Finance

Where Does Petty Cash Go On The Balance Sheet

Modified: December 30, 2023

Discover where petty cash is recorded on the balance sheet and learn more about its role in finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where every dollar counts and meticulous record-keeping is essential for accurate financial reporting. In this realm, even the smallest sums of money hold significance and have their place on the balance sheet. One such example is petty cash, a term that often raises questions about its treatment on the balance sheet.

Petty cash refers to a small amount of cash kept on hand by businesses to cover minor expenses, such as office supplies, coffee for the breakroom, or reimbursement for employee expenses. It enables companies to handle small transactions efficiently without the need for writing checks or using credit cards for every minor purchase.

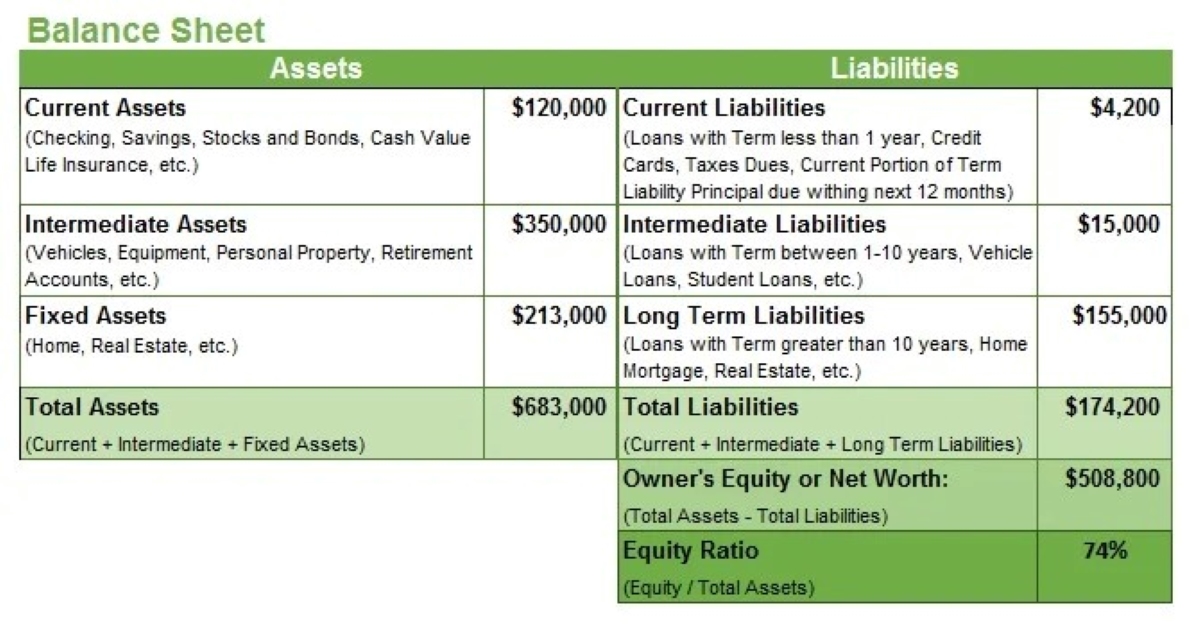

While petty cash may seem insignificant in the grand scheme of a company’s financials, it plays a vital role on the balance sheet. The balance sheet provides a snapshot of a company’s financial position at a specific point in time and shows the assets, liabilities, and owner’s equity.

Properly recording and reporting petty cash transactions is crucial for maintaining accurate financial statements. It ensures transparency, helps prevent fraud or misuse, and provides a complete picture of a company’s financial health. In this article, we will explore the importance of petty cash on the balance sheet, how to record petty cash transactions, and the classification and reporting of petty cash on the balance sheet.

Definition of Petty Cash

Petty cash is a small amount of money that is set aside and kept on hand by businesses to cover day-to-day minor expenses. It is typically used for small purchases that do not warrant the time or effort of writing a check or using a credit card. By having a designated petty cash fund, companies can streamline their expense management process and ensure quick access to cash for immediate spending needs.

The amount of petty cash held by a business can vary depending on its size and needs. It is usually a relatively small amount, such as $100 or $200, but can be higher depending on the organization’s requirements. The petty cash is maintained in a secure location, such as a locked drawer or cash box, to prevent unauthorized access.

The purpose of petty cash is to provide a convenient way to handle small expenses that occur frequently. Some common examples of expenses covered by petty cash include office supplies, postage, minor repairs, employee meals, and reimbursement for small purchases made on behalf of the company.

Proper management of petty cash is essential to ensure accuracy and accountability. Therefore, businesses often appoint a petty cash custodian who is responsible for overseeing the petty cash fund. This individual is responsible for disbursing cash, keeping accurate records of transactions, and reconciling the petty cash fund regularly.

By maintaining a petty cash fund, businesses can efficiently handle low-value transactions, avoid the hassle of processing paperwork for minor expenses, and maintain a proper audit trail of expenditures.

Importance of Petty Cash on the Balance Sheet

Despite its small size, petty cash plays an important role on the balance sheet of a business. It is essential for accurately reflecting the company’s financial position and ensuring transparency in financial reporting. Here are a few reasons why petty cash is significant on the balance sheet:

- Asset Representation: Petty cash is considered part of a company’s assets. It represents the cash that is readily available for immediate use to cover small expenses. Inclusion of petty cash on the balance sheet provides a comprehensive view of a company’s cash holdings, both the significant sums in bank accounts and the smaller, but still important, amounts in petty cash.

- Accuracy of Financial Statements: The balance sheet is one of the three main financial statements that a company prepares, along with the income statement and cash flow statement. As the balance sheet provides a snapshot of a company’s financial position, omitting petty cash would present an incomplete picture. Including petty cash ensures that the balance sheet accurately reflects all the company’s available cash resources.

- Control and Accountability: By recording petty cash on the balance sheet, businesses can monitor and control their expenses effectively. It allows for greater accountability since each use of petty cash needs to be documented and supported by receipts. This helps prevent unauthorized spending and reduces the risk of misuse or fraud.

- Evaluation of Liquidity: Petty cash is part of a company’s liquid assets, along with cash in bank accounts and short-term investments. Including petty cash on the balance sheet enables stakeholders, such as investors and creditors, to assess the company’s liquidity position more comprehensively. It indicates the availability of immediate cash to cover small expenses and demonstrates the company’s ability to meet short-term obligations.

In summary, petty cash may be a small component of a company’s financial resources, but its inclusion on the balance sheet is crucial for a holistic and accurate representation of the company’s financial health. By including petty cash, businesses can demonstrate transparency, maintain control over expenses, and enable stakeholders to make informed decisions based on complete financial information.

Recording Petty Cash Transactions

Accurate recording of petty cash transactions is essential for proper financial management and maintaining transparency. By following a systematic approach, businesses can ensure that petty cash transactions are properly documented. Here are the steps typically involved in recording petty cash transactions:

- Establish a Petty Cash Fund: Determine the initial amount of cash to be set aside as petty cash. This amount should be based on the expected frequency and amount of small expenses. Once established, place the cash in a secure location, such as a locked drawer or cash box.

- Designate a Petty Cash Custodian: Appoint a trusted employee as the petty cash custodian, who will have responsibility for handling and recording petty cash transactions. This individual will disburse the cash, collect receipts, and reconcile the petty cash fund.

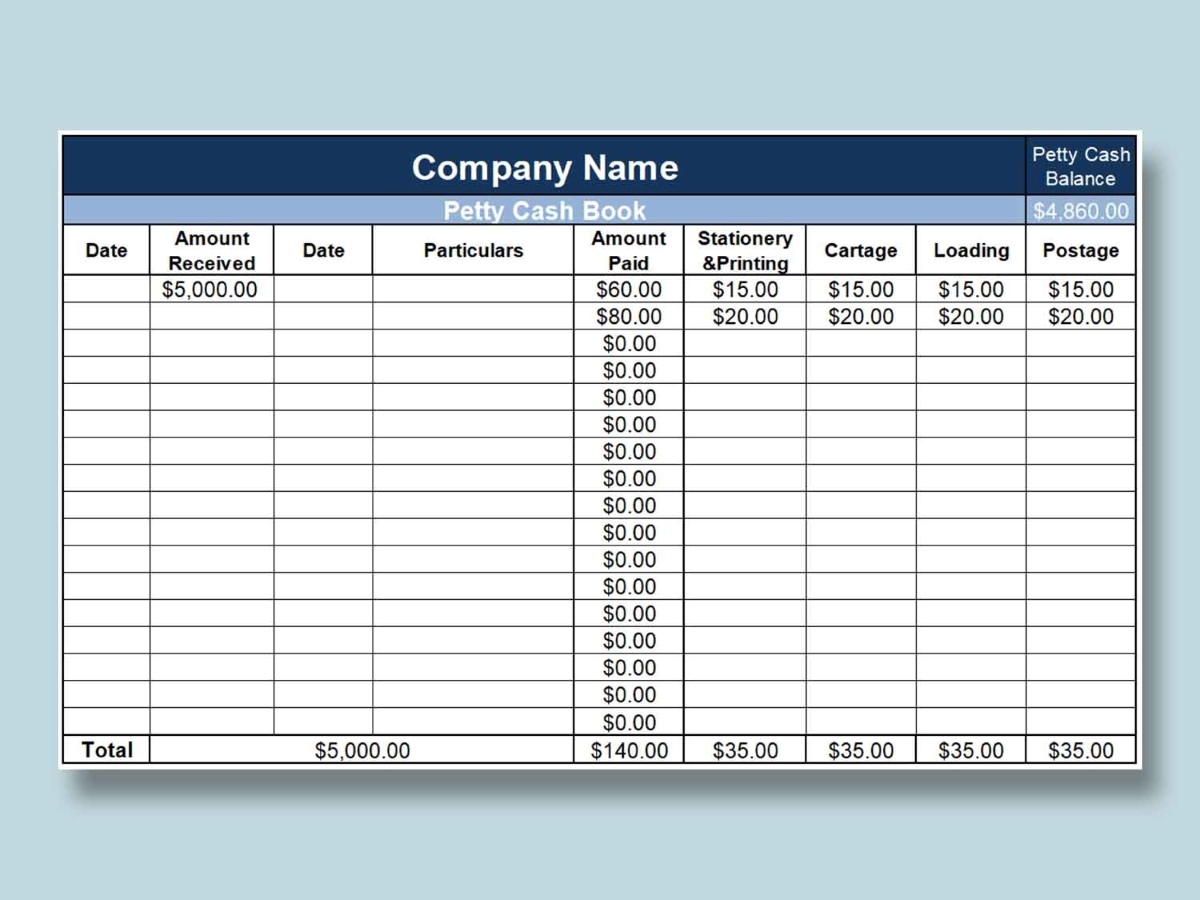

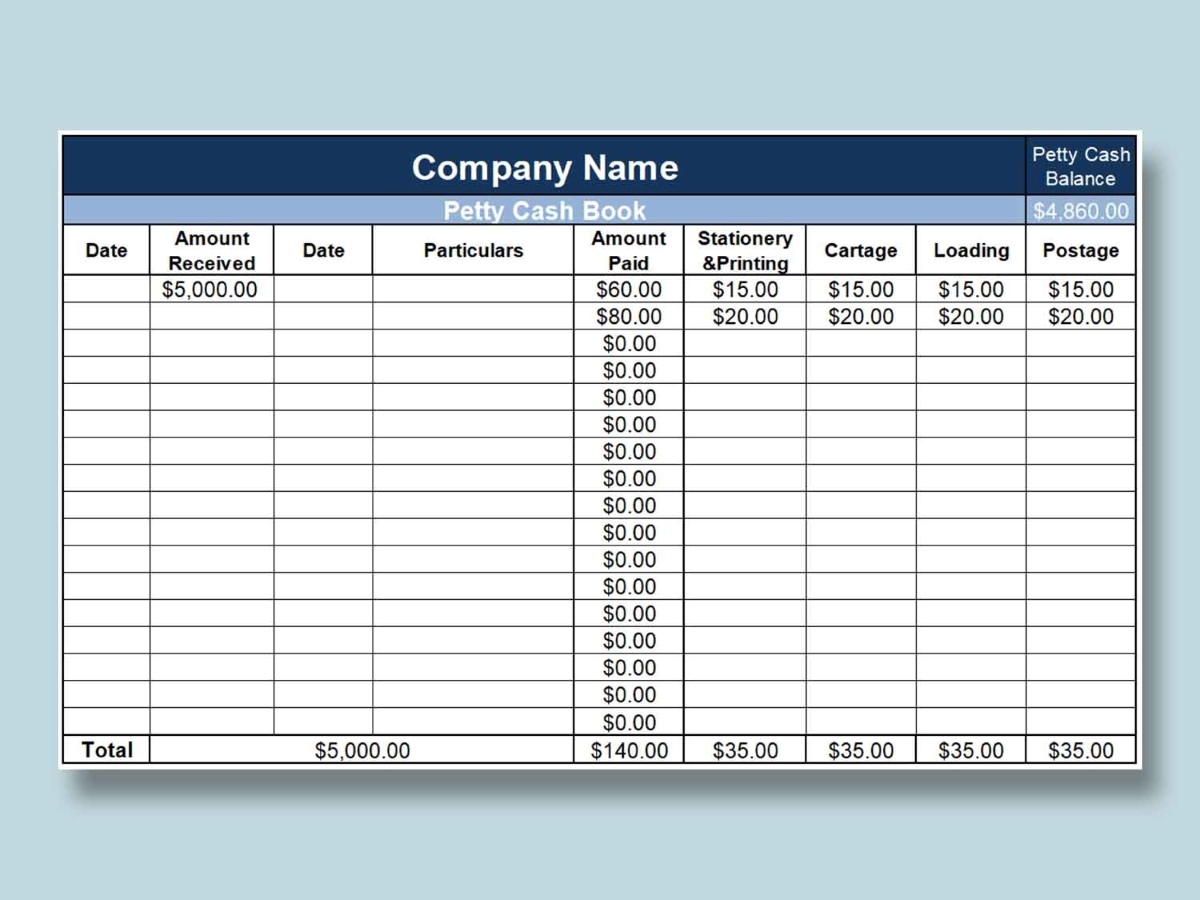

- Create a Petty Cash Log: Prepare a log or a register where all petty cash transactions will be recorded. The log should include fields for the date, description of the expense, amount spent, and the remaining balance of the petty cash fund.

- Issue Petty Cash Vouchers: When disbursing cash from the petty cash fund, the custodian should provide a petty cash voucher to the recipient. The voucher should include the date, the purpose or description of the expense, the amount, and the signature of the recipient.

- Collect and Retain Receipts: As expenses are incurred, the custodian must collect receipts for each transaction. These receipts are crucial for documentation and to validate the authenticity of the expenses incurred.

- Record Transactions in the Petty Cash Log: The custodian should record each petty cash transaction in the log, including the date, description, amount spent, and the remaining balance. This will ensure that all transactions are properly tracked and accounted for.

- Reconcile the Petty Cash Fund: Periodically, the custodian should reconcile the petty cash fund by comparing the remaining cash balance with the recorded balance in the petty cash log. Any discrepancies should be investigated and resolved to maintain accurate financial records.

By following these steps consistently and accurately, businesses can ensure that petty cash transactions are properly recorded and accounted for. This process not only helps in maintaining accurate financial statements but also facilitates effective control and monitoring of petty cash usage, reducing the risk of unauthorized expenses or fraudulent activities.

Classification of Petty Cash on the Balance Sheet

When preparing the balance sheet, it is important to properly classify and present petty cash. Petty cash is generally categorized as a current asset, as it represents cash that is available for immediate use in covering small expenses. The classification of petty cash on the balance sheet ensures that it is appropriately reflected in the financial statement. Here are some key points to consider regarding the classification of petty cash:

Current Asset: As mentioned earlier, petty cash is considered a current asset because it represents cash that is expected to be used within the current operating cycle of a business, typically one year. Current assets are those that can be easily converted into cash or used up in the near future.

Separate Line Item: Petty cash is often presented as a separate line item on the balance sheet to distinguish it from other cash accounts. This allows for a clear identification of the amount of cash available for day-to-day minor expenses.

Valuation: The value of petty cash reported on the balance sheet should represent the actual amount of cash on hand in the petty cash fund. It is important to reconcile the petty cash fund regularly to ensure accurate reporting of the cash balance.

Disclosure: Along with the amount of petty cash, it is important to disclose any restrictions or limitations on its use. For example, if there are specific guidelines or approval processes for accessing and using petty cash, these should be disclosed in the accompanying notes to the financial statements.

Audit Trail: To maintain transparency and accountability, it is crucial to keep a proper record of all petty cash transactions. The supporting documentation, including receipts and petty cash vouchers, should be available for audit purposes. This audit trail aids in the verification of petty cash balances and ensures the accuracy of the financial statements.

By correctly classifying and presenting petty cash on the balance sheet, businesses provide stakeholders with a clear depiction of their available cash resources, including the funds allocated for small, day-to-day expenses. This transparency helps stakeholders assess the financial position and liquidity of the company and promotes trust and credibility in the financial reporting process.

Reporting Petty Cash on the Balance Sheet

When it comes to reporting petty cash on the balance sheet, there are a few important considerations to keep in mind. The objective is to accurately present the value of the petty cash fund and distinguish it as a separate asset. Here is how petty cash is typically reported on the balance sheet:

Current Assets Section: Petty cash is reported as a current asset in the current assets section of the balance sheet. It is classified as a separate line item, distinct from other cash accounts, to give clarity to the amount of cash available for small, day-to-day expenses.

Specific Labeling: To clearly indicate the nature of the asset, the line item for petty cash should be labeled as “Petty Cash” or “Cash on Hand”. This labeling allows stakeholders to easily identify and understand the purpose of the amount listed on the balance sheet.

Amount Disclosure: The balance sheet should disclose the specific amount of petty cash held by the company. This amount should be reflective of the actual cash on hand in the petty cash fund, which should be regularly reconciled to ensure accuracy.

Notes to Financial Statements: In the accompanying notes to the financial statements, it is essential to provide additional information about the petty cash fund. This may include any guidelines or restrictions on its use, the frequency of reconciliation, and any relevant policies or procedures regarding the management and recording of petty cash transactions.

Audit Trail: As mentioned earlier, maintaining a proper audit trail is vital. This includes retaining supporting documentation, such as petty cash vouchers and receipts, to support the reported balance. The audit trail provides evidence of the validity of the petty cash transactions and ensures transparency in the financial reporting process.

By accurately reporting petty cash on the balance sheet, businesses demonstrate their commitment to transparent financial reporting and highlight the availability of cash resources for small expenses. This information is crucial for stakeholders, including investors, creditors, and regulatory bodies, in evaluating a company’s liquidity position and financial health.

Examples of Petty Cash on the Balance Sheet

To understand how petty cash is reported on the balance sheet, let’s consider a few examples:

Example 1: ABC Company

ABC Company maintains a petty cash fund of $200. On its balance sheet, the company reports the following:

- Petty Cash: $200

This disclosure indicates that ABC Company has $200 in cash readily available for small, day-to-day expenses.

Example 2: XYZ Corporation

XYZ Corporation operates on a larger scale and maintains a petty cash fund of $500. Its balance sheet presentation may look like this:

- Cash on Hand:

- Petty Cash: $500

By separating the petty cash amount within the broader cash on hand category, XYZ Corporation provides a clear breakdown of its cash resources.

Example 3: Dreamland Retail Store

Dreamland Retail Store operates several branches and assigns a petty cash fund of $100 to each location. The balance sheet reporting would show:

- Petty Cash (Branch A): $100

- Petty Cash (Branch B): $100

- Petty Cash (Branch C): $100

In this example, the separate disclosure of petty cash for each branch allows for a more detailed representation of the company’s cash holdings.

These examples illustrate how petty cash can be presented on the balance sheet. The specific format and labeling may vary depending on the company’s policies and reporting preferences. However, the common thread is the need to explicitly disclose petty cash as a separate current asset, indicating the available cash for small expenses.

Conclusion

Petty cash plays a significant role on the balance sheet of a business, despite its seemingly small size. It represents the cash set aside to cover day-to-day minor expenses, allowing for efficient and convenient handling of small transactions. While petty cash may appear trivial, it is crucial to accurately record and report it on the balance sheet to maintain transparency, control, and accountability.

Properly classifying and reporting petty cash as a current asset on the balance sheet ensures that it is appropriately recognized as part of a company’s cash holdings. It allows stakeholders to assess the company’s liquidity, understand the availability of immediate funds, and make informed decisions based on a complete financial picture.

Recording petty cash transactions involves establishing a fund, designating a custodian, maintaining a petty cash log, issuing vouchers, collecting receipts, and reconciling the fund regularly. These processes ensure accuracy in financial reporting and promote control over petty cash usage.

Classification of petty cash on the balance sheet involves presenting it as a separate line item within the current assets section. Clear labeling and disclosure of the petty cash amount, along with any relevant restrictions or policies, provide stakeholders with a comprehensive understanding of the company’s cash resources.

By accurately reporting petty cash on the balance sheet, businesses demonstrate their commitment to transparent financial reporting practices. This fosters trust and confidence among investors, creditors, and other stakeholders who rely on accurate financial information to assess the company’s financial position and make informed decisions.

In conclusion, while petty cash may seem insignificant, its proper recognition and presentation on the balance sheet are vital for maintaining accurate and transparent financial statements. By understanding the importance of petty cash on the balance sheet and implementing appropriate recording and reporting practices, businesses can effectively manage small expenses, maintain control over cash resources, and enhance their overall financial management processes.