Finance

What Does Cost To Borrow Mean In Stocks

Published: January 18, 2024

Learn the meaning of "cost to borrow" in stocks and how it impacts finance. Gain insights into borrowing costs and its influence on stock investment.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of stock trading, where savvy investors and traders capitalize on market opportunities to maximize their returns. While buying and holding stocks is the traditional approach, there is another strategy that can be just as lucrative – short selling. Short selling involves borrowing stocks from a broker and selling them with the intention of buying them back at a lower price in the future, thereby profiting from a decline in the stock’s value.

However, when you borrow stocks, you are not doing so for free. There is a cost attached to borrowing these shares, known as the cost to borrow. In this article, we will explore what cost to borrow means in stocks, the factors influencing it, and its significance in the stock market.

Understanding the concept of the cost to borrow is essential for anyone considering short selling or engaging in any stock trading activity that involves borrowing shares. It is a metric that helps investors evaluate the potential profitability and risk associated with borrowing stocks.

By delving into this topic, we aim to provide you with a comprehensive understanding of the cost to borrow and its implications in stock trading. So, let’s dive in and explore this fascinating aspect of the financial markets.

Definition of Cost to Borrow in Stocks

The cost to borrow in stocks refers to the fee or interest rate that a borrower incurs for borrowing shares of a stock from a broker or another investor. It is the price that an investor pays for the privilege of borrowing someone else’s shares to execute a short-selling strategy or engage in other trading activities that involve borrowing stocks.

When an investor wishes to sell short, they borrow shares from a broker or an existing shareholder and sell them in the market with the expectation that the stock’s price will decline. Eventually, they repurchase the shares at a lower price and return them to the lender, pocketing the difference as profit.

The cost to borrow is essentially the interest rate or fee charged for this borrowing arrangement. It compensates the lender for the risk and opportunity cost of temporarily parting with their shares. The cost to borrow is typically expressed as an annualized percentage rate (APR), but it may also be specified as a fixed fee or a combination of both.

The specific cost to borrow can vary widely depending on a range of factors, including the demand for the particular stock, its availability for borrowing, the perceived risk associated with the short sale, and prevailing market conditions. Companies with smaller market capitalizations and stocks that are in high demand for short selling may attract higher borrowing costs, reflecting the scarcity of shares available for borrowing.

It is important to note that the cost to borrow is not a static figure. It can change throughout the borrowing period, depending on market dynamics and changes in supply and demand. Traders should be mindful of these fluctuations and factor in the cost to borrow when evaluating the potential profitability of their short-selling strategies.

Next, we will explore the various factors that can influence the cost to borrow in stocks, shedding light on the complexities of this metric.

Factors Affecting Cost to Borrow

The cost to borrow in stocks is influenced by several key factors that determine the overall supply and demand dynamics of borrowed shares. Understanding these factors can help traders anticipate changes in the borrowing costs and make informed decisions when engaging in short selling or other activities that involve borrowing stocks. Let’s explore the main factors affecting the cost to borrow:

- Stock Market Volatility: The level of volatility in the stock market plays a significant role in determining the cost to borrow. Stocks with high levels of volatility are generally more expensive to borrow, as lenders demand a higher fee or interest rate to compensate for the increased risk.

- Short Interest and Demand: The level of demand from short sellers also influences the cost to borrow. If a stock has a high short interest, meaning there are many traders looking to borrow shares for short selling, the borrowing costs may increase due to limited availability.

- Stock Availability: The supply and availability of shares for borrowing impact the cost to borrow. If a stock is in high demand for short selling and there are limited shares available to borrow, the cost to borrow is likely to be higher.

- Interest Rates: General interest rates in the market can affect the cost to borrow. If interest rates are high, it may result in higher borrowing costs, as lenders can potentially earn more by lending their shares elsewhere.

- Company Size and Liquidity: The size and liquidity of a company can impact the cost to borrow. Stocks of smaller companies or those with low trading volume may have higher borrowing costs due to the limited availability of shares.

- Market Conditions: Overall market conditions and investor sentiment can also influence the cost to borrow. During periods of heightened market volatility or economic uncertainty, the cost to borrow may increase as lenders become more risk-averse.

It is important to note that these factors are interconnected and can influence each other. Traders and investors should carefully consider these factors when evaluating the cost to borrow and its impact on their trading strategies.

Now that we understand the factors affecting the cost to borrow, let’s move on to exploring the significance of this metric in stock trading.

Importance of Cost to Borrow in Stock Trading

The cost to borrow is a crucial aspect of stock trading, especially for those engaging in short selling or other strategies that involve borrowing shares. Understanding the importance of the cost to borrow can help traders make informed decisions and manage their risk effectively. Let’s explore why the cost to borrow is significant in stock trading:

- Evaluating Profitability: The cost to borrow directly impacts the potential profitability of a short selling strategy. Higher borrowing costs can erode profits, especially if the price of the borrowed stock does not decline significantly. It is important to assess whether the potential gains from short selling outweigh the associated borrowing costs.

