Finance

Where Do Dividends Go On The Balance Sheet

Published: January 2, 2024

Discover the role of dividends in finance and where they are recorded on the balance sheet. Gain insights into how this key financial indicator impacts a company's financial health.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Dividends are an important aspect of finance that can greatly affect a company’s financial performance and the returns received by its shareholders. When a company generates profits, it has the option to distribute a portion of those earnings to its shareholders as dividends. These distributions can take various forms, such as cash dividends or stock dividends, and provide an incentive for investors to hold onto shares of the company.

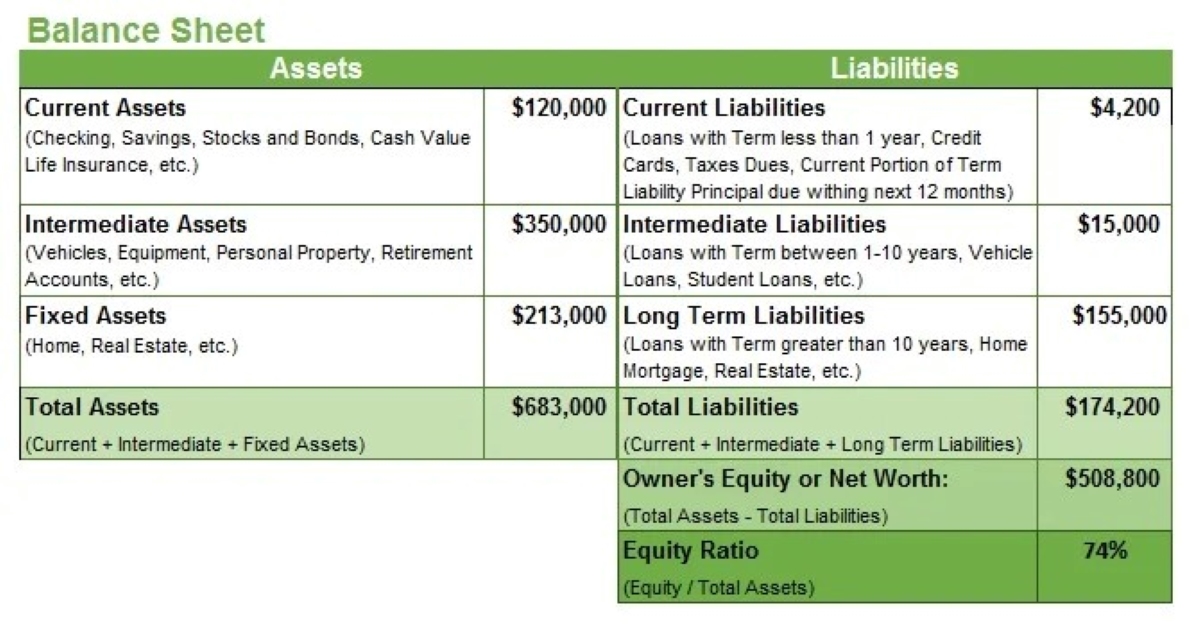

Understanding where dividends are recorded on the balance sheet is crucial for investors, as it helps them evaluate the financial health of a company and its willingness to distribute profits to shareholders. The balance sheet is a financial statement that provides a snapshot of a company’s assets, liabilities, and shareholders’ equity at a specific point in time.

In this article, we will explore the different components of the balance sheet where dividends are recorded. We will discuss the impact of dividends on the company’s equity, as well as their effect on assets and liabilities. By understanding how dividends are reflected on the balance sheet, investors can gain valuable insights into a company’s financial operations and make informed decisions.

Definition of Dividends

Dividends are distributions of a company’s profits or retained earnings to its shareholders. They represent a reward for investing in the company, as shareholders receive a portion of the profits generated. Dividends can be in the form of cash, additional shares of stock, or other property.

Companies typically declare dividends on a regular basis, such as quarterly or annually, although some companies may also issue special dividends on occasion. The amount of dividends paid to each shareholder is determined by the company’s dividend policy and the number of shares they own. The board of directors, in consultation with management, decides on the dividend amount and announces it to the shareholders.

Dividends can be an attractive feature for investors, as they provide a consistent income stream and can contribute to overall investment returns. However, not all companies pay dividends, especially early-stage or high-growth companies that reinvest their profits back into the business to fuel expansion and future growth.

