Finance

What Is Expenditure In Accounting

Published: October 10, 2023

Learn about expenditure in accounting and how it relates to finance. Gain a deeper understanding of financial management and its impact on businesses.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of accounting and finance, where every penny counts! In the realm of financial management, it is crucial to have a clear understanding of various terms and concepts to effectively manage your organization’s resources. One such fundamental concept is expenditure.

Expenditure is a term commonly used in both personal and business finance. It refers to the act of spending money to acquire goods or services. Understanding expenditure is essential for individuals, businesses, and corporations alike, as it allows them to track and control their financial outflows.

In accounting, expenditure plays a vital role in determining the financial health of an organization. It is a key component of financial statements, providing insights into how money is being utilized and the impact it has on the company’s overall profitability.

In this article, we will explore the definition of expenditure, its types, and the importance of tracking expenditure. We will also delve into the accounting treatment of expenditure and how it affects the financial statements of a company.

Whether you are an accounting professional, a business owner, or simply curious about the world of finance, understanding expenditure is essential. So let’s dive in and discover the intricacies of this critical financial concept.

Definition of Expenditure

Expenditure refers to the act of spending money to acquire goods or services. It encompasses any outflow of cash or the depletion of assets to meet the financial obligations of an individual or organization. Expenditure can be categorized into various types based on the purpose and nature of the expense.

In simple terms, expenditure represents the financial transactions that result in the reduction of an entity’s resources or increase in its liabilities. It is recorded in the financial statements and is a crucial element in assessing the financial performance and sustainability of an organization.

Expenditure is not limited to the cash outflow only; it can also include non-cash transactions such as the exchange of assets or the assumption of liabilities. These non-cash expenditures are recorded based on their fair market value at the time of the transaction.

Furthermore, expenditure can be viewed from both a short-term and long-term perspective. Short-term expenditure refers to the regular and ongoing costs incurred by an organization to maintain its day-to-day operations. Long-term expenditure, on the other hand, involves significant investments or expenses that have a lasting impact on the organization’s financial position.

Overall, expenditure represents the financial resources utilized by an individual or organization to achieve its goals, whether it’s purchasing inventory, paying salaries, investing in assets, or servicing debt.

Now that we have a clear understanding of what expenditure entails, let’s explore the different types of expenditure in more detail.

Types of Expenditure

Expenditure can be categorized into various types based on the purpose and nature of the expense. Understanding these different types of expenditure is essential for effective financial management and decision-making. Let’s explore the two main categories of expenditure: capital expenditure and revenue expenditure.

