Finance

How Much Is A Credit Default Swap

Published: March 4, 2024

Learn about credit default swaps and how they impact the finance industry. Understand the costs and implications of using credit default swaps in financial transactions. Gain insights into the pricing and valuation of credit default swaps.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Understanding the Basics of Credit Default Swaps

- Unraveling the Essence of Credit Default Swaps

- Unveiling the Mechanisms of Credit Default Swaps

- Deciphering the Complexities of Credit Default Swap Valuation

- Unraveling the Influential Determinants of CDS Pricing

- Exploring the Versatile Applications of CDS in Financial Markets

- Navigating the Complexities and Potential Pitfalls of CDS Transactions

- Navigating the Dynamics of Credit Default Swaps: A Comprehensive Insight

Introduction

Understanding the Basics of Credit Default Swaps

When delving into the intricate world of finance, one often encounters terms that may seem perplexing at first glance. Among these is the enigmatic concept of a Credit Default Swap (CDS). This financial instrument has garnered attention due to its role in the global financial landscape, particularly during times of economic turbulence. Understanding the fundamentals of a Credit Default Swap is crucial for investors, financial professionals, and anyone seeking insight into the mechanisms that underpin the financial markets.

A Credit Default Swap serves as a form of insurance against the default of a borrower, typically a corporation or government entity. It is essentially a contract between two parties, where the buyer makes periodic payments to the seller in exchange for protection in the event of a credit event, such as a default or bankruptcy. This innovative financial tool has the potential to mitigate risks, but it also carries inherent complexities that warrant a closer examination.

As we navigate through the intricacies of Credit Default Swaps, we will unravel the mechanics, pricing, and utilization of this financial instrument. Moreover, we will explore the factors influencing the pricing of Credit Default Swaps and the associated risks. By the end of this journey, you will have gained a comprehensive understanding of Credit Default Swaps and their significance within the realm of finance.

What is a Credit Default Swap (CDS)?

