Finance

What Credit Score Is Good Uk

Published: October 23, 2023

Looking for information on what credit score is considered good in the UK? Check out our guide to understanding credit scores and finance in the UK.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of credit scores, where a three-digit number can wield significant influence over your financial life. Whether you’re applying for a loan, a credit card, or even a rental property, your credit score plays a crucial role in determining your eligibility and the terms you’re offered. In the UK, just like in many other countries, having a good credit score is essential for accessing favorable financial opportunities.

But what exactly is a credit score, and why is it so important? Your credit score is a numerical representation of your creditworthiness, which is calculated based on various factors such as your payment history, outstanding debt, credit utilization, and length of credit history. It provides lenders and financial institutions with an indicator of how likely you are to repay your debts on time.

Having a good credit score can unlock a world of possibilities. It can help you secure better interest rates on loans, credit cards with more favorable terms, and even increase your chances of being approved for a rental property. On the other hand, a poor credit score can limit your options, making it harder to obtain credit or forcing you to settle for less favorable terms.

In this article, we’ll delve into the world of credit scores in the UK, exploring the factors that affect your score, the different credit score ranges, and the importance of maintaining a good credit score. We’ll also provide you with some essential tips on how to check your credit score and how to improve it if it’s not as stellar as you’d like.

So, if you’re ready to unlock the secrets of credit scores and take control of your financial future, let’s dive in!

Understanding Credit Scores

Before we dive into the specifics of what makes a credit score good or bad, let’s first understand how credit scores are calculated and what factors contribute to their determination.

In the UK, credit scoring is typically done by three main credit reference agencies: Experian, Equifax, and TransUnion. These agencies collect financial information about individuals from various sources, such as banks, lenders, and utility companies, and use this data to generate credit scores.

The most commonly used credit scoring model in the UK is the FICO Score, which ranges from 300 to 850. The higher your score, the better your creditworthiness.

Several key factors impact your credit score:

- Payment History: This is the most influential factor in determining your credit score. It reflects whether you have made past payments on time and in full.

- Amount Owed: Your outstanding debt and credit utilization ratio are taken into account. Keeping your credit utilization low demonstrates responsible borrowing.

- Length of Credit History: The longer your credit history, the more information there is for lenders to assess your creditworthiness.

- Credit Mix: Having a diverse mix of credit accounts, such as credit cards, loans, and mortgages, can positively impact your score.

- New Credit Applications: Opening multiple credit accounts within a short period may raise concerns about your financial stability.

It’s important to note that credit scoring models may vary slightly between credit reference agencies, so your score may differ slightly depending on which agency is used. However, the general principles of credit scoring remain the same.

Now that we have a basic understanding of how credit scores are calculated, let’s take a closer look at the credit score ranges commonly used in the UK and what they mean for your financial health.

Factors Affecting Credit Scores

Your credit score is a reflection of your financial behavior and responsibilities. It is influenced by various factors that can either positively or negatively impact your score. Understanding these factors can help you make informed decisions and take actions to improve your creditworthiness. Here are the key factors that affect your credit score:

- Payment History: Your payment history is one of the most critical factors in determining your credit score. Lenders want to see a consistent record of on-time payments. Late payments, defaults, or bankruptcies can significantly damage your credit score.

- Amount of Debt: The amount of debt you owe, compared to your available credit limit, also known as your credit utilization ratio, plays a role in determining your credit score. High credit card balances and being close to your credit limits can negatively impact your score. It is advisable to keep your credit utilization ratio below 30%.

- Length of Credit History: The length of your credit history is another important factor. Lenders prefer borrowers with a longer credit history, as it provides more information about your creditworthiness. If you’re new to credit, it may take time to build a solid credit history.

- Credit Mix: Having a mix of different types of credit accounts, such as credit cards, loans, and mortgages, can positively impact your credit score. It shows that you can manage different types of credit responsibly.

- New Credit Applications: Applying for multiple credit accounts within a short period can be seen as a red flag. Each application creates a hard inquiry on your credit report, which can temporarily lower your credit score. It is wise to only apply for credit when necessary.

- Public Records and Collections: Public records, such as tax liens, bankruptcies, or collections, can have a significant negative impact on your credit score. It is crucial to address any outstanding issues and settle any outstanding debts to improve your score.

It’s important to keep in mind that the weightage of each factor may vary depending on your individual circumstances and the credit scoring model used by lenders or credit reference agencies. It’s always a good idea to consistently practice good credit habits and maintain a healthy financial profile to ensure a higher credit score.

Now that you understand the factors that impact your credit score, let’s explore the credit score ranges commonly used in the UK and their significance.