It’s important to note that dividends are not guaranteed. Even if a company has a long history of paying dividends, it may choose to lower or suspend them if it faces financial difficulties or wants to redirect funds for other purposes, such as debt repayment or capital investments.

Investors often pay attention to a company’s dividend yield, which is calculated by dividing the annual dividend per share by the stock price. The dividend yield provides an indication of the return an investor can expect from their investment in the form of dividends.

Overall, dividends are a way for companies to share their success and reward shareholders for their investment. They play a significant role in attracting and retaining investors while also providing a valuable source of income for those seeking regular cash flow from their investments.

Purpose of Dividends

The purpose of dividends is multi-faceted and serves various stakeholders involved in a company. Understanding the reasons behind dividend payments can provide insight into a company’s financial management and its commitment to shareholders. Here are some key purposes of dividends:

- Shareholder Return: One of the primary purposes of dividends is to provide a return on investment to shareholders. By distributing a portion of the company’s profits, dividends reward shareholders for their ownership and give them access to a share of the company’s earnings.

- Stability and Income: Dividends can provide stability and regular income for investors, particularly those who rely on their investments for cash flow. Investors looking for stable and predictable returns often seek out companies with a track record of paying consistent dividends.

- Social Responsibility: Companies that distribute dividends also demonstrate their commitment to social responsibility. By sharing the profits with shareholders, companies acknowledge the role investors play in supporting business growth and success.

- Market Perception: Consistently paying dividends can enhance a company’s reputation and make it more attractive to new investors. Dividend payments are often seen as a sign of financial strength and stability, indicating that a company has sufficient profits to distribute to shareholders.

- Shareholder Loyalty: Dividends can foster shareholder loyalty and encourage long-term investment. By consistently paying dividends, companies can build a base of loyal shareholders who are more likely to retain their ownership stakes and support the company’s long-term growth.

- Efficient Capital Allocation: Dividends provide an effective way for companies to allocate excess cash. Instead of accumulating large amounts of cash on their balance sheets, companies can distribute dividends to shareholders, who can then reinvest the funds in other investment opportunities.

It’s important to note that companies need to strike a balance when it comes to dividend payments. While shareholders appreciate dividends, companies also need to retain sufficient earnings to fuel growth, invest in research and development, and maintain financial stability. The decision to pay dividends is influenced by various factors, including the company’s financial position, cash flow, profitability, future growth prospects, and capital requirements.

Overall, dividends serve as a means to reward shareholders, provide income, enhance a company’s market perception, and allocate capital efficiently. They play a crucial role in the relationship between a company and its shareholders, reflecting its financial success and commitment to generating value for investors.

Where Dividends are Recorded on the Balance Sheet

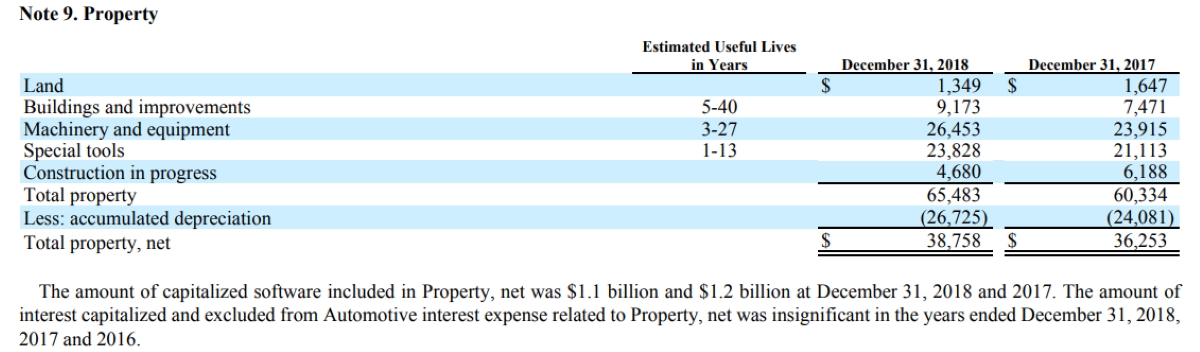

Dividends have a direct impact on a company’s balance sheet as they involve the distribution of profits to shareholders. On the balance sheet, dividends are primarily recorded in two main sections: retained earnings and dividends payable.

