Finance

What Are Notes To The Financial Statements

Published: December 23, 2023

Learn about the significance and elements of notes to the financial statements, an essential aspect of finance. Enhance your understanding of financial reporting and analysis.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Financial Statements

- Importance of Notes to the Financial Statements

- Purpose of Notes to the Financial Statements

- Types of Notes to the Financial Statements

- Content of Notes to the Financial Statements

- Disclosure Requirements for Notes to the Financial Statements

- Examples of Notes to the Financial Statements

- Conclusion

Introduction

When it comes to understanding the financial health and performance of a company, financial statements play a crucial role. They provide a snapshot of a company’s financial position, cash flow, and operating performance. However, these financial statements might not tell the whole story.

That is where the notes to the financial statements come into play. Consider them as the footnotes to the main financial statements. Notes to the financial statements provide additional information, explanations, and details that are essential for a complete understanding of the financial statements.

In this article, we will dive deeper into the world of notes to the financial statements. We will explore their definitions, importance, purpose, different types, required contents, disclosure requirements, and even provide some examples. So, let’s get started!

Definition of Financial Statements:

In the simplest terms, financial statements are formal records of the financial activities and performance of a company, organization, or individual. They typically include the balance sheet, income statement, statement of cash flows, and statement of changes in equity. These statements are prepared in accordance with accounting principles and provide valuable insights into a company’s financial performance.

Definition of Financial Statements

In the simplest terms, financial statements are formal records of the financial activities and performance of a company, organization, or individual. They are essential tools that provide a structured representation of financial data, allowing stakeholders to analyze and make informed decisions based on the company’s financial health.

The three main financial statements are the balance sheet, income statement, and statement of cash flows. Each statement serves a different purpose and provides specific information about an organization’s financial position, profitability, and cash flow.

Balance Sheet:

The balance sheet, also known as the statement of financial position, provides a snapshot of a company’s financial condition at a specific point in time. It presents the company’s assets, liabilities, and shareholders’ equity. By comparing the assets to the liabilities, stakeholders can understand the company’s net worth or owner’s equity.

Income Statement:

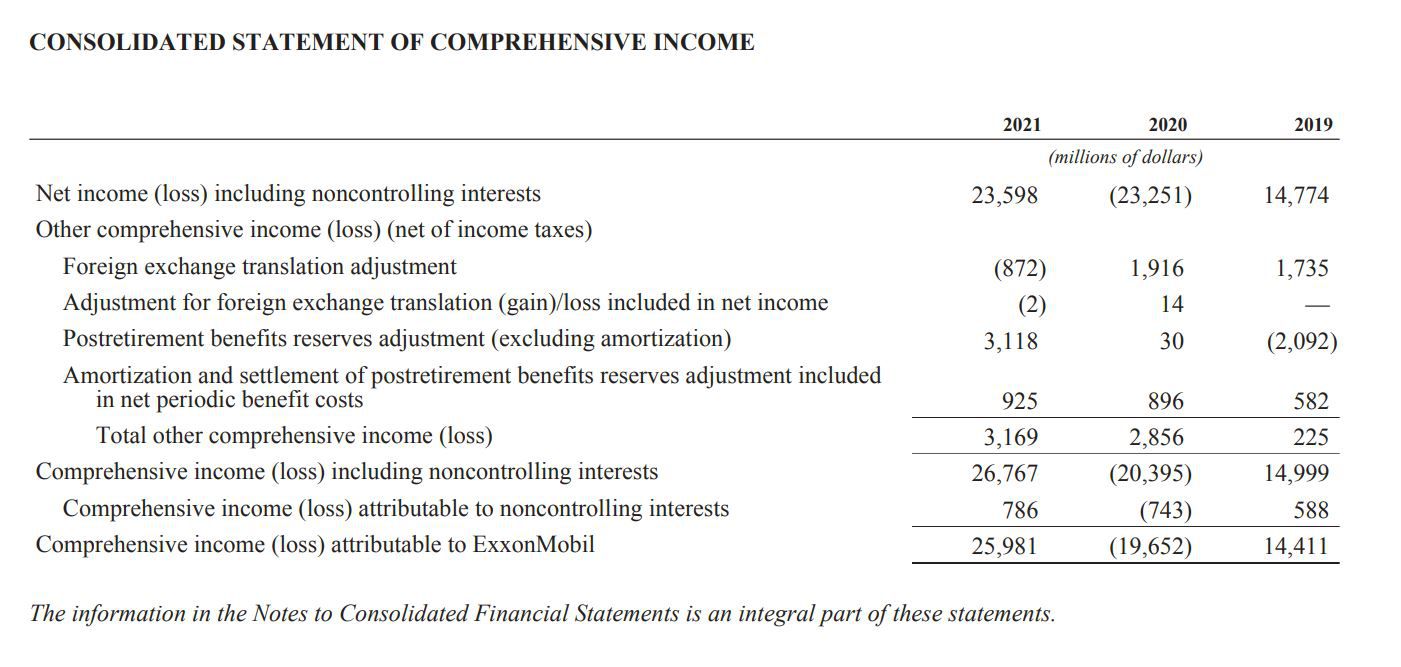

The income statement, also called the profit and loss statement or statement of earnings, shows the company’s revenues, expenses, gains, and losses over a given period. It provides insights into the organization’s ability to generate profits from its operations and identifies any non-operational income or expenses.

Statement of Cash Flows:

The statement of cash flows tracks the cash inflows and outflows during a specific period, classifying them into three categories: operating activities, investing activities, and financing activities. It allows stakeholders to understand how a company generates and uses cash, providing insights into its financial liquidity and ability to meet its short-term obligations.

These financial statements, while comprehensive, might not capture all the necessary information about a company’s financial transactions and their associated risks. This is where the notes to the financial statements play a crucial role.

The notes to the financial statements provide additional explanations, disclosures, and details that are not evident on the face of the financial statements. They are essential for a complete understanding of the financial position, performance, and risks of a company. Let’s explore their importance and purpose in the next section.

Importance of Notes to the Financial Statements

The notes to the financial statements are an integral part of the overall financial reporting process. They provide important supporting information and explanations that help users understand the numbers presented in the main financial statements. Here are some key reasons why the notes to the financial statements are of utmost importance:

1. Enhancing Clarity and Context: Financial statements alone may not provide sufficient context or clarity regarding specific transactions and events. The notes serve as a supplement by providing additional details, descriptions, and explanations. They help users to interpret the financial numbers accurately and understand the underlying reasons or circumstances behind them.

2. Providing Disclosure and Transparency: Notes to the financial statements play a vital role in ensuring transparency and disclosure. They provide information regarding various accounting policies and practices followed by the company, including measurement techniques, recognition criteria, and assumptions made. This level of transparency helps users in making informed decisions, assessing the risks, and evaluating the financial performance and position of the company.

3. Addressing Complex Transactions and Arrangements: Companies often engage in complex transactions, such as mergers, acquisitions, leases, contingent liabilities, or employee benefit plans. The notes to the financial statements provide detailed disclosures about these transactions, helping users understand the potential implications on the financial position and performance of the company. This enables stakeholders to assess the impact of these transactions and make better-informed decisions.

4. Complying with Accounting Standards: The notes to the financial statements are essential for compliance with accounting standards and regulations. They ensure that the financial statements are prepared in accordance with Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). By providing the necessary disclosures and explanations, the notes help companies demonstrate their adherence to the required accounting standards.

5. Facilitating Comparability and Consistency: The notes to the financial statements provide information about any changes in accounting policies, estimates, or significant events affecting the financial statements. This allows users to compare financial information across different periods and assess the consistency of accounting practices followed by the company. It ensures that users have access to accurate and consistent financial data for making meaningful comparisons and analyses.

The notes to the financial statements serve as a bridge between the technical accounting language used in the financial statements and the users of financial information. They help users understand the story behind the numbers, unravel complexities, and evaluate the financial performance and position of the company in a more meaningful way. In the next section, we will delve into the specific purposes that the notes to the financial statements serve.

Purpose of Notes to the Financial Statements

The purpose of the notes to the financial statements is to provide additional information, explanations, and disclosures that are essential for a complete understanding of the financial statements. These notes serve various purposes, ensuring transparency, clarity, and compliance. Let’s explore some of the key purposes of the notes to the financial statements:

1. Explanatory Notes: The primary purpose of the notes is to provide explanations and descriptions of the significant accounting policies, methods, and assumptions used in preparation of the financial statements. They clarify how specific items are measured, recognized, and presented in the financial statements. This helps users understand the rationale behind the numbers and evaluate the reliability of the financial information.

