Finance

Where To Find Debt On Financial Statements

Published: December 23, 2023

Looking to understand debt on financial statements? Learn where to find debt and improve your financial knowledge with our comprehensive finance guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to evaluating the financial health of a company, examining its debt is crucial. Debt on a company’s financial statements provides valuable insights into its borrowing activities, obligations, and overall financial stability. By analyzing the various components of a company’s financial statements, investors, creditors, and other stakeholders can gain a comprehensive understanding of the company’s debt profile.

Financial statements, such as the balance sheet, income statement, and statement of cash flows, along with accompanying notes and disclosures, provide a wealth of information about a company’s debt. These statements are prepared in accordance with Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) and provide a standardized framework for presenting a company’s financial performance.

Understanding where to find debt on financial statements requires a basic understanding of these key financial statements and the underlying accounting principles. By examining these statements and the accompanying explanations and disclosures, stakeholders can assess a company’s debt position and evaluate its ability to manage its financial obligations.

In this article, we will dive into the various sources and locations where debt can be found within a company’s financial statements. By familiarizing ourselves with these areas, we can uncover important details about a company’s borrowing activities and financial stability.

Before we delve into the specifics, it is important to note that debt on financial statements can include various types of liabilities, such as bank loans, bonds, mortgages, and lease obligations. Additionally, the terms “liabilities,” “debt,” and “obligations” are often used interchangeably throughout this article and refer to the same concept – the financial obligations that a company owes to its creditors.

Now, let’s explore the different sections of a company’s financial statements where debt is typically disclosed.

Balance Sheet

The balance sheet is one of the primary financial statements that provides a snapshot of a company’s financial position at a specific point in time. It presents a company’s assets, liabilities, and shareholders’ equity. The debt component is captured under the liabilities section of the balance sheet.

Within the liabilities section, you will typically find both short-term and long-term debt. Short-term debt represents obligations that are due within a year or less, while long-term debt refers to obligations due beyond one year.

The specific line items where debt can be found on the balance sheet may vary depending on the reporting standards used and the individual company’s financial structure. However, common line items that indicate the presence of debt include:

- Short-term Debt or Current Liabilities: This category encompasses debts that are due within the next 12 months. It includes items such as bank loans, lines of credit, and short-term borrowings.

- Long-term Debt or Non-current Liabilities: This category includes debts that extend beyond the next 12 months. It typically includes items such as bonds, mortgages, and long-term loans.

- Finance Leases or Capital Leases: If a company has entered into lease agreements that are considered to be capital or finance leases, the corresponding lease liabilities will be recorded on the balance sheet.

These line items provide information about the outstanding debt obligations of a company. Investors and creditors can analyze the amount and nature of these liabilities to assess a company’s solvency, liquidity, and ability to meet its financial obligations in the short and long term.

It is important to note that the balance sheet also displays additional information that can further enhance our understanding of a company’s debt. For example, the balance sheet may provide details on any pledged assets or collateralized debt, such as mortgages secured by specific properties or loans backed by specific equipment.

By analyzing the balance sheet, stakeholders can evaluate the overall debt structure of a company and make informed decisions about its financial stability and risk profile.