- Managing Risk: The cost to borrow also plays a role in risk management. Traders need to consider the potential losses from a short position if the borrowed stock increases in value. By factoring in the borrowing costs, traders can better assess the risk of their positions and implement risk management strategies accordingly.

- Sizing Positions: The cost to borrow can impact the sizing of short positions. Higher borrowing costs may warrant smaller position sizes to limit potential losses. Conversely, lower borrowing costs may allow for larger positions and potentially higher profits.

- Market Efficiency: The cost to borrow reflects the supply and demand dynamics of borrowed shares. Monitoring changes in the cost to borrow can provide insights into market sentiment and potential inefficiencies. For example, a sudden increase in borrowing costs may indicate increased short selling interest or a scarcity of shares, potentially signaling negative market sentiment towards a particular stock.

- Long Bias of Market: The cost to borrow can also reflect the overall long bias of the market. Stocks that are in high demand for short selling and have higher borrowing costs may indicate a market sentiment skewed towards bullishness. Conversely, low borrowing costs on stocks may suggest a market sentiment favoring bearishness.

Traders and investors should carefully assess the cost to borrow and its implications before engaging in short selling or other activities involving borrowed stocks. By taking into account the borrowing costs, traders can make more informed decisions and effectively manage their positions.

Next, let’s explore how the cost to borrow is calculated in the stock market.

Calculation of Cost to Borrow

The cost to borrow in stocks can be calculated using different methods, depending on the specific terms and conditions set by the lender and the prevailing market conditions. Here are a few common ways to calculate the cost to borrow:

- Annualized Percentage Rate (APR): One common method is to express the cost to borrow as an annualized percentage rate. This calculation takes into account the duration of the borrowing period. For example, if the lender charges a 2% fee for borrowing shares for a one-month period, the APR would be 24% (2% * 12 months).

- Fixed Fee: In some cases, the cost to borrow may be specified as a fixed fee rather than a percentage. For instance, a lender may charge a flat fee of $10 for borrowing a certain number of shares for a specific period. In this case, the cost to borrow is fixed and does not change based on the duration of the borrowing period.

- Negotiated Rate: Depending on the arrangement between the borrower and the lender, the cost to borrow can be negotiated. Traders with larger portfolios or established relationships with brokers may have more flexibility in negotiating favorable rates for borrowing shares.

It’s important to note that the calculation of the cost to borrow may also take into account other factors such as the demand for the stock, the risks associated with short selling, and prevailing market conditions. The specific calculation method may vary based on the lending agreement and the terms set by the lender.

For most retail traders, the cost to borrow is typically determined by the brokerage firm through which the trading activity is conducted. Brokerages may have different fee structures and guidelines for borrowing shares, so it’s important to review the terms and conditions provided by the broker before initiating any short selling or borrowing transactions.

Now that we understand how the cost to borrow is calculated, let’s move on to discussing the risks and benefits associated with borrowing stocks.

Risks and Benefits of Borrowing Stocks

Borrowing stocks, while offering potential opportunities for profit, also carries its own set of risks and benefits. Traders and investors should carefully consider these factors before engaging in short selling or any activity involving borrowed stocks. Let’s explore the risks and benefits associated with borrowing stocks:

Risks:

- Market Risk: When borrowing stocks, traders are exposed to market risk. If the price of the borrowed stock goes up instead of down, the trader may incur losses when repurchasing the shares to return them to the lender.

- Borrowing Costs: The cost to borrow, as discussed earlier, represents an additional expense that must be considered. Higher borrowing costs can eat into potential profits and may affect the overall profitability of a short selling strategy.

- Limited Availability: The availability of borrowed shares can sometimes be limited, especially for stocks with high demand for short selling. This scarcity can lead to higher borrowing costs and difficulty in executing short positions.

- Margin Calls: When borrowing stocks on margin, traders may be required to maintain a certain level of collateral, such as cash or other securities, to secure the position. If the borrowed stock increases significantly in value, the lender may make a margin call, forcing the trader to provide additional collateral or liquidate the position at a potentially unfavorable time.

Benefits:

- Profit Potential: Short selling and borrowing stocks provide opportunities to profit from declining stock prices. If the price of the borrowed stock goes down, traders can repurchase them at a lower price and profit from the difference.

- Diversification: Borrowing stocks allows traders to diversify their portfolio and potentially benefit from market downturns or specific stock movements that are not possible with traditional long-only positions.

- Hedging: Short selling and borrowing stocks can act as a hedging strategy to mitigate the potential losses in a long portfolio during market downturns. By taking short positions on certain stocks, traders can offset the losses incurred by their long positions.

