Finance

What Is Interest Checking Account

Published: October 28, 2023

Discover the benefits of interest checking accounts in the world of finance. Maximize your financial growth with this versatile banking option.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Interest Checking Account

- How Does an Interest Checking Account Work?

- Pros and Cons of Interest Checking Accounts

- Factors to Consider Before Opening an Interest Checking Account

- Comparison of Interest Checking Accounts

- Tips to Maximize Interest Earnings in a Checking Account

- Conclusion

Introduction

Welcome to the world of personal finance, where various banking products and services aim to help individuals manage their money effectively. One such product is the interest checking account. If you’ve ever wondered what an interest checking account is and how it can benefit you, you’ve come to the right place.

An interest checking account is a type of bank account that combines the features of a traditional checking account with the added benefit of earning interest on the deposited funds. It offers a convenient way to access your money while also providing an opportunity to grow your savings. With an interest checking account, you can have the best of both worlds – easy access to your funds and the potential to earn some extra money.

Unlike a regular checking account, where the primary function is to facilitate transactions such as paying bills and making purchases, an interest checking account offers the advantage of accruing interest on the balance maintained in the account. This means that the more money you keep in your account, the more interest you can earn over time.

Interest rates on checking accounts may vary from one financial institution to another, and they are typically lower than what you would find on other types of savings or investment accounts. Nevertheless, an interest checking account can still be a valuable tool for your financial management strategy.

Whether you’re someone who prefers the convenience of a checking account or you’re looking for a way to earn interest on your everyday funds, an interest checking account could be a suitable option for you. In the following sections, we will explore how an interest checking account works, its pros and cons, factors to consider before opening one, and tips to maximize interest earnings in a checking account.

Definition of Interest Checking Account

An interest checking account is a type of bank account that allows individuals to deposit and withdraw funds for everyday transactions while also earning interest on the balance maintained in the account. It combines the convenience of a traditional checking account with the added benefit of potential interest earnings.

Unlike a regular checking account that typically doesn’t earn any interest or offers minimal interest rates, an interest checking account provides an opportunity to grow your savings without sacrificing accessibility to your funds. The interest earned on the account is typically calculated on a daily or monthly basis and added to the account balance.

Interest checking accounts are offered by various financial institutions, including banks and credit unions. These accounts may have certain requirements, such as maintaining a minimum balance or meeting specific criteria, to be eligible for earning interest. It’s important to review the terms and conditions of different interest checking accounts to understand the specific requirements and benefits they offer.

One of the key features of an interest checking account is the ability to write checks and make electronic transactions for everyday expenses and payments. This allows you to have easy access to your funds for bill payments, shopping, and other financial needs, while also benefiting from the potential earnings on your account balance.

It’s important to note that interest rates on checking accounts vary among financial institutions and can be subject to change based on market conditions. Typically, the rates on interest checking accounts are lower than those on other savings accounts or investment options. However, they still provide an opportunity to earn some additional income on the funds held in the account.

Overall, an interest checking account offers the convenience of a traditional checking account along with the advantage of potentially earning interest on your deposited funds. It’s a versatile financial tool that can be suitable for individuals looking for a balance between accessibility to their money and the opportunity to grow their savings.

How Does an Interest Checking Account Work?

An interest checking account works much like a regular checking account in terms of day-to-day transactions and accessibility to your funds. However, the key difference is that an interest checking account provides the additional benefit of earning interest on the balance you maintain in the account.