Unraveling the Essence of Credit Default Swaps

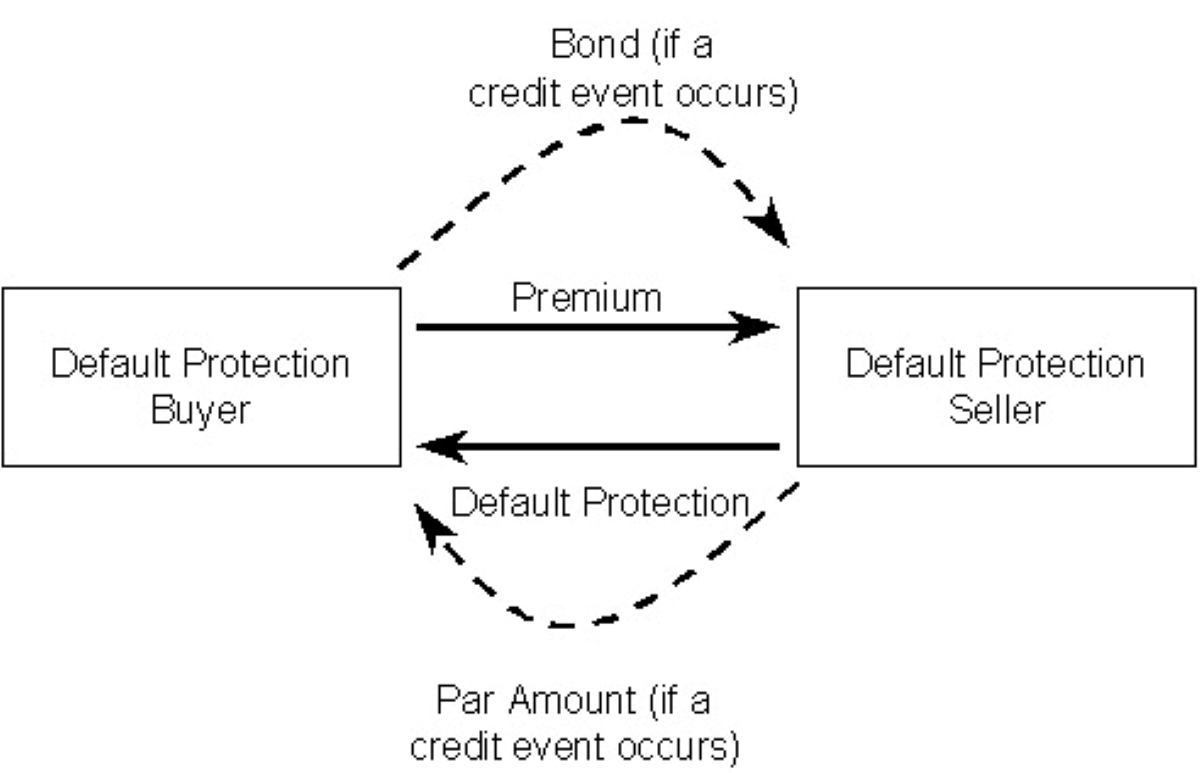

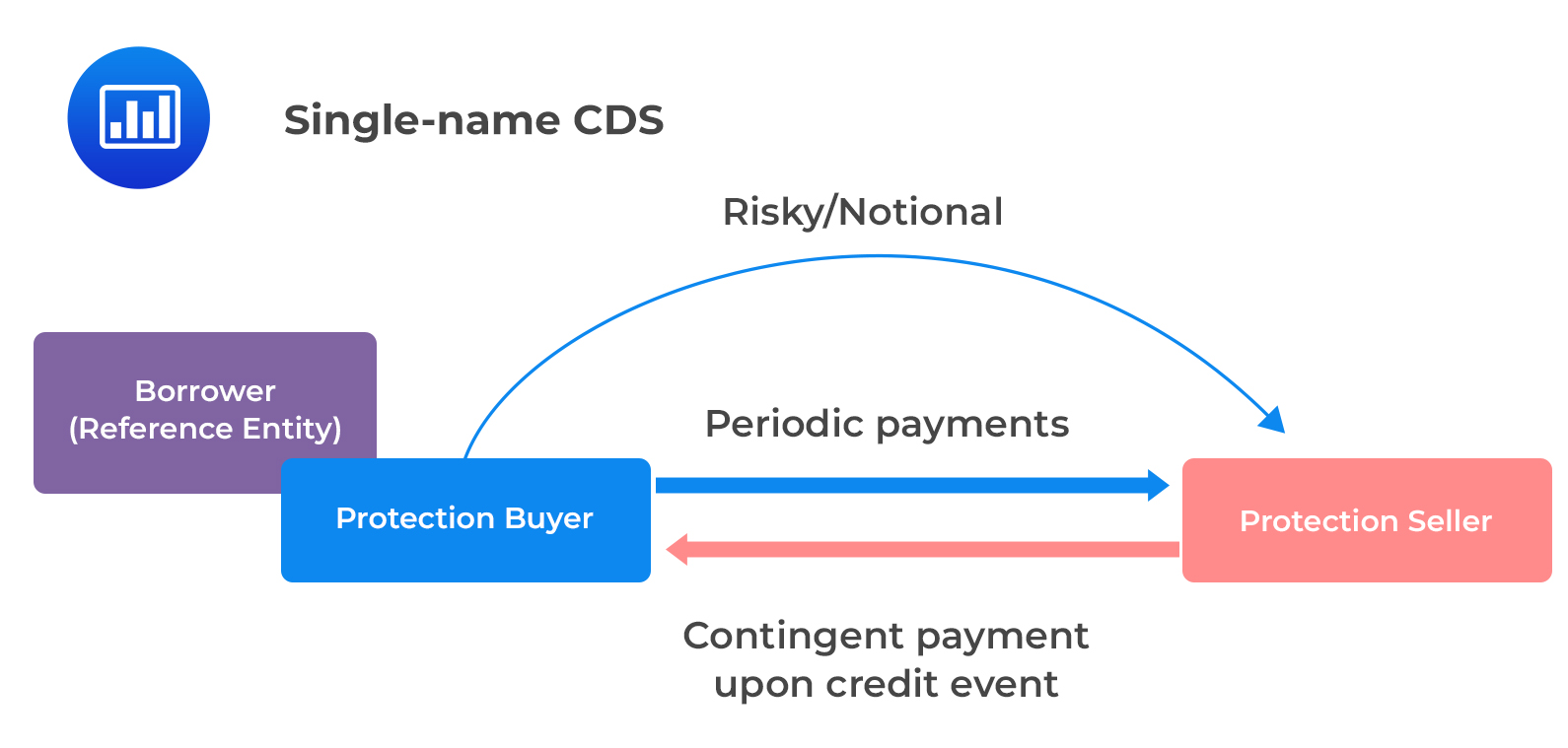

A Credit Default Swap (CDS) is a financial derivative that allows investors to mitigate the risk of a borrower defaulting on its debt obligations. In essence, it is a bilateral contract between two parties, often referred to as the protection buyer and the protection seller. The buyer of the CDS makes periodic payments to the seller, known as the premium, in exchange for protection against potential credit events.

At its core, a Credit Default Swap is akin to an insurance policy against the default of a specific entity, such as a corporation or government. If the borrower experiences a credit event, such as a default, the protection buyer is entitled to receive compensation for the loss incurred. This compensation typically corresponds to the face value of the underlying debt instrument, thereby shielding the buyer from the adverse financial impact of the default.

One notable aspect of Credit Default Swaps is that the buyer does not need to own the underlying debt instrument of the referenced entity. This characteristic sets CDS apart from traditional insurance, as it allows investors to speculate on the creditworthiness of a borrower without holding their debt. Consequently, Credit Default Swaps have been associated with speculative activities and have been subject to scrutiny regarding their potential impact on financial markets.

It is important to note that Credit Default Swaps are not limited to individual entities; they can also be based on a basket of entities or specific debt obligations, providing a diversified approach to managing credit risk. This flexibility has contributed to the widespread use of Credit Default Swaps across various sectors of the financial market.

How Does a Credit Default Swap Work?