Credit Score Ranges in the UK

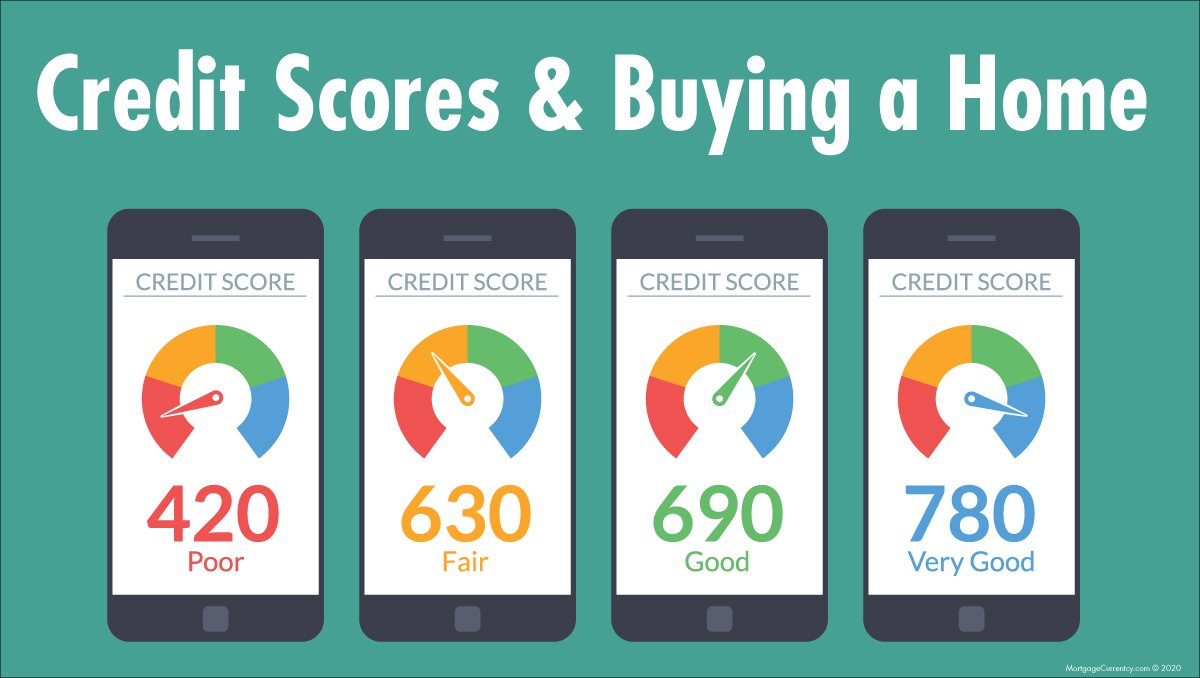

In the UK, credit scores are typically categorized into different ranges to help lenders assess an individual’s creditworthiness more easily. While the specific ranges may vary slightly between credit reference agencies, they generally follow a similar pattern. Here are the common credit score ranges used in the UK:

- Excellent (800-850): A credit score in this range indicates excellent creditworthiness. Lenders view individuals in this range as highly reliable and responsible borrowers. It increases the likelihood of approval for credit applications and opens doors to the best interest rates and terms.

- Very Good (740-799): Falling into this range still represents a strong credit profile. It may not provide access to the absolute best rates, but individuals can still expect attractive terms on credit applications.

- Good (670-739): Credit scores in this range are considered good, demonstrating a solid credit history. Lenders generally view individuals in this range as low-risk borrowers, providing access to competitive interest rates and favorable terms.

- Fair (580-669): Falling into this range suggests a fair credit history. While individuals within this range may still be eligible for credit, they may face higher interest rates and less favorable terms than those with higher scores.

- Poor (300-579): A credit score in this range indicates poor creditworthiness. It is likely to result in difficulty obtaining credit, and if approved, it may come with high-interest rates and unfavorable terms. Rebuilding credit is essential for individuals in this range.

It’s important to remember that these credit score ranges are not set in stone and can vary between lenders and credit reference agencies. Lenders may also consider other factors, such as income and employment stability, when making lending decisions.

Now that we have covered the credit score ranges, it’s crucial to understand why having a good credit score is so important.

Importance of a Good Credit Score

A good credit score is not just a number; it’s a powerful financial tool that can open up a world of opportunities. Here are the key reasons why having a good credit score is important:

- Access to Credit: A good credit score increases your chances of being approved for credit applications, such as loans, credit cards, and mortgages. Lenders perceive individuals with higher credit scores as lower-risk borrowers, making them more likely to extend credit.

- Favorable Interest Rates: When you have a good credit score, you are more likely to qualify for loans and credit cards with lower interest rates. This means you’ll pay less in interest over time, potentially saving you thousands of pounds.

- Better Loan Terms: Lenders may be more willing to offer you better terms, such as longer repayment periods or higher credit limits, if you have a good credit score. This can provide greater flexibility and help you better manage your finances.

- Employment Opportunities: Some employers, especially those in the financial industry, may consider credit checks as part of their hiring process. A good credit score reflects your financial responsibility and can enhance your chances of securing certain job opportunities.

- Rental Applications: Landlords and rental agencies often run credit checks on prospective tenants. A good credit score can make you a more attractive candidate and increase your chances of being approved for a rental property.

- Insurance Premiums: In some cases, insurance companies may consider your credit score when determining your premiums. A good credit score can help you secure lower insurance rates, saving you money in the long run.

