Finance

What Are Working Capital Loans

Modified: February 21, 2024

Looking for finance options? Learn more about working capital loans, a valuable source of funding for businesses to cover operational expenses and improve cash flow.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Working Capital Loans

- Uses of Working Capital Loans

- Eligibility Criteria for Working Capital Loans

- Types of Working Capital Loans

- Benefits of Working Capital Loans

- Drawbacks of Working Capital Loans

- How to Apply for a Working Capital Loan

- Tips for Managing Working Capital Loans

- Conclusion

Introduction

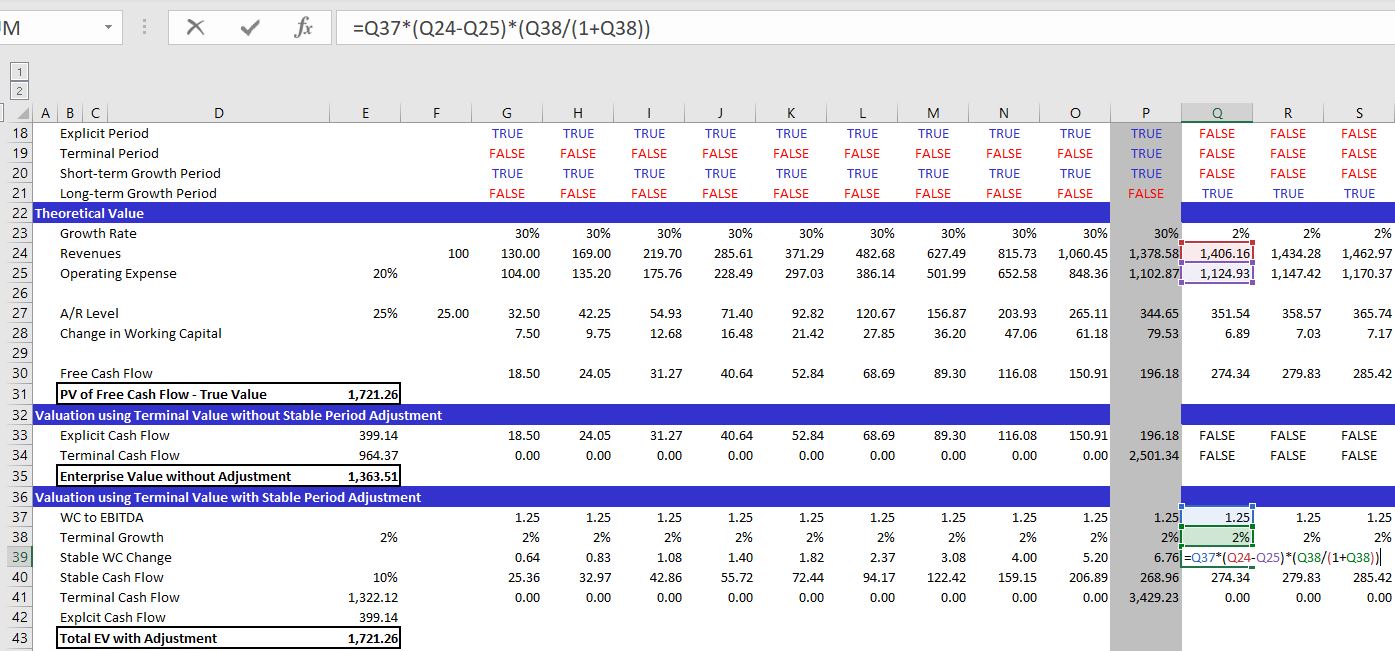

Running a business requires careful financial management, and one crucial aspect is maintaining adequate working capital. Working capital is the capital available to a company to fund its day-to-day operations, such as purchasing inventory, paying employees, and covering other operational expenses. However, there may be times when a business faces temporary cash flow issues or requires additional funds to support its growth initiatives. This is where working capital loans play a vital role.

A working capital loan is a type of financing that provides businesses with the necessary funds to cover their short-term operational needs. This kind of loan is specifically designed to bridge the gap between a company’s current assets (cash, accounts receivable, inventory, etc.) and current liabilities (accounts payable, short-term debt, etc.). By obtaining a working capital loan, businesses can maintain a healthy cash flow and ensure smooth operations.

Working capital loans are an essential financial tool for businesses across various industries. Whether it’s a small startup, a growing mid-sized company, or even an established enterprise, these loans can provide the necessary financial flexibility to meet their short-term obligations.

In this article, we will explore the definition of working capital loans, understand their uses, eligibility criteria, and different types available. We will also discuss the benefits and drawbacks of working capital loans and provide tips for managing them effectively. By the end of this article, you will have a comprehensive understanding of working capital loans and their significance in maintaining the financial health of your business.

