Finance

What Are Compiled Financial Statements

Published: December 22, 2023

Learn about compiled financial statements and their importance in finance. Gain insight into how these statements provide a clear picture of your financial situation.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Compiled Financial Statements

- Purpose of Compiled Financial Statements

- Key Components of Compiled Financial Statements

- Benefits of Compiled Financial Statements

- Differences Between Compiled Financial Statements and Reviewed Financial Statements

- When to Use Compiled Financial Statements

- Limitations of Compiled Financial Statements

- Conclusion

Introduction

Welcome to the world of finance, where numbers tell a story and financial statements play a crucial role in capturing that narrative. When it comes to financial reporting, there are various types of statements that organizations use to present their financial position and performance. One such statement is the compiled financial statement.

Compiled financial statements provide valuable insights into the financial health of a company, offering a snapshot of its financial activities and transactions. They are produced by certified public accountants (CPAs) who gather financial data provided by management and organize it into a presentable format.

In this article, we will delve into the world of compiled financial statements, exploring their definition, purpose, key components, benefits, and limitations. We will also discuss the differences between compiled financial statements and other types of financial statements, as well as when it is appropriate to use them.

Whether you are an entrepreneur, an investor, or simply curious about financial reporting, understanding compiled financial statements is essential for making informed decisions and gaining insights into the financial performance of an organization.

So, let’s dive into the world of compiled financial statements and demystify their role in the finance realm.

Definition of Compiled Financial Statements

Compiled financial statements are a type of financial report that provides a summary of a company’s financial activities and transactions. These statements are prepared by a certified public accountant (CPA) after compiling financial information provided by the company’s management.

Unlike reviewed or audited financial statements, compiled financial statements are not subjected to in-depth examination or verification by an external auditor. Instead, the CPA takes the data provided by the company and organizes it into a formal financial statement format.