Income Statement

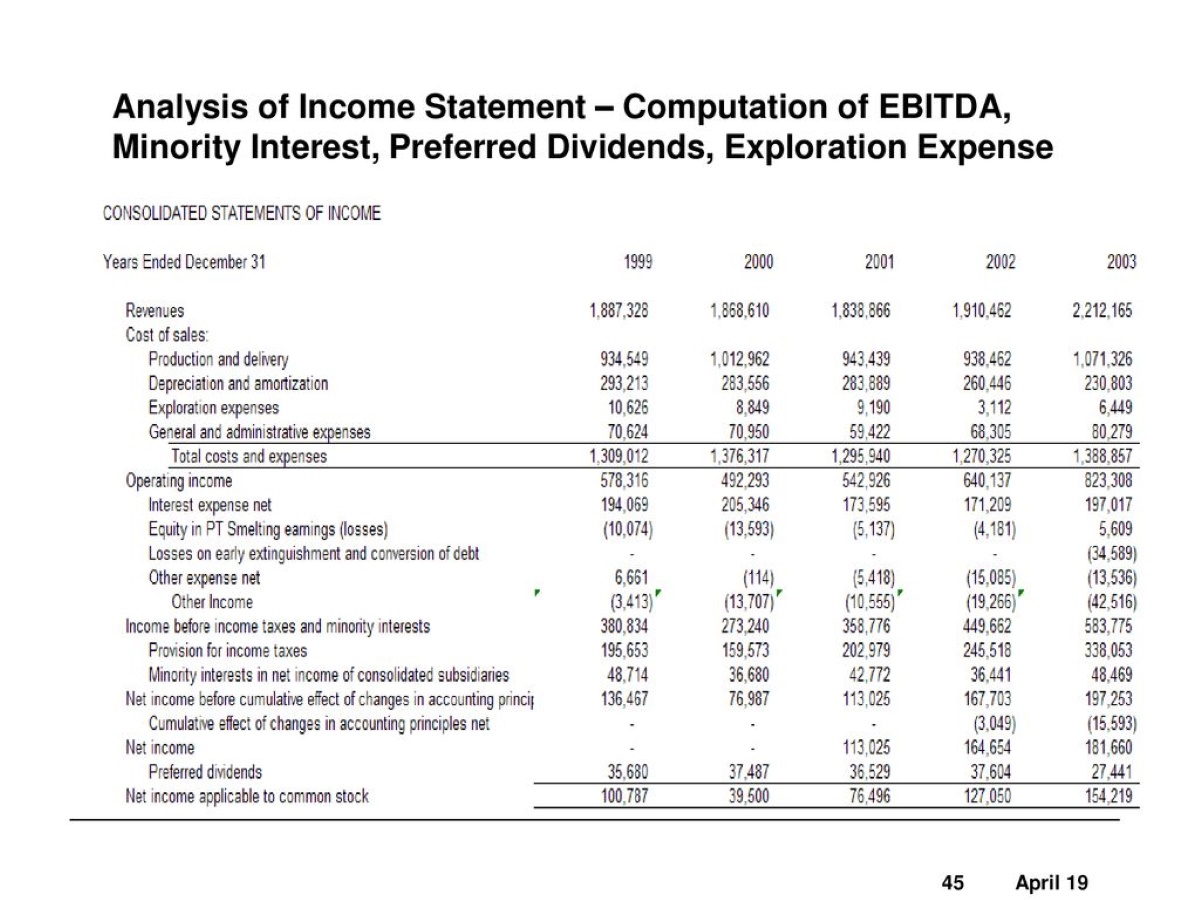

The income statement, also known as the profit and loss statement or statement of operations, provides a summary of a company’s revenues, expenses, gains, and losses over a specific period of time. While the income statement primarily focuses on a company’s profitability, it also provides insights into its debt-related activities.

Although debt is not directly presented as a separate line item on the income statement, certain sections can indirectly reveal the impact of debt on a company’s financial performance. These sections include:

- Interest Expense: Interest expense represents the cost of borrowing funds and is an important indicator of a company’s debt obligations. It includes interest payments made on loans, bonds, and other types of debt. Higher interest expense may indicate a higher debt burden and can affect a company’s profitability.

- Other Financing Costs: Apart from interest expense, there may be other financing costs related to debt, such as bank fees, loan origination fees, and bond issuance costs. These costs are often included in the income statement and can provide additional insights into a company’s debt-related expenses.

- Impairment Losses: If a company is unable to meet its debt obligations, it may result in impairment losses related to debt. These losses are recognized in the income statement and reflect the reduction in the value of the debt due to its impaired status.

By analyzing these elements of the income statement, stakeholders can gain a better understanding of a company’s ability to generate profits and manage its debt-related expenses. It is important to consider the income statement in conjunction with the balance sheet and other financial statements to get a comprehensive view of a company’s financial performance and debt position.