1. Capital Expenditure

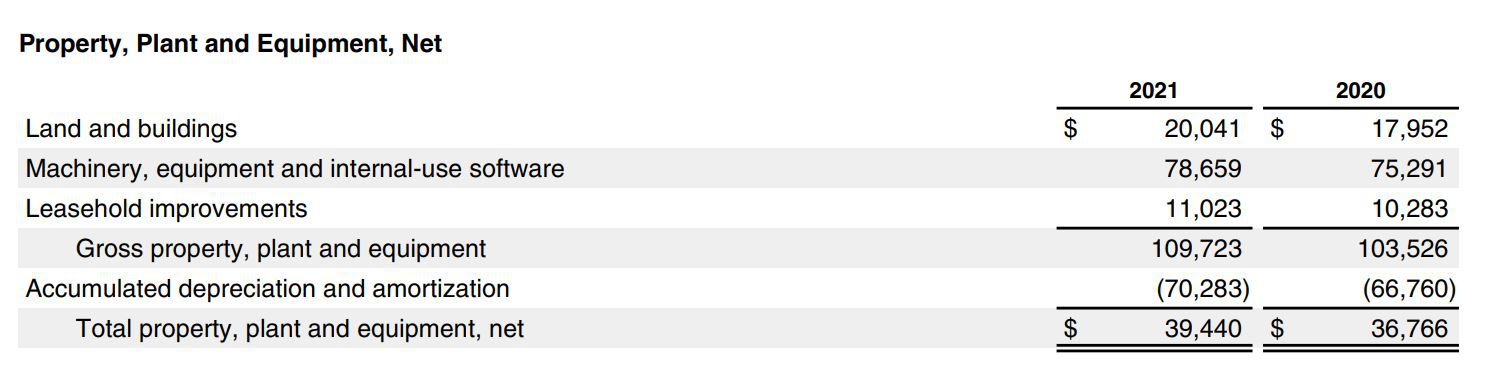

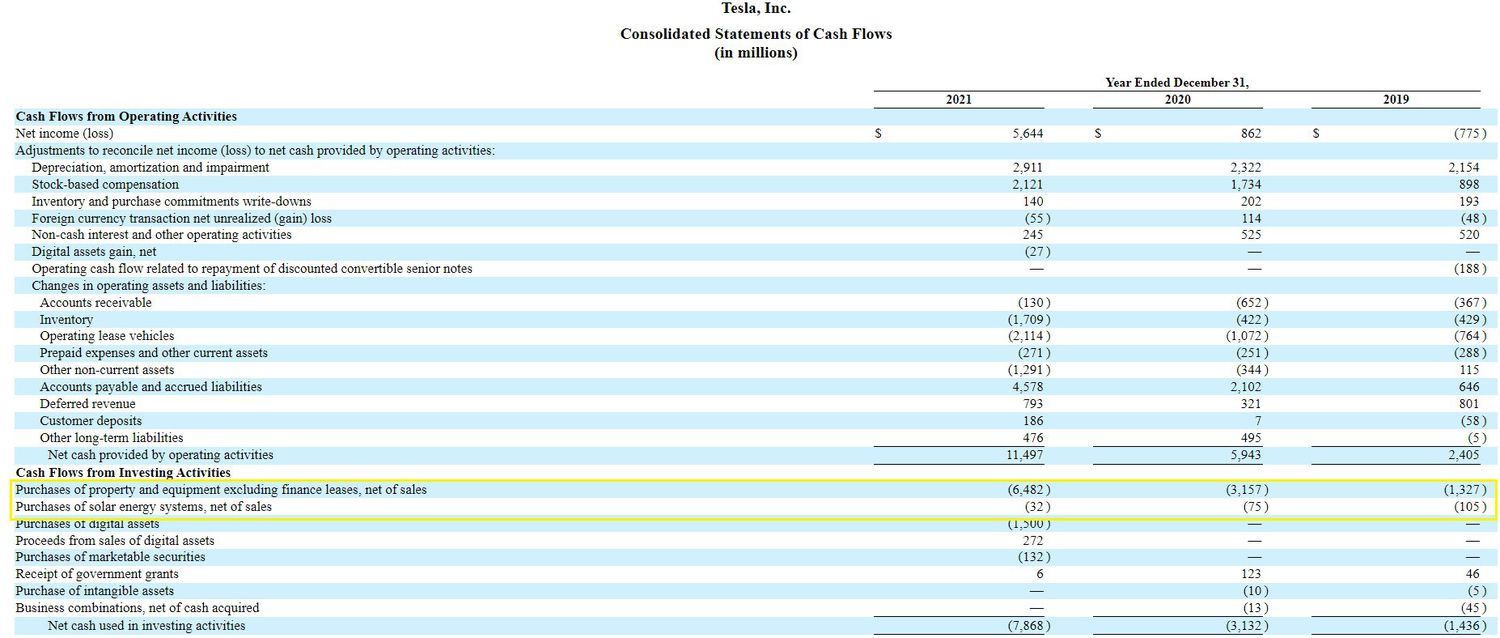

Capital expenditure, also known as capital outlay, refers to the expenditure incurred on acquiring or improving fixed assets that provide long-term benefits to a business. These assets are vital for the smooth functioning and growth of the organization. Examples of capital expenditure include the purchase of land, buildings, machinery, vehicles, and the development of software or patents.

Capital expenditure is typically characterized by its substantial cost and long-term impact on the organization. It is considered an investment because these assets generate revenue or provide cost-saving benefits over an extended period. Capital expenditures are usually recorded as assets on the balance sheet and depreciated over their useful life to reflect their gradual consumption or obsolescence.

2. Revenue Expenditure

Revenue expenditure, also known as operating expenditure, refers to the day-to-day expenses incurred to maintain the normal operations of a business. These expenses are necessary for the continuous functioning of the organization and do not provide long-term benefits like fixed assets. Examples of revenue expenditure include utility bills, employee salaries, rent, office supplies, advertising costs, and repairs and maintenance expenses.