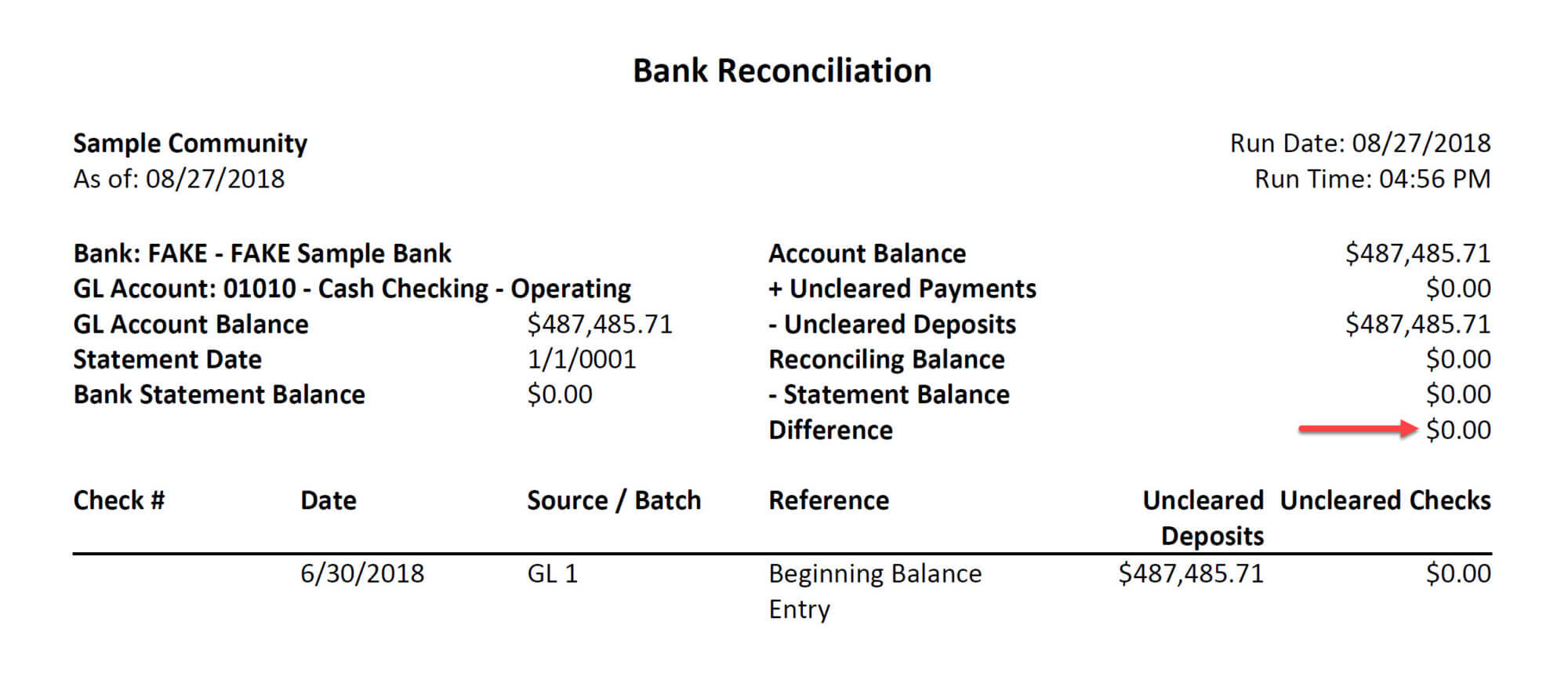

The compilation process involves organizing financial data into financial statements, including the balance sheet, income statement, and statement of cash flows. The CPA may also include footnotes and disclosures to provide additional information and context to the financial statements.

Compiled financial statements are typically intended for internal use within the organization, such as for management decision-making purposes or to meet regulatory requirements. They may also be used by small businesses or non-profit organizations that do not require a higher level of assurance on their financial statements.

It is important to note that compiled financial statements do not provide any assurance or opinion on the accuracy or completeness of the financial information. These statements are simply a presentation of the financial data provided by the company.

While compiled financial statements do not offer the same level of credibility as reviewed or audited financial statements, they still serve a valuable purpose in providing a snapshot of a company’s financial position and performance.

Now that we understand the definition of compiled financial statements, let’s explore their purpose and why organizations choose to use them.

Purpose of Compiled Financial Statements

The purpose of compiled financial statements is to provide management, stakeholders, and regulatory bodies with a concise overview of a company’s financial activities. These statements serve as a useful tool for decision-making, planning, and compliance purposes. Let’s take a closer look at the main objectives of compiled financial statements:

- Internal Decision Making: Compiled financial statements are primarily used by management for internal decision-making processes. They help management assess the financial health of the company and make informed decisions regarding budgeting, investments, and resource allocation. By presenting financial data in a consistent and organized manner, compiled financial statements provide a clear picture of the company’s financial performance and assist management in identifying areas for improvement.

- Regulatory Compliance: Many organizations are required by law to prepare and submit financial statements to regulatory bodies. Compiled financial statements serve this purpose, as they provide a summary of the company’s financial information in a format that meets regulatory requirements. While these statements do not provide the same level of assurance as reviewed or audited financial statements, they still demonstrate compliance with financial reporting regulations.

- External Stakeholder Communication: Compiled financial statements can be shared with external stakeholders, such as investors, lenders, and potential business partners. These stakeholders may rely on compiled financial statements to gain insights into the financial performance and stability of the company. While it is important to note that compiled financial statements carry less assurance than reviewed or audited ones, they still provide stakeholders with a basic understanding of the company’s financial position.

- Internal Control Assessment: Compiled financial statements can also assist companies in evaluating their internal controls. By reviewing the financial data compiled in the statements, management can identify any weaknesses or gaps in their internal control processes and take necessary steps to address them. This helps ensure the accuracy and integrity of financial information within the organization.

Overall, the purpose of compiled financial statements is to provide a snapshot of a company’s financial position and performance, support internal decision-making, demonstrate regulatory compliance, communicate with external stakeholders, and assess internal controls.

Now that we understand the purpose of compiled financial statements, let’s explore the key components that make up these statements.

Key Components of Compiled Financial Statements

Compiled financial statements consist of several key components that provide a comprehensive overview of a company’s financial position and performance. These components include:

- Balance Sheet: The balance sheet presents the company’s assets, liabilities, and equity at a specific point in time. It provides a snapshot of the company’s financial position, showing what it owns (assets) and what it owes (liabilities), as well as the owner’s equity in the business.