Definition of Working Capital Loans

Working capital loans are a form of financing specifically designed to provide businesses with the necessary funds to cover their day-to-day operational expenses. These loans are typically short-term in nature and are used to bridge the gap between a company’s current assets and liabilities. The primary objective of a working capital loan is to ensure that businesses have enough capital to sustain their operations and maintain a healthy cash flow.

Unlike other types of business loans that are used for specific purposes, such as purchasing equipment or expanding facilities, working capital loans are versatile and can be utilized for various operational needs. These may include paying suppliers, covering payroll expenses, restocking inventory, or even investing in marketing and advertising campaigns to drive sales.

Working capital loans can be obtained from traditional financial institutions such as banks or credit unions, as well as from alternative lenders, including online lenders and peer-to-peer lending platforms. The loan amount and terms will depend on the lender’s assessment of the business’s creditworthiness and financial stability.

It’s important to note that working capital loans are different from long-term loans, which are typically used for larger investments like purchasing real estate or financing major expansions. Working capital loans, on the other hand, are meant to address short-term financial needs and are typically repaid within a shorter period, ranging from a few months to a couple of years.

One key aspect of working capital loans is that they do not require collateral in most cases. This means that businesses can obtain the necessary funds without having to pledge specific assets as security. Instead, lenders primarily evaluate the business’s creditworthiness, cash flow, and overall financial health to determine the loan’s terms and interest rates.

In summary, working capital loans are a crucial financial tool that allows businesses to address short-term cash flow issues, maintain smooth operations, and seize growth opportunities. They provide access to immediate funds without the need for collateral, making them a flexible and convenient financing option for businesses of all sizes.

Uses of Working Capital Loans

Working capital loans are a valuable source of financing for businesses of all sizes and industries. These loans can be used for a variety of purposes to support a company’s day-to-day operations and ensure its financial stability. Here are some common uses of working capital loans:

- Managing Cash Flow: One of the primary uses of working capital loans is to manage cash flow fluctuations. Businesses often face situations where their accounts receivable are delayed, but they still need to meet their immediate financial obligations, such as paying suppliers or employees. A working capital loan can provide the necessary funds to bridge this gap and maintain a healthy cash flow.

- Purchasing Inventory: Retailers, wholesalers, and manufacturing businesses often require a significant amount of inventory to fulfill customer orders and keep their operations running smoothly. However, purchasing inventory upfront can strain a company’s cash flow. Working capital loans can be used to finance inventory purchases, ensuring that businesses can meet customer demands and take advantage of bulk purchase discounts.

- Expanding or Renovating: Businesses may also use working capital loans to finance expansion projects, such as opening a new location, renovating existing premises, or investing in equipment upgrades. These loans provide the necessary funds to cover the upfront costs and allow businesses to grow and improve their infrastructure.

- Meeting Seasonal Demands: Many businesses, especially those in industries with seasonal fluctuations, experience peaks and troughs in demand throughout the year. During the busy seasons, businesses may require additional funds to hire extra staff, purchase more inventory, or increase production capacity. Working capital loans can help businesses meet these seasonal demands and seize growth opportunities.

- Financing Marketing Campaigns: Effective marketing and advertising campaigns can significantly impact a business’s growth and revenue. Working capital loans can be used to invest in marketing initiatives, such as digital advertising, social media campaigns, or promotional events. By allocating funds to marketing efforts, businesses can attract more customers, increase sales, and ultimately generate higher profits.

These are just a few examples of how working capital loans can be used. The flexibility and versatility of these loans make them an excellent financial tool to address a wide range of operational needs. It is important for businesses to carefully evaluate their financial requirements and consider how a working capital loan can best serve their specific needs.

Eligibility Criteria for Working Capital Loans

While working capital loans can provide much-needed financial support for businesses, lenders have certain eligibility criteria that must be met in order to qualify for these loans. The specific requirements can vary depending on the lender and the type of loan, but here are some common factors that lenders consider when evaluating a business’s eligibility for a working capital loan:

- Credit Score: Lenders typically assess the creditworthiness of a business by reviewing its credit score. A higher credit score indicates a lower risk of defaulting on the loan and can improve the chances of approval. However, some lenders may be willing to work with businesses that have less-than-perfect credit scores.

- Time in Business: Lenders often prefer to work with businesses that have been operating for a certain period of time, typically at least one or two years. This demonstrates stability and reduces the risk associated with lending to newer businesses.

