Finance

What Futures Contracts Are Traded On TOS?

Published: December 24, 2023

Discover the variety of finance futures contracts traded on TOS, including equity index, interest rate, currency, and more. Boost your investment opportunities with our wide range of offerings.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Futures contracts play a crucial role in the world of finance, serving as essential tools for investors, traders, and businesses. These contracts allow parties to buy or sell assets at a predetermined price and date in the future. Through futures trading, market participants can hedge against price volatility, speculate on future price movements, or simply manage their exposure to different asset classes.

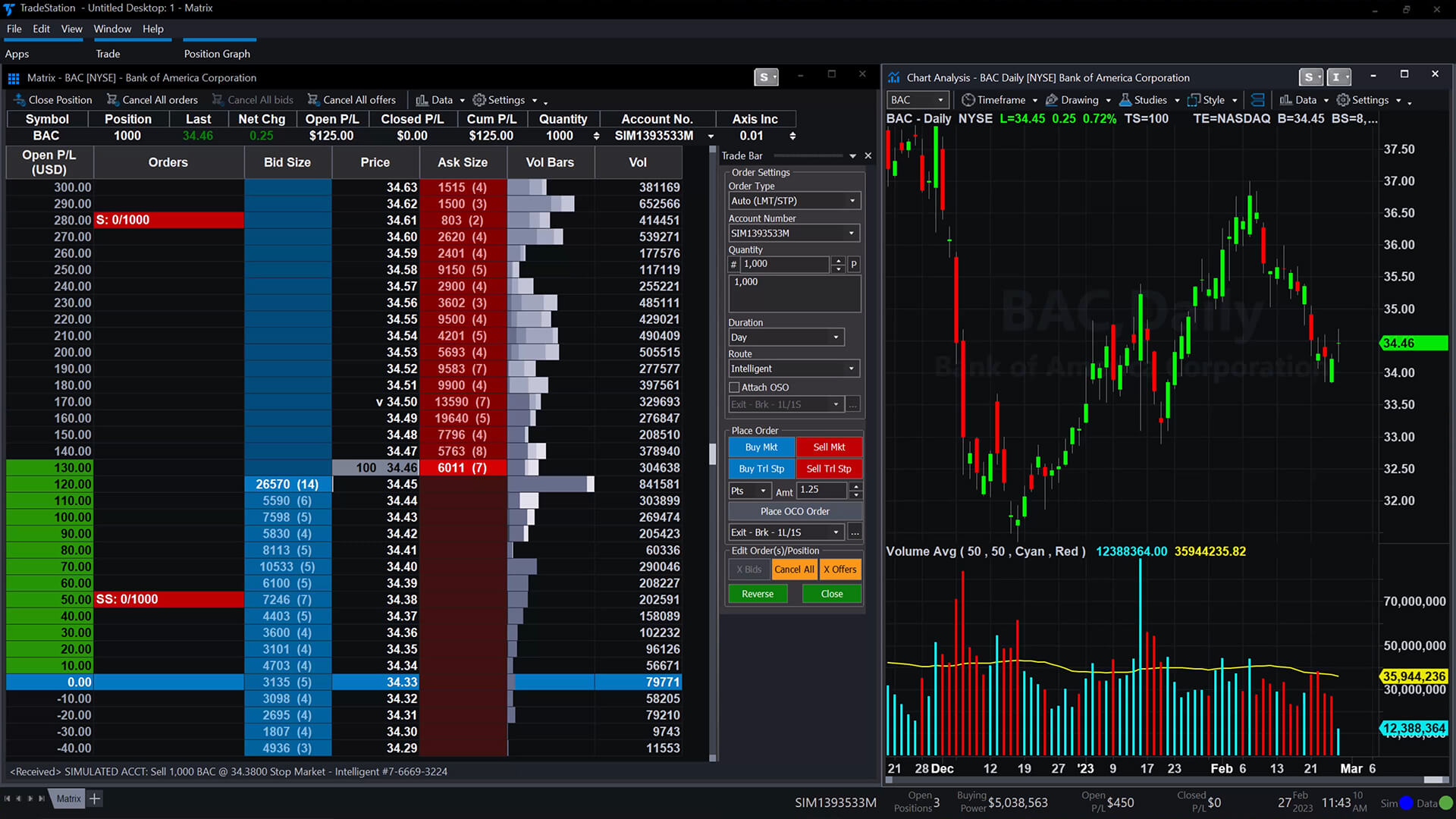

On the trading platform thinkorswim (TOS), a wide range of futures contracts are available for traders to explore and capitalize on various market opportunities. From equity index futures to agricultural futures, currency futures to energy futures, TOS offers a comprehensive selection of contracts to cater to the diverse needs of investors.

