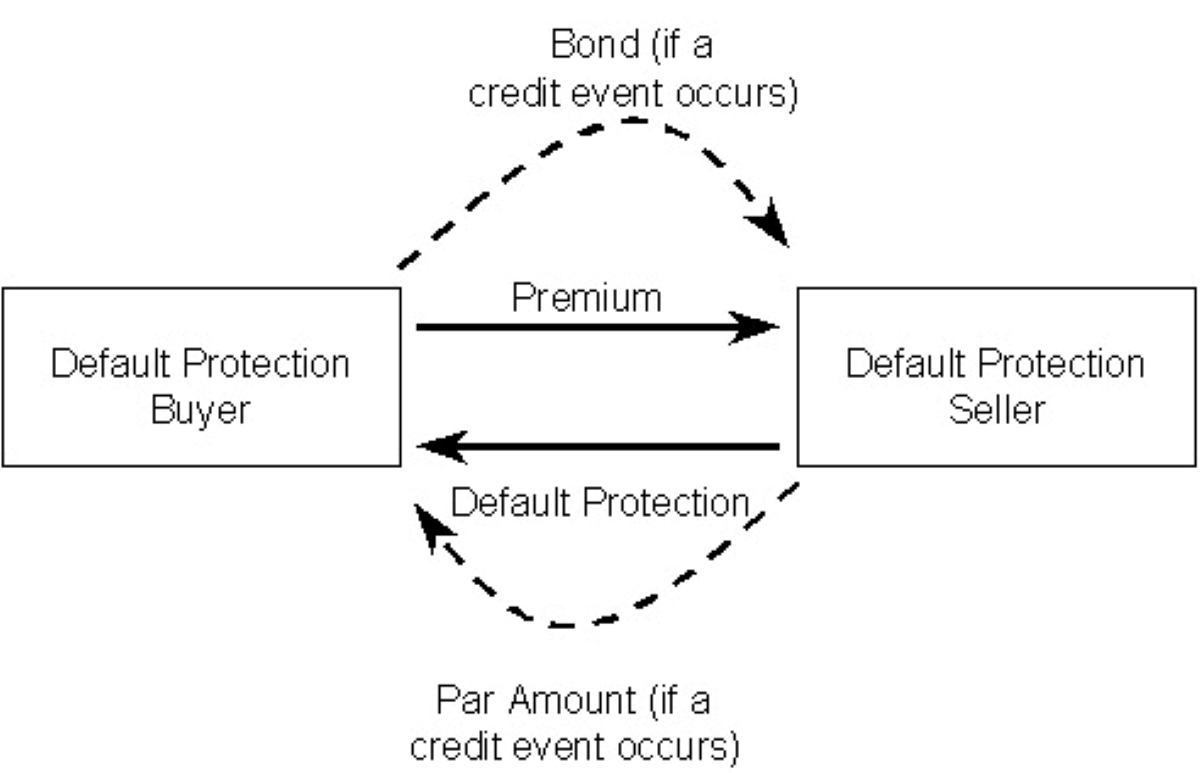

To comprehend the concept of shorting credit default swaps, it is imperative to first grasp the fundamental workings of credit default swaps (CDS). At its core, a credit default swap is a financial derivative that enables investors to hedge against the risk of default on debt or speculate on the creditworthiness of a particular entity. This derivative functions as a form of insurance against non-payment, providing protection to the buyer in the event of a credit event, such as a default or restructuring.

When an investor purchases a credit default swap, they are essentially acquiring a contract that transfers the credit risk of a reference entity to the seller of the swap. In return for this protection, the buyer makes periodic payments, often referred to as premiums, to the seller. In the event of a credit event, the seller is obligated to compensate the buyer for the loss incurred due to the default or restructuring of the underlying debt.

Notably, credit default swaps are traded over-the-counter (OTC), allowing for customized terms and agreements between the counterparties. This flexibility in structuring CDS contracts contributes to their widespread use in the financial markets, providing investors with tailored risk management solutions and speculative opportunities.

