Home>Finance>When Do We Know That A Company Has Goodwill? When Can Goodwill Appear On A Company’s Balance Sheet?

Finance

When Do We Know That A Company Has Goodwill? When Can Goodwill Appear On A Company’s Balance Sheet?

Modified: December 30, 2023

Learn about goodwill in finance and how it can appear on a company's balance sheet. Gain insights into recognizing when a company has goodwill.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Goodwill

- Definition of Goodwill

- Characteristics of Goodwill

- Importance of Goodwill in a Company

- Recognition of Goodwill on a Company’s Balance Sheet

- Criteria for Goodwill Recognition

- Factors Influencing Goodwill Recognition

- Accounting Treatment of Goodwill

- Implications of Goodwill on Financial Statements

- Conclusion

Introduction

When analyzing a company’s financial status, one important factor to consider is its goodwill. Goodwill is an intangible asset that represents the value of a company’s reputation, customer base, and other non-physical assets. It plays a significant role in assessing a company’s overall worth and potential for future growth.

Understanding what goodwill is and when it appears on a company’s balance sheet is crucial for investors, analysts, and stakeholders. It helps them gauge the company’s ability to generate profits from intangible assets and provides insights into its long-term sustainability.

In this article, we will delve into the concept of goodwill, its definition, characteristics, and the criteria for its recognition on a company’s balance sheet. We will also explore the accounting treatment of goodwill and its implications on financial statements.

By the end of this article, you will have a comprehensive understanding of goodwill and its significance in evaluating a company’s financial standing.

Understanding Goodwill

Goodwill is an intangible asset that represents the intangible value of a company. It encompasses various factors such as brand reputation, customer loyalty, intellectual property, and employee expertise. Unlike tangible assets such as buildings or machinery, goodwill cannot be easily measured or quantified. However, it holds significant value and can contribute to the success and profitability of a company.

Goodwill arises from factors such as strong customer relationships, a reputable brand name, unique business processes, patents, copyrights, or other intellectual property. It is often a result of successful marketing strategies, outstanding customer service, or a proven track record of quality products or services.

The presence of goodwill can give a company a competitive edge in the market. It establishes trust and loyalty among customers, which can lead to increased sales, repeat business, and referrals. Goodwill can also attract top talent, as employees are often drawn to companies with a solid reputation and positive work environment.

While goodwill is an intangible asset, it still holds a value that can be reflected in a company’s financial statements. The recognition and measurement of goodwill play a crucial role in assessing a company’s financial health and potential for future growth.

It is important to note that not all companies possess goodwill. Startups or companies in highly competitive industries may not have established a strong reputation or brand presence yet. For these companies, goodwill may not be a significant factor and may not appear on their balance sheets.

Now that we have a basic understanding of goodwill, let’s move on to learn its specific definition and characteristics.

Definition of Goodwill

Goodwill, in accounting terms, is defined as the excess of the purchase price of a company over its net tangible assets. In other words, it is the amount paid by an acquiring company to acquire another company that cannot be attributed to identifiable tangible or financial assets.

Goodwill represents the intangible value of a company, including its reputation, customer relationships, brand equity, and intellectual property. It is an asset that exists beyond what can be physically seen or quantified, yet it contributes to the company’s ability to generate future earnings and maintain a competitive advantage.

To fully grasp the concept of goodwill, let’s consider an example. Suppose Company A acquires Company B for $10 million. The net tangible assets of Company B, including its physical assets and liabilities, amount to $8 million. The remaining $2 million represents the goodwill of Company B, which reflects the intangible value that Company A sees in acquiring the company.

It is important to note that goodwill can only be recognized in the context of a business combination. It arises when a company acquires another company and pays a price that exceeds the net tangible assets of the acquired company. Goodwill cannot be generated internally by a company; it can only be acquired through an external transaction.