Furthermore, the income statement may also include disclosure notes that provide additional information about the company’s debt-related activities. These notes can provide details on significant debt transactions, debt restructuring, and any contingencies related to debt obligations. They can offer valuable insights and context for interpreting the financial impact of debt on a company.

Overall, the income statement helps stakeholders evaluate how a company’s debt-related activities impact its profitability and financial health. It is an essential component in understanding the financial implications of a company’s borrowing activities.

Statement of Cash Flows

The statement of cash flows is a financial statement that provides information about the cash inflows and outflows of a company during a specific period. While its main purpose is to report the cash generated from operating, investing, and financing activities, it can also shed light on a company’s debt-related cash flows.

Although the statement of cash flows does not explicitly list debt as a separate category, it includes certain sections that indirectly reflect debt-related cash flows. These sections include:

- Cash Flows from Financing Activities: This section reports the cash inflows and outflows related to a company’s financing activities, which include obtaining or repaying debt. Cash inflows from debt financing activities include proceeds from borrowings, issuance of bonds, or other debt instruments. Cash outflows include repayments of principal and interest payments.

- Interest Paid: The statement of cash flows may disclose the amount of interest paid during the reporting period. This information is valuable in assessing a company’s cash outflow related to its debt obligations.

By reviewing the statement of cash flows, stakeholders can gain insights into the company’s ability to generate cash flow to meet its debt payments and evaluate its liquidity position. It provides a clearer picture of how the company’s borrowing activities impact its cash position.

It is important to note that the statement of cash flows should be analyzed in conjunction with the balance sheet and income statement to fully understand a company’s debt situation. Examining the cash position, operating cash flows, and cash flow patterns can give stakeholders a comprehensive understanding of how debt influences a company’s cash flow stability and its ability to meet its financial obligations.

Additionally, the statement of cash flows may include relevant notes and disclosures that provide further clarification about debt-related cash flows. These notes may outline significant debt transactions or arrangements, such as debt issuances, repayments, interest rate changes, and any associated contingent liabilities.

Overall, the statement of cash flows provides valuable insights into a company’s cash flows, including the impact of its debt-related activities. By analyzing this statement, stakeholders can evaluate a company’s ability to generate cash and meet its debt obligations, enhancing their understanding of its financial health.