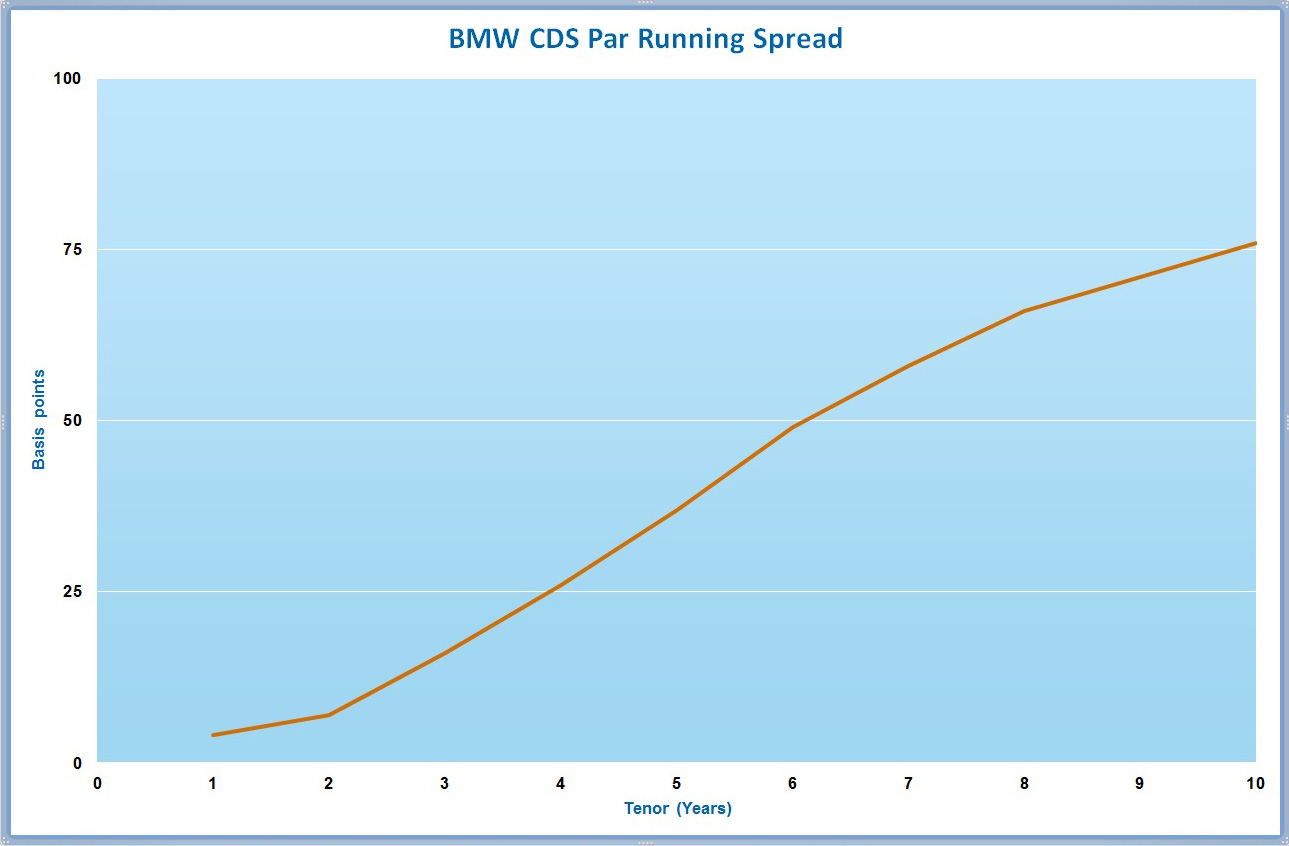

Furthermore, credit default swaps are commonly linked to a specific reference obligation, which could be a corporate bond, a loan, or a sovereign debt instrument. The notional amount of the CDS reflects the value of the underlying debt, and the premium payments are determined based on the perceived credit risk of the reference entity. As such, the pricing of credit default swaps is influenced by market sentiment, credit ratings, and the overall economic environment.