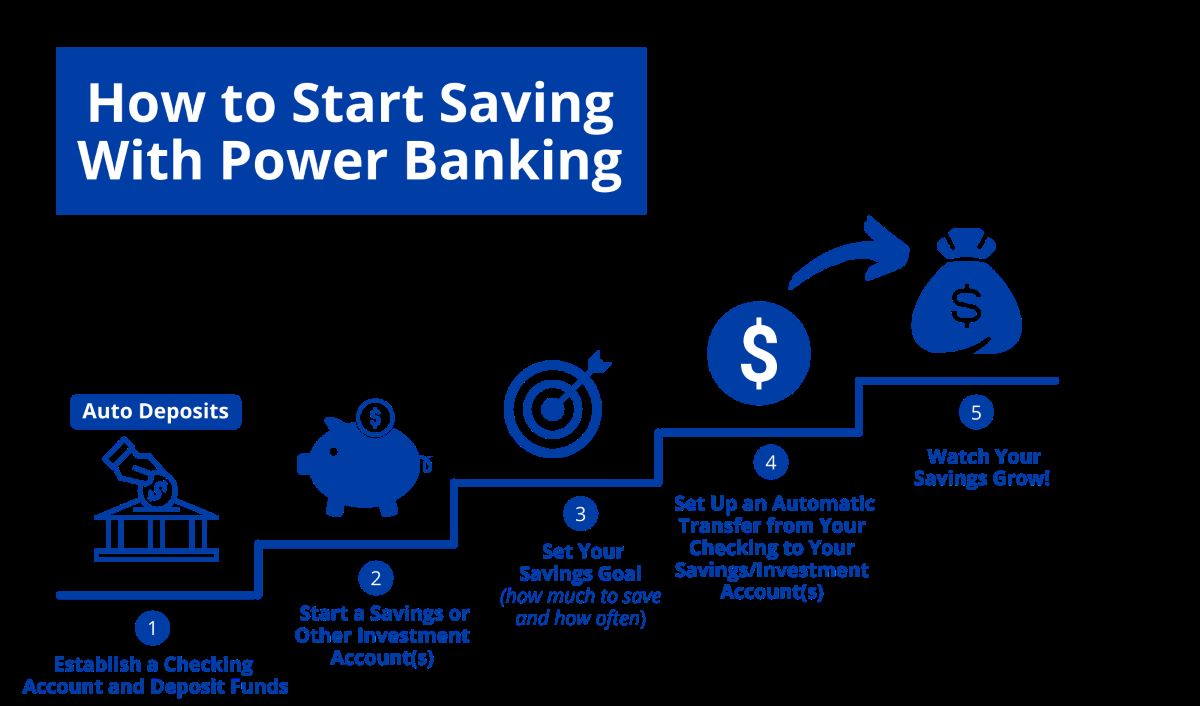

When you open an interest checking account, you will typically be required to deposit an initial amount to activate the account. The interest on this account is calculated based on the average daily balance in the account over a specific period, such as a month. The interest earned is then added to your account balance and continues to compound over time.

The interest rates on interest checking accounts are usually variable and can vary depending on factors such as market conditions and the financial institution offering the account. It’s important to monitor the interest rates and compare them across different banks or credit unions to ensure you’re getting competitive rates for your money.

Interest on checking accounts is usually calculated using the concept of Annual Percentage Yield (APY). APY takes into account the compounding nature of interest and provides a more accurate measure of the actual return on your account balance. This means that the more money you keep in your account, and the longer you keep it there, the more interest you can potentially earn.

While an interest checking account allows you to earn interest on your funds, it’s important to note that these accounts may have certain requirements or limitations. For instance, there may be a minimum balance requirement to earn interest, and if your balance falls below this threshold, you may not receive any interest for that period. Additionally, there may be a maximum limit on the amount that can earn interest, often referred to as the “tiered interest structure.”

Interest on checking accounts is typically paid out at regular intervals, such as monthly or quarterly, but this can vary depending on the financial institution. Some banks may offer the option to have the interest automatically reinvested in the account, while others may provide the choice to have it deposited into a separate savings account or disbursed to you directly.

It’s essential to review the terms and conditions of an interest checking account carefully to understand how interest is calculated, when it is paid, and any associated fees or limitations. This will help you make informed decisions and maximize the benefits of your interest checking account.

In summary, an interest checking account allows you to earn interest on the funds you deposit while maintaining the convenience and accessibility of a regular checking account. By maintaining a sufficient balance and understanding the terms of the account, you can make the most of this financial tool and contribute to your overall savings goals.

Pros and Cons of Interest Checking Accounts

Interest checking accounts offer several advantages and disadvantages that you should consider before deciding to open one. Understanding the pros and cons can help you make an informed decision that aligns with your financial goals and needs.

Pros:

- Earn Interest: The primary advantage of an interest checking account is the opportunity to earn interest on your deposited funds. While the interest rates may be lower compared to other savings accounts, it still provides you with the potential to grow your savings over time.

- Accessibility: Unlike some savings accounts that might have restrictions on withdrawals and transfers, an interest checking account offers convenient access to your funds. You can write checks, make electronic transactions, and use a debit card to pay for everyday expenses, bills, and other financial obligations.

- Combination of Services: With an interest checking account, you get the benefits of both a checking account and a savings account. You can manage your everyday expenses and transactions while also earning interest on the balance you keep in the account.

