Finance

Where Do Dividends Go On The Balance Sheet

Modified: March 1, 2024

Learn where dividends are recorded on the balance sheet in finance. Find out how dividends affect the financial position of a company.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the world of finance, dividends play a crucial role in the distribution of profits to the shareholders of a company. They serve as a reward for investing in the company and provide shareholders with a tangible return on their investment. Understanding where dividends go on the balance sheet is essential for investors and financial analysts alike.

Dividends are essentially a share of a company’s profits that are distributed to its shareholders. While dividend payments can take various forms, such as cash or stock dividends, the underlying principle remains the same: to reward shareholders for their stake in the company. However, dividends have a significant impact on a company’s financial statements, particularly the balance sheet.

The balance sheet is a financial statement that provides a snapshot of a company’s financial position at a given point in time. It presents the company’s assets, liabilities, and equity, and it is crucial in assessing a company’s overall financial health. Dividends, being an integral part of a company’s financial operations, have a direct impact on the balance sheet.

In this article, we will delve deeper into the concept of dividends and explore their placement on the balance sheet. We will examine the various components of the balance sheet, including assets, liabilities, and equity, and discuss how dividends are reflected in these sections. Furthermore, we will explore the implications of dividend distribution on a company’s equity and retained earnings.

By gaining a comprehensive understanding of where dividends go on the balance sheet, investors can make informed decisions and assess the financial stability and performance of a company. Additionally, financial analysts can analyze dividend trends and use this information to evaluate a company’s ability to generate consistent profits and sustain dividend payments over time.

Now, let’s delve into the world of dividends and explore their impact on the balance sheet.

Definition of Dividends

Before we dive into where dividends go on the balance sheet, it’s important to have a clear understanding of what dividends are. Dividends are a distribution of a company’s profits to its shareholders on a pro-rata basis. They serve as a way for companies to reward their shareholders for investing in the company and provide them with a return on their investment.

Dividends can be paid in various forms, including cash dividends and stock dividends. Cash dividends are the most common form, wherein shareholders receive a cash payment for each share they own. Stock dividends, on the other hand, involve the issuance of additional shares to shareholders based on their existing holdings.

Companies are not legally obligated to pay dividends to their shareholders. The decision to declare and distribute dividends is at the discretion of the company’s management and board of directors. The frequency and amount of dividend payments can vary greatly among companies and can be influenced by factors such as the company’s profitability, cash flow, growth prospects, and financial obligations.

Dividends are an important consideration for investors, as they provide a tangible return on their investment in addition to any potential capital gains. Dividend-paying stocks are often sought after by income-oriented investors who rely on regular dividend payments to generate passive income. Additionally, dividends can also be an indication of a company’s financial health and stability.

It’s worth noting that not all companies pay dividends. Some companies, particularly those in growth industries or in the early stages of development, may choose to reinvest their profits back into the business to fund expansion and future growth. These companies may opt to retain their earnings and forgo dividend payments.

Now that we have defined what dividends are, let’s move on to understanding how they are reflected on the balance sheet.