Revenue expenditure is generally of a recurring nature and is necessary to sustain the business’s ongoing operations. These expenses are fully charged against the revenue generated during the accounting period and are reflected in the income statement. Unlike capital expenditure, revenue expenditure does not create assets and is expensed immediately.

It’s important to note that while capital and revenue expenditures differ in terms of their nature and impact, both are essential for the successful operation of a business. Proper classification and tracking of expenditure are crucial for accurate financial reporting, budgeting, and decision-making.

Now that we have explored the different types of expenditure, let’s move on to understanding why tracking expenditure is of utmost importance in financial management.

Capital Expenditure

Capital expenditure, also known as capital outlay, refers to the expenditure incurred on acquiring or improving fixed assets that provide long-term benefits to a business. These assets are vital for the smooth functioning and growth of the organization, making capital expenditure an essential component of financial management.

Capital expenditures are typically characterized by their substantial cost and long-term impact on the organization. These expenses are considered investments because they generate revenue or provide cost-saving benefits over an extended period. The primary purpose of capital expenditure is to increase the productive capacity of the business or enhance its efficiency and competitiveness.

Examples of capital expenditure include the purchase of land, buildings, machinery, vehicles, and the development of software or patents. These assets form the foundation of a company’s operations and contribute to its long-term growth and profitability.

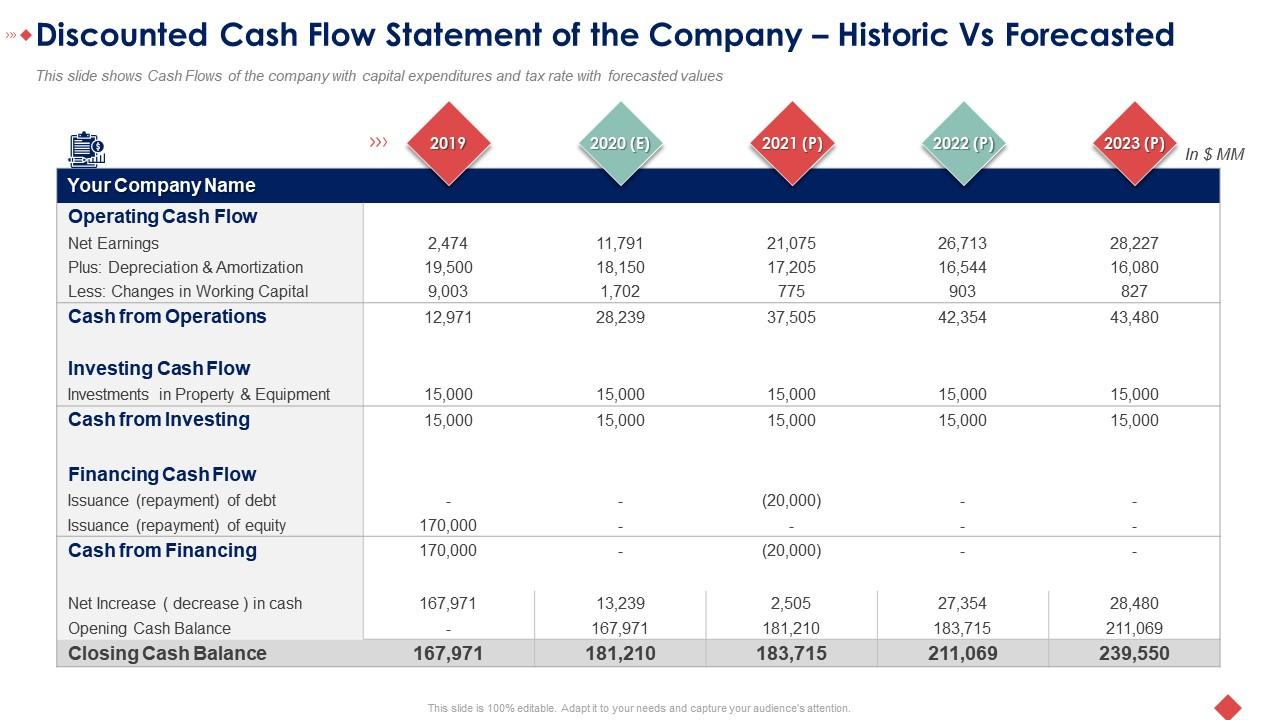

When recording capital expenditure, it is important to properly classify and document these expenses. Capital expenses are typically capitalized and recorded as assets on the balance sheet. They are then depreciated or amortized over their useful life to reflect their gradual consumption or obsolescence.