Unveiling the Mechanisms of Credit Default Swaps

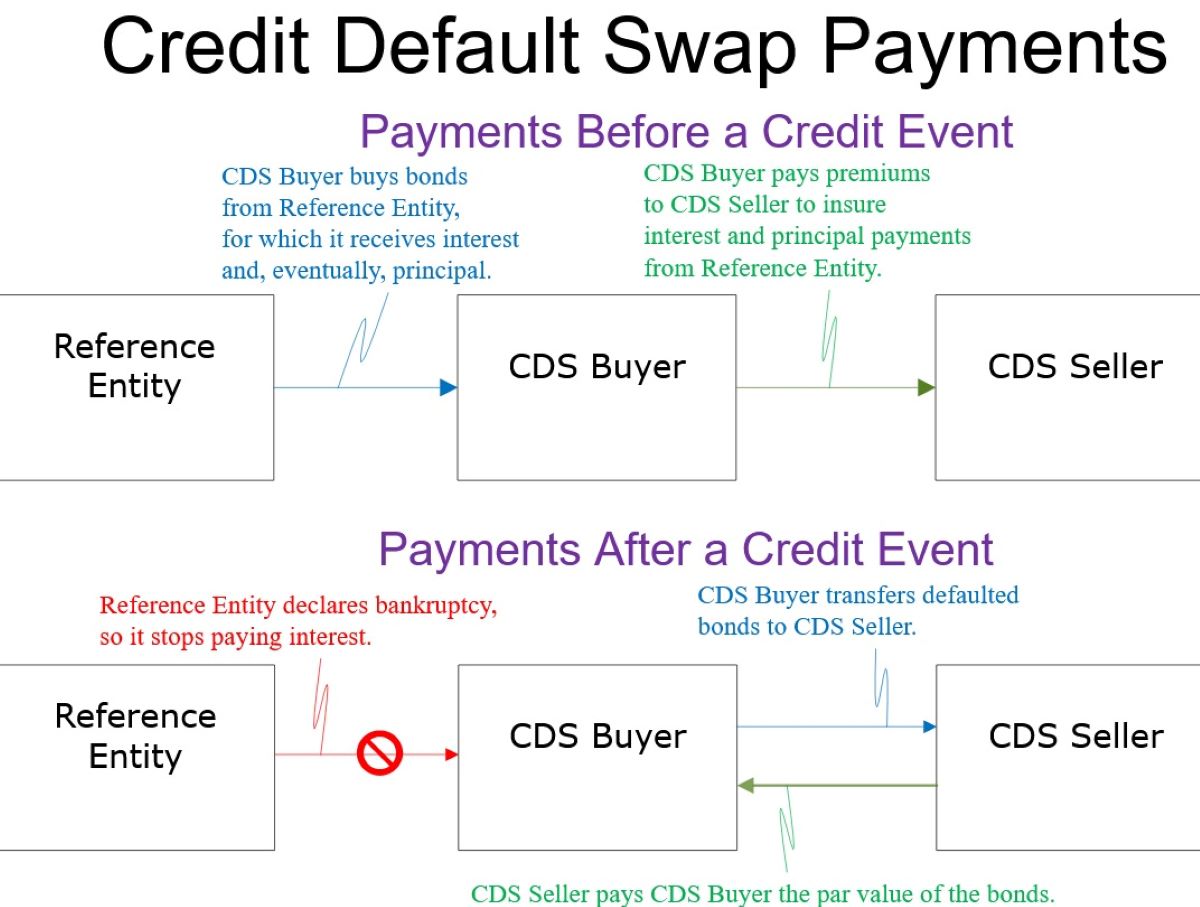

To comprehend the functionality of a Credit Default Swap (CDS), it is imperative to delve into the intricacies of its operation. At its core, a CDS operates as a form of insurance against the default of a borrower. The buyer of the CDS, often seeking protection against potential credit events, enters into a contractual agreement with the seller, thereby initiating the dynamics of this financial instrument.

Upon the initiation of the CDS, the buyer agrees to make periodic payments, known as premiums, to the seller for the duration of the contract. In return, the seller commits to providing compensation to the buyer in the event of a credit event, such as a default or bankruptcy, concerning the referenced entity. This compensation typically corresponds to the face value of the underlying debt instrument or the loss incurred by the buyer due to the credit event.

It is essential to recognize that the buyer of the CDS does not need to hold the underlying debt instrument of the referenced entity, thereby distinguishing CDS from traditional insurance. This characteristic has facilitated the use of Credit Default Swaps for speculative purposes, enabling investors to hedge against the credit risk of entities without owning their debt obligations.

Furthermore, the seller of the CDS assumes the risk of the referenced entity experiencing a credit event, thereby obligating the seller to provide compensation to the buyer in such an eventuality. In exchange for assuming this risk, the seller receives the premiums from the buyer throughout the duration of the contract, thereby generating a potential source of income for the seller.

As such, the dynamics of a Credit Default Swap revolve around the transfer of credit risk from the buyer to the seller in exchange for periodic payments. This mechanism enables market participants to manage and hedge against credit risk, thereby contributing to the overall stability and resilience of the financial system.

Pricing a Credit Default Swap

Deciphering the Complexities of Credit Default Swap Valuation

The pricing of a Credit Default Swap (CDS) hinges on a multifaceted evaluation of various factors that collectively determine the cost of protection against credit events. Understanding the intricacies of CDS pricing is paramount for investors and market participants, as it directly influences the cost and effectiveness of managing credit risk.