- Revenue and Cash Flow: Lenders assess a business’s revenue and cash flow to ensure that it has the ability to repay the loan. They may ask for financial documents such as income statements, balance sheets, and bank statements to evaluate the company’s financial health and stability.

- Profitability: While not all lenders require a business to be profitable, demonstrating a positive cash flow and the potential to generate profits can strengthen the loan application. Lenders want to ensure that the business is capable of sustaining its operations and repaying the loan.

- Collateral: Although working capital loans are generally unsecured, meaning they do not require collateral, some lenders may ask for collateral to secure the loan. This can be in the form of business assets, such as inventory, equipment, or accounts receivable.

- Legal and Regulatory Compliance: Lenders may also consider the business’s compliance with legal and regulatory requirements. This includes factors such as proper licensing, tax filings, and adherence to industry-specific regulations.

It’s important to note that each lender may have its own specific eligibility criteria, so businesses should thoroughly research and compare different lenders before applying for a working capital loan. Additionally, businesses should be prepared to provide relevant documents and financial information to support their loan application.

While meeting these eligibility criteria can increase the chances of getting approved for a working capital loan, it’s worth exploring alternative financing options if a business does not meet certain requirements. Online lenders, crowdfunding platforms, and government-backed loan programs can provide additional avenues for businesses in need of working capital.

By understanding and meeting the eligibility criteria for working capital loans, businesses can position themselves for a successful loan application and access the funds needed to support their day-to-day operations.

Types of Working Capital Loans

Working capital loans come in various forms, each tailored to meet different business needs. Here are some common types of working capital loans:

- Line of Credit: A line of credit is a revolving loan that provides businesses with access to a predetermined amount of funds. Similar to a credit card, businesses can borrow and repay funds as needed, and interest is charged only on the amount used. This type of loan offers flexibility and can be a useful option for managing day-to-day cash flow fluctuations.

- Accounts Receivable Financing: Accounts receivable financing, also known as invoice financing or factoring, involves selling outstanding customer invoices to a lender at a discounted rate. The lender advances a portion of the invoice amount to the business, providing immediate cash flow while waiting for customers to make payment. This type of financing can be beneficial for businesses with long payment cycles or those that need quick access to cash.

- Merchant Cash Advance: A merchant cash advance is a lump sum payment provided to a business in exchange for a percentage of its future credit card sales. The lender collects the payment by automatically deducting a fixed percentage from daily credit card sales. This type of working capital loan is often used by businesses in the retail or hospitality industry that have high credit card sales volume.

- Inventory Financing: Inventory financing allows businesses to use their existing inventory as collateral to secure a loan. The lender evaluates the value of the inventory and provides a loan based on a percentage of its worth. This type of loan is particularly useful for businesses that need to purchase additional inventory to meet customer demand.

- Short-term Loans: Short-term loans are traditional loans with a fixed repayment term, typically ranging from a few months to a year. These loans are suitable for businesses that require a one-time infusion of funds to address immediate working capital needs, such as paying suppliers or meeting unexpected expenses.

- Asset-Based Loans: Asset-based loans are secured by the business’s assets, such as accounts receivable, inventory, or equipment. The loan amount is determined based on the value of the pledged assets. This type of loan can be useful for businesses that have valuable assets but may not meet the requirements for traditional financing.

It’s essential for businesses to carefully consider their specific needs and financial situation when choosing the type of working capital loan. Consulting with financial advisors or loan specialists can help businesses identify the most suitable option and navigate the application process.

Additionally, it’s worth noting that there may be alternative financing options available, such as grants or government-backed loans, depending on the industry or location of the business. Exploring all available options can help businesses secure the most favorable financing terms and support their ongoing operations.

Benefits of Working Capital Loans

Working capital loans offer several benefits to businesses facing temporary cash flow challenges or seeking to expand their operations. Here are some key advantages of utilizing working capital loans:

- Improved Cash Flow: By obtaining a working capital loan, businesses can address immediate cash flow gaps and maintain a steady stream of funds. This ensures that they can meet their day-to-day financial obligations, such as paying suppliers, covering payroll, and other operational expenses.

- Flexibility: Working capital loans provide businesses with flexibility in terms of how funds can be used. Unlike loans that are specific to certain purposes, these loans can be utilized for various operational needs, such as purchasing inventory, investing in marketing campaigns, or covering unexpected expenses.

- Fast Access to Funds: In comparison to traditional long-term loans, working capital loans often have a simpler application process and shorter approval times. This allows businesses to access the funds they need quickly, providing immediate relief during cash flow crises or time-sensitive opportunities.

- Growth Opportunities: Working capital loans can help businesses take advantage of growth opportunities. Whether it’s expanding to a new market, launching a new product or service, or investing in marketing initiatives, these loans provide the necessary capital to fuel growth and generate higher revenues.

