Finance

What Is Free Cash Flow Yield

Modified: February 21, 2024

Learn about free cash flow yield and how it is calculated in finance. Understand its significance in evaluating investment opportunities and making informed financial decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to evaluating the financial health and performance of a company, investors and analysts rely on various metrics and ratios. One such important metric is the Free Cash Flow Yield. This metric helps investors gauge a company’s ability to generate free cash flow in relation to its market value.

Free Cash Flow (FCF) is the amount of cash generated by a company’s operations that is available for distribution to its investors, including shareholders and debt holders, after deducting capital expenditures. It essentially represents the cash that is left over after a company has met all its operational and capital expenditure needs.

The Free Cash Flow Yield is calculated by dividing the free cash flow per share by the market price per share. This ratio provides insights into the return a potential investor can expect to receive on their investment in the form of free cash flow.

The concept of Free Cash Flow Yield is particularly important for investors seeking dividend-paying stocks or those interested in evaluating the potential for future growth and profitability. A high Free Cash Flow Yield indicates that a company generates significant cash flows that can be reinvested into the business, distributed to shareholders, or used to pay down debt.

In this article, we will explore the definition of Free Cash Flow, understand how it is calculated, and delve deeper into the concept of Cash Flow Yield. We will also discuss the importance of Free Cash Flow Yield in investment analysis, its limitations, and how it compares to other financial metrics. To further illustrate its practical application, we will provide examples of Free Cash Flow Yield calculations.

Definition of Free Cash Flow

Free Cash Flow (FCF) is a measure of the cash generated by a company’s operations that is available for distribution to its investors, both equity and debt holders. It represents the amount of cash left over after a company has covered all its operational expenses and capital expenditures needed to maintain or expand its business.

To calculate Free Cash Flow, we start with the company’s operating cash flow, which is the cash generated by its core business operations. This includes cash received from customers for goods or services, as well as cash paid for operating expenses.

From the operating cash flow, we subtract the capital expenditures, which represent the cash spent on acquiring or upgrading assets such as property, plant, and equipment. These expenditures are essential for the company’s long-term growth and maintenance of its operations.

Once we have the operating cash flow and capital expenditures, we can calculate the Free Cash Flow using the following formula:

Free Cash Flow = Operating Cash Flow – Capital Expenditures

The resulting Free Cash Flow number represents the amount of cash that a company can use for various purposes, such as paying dividends to shareholders, reducing debt, repurchasing shares, or reinvesting in growth opportunities.

It is important to note that Free Cash Flow is different from net income or earnings. Net income is calculated based on accounting principles and includes non-cash items such as depreciation and amortization. On the other hand, Free Cash Flow focuses on the actual cash generated and available for use.

Free Cash Flow is a crucial metric in financial analysis as it provides insights into a company’s ability to generate cash and its financial flexibility. It allows investors to assess whether a company has sufficient funds to meet its obligations, invest in growth, and reward its shareholders.

Calculation of Free Cash Flow

To calculate Free Cash Flow (FCF), we follow a specific formula that considers the operating cash flow and capital expenditures of a company. Let’s break down the components of this calculation:

- Operating Cash Flow (OCF): This represents the cash generated from a company’s normal business operations. It includes cash received from customers, minus cash paid for operating expenses, taxes, and interest.

- Capital Expenditures (Capex): Capex refers to the cash spent on acquiring or upgrading assets necessary for a company’s operations. This includes investments in property, plant, and equipment.

To calculate Free Cash Flow, we use the following formula:

Free Cash Flow = Operating Cash Flow – Capital Expenditures

By subtracting the capital expenditures from the operating cash flow, we can determine the amount of cash that remains after meeting the company’s operational and investment needs.

If the result of the calculation is positive, it indicates that the company has generated more cash from its operations than it has spent on capital expenditures. This surplus cash is available for other purposes, such as paying dividends, reducing debt, or investing in new projects.

On the other hand, if the result is negative, it suggests that the company has spent more on capital expenditures than it has generated from operations. This may indicate a need for additional financing or a potential strain on the company’s cash flow.

The calculation of Free Cash Flow provides valuable insights for investors and analysts. It helps assess a company’s ability to generate cash, analyze its profitability, and evaluate its financial strength and flexibility.

It is important to note that Free Cash Flow should be analyzed in the context of the industry and company-specific factors. Comparing the Free Cash Flow of companies within the same industry can help identify outliers and determine whether a company is performing well relative to its peers.

Understanding Cash Flow Yield

Cash Flow Yield is a financial ratio that measures the return an investor can expect to receive on their investment based on the company’s Free Cash Flow (FCF). It is calculated by dividing the Free Cash Flow per share by the market price per share.