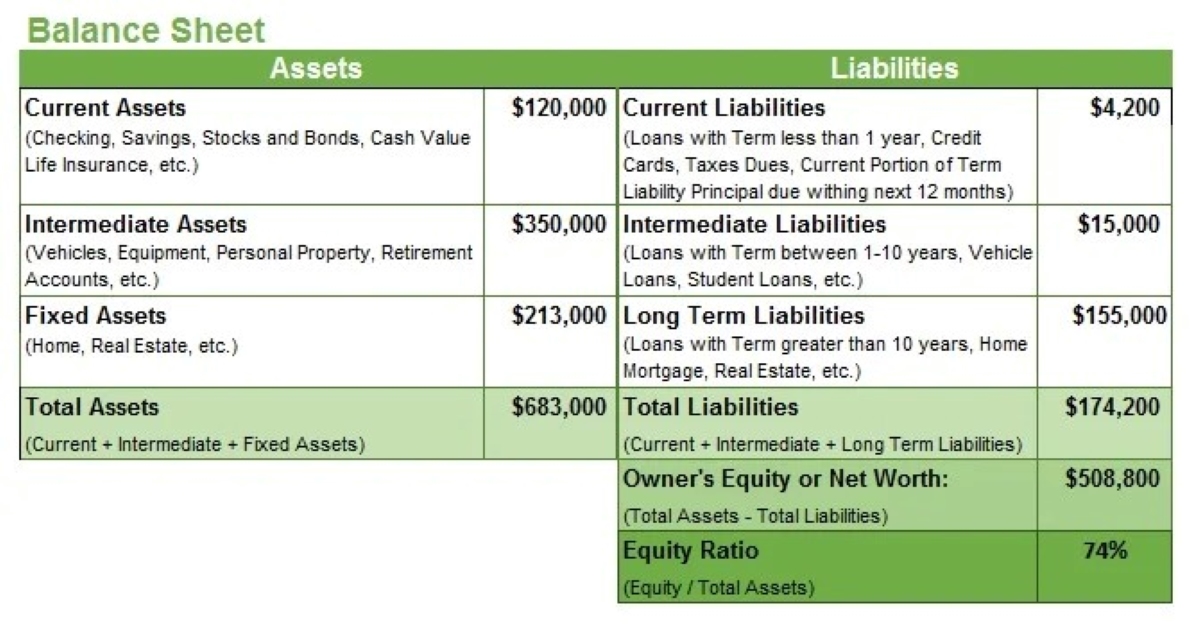

The Balance Sheet

The balance sheet is a financial statement that provides a snapshot of a company’s financial position at a given point in time. It presents a summary of a company’s assets, liabilities, and equity, and is divided into two main sections: the left-hand side, which represents the company’s assets, and the right-hand side, which represents its liabilities and equity.

The balance sheet follows the fundamental accounting equation: Assets = Liabilities + Equity. The equation signifies that a company’s assets are financed by a combination of liabilities and equity. Assets represent what a company owns, while liabilities and equity represent how the assets are financed.

On the balance sheet, assets are generally categorized into current assets and non-current assets. Current assets are those that are expected to be converted into cash or used up within one year, while non-current assets are those that are expected to be held for more than one year. Examples of assets include cash, accounts receivable, inventory, property, plant, and equipment.

Liabilities, on the other hand, represent a company’s financial obligations or debts. Similar to assets, liabilities are also classified into current liabilities and non-current liabilities. Current liabilities are those that are expected to be settled within one year, while non-current liabilities are those that are due in more than one year. Examples of liabilities include accounts payable, short-term debt, long-term debt, and accrued expenses.

Equity represents the residual interest in the company’s assets after deducting its liabilities. It represents the shareholders’ stake in the company and is usually composed of two main components: contributed capital and retained earnings. Contributed capital refers to the amount of money or assets that shareholders have invested in the company, while retained earnings represent the accumulated profits that have been retained in the company rather than distributed as dividends.

Now that we have a clear understanding of the balance sheet and its components, let’s explore where dividends fit into this financial statement.

Assets

Assets are the resources that a company owns, which have economic value and are expected to provide future benefits. They are classified into current assets and non-current assets on the balance sheet.

Current assets are those that are expected to be converted into cash or used up within one year. Examples of current assets include cash and cash equivalents, accounts receivable, inventory, and short-term investments. These assets are crucial for the day-to-day operations of the company and its ability to meet short-term financial obligations.

Non-current assets, also known as long-term assets, are those that are expected to be held for more than one year. Examples of non-current assets include property, plant, and equipment (PP&E), intangible assets, such as patents or trademarks, and long-term investments. These assets represent the company’s long-term investment in its operations and its ability to generate future income.

When it comes to dividends, they do not directly impact the asset section of the balance sheet. Dividend payments are made from the company’s retained earnings, which is a component of equity, rather than from its asset base.