1. Retained Earnings: Retained earnings represent the accumulated profits of a company that have not been distributed to shareholders as dividends. When dividends are paid, they reduce the amount of retained earnings. The retained earnings section on the balance sheet shows the net income earned by the company over time, minus any dividends paid out.

Retained earnings are considered a part of shareholders’ equity, representing the portion of the company’s earnings that are reinvested back into the business. Dividends paid out of retained earnings decrease the company’s overall equity value.

2. Dividends Payable: Dividends payable is a liability on the balance sheet that represents the amount owed to shareholders in the form of dividends. When a company declares a dividend but has not yet made the payment, it records this liability on its balance sheet as dividends payable.

The dividends payable account reflects the outstanding dividend obligation until the payment is made to the shareholders. Once the dividends are paid, the amount is reduced in the dividends payable account, and the liability is removed from the balance sheet.

It’s important to note that the dividends payable account is temporary and does not impact the company’s overall equity. It solely represents the obligation to distribute the declared dividends to shareholders.

In summary, on the balance sheet, dividends are recorded in the retained earnings section, where they decrease the accumulated profits of the company. Additionally, they are recorded in the dividends payable section as a liability until the payment is made to shareholders.

Investors and stakeholders can analyze the balance sheet to see the distribution of profits to shareholders and gain insights into a company’s dividend history and payout policy. By evaluating the impact of dividends on the balance sheet, investors can assess the financial health and sustainability of a company’s dividend payments.

Retained Earnings

Retained earnings are a crucial component of a company’s balance sheet and represent the accumulated profits that have not been distributed to shareholders as dividends. This section showcases the reinvestment of earnings back into the company to support growth and expansion.

When a company generates profits, it has the choice to either distribute them as dividends or retain them. Retained earnings reflect the portion of profits that are retained by the company after all expenses, taxes, and dividends have been accounted for.

Retained earnings are included in the shareholders’ equity section of the balance sheet. They are considered an internal source of capital for the company, representing the company’s cumulative net income over time, minus any dividends paid out to shareholders.

Retained earnings play a critical role in a company’s financial stability and growth. They provide the company with flexibility in funding future projects, such as research and development, acquisitions, marketing initiatives, or capital expenditures.

Additionally, retained earnings have implications for the shareholders. As the company retains earnings, it increases its overall equity value. This, in turn, can lead to an increase in the value of shareholders’ ownership stakes. Higher retained earnings can also contribute to a company’s ability to attract investors and financing for future endeavors.

Changes in retained earnings are reflected in the balance sheet statement of shareholder’s equity. At the end of each accounting period, the company calculates its net income, subtracts any dividends declared and paid during that period, and adds or subtracts any other adjustments or transactions affecting the retained earnings balance.

For example, if a company has a net income of $1 million and declares and pays $200,000 in dividends, the retained earnings will increase by $800,000. If the company experiences a net loss of $500,000, the retained earnings will decrease by that amount.

It’s important for investors to pay attention to the trend of retained earnings over time. A consistently increasing retained earnings balance indicates that the company is effectively generating and retaining profits. On the other hand, a declining balance may suggest that the company is struggling to generate sufficient profits or is paying out more in dividends than it is earning.

Retained earnings not only provide a measure of financial stability for a company but also serve as a signal of its ability to reinvest in itself for future growth. Tracking changes in retained earnings is an essential aspect of financial analysis and helps investors assess a company’s long-term financial health and its commitment to reinvesting in its own success.

Dividends Payable

Dividends payable is a liability account on a company’s balance sheet that represents the outstanding dividend obligations to shareholders. When a company declares a dividend but has not yet made the payment, it records this liability in the dividends payable section.

When a company announces a dividend, it specifies a record date and a payment date. The record date determines which shareholders are eligible to receive the dividend, while the payment date is when the actual dividend distribution occurs. Between these two dates, the dividend payable liability is recorded on the balance sheet.

Dividends payable are categorized as a current liability because they represent an obligation that is expected to be settled within one year. Once the dividend is paid to the shareholders, the amount is reduced from the dividends payable account, and the liability is removed from the balance sheet.

It’s important to note that the dividends payable account has no impact on the company’s overall equity. It solely represents the obligation to distribute the declared dividends to the shareholders. The payment of dividends does not reduce the company’s assets or equity; rather, it represents the transfer of funds from one part of the balance sheet (cash) to another (dividends payable).