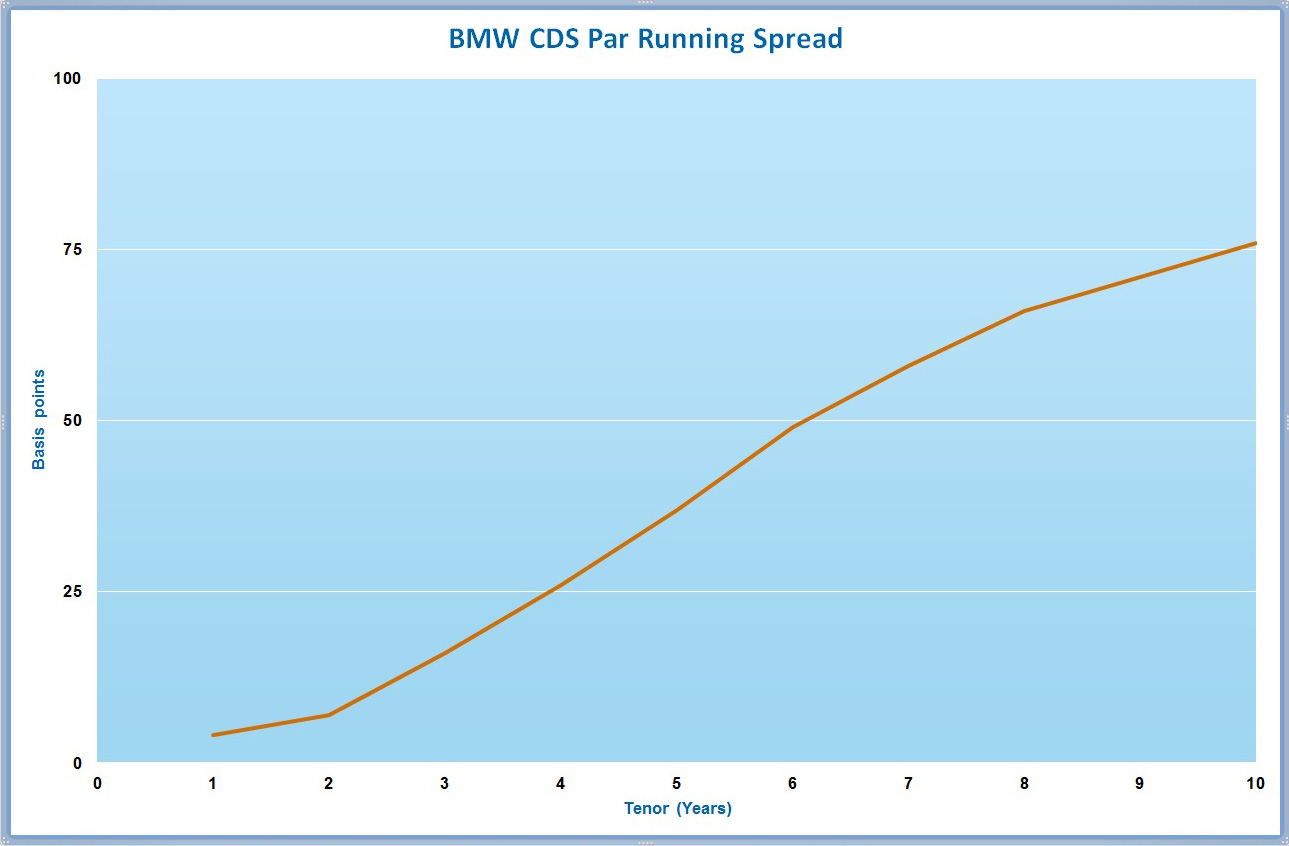

At the heart of CDS pricing lies the determination of the premium, which represents the periodic payments made by the buyer to the seller in exchange for protection. The premium is influenced by several key factors, including the creditworthiness of the referenced entity, the term of the CDS contract, prevailing market conditions, and the overall demand for credit protection.

The creditworthiness of the referenced entity plays a pivotal role in CDS pricing. Entities with higher credit risk, as indicated by credit ratings or market sentiment, typically command higher premiums due to the increased likelihood of potential credit events. Conversely, entities with strong credit profiles may attract lower premiums, reflecting the diminished risk of default.