2. Additional Disclosures: The notes provide additional disclosures that are not presented in the financial statements. These disclosures include information regarding significant events, contingencies, commitments, related party transactions, and changes in accounting policies. Such disclosures are important for assessing the potential risks and uncertainties faced by the company, as well as the impact of specific events on its financial position and performance.

3. Regulatory Compliance: Companies are required to comply with accounting standards and regulations while preparing their financial statements. The notes to the financial statements ensure compliance by providing the necessary disclosures and explanations required by the applicable accounting framework. This helps companies demonstrate their adherence to the required standards and enables users to assess the reliability and integrity of the financial statements.

4. Supporting Information: The notes provide supporting information that helps users interpret and analyze the financial statements more effectively. They include details about specific transactions, events, or arrangements that are not directly reflected in the financial statements. This information provides context and assists users in understanding the financial performance, position, and potential risks of the company.

5. Enabling Comparability: The notes to the financial statements assist in promoting comparability between different companies or across different periods for the same company. They provide details of any changes in accounting policies, estimates, or significant events that may impact the comparability of financial data. This information allows users to make meaningful comparisons, assess trends, and evaluate the consistency of accounting practices followed by the company.

6. Meeting Stakeholder Information Needs: The notes to the financial statements cater to the information needs of various stakeholders, including investors, creditors, analysts, and regulatory authorities. They provide a deeper understanding of the financial position, performance, and risks of the company, enabling stakeholders to make informed decisions, assess creditworthiness, and evaluate investment opportunities.

The purpose of the notes to the financial statements is to provide clarity, transparency, and context to the numbers presented in the financial statements. They serve as a vital tool in enhancing the understanding and usefulness of financial information. In the next section, we will explore the different types of notes to the financial statements.

Types of Notes to the Financial Statements

Notes to the financial statements can be categorized into various types based on their content and purpose. These notes provide detailed information, disclosures, and explanations that complement the main financial statements. Let’s explore some of the common types of notes to the financial statements:

1. Accounting Policies: These notes provide information about the significant accounting policies followed by the company. They outline the specific methods and assumptions used to recognize, measure, and present various elements in the financial statements. Accounting policies notes ensure transparency and help users understand the basis for preparing the financial statements.

2. Contingencies: Contingencies refer to uncertain events or conditions that may result in a gain or loss for the company. These notes disclose potential contingent liabilities, such as pending legal cases, warranty obligations, or environmental liabilities. They provide details about the nature, estimated financial impact, and the likelihood of occurrence of these contingent events.

3. Related Party Transactions: Companies often engage in transactions with related parties, such as subsidiaries, parent companies, or key management personnel. These notes disclose the nature, extent, and financial impact of such transactions. They ensure transparency and help users assess the potential influence of related parties on the financial position and performance of the company.

4. Segment Reporting: If a company operates in multiple business segments or geographical regions, it may provide segment reporting notes. These notes provide details of the company’s business segments, including their operations, financial performance, and assets/liabilities. Segment reporting notes enable users to evaluate the profitability and risks associated with different segments of the company.

5. Employee Benefits: These notes disclose information about employee benefit plans, such as pension plans, post-employment benefits, and share-based payment arrangements. They provide details about the company’s obligations, costs, and assumptions related to these benefit plans. Employee benefit notes help users assess the future financial burden and potential impact on the company’s financial position.

6. Revenue Recognition: Given the complexities surrounding revenue recognition, companies often provide revenue recognition notes. These notes disclose the specific methods used to recognize revenue, including any significant judgments or estimates involved. Revenue recognition notes ensure transparency and help users understand the company’s revenue recognition policies and practices.

7. Changes in Accounting Policies: Companies may change their accounting policies from one period to another. These notes provide details about such changes, including the reasons for the change and the impact on the financial statements. Changes in accounting policies notes enable users to assess the consistency and comparability of financial information.

These are just a few examples of the types of notes to the financial statements. Depending on the industry, regulatory requirements, and specific circumstances of the company, additional types of notes may be included to provide further information and disclosures. In the next section, we will delve into the typical content found in notes to the financial statements.