However, the decision to pay dividends may be influenced by the company’s asset position. A company with a strong asset base, particularly in terms of cash and liquid assets, may be more likely to afford regular dividend payments. On the other hand, a company with limited cash reserves or significant investment requirements may choose to retain its earnings and forgo or reduce dividend payments.

It’s important for investors to assess a company’s asset position when evaluating its ability to sustain dividend payments. An analysis of a company’s liquidity and its ability to generate cash flow from its assets can provide insights into its financial stability and its capacity to meet its dividend obligations.

Now that we have covered the asset section of the balance sheet, let’s move on to understanding the liabilities section.

Liabilities

Liabilities represent a company’s financial obligations or debts. They are the claims that external parties have on the company’s assets and are classified into current liabilities and non-current liabilities on the balance sheet.

Current liabilities are those that are expected to be settled within one year or the operating cycle of the company, whichever is longer. Examples of current liabilities include accounts payable, short-term loans, accrued expenses, and current portions of long-term debt. These liabilities represent the company’s short-term financial obligations that need to be settled in the near future.

Non-current liabilities, also known as long-term liabilities, are those that are due in more than one year or beyond the company’s normal operating cycle. Examples of non-current liabilities include long-term debt, deferred tax liabilities, and pension obligations. These liabilities represent the company’s long-term financial obligations that extend beyond the next year.

When it comes to dividends, liabilities are not directly affected. Dividend payments are made from the company’s retained earnings, which is a component of equity, rather than from its liabilities. However, the presence of substantial liabilities, particularly in the form of debt, can impact a company’s ability to pay dividends.

Companies with a high level of debt obligations may face restrictions on dividend payments due to debt covenants or contractual agreements. Lenders may impose limitations on distributing profits to shareholders to ensure that the company can meet its debt obligations. This is especially true for companies that are heavily leveraged or struggling to generate sufficient cash flow.

Furthermore, the decision to pay dividends may also be influenced by a company’s ongoing financial obligations. If a company is facing significant liabilities or has substantial financial commitments, it may choose to retain its earnings to strengthen its financial position and fulfill its obligations.

Analysts and investors analyze a company’s liabilities to gauge its financial stability and its ability to generate sufficient cash flow to meet both its obligations and potential dividend payouts. They assess the company’s debt levels, debt maturity profiles, and debt service capacity to evaluate the potential risks and impacts on dividend payments.

Now that we have covered the liabilities section of the balance sheet, let’s move on to understanding the equity section and its relationship with dividends.

Equity

Equity is a vital component of the balance sheet and represents the residual interest in the assets of a company after deducting its liabilities. It is the shareholders’ stake in the company and is divided into two main components: contributed capital and retained earnings.

Contributed capital, also known as share capital, refers to the amount of money or assets that shareholders have invested in the company in exchange for ownership. This includes the proceeds from the issuance of common stock or preferred stock, as well as any additional paid-in capital from stock options or other equity instruments.

Retained earnings are the accumulated profits that the company has retained over time rather than distributing as dividends. They represent the portion of the company’s earnings that have been reinvested back into the business for growth, expansion, or to fulfill financial obligations. Retained earnings are essential as they contribute to the overall equity value of the company.

Dividends directly impact the equity section of the balance sheet. When a company declares and pays dividends, it reduces its retained earnings and consequently reduces the overall equity position. The amount of dividends paid is deducted from the retained earnings and is transferred to a separate account known as “dividends payable” or “dividends declared.”

In terms of classification, dividends declared but not yet paid are reported as a current liability in the liabilities section of the balance sheet under “dividends payable.” Once the dividends are paid to the shareholders, the liability is reduced, reflecting the distribution of dividends. This reflects the company’s obligation to fulfill its dividend payments to shareholders.

It’s worth noting that the reduction in retained earnings and equity due to dividend payments does not necessarily indicate a negative impact on the company’s financial health. The decision to pay dividends is often a strategic choice made by management, taking into consideration various factors such as profitability, liquidity, future growth plans, and shareholders’ expectations.