By comprehending the mechanics of credit default swaps, investors can gain valuable insights into the dynamics of the credit derivatives market and the underlying factors driving the pricing and trading of these financial instruments. This foundational knowledge serves as a crucial precursor to exploring the strategy of shorting credit default swaps and the associated implications.

Shorting Credit Default Swaps

Unveiling the Strategy of Betting Against Creditworthiness

Shorting credit default swaps entails taking a pessimistic stance on the credit quality of a specific entity, effectively profiting from the potential deterioration of its financial standing. This strategy involves entering into a CDS contract as a seller, thereby assuming the obligation to compensate the buyer in the event of a credit event, such as a default or restructuring, related to the reference entity’s debt.

When an investor decides to short a credit default swap, they are essentially betting that the creditworthiness of the referenced entity will weaken, leading to a payout on the CDS contract. This speculative maneuver allows investors to capitalize on the negative outlook for the underlying debtor’s financial health, potentially reaping profits if the anticipated credit event materializes.

Shorting credit default swaps can be executed for various reasons, including expressing a bearish view on a particular company’s prospects, hedging an existing credit exposure, or purely engaging in speculative trading to profit from adverse credit developments. This strategy provides a means for investors to actively manage their credit risk exposure and pursue alternative investment opportunities within the realm of credit derivatives.

It is important to note that shorting credit default swaps involves assuming the role of a protection seller, thereby incurring the obligation to make payments in the event of a credit event. As such, this strategy carries inherent risks, particularly if the credit quality of the reference entity improves, leading to potential losses for the protection seller.

Moreover, the practice of shorting credit default swaps has been subject to scrutiny and ethical considerations, as it raises questions about profiting from the financial distress of entities. The role of credit default swaps in amplifying systemic risk and contributing to market instability has been a topic of debate, particularly in the aftermath of the 2008 financial crisis.

By delving into the strategy of shorting credit default swaps, investors can gain a deeper understanding of the intricacies involved in taking a negative position on credit risk and the implications of such speculative endeavors within the broader financial landscape.

Risks and Considerations

Navigating the Complexities and Potential Pitfalls of Shorting Credit Default Swaps

Shorting credit default swaps, while offering the potential for financial gain, carries inherent risks and considerations that necessitate prudent assessment and risk management. As investors explore this speculative strategy, it is imperative to acknowledge the multifaceted nature of the associated risks and the critical factors that warrant careful consideration.

One of the primary risks of shorting credit default swaps pertains to the potential for unlimited losses. As a protection seller, the investor assumes the obligation to compensate the buyer in the event of a credit event, which can result in substantial payouts if the creditworthiness of the reference entity deteriorates significantly. This unlimited loss exposure underscores the necessity of robust risk management practices and vigilant monitoring of credit developments.

Furthermore, shorting credit default swaps involves exposure to counterparty risk, given the bilateral nature of over-the-counter derivatives. In the event of the protection buyer’s default, the protection seller may encounter challenges in receiving the intended payments, thereby amplifying the credit risk associated with this speculative strategy.