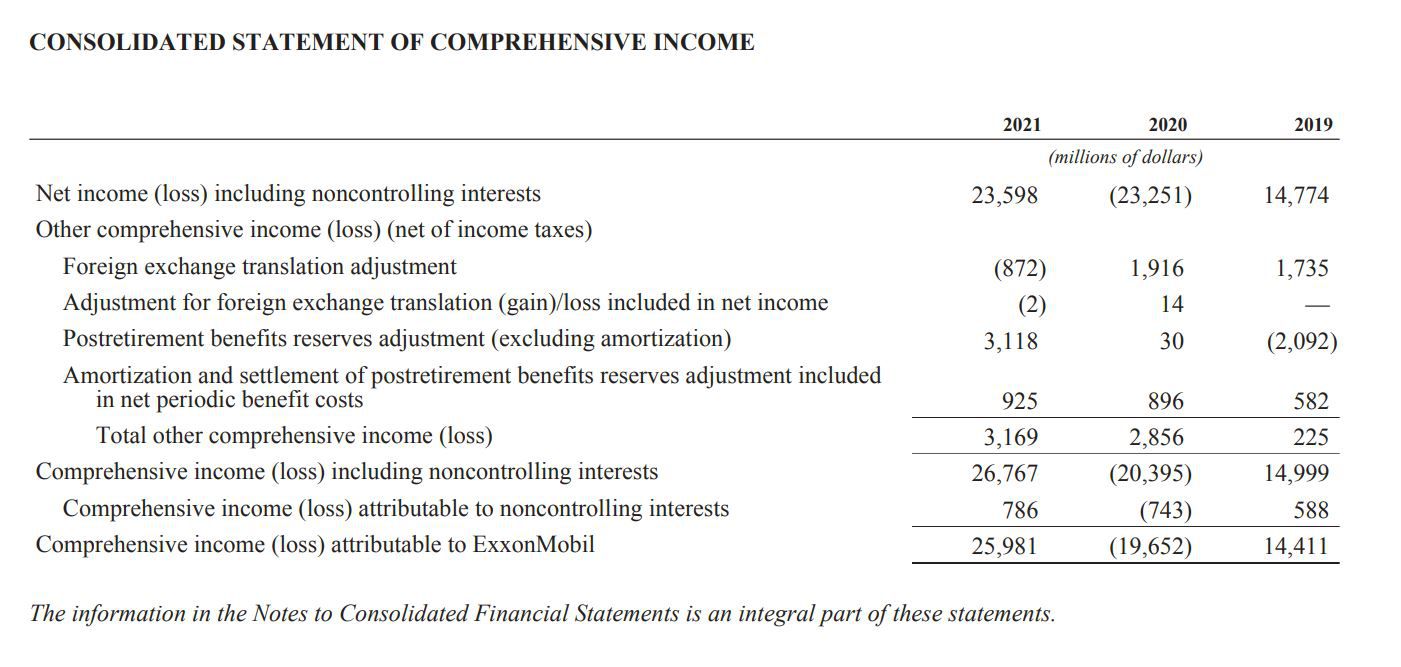

- Income Statement: The income statement, also known as the profit and loss statement, details the company’s revenues, expenses, gains, and losses over a specified period. It shows whether the company has generated a profit or incurred a loss during that time, providing insights into its financial performance.

- Statement of Cash Flows: The statement of cash flows tracks the company’s cash inflows and outflows during a specific period. It divides cash flow into three categories: operating activities, investing activities, and financing activities. This statement helps stakeholders understand how the company generates and uses its cash.

- Notes to Financial Statements: The notes to financial statements provide additional information and context to the numbers presented in the other components. These notes include explanations of accounting policies, details of significant transactions, contingencies, and other relevant disclosures. They help users of the financial statements understand the assumptions and considerations behind the reported numbers.

- Other Supplementary Information: Besides the core financial statements, compiled financial statements may also include supplementary information specific to the company’s requirements. This can include schedules, analyses, or additional reports that provide further insights into the financial performance or position of the organization.

By including these key components, compiled financial statements provide a comprehensive summary of a company’s financial activities and its overall financial health. These components work together to present a clear and structured representation of the company’s financial data.

Now that we have covered the key components of compiled financial statements, let’s explore the benefits that these statements offer to organizations.