Investors and analysts pay close attention to the equity section of the balance sheet to assess a company’s overall financial position and its ability to sustain dividend payments. They analyze trends in retained earnings, assess the dividend payout ratio, and evaluate the company’s capacity to generate consistent earnings and maintain a healthy equity base.

Now that we have covered the equity section and its relationship with dividends, let’s explore the specific impact of dividend distribution on retained earnings.

Retained Earnings

Retained earnings are a vital component of equity on the balance sheet. They represent the accumulated profits of a company that have been retained and reinvested in the business rather than distributed as dividends to shareholders. Retained earnings reflect the company’s historical profitability and its capacity to generate and retain earnings over time.

When a company earns profits, it has the option to either distribute them to shareholders as dividends or reinvest them back into the business for growth and expansion. If the company chooses to retain its earnings, they are added to the retained earnings account on the balance sheet.

Retained earnings are an important measure of a company’s financial health and stability. They indicate the capital that has been internally generated and reinvested into the company, which can be used for various purposes such as research and development, acquisitions, debt reduction, or working capital needs.

Dividend payments directly impact the retained earnings balance. When a company declares and pays dividends, the amount of dividends paid is subtracted from the retained earnings account. This reflects a reduction in the accumulated profits that have been retained in the business.

It’s important to note that if a company distributes dividends that are larger than the amount of its current retained earnings, it may dip into its previous accumulated profits or even its contributed capital. This can result in negative retained earnings, also known as a deficit, which signifies that the company has accumulated losses in excess of its retained earnings.

When negative retained earnings occur, it is a red flag for investors as it can indicate financial distress or past sustainability issues. Companies with negative retained earnings may face challenges in meeting their financial obligations, and it may be difficult to sustain dividend payments in such situations.

However, it’s important to interpret negative retained earnings in the context of the company’s overall financial condition. Companies may experience temporary negative retained earnings due to one-time events or accounting adjustments. It’s crucial to assess the underlying causes and evaluate the company’s ability to recover and generate future profits.

Investors and analysts closely monitor a company’s retained earnings to assess its profitability, dividend sustainability, and long-term growth prospects. A consistent and growing trend of retained earnings indicates a healthy financial position and the potential for future dividend growth.

Now that we have covered the concept of retained earnings, let’s discuss the distribution of dividends and its impact on equity and retained earnings.

Distribution of Dividends

The distribution of dividends involves the process of paying out a portion of a company’s profits to its shareholders. Dividends can be distributed in various forms, including cash dividends, stock dividends, or a combination of both.

When a company decides to distribute dividends, it typically goes through a series of steps. Firstly, the board of directors declares the dividend, setting the amount to be paid per share and the record and payment dates. The record date determines which shareholders are eligible to receive the dividend, and the payment date is when the actual payment is made to the shareholders.

For cash dividends, the company uses its available cash balance to make the payments to shareholders. The amount of cash used for the dividend payment is deducted from the company’s retained earnings. This reduction in retained earnings reflects the transfer of profits from the company to its shareholders as a cash distribution.

In the case of stock dividends, the company issues additional shares to its shareholders instead of making a cash payment. The newly issued shares are allocated to shareholders based on their existing holdings. This results in an increase in the number of outstanding shares, but it does not impact the company’s retained earnings. However, stock dividends can dilute the ownership stake of existing shareholders.

It’s important to note that the distribution of dividends can have tax implications for shareholders. Depending on the jurisdiction and the individual’s tax situation, dividends may be subject to taxes such as dividend tax, capital gains tax, or income tax. Shareholders should consult with tax professionals to understand the tax implications of receiving dividends.

The decision to distribute dividends rests with the company’s management and board of directors. They consider several factors, including profitability, cash flow, future growth plans, debt obligations, and the expectations of shareholders. Companies with a history of consistent and growing dividends are often favored by income-oriented investors.