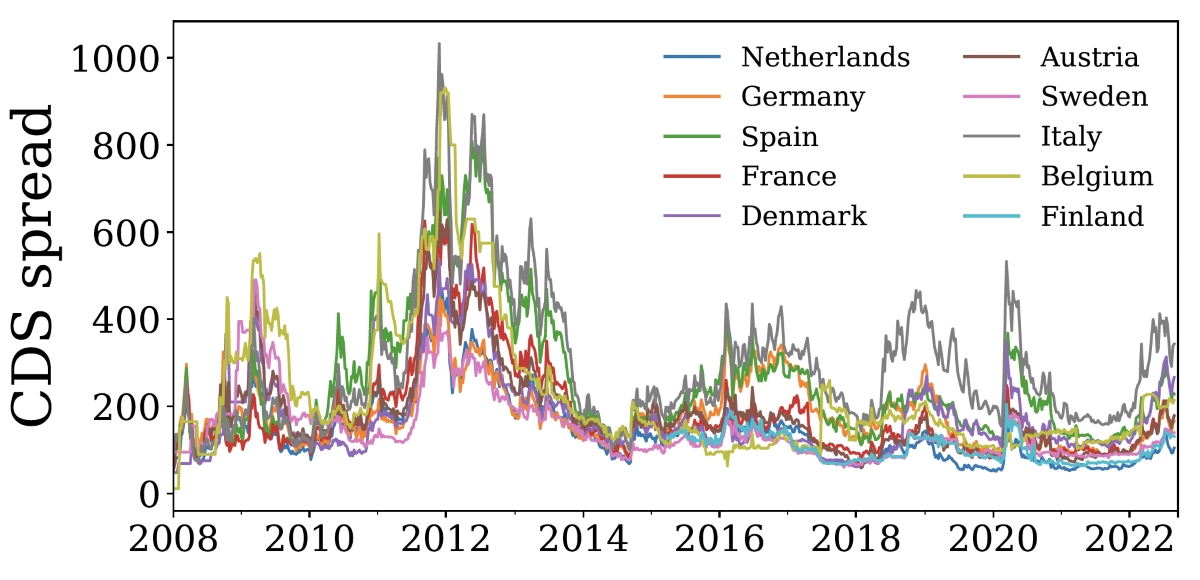

Another critical consideration relates to the potential for market volatility and liquidity constraints impacting the pricing and tradability of credit default swaps. The dynamic nature of credit markets and the interconnectedness of financial instruments can contribute to rapid fluctuations in CDS pricing, posing challenges for investors seeking to manage their positions effectively.

Ethical and reputational considerations also come into play when contemplating the practice of shorting credit default swaps. The perception of profiting from the financial distress of entities raises ethical dilemmas and may influence the decision-making processes of investors, particularly those with a focus on corporate social responsibility and sustainable investment practices.

Moreover, the regulatory environment surrounding credit derivatives, including CDS, remains a key factor in evaluating the risks and implications of engaging in short positions. Regulatory changes, disclosure requirements, and capital adequacy standards can impact the operational and compliance aspects of shorting credit default swaps, necessitating ongoing diligence and adherence to evolving regulatory frameworks.

By meticulously weighing the risks and considerations associated with shorting credit default swaps, investors can make informed decisions and implement robust risk mitigation strategies to navigate the complexities of this speculative endeavor.

Conclusion

Navigating the Dynamics of Shorting Credit Default Swaps

As we conclude our exploration of shorting credit default swaps, it becomes evident that this speculative strategy is intertwined with a myriad of complexities, risks, and ethical considerations. The practice of shorting CDS involves taking a pessimistic view on the creditworthiness of a specific entity, presenting investors with the opportunity to profit from potential credit events. However, this endeavor is not devoid of challenges and critical factors that warrant careful evaluation.

By understanding the fundamental mechanics of credit default swaps and the dynamics of shorting these derivatives, investors can gain valuable insights into the intricacies of credit risk management and speculative trading within the financial markets. The nuanced interplay of market sentiment, credit developments, and regulatory considerations underscores the multifaceted nature of shorting credit default swaps and the imperative need for comprehensive risk assessment.

It is crucial for market participants to approach the strategy of shorting credit default swaps with a balanced perspective, acknowledging the potential for financial gain alongside the inherent risks and ethical implications. Prudent risk management, diligent monitoring of credit developments, and adherence to regulatory requirements are paramount in navigating the complexities of engaging in short positions within the credit derivatives landscape.

As the financial landscape continues to evolve, the role of credit default swaps and the practice of shorting these derivatives remain subject to ongoing scrutiny, regulatory developments, and ethical considerations. Investors are tasked with the responsibility of conducting thorough due diligence, implementing robust risk mitigation measures, and upholding ethical standards as they navigate the intricate realm of shorting credit default swaps.

Ultimately, the strategy of shorting credit default swaps embodies the convergence of financial acumen, risk management proficiency, and ethical discernment, encapsulating the multifaceted nature of speculative trading within the domain of credit derivatives.