Furthermore, under generally accepted accounting principles (GAAP), companies are required to test their goodwill for impairment at least annually. This means that if the value of the acquired company’s goodwill declines, it must be recorded as an impairment loss on the acquiring company’s financial statements.

Now that we have a clear understanding of the definition of goodwill, let’s explore the characteristics that distinguish it from other assets.

Characteristics of Goodwill

Goodwill possesses several notable characteristics that differentiate it from other assets on a company’s balance sheet. Understanding these characteristics can provide valuable insights into the nature and value of this intangible asset. Let’s explore some key characteristics of goodwill:

1. Non-physical and Intangible: Unlike tangible assets such as buildings or inventory, goodwill does not have a physical form. It represents the intangible value of a company, including its brand reputation, customer relationships, and intellectual property.

2. Non-separable: Goodwill is inseparable from the business itself. It cannot be sold or transferred independently from the company. If a company is acquired, the goodwill is transferred as part of the overall acquisition process.

3. Non-substitutable: Goodwill is unique to each company and cannot be easily reproduced or substituted. It represents the company’s specific advantages, competencies, and relationships that contribute to its success and competitive position.

4. Long-term value: Goodwill is expected to have long-term value for the company. It reflects the potential for future earnings, growth, and market presence based on the intangible assets and advantages that the company possesses.

5. Subjective valuation: Determining the value of goodwill is a subjective process. It involves making judgments and estimates based on factors such as brand recognition, customer loyalty, and industry dynamics. The valuation of goodwill can vary depending on the expectations and perspectives of different stakeholders.

6. Impacted by external factors: Goodwill can be influenced by external factors such as changes in customer preferences, industry trends, or economic conditions. These factors can impact the future expected cash flows and performance of the company, therefore affecting the value of goodwill.

7. Indefinite useful life: Goodwill is considered to have an indefinite useful life, as it represents the long-term reputation and relationships of the company. However, it is subject to impairment testing, and if its value declines, an impairment loss must be recognized on the company’s financial statements.

Understanding the characteristics of goodwill is essential for accurate valuation, financial reporting, and decision-making. It helps stakeholders assess the value and sustainability of a company’s intangible assets and their potential impact on future performance and profitability.

Importance of Goodwill in a Company

Goodwill plays a significant role in a company’s overall success, as it represents the intangible assets and advantages that contribute to its value and competitive position. Let’s explore the importance of goodwill in a company:

1. Brand Reputation: Goodwill reflects a company’s brand reputation and customer perception. A strong and positive brand image can attract new customers, build customer loyalty, and differentiate the company from its competitors. Goodwill associated with a reputable brand can provide a competitive advantage and drive long-term profitability.

2. Customer Relationships: A company’s existing customer relationships contribute to its goodwill. Positive customer experiences, reliable customer service, and strong customer loyalty enhance the company’s reputation and increase the likelihood of repeat business. Goodwill stemming from strong customer relationships can lead to sustainable revenue streams and long-term success.

3. Market Positioning: Goodwill influences a company’s market positioning by establishing it as a leader in its industry or niche. It reflects the company’s unique attributes, competitive advantages, and its ability to meet customer needs. A strong market position fosters trust and attracts customers, suppliers, and potential investors.

4. Competitive Advantage: Goodwill provides a competitive edge by enabling a company to differentiate itself from competitors. It encompasses factors such as innovation, unique business processes, proprietary technology, or intellectual property. Goodwill arising from these advantages can drive market share growth and protect the company against new entrants.

5. Employee Morale and Retention: A positive brand image and strong goodwill can enhance employee morale and motivate employees to perform at their best. Companies with a good reputation are often seen as desirable employers, attracting top talent. Additionally, employees who align with a company’s positive values and mission are more likely to stay with the company, reducing turnover costs.

6. Attracting Partnerships and Opportunities: Companies with strong goodwill are often sought after for partnerships, collaborations, or expansion opportunities. Other businesses may be inclined to associate themselves with a company that has a positive reputation and a loyal customer base. Goodwill can open doors to strategic alliances, joint ventures, or licensing agreements.