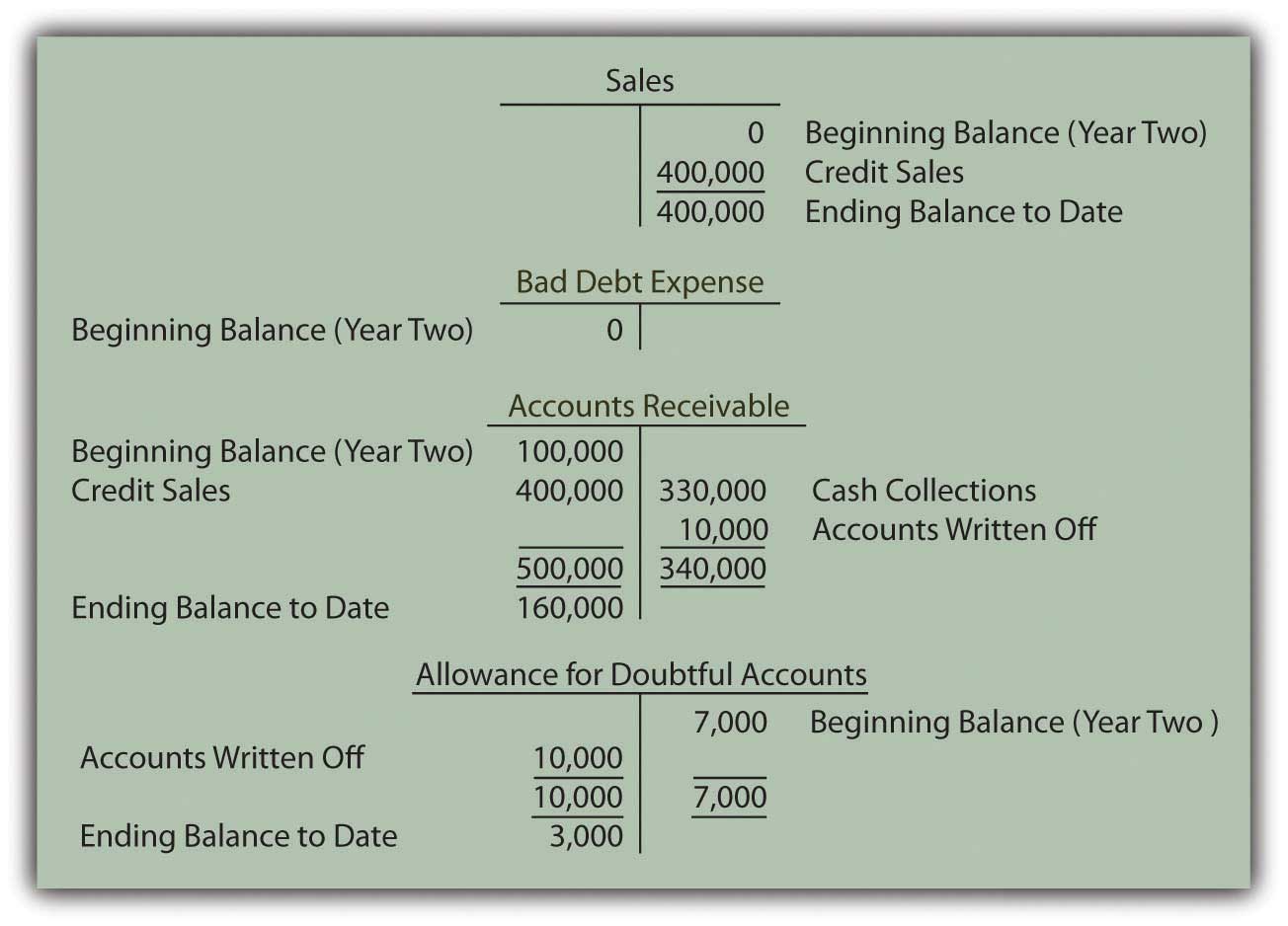

Notes to the Financial Statements

The notes to the financial statements, also known as the footnotes or explanatory notes, provide additional details and explanations that complement the information presented in the balance sheet, income statement, and statement of cash flows. These notes are an integral part of the financial statements and play a crucial role in providing clarity and transparency about a company’s debt-related activities.

Within the notes to the financial statements, you will often find specific disclosures related to the company’s debt. These disclosures can include:

- Debt Terms and Conditions: The notes provide information about the terms, interest rates, maturities, and repayment terms of the company’s debt. This helps investors and creditors in understanding the contractual obligations and interest expense associated with the debt.

- Collateral and Guarantees: If the company has pledged assets as collateral for its debt or issued guarantees on behalf of other entities, these details will be disclosed in the notes. This provides insights into the company’s potential obligations and potential risks associated with the debt arrangements.

- Debt Covenants: Covenants are conditions imposed by lenders to ensure that borrowers comply with certain financial and operational requirements. The notes may include information about any significant debt covenants and the company’s compliance status.

- Debt Repayment Schedule: The notes may outline the repayment schedule for the company’s debt obligations, providing details on principal repayments and interest payments due in the coming years.

- Related Party Debt: If the company has borrowed funds from related parties, such as its subsidiaries, affiliates, or key shareholders, the notes will disclose these related party transactions.

- Contingent Liabilities: Contingent liabilities are potential obligations that may arise in the future, such as pending lawsuits or indemnification obligations. The notes may disclose any significant contingent liabilities related to debt that could impact the company’s financial position.