Capital expenditure decisions require careful analysis and consideration of various factors, such as the expected return on investment, the useful life of the asset, and the potential for future growth. These decisions often involve significant financial resources and have long-term implications on the organization’s financial health and strategic objectives.

Proper budgeting and planning for capital expenditure are crucial to ensure the availability of funds and the successful implementation of projects or acquisitions. It is essential to align capital expenditure with the organization’s overall financial goals and priorities, taking into account factors such as cash flow, debt obligations, and the current economic environment.

Monitoring and evaluating the performance of capital expenditures are equally important. Regular reviews and assessments help identify any deviations from the expected outcomes and allow for timely adjustments or corrective measures. This ensures that the company’s investments are delivering the expected returns and contributing to its long-term success.

In summary, capital expenditure plays a vital role in financial management by enabling businesses to acquire and improve fixed assets that contribute to their long-term growth and profitability. Careful planning, analysis, and monitoring are necessary to make informed capital expenditure decisions and ensure the optimal allocation of financial resources.

Now that we have explored capital expenditure, let’s move on to understanding revenue expenditure and its significance in financial management.

Revenue Expenditure

Revenue expenditure, also referred to as operating expenditure, is the day-to-day expenses incurred by a business to maintain its normal operations. Unlike capital expenditure, revenue expenditure does not create long-term assets and is necessary for the continuous functioning of the organization.

Examples of revenue expenditure include utility bills, employee salaries, rent, office supplies, advertising costs, repairs and maintenance expenses, and other expenses incurred in the ordinary course of business operations. These expenses are recurring in nature and are essential to run the business on a daily basis.

Revenue expenditure is recorded as an expense in the income statement during the accounting period in which it is incurred. The full cost of revenue expenditure is immediately charged against the revenue generated during the same period, reducing the net income of the business.

Monitoring and controlling revenue expenditure are critical aspects of financial management. By keeping a close eye on these expenses, businesses can optimize their operating costs and improve their overall profitability.

Proper budgeting and forecasting techniques help businesses plan and allocate funds for revenue expenditure. By accurately estimating their day-to-day operating expenses, businesses can ensure that they have enough liquidity to cover these costs without impacting their overall financial stability.

In addition to budgeting, businesses also need to actively manage and control revenue expenditure. This involves implementing cost-saving measures, negotiating favorable terms with vendors, and regularly reviewing expenses to identify areas where efficiency can be improved.

It is worth noting that while revenue expenditure does not create long-term assets, it is still crucial for the proper functioning and growth of the business. By investing in revenue-generating activities and maintaining the necessary infrastructure and resources, businesses can maintain their competitive edge and ensure continued success.

To summarize, revenue expenditure represents the day-to-day expenses incurred by a business to sustain its operations. Effective management and control of revenue expenditure are vital for maintaining financial stability, optimizing costs, and maximizing profitability.

Now that we have explored both capital and revenue expenditure, let’s move on to discussing the importance of tracking expenditure in financial management.

Importance of Tracking Expenditure

Tracking expenditure is a fundamental aspect of financial management for individuals and businesses alike. It involves closely monitoring and recording all expenses incurred to gain a comprehensive understanding of where funds are being allocated and how they impact the overall financial health of an organization.