Investors often monitor the dividends payable account to gain insights into a company’s dividend distribution history and its ability to fulfill its obligations to shareholders. A consistently increasing dividends payable balance may indicate a company’s commitment to regular dividend payments, while a declining balance may suggest a company’s financial difficulties or a change in dividend policy.

It’s worth mentioning that companies can also have a dividends declared but not paid account, which represents the cumulative amount of dividends declared but not yet paid to shareholders. This account is used when a company declares dividends but the payment date falls after the end of the accounting period.

From a financial analysis perspective, evaluating the dividends payable account can provide investors with insights into a company’s liquidity and its ability to generate sufficient cash flow to meet its dividend obligations. It is also important to compare the amount of dividends payable with the company’s cash flow to determine if it is capable of fulfilling its dividend commitments.

In summary, dividends payable represents the outstanding dividend obligations to shareholders. It is recorded as a liability on the balance sheet and provides transparency into a company’s commitment to distributing dividends and its ability to meet its dividend obligations.

Changes in Equity

Dividends play a significant role in shaping the equity section of a company’s balance sheet. Equity represents the ownership interest in a company and is affected by various factors, including changes in retained earnings, dividends, and other equity transactions.

When dividends are paid, they directly impact the equity section of the balance sheet. Here are some key changes in equity that occur as a result of dividend distributions:

- Retained Earnings: Dividends reduce the retained earnings balance, as they represent a distribution of accumulated profits that have not been reinvested back into the business. The reduction in retained earnings reflects the portion of profits that are distributed to shareholders as dividends.

- Dividends Payable: Before the dividends are paid, they are recorded as a liability in the dividends payable account. Dividends payable represent the outstanding obligation to distribute the declared dividends to shareholders. Once the dividends are paid, the liability is removed from the balance sheet, resulting in a decrease in the liabilities and an equivalent decrease in equity.

- Common Stock: In some cases, dividends may be paid in the form of additional shares of stock rather than cash. In such situations, the common stock account on the balance sheet increases, reflecting the issuance of new shares to shareholders as a dividend payment.

- Treasury Stock: When a company repurchases its own shares from the market, those shares are recorded as treasury stock. If dividends are paid by utilizing treasury stock, the decrease in equity is reflected by the reduction in the treasury stock account.

It’s important to note that dividends, in and of themselves, do not have a direct impact on the total equity value of a company. The reduction in retained earnings due to dividend payouts is offset by the increase in dividends payable or the decrease in treasury stock or common stock, depending on the type of dividend payment.

Changes in equity due to dividends reflect the distribution of profits to shareholders and ultimately affect the ownership value in the company. Investors analyze these changes to understand how dividends impact the overall financial position and value of their investment.

It’s worth noting that changes in equity encompass more than just dividends. Other factors that can affect equity include stock issuances, stock repurchases, stock options, comprehensive income, and other equity transactions. These changes collectively shape the equity section of the balance sheet and provide valuable insights into the financial activities and health of the company.

Overall, changes in equity due to dividend distributions highlight the transfer of ownership value from the company to its shareholders. By analyzing these changes, investors can assess the impact of dividends on the overall equity structure and make informed decisions about their investments.

Effect on Assets and Liabilities

Dividend payments have an impact on a company’s balance sheet by affecting both its assets and liabilities. Let’s explore how dividends affect these two fundamental components:

Assets: Dividend payments do not directly affect a company’s total assets. However, they do impact the asset category of cash. When dividends are paid, cash is reduced as the company transfers funds to shareholders. This decrease in cash is reflected in the asset section of the balance sheet, specifically in the cash and cash equivalents account.

It’s important to note that dividends do not result in a reduction of other assets such as inventory, property, or equipment. These assets remain unchanged unless impacted by other financial transactions or operational activities.

Liabilities: Dividends also have an impact on a company’s liabilities, specifically the dividends payable account. This account represents the outstanding obligation to distribute dividends to shareholders. Before the actual payment is made to shareholders, the declared dividends are recorded as a liability in the dividends payable account.

By recording the dividends payable, the company acknowledges its responsibility to fulfill the dividend distribution. This liability is reflected in the liability section of the balance sheet. Once the dividends are paid to the shareholders, the dividends payable liability is reduced, resulting in a decrease in the overall liabilities of the company.