- Familiarity: If you already have a checking account, opening an interest checking account allows you to take advantage of the interest-earning feature without having to open a separate savings account. It keeps all your banking activities streamlined in one place.

- Flexibility: Interest checking accounts often come with the flexibility to deposit or withdraw funds as needed. This provides you with liquidity and the ability to access your money when you require it, making it a suitable option for individuals who need frequent access to their funds.

Cons:

- Lower Interest Rates: While an interest checking account offers the opportunity to earn interest, the rates are typically lower compared to other savings or investment options. If maximizing your interest earnings is a priority, you might find higher rates in other financial products.

- Higher Fees: Some interest checking accounts may have higher fees compared to regular checking accounts to compensate for the additional features and benefits. It’s important to review the fee structure and determine if the benefits outweigh the costs.

- Minimum Balance Requirements: To qualify for earning interest, many interest checking accounts require you to maintain a minimum balance. If your balance falls below this threshold, you might not earn any interest or incur additional fees. This can be a disadvantage for individuals with fluctuating account balances.

- Limitations on Interest Earnings: Interest checking accounts may have tiers or limits on the amount that can earn interest. Once your balance exceeds a certain threshold, the additional funds might not earn any additional interest. This can impact your overall interest earnings potential.

- Opportunity Cost: By keeping a significant amount of funds in an interest checking account, you might miss out on potentially higher returns in other investment options. If you have long-term financial goals, it’s worth considering diversifying your investments to maximize your overall wealth growth.

As with any financial decision, it’s essential to weigh the pros and cons of an interest checking account based on your individual circumstances and goals. Consider factors such as your spending habits, need for liquidity, and interest rate expectations to determine if an interest checking account is the right fit for you.

Factors to Consider Before Opening an Interest Checking Account

Before opening an interest checking account, it’s important to consider various factors to ensure it aligns with your financial goals and needs. Taking the time to evaluate these factors will help you make an informed decision and choose the right account for you. Here are some key factors to consider:

1. Interest Rates:

The interest rates offered on interest checking accounts can vary among financial institutions. Take the time to research and compare the rates available to ensure you’re getting competitive offers. While interest rates may not be as high as those offered on other savings accounts, it’s still important to find an account with a reasonable rate to maximize your earnings.

2. Fees and Charges:

Review the fee structure associated with the interest checking account. Ensure that the fees, such as monthly maintenance fees, ATM fees, or overdraft fees, are reasonable and align with your usage patterns. Some accounts may waive fees if you meet certain criteria, such as maintaining a minimum balance or having direct deposits.

3. Minimum Balance Requirement:

Consider the minimum balance requirement to qualify for earning interest on the account. If the minimum balance is too high and doesn’t align with your financial situation, you may face penalties or not be able to earn interest at all. Evaluate your average balance and ensure that it meets the requirement, or look for accounts with lower minimum balance requirements.

4. Account Access:

Assess the accessibility of the interest checking account. Consider whether the account provides online and mobile banking options, along with the ability to write checks and make electronic transactions. Having convenient access to your funds enables you to manage your finances efficiently and handle everyday transactions with ease.

5. Overdraft Protection:

Check if the interest checking account offers overdraft protection. This feature can be beneficial in helping you avoid costly overdraft fees if you accidentally spend more than the available balance in your account. Look for accounts that provide options such as linking to a savings account or a line of credit for overdraft protection.

6. Customer Service and Support:

Consider the quality of customer service provided by the financial institution. Look for banks or credit unions known for their excellent customer support. Having access to helpful and responsive customer service representatives can make a significant difference in addressing any issues or concerns you might have.

By carefully evaluating these factors, you can find an interest checking account that meets your financial needs and preferences. Take the time to research different options, review account details, and compare offers before making a decision. Remember, the right interest checking account will provide a balance of convenience, accessibility, and favorable interest rates to help you manage your finances effectively.

Comparison of Interest Checking Accounts

When considering opening an interest checking account, it’s essential to compare different options to find the one that best suits your financial needs. Here are some factors to consider when comparing interest checking accounts:

1. Interest Rates:

Compare the interest rates offered by different financial institutions. Look for accounts with competitive rates that can help you maximize your earnings on the funds in your account. Keep in mind that interest rates may be variable and subject to change.

2. Minimum Balance Requirement:

Consider the minimum balance required to earn interest. Some accounts may require a higher minimum balance, while others may have lower or no minimum balance requirements. Evaluate your average balance and choose an account that aligns with your financial situation.