Benefits of Compiled Financial Statements

Compiled financial statements offer several important benefits to organizations. While they may not provide the same level of assurance as reviewed or audited financial statements, they serve as a valuable tool for decision-making, compliance, and communication. Let’s explore some of the key benefits:

- Internal Decision Making: Compiled financial statements provide management with a clear and organized view of the company’s financial performance. This enables informed decision-making regarding budgeting, investment strategies, and resource allocation. By having access to up-to-date financial information, management can effectively plan for the future and identify areas that require attention or improvement.

- Cost-Effectiveness: Compared to reviewed or audited financial statements, compiled financial statements are typically more cost-effective to prepare. They involve less rigorous examination and verification processes, which can help small businesses or organizations with limited resources meet their financial reporting requirements without incurring excessive costs.

- Regulatory Compliance: Many regulatory bodies require businesses to submit financial statements as part of their compliance obligations. Compiled financial statements serve this purpose, providing an organized and concise summary of an organization’s financial activities. They help ensure that the company meets its legal requirements and provides transparency to regulators, shareholders, and other stakeholders.

- External Communication: Compiled financial statements can be shared with external stakeholders, such as investors, creditors, and potential business partners. While they do not provide the same level of assurance as reviewed or audited statements, they still offer insights into the company’s financial position and performance. These statements can help build trust and credibility with external parties and facilitate better communication and decision-making.

- Benchmarking and Performance Evaluation: Compiled financial statements allow organizations to compare their financial performance against industry benchmarks and key performance indicators. This helps identify strengths, weaknesses, and areas for improvement. By analyzing the compiled financial statements, organizations can gain insights into their financial health and performance and make strategic decisions to achieve their goals.

Overall, compiled financial statements provide organizations with valuable insights into their financial activities and facilitate better decision-making, regulatory compliance, and communication with stakeholders. While they may not carry the same level of assurance as reviewed or audited statements, they are a cost-effective and efficient way to present financial information.

Now, let’s explore the differences between compiled financial statements and reviewed financial statements.

Differences Between Compiled Financial Statements and Reviewed Financial Statements

While both compiled financial statements and reviewed financial statements serve the purpose of providing financial information to stakeholders, there are several key differences between the two. These differences lie in the level of assurance, examination procedures, and the responsibilities of the accounting professional. Let’s explore the distinctions:

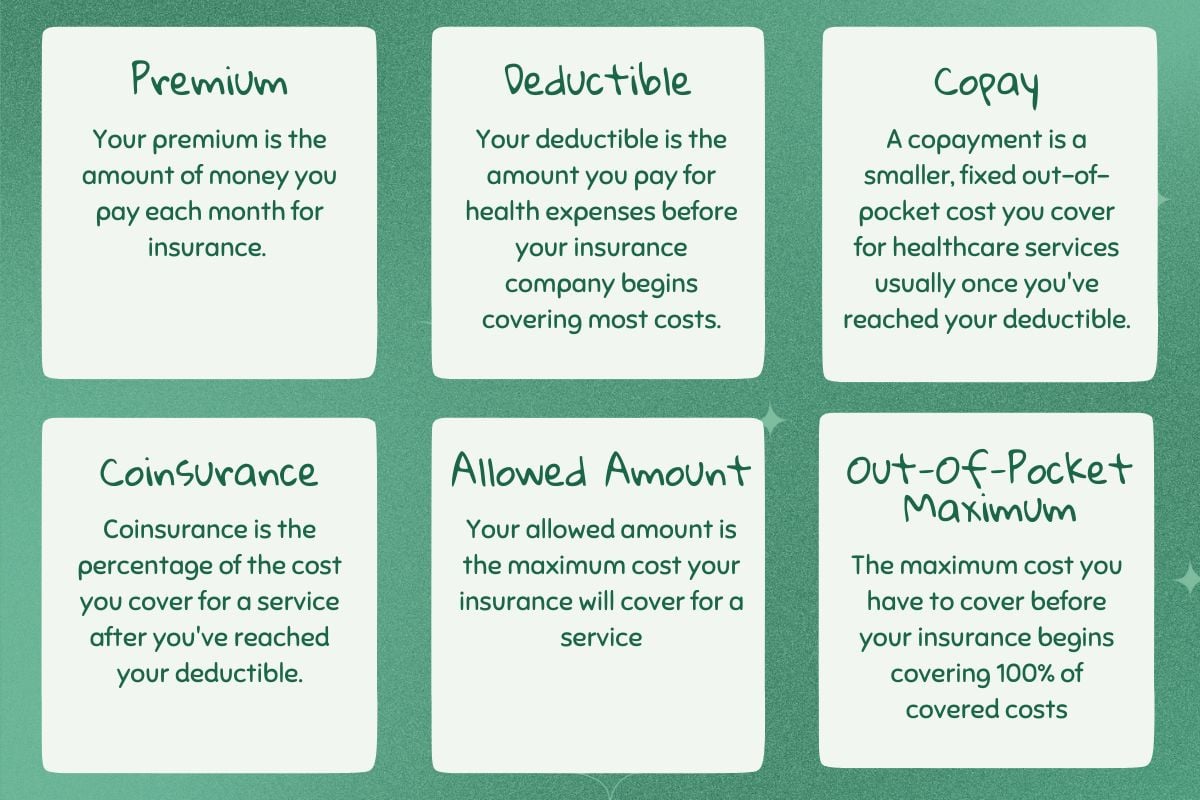

- Level of Assurance: One of the primary differences between compiled and reviewed financial statements is the level of assurance provided. Compiled financial statements offer no assurance on the accuracy or completeness of the financial information presented. On the other hand, reviewed financial statements provide limited assurance that no material modifications are necessary for the financial statements to conform with the applicable financial reporting framework. The reviewer performs procedures to obtain a moderate level of assurance on the financial statements, although they are not as comprehensive as those performed for audited financial statements.

- Examination Procedures: With compiled financial statements, the certified public accountant (CPA) simply organizes and presents the financial information provided by the company. No verification or testing of the data is conducted. In contrast, when creating reviewed financial statements, the CPA performs inquiry and analytical procedures to obtain a limited level of assurance. These procedures may include comparing financial data with industry norms, reviewing supporting documents, conducting inquiries of management, and performing analytical procedures to identify any potential material misstatements or inconsistencies.

- Responsibility of the Accounting Professional: When compiling financial statements, the accounting professional’s responsibility is limited to organizing and presenting the financial information received from the organization. They do not express an opinion or provide any assurance on the accuracy or completeness of the financial data. In the case of reviewed financial statements, the CPA takes on a higher level of responsibility by conducting an examination of the statements and expressing limited assurance on their accuracy and conformity with the applicable financial reporting framework.

- Degree of Independence: While CPAs preparing compiled financial statements can exercise professional judgment and provide recommendations, they may have a closer relationship with the organization, potentially compromising their independence. In contrast, the reviewer of financial statements must maintain the necessary independence to provide an objective assessment of the financial information provided.

It is important to note that both compiled and reviewed financial statements serve specific purposes depending on the needs of the organization and stakeholders. While compiled financial statements may be sufficient for internal decision-making or regulatory compliance, reviewed financial statements offer a higher level of credibility and assurance for external stakeholders, such as investors or lenders.

Now that we understand the differences between compiled and reviewed financial statements, let’s explore when it is appropriate to use compiled financial statements.

When to Use Compiled Financial Statements

Compiled financial statements are commonly used in situations where a higher level of assurance is not required, but organizations still need to present their financial information in a standardized and organized format. Here are some scenarios where it is appropriate to use compiled financial statements:

- Internal Decision-Making: Compiled financial statements are primarily used for internal purposes, such as management decision-making. When management needs a clear understanding of the company’s financial performance and position to make informed decisions regarding investments, budgeting, or resource allocation, compiled financial statements are a valuable tool.

- Small Businesses or Startups: Small businesses or startups with limited resources may opt for compiled financial statements due to cost considerations. Reviewed or audited financial statements can be more expensive and time-consuming to prepare. Compiled financial statements provide a cost-effective way for these organizations to meet their financial reporting requirements and ensure compliance.

- Nonprofit Organizations: Nonprofit organizations may choose to use compiled financial statements as they often have different reporting requirements compared to for-profit businesses. Compiled financial statements can provide transparency and accountability to donors, granting organizations, and other stakeholders without the need for a higher level of assurance.