Furthermore, the term of the CDS contract significantly impacts its pricing. Longer contract durations generally entail higher premiums, as they expose the protection seller to credit risk for an extended period. Shorter contract terms, on the other hand, may result in lower premiums, reflecting the reduced duration of credit protection provided by the seller.

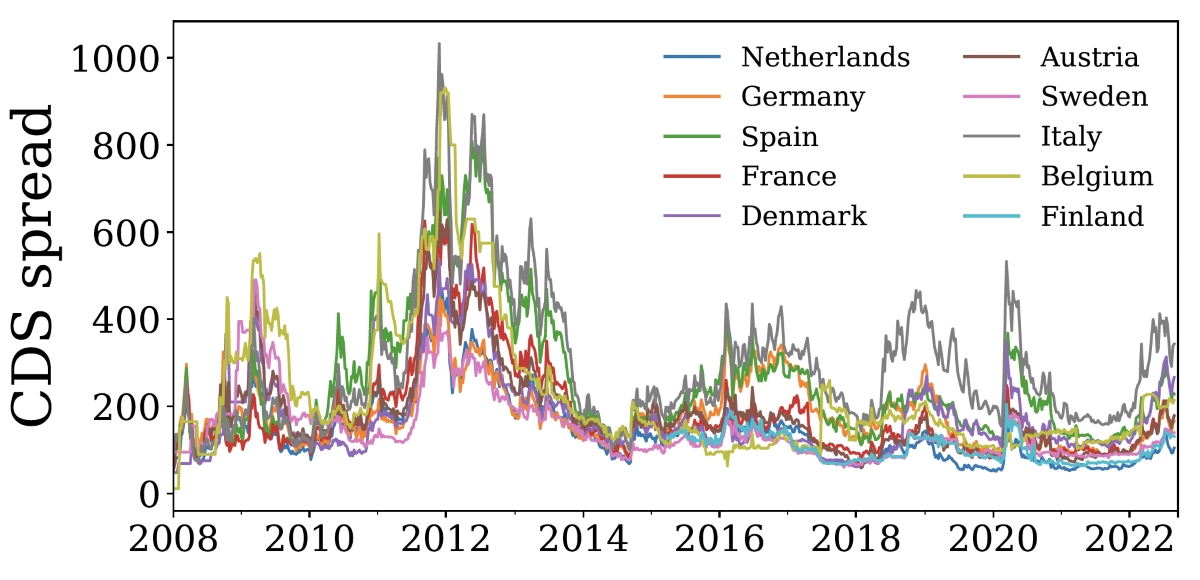

Market conditions and the prevailing demand for credit protection also influence CDS pricing. Heightened market volatility, economic uncertainty, or shifts in investor sentiment can lead to fluctuations in CDS premiums, reflecting the evolving perceptions of credit risk within the market. Additionally, changes in the demand for credit protection, driven by macroeconomic factors or industry-specific developments, can impact the cost of CDS contracts.

Overall, the pricing of a Credit Default Swap is a dynamic process that integrates various quantitative and qualitative factors to determine the cost of mitigating credit risk. By comprehending the intricacies of CDS valuation, market participants can make informed decisions regarding risk management and portfolio optimization within the realm of credit derivatives.

Factors Affecting the Price of a Credit Default Swap

Unraveling the Influential Determinants of CDS Pricing

The pricing of a Credit Default Swap (CDS) is intricately linked to a myriad of factors that collectively shape the cost of protection against credit events. Understanding these influential determinants is essential for investors and market participants, as it enables a comprehensive assessment of the dynamics driving CDS pricing.

- Creditworthiness of the Referenced Entity: The credit risk associated with the referenced entity profoundly impacts the price of a CDS. Entities with a higher probability of default, as indicated by credit ratings or market sentiment, typically command higher CDS premiums. Conversely, entities with robust credit profiles may attract lower premiums, reflecting the diminished risk of credit events.