3. Fees and Charges:

Review the fee structure associated with each account. Compare monthly maintenance fees, ATM fees, overdraft fees, and other charges. Look for accounts that have reasonable fees or offer options to waive fees based on certain conditions, such as maintaining a particular balance or having direct deposits.

4. Account Features:

Compare the features and benefits offered by each account. Look for options that provide convenient access to your funds, such as online and mobile banking, check writing capabilities, and electronic transactions. Consider whether the account offers added features like debit cards, bill payment services, or overdraft protection.

5. ATM Network:

Check if the financial institution has an extensive ATM network. Access to a wide range of ATMs can help you avoid ATM fees and make it more convenient to withdraw cash when needed. Look for accounts that provide free access to a large number of ATMs or reimburse ATM charges incurred at other banks’ ATMs.

6. Customer Service:

Consider the quality of customer service provided by the financial institution. Look for accounts offered by banks or credit unions known for their excellent customer support. Having access to responsive and helpful customer service representatives can be invaluable when you have questions or encounter issues with your account.

7. Additional Account Benefits:

Take note of any additional benefits that come with the interest checking account. Some accounts may offer perks such as cashback rewards, discounts on certain services, or rewards programs that can enhance your banking experience.

By comparing these factors among different interest checking accounts, you can identify the account that best aligns with your financial goals and preferences. Take the time to research, read customer reviews if available, and consider seeking advice from a financial professional if needed. Making an informed decision will not only help you earn interest on your funds but also ensure that you have a positive banking experience.

Tips to Maximize Interest Earnings in a Checking Account

While interest rates on checking accounts may not be as high as other savings or investment options, there are still ways to maximize your earnings. Consider the following tips to make the most of your interest checking account:

1. Maintain a Sufficient Balance:

Interest is typically calculated based on the average daily balance in your account. To maximize your earnings, aim to maintain a sufficient balance in your interest checking account. This allows you to earn more interest over time. However, be mindful of any minimum balance requirements to avoid fees or the account becoming ineligible for earning interest.

2. Compare Rates:

Monitor the interest rates offered by different financial institutions. Interest rates can vary, so it’s worth comparing rates periodically to ensure you’re getting the most competitive offer. Consider switching to an account that offers a higher interest rate if it aligns with your financial needs.

3. Take Advantage of Freebies:

Some interest checking accounts offer additional benefits such as cashback rewards, discounts, or rewards programs. Take advantage of these perks to maximize the overall value of your account. Utilize any cashback offers or discounts on services you frequently use to save money and potentially earn more in the process.

4. Opt for Direct Deposits:

Many banks offer higher interest rates or waived fees for accounts that have regular direct deposits. Consider setting up direct deposit for your paycheck or other recurring income sources to benefit from these incentives.

5. Utilize Online Banking Tools:

Make the most of online banking tools provided by your financial institution. Set up alerts to keep track of your account balance and any changes in interest rates. Use online bill payment services to streamline your payments and potentially earn interest for a longer period by making payments closer to the due date.