It’s essential to note that the payment of dividends doesn’t affect other liabilities such as accounts payable, accrued expenses, or long-term debt. Dividends payable is a specific liability account that pertains to dividend obligations only.

Although dividend payments do not directly impact other assets and liabilities on the balance sheet, they indirectly influence the financial position and the overall equity of the company. The reduction in assets (cash) reflects the outflow of funds to shareholders, while the decrease in liabilities (dividends payable) represents the fulfillment of the dividend obligation.

Investors analyze the effect of dividends on assets and liabilities to understand how they contribute to the enterprise’s financial health and decision-making regarding the allocation of resources. By assessing the impact of dividend payments on the balance sheet, investors can gain insights into a company’s cash management, dividend policy, and its overall financial standing.

Impact on Shareholders’ Equity

The payment of dividends directly impacts the shareholders’ equity section of a company’s balance sheet. Shareholders’ equity represents the residual interest in the company’s assets after deducting liabilities. Dividends, as distributions of profits to shareholders, have significant implications for the equity position of shareholders. Here’s how dividends impact shareholders’ equity:

Reduction in Retained Earnings: One of the key impacts of dividends on shareholders’ equity is the reduction in the retained earnings balance. When dividends are paid, they decrease the retained earnings account, which represents the accumulated profits that have not been distributed to shareholders. The reduction in retained earnings reflects the portion of profits that is distributed to shareholders as dividends, thereby lowering the overall equity value.

Change in Common Stock: In some cases, dividends may be paid in the form of additional shares of stock rather than cash. If this occurs, the common stock account on the balance sheet increases. This increase in common stock reflects the issuance of new shares to shareholders as a form of dividend payment. As a result, the overall equity value may remain the same, but the composition of shareholders’ equity changes as new shares are issued.

Adjustment in Treasury Stock: Treasury stock refers to shares of a company’s own stock that it has repurchased from the market. When dividends are paid using treasury stock, the reduction in equity is reflected by decreases in the treasury stock account. This adjustment indicates the reduction in the number of shares held by the company as treasury stock.

It is important to note that while dividends directly impact the retained earnings and potentially other equity accounts, they do not typically affect additional components of shareholders’ equity such as contributed capital or other comprehensive income. Dividends primarily reflect the distribution of profits to shareholders and the corresponding decrease in retained earnings.

The impact of dividends on shareholders’ equity reflects the transfer of value from the company to its shareholders. It represents the company’s commitment to sharing profits with its owners. Tracking changes in shareholders’ equity due to dividend payments can provide valuable insights into the company’s dividend policy, financial performance, and commitment to creating value for shareholders.

Investors and analysts closely monitor shareholders’ equity to assess the overall financial health and stability of a company. By analyzing the impact of dividends on the equity section of the balance sheet, investors can better understand the company’s capital structure, the relationship between retained earnings and dividend payments, and make informed decisions regarding their investments.

Conclusion

Dividends play a crucial role in the financial landscape as they impact a company’s balance sheet and shareholders’ equity. Understanding where dividends are recorded on the balance sheet provides valuable insights into a company’s financial health and its commitment to sharing profits with shareholders.

Dividends are recorded in two main sections of the balance sheet: retained earnings and dividends payable. Retained earnings represent the accumulated profits that have not been distributed as dividends, while dividends payable is a liability that reflects the outstanding dividend obligations to shareholders.

Dividends not only provide shareholders with a return on their investment but also serve various purposes such as providing stable income, demonstrating social responsibility, and attracting new investors. Dividends are also a way for companies to efficiently allocate excess cash and foster shareholder loyalty.

Dividend payments have implications for both assets and liabilities on the balance sheet. Cash is reduced when dividends are paid, impacting the asset category. Dividends payable, as a liability, represents the obligation to distribute declared dividends to shareholders.

Moreover, dividend payments impact shareholders’ equity by reducing retained earnings or changing the common stock or treasury stock accounts. Shareholders’ equity reflects the ownership interest in the company and changes as dividends are distributed.

In conclusion, understanding the impact and recording of dividends on the balance sheet is vital for investors to assess a company’s financial strength, dividend policy, and commitment to shareholders. By analyzing the balance sheet, investors can gain insights into a company’s dividend history, financial stability, and potential for future growth. Dividends serve as a vital link between a company and its shareholders, facilitating the sharing of profits and contributing to the overall value proposition for investors.