7. Enhanced Financial Performance: Goodwill, when managed effectively, can generate financial benefits. Positive brand perception and customer loyalty can lead to increased sales, higher profit margins, and improved financial performance. Goodwill is an intangible asset that can contribute to a company’s valuation and enhance its market capitalization.

Goodwill is a valuable asset that can significantly impact a company’s success and growth trajectory. It is important for companies to cultivate and protect their goodwill by consistently delivering on their brand promise, maintaining strong customer relationships, and nurturing their reputation in the marketplace.

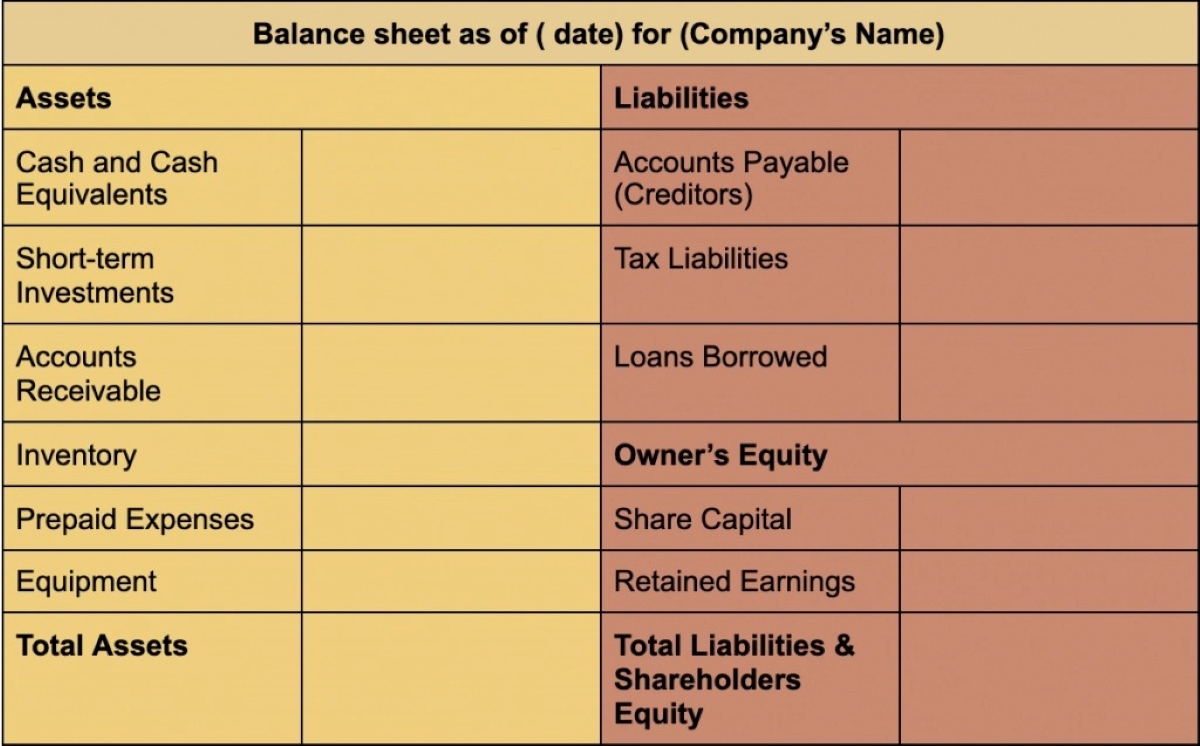

Recognition of Goodwill on a Company’s Balance Sheet

The recognition of goodwill on a company’s balance sheet is an essential step in accurately reflecting its financial position and intangible assets. Goodwill is typically recognized when a company acquires another business and pays a purchase price that exceeds the net tangible assets of the acquired company.