This article will delve into the different types of futures contracts that are traded on TOS, providing a brief overview of each category. By understanding the various futures markets available on TOS, traders can make informed decisions and navigate the complexities of futures trading with confidence.

Whether you are a seasoned futures trader or just starting out, gaining knowledge about the different types of futures contracts will empower you to make strategic investment choices and potentially maximize profit potential.

Equity Index Futures

Equity index futures are financial contracts that allow investors to speculate on the future value of a specific stock market index. By trading equity index futures on TOS, traders can take positions on the overall direction of the market without directly buying or selling individual stocks.

TOS offers a variety of equity index futures, including popular indices such as the S&P 500, Dow Jones Industrial Average (DJIA), and Nasdaq-100. These futures contracts enable traders to participate in the performance of the broader market, providing exposure to a basket of top-performing companies across different industries.

Trading equity index futures on TOS offers several advantages. Firstly, it provides diversification as traders gain exposure to multiple stocks within an index rather than investing in individual securities. Additionally, futures trading allows for leverage, enabling traders to control a larger position with a relatively smaller amount of capital. This can amplify potential profits but also carries inherent risks.

Traders can utilize a range of strategies when trading equity index futures on TOS. Some common strategies include trend-following, mean reversion, and volatility trading. Technical analysis tools and indicators available on the TOS platform can assist in identifying potential trading opportunities and implementing these strategies effectively.

It’s important to note that trading equity index futures on TOS requires a thorough understanding of market dynamics and risk management. Traders should stay updated on market news and economic indicators that can impact stock market indices. Keeping a close eye on key support and resistance levels, moving averages, and other technical analysis tools can also enhance trading decisions.

Overall, equity index futures on TOS provide traders with an avenue to capitalize on market trends and fluctuations. With the right knowledge and strategy, traders can potentially achieve significant returns by trading these popular futures contracts.

Interest Rate Futures

Interest rate futures are derivative contracts that allow traders to speculate on the movement of interest rates. These futures contracts are based on various interest rate benchmarks, such as government bonds or Treasury bills. Trading interest rate futures on TOS provides traders with opportunities to profit from changes in interest rates and manage interest rate risk.

TOS offers a range of interest rate futures, including contracts based on short-term and long-term interest rates. Some common interest rate futures traded on TOS include Eurodollar futures, Treasury bond futures, and Treasury note futures.

Interest rate futures are influenced by factors such as monetary policy decisions, economic indicators, inflation expectations, and market sentiment. Traders need to stay informed about these factors to make informed trading decisions.

Traders can use interest rate futures to implement various trading strategies, such as speculating on the direction of interest rates, hedging against interest rate fluctuations, or capturing yield spreads between different maturities. These strategies require a deep understanding of interest rate dynamics and the factors that drive interest rate movements.

Trading interest rate futures on TOS offers several advantages. Firstly, it provides liquidity, as these futures contracts are actively traded. It also allows traders to manage interest rate risk effectively by taking positions that offset potential losses in other interest rate-sensitive investments. Additionally, leverage is available in interest rate futures trading, enabling traders to control a larger notional value of contracts with a smaller capital outlay.

Successful trading of interest rate futures on TOS requires thorough analysis, risk management, and a disciplined approach. Traders should consider using technical analysis tools, such as moving averages or Fibonacci retracements, to identify potential entry and exit points. They should also closely monitor economic indicators, central bank policies, and market sentiment that can impact interest rates.

Overall, interest rate futures on TOS offer traders the opportunity to speculate on interest rate movements and manage interest rate risk. By understanding the intricacies of interest rate dynamics and employing effective trading strategies, traders can potentially profit from these derivative contracts.

Energy Futures

Energy futures are derivative contracts that enable traders to speculate on the price movements of various energy commodities, including crude oil, natural gas, heating oil, and gasoline. These futures contracts provide an avenue for traders to participate in the energy market without owning physical commodities.

TOS offers a wide range of energy futures contracts, allowing traders to take advantage of opportunities in the energy sector. Some commonly traded energy futures on TOS include WTI crude oil futures, Brent crude oil futures, natural gas futures, and heating oil futures.

Trading energy futures on TOS offers several advantages. Firstly, the energy market is highly liquid, providing ample trading opportunities. Secondly, energy futures allow traders to gain exposure to the price movements of commodities that have significant impact on the global economy. Additionally, energy futures trading on TOS offers leverage, enabling traders to control larger contract sizes with a smaller capital outlay.

Energy futures can be influenced by various factors, including supply and demand dynamics, geopolitical tensions, weather patterns, and government policies. Traders need to stay updated on these factors to make informed trading decisions.