- Market Efficiency and Discovery: Short selling plays a vital role in market efficiency as it helps identify overvalued stocks and brings them closer to their fair value. Borrowing stocks and selling them short allows traders to participate in the price discovery process.

It’s essential for traders to carefully weigh the risks and benefits before engaging in short selling or borrowing stocks. Performing thorough research, implementing risk management strategies, and understanding the market dynamics can help traders navigate the complexities associated with borrowing stocks.

Next, let’s examine some examples of the cost to borrow in the stock market to provide further clarity on this concept.

Examples of Cost to Borrow in Stock Market

The cost to borrow in the stock market can vary widely depending on various factors, including the specific stock, market conditions, and demand for short selling. Here are a few examples illustrating the range of costs to borrow in the stock market:

- High Demand Stocks: Stocks that are in high demand for short selling may attract higher borrowing costs. For example, if a popular tech stock is in high demand for shorting due to negative sentiment or expected downside, the cost to borrow may be around 10-20% APR or even higher.

- Low Demand Stocks: Stocks with lower short interest and lesser demand for borrowing may have lower borrowing costs. The cost to borrow for these stocks could range from 1-5% APR or even lower, depending on other factors such as liquidity and market conditions.

- Volatile Stocks: Stocks with high levels of volatility, such as those in the biotech or small-cap sectors, may have higher borrowing costs. The increased risk associated with these stocks can result in borrowing costs ranging from 5-15% APR or higher.

- Blue-Chip Stocks: Large, stable companies with substantial market capitalization and high liquidity often have lower borrowing costs. The cost to borrow for blue-chip stocks could be in the range of 1-5% APR, as these stocks are generally considered less risky by lenders.

It is important to note that these examples are not fixed or definitive. The cost to borrow can vary greatly based on factors such as market conditions, supply and demand dynamics, and the individual arrangements made with the lender or brokerage firm.