Content of Notes to the Financial Statements

The content of notes to the financial statements may vary depending on the company’s specific circumstances, industry, and regulatory requirements. However, there are some common elements that are typically included in these notes. Let’s explore the typical content found in notes to the financial statements:

1. Summary of Significant Accounting Policies: This section provides a summary of the company’s significant accounting policies, including details about revenue recognition, inventory valuation, depreciation methods, and more. It helps users understand the key principles and assumptions applied in preparing the financial statements.

2. Contingent Liabilities: Contingent liabilities notes disclose potential liabilities that may arise in the future, depending on the outcome of uncertain events. This section includes information about pending lawsuits, warranties, guarantees, and other potential obligations that may have an impact on the company’s financial position.

3. Property, Plant, and Equipment: These notes provide details about the company’s property, plant, and equipment. They include information about the cost, depreciation methods, useful lives of assets, impairment assessments, and any significant changes in the carrying amount or valuation of these assets.

4. Financial Instruments: Financial instruments notes provide information about the company’s financial assets and liabilities, including details about their fair value measurements, classification, and any significant risks associated with these instruments. They may also include disclosures related to derivative financial instruments, hedging activities, and debt obligations.

5. Leases: If the company has entered into significant leases, this section provides information about the nature of these leases, lease terms, lease payments, and any commitments related to future lease payments. It may also include additional disclosures required under accounting standards related to lease accounting.

6. Income Taxes: Income taxes notes provide details about the company’s income tax expenses, deferred tax assets, and liabilities, tax credits, and significant tax-related issues. They may also include disclosures related to uncertain tax positions, tax provisions, and any significant changes in tax laws or interpretations.

7. Related Party Transactions: This section includes information about transactions with related parties, such as transactions with subsidiaries, parent companies, key management personnel, or entities under common control. It discloses the nature of these transactions and any related-party balances outstanding during the reporting period.

8. Employee Benefits: Employee benefits notes provide information about the various employee benefit plans in place, such as pension plans, post-employment benefits, and share-based payment arrangements. They include details about the types of benefits, funding levels, obligations, and any significant changes in the plans.

9. Segment Reporting: If the company operates in multiple business segments, this section provides information about the company’s reportable segments, their operations, revenues, and operating expenses. It may also include details about any changes in segment reporting during the reporting period.

These are just a few examples of the typical content found in notes to the financial statements. The specific content and level of detail may vary depending on the company’s unique circumstances and regulatory requirements. Careful consideration should be given to providing relevant and meaningful information in a clear and understandable manner to meet the needs of financial statement users.

In the next section, we will explore the disclosure requirements and regulations governing the presentation of notes to the financial statements.

Disclosure Requirements for Notes to the Financial Statements

Notes to the financial statements are governed by various accounting standards, regulatory requirements, and reporting frameworks. These frameworks provide guidelines for the disclosure of information in financial statements to ensure transparency, comparability, and consistency. Let’s explore some of the key disclosure requirements for notes to the financial statements:

1. Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS): Companies are required to prepare their financial statements in accordance with the applicable accounting standards, such as GAAP or IFRS. These standards provide specific guidelines on the disclosure requirements for various financial statement items, including the notes to the financial statements.

2. Materiality: The disclosure requirements for notes to the financial statements are based on materiality. Materiality is the concept that information is material if its omission or misstatement could influence the decisions of users of the financial statements. Companies need to consider the materiality of the information to determine what needs to be disclosed in the notes.

3. Specific Accounting Standards: Certain accounting standards have specific disclosure requirements for particular items. For example, International Accounting Standard (IAS) 24 requires the disclosure of related party transactions, IAS 36 requires the disclosure of information about impairment of assets, and IAS 37 requires disclosure of information about provisions, contingent liabilities, and contingent assets.

4. Regulatory Requirements: Companies may need to comply with additional disclosure requirements imposed by regulatory bodies such as the Securities and Exchange Commission (SEC) in the United States or other regulators in different jurisdictions. These regulatory requirements may mandate specific disclosures related to industry-specific regulations or local reporting standards.

5. Material Events and Transactions: The notes to the financial statements should disclose material events, transactions, or changes that impact the financial statements. These might include mergers, acquisitions, disposals, restructuring, significant contracts, lease agreements, or changes in accounting policies, estimates, or judgments.