Traders can employ a variety of strategies when trading energy futures on TOS. Some common strategies include trend-following, mean reversion, and fundamental analysis based on supply and demand dynamics. Technical analysis tools available on TOS can assist in identifying potential entry and exit points.

Risks are inherent in trading energy futures on TOS. Energy markets can be volatile and impacted by unforeseen events or geopolitical developments. Traders should implement proper risk management strategies, such as setting stop-loss orders and position sizing, to mitigate potential losses.

Overall, trading energy futures on TOS allows traders to participate in the dynamic energy market and potentially capitalize on price movements in various energy commodities. By staying informed, employing effective strategies, and managing risks, traders can navigate the energy futures market with confidence.

Metal Futures

Metal futures are financial contracts that allow traders to speculate on the price movements of various metals, such as gold, silver, platinum, and copper. These futures contracts provide an avenue for traders to take positions on the future value of these metals without owning the physical assets themselves.

TOS offers a range of metal futures contracts, enabling traders to participate in the metal market and potentially capitalize on price fluctuations. Some commonly traded metal futures on TOS include gold futures, silver futures, platinum futures, and copper futures.

Trading metal futures on TOS offers several advantages. Firstly, metals are considered tangible assets and are often seen as a safe haven during times of economic uncertainty. By trading metal futures, traders can diversify their portfolios and potentially hedge against inflation or geopolitical risks. Secondly, metal futures provide liquidity, allowing traders to enter and exit positions efficiently. Additionally, leverage is available in metal futures trading, enabling traders to control a larger contract size with a relatively smaller capital outlay.

Market factors that can influence metal futures prices include supply and demand dynamics, economic indicators, central bank policies, currency fluctuations, and investor sentiment. Traders need to stay informed about these factors to make informed trading decisions.

Traders can use various strategies when trading metal futures on TOS. Some common strategies include trend-following, mean reversion, and using technical analysis tools such as trendlines and moving averages to identify potential entry and exit points. It is also important to pay attention to market news and economic events that can impact metal prices.

Risks are inherent in trading metal futures on TOS. Metal markets can be volatile, and unexpected events or economic developments can impact prices. Traders should implement risk management strategies, such as setting stop-loss orders and managing position sizes, to protect against potential losses.

Overall, trading metal futures on TOS provides traders with opportunities to participate in the metal market and potentially profit from price movements. By staying informed, employing effective trading strategies, and managing risks, traders can navigate the metal futures market with confidence.

Agricultural Futures

Agricultural futures are derivative contracts that allow traders to speculate on the price movements of various agricultural commodities, including grains, livestock, and soft commodities. Trading agricultural futures on TOS provides traders with opportunities to take positions on the future value of these commodities without owning the physical assets.

TOS offers a wide range of agricultural futures contracts, enabling traders to participate in the agricultural market and potentially profit from price fluctuations. Some commonly traded agricultural futures on TOS include corn futures, soybean futures, wheat futures, cattle futures, and coffee futures.

Trading agricultural futures on TOS offers several advantages. Firstly, agricultural commodities are essential for food production and have a significant impact on the global economy. By trading agricultural futures, traders can gain exposure to this vital sector and potentially capitalize on price movements driven by supply and demand dynamics, weather conditions, governmental policies, and economic indicators. Additionally, trading agricultural futures on TOS offers liquidity and leverage, allowing traders to enter and exit positions efficiently and control larger contract sizes with a smaller capital outlay.

When trading agricultural futures, it is essential to stay updated on market news, weather patterns, crop reports, and global demand for commodities. These factors can impact agricultural prices and provide trading opportunities.

Traders can employ various strategies when trading agricultural futures on TOS. Some common strategies include trend-following, seasonal patterns, and fundamental analysis based on crop reports and supply and demand fundamentals. Technical analysis tools available on TOS can assist in identifying potential entry and exit points.

Risks are inherent in trading agricultural futures on TOS. Agricultural markets can be volatile, especially due to factors such as weather events, government policies, and global trade dynamics. Traders should implement proper risk management strategies, such as setting stop-loss orders and managing position sizes, to mitigate potential losses.

Overall, trading agricultural futures on TOS provides traders with opportunities to participate in the agricultural market and potentially capitalize on price movements in various agricultural commodities. By staying informed, employing effective trading strategies, and managing risks, traders can navigate the agricultural futures market with confidence.

Currency Futures

Currency futures are derivative contracts that enable traders to speculate on the price movements of different currencies. These futures contracts provide an avenue for traders to take positions on the future value of a currency pair without directly exchanging the underlying currencies.