The formula for Cash Flow Yield is as follows:

Cash Flow Yield = Free Cash Flow per Share / Market Price per Share

The Cash Flow Yield is expressed as a percentage, representing the cash return on each dollar invested. A higher cash flow yield indicates a higher return on investment.

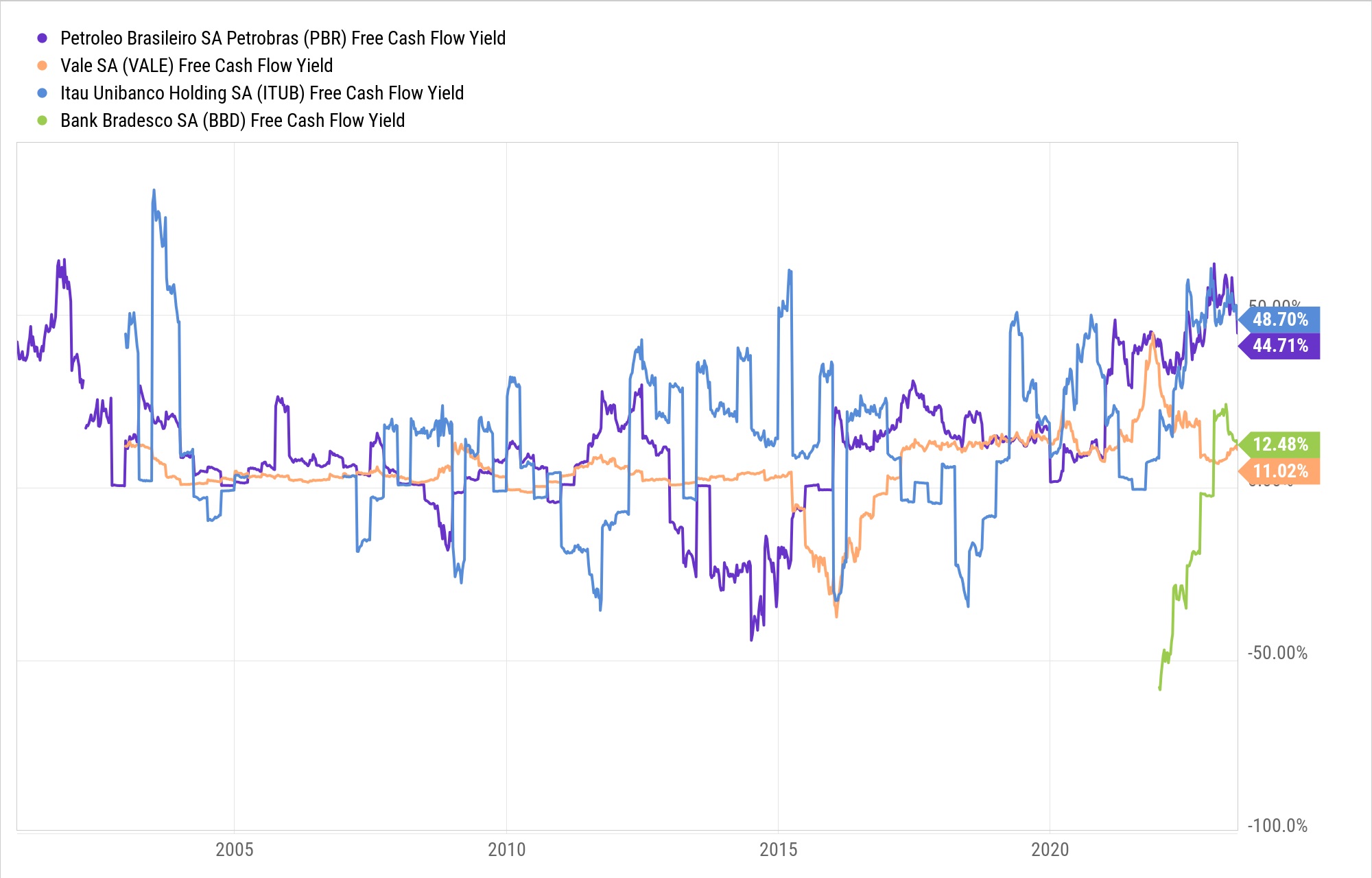

Investors use the Cash Flow Yield to assess the attractiveness of an investment opportunity. It provides insights into a company’s ability to generate cash relative to its market value. A high Cash Flow Yield suggests that a company is generating ample cash flow compared to its stock price, making it potentially undervalued and attractive for investment.

Cash Flow Yield is particularly valuable for investors who prioritize cash flow generation and potential income from dividends. By considering the Free Cash Flow as a percentage of the market price, investors can compare the cash flow return of different companies and determine which ones offer better investment opportunities.