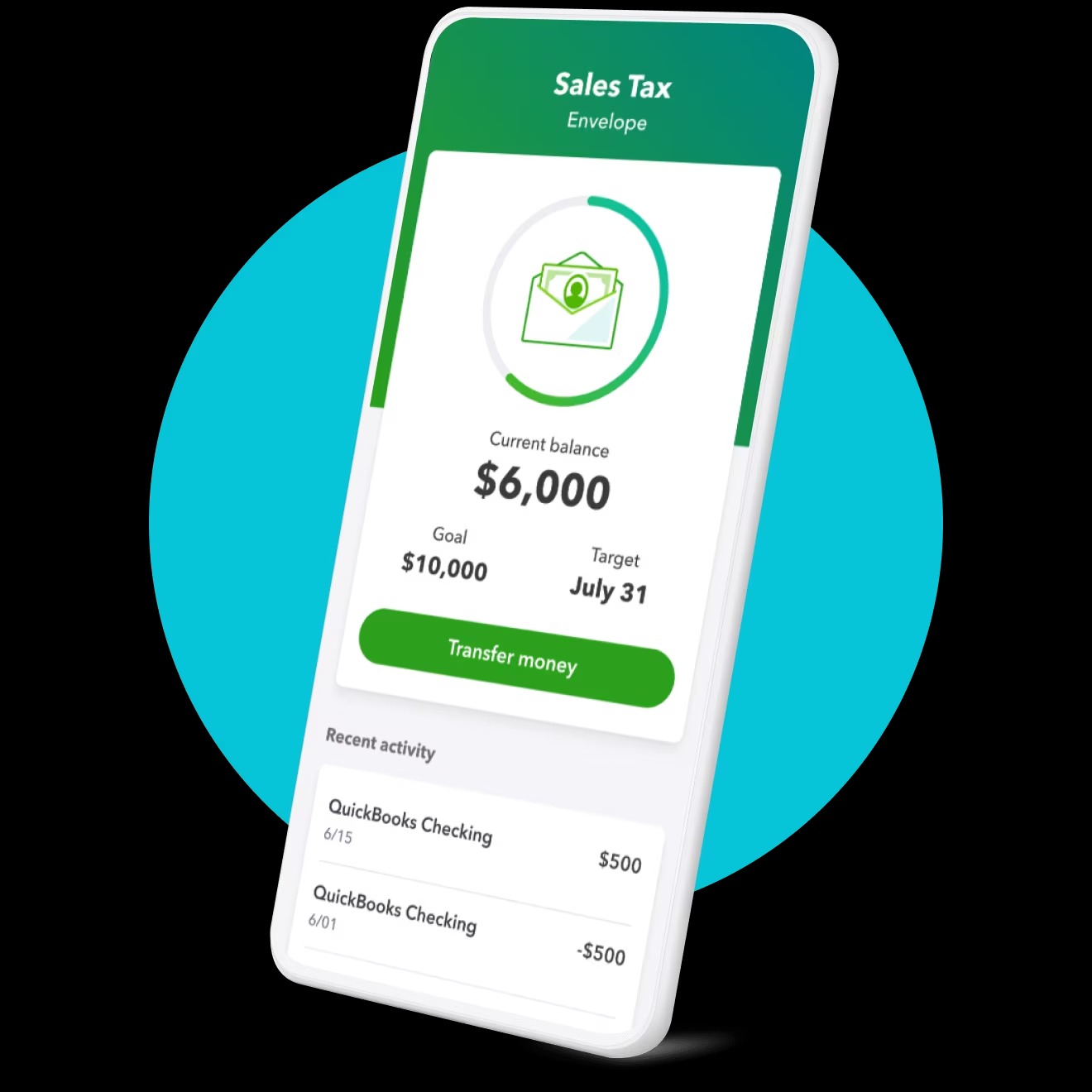

6. Consider a Linked Savings Account:

If your interest checking account permits, consider linking it to a separate high-interest savings account within the same institution. This allows you to maximize your interest earnings by transferring excess funds from your checking account to the linked savings account, which may offer higher interest rates.

7. Limit ATM Usage:

Be mindful of ATM fees as they can eat into your interest earnings. Limit your ATM usage to the ones provided by your bank or seek out accounts that offer fee reimbursements for using out-of-network ATMs. Utilize debit card cashback options when making purchases to reduce the need for ATM withdrawals.

By implementing these tips, you can make the most of your interest checking account and maximize your earnings. Remember to review the terms and conditions of your account and regularly reassess your financial needs to ensure you’re optimizing your banking relationships.

Conclusion

Interest checking accounts offer a unique blend of convenience and the opportunity to earn interest on your everyday funds. These accounts provide a practical solution for individuals who want easy access to their money while also growing their savings.

In this article, we explored the definition of interest checking accounts and how they work. We discussed the pros and cons of these accounts, highlighting the advantages of earning interest and maintaining accessibility to your funds, as well as the potential drawbacks such as lower interest rates.

Before opening an interest checking account, we emphasized the importance of considering various factors such as interest rates, fees, minimum balance requirements, and account accessibility. It’s crucial to choose an account that aligns with your financial goals and preferences.

We also discussed the significance of comparing different interest checking accounts to find the one that best suits your needs. Factors such as interest rates, fees, account features, ATM network, customer service, and additional benefits should be evaluated to make an informed decision.

Finally, we provided tips to maximize your interest earnings in a checking account. By maintaining a sufficient balance, comparing rates, taking advantage of additional benefits, utilizing online banking tools, considering a linked savings account, and being mindful of ATM usage, you can make the most of your account and increase your earnings.

In conclusion, an interest checking account can be a valuable addition to your financial management strategy. It offers the flexibility and convenience of a traditional checking account while providing the opportunity to earn some extra money. With careful consideration, comparisons, and implementation of the tips mentioned, you can make your interest checking account work harder for your financial goals.