Ultimately, having a good credit score is about financial freedom and flexibility. It enables you to access credit at competitive rates, qualify for better loan terms, and open doors to various opportunities.

Now that you understand the importance of a good credit score, let’s explore how you can check your credit score in the UK.

How to Check Your Credit Score in the UK

Checking your credit score in the UK is a crucial step towards understanding your financial health and taking control of your creditworthiness. Here are the steps to check your credit score:

- Choose a Credit Reference Agency: Start by selecting a reputable credit reference agency, such as Experian, Equifax, or TransUnion. These agencies collect and analyze your financial information to generate your credit score.

- Create an Account: Visit the website of your chosen credit reference agency and create an account. You’ll typically need to provide personal information, such as your name, address, and date of birth.

- Verify Your Identity: The credit reference agency will require you to go through an identity verification process. This may involve answering security questions or providing documentation to confirm your identity.

- Access Your Credit Report: Once your identity is verified, you’ll be able to access your credit report and credit score. Review your report carefully for any errors or inconsistencies, as these can impact your creditworthiness.

- Monitor Your Credit: Along with checking your credit score, it’s essential to regularly monitor your credit report for any changes or suspicious activity. This allows you to identify potential issues early on and take appropriate action.

Some credit reference agencies offer free basic access to your credit score and report, while others may require a subscription or offer additional paid services for more in-depth analysis. It’s worth exploring the options available to find the one that best suits your needs.

Remember, checking your credit score should be a regular practice, especially if you’re planning to apply for credit in the near future or want to keep a close eye on your financial health. Being aware of your credit score empowers you to make informed decisions and take steps to improve your creditworthiness.

Now let’s move on to the next step – understanding how to improve your credit score.

Ways to Improve Your Credit Score

If your credit score is not as good as you’d like it to be, don’t fret! There are steps you can take to improve your creditworthiness over time. Here are some effective ways to improve your credit score:

- Pay Bills on Time: Your payment history is a crucial factor in your credit score. Make sure to pay all your bills, including credit card payments, loans, and utilities, on time. Set up reminders or automatic payments to avoid missing any due dates.

- Pay Down Outstanding Debt: Aim to reduce the amount of debt you owe, especially on credit cards. Paying down your balances can improve your credit utilization ratio and demonstrate responsible credit management.

- Avoid Opening Unnecessary Credit Accounts: While having a mix of credit accounts can be beneficial, avoid opening new credit accounts unless necessary. Each application creates a hard inquiry on your credit report, which can temporarily lower your score.

- Check for Errors on Your Credit Report: Regularly review your credit report for any errors or inaccuracies. Dispute any incorrect information and work with the credit reference agency to have it corrected. Removing errors can boost your credit score.

- Keep Unused Credit Accounts Open: Closing old credit accounts may seem like a good idea, but it can actually harm your credit score. Keeping them open shows a longer credit history and improves your credit utilization ratio.

- Use Credit Responsibly: Use credit cards and other credit accounts responsibly. Avoid maxing out your credit limit and try to keep your credit utilization ratio below 30% to show lenders that you can manage credit responsibly.

- Build a Positive Credit History: If you’re new to credit or have limited credit history, consider building it up gradually. Start with a secured credit card or a credit builder loan to establish a positive payment history.

- Be Patient and Consistent: Improving your credit score takes time. Be patient and consistent in your efforts to pay bills on time, reduce debt, and practice responsible credit management. Your efforts will pay off in the long run.

Remember, improving your credit score is a gradual process, and there are no quick fixes. It requires responsible financial habits, consistency, and patience. By following these steps, you can steadily improve your creditworthiness and open up more opportunities for favorable rates and terms.

Now that you have a better understanding of how to improve your credit score, let’s wrap up this article.

Conclusion

Managing and understanding your credit score is an essential part of maintaining a healthy financial life in the UK. Your credit score plays a significant role in determining your access to credit, interest rates on loans, rental applications, and even employment opportunities. By staying informed and taking proactive steps to improve your creditworthiness, you can unlock a world of financial opportunities.

In this article, we discussed the key components of credit scores, including payment history, amount owed, length of credit history, credit mix, and new credit applications. We explored the different credit score ranges commonly used in the UK and their implications for your financial health. Additionally, we highlighted the importance of having a good credit score, such as accessing credit at favorable terms and securing lower interest rates.

We also provided guidance on how to check your credit score through credit reference agencies and emphasized the need for regular monitoring. Furthermore, we discussed effective ways to improve your credit score, including paying bills on time, reducing outstanding debt, checking for errors on your credit report, and using credit responsibly.

Remember, building and maintaining a good credit score is a journey. It requires patience, discipline, and responsible financial practices. By following the tips outlined in this article, you can take control of your creditworthiness and work towards achieving your financial goals.

So, take the time to check your credit score, understand the factors that influence it, and make conscious efforts to improve it. Your credit score is not just a number—it’s a reflection of your financial responsibility and a gateway to better financial opportunities in the UK.