These notes provide valuable information about a company’s debt-related activities, allowing stakeholders to assess the company’s creditworthiness, debt repayment capabilities, and potential risks associated with its debt arrangements.

It is important to carefully review the notes to the financial statements to gain a comprehensive understanding of a company’s debt-related disclosures. These notes often contain important details that may not be apparent from the primary financial statements alone.

By analyzing the notes to the financial statements, stakeholders can gain deeper insights into a company’s debt profile, helping them make more informed decisions and assessments about the company’s financial health and risk profile.

Management’s Discussion and Analysis (MD&A)

Management’s Discussion and Analysis (MD&A) is a section of a company’s financial statements that provides a narrative analysis of the company’s financial performance, results of operations, and future outlook. This section is typically prepared by the company’s management and offers insights into the underlying factors that have influenced the financial statements, including debt-related matters.

Within the MD&A, management may discuss various aspects of the company’s debt, including:

- Borrowing Activities: Management may provide an overview of the company’s borrowing activities during the reporting period. This can include details on new debt issuances, debt repayments, and any significant debt refinancing or restructuring.

- Debt Management and Strategies: The MD&A may outline the company’s overall debt management approach and strategies. This can include discussions on debt capital structures, interest rate risk management, and efforts to optimize the company’s debt portfolio.

- Debt Service Requirements: Management may discuss the company’s ability to meet its debt service requirements, including interest and principal payments. They may provide information on cash flow projections and sources of funds to meet these obligations.

- Debt-related Risks: The MD&A may highlight the potential risks associated with the company’s debt, such as interest rate fluctuations, currency risk, and refinancing risk. Management may provide insights into the actions taken to mitigate these risks and maintain the company’s financial stability.

- Debt Covenant Compliance: Management may address the company’s compliance with debt covenants and any potential risks or implications of non-compliance. They may discuss proactive measures taken to meet covenant requirements or negotiate with lenders if necessary.

Through the MD&A, management provides a qualitative assessment of the company’s debt-related activities and their impact on its financial performance and position. It offers a forward-looking perspective on debt management strategies and the company’s ability to navigate through potential challenges and uncertainties.

Stakeholders can gain valuable insights from the MD&A section, as it provides management’s perspective on the company’s debt dynamics and their potential implications. The MD&A complements the information provided in the financial statements by providing a narrative explanation that enhances understanding and interpretation.

It is important to note that the MD&A is a non-standardized section and can vary in depth and detail from one company to another. However, it serves as a crucial source of information for stakeholders, enabling them to assess the company’s debt-related risks, management’s strategies, and their potential impact on the company’s overall financial health.

Footnotes

Footnotes are an essential component of a company’s financial statements that provide additional context, explanations, and disclosures regarding specific items on the statements. In relation to debt, footnotes play a significant role in enhancing transparency and providing important details that may not be explicitly stated in the primary financial statements.

Within the footnotes, you may find various disclosures related to a company’s debt, including:

- Debt Instruments: Footnotes often disclose information about the specific debt instruments utilized by the company, such as bonds, notes, loans, or leases. These disclosures may include details regarding interest rates, maturity dates, and any applicable terms and conditions.

- Interest and Coupon Rates: Footnotes can provide information about the interest rates or coupon rates associated with the company’s debt. This allows stakeholders to understand the cost of borrowing and the impact of interest expenses on the company’s financial performance.

- Principal Repayment Schedule: Footnotes may outline the schedule for repaying the principal amount borrowed. This helps stakeholders gain insights into the company’s debt repayment obligations over time.

- Debt Maturities: Footnotes often disclose the maturities of the company’s outstanding debt, including both short-term and long-term obligations. This information is crucial for assessing the company’s ability to meet its debt obligations on time.

- Debt Restructuring and Refinancing: If the company has undergone any significant debt restructuring or refinancing activities, footnotes may provide details about these transactions. This can include information about the terms, costs, and potential impacts on the company’s debt profile.