However, it is important to consider the context when analyzing the Cash Flow Yield. A high Cash Flow Yield may indicate an undervalued stock, but it could also suggest challenges or uncertainties within the company. It is crucial to evaluate other factors such as the company’s financial health, industry performance, and growth potential alongside the Cash Flow Yield.

Furthermore, the Cash Flow Yield should not be the sole determinant of an investment decision. It is essential to conduct thorough research, consider the company’s overall financial performance, and analyze other relevant factors such as the company’s competitive advantage, management team, and market conditions.

Overall, the Cash Flow Yield provides investors with a useful measure to assess the potential return on investment based on a company’s Free Cash Flow. It helps identify investment opportunities and enables investors to make informed decisions by considering the cash flow generated by a company relative to its market value.

Importance of Free Cash Flow Yield

Free Cash Flow Yield is an important metric for investors and analysts when evaluating investment opportunities. Here are several key reasons why Free Cash Flow Yield is considered significant:

- Assessment of Financial Health: Free Cash Flow Yield provides insights into a company’s financial health by examining its ability to generate free cash flow. It indicates whether a company has enough cash flow to cover its capital expenditures, debt obligations, and potential shareholder returns.

- Potential for Dividend Payments: For investors seeking dividend income, Free Cash Flow Yield is a valuable metric. A higher Free Cash Flow Yield suggests that a company has ample cash available to distribute to shareholders in the form of dividends. It helps investors identify companies that have the potential to sustain and grow their dividend payments.

- Indication of Value and Investment Potential: Free Cash Flow Yield can be used as a tool to identify undervalued or overvalued stocks. A higher Free Cash Flow Yield relative to the market price per share may suggest that a company is undervalued, presenting an attractive investment opportunity.

- Measurement of Operational Efficiency: Free Cash Flow Yield assesses a company’s operational efficiency by examining its ability to generate cash from its core operations. A higher Free Cash Flow Yield indicates that a company is generating more cash relative to its operating expenses, which can be a positive indicator of strong operational performance.

- Insight into Growth Potential: Companies with a higher Free Cash Flow Yield have the potential to reinvest their excess cash into new projects, research and development, or expanding their operations. This reinvestment can drive future growth and increase shareholder value.

By considering the Free Cash Flow Yield in investment analysis, investors can gain a clearer understanding of a company’s financial strength, dividend potential, valuation, operational efficiency, and growth prospects. It provides a comprehensive view of a company’s cash generation capabilities and assists in making informed investment decisions.

Limitations of Free Cash Flow Yield

While Free Cash Flow Yield is a valuable metric for investment analysis, it is important to recognize its limitations and consider them when evaluating companies. Here are some key limitations to be aware of:

- Dependence on Assumptions and Estimates: Calculating Free Cash Flow involves making assumptions and estimates about a company’s future cash flows, operating expenses, and capital expenditures. These estimates may not always accurately reflect the actual figures, leading to potential inaccuracies in the Free Cash Flow Yield.

- Volatility and Cyclical Nature: Free Cash Flow can vary significantly from year to year, especially for companies operating in cyclical industries. Companies may experience periods of high Free Cash Flow followed by periods of low or negative Free Cash Flow. This volatility can affect the reliability of the Free Cash Flow Yield as a long-term indicator.

- Non-Consideration of Debt: Free Cash Flow Yield does not take into account a company’s debt obligations. While a company may generate significant Free Cash Flow, it may also have substantial debt that needs to be serviced or repaid. Investors should consider a company’s overall debt position in conjunction with the Free Cash Flow Yield to assess its financial health and capacity to meet its obligations.

- Industry and Company-Specific Factors: Free Cash Flow Yield should be analyzed in the context of the industry and company-specific factors. Different industries may have varying capital expenditure requirements, profit margins, and growth prospects. Comparing the Free Cash Flow Yield of companies within the same industry can provide more meaningful insights.

- Short-Term Focus: Free Cash Flow Yield focuses on the company’s cash flow generation and market price in the short term. It may not capture the long-term value and growth potential of a company. Investors should consider other fundamental analysis factors alongside the Free Cash Flow Yield to make informed investment decisions.

Despite these limitations, Free Cash Flow Yield remains a valuable tool for investors in assessing a company’s cash generation capabilities and potential returns. It provides a starting point for analysis but should be used in conjunction with other financial metrics, industry benchmarks, and qualitative factors to gain a comprehensive understanding of a company’s financial health and investment potential.

Comparison of Free Cash Flow Yield with Other Metrics

While Free Cash Flow Yield is a useful metric in investment analysis, it is important to consider it in combination with other financial metrics to gain a comprehensive view of a company’s performance and valuation. Here are some other metrics commonly used in comparison with Free Cash Flow Yield:

- Price-to-Earnings Ratio (P/E Ratio): The P/E ratio compares a company’s market price per share to its earnings per share. It helps investors assess the valuation of a company by indicating how much an investor is willing to pay for each dollar of earnings. Comparing Free Cash Flow Yield with the P/E ratio can provide insights into the relationship between a company’s cash flow generation and its profitability.

- Dividend Yield: Dividend Yield compares a company’s dividend per share to its market price per share. It indicates the annual return an investor can expect from dividend payments. Free Cash Flow Yield and Dividend Yield both provide insights into a company’s ability to generate cash for distributions, making them useful for investors seeking income-oriented investments.

- Return on Equity (ROE): ROE measures a company’s profitability by comparing its net income to shareholders’ equity. It indicates how effectively a company generates profits from its shareholders’ invested capital. While Free Cash Flow Yield focuses on cash flow, ROE highlights a company’s profitability. Comparing the two metrics can provide a more comprehensive understanding of a company’s financial performance.

- Debt-to-Equity Ratio (D/E Ratio): The D/E ratio compares a company’s total debt to its shareholders’ equity. It indicates the proportion of a company’s funding that comes from debt versus equity. Comparing Free Cash Flow Yield with the D/E ratio helps assess a company’s financial health and its ability to generate cash while managing its debt obligations.

- Growth Rates: Comparing Free Cash Flow Yield with growth rates, such as revenue growth or earnings growth, can help evaluate a company’s potential for future cash flow generation. A high Free Cash Flow Yield in conjunction with consistent growth rates may highlight an attractive investment opportunity.

By considering Free Cash Flow Yield alongside these other metrics, investors can gain a more comprehensive understanding of a company’s financial performance, valuation, profitability, and growth potential. It is important to analyze these metrics within the context of the industry, company-specific factors, and overall market conditions to make well-informed investment decisions.

Examples of Free Cash Flow Yield Calculation

Let’s consider two hypothetical companies, Company A and Company B, to illustrate the calculation of Free Cash Flow Yield.

Company A:

- Operating Cash Flow: $1,500,000

- Capital Expenditures: $500,000

- Market Price per Share: $50

- Shares Outstanding: 1,000,000

To calculate Free Cash Flow per Share:

Free Cash Flow per Share = Operating Cash Flow / Shares Outstanding = $1,500,000 / 1,000,000 = $1.50

To calculate Free Cash Flow Yield:

Free Cash Flow Yield = Free Cash Flow per Share / Market Price per Share = $1.50 / $50 = 0.03 or 3%

Company B:

- Operating Cash Flow: $3,000,000

- Capital Expenditures: $1,200,000

- Market Price per Share: $80

- Shares Outstanding: 2,500,000

To calculate Free Cash Flow per Share:

Free Cash Flow per Share = Operating Cash Flow / Shares Outstanding = $3,000,000 / 2,500,000 = $1.20

To calculate Free Cash Flow Yield:

Free Cash Flow Yield = Free Cash Flow per Share / Market Price per Share = $1.20 / $80 = 0.015 or 1.5%

In this example, Company A has a Free Cash Flow Yield of 3%, indicating that for every dollar invested, an investor can expect to receive a cash return of 3%. Company B, on the other hand, has a Free Cash Flow Yield of 1.5%, suggesting a lower cash return for every dollar invested.

By comparing the Free Cash Flow Yield of different companies within the same industry or across industries, investors can assess the relative attractiveness of investment opportunities. However, it is important to consider additional factors such as the company’s overall financial health, growth prospects, and industry conditions when making investment decisions.

Conclusion

Free Cash Flow Yield is a valuable metric that provides insights into a company’s ability to generate cash flow relative to its market value. It helps investors and analysts assess a company’s financial health, potential for dividend payments, and overall investment attractiveness.

By calculating Free Cash Flow and comparing it to the market price per share, investors can determine the Free Cash Flow Yield and gauge the potential return on their investment. A higher Free Cash Flow Yield suggests a higher return on investment, indicating that the company generates significant cash flow relative to its market price.

While Free Cash Flow Yield is an important metric, it should not be used in isolation. It is important to consider other financial metrics and qualitative factors when evaluating investment opportunities. Metrics such as the Price-to-Earnings ratio, Dividend Yield, Return on Equity, Debt-to-Equity ratio, and growth rates provide additional insights and context.

Furthermore, it is crucial to consider the limitations of Free Cash Flow Yield, such as its dependence on assumptions and estimates, the cyclical nature of businesses, and industry-specific factors. These considerations can help provide a more comprehensive understanding of a company’s financial performance and valuation.

In conclusion, Free Cash Flow Yield is a powerful tool for investors to assess a company’s cash flow generation capabilities, financial strength, and investment potential. By utilizing this metric alongside other financial ratios and conducting thorough analysis, investors can make informed investment decisions and enhance their chances of success in the ever-changing world of finance.