Here are some reasons why tracking expenditure is of utmost importance:

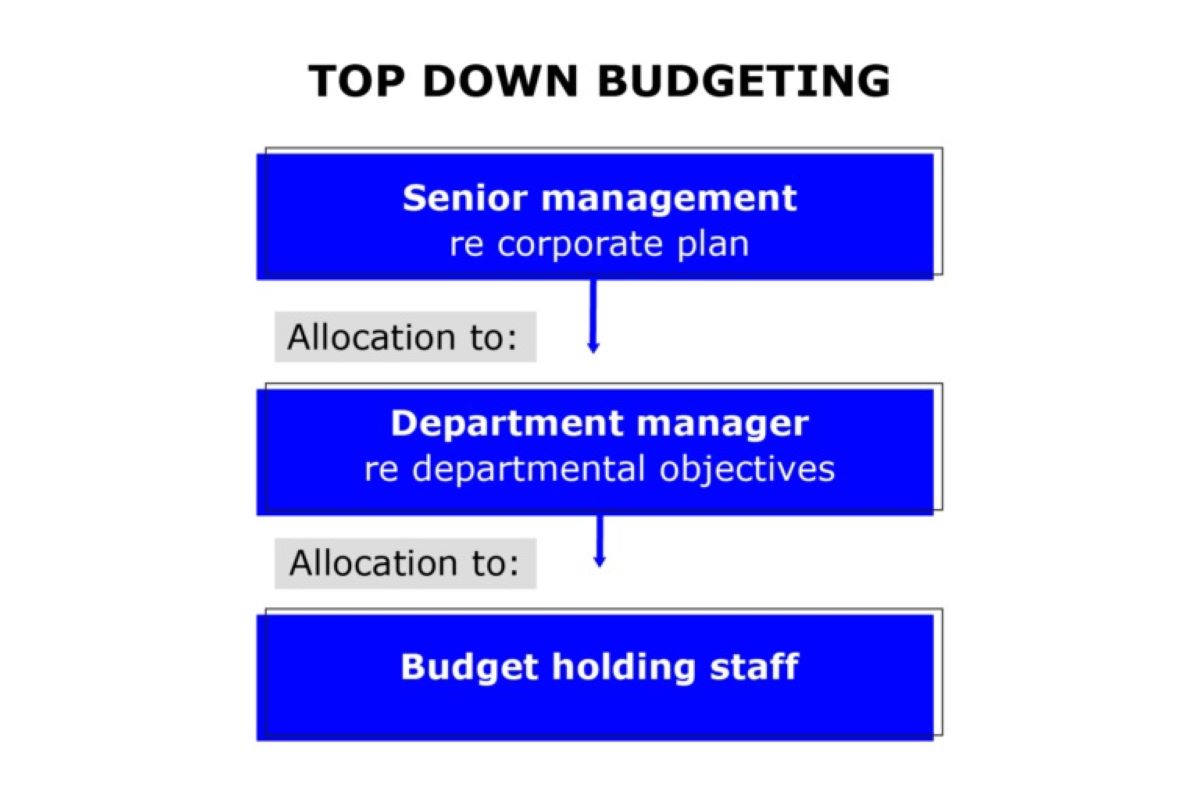

1. Financial Planning and Budgeting

Tracking expenditure allows individuals and businesses to effectively plan and budget their finances. By analyzing past spending patterns, they can identify areas of overspending or potential cost-saving opportunities. This insight enables better financial planning and the allocation of resources to meet short-term and long-term goals.

2. Decision-Making and Prioritization

Accurate expenditure tracking provides the necessary data for informed decision-making. It helps identify areas where funds can be reallocated or invested for maximum returns. Businesses can prioritize expenditure based on their strategic objectives, ensuring that resources are utilized efficiently and effectively.

3. Expense Control and Cost Optimization

Tracking expenses allows businesses to have better control over their costs. By having a clear view of all expenditures, including capital and revenue expenditure, organizations can identify areas where costs can be reduced or eliminated. This helps improve overall profitability and ensures financial sustainability.

4. Compliance and Tax Reporting

Accurate tracking of expenditure is essential for compliance with legal and regulatory requirements. It ensures that businesses are properly recording and reporting their expenses, which is crucial for tax filings and audits. Failure to track and report expenditure accurately can result in penalties, fines, or even legal consequences.

5. Fraud Prevention and Detection

By diligently tracking and reviewing expenditure, businesses can detect and prevent fraudulent activities. Regular monitoring helps identify any unusual or unauthorized expenditure, allowing for timely investigations and corrective actions.

6. Performance Evaluation

Tracking expenditure provides valuable insights into the financial performance of an organization. By comparing actual expenditure against projected budgets, businesses can evaluate their performance and measure their progress towards financial goals. This analysis helps identify areas of improvement and implement necessary adjustments.