- Loan Applications: When applying for loans from financial institutions, some lenders may accept compiled financial statements as sufficient documentation of the organization’s financial position. However, it is essential to check with the specific lender to determine their requirements and any additional assurance or documentation needed.

- Regulatory Compliance: In certain regulatory contexts, compiled financial statements may be acceptable to meet the reporting requirements. However, it is crucial to consult with the relevant regulatory bodies to confirm the level of assurance needed and ensure compliance with their specific guidelines.

- Interim Reporting: Interim financial statements, which cover shorter periods of time (e.g., monthly or quarterly), are often compiled rather than reviewed or audited. Interim financial statements provide snapshots of financial performance and position during the reporting period and are useful for management decision-making and monitoring financial trends.

It is important to consider the specific needs of the organization and the expectations of stakeholders when determining whether compiled financial statements are appropriate. In some cases, stakeholders may require a higher level of assurance, such as reviewed or audited financial statements, for greater credibility and reliability.

Now that we understand when to use compiled financial statements, let’s explore the limitations of these statements.

Limitations of Compiled Financial Statements

While compiled financial statements serve as a useful tool for presenting financial information, it is important to recognize their limitations. Here are some key limitations to consider:

- Lack of Assurance: Unlike reviewed or audited financial statements, compiled financial statements do not provide any assurance or opinion on the accuracy, completeness, or fairness of the financial information presented. The CPA compiling the statements is not responsible for verifying the data provided by the organization.

- Potential Bias: Since the CPA preparing compiled financial statements relies on information provided by the organization, there is a risk of inherent bias or intentional misrepresentation of financial data. Without an independent verification process, the reliability and objectivity of the statements may be compromised.

- Limited Level of Detail: Compiled financial statements may lack the level of detail found in reviewed or audited financial statements. This can make it more challenging for stakeholders to fully understand the nuances of the organization’s financial position and performance.

- Less Credibility for External Users: External stakeholders, such as investors or lenders, may require a higher level of assurance to make decisions based on the financial statements. Compiled financial statements may not provide the level of credibility or trustworthiness necessary for these stakeholders, potentially impacting their confidence in the reported financial information.

- Potential Omission of Material Misstatements: Without the rigorous examination procedures conducted in the review or audit process, compiled financial statements may not detect material misstatements or irregularities in the financial data. This presents a risk to stakeholders who rely on the statements for decision-making purposes.

- Lack of Compliance with Reporting Frameworks: Depending on the specific reporting requirements, compiled financial statements may not fully conform to applicable financial reporting frameworks or standards. This can impact the comparability and consistency of financial information, making it more challenging to analyze and evaluate the statements.

It is crucial for stakeholders to understand the limitations of compiled financial statements when relying on them for decision-making or assessment purposes. In situations where a higher level of assurance or more detailed financial information is required, reviewed or audited financial statements may be necessary.

Now that we have explored the limitations of compiled financial statements, let’s conclude our discussion.

Conclusion

Compiled financial statements provide organizations with a valuable tool for presenting financial information in a standardized and organized format. While they lack the level of assurance and in-depth examination of reviewed or audited financial statements, compiled financial statements serve specific purposes such as internal decision-making, regulatory compliance, and communication with stakeholders.

These statements offer benefits such as cost-effectiveness, simplified reporting requirements, and flexibility for small businesses or organizations with limited resources. They also provide a snapshot of the company’s financial position and performance, aiding management in making informed decisions and assessing internal controls.

However, it is crucial to understand the limitations of compiled financial statements. They do not provide the same level of credibility or assurance as reviewed or audited statements, and stakeholders should exercise caution when relying solely on compiled financial statements for decision-making or evaluating an organization’s financial health.

In situations where a higher level of assurance is required or where more detailed financial information is needed, reviewed or audited financial statements are recommended.

Overall, compiled financial statements offer a practical solution for organizations to meet their financial reporting needs, providing a summary of financial activities and facilitating internal decision-making and compliance with regulatory requirements. By understanding their purpose, key components, benefits, differences, and limitations, stakeholders can effectively leverage compiled financial statements to gain insights into an organization’s financial performance.

Remember, when it comes to financial reporting, it is crucial to consider the specific needs of the organization and the expectations of stakeholders to determine the most appropriate type of financial statements to use.