6. Explanation of Significant Judgments and Estimates: Companies are required to disclose significant accounting judgments or estimates made in the preparation of the financial statements. This includes disclosure of critical accounting policies, assumptions used, and sensitivity analyses related to estimates that have a high degree of estimation uncertainty.

7. Clear and Understandable Language: The information disclosed in the notes should be written in clear and understandable language. It should avoid excessive technical jargon and be presented in a manner that is easily comprehensible to users of the financial statements.

8. Consistency and Comparability: The disclosure requirements aim to achieve consistency and comparability of financial information across different periods and companies. Thus, they provide guidelines on the minimum disclosures required to ensure that the financial statements are comparable and can be analyzed in a meaningful way.

It is important for companies to carefully review the disclosure requirements applicable to their specific circumstances and ensure compliance with the relevant accounting standards and regulations. Failure to disclose required information accurately and comprehensively could lead to misinterpretation or inadequate understanding of the financial statements by users.

In the next section, we will provide some examples of common notes to the financial statements to further illustrate their content and purpose.

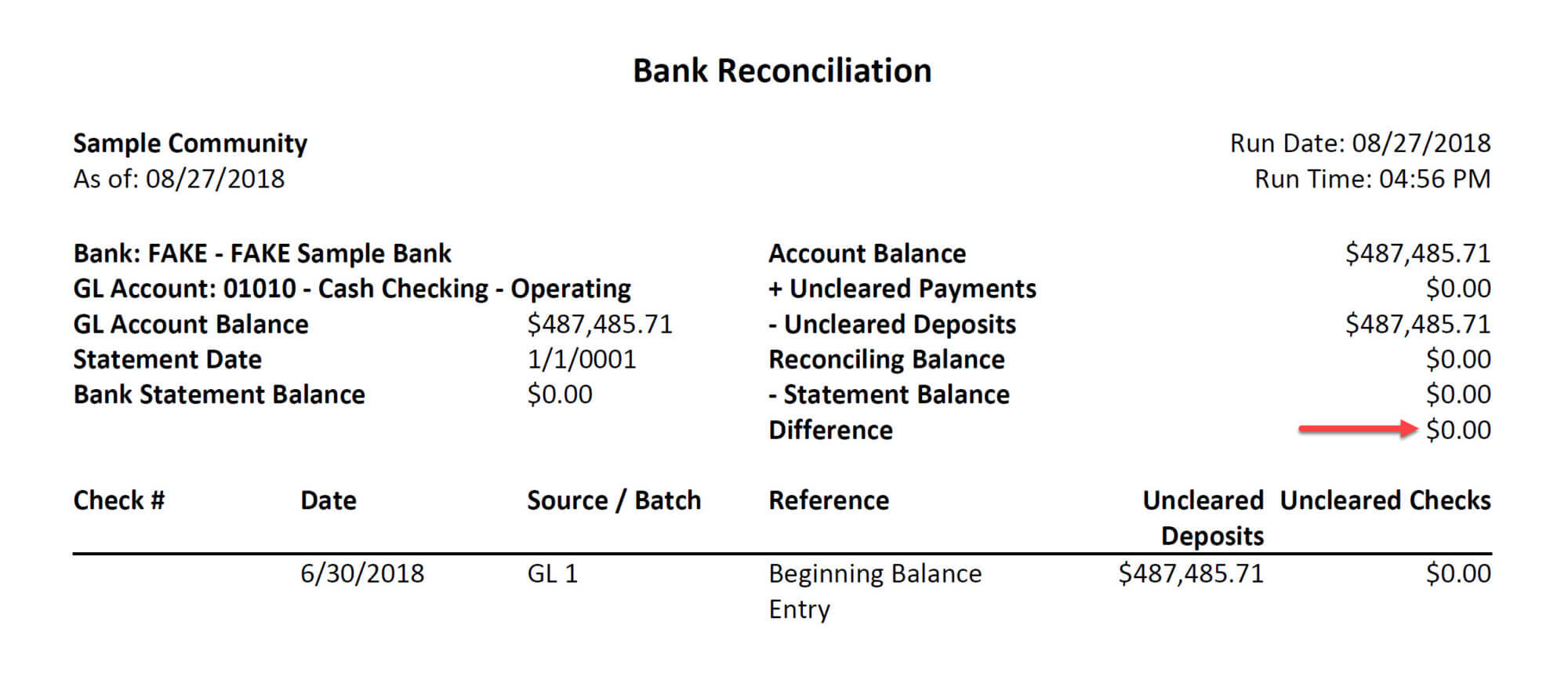

Examples of Notes to the Financial Statements

To provide a better understanding of the content and purpose of notes to the financial statements, let’s explore some examples of common notes that are typically included:

1. Accounting Policies: This note provides a summary of the significant accounting policies followed by the company. It may include details about revenue recognition methods, depreciation and amortization policies, inventory valuation methods, and other key accounting principles applied by the company.

2. Leases: This note discloses information about the company’s significant leasing arrangements. It provides details about lease terms, lease payments, and any commitments related to future lease payments. It may also specify the classification of leases and any related financial obligations.

3. Contingencies and Legal Proceedings: This note provides information about current or potential legal proceedings that the company is involved in. It discloses details about the nature of the claims, potential liabilities, and the estimated financial impact. It also includes information about any warranties, guarantees, or other contingent liabilities that could affect the company’s financial position.

4. Employee Benefits: This note discloses information about the company’s employee benefit plans, such as pension plans or post-employment benefit obligations. It includes details about the nature of the plans, funding levels, and the company’s obligations towards employees. It may also provide information about any changes in benefit plans or significant actuarial assumptions made.

5. Related Party Transactions: This note provides information about transactions with related parties, such as subsidiaries, parent companies, or key management personnel. It discloses the nature, terms, and financial impact of these transactions. This note ensures transparency and helps users analyze the potential influence of related parties on the company’s financial position.

6. Revenue Recognition: This note explains the company’s policies and practices for recognizing revenue. It may include information about specific revenue streams, contractual arrangements, significant judgments made, and any changes in the revenue recognition policies. The note ensures transparency and helps users understand the company’s revenue recognition practices.

7. Segment Reporting: This note provides information about the company’s operating segments, if applicable. It includes details about the company’s reportable segments, their operations, revenues, and operating expenses. The note enables users to assess the profitability and risks associated with different segments of the company.

These are just a few examples of the notes to the financial statements. Depending on the specific circumstances and regulatory requirements, companies may include additional disclosures related to significant events, financial instruments, tax obligations, or other relevant information.

It is worth noting that the content and disclosures within these notes can vary significantly between companies, industries, and jurisdictions. It is crucial for companies to carefully consider their specific reporting requirements and ensure compliance with the applicable accounting standards and regulations.

Understanding the significance and content of the notes to the financial statements is essential for users of financial statements to gain a comprehensive understanding of a company’s financial position, performance, and overall risk profile.

In the next section, we will conclude our exploration of the notes to the financial statements.

Conclusion

Notes to the financial statements are an integral part of the financial reporting process, providing additional information, explanations, and disclosures that complement the main financial statements. They serve a crucial role in enhancing the clarity, transparency, and understanding of a company’s financial position, performance, and risks.

Through a variety of disclosure requirements and regulations, notes to the financial statements ensure that companies provide comprehensive and relevant information to users of financial statements. They provide insights into accounting policies, contingent liabilities, related party transactions, and other crucial aspects of a company’s financial operations.

The importance of notes to the financial statements lies in their ability to provide context, clarify complexities, and ensure compliance with accounting standards and regulations. They enable users to understand the story behind the numbers, evaluate the company’s financial health, and make informed decisions.

From explaining significant accounting policies to disclosing contingencies and legal proceedings, employee benefits, or segment reporting information, the content of notes to the financial statements can vary depending on the company’s specific circumstances and reporting requirements.

By adhering to the disclosure requirements and providing comprehensive and transparent information in the notes, companies can enhance the comparability, reliability, and utility of their financial statements. This, in turn, builds trust and confidence among users of financial information, such as investors, creditors, analysts, and regulatory authorities.

In conclusion, notes to the financial statements are an invaluable component of the financial reporting process. They bridge the gap between the technical language used in the financial statements and the users’ need for clarity and understanding. By providing additional information, explanations, and disclosures, notes to the financial statements contribute to a more accurate, informed, and meaningful analysis of a company’s financial position and performance.