TOS offers a wide range of currency futures contracts, allowing traders to participate in the foreign exchange market and potentially profit from currency fluctuations. Some commonly traded currency futures on TOS include contracts based on major currency pairs like EUR/USD, GBP/USD, USD/JPY, and AUD/USD.

Trading currency futures on TOS offers several advantages. Firstly, currency markets are highly liquid, providing ample trading opportunities throughout the day. Secondly, currency futures allow traders to gain exposure to the foreign exchange market and potentially profit from both rising and falling currency values. Additionally, trading currency futures on TOS offers leverage, allowing traders to control larger contract sizes with a relatively smaller capital outlay.

Currency futures prices are influenced by a range of factors, including interest rates, economic indicators, geopolitical events, central bank policies, and market sentiment. Traders need to stay informed about these factors to make informed trading decisions.

Traders can utilize various strategies when trading currency futures on TOS. Some common strategies include trend-following, range trading, and using technical analysis tools such as moving averages and Fibonacci retracement to identify potential entry and exit points. Monitoring economic events, interest rate decisions, and political developments can also provide insights for trading currency futures.

Risks are inherent in trading currency futures on TOS. Currency markets can be volatile, and unexpected events or economic indicators can impact currency values. Traders should implement risk management strategies, such as setting stop-loss orders and managing position sizes, to protect against potential losses.

Overall, trading currency futures on TOS provides traders with opportunities to participate in the global foreign exchange market and potentially profit from currency fluctuations. By staying informed, employing effective trading strategies, and managing risks, traders can navigate the currency futures market with confidence.

Commodity Futures

Commodity futures are derivative contracts that enable traders to speculate on the price movements of various physical commodities, such as metals, energy products, agricultural products, and more. Trading commodity futures on TOS provides traders with opportunities to participate in the commodity market and potentially profit from price fluctuations.

TOS offers a diverse range of commodity futures contracts, allowing traders to trade commodities from different sectors. Some commonly traded commodity futures on TOS include gold futures, oil futures, corn futures, natural gas futures, and coffee futures.

Trading commodity futures on TOS offers several advantages. Firstly, commodities are essential resources and play a vital role in various industries. By trading commodity futures, traders can gain exposure to these markets and potentially profit from price movements influenced by supply and demand dynamics, seasonal patterns, political or geopolitical events, and economic indicators. Secondly, commodity futures provide liquidity, allowing traders to enter and exit positions efficiently. Additionally, trading commodity futures on TOS offers leverage, enabling traders to control larger contract sizes with a relatively smaller capital outlay.

When trading commodity futures, it is important to stay updated on market news, industry reports, global economic conditions, and geopolitical developments that can impact commodity prices. Understanding the fundamental factors that drive supply and demand in the specific commodity markets is crucial.

Traders can employ various strategies when trading commodity futures on TOS. These strategies may include trend-following, mean reversion, or utilizing technical analysis tools such as moving averages, trend lines, and key support and resistance levels. Seasonal patterns and weather conditions can also play a role in trading commodity futures.

Risks are inherent in trading commodity futures on TOS. Commodity markets can be volatile, and unexpected events or disruptions can impact prices. Traders should implement proper risk management strategies, such as setting stop-loss orders and managing position sizes, to mitigate potential losses.

Overall, trading commodity futures on TOS provides traders with opportunities to participate in the commodity market and potentially profit from price movements in various physical commodities. By staying informed, employing effective trading strategies, and managing risks, traders can navigate the commodity futures market with confidence.

Conclusion

Trading futures contracts on the thinkorswim (TOS) platform offers a wide range of opportunities for traders to explore and profit from various markets. Whether it’s equity index futures, interest rate futures, energy futures, metal futures, agricultural futures, currency futures, or commodity futures, TOS provides a comprehensive selection of futures contracts to cater to the diverse needs of traders.

By trading futures on TOS, traders can take advantage of factors such as market trends, economic indicators, geopolitical events, and supply and demand dynamics. The platform’s liquidity, leverage, and technical analysis tools offer advantages to traders seeking to capitalize on price fluctuations and manage risk effectively.

However, it’s important for traders to approach futures trading on TOS with a solid understanding of market dynamics, risk management strategies, and the factors that impact the specific futures markets they are interested in. Staying informed, conducting thorough analysis, and employing effective trading strategies will be key to navigating the complexities of futures trading and potentially achieving success.

In conclusion, the variety of futures contracts available on TOS provides traders with ample opportunities to participate in different markets and potentially profit from price movements. By leveraging the platform’s features and combining it with sound trading strategies and risk management, traders can enhance their trading experience and increase their chances of success in the futures market.