Home>Finance>Balanced Budget: Definition, Example Of Uses, And How To Balance

Finance

Balanced Budget: Definition, Example Of Uses, And How To Balance

Published: October 13, 2023

Learn the definition and importance of a balanced budget in finance, and discover examples of how to use it effectively. Find out how to balance your budget for financial success.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

What is a Balanced Budget?

A balanced budget is a financial concept that involves spending no more money than what is earned or allocated for a specific period. It is a crucial aspect of managing personal finances or running a business efficiently. This blog post will provide a detailed explanation of what a balanced budget is, give a practical example of how it can be used, and provide tips on how to achieve and maintain a balanced budget successfully.

Key Takeaways:

- A balanced budget means spending within your means and not exceeding your income.

- It involves careful planning and tracking of expenses to ensure that income and expenses are in equilibrium.

Why is a Balanced Budget Important?

Having a balanced budget is crucial for financial stability and long-term success. It helps individuals and businesses to:

- Avoid debt: By living within your means, you reduce the need to rely on credit cards, loans, or other forms of debt.

- Save for the future: With a balanced budget, you can allocate funds towards savings, investments, or emergency funds, ensuring financial security.

- Plan for expenses: By tracking your income and expenses, you can anticipate upcoming bills, plan for major purchases, and avoid financial surprises.

- Reduce financial stress: A balanced budget helps you stay in control of your finances and prevents the anxiety that comes with financial instability.

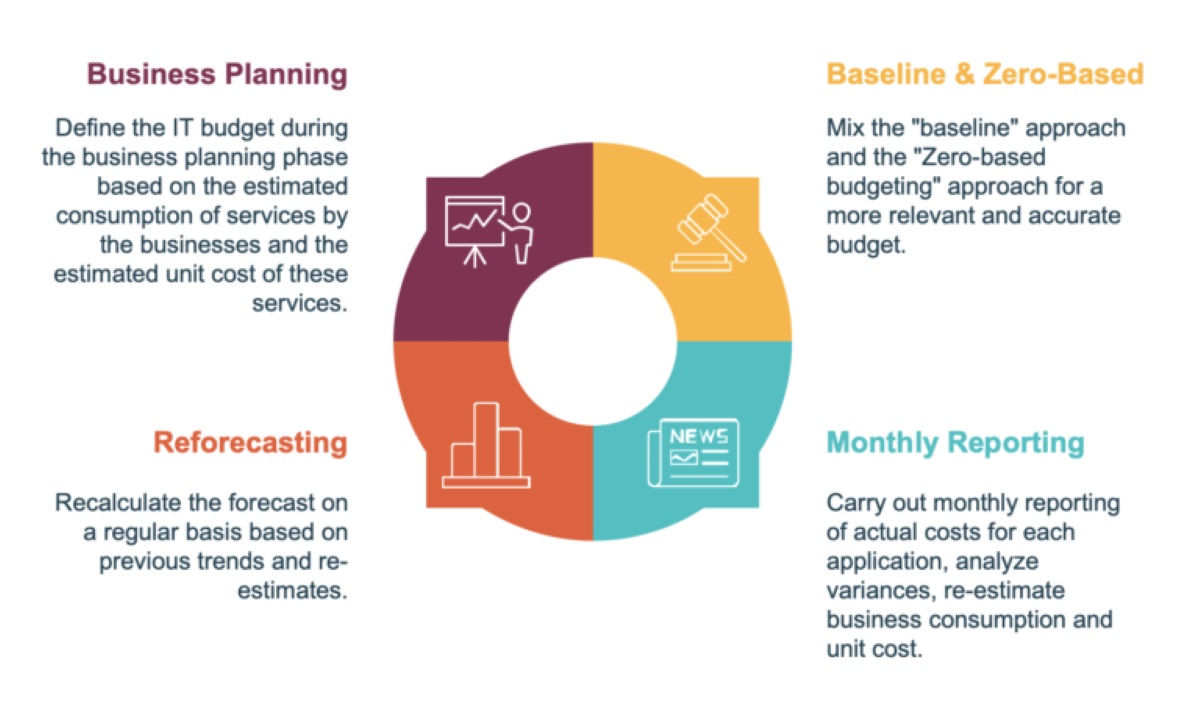

How to Balance Your Budget

Creating and maintaining a balanced budget is a proactive process that requires discipline and organization. Here are some steps to help you balance your budget:

- Evaluate your income: Calculate your total income for a specific period, considering all sources.

- List your expenses: Make a comprehensive list of all your expenses, including fixed costs (rent, utilities) and variable costs (groceries, entertainment).

- Categorize your expenses: Group your expenses into categories such as housing, transportation, food, and entertainment.

- Analyze your spending: Review your spending patterns to identify areas where you can cut back or eliminate unnecessary expenses.

- Set financial goals: Establish realistic goals for saving, debt repayment, and other financial objectives.

- Create a budget plan: Allocate your income to cover all necessary expenses and ensure that your expenses do not exceed your income.

- Track your progress: Regularly monitor your budget to check if you are on track and make adjustments if necessary.

Remember, balancing your budget is an ongoing process. It may require adjustments as your financial situation changes, such as an increase in income or unexpected expenses. Flexibility and adaptability are key in maintaining a balanced budget.

Conclusion

Achieving a balanced budget is a fundamental financial practice that leads to financial stability, reduced stress, and a more secure future. By evaluating your income, tracking your expenses, and making informed decisions about your spending, you can achieve a balanced budget and take control of your finances.

So, start your journey towards financial well-being today by taking the necessary steps to balance your budget. Your future self will thank you!