- Increased Purchasing Power: With a working capital loan, businesses can enhance their purchasing power by being able to buy inventory in bulk or take advantage of supplier discounts. This not only improves their ability to meet customer demands promptly but can also lead to cost savings in the long run.

- Building Credit History: Consistently repaying a working capital loan on time can help businesses establish or improve their credit history. This can be beneficial for securing future financing options at better terms and conditions.

- Preserving Equity: Unlike equity financing, where business owners have to dilute their ownership by selling shares, working capital loans allow businesses to retain full ownership. This preserves the equity of the business and gives owners more control over its operations and decision-making processes.

It’s important for businesses to carefully consider their specific needs and financial situation when considering a working capital loan. Conducting a thorough analysis of the potential benefits and costs associated with the loan can help businesses make an informed decision and optimize its impact on their operations.

However, it’s worth noting that working capital loans may not be suitable for all businesses. Borrowers should assess their ability to repay the loan, including the associated interest rates and fees, before committing to this type of financing.

Drawbacks of Working Capital Loans

While working capital loans can be beneficial for businesses, it is important to consider the potential drawbacks associated with these types of financing. Here are some common drawbacks to be aware of:

- Interest Rates: Working capital loans often come with higher interest rates compared to long-term loans. This is due to the short-term nature of the loan and the perceived higher risk for lenders. The higher interest rates can increase the overall cost of borrowing and impact the profitability of the business.

- Fees and Additional Costs: In addition to interest rates, working capital loans may have other associated fees, such as loan origination fees, application fees, or prepayment penalties. These costs can add up, increasing the overall expense of the loan.

- Debt Burden: Taking on additional debt through a working capital loan can increase the financial burden on a business. Repayment obligations must be factored into the cash flow, and failure to meet these obligations can negatively impact the creditworthiness and financial stability of the business.

- Short Repayment Terms: Working capital loans typically have shorter repayment terms compared to long-term loans. While this allows businesses to access funds quickly, it also means higher monthly repayments. Businesses must carefully assess their cash flow and ability to meet these shorter-term repayment requirements.

- Impact on Creditworthiness: Taking on additional debt can impact a business’s creditworthiness, especially if there are difficulties in making timely repayments. This can make it more challenging to secure future financing or negotiate favorable terms with lenders in the future.

- Limited Eligibility: Not all businesses may meet the eligibility criteria set by lenders for working capital loans. This can be a disadvantage for businesses that are in the early stages of operation or have a less-than-ideal credit history.

- Lender Requirements: Some lenders may impose certain restrictions on how the borrowed funds can be used. This can limit the flexibility and restrict the business’s ability to allocate the funds according to its specific needs.

It is important for businesses to carefully consider these drawbacks and evaluate their financial situation before deciding to pursue a working capital loan. Thoroughly understanding the terms, costs, and potential risks associated with the loan can help businesses make informed decisions and mitigate any potential negatives.

Alternatives, such as bootstrapping, seeking equity funding, or exploring government-backed loan programs, can also be considered based on the specific needs and circumstances of the business. Consulting with financial advisors or loan specialists can provide valuable insights and guidance in making the right financing choices for the business.

How to Apply for a Working Capital Loan

Applying for a working capital loan requires careful preparation and attention to detail. Here are the steps to follow when applying for a working capital loan:

- Evaluate Your Financial Needs: Before applying for a working capital loan, assess your financial needs and determine the amount of funding required to support your business operations. Consider factors such as cash flow requirements, outstanding payables, and growth opportunities.

- Review Your Credit Profile: Obtain a copy of your business credit report and review it for any errors or discrepancies. Lenders will evaluate your creditworthiness, so it’s important to ensure the accuracy of your credit profile.

- Gather Required Documentation: Prepare the necessary documentation that lenders may require, including financial statements such as balance sheets, income statements, and cash flow statements. Additionally, gather documents such as bank statements, tax returns, business licenses, and any other relevant financial records.

- Research and Compare Lenders: Research various lenders who offer working capital loans and compare their interest rates, terms, and eligibility criteria. Consider both traditional financial institutions and alternative lenders to find the best fit for your business.

- Prepare a Loan Proposal: Create a loan proposal that outlines your business’s financial history, anticipated use of funds, and a repayment plan. This proposal should provide lenders with a comprehensive overview of your business and demonstrate the viability of your loan application.

- Apply for the Loan: Once you have selected a lender, complete the loan application form accurately and provide all the necessary documentation. Some lenders may require an in-person meeting or phone interview to discuss your loan application in more detail.