In summary, tracking expenditure is crucial for effective financial management. It enables better financial planning, informed decision-making, expense control, compliance, fraud prevention, and performance evaluation. By maintaining diligent tracking, individuals and businesses can optimize their financial resources, ensure financial stability, and achieve their desired financial outcomes.

Now that we understand the importance of tracking expenditure, let’s explore the accounting treatment of expenditure in more detail.

Accounting Treatment of Expenditure

The accounting treatment of expenditure is crucial for accurate financial reporting and determining the financial health of an organization. Properly recording and classifying expenditure enables businesses to track their expenses effectively and present a true and fair view of their financial position. Let’s explore how different types of expenditure are accounted for.

1. Capital Expenditure

Capital expenditure is recorded as an asset on the balance sheet. These expenditures are capitalized because they create long-term benefits for the business. The cost of the asset is recorded at its acquisition or production cost, including any directly attributable costs such as installation or transportation charges.

Instead of being immediately expensed, capital expenditures are depreciated or amortized over their useful life. Depreciation is the systematic allocation of the cost of fixed assets over time, reflecting their gradual consumption or obsolescence. The accumulated depreciation is recorded as a contra-asset on the balance sheet, reducing the net carrying value of the asset.

When disposing of a capitalized asset, any remaining net book value is removed from the balance sheet, and any gain or loss on the disposal is recognized in the income statement.

2. Revenue Expenditure

Revenue expenditure is expensed in the period it is incurred and is recorded in the income statement. These expenses are fully recognized as deductions from revenue to calculate the net income of the business.

Unlike capital expenditures, revenue expenditures do not create long-term assets and do not provide future economic benefits. They are necessary for day-to-day operations and are recognized as expenses in the period in which they are incurred.

3. Treatment of Non-Cash Expenditure

Non-cash expenditure, such as the exchange of assets or the assumption of liabilities, is recorded based on its fair market value at the time of the transaction. This ensures that the financial statements reflect the economic impact of these non-cash transactions.

The fair market value of the asset received or the liability assumed is recorded as an expense in the income statement. Simultaneously, the asset or liability is recognized on the balance sheet at its fair value.

It is worth noting that proper documentation and supporting evidence are essential in the accounting treatment of expenditure. All expenditures should be supported by relevant invoices, receipts, or agreements to ensure the accuracy and authenticity of the recorded expenses.

In summary, capital expenditure is recorded as an asset and depreciated over its useful life, while revenue expenditure is expensed in the period incurred. Non-cash expenditures are recorded at fair value to reflect their economic impact. Following proper accounting treatment of expenditure ensures accurate financial reporting and provides a clear picture of the financial position and performance of the organization.

Now that we have explored the accounting treatment of expenditure, let’s conclude our discussion on this important financial concept.

Conclusion

Expenditure is a fundamental concept in accounting and finance, representing the act of spending money to acquire goods or services. Understanding the different types of expenditure and the importance of tracking them is essential for effective financial management.

Capital expenditure involves the acquisition or improvement of fixed assets that provide long-term benefits to a business. These expenses are capitalized, recorded as assets on the balance sheet, and depreciated over their useful life. On the other hand, revenue expenditure represents day-to-day expenses required to sustain the operations of a business. These expenses are recognized as expenses in the income statement for the period in which they are incurred.

Tracking expenditure is crucial for financial planning, budgeting, decision-making, and cost optimization. By closely monitoring expenses, individuals and businesses can identify areas for cost-saving, allocate resources effectively, and ensure compliance with legal and regulatory requirements.

The accurate accounting treatment of expenditure is vital for proper financial reporting. Capital expenditures are capitalized and depreciated, while revenue expenditures are expensed immediately. Non-cash expenditures are recorded at fair value to reflect their economic impact on the financial statements.

In conclusion, expenditure is an integral part of financial management, and tracking and accounting for it accurately are essential for assessing the financial health of an organization. By effectively managing and controlling expenditure, businesses can ensure financial stability, make informed decisions, and work towards achieving their desired financial outcomes.

Now that you have a comprehensive understanding of expenditure and its significance, you can apply this knowledge to effectively manage your finances and make informed financial decisions.