It’s worth noting that the distribution of dividends is not a mandatory requirement for companies. Some companies, particularly those in growth phases or with limited profits, may choose to retain earnings and reinvest them in the business rather than paying dividends. This decision is aimed at fueling future growth and maximizing shareholder value in the long term.

Now that we have discussed the distribution of dividends, let’s explore the impact of dividend distribution on a company’s equity and retained earnings.

Impact on Equity and Retained Earnings

The distribution of dividends has a direct impact on a company’s equity and retained earnings. Let’s explore how dividend payments affect these two important components of the balance sheet.

When a company declares and pays dividends, the amount of the dividends is subtracted from the company’s retained earnings. This reduction in retained earnings directly reduces the company’s equity. This is because retained earnings are a part of equity that reflects the accumulated profits that have been retained in the business.

For example, if a company has $1 million in retained earnings and declares and pays $200,000 in dividends, its retained earnings balance will decrease to $800,000, resulting in a decrease in equity. This reduction indicates that a portion of the company’s accumulated profits has been distributed to shareholders.

It’s important to note that the decrease in retained earnings due to dividend payments does not necessarily indicate a negative impact on the company’s financial health. Dividend payments are a form of capital allocation decision made by the company’s management, taking into consideration various factors such as profitability, growth plans, and cash flow requirements.

While dividend payments reduce retained earnings and equity in the short term, they can have positive implications for a company’s shareholders. Dividends provide investors with a tangible return on their investment and can be an attractive incentive for holding a company’s stock. They can also signify confidence from the company’s management in the company’s financial stability and profitability.

Furthermore, the payment of dividends can also impact the company’s stock price. Dividend payments can attract income-oriented investors who seek regular cash flow from their investments. This increased demand for the stock can lead to an increase in the company’s stock price, benefiting existing shareholders.

On the other hand, companies with a history of consistently increasing dividends can enhance their reputation, attracting long-term investors who value stability and reliable income. This can contribute to a positive perception of the company and potentially increase its market value.

It’s essential for investors and analysts to consider the impact of dividend payments on a company’s equity and retained earnings. They analyze trends in retained earnings, assess the dividend payout ratio, and evaluate the company’s ability to sustain dividend payments over time. Understanding the relationship between dividends and these financial metrics provides valuable insights into a company’s financial health and its commitment to shareholder value.

Now that we have explored the impact of dividend distribution on equity and retained earnings, let’s summarize our findings.

Conclusion

Understanding where dividends go on the balance sheet is crucial for investors and financial analysts alike. Dividends are a distribution of a company’s profits to its shareholders, serving as a way to reward them for their investment and provide a tangible return.

On the balance sheet, dividends do not directly impact the asset and liability sections. However, they have a direct impact on the equity section, specifically on retained earnings. Dividend payments reduce retained earnings, resulting in a decrease in equity. This reduction reflects the allocation of a portion of the company’s accumulated profits to shareholders.

The distribution of dividends is a strategic decision made by the company’s management, considering factors such as profitability, cash flow, growth prospects, and shareholder expectations. It is important to note that while dividend payments decrease retained earnings and equity in the short term, they provide investors with a tangible return on their investment and can have positive implications for a company’s stock price and investor perception.

Investors and analysts closely monitor the impact of dividend distribution on a company’s financial health and its ability to sustain dividend payments. They analyze trends in retained earnings, assess the dividend payout ratio, and evaluate the company’s overall financial stability.

Ultimately, understanding the placement of dividends on the balance sheet provides valuable insights into a company’s financial position, its distribution of profits, and its commitment to maximizing shareholder value over the long term.

By considering the impact of dividend payments on equity and retained earnings, investors can make informed decisions and assess a company’s ability to generate consistent profits and sustain dividend payments.

In conclusion, the distribution of dividends and its reflection on the balance sheet is a critical aspect of understanding a company’s financial operations and its relationship with shareholders.