- Contingent Liabilities: Footnotes may include information about contingent liabilities related to the company’s debt, such as guarantees, legal claims, or pending lawsuits. These disclosures allow stakeholders to assess the potential risks and financial implications associated with these contingent obligations.

Footnotes are crucial for providing clarity and additional insights into a company’s debt-related activities and associated risks. They ensure the financial statements are presented in a comprehensive and transparent manner, enabling stakeholders to make well-informed decisions and assessments.

It is important to carefully review the footnotes to gain a more nuanced understanding of a company’s debt arrangements. These disclosures can illuminate important details that may significantly impact the interpretation of a company’s financial statements.

By analyzing the footnotes, stakeholders can better evaluate the nature of a company’s debt, assess the associated risks, and understand the company’s financial position and obligations related to its borrowings.

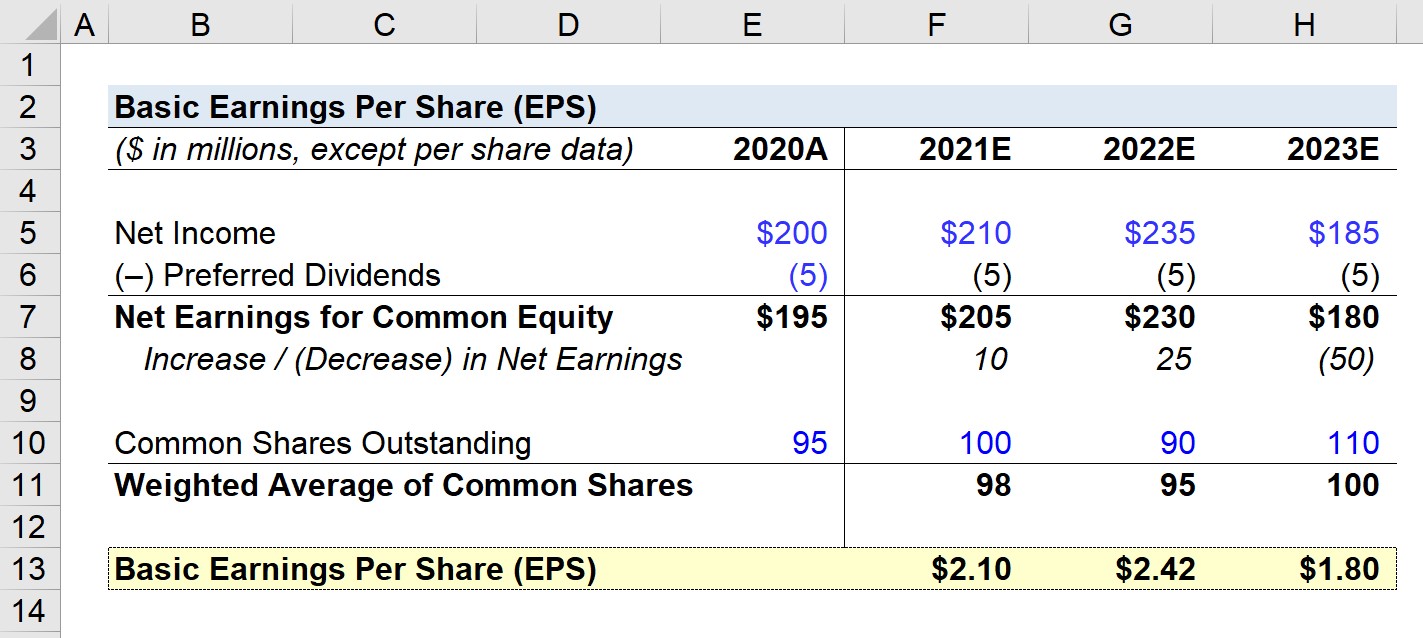

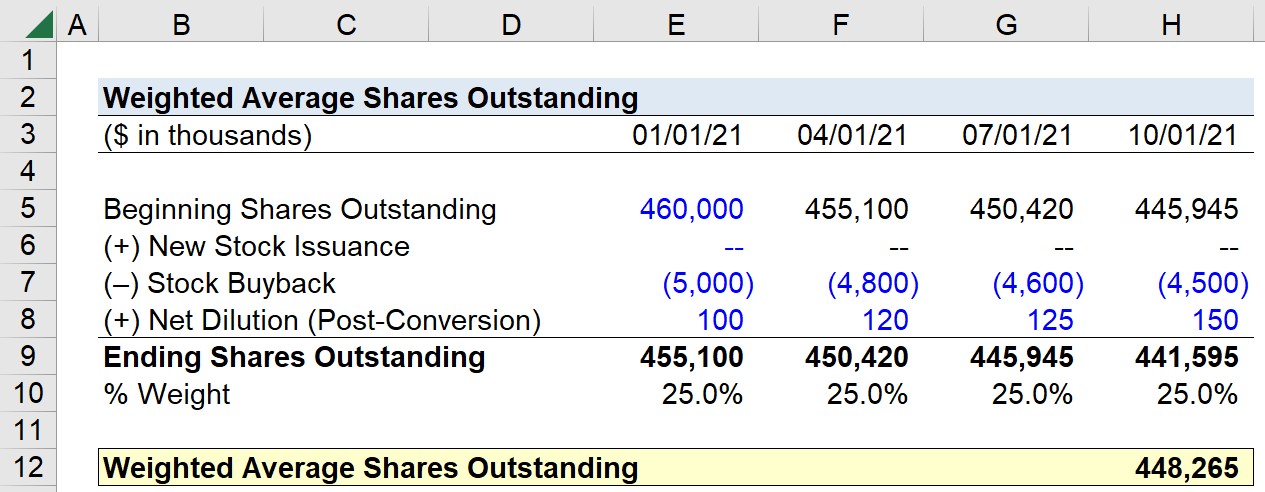

Supplementary Schedules

In addition to the main financial statements and accompanying footnotes, companies may include supplementary schedules that provide further details and breakdowns related to their debt. These schedules provide additional granularity and can help stakeholders gain a more comprehensive understanding of the company’s debt profile and related activities.

Supplementary schedules related to debt can include:

- Debt Composition: These schedules provide a breakdown of the types and categories of debt held by the company. It may include details such as the amount of bank loans, bonds, leases, or other debt instruments to provide a comprehensive view of the company’s liabilities.

- Debt Maturities: Supplementary schedules may outline the maturity profile of the company’s debt, providing a timeline of when different debt obligations are due. This helps stakeholders identify any concentration of repayment obligations in a particular period.