- Review and Negotiate Loan Terms: Once your loan application is reviewed, carefully review the loan terms offered by the lender. Pay attention to details such as interest rates, fees, repayment terms, and any additional requirements. If necessary, negotiate the terms to ensure they align with your business’s financial capabilities.

- Close the Loan: If the loan terms are satisfactory, complete the necessary paperwork and meet any remaining conditions requested by the lender. Ensure that you understand the loan agreement and your responsibilities as a borrower.

- Utilize Funds Responsibly: Once the loan is approved and disbursed, utilize the funds responsibly for the intended purposes outlined in your loan application. Track and manage your cash flow to ensure timely loan repayments.

It is important to note that the application process and timeline may vary depending on the lender and the type of loan. Be sure to read the lender’s requirements carefully and seek guidance from financial advisors or loan specialists if needed.

Lastly, keep in mind that an organized and well-prepared loan application, accompanied by a strong loan proposal, can significantly improve your chances of securing a working capital loan for your business.

Tips for Managing Working Capital Loans

Managing working capital loans effectively is crucial for maintaining the financial health of your business. Here are some essential tips to help you successfully manage your working capital loan:

- Create a Detailed Financial Plan: Develop a comprehensive financial plan that includes accurate revenue forecasts, expense projections, and cash flow analysis. This will help you anticipate and manage any potential cash flow gaps and ensure timely loan repayments.

- Monitor Cash Flow: Regularly monitor your cash flow to track incoming and outgoing funds. Stay on top of accounts payable and accounts receivable to ensure that payments are made promptly and payments are collected on time.

- Communicate with Lenders: Maintain open communication with your lender throughout the loan repayment period. If you anticipate any challenges in making loan payments, communicate with your lender proactively to explore potential solutions. They may be willing to work with you to modify the loan terms or develop a repayment plan that fits your cash flow situation.

- Optimize Working Capital: Continuously evaluate and optimize your working capital to improve efficiency and reduce the need for additional borrowing. Efficient cash management, inventory control, and careful credit terms with suppliers and customers can help reduce the strain on working capital.

- Review Expenses: Regularly review your expenses and identify areas where you can cut costs or find more cost-effective alternatives. This can help free up cash flow and reduce the reliance on borrowed funds.

- Plan for Loan Repayment: Prioritize loan repayments in your budget and allocate funds accordingly. Make timely payments to avoid any penalties or negative impact on your creditworthiness.

- Explore Refinancing Options: As your business grows and improves its creditworthiness, consider refinancing your working capital loan to secure better terms and lower interest rates. However, carefully evaluate the costs and benefits of refinancing before making a decision.

- Stay Updated on Financial Trends: Keep yourself informed about industry trends, economic conditions, and financial market changes that could impact your business. This will help you make informed decisions and adjust your financial strategies accordingly.

- Seek Professional Advice: Consulting with financial advisors, accountants, or business coaches can provide valuable insights and guidance on managing your working capital loan effectively. They can help you navigate financial challenges and develop strategies to optimize your business’s financial performance.

By implementing these tips, you can better manage your working capital loan and ensure that it remains a beneficial tool for supporting your business’s growth and operational needs.

Remember, proactive financial management and responsible utilization of borrowed funds are key to successfully navigating the repayment process and maintaining a strong financial position for your business.

Conclusion

Working capital loans can be a valuable financial resource for businesses of all sizes and industries. These loans play a crucial role in addressing short-term cash flow gaps, managing day-to-day operations, and supporting growth initiatives. By providing businesses with immediate access to funds, working capital loans allow them to maintain a healthy cash flow, invest in necessary resources, and seize opportunities for expansion.

Throughout this article, we have explored the definition of working capital loans, their uses, eligibility criteria, and various types available. We have also discussed the benefits and drawbacks of utilizing these loans and provided tips for effectively managing them.

When applying for a working capital loan, it is essential to evaluate your business’s financial needs, review your credit profile, and gather the required documentation. Researching and comparing lenders will help you find the best fit for your business, while a well-prepared loan proposal enhances your chances of approval. Once the loan is secured, responsible utilization of the funds and efficient cash flow management are crucial for successful loan repayment.

While working capital loans offer numerous advantages, it is important to consider potential drawbacks such as higher interest rates, fees, and the potential impact on your creditworthiness. Careful financial planning, open communication with lenders, and exploring opportunities for refinancing can help mitigate these drawbacks and optimize the benefits of working capital loans for your business.

Remember, managing working capital loans requires ongoing vigilance, proactive financial management, and staying informed about market trends and industry changes. By effectively managing your working capital loans, you can maintain the financial stability and sustainability of your business.