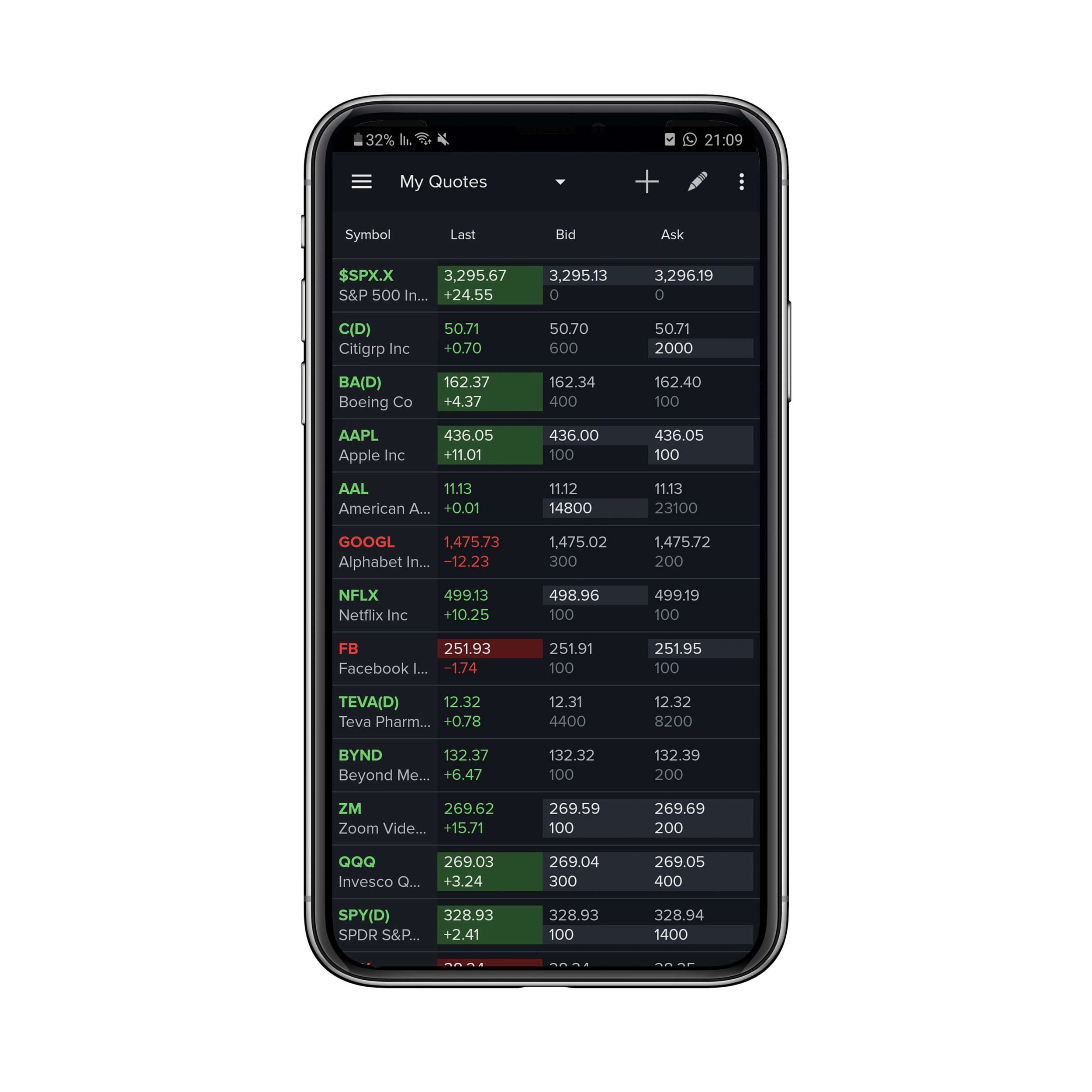

Traders and investors should research and monitor the current borrowing rates for specific stocks of interest. Brokerage firms often provide information on the cost to borrow for different securities, allowing traders to make informed decisions based on the prevailing rates.

As borrowing costs can change over time, it’s crucial to stay updated on the latest rates and market conditions when considering short selling or any trading activity involving borrowed stocks.

Now that we have explored examples of the cost to borrow, let’s move on to discuss strategies for managing the cost to borrow effectively.

Strategies to Manage Cost to Borrow

Managing the cost to borrow effectively is essential for traders and investors engaged in short selling or any activity involving borrowed stocks. By implementing the following strategies, individuals can optimize their borrowing costs and mitigate potential risks:

- Research and Compare: It is crucial to research and compare the borrowing rates offered by different brokerage firms. Rates can vary, so it’s important to choose a broker with competitive borrowing costs to minimize expenses.

- Monitor Short Interest: Keeping an eye on short interest and understanding market sentiment towards specific stocks can provide valuable insights. Higher short interest may result in increased borrowing costs, while lower short interest can lead to lower borrowing costs.

- Timing: Timing can play a significant role in managing borrowing costs. Monitoring market conditions and taking advantage of periods of low demand or market inefficiencies can help secure more favorable borrowing rates.

- Optimal Position Sizing: Carefully determining the size of short positions can help manage borrowing costs effectively. Smaller positions can reduce potential losses and mitigate the impact of higher borrowing costs.

- Risk Management: Implementing risk management strategies, such as setting stop-loss orders, can help limit potential losses in case the borrowed stock moves against the short position. This can protect traders from incurring significant losses, including borrowing costs.

- Establish Relationships: Building relationships with brokerage firms or lenders can provide opportunities for negotiation and potentially lower borrowing costs. Establishing trust and credibility through consistent and responsible trading behavior can lead to better terms and conditions.

- Consider Alternatives: Exploring alternative strategies, such as options trading or inverse ETFs, can provide similar market exposure without the need to borrow stocks. These alternatives can help avoid the associated borrowing costs altogether.

By combining these strategies and adapting them to individual trading styles and goals, traders can manage the cost to borrow more effectively and maximize their potential returns while minimizing risks.

It’s important to note that managing borrowing costs is an ongoing process, and market conditions can change rapidly. Traders should regularly reassess their positions, monitor borrowing rates, and adjust their strategies accordingly.

Now let’s wrap up our discussion on the cost to borrow and summarize the key points we have covered.

Conclusion

The cost to borrow in stock trading plays a crucial role in short selling and other activities that involve borrowing shares. It represents the fee or interest rate that traders incur for borrowing stocks from brokers or other lenders. Understanding the concept of the cost to borrow is essential for evaluating the profitability and risk associated with these trading strategies.

In this article, we explored the definition of the cost to borrow, the factors that influence it, and its importance in stock trading. We discussed how the cost to borrow is calculated and examined its risks and benefits. Additionally, we provided examples of the cost to borrow in different scenarios and offered strategies to effectively manage borrowing costs.

By considering the various factors that affect the cost to borrow, traders and investors can make informed decisions and navigate the complexities of short selling and other activities involving borrowed stocks. It is important to monitor market conditions, research borrowing rates, and implement risk management strategies to optimize the cost to borrow and maximize potential returns while managing risks.

Remember, the cost to borrow is not a static figure and can change over time based on market conditions, demand for short selling, and availability of shares. Therefore, staying informed and adaptable is key to successful cost to borrow management.

As with any investment or trading strategy, it is advisable to consult with financial professionals or experts before engaging in short selling or borrowing stocks to ensure alignment with personal financial goals and risk tolerance.

Armed with the knowledge gained from this article, you are now equipped to navigate the world of cost to borrow in stocks with confidence and make informed decisions to meet your financial objectives.