- Interest Expense Analysis: These schedules provide a breakdown of the company’s interest expense by type of debt or interest rate component. It can help stakeholders understand how interest costs are allocated and the impact of different interest rates on the overall interest expense.

- Debt Ratios and Metrics: Supplementary schedules may include calculations of debt ratios and metrics that assess the company’s debt servicing capabilities and financial leverage. This can include metrics such as debt-to-equity ratio, interest coverage ratio, or debt service coverage ratio.

- Debt Covenants: If the company has loan agreements or debt covenants, supplementary schedules can provide details on these requirements. This may include information on key covenant ratios, financial tests, or other compliance metrics that the company is required to meet.

Supplementary schedules vary across companies and industries depending on specific reporting requirements and management preferences. These schedules are typically presented alongside the main financial statements and other disclosures to provide a detailed and comprehensive view of the company’s debt-related information.

Stakeholders can use supplementary schedules to gain deeper insights into a company’s debt structure, repayment capacities, and associated risks. These schedules allow for a more nuanced analysis of the company’s debt-related activities and can help evaluate the financial health and stability of the organization.

When reviewing supplementary schedules, it is important to interpret the information in conjunction with the primary financial statements and footnotes to ensure a holistic understanding of the company’s debt position.

By analyzing supplementary schedules, stakeholders can gain a more granular and detailed perspective on a company’s debt profile, facilitating more informed decision-making and assessments of the company’s financial situation.