- Market Conditions and Economic Outlook: The prevailing market environment and broader economic outlook play a pivotal role in shaping CDS pricing. Heightened market volatility, economic uncertainty, or shifts in investor sentiment can lead to fluctuations in CDS premiums, reflecting the evolving perceptions of credit risk within the market. Economic indicators and macroeconomic developments also influence the cost of credit protection, as they impact the overall creditworthiness of entities.

- Term of the CDS Contract: The duration of the CDS contract significantly influences its pricing. Longer contract durations generally entail higher premiums, as they expose the protection seller to credit risk for an extended period. Shorter contract terms may result in lower premiums, reflecting the reduced duration of credit protection provided by the seller.

- Supply and Demand Dynamics: The interplay between supply and demand for credit protection directly affects CDS pricing. Changes in the demand for credit protection, driven by macroeconomic factors or industry-specific developments, can lead to fluctuations in CDS premiums. Moreover, the availability of protection sellers and the overall market liquidity for CDS contracts can impact pricing dynamics.

- Market Sentiment and Investor Perception: Investor sentiment and market perceptions of credit risk contribute to the pricing of CDS contracts. Positive or negative shifts in investor sentiment regarding specific entities or market segments can influence the cost of credit protection, reflecting the prevailing attitudes towards credit risk.

By comprehensively analyzing these influential factors, market participants can gain a nuanced understanding of the complexities underlying CDS pricing. This holistic perspective empowers investors to make informed decisions regarding risk management, portfolio optimization, and the strategic utilization of credit derivatives within the dynamic landscape of financial markets.

Uses of Credit Default Swaps

Exploring the Versatile Applications of CDS in Financial Markets

Credit Default Swaps (CDS) serve as versatile financial instruments with a range of applications across the global financial landscape. Their inherent flexibility and risk management capabilities have led to diverse uses by investors, institutions, and market participants seeking to navigate the complexities of credit risk and capitalize on strategic opportunities.

- Risk Mitigation and Hedging: One of the primary uses of CDS is to mitigate credit risk and hedge against potential losses arising from the default of a borrower. Investors and institutions utilize CDS contracts to protect their portfolios from adverse credit events, thereby enhancing risk management and safeguarding against potential financial repercussions.

- Speculation and Investment Strategies: Credit Default Swaps are employed for speculative purposes and investment strategies, allowing market participants to capitalize on their views regarding the creditworthiness of specific entities or sectors. Investors may take positions in CDS contracts to express bullish or bearish sentiments on credit risk, potentially generating profits from favorable movements in the market.

- Portfolio Diversification and Risk Allocation: CDS contracts offer a mechanism for portfolio diversification and risk allocation. By engaging in CDS transactions, investors can optimize their portfolio composition, manage sector-specific risks, and enhance overall diversification, thereby fostering a balanced and resilient investment approach.

- Credit Exposure Management: Financial institutions and corporate entities utilize CDS to manage their credit exposure and regulatory capital requirements. CDS contracts enable these entities to transfer credit risk, optimize capital allocation, and comply with prudential regulations, thereby enhancing their overall financial stability and regulatory adherence.

- Credit Spread Trading: CDS contracts facilitate credit spread trading, allowing investors to capitalize on movements in credit spreads and the relative pricing of credit risk. Market participants engage in trading strategies that leverage CDS contracts to exploit discrepancies in credit spreads, potentially generating returns from market inefficiencies.

These diverse applications underscore the pivotal role of Credit Default Swaps in fostering risk management, investment strategies, and financial resilience within the global financial ecosystem. By harnessing the inherent versatility of CDS, market participants can navigate the complexities of credit risk, optimize their investment portfolios, and capitalize on strategic opportunities in an ever-evolving market environment.

Risks Associated with Credit Default Swaps

Navigating the Complexities and Potential Pitfalls of CDS Transactions

While Credit Default Swaps (CDS) offer valuable risk management and investment opportunities, they also entail inherent complexities and associated risks that warrant careful consideration by market participants. Understanding these risks is essential for investors, institutions, and regulatory authorities to effectively navigate the dynamics of CDS transactions and mitigate potential adverse outcomes.

- Credit Risk Exposure: One of the primary risks associated with CDS is credit risk exposure. Protection buyers face the potential of counterparties defaulting on their obligations, leading to financial losses and disruptions in the CDS market. The creditworthiness of the protection seller is a critical factor in determining the extent of credit risk exposure faced by the buyer.

- Counterparty Risk: CDS transactions are subject to counterparty risk, wherein the default or insolvency of the protection seller can significantly impact the buyer. Counterparty risk is particularly pronounced during times of financial distress, underscoring the importance of evaluating the creditworthiness and stability of counterparties in CDS transactions.

- Market Liquidity and Valuation Risk: The liquidity of CDS contracts and the valuation of underlying credit derivatives pose inherent risks. Market liquidity constraints can impede the ability to enter into or exit CDS positions, potentially leading to challenges in managing credit risk exposure. Valuation risk encompasses the complexities of accurately pricing CDS contracts, particularly during periods of market volatility and uncertainty.

- Regulatory and Legal Risks: CDS transactions are subject to regulatory and legal risks, including changes in regulatory frameworks, legal uncertainties, and potential disputes arising from CDS contracts. Adherence to regulatory requirements and the legal enforceability of CDS agreements are critical considerations for market participants to mitigate regulatory and legal risks.

- Systemic Risk and Market Contagion: The interconnected nature of CDS transactions can contribute to systemic risk and market contagion. Adverse developments in the CDS market, such as widespread credit events or disruptions in the financial system, can propagate systemic risks, potentially leading to broader market contagion and adverse spillover effects.

By acknowledging and addressing these risks, market participants can adopt prudent risk management practices, enhance due diligence in counterparties selection, and leverage risk mitigation strategies to navigate the complexities associated with CDS transactions. Furthermore, regulatory oversight and transparency initiatives play a crucial role in promoting the stability and integrity of the CDS market, thereby mitigating potential risks and fostering confidence among market participants.

Conclusion

Navigating the Dynamics of Credit Default Swaps: A Comprehensive Insight

As we conclude our exploration of Credit Default Swaps (CDS), it becomes evident that these financial instruments embody a multifaceted landscape characterized by risk management, investment opportunities, and inherent complexities. The intricate nature of CDS transactions underscores the importance of comprehensively understanding their mechanics, pricing dynamics, and associated risks within the broader context of financial markets.

Credit Default Swaps serve as pivotal tools for mitigating credit risk, hedging against potential defaults, and capitalizing on strategic investment strategies. Their versatility enables market participants to navigate the complexities of credit risk exposure, optimize portfolio diversification, and manage regulatory capital requirements. Furthermore, CDS transactions provide a platform for credit spread trading, speculation, and risk allocation, fostering a dynamic and adaptive approach to investment activities.

However, it is imperative to acknowledge the risks associated with CDS, including credit risk exposure, counterparty risk, market liquidity challenges, and regulatory complexities. These risks underscore the importance of prudent risk management practices, due diligence in counterparties selection, and regulatory oversight to safeguard the stability and integrity of the CDS market.

By embracing a holistic understanding of Credit Default Swaps, market participants can harness their inherent potential while prudently managing associated risks. The strategic utilization of CDS empowers investors, institutions, and regulatory authorities to navigate the complexities of credit risk, optimize investment portfolios, and foster resilience within the ever-evolving landscape of financial markets.

Ultimately, the comprehensive insight gained from our exploration of Credit Default Swaps serves as a foundational pillar for informed decision-making, risk mitigation, and strategic positioning within the dynamic realm of credit derivatives. As market dynamics continue to evolve, a nuanced understanding of CDS will remain instrumental in fostering financial stability, risk resilience, and strategic agility for market participants across the global financial ecosystem.