When a business combination occurs, the excess amount paid over the fair value of the acquired company’s identifiable net assets is recorded as goodwill. This excess represents the value of the intangible assets and advantages gained through the acquisition, such as brand reputation, customer relationships, and intellectual property.

Goodwill is classified as an intangible asset and is presented separately on the balance sheet. It is not amortized but rather tested for impairment at least annually or whenever there are triggering events that indicate a potential decline in its value.

It’s important to note that goodwill can only be recognized when there is a business combination. Internal development of intangible assets, such as investing in brand building or research and development, cannot result in the recognition of goodwill on the balance sheet.

The recognition of goodwill on a company’s balance sheet has several implications. First, it increases the total assets of the acquiring company, thereby impacting its overall financial position. Second, it provides insight into the company’s growth strategy and its investment in long-term value creation. Finally, it serves as an indicator of the company’s ability to leverage intangible assets and gain a competitive advantage in the market.

It is worth noting that the recognition of goodwill can vary between different accounting frameworks. Some jurisdictions may have specific rules or restrictions on the recognition of goodwill, so it is important to adhere to the appropriate accounting standards applicable to the company.

In the next section, we will explore the criteria that must be met for goodwill recognition and the factors that influence its recognition in accounting practices.

Criteria for Goodwill Recognition

The recognition of goodwill on a company’s balance sheet is subject to specific criteria that must be met. These criteria ensure that the recognition of goodwill is transparent, reliable, and reflects the economic substance of a business combination. Let’s explore the key criteria for goodwill recognition:

1. Business Combination: Goodwill can only be recognized when a business combination occurs. A business combination involves the acquisition of one company by another, resulting in control over the acquired company. This can be achieved through various methods, such as mergers, acquisitions, or consolidations.

2. Purchase Price Exceeds Fair Value: Goodwill is recognized when the purchase price paid by the acquiring company exceeds the fair value of the net identifiable assets acquired. The excess amount represents the value of the intangible assets and advantages gained through the acquisition.

3. Identifiable Net Assets: The acquired company’s net identifiable assets must be individually identified and valued. This includes tangible assets, liabilities, and identifiable intangible assets such as patents, licenses, or customer contracts. Goodwill is not recognized if the fair value of the identifiable net assets equals or exceeds the purchase price paid.

4. Reliable Valuation: Goodwill recognition requires a reliable valuation of the identifiable net assets and the fair value of the acquired business as a whole. This valuation process involves considerations such as market conditions, future cash flows, industry comparables, and the expertise of professional appraisers.

5. Independence of Valuation: The valuation of identifiable net assets and determination of goodwill should be conducted independently. This means that the acquiring company should not influence or manipulate the valuation process to overstate or understate the amount of goodwill recognized.

It is important to note that the criteria for goodwill recognition can vary based on the applicable accounting standards in different jurisdictions. For example, the International Financial Reporting Standards (IFRS) and the Generally Accepted Accounting Principles (GAAP) in the United States have specific guidelines and requirements for recognizing and measuring goodwill.

Adhering to these criteria ensures that the recognition of goodwill provides a faithful and reliable representation of the economic impact of a business combination. It allows stakeholders, including investors, analysts, and regulators, to assess the value and implications of the acquired intangible assets on the acquiring company’s financial position.

Factors Influencing Goodwill Recognition

The recognition of goodwill on a company’s balance sheet is influenced by various factors. These factors can impact the determination of the excess purchase price and the valuation of the intangible assets gained through a business combination. Let’s explore some key factors that influence goodwill recognition:

1. Market Conditions: The overall market conditions play a significant role in determining the fair value of the acquired business and its identifiable net assets. Market conditions can affect the valuation multiples used, discount rates applied, and the overall pricing dynamics of the acquisition.

2. Industry Dynamics: The characteristics and dynamics of the industry in which the acquiring company operates can influence the recognition of goodwill. Industries with high barriers to entry, strong customer loyalty, or significant brand importance may have higher goodwill values due to the intangible advantages they possess.

3. Brand Strength: The strength and reputation of the acquired company’s brand can impact the valuation of goodwill. Well-established brands with positive customer perception and strong market presence may result in higher goodwill recognition.

4. Customer Relationships: The quality of customer relationships and the level of customer loyalty associated with the acquired company can influence the recognition of goodwill. A loyal customer base and long-term contracts can contribute to the intangible value attributed to goodwill.

5. Intellectual Property: The presence and value of patents, trademarks, copyrights, or other intellectual property owned by the acquired company can significantly impact the recognition of goodwill. These intangible assets contribute to the overall value of the business and can result in higher goodwill recognition.

6. Management Expertise: The expertise and capabilities of the acquired company’s management team can influence the recognition of goodwill. A strong management team with a track record of success and strategic vision may contribute to the recognition of higher goodwill due to their ability to drive future earnings and growth.

7. Synergies and Cost Savings: The potential synergies and cost savings expected from the business combination can also influence goodwill recognition. If the acquiring company can leverage the resources and operations of the acquired company to generate additional value, it may result in higher goodwill recognition.

8. Future Growth Potential: The perceived future growth potential of the acquired business is a critical factor in goodwill recognition. If the acquiring company expects significant future cash flows, market expansion, or increased market share due to the acquisition, it may result in higher goodwill recognition.

It’s important to note that the factors influencing goodwill recognition are subjective and require professional judgment. Assessing these factors accurately and applying them in a consistent and transparent manner is crucial to ensure the reliability and relevancy of goodwill recognition on a company’s balance sheet.

Accounting Treatment of Goodwill

The accounting treatment of goodwill involves its initial recognition on the balance sheet and subsequent measurement and reporting. Proper accounting treatment ensures that the financial statements accurately reflect the value and implications of goodwill. Let’s explore the key aspects of accounting treatment for goodwill:

1. Initial Recognition: Goodwill is recognized on the balance sheet when a business combination occurs, and the purchase price exceeds the fair value of the acquired company’s identifiable net assets. The excess amount is recorded as goodwill and classified as an intangible asset.

2. Non-Amortization: Unlike most intangible assets, goodwill is not amortized over its useful life. Instead, it is considered to have an indefinite useful life, as its value is expected to continue indefinitely. As a result, goodwill remains on the balance sheet without being systematically reduced over time.

3. Impairment Testing: Goodwill is tested for impairment at least annually or whenever there are indications of potential impairment. Impairment testing compares the carrying value of the reporting unit, which includes the goodwill, with its fair value. If the carrying value exceeds the fair value, an impairment loss is recognized on the income statement.

4. Impairment Recognition: When goodwill is impaired, the impairment loss is calculated by determining the difference between the carrying value and the fair value of the reporting unit to which the goodwill is allocated. The impairment loss is recorded as an expense on the income statement, reducing the carrying value of the goodwill on the balance sheet.

5. Impairment Reversal: In some cases, if there is an improvement in the estimated fair value of the reporting unit, a previously recognized impairment loss on goodwill can be reversed, up to the amount of the original impairment. The reversal is recorded as a gain on the income statement, increasing the carrying value of goodwill.

6. Disclosure: Companies are required to disclose relevant information about their goodwill, including the carrying amount, impairment losses or reversals, and any key assumptions made in measuring the fair value. This disclosure allows stakeholders to understand the significance of goodwill and its impact on the financial statements.

Proper accounting treatment of goodwill is crucial for providing transparent and reliable financial information to stakeholders. It ensures that the value of goodwill is accurately reflected on the balance sheet and that any impairment is promptly recognized. Additionally, disclosure requirements provide transparency and allow stakeholders to assess the implications of goodwill on the company’s financial position and performance.

It’s important to note that accounting standards such as the International Financial Reporting Standards (IFRS) and the Generally Accepted Accounting Principles (GAAP) may have specific guidelines and requirements regarding the accounting treatment of goodwill. Companies should adhere to the appropriate accounting standards relevant to their jurisdiction to ensure compliance and consistency in reporting.

Implications of Goodwill on Financial Statements

Goodwill has significant implications on a company’s financial statements, as it is an intangible asset that represents the value of goodwill recognized in a business combination. Understanding these implications is essential for stakeholders to assess the financial health and performance of a company. Let’s explore the key implications of goodwill on financial statements:

1. Balance Sheet: Goodwill is reported as a separate line item on the balance sheet under the category of intangible assets. It is placed after identifiable intangible assets, such as patents or trademarks. The carrying value of goodwill reflects the excess purchase price paid for the acquired company over its identifiable net assets.

2. Income Statement: Goodwill does not directly impact the income statement, as it is not amortized like other intangible assets. However, impairment losses or reversals of goodwill are recognized as expenses or gains, respectively, on the income statement. These adjustments impact the company’s net income and profitability.

3. Cash Flow Statement: Goodwill does not affect cash flows directly, as it represents an accounting value rather than a physical asset. However, impairment losses and reversals of goodwill can impact cash flows indirectly through changes in the carrying value and potential tax implications.

4. Shareholders’ Equity: Goodwill is reflected in the shareholders’ equity section of the balance sheet. Any impairment losses on goodwill reduce the overall shareholders’ equity, while reversals of impairment increase it. Shareholders’ equity also includes the retained earnings related to goodwill, which may be impacted by impairment testing.

5. Financial Ratios: Goodwill can have implications on financial ratios used to assess the company’s performance and financial health. For example, a high level of goodwill relative to other assets or lower-than-expected cash flows can impact ratios related to profitability, return on assets, or leverage.

6. Disclosures: Companies are required to provide disclosures about their goodwill in the financial statements and accompanying notes. This includes information about the carrying value, impairment losses or reversals, and any key assumptions made in measuring the fair value of goodwill. These disclosures provide transparency and enable stakeholders to evaluate the implications of goodwill on the company’s financial position.

Understanding the implications of goodwill on financial statements is crucial for investors, analysts, and other stakeholders. It helps in assessing the value and risks associated with intangible assets, evaluating the company’s growth potential, and making informed decisions. Goodwill can have a significant impact on a company’s financial performance, and it is important to monitor its value, potential impairments, and overall contribution to the company’s long-term success.

Conclusion

Goodwill is a valuable and intangible asset that represents the intangible value of a company, including its brand reputation, customer relationships, and intellectual property. Understanding the concept of goodwill and its implications is crucial for assessing a company’s financial standing and its potential for future growth.

We have explored various aspects of goodwill, starting from its definition and characteristics to its recognition on a company’s balance sheet. Goodwill arises through business combinations when the purchase price exceeds the fair value of the acquired company’s identifiable net assets.

Recognizing goodwill on a balance sheet provides insight into a company’s growth strategy, market positioning, and ability to leverage intangible assets. It serves as an indicator of the company’s long-term value creation and its competitive advantage in the marketplace.

The accounting treatment of goodwill involves its initial recognition, non-amortization, impairment testing, and appropriate disclosure. This treatment ensures that goodwill is accurately reflected on the balance sheet and that any impairments or reversals are promptly recognized in the financial statements.

Goodwill has significant implications on a company’s financial statements, including the balance sheet, income statement, shareholders’ equity, and financial ratios. Understanding these implications enables stakeholders to evaluate the financial health and performance of a company, assess its growth potential, and make informed decisions.

In conclusion, goodwill represents the intangible factors that contribute to a company’s value and success. It signifies the importance of brand reputation, customer relationships, and unique advantages in today’s competitive business landscape. Assessing and managing goodwill effectively is crucial for companies to enhance their market position, build sustainable